The concept and essence of the liquidity and solvency of the organization. Essence and value of liquidity and solvency of the enterprise. Comprehensive diagnostics of the state of the organization

UDC 336.647/.648

L.Yu. Zimina

cand. economy Sci., Associate Professor, Department of Economics and Organization of Production, Ulyanovsk State

university"

V.M. Perfilieva

undergraduate,

Federal State Budgetary Educational Institution of Higher Education "Ulyanovsk State

university"

SOLVENCY AND LIQUIDITY AS ELEMENTS OF ANALYSIS OF THE FINANCIAL STATE OF THE ENTERPRISE

Annotation. The article discusses approaches to understanding the essence of the solvency and liquidity of an enterprise, as well as the relationship between these categories. Separate problems in assessing the financial condition of an enterprise in the short term are revealed.

Keywords: solvency of the organization, liquidity of assets, liquidity of the balance sheet, liquidity of the enterprise, liquidity ratios.

L. Yu. Zimina, Ulyanovsk State University

V.M. Perfilyeva, Ulyanovsk State University

SOLVENCY AND LIQUIDITY AS AN ELEMENT OF THE ANALYSIS OF FINANCIAL CONDITION OF THE ENTERPRISE

abstract. This article considers approaches to understanding the nature of solvency and liquidity of the enterprise, also the interrelation of these categories. Specific problems are revealed in the assessment of the financial condition of the company in the short perspectives.

Keywords: organization's solvency, liquidity of assets, balance sheet liquidity, the liquidity of the company, the liquidity ratios.

An enterprise, from the point of view of a systematic approach, is a complex system that consists of many interacting and interconnected elements. For its constant and uninterrupted operation without disrupting the relationship, it is necessary to manage all economic and financial processes. In the system of this management, a special place is given to liquidity and solvency.

Meanwhile, there are no unambiguous and generally accepted definitions of these categories. Researchers interpret their essence differently. It should be noted that the definitions formulated by different researchers do not contradict each other, but rather reflect the priority aspects from the point of view of the authors in assessing the solvency and liquidity of an enterprise.

So, according to Sheremet A. D., the solvency of an organization is a signal indicator in which its financial condition is manifested. By solvency, he means the ability of the organization to meet the payment requirements of suppliers in time in accordance with business contracts, repay loans, pay staff, make payments to budgets and extrabudgetary funds.

Petrova L.V. considers that solvency is the ability of an enterprise to pay for its long-term obligations. Therefore, an enterprise will be solvent if its assets are greater than external liabilities.

According to Kovaleva V.V., solvency is the readiness of an enterprise to reimburse accounts payable when the payment deadlines come due with current cash receipts.

In turn, Berdnikova T.V. believes that solvency is the ability of an enterprise to timely and in full make settlements on short-term obligations to counterparties.

As Ukhov I.N. writes, solvency means the ability of an enterprise to timely fulfill monetary obligations stipulated by law or an agreement, at the expense of the financial resources at its disposal.

Thus, we can conclude that a solvent organization is one that has the opportunity to fulfill the debt repayment schedule to its creditors without violating contractual terms. And the main signs of solvency are: the presence of sufficient funds in the current account and the absence of overdue accounts payable. It is possible to allocate current and expected solvency. Current solvency is determined on the balance sheet date. An enterprise is considered solvent if it has no overdue debts to suppliers, bank loans and other settlements. Expected solvency is determined at a certain future date by comparing means of payment and senior obligations at that date.

Many scientists also worked on the study of the concept of liquidity of an enterprise. For example, Petrova L.V. believes that an enterprise that can fulfill its short-term obligations by realizing current assets is considered liquid.

According to Bocharov V.V., liquidity is the ability of an organization to quickly fulfill its financial obligations, and, if necessary, quickly realize its funds.

According to Efimova O.E. liquidity is the ability of the creditor to ensure the fulfillment of debt obligations.

I.N. has the same position. Ukhov, in his article the term "liquidity" is described as the mobility of assets of enterprises, firms or banks, ensuring the timely payment of their obligations.

Kovaleva V.V. adheres to a similar position, emphasizing that liquidity is a property of the assets of an economic entity, namely mobility, mobility, which lies in the rapid ability to turn into money.

In a broader sense, the concept of "liquidity" is presented by Ostroumova A.N., who claims that this is an economic term denoting the ability of assets to be quickly sold at a price close to the market.

That is, we can conclude that the concept of liquidity refers only to the assets of the enterprise, since only they can be converted into cash.

funds, while liabilities do not have this capability.

Meanwhile, for example, Eisenberg F.A. and other researchers, depending on the analysis being characterized, distinguish the following types of liquidity:

1. The liquidity of an enterprise's assets is a complex analytical category that characterizes the ability of each specific asset to be transformed into cash. At the same time, the degree of liquidity is determined by two factors: the speed of transformation and the owner's losses from a decrease in the value of an asset as a result of an emergency sale.

2. Balance sheet liquidity is a characteristic of the theoretical accounting ability of an enterprise to turn assets into cash and pay off its liabilities, as well as the degree to which liabilities are covered by assets on various payment horizons.

3. The liquidity of an enterprise is understood as the ability to repay the requirements of counterparties both at the expense of its own funds and on the basis of borrowed funds.

The considered points of view lead to the idea that the liquidity of an asset is understood as its ability to be transformed into cash in the course of the envisaged production and technological process, and the degree of liquidity of a particular asset is determined by the duration of the time period during which this transformation can be carried out. The shorter the period, the higher the liquidity of this type of assets. In the accounting and analytical literature, liquid assets are understood to be assets consumed during one production cycle (year).

Speaking about the liquidity of an enterprise, they mean that it has working capital in an amount theoretically sufficient to repay short-term obligations, even if they do not meet the maturity dates stipulated by contracts. In practice, there are also several levels of liquidity of the enterprise: normal, limited and low. They are shown schematically in Figure 1.

normal

characterizes the ability of the enterprise to pay off debts on its obligations on time throughout the year

Figure 1 - Levels of liquidity of the enterprise

Liquidity ratios are used to assess the company's ability to meet its short-term obligations. Calculation formulas and interpretation

liquidity ratios are shown in table 1.

Table 1 - Liquidity ratios and their interpretation

Name of the indicator Calculation formula Characteristic Interpretation of the indicator and recommended value

1. Absolute liquidity ratio (Kal) Kal=(DS+KFV)/ KO where DS - cash, KFV - short-term financial investments, KO - short-term liabilities Reflects the part of short-term debt obligations, which, if necessary, can be repaid immediately. indicator should be higher than or equal to 0.2, in Russia - from 0.15 to 0.20. A low value indicates a decrease in solvency

2. Current liquidity ratio (Ktl) KTL=(DS+KFV+DZ)/KO 0.5 to 0.8.

3. General liquidity ratio (Kol) Kol \u003d (DS + KFV + DZ + Z) / KO where Z - stocks of commodities and material assets Reflects an assessment of the liquidity of assets, showing how many rubles of the enterprise's current assets account for one ruble of current liabilities, it is necessary that current assets exceed the value of current liabilities In Western practice, the critical value of the indicator is given - 2

Balance sheet liquidity is defined as the extent to which an organization's liabilities are covered by its assets, the maturity of which is equal to the maturity of the liabilities. The liquidity of the company's balance sheet is closely related to its solvency.

Based on the above definitions, it is obvious that liquidity and solvency are not identical concepts, but, nevertheless, are closely related to each other, since liquidity is also analyzed to determine the solvency of an enterprise. In the most general form, solvency and liquidity characterize the financial condition of an enterprise from a short-term perspective, and show whether it can timely and in full make settlements on short-term obligations to counterparties.

Meanwhile, liquidity ratios may characterize the financial position as satisfactory, however, in essence, this assessment may be erroneous if a significant proportion of current assets falls on illiquid assets and overdue receivables. In many ways, solvency depends on the degree of liquidity of the balance sheet. At the same time, liquidity characterizes not only the current state of settlements, but also the prospects.

The assessment of liquidity and solvency can be performed with a certain

a certain degree of accuracy. In particular, as part of the express analysis of solvency, attention is paid to articles characterizing cash on hand and on bank accounts. These articles express the totality of cash, that is, property that has an absolute value, in contrast to any other property that has only a relative value. These resources are the most mobile; they can be included in financial and economic activities at any time. The art of financial management is precisely to keep only the minimum necessary amount of funds in the accounts, and the rest, which may be needed for current operational activities, in fast-moving assets.

Thus, the more significant the amount of funds in the current account, the more likely it can be argued that the company has sufficient funds for current settlements and payments. At the same time, the presence of insignificant balances on the current account does not mean at all that the enterprise is insolvent - the funds can be credited to the current account within the next few days, some types of assets, if necessary, are easily converted into cash, etc.

The main problem in ratio analysis is that the end result does not always give the full picture. So, for example, the current liquidity ratio of an enterprise calculated according to the generally accepted methodology is 2, but in practice the enterprise has financial difficulties and has no sources of repayment of accounts payable. This means that a high value of the coefficient is not a guarantee that the company will be able to fully fulfill its obligations.

But there are also reverse situations, when the company's current ratio is barely more than 1, and this indicates an unsatisfactory financial condition of the enterprise. However, the company is profitable and does not experience financial difficulties. This means that enterprises can be considered solvent even when current assets exceed current liabilities by less than 2 times. It all depends on the specifics of the organization. To do this, it is important to analyze the structure of current assets, assess the amount of cash on the current account, it is necessary to compare the structure of current assets with the structure of current liabilities, calculate the indicators of asset and liability turnover, which will give a more accurate assessment of the financial condition.

When calculating liquidity ratios, a problem also arises that carries a logical impoliteness, since all assets are presented on a certain date, and debts that are registered on the same date must be repaid within a certain period of time. So we can conclude that the presence of debts does not indicate the danger of loss of solvency, but only makes you pay attention to the timing of their repayment. This can be illustrated by an example, when most of the obligations of the enterprise must be repaid in more than six months of the reporting date, then the solvency indicators will no longer look so burdensome, since the denominator of the solvency ratios will become

much less at the time of calculation.

Figure 2 shows a diagram that shows the dependence of solvency on the liquidity of the enterprise and the liquidity of the balance sheet. It can be conditionally compared with a multi-storey building, in which each floor is equivalent, but the construction of the second floor is unacceptable without the first, and the construction of the third floor is not possible without the first and second; if the destruction of the first floor occurs, then the same will happen to the rest.

Thus, the liquidity of the balance is the basis of the solvency and liquidity of the enterprise. That is, liquidity is a method of maintaining solvency. It is easier for an enterprise with a high image and being continuously solvent to maintain its liquidity. The low level of solvency, which can be presented in the form of a lack of cash and the presence of overdue payments, can be accidental (temporary) and chronic (long-term).

Solvency of the enterprise

Enterprise liquidity

Balance liquidity

Image of the enterprise, its investment attractiveness Quality of asset management

Figure 2 - Relationship between liquidity and solvency

enterprises

As a result, when analyzing the state of solvency of an enterprise, it is necessary to pay attention to the causes of financial difficulties, how often they are formed and for what period. The reasons for insolvency may be: non-fulfillment of the plan for the production and sale of products; increase in its cost; non-fulfillment of the profit plan - lack of own sources of self-financing; high tax rate. One of the reasons for the deterioration of solvency may be the misuse of working capital: the diversion of funds into accounts receivable, investment in excess reserves and for other purposes that temporarily do not have sources of financing.

Thus, the analysis of liquidity and solvency is an important link in well-planned financial management in any enterprise. Liquidity difficulties can have very dire consequences for a company, including bankruptcy. In order to increase the liquidity and solvency of the enterprise, first of all, it is necessary to analyze the financial activity of the enterprise in a timely manner.

Bibliography:

1. Berdnikova T.B. Analysis and diagnostics of financial and economic activities of the enterprise: study guide / T.B. Berdnikov. - M.: INFRA-M, 2011. - 224 p.

2. Bocharov V.V. Financial analysis: textbook / V.V. Bocharov. - 2nd ed.

St. Petersburg: Piter, 2009. -240 p.

3. Efimova O.V. Analysis of liquidity indicators / O.V. Efimova // Accounting. - 2014. - No. 6. - S. 54-58.

4. Kovalev V.V. Financial analysis: methods and procedures: textbook / V.V. Kovalev. - M.: Finance and statistics, 2009. - 260 p.

5. Ostroumova A.N. Methods for assessing the absolute indicators of solvency and liquidity / A.N. Ostroumova // Audit and financial analysis. - 2013. - No. 11.

6. Petrova L.V. Analysis and diagnostics of financial and economic activity: a textbook for universities / L.V. Petrova, N.A. Ignatushchenko, T.P. Frolova. - M.: Publishing house of the Moscow State Open University, 2009. - 179 p.

7. Ukhov I.N. Types of solvency and ways to assess it / I.N. Ukhov // Management in Russia and abroad. - 2013. - No. 3. - S. 8-18.

8. Sheremet A.D. Methods of financial analysis of the activities of commercial organizations: a practical guide / A.D. Sheremet, E.V. Negashev. - 2nd ed., revised. and additional - M.: INFRA-M, 2012. - 208 p.

9. Eisenberg F.A. Financial management at the enterprise / F.A. Eisenberg. -Minsk: Higher school, 2014. - 366 p.

The financial condition is assessed from the perspective of the short and long term. The assessment criteria at the current time are liquidity and solvency. In the long run, the financial condition is characterized by financial stability, reflecting the inner side of the financial condition and balance:

- cash and commodity flows;

- income and expenses;

- means and sources of their formation.

Solvency - this is the ability to pay off your obligations on time and in full: to satisfy the payment requirements of creditors, to pay staff, i.e. the ability to pay in cash in a timely manner their payment obligations. It follows from this definition that an enterprise is solvent if it currently does not have overdue debts. Such solvency is assessed as current, prevailing at the present moment of time and indicating the availability of a sufficient amount of cash and cash equivalents to settle accounts payable requiring immediate repayment. Hence, the main indicator of current solvency is the availability of a sufficient amount of funds. However, delays in payment of upcoming obligations may be caused by the lack or shortage of cash as a result of the excess of borrowed capital over equity. At the same time, continuing economic activity, the enterprise receives cash, acting, as a rule, at the same time as a creditor. Temporary delays in payments indicate practical insolvency, i.e. a situation that is resolved within a certain period (not exceeding three months). Overdue obligations within three months from the date of payment give grounds for creditors to apply to the arbitration court to declare the debtor bankrupt (Federal Law of October 26, 2002 No. 127-FZ "On Insolvency (Bankruptcy)").

If the company is not able to pay off its obligations in the course of further current activities due to the excess of borrowed capital over its own income, losses incurred from financial and economic activities, the debtor is in absolute insolvency. In relation to such an organization, at the request of creditors or at the initiative of the debtor himself, a bankruptcy case is initiated.

Prospective solvency is assessed in terms of the ability to pay off long-term obligations in the medium and long term and future solvency due to the balance of obligations and income from core activities.

Solvency analysis is carried out to solve the following tasks:

- give an assessment of the current solvency, i.e. the ability to repay obligations, the due date of which has come, at the expense of available funds;

- assess prospective solvency, i.e. the potential ability in the future to maintain the consistency of means of payment and obligations in terms of volume and timing of performance;

- determine the possibility of paying off obligations at the expense of the results of their own activities.

The assessment of solvency and the calculation of the main indicators are carried out on a specific date and can be performed with varying degrees of accuracy depending on the methods and methods of research used. To assess solvency, the following basic techniques are traditionally used, presented in Fig. 11.2.

One of the generally accepted methods of solvency analysis is the assessment of balance sheet liquidity. In the economic literature, it is customary to distinguish between:

- liquidity of assets;

- balance sheet liquidity;

- liquidity of the enterprise.

Under liquidity of current assets refers to the ability and speed of their transformation into cash in the process of production and economic activity. Each type of asset requires an individual time to complete all stages of the operating cycle - from the acquisition of raw materials, materials to the receipt of cash.

Rice. 11.2.

funds from the sale of products. The shorter the period of transformation of this asset into cash, the higher its liquidity. It is the liquidity of current assets that ensures current solvency.

The liquidity of total assets has a completely different meaning and is understood as the possibility of their rapid sale in case of bankruptcy or self-liquidation of the enterprise.

Balance liquidity - this is the degree of coverage of the debt obligations of the enterprise by assets, the period of transformation of which into cash corresponds to the maturity of payment obligations.

Enterprise liquidity a more general concept than the liquidity of the balance, and is understood as the ability to repay its obligations, attracting various sources due to its market reputation, a high level of investment attractiveness.

When analyzing the liquidity of the balance sheet, assets are compared, grouped according to their degree of liquidity, with liabilities according to their maturity (Table 11.6).

Table 11.6

Grouping of assets according to their degree of liquidity and liabilities according to their maturity

GP - finished products; Tov OT1 . - goods shipped; 3 - production stocks; VAT - value added tax; DZ d - long-term receivables; (taken from the Notes to the balance sheet and income statement, section 5.1 "The presence and movement of receivables"); AB - non-current assets; KZ - accounts payable; PO kr - other short-term liabilities from section V of the balance sheet; ZS K - borrowed funds from the V section of the balance sheet (loans and short-term credits); KO (Ш - estimated liabilities from the V section of the balance sheet, TO - long-term liabilities; SC - capital and reserves ill section of the balance sheet (own capital); DBP - deferred income; TA - current assets; TO - current liabilities.

Assets are distributed according to the degree of decreasing liquidity, i.e. the rate of conversion into cash, but to the following groups:

- the first group (L1) - the most liquid assets: this includes the company's cash and cash equivalents;

- second group (L2 ) - quickly realizable assets, includes short-term financial investments, receivables with maturities in the reporting period. This group of assets can also include finished products that are in demand, and goods shipped. The decision to assign these articles to the A2 group can be made by the analyst independently, based on the individual characteristics of the implementation process;

- third group (AZ) - slow-moving assets: represented by the sum of inventories minus finished products and goods shipped, if they were assigned to group A2, VAT, long-term receivables and other current assets. On the issue of classifying other current assets as slow-moving assets: if this line takes into account the identified shortages and losses from damage to valuables or the amount of excises, VAT on export operations that will not be reimbursed, in this case these amounts must be attributed to the group of illiquid assets.

The listed groups of assets are located at the very beginning of the production cycle, therefore, a sufficiently long period of their transition into cash is required;

- fourth group (A4) - hard-to-sell assets. This includes all articles of section I of the balance sheet "Non-current assets": fixed assets, intangible assets, long-term financial investments, etc.;

- fifth group of assets (L5 ) - illiquid assets. This group is formed on the condition that there are such assets as uncollectible receivables, slow, stale material assets, defective products, etc.

Liabilities are collected according to the degree of urgency of their repayment:

- P1 - the most short-term liabilities : these include the articles "Accounts payable", bank loans with a due date and "Other liabilities" from section V of the balance sheet; Debt to owners for the payment of dividends;

- 112 - medium-term liabilities : short-term bank loans from section V of the balance sheet "Current liabilities";

- PZ - long-term liabilities, under section IV of the balance sheet "Long-term liabilities";

- P4 - permanent liabilities: consist of equity, which is reflected in section III of the balance sheet, and the article of section V "Deferred income";

- /75 - revenue of the future periods. This group is formed in the presence of allocated illiquid assets A5.

The value of indicators of liquidity groups is rather conditional, since liquidity for individual items of assets is associated with many internal factors of the enterprise. So, the liquidity of stocks depends on their turnover, the share of scarce, stale materials. The liquidity of receivables is determined by the speed of their turnover, the share of overdue payments and unrealistic amounts for collection. Therefore, when calculating and evaluating individual liquidity groups, it is necessary to use an individual approach for each enterprise, based on the characteristics of its activities and the duration of the production cycle, which includes the storage of production inventories from the moment they are received until the moment they are put into production, the production process itself, the period of storage of finished products for warehouse, etc. The accuracy of the liquidity estimate can be obtained through internal analysis based on analytical accounting data.

The liquidity of the balance is determined by the ratio of groups of assets and liabilities. There are the following types of liquidity:

absolute liquidity of the balance sheet : a necessary condition is the fulfillment of the first three inequalities, when

assets exceed liabilities. Then in the fourth inequality assets A4 will be less than P4 (A4< 114), характеризуя наличие у предприятия собственных оборотных средств:

The negative value of the fourth inequality (P4< А4) показывает отсутствие собственных средств в обороте;

current liquidity : the sum of the most liquid and quickly sold assets is greater than current liabilities (A1 + A2) > (P1 + P2).

Current liquidity rather conditionally characterizes the solvency of an enterprise for the next moment of time, since the lack of funds in one group of assets is only theoretically compensated by an excess in another, and in practice less liquid funds cannot be directed to repay the most urgent obligations;

prospective liquidity - this is solvency forecasting based on a comparison of future receipts and payments with long-term obligations (AZ > PZ). This ratio reveals information about the possibility of repaying long-term loans and credits at the expense of future products.

When assessing liquidity, it is important to take into account not only the shortage of funds for certain groups of assets that should cover liabilities, but also the risk of excessive liquidity in the presence of an excess of highly liquid assets that are low-yield, which leads to lost opportunities as a result of inefficient use of financial resources.

The assessment of liquidity in absolute terms of the compared groups of assets and liabilities (Table 11.7) does not answer a number of questions, in particular, about the sufficiency of the remaining funds after debt repayment for further current activities, therefore, about future solvency, the level of missing funds necessary to reimburse debt obligations . The coefficient analysis of liquidity complements the study of solvency from the standpoint of possible prospects for current activities with timely repayment of obligations. For this purpose, the following coefficients are calculated:

absolute liquidity ratio", characterizes the payment capabilities of the enterprise, i.e. answers the question what part of current liabilities (accounts payable and short-term credits, loans) can be immediately paid out of available cash:

![]()

![]()

The normative value of the coefficient is 0.2, indicating that at least 20% of term liabilities must be covered in cash.

According to the level of the absolute liquidity ratio, it is impossible to judge the solvency of the enterprise, since the rate of turnover of funds and the rate of turnover of short-term obligations will play an important role in the assessment. If the means of payment are turned around faster than the debt grace period, then even with a small value of this coefficient, the requirements will be provided with an inflow of cash, and the company's solvency at a particular point in time can be considered normal. The constant lack of funds is a sign of chronic insolvency, which can be regarded as the first step towards bankruptcy;

critical liquidity ratio (quick liquidity ratio) is calculated by the ratio of the most liquid and quickly realizable assets to short-term liabilities:

![]()

In the line-by-line algorithm for calculating the critical liquidity ratio according to the methodology for training and certification of professional accountants, finished products and shipped goods are not included in the assets.

The allowable, set value of the coefficient is in the range of 0.7-1.0, and its desirable value is more than 1.5. In a situation where a large share of liquid funds is occupied by accounts receivable, among which it may not be collected in a timely manner, it is necessary to focus on the maximum recommended value - 1.5. The minimum allowable value will be regarded positively if cash and cash equivalents (securities) constitute a significant amount in the volume of current assets.

The coefficient shows what part of short-term liabilities can be repaid in a relatively short time from funds in various accounts, in short-term securities, as well as proceeds from debtors;

current ratio gives an assessment of the security of the enterprise with working capital for conducting business activities with the timely repayment of obligations. In general, it is calculated by the ratio of liquid assets to current liabilities:

![]()

In the calculation of the coefficient, adjustments may be allowed for individual items of the balance sheet. In particular, according to the training and certification program for professional accountants, it is proposed to calculate the coefficient without including VAT amounts on acquired valuables and long-term receivables in current assets:

![]()

The ratio gives an idea of the remaining current assets of the enterprise, if all current liabilities are paid. The normative value of this coefficient is in the range from 1 to 2, assuming that the funds that are directed to current activities should ideally be twice as much as current liabilities, and with an acceptable minimum value, the same amount as short-term liabilities. An excess of current assets by more than two times is considered undesirable, since it indicates an irrational investment of capital and inefficient one hundred use;

complex liquidity indicator calculated by the weighted shares of groups of assets and liabilities according to the formula

![]()

The optimal level of this indicator will be considered to be one or more, and its dynamics can be used to assess the emerging positive or negative trend in the formation of the liquidity structure of the balance sheet.

The coefficient gives a general assessment of changes in the financial situation as a whole in terms of balance sheet liquidity;

- solvency ratio for the period (year). As part of the training and certification program for professional accountants, it is proposed to calculate one hundred in the form of a cash flow statement:

- (Balance of cash at the beginning of the period + Cash received for the period) / Total amount of cash spent.

The solvency ratio for the period does not have a standard value, but, obviously, its value should be equal to or greater than one, showing the adequacy of the cash flow and the timeliness of payment for current activities.

Additional indicators that provide an opportunity to comprehensively assess the ability of the enterprise to repay obligations are given in table. 11.8. This is a group of relative indicators characterizing the long-term, prospective solvency of the organization. The optimal values for many of the given coefficients for each organization are determined based on the characteristics of their functioning, the rate of turnover of funds and the duration of the operating cycle. At the same time, acceptable values within the recommended limits for each coefficient will help to assess the current situation and prospective opportunities for stable solvency.

Table 11.8

Indicators for assessing long-term and prospective solvency

The ratio of receivables and payables as of a certain date may provide additional information on the possibility of repayment of the most urgent obligations (accounts payable) at the expense of funds in the calculation. In the absence of overdue receivables and doubtful repayment, this indicator will assess the ability of the enterprise to pay off creditors in the short term. Multiple excess of one of the debts is undesirable, so you can focus on the value of this coefficient equal to one.

Period of collection of receivables shows how many days on average the company will receive receivables and will be able to pay its obligations from it. The shorter the repayment period for receivables, the better. Therefore, according to the value of this indicator, it is possible to adjust the required level of the ratio of receivables and payables. The faster the accounts receivable takes the form of money, the faster you can pay off accounts payable, therefore, the acceptable level of the ratio of accounts receivable to accounts payable will be less than one.

Net asset coverage ratio of total liabilities - this is an indicator of the ability of the enterprise, regardless of time, to pay off obligations due to the available potential, i.e. accumulated equity capital. The low value of the coefficient indicates a high dependence on borrowed capital and the inability to pay off all obligations with property formed at the expense of equity capital.

Coverage ratio of net current assets of accounts payable characterizes the share of own funds in turnover, which can be used to pay off accounts payable. The minimum recommended value of the coefficient should be in the range of 0.3-0.4, indicating the possibility of repaying at least 30-40% of accounts payable at the expense of own funds in circulation.

Share of net current assets in total net assets shows what part of the total value of net assets is own funds allocated to finance current activities in the reporting year. Focusing on the minimum recommended value of the share of your own turnover captain, equal to 0.1-0.2, we can assume that this coefficient should not be lower than this level.

Interest coverage ratio - it is an indicator of the organization's ability to pay for specific obligations at the expense of the results of its own activities. Shows how many times during the reporting period the company can pay interest on loans. Assesses the degree of risk of a decrease in operating profit, at which it is possible to service bank loans. For creditors, it provides information on the level of protection against non-payment of debts. The normal value of the indicator is from 3 to 4. If the coefficient is less than one, raising borrowed capital becomes unprofitable for the organization itself, and possibly unprofitable, and extremely risky for creditors, since the cash flow from operating activities is not enough to service interest payments.

Cash flow ratio (Cash Flow Liquidity) is defined as the ratio of cash flow from operating activities to the organization's current liabilities. Cash flow from operating activities can be calculated as the sum of net profit and depreciation minus the increase in own working capital (other than cash) for the reporting period. The reciprocal of the coefficient shows how many years the organization is able to pay off its current liabilities through its operating activities.

Solvency recovery ratio is equal to six months and is similar to the coefficient of loss of solvency. The forecast period for restoring solvency is six months, and for calculating a possible loss of solvency - three months. The criterion level for both coefficients is a value greater than one: Kvp > 1 and Kup > 1. insolvency is obvious.

Degree of solvency on current liabilities determines the current solvency of the organization and the period of possible repayment of urgent debt to creditors at the expense of proceeds. The growth of the coefficient in dynamics indicates a deterioration in solvency. Its increase above the critical value equal to 3 indicates the impossibility of paying off debts at the expense of current activities within three months.

An absolute indicator of a qualitative assessment of solvency is net working capital, which characterizes the amount of the enterprise's own funds in circulation and long-term sources (Section IV). It is calculated as the difference between current assets and short-term liabilities.

In table. 11.9 coefficients of liquidity and perspective solvency are resulted.

Table 11.9

Liquidity and prospective solvency ratios

Continuation of the table. 11.9

|

Odds |

Tx |

Deviation from the pip criterion |

|||

|

Absolute coverage of accounts payable |

|||||

|

Solvency ratio for the period (year) |

|||||

|

Complex liquidity indicator |

|||||

|

Indicators of the qualitative characteristics of solvency |

|||||

|

Net working capital, thousand rubles |

|||||

|

Indicators for assessing the long-term solvency of the organization |

|||||

|

The ratio of receivables and payables |

|||||

|

Period of collection of receivables, days |

|||||

|

Net asset coverage ratio of total liabilities |

|||||

|

Coverage ratio of net current assets of accounts payable |

|||||

|

Share of net current assets in total net assets |

|||||

The end of the table. 11.9

Liquidity ratios that characterize the level of possible repayment of obligations at the current time, as well as in the future, indicate an extremely difficult current situation. All coefficients have values much lower than the criteria: the absolute liquidity ratio of 0.014 says that the company will immediately be able to pay off more than 1.4% of its term obligations, which in itself increases the risk of bankruptcy. The critical liquidity ratio is less than the recommended level by 1.1 percentage points, which indicates the impossibility in the near future to reach a solvent level and pay off urgent debt obligations. The current liquidity ratio with a value of 0.5 characterizes the enterprise as insolvent in the long term, since working capital is not enough to cover current liabilities. For every ruble of short-term liabilities in the reporting year, only 50 kopecks. liquid funds. A negative factor is also the declining dynamics in many ratios. Negative values of the indicator of the qualitative characteristics of solvency are evidence of deep, rapidly growing crisis phenomena. Net working capital, having a negative value, decreased even more and amounted to -32,618 thousand rubles, therefore, the level of short-term borrowed capital exceeded current assets. Additional solvency indicators confirm the existence of a payments crisis. The situation is further aggravated due to the diversion of funds into accounts receivable and an increase in the period of its return (the ratio of accounts receivable to accounts payable increased by 0.2 times, while the time for collection of accounts receivable increased by almost 14.9 days). The dynamics of other indicators is a clear confirmation of the conclusions drawn. The predicted value of the solvency recovery ratio is less than one, which means that in the future the enterprise does not have the opportunity to pay off its debts.

The current situation requires the immediate adoption of a set of anti-crisis measures aimed at restoring solvency.

The understanding of liquidity in modern economic literature and practice is not unambiguous. What is liquidity? The term “liquidity” comes from the Latin “liquidus”, which means fluid, liquid, i.e. liquidity gives this or that object a characteristic of ease of movement, movement. The term “liquidity” was borrowed from the German language at the beginning of the 20th century. Thus, liquidity meant the ability of assets to quickly and easily mobilize. The main points of liquidity have been reflected in the economic literature since the second half of the 20th century, in connection with the unprofitable activities of state banks and enterprises, as well as with the formation of commercial banks. For example, from the point of view of liquidity, economists wrote about the importance of observing the correspondence between the terms of active and passive operations at the end of the 19th century.

In modern economic literature, the term “liquidity” has a wide range of applications and characterizes completely different objects of the economy. In addition to the definitions already given, it is used in combination with other concepts related to both specific objects of economic life (goods, securities) and subjects of the national economy (bank, enterprise, market), as well as to determine the characteristic features of the activities of economic entities (balance sheet of an enterprise , bank balance).

The connection between the categories of money and liquidity is found, for example, in the analysis of the most common object of economic relations - goods. To be liquid, a product must be at least needed by someone, i.e. have a use value and, since it was produced with the direct participation of human labor, have a value, the measurement of which is money. At the same time, to examine the turnover of goods, the amount of money should be sufficient.

In addition, a necessary condition for comparing commodity values in the asset of sale and purchase is the presence of an equivalent product - an intermediary capable of maintaining value throughout the entire period of sale and purchase. Under the gold standard, money performed this function, one might say, absolutely. The continuity of the C-D-T chain was practically ensured by a real guarantee, since the seller could exchange the credit instruments of circulation received from the buyer for metal in banks or demand gold in payment for his goods. Subsequently, the liquidity of a commodity was made dependent not only on public recognition of the labor expended on the production of this commodity, but also on the quality, availability and sufficiency of credit instruments that perform the function of money as a means of circulation.

In modern conditions, to maintain the continuity of the process of commodity-money exchange, credit instruments of circulation that have public recognition are used. Since in the process of commodity-money circulation a gap inevitably arises between buying and selling and, consequently, between the moments of the appearance of a debt obligation and its repayment, in the event of serious financial difficulties for the issuer of a debt obligation, the C-D-T chain may be interrupted. This is one of the main aspects that determine the content of the concept of liquidity - the unconditional fulfillment by the borrower of his obligation to the creditor within a certain period.

Thus, liquidity is connected, firstly, with the ability of instruments of circulation to perform their main functions, secondly, with the sufficiency of money, and thirdly, with the reliability of fulfilling debt obligations in society.

Consequently, liquidity can be defined as social relations that develop over the timely and adequate realization of the exchange value (ownership for an equivalent). In all cases where we are dealing with the circulation of value, whether it be the circulation of commodities or money, the problem of liquidity arises at the final stage of the circulation. The liquidity of an object can be considered such a qualitative characteristic of it, which reflects the ability to return the advanced value after a certain time, and the shorter the return period, the higher the liquidity. Thus, liquidity expresses a social bond that develops constantly when it is necessary to realize value in a timely manner, i.e. the essence of the concept of "liquidity" can be defined as the possibility of timely realization of value.

So, liquidity is the ability of a firm to:

1) respond quickly to unexpected financial challenges and opportunities;

2) increase assets with an increase in sales;

3) to return short-term debts by the usual conversion of assets into cash.

There are several degrees of liquidity in determining the management capabilities of the enterprise, and hence the sustainability of the entire project. Thus, insufficient liquidity usually means that the company is not able to take advantage of discounts and emerging profitable commercial opportunities. At this level, the lack of liquidity means that there is no freedom of choice, and this limits the discretion of management. A more significant lack of liquidity leads to the fact that the company is not able to pay its current debts and obligations. The result is an intensive sale of long-term investments and assets, and in the worst case, insolvency and bankruptcy.

For business owners, insufficient liquidity can mean reduced profitability, loss of control, and partial or complete loss of capital investments. For creditors, the debtor's lack of liquidity may mean a delay in paying interest and principal, or a partial or complete loss of funds lent. The current state of a company's liquidity may also affect its relationships with customers and suppliers of goods and services. Such a change may result in the inability of the enterprise to fulfill the terms of contracts and lead to the loss of ties with suppliers. That is why liquidity is given such great importance.

If an enterprise cannot pay off its current liabilities as they fall due, its continued existence is called into question, and this pushes all other performance indicators into the background. In other words, the lack of financial management of the project will lead to the risk of suspension and even its destruction, i.e. to the loss of investor funds.

Liquidity characterizes the ratio of various items of current (current) assets and liabilities of the company and, thus, the availability of free (not related to current payments) liquid resources.

Depending on the degree of liquidity, the assets of the enterprise are divided into the following groups:

A1. The most liquid assets. These include all items of cash assets of the enterprise and short-term financial investments.

A2. Marketable assets are accounts receivable, payments on which are expected within 12 months after the reporting date.

A3. Slowly realizable assets - items in section II of the balance sheet asset, including inventories, value added tax, receivables (payments for which are expected more than 12 months after the reporting date) and other current assets.

A4. Difficult-to-sell assets - items in section I of the asset balance - non-current assets.

Liabilities of the balance are grouped according to the degree of urgency of payment:

P1. The most urgent obligations, these include accounts payable.

P2. Short-term liabilities are short-term borrowed funds, etc.

P3. Long-term liabilities are balance sheet items related to sections V and VI, i.e. long-term loans and borrowings, as well as deferred income, consumption funds, reserves for future expenses and payments.

P4. Permanent liabilities or stable ones are articles IV of the balance sheet section "Capital and reserves". If the organization has losses, they are deducted.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

TEST

Discipline: Anti-crisis management

Topic: The essence of the organization's solvency

1. Introduction

2. The essence of the solvency of the organization and indicators of its assessment

3. The purpose of the analysis of the solvency of enterprises

4. Internal and external analysis of the solvency of enterprises

5. Conclusion

6. References

Introduction

The transition to a market economy requires enterprises to increase production efficiency, competitiveness of products and services based on the introduction of scientific and technological progress, effective forms of management and production management, overcoming mismanagement, enhancing entrepreneurship, and initiative. An important role in the implementation of these tasks is given to the analysis of the solvency and creditworthiness of the enterprise. It allows you to study and assess the security of the enterprise and its structural divisions with its own working capital as a whole, as well as for individual divisions, determine the solvency indicators of the enterprise, establish a methodology for rating borrowers and the degree of risk of banks.

Solvency assessment is also the main element of the analysis of the financial condition, necessary for control, allowing to assess the risk of violation of obligations under the company's settlements.

Solvency and financial stability are the most important characteristics of the financial and economic activity of an enterprise in a market economy. If an enterprise is financially stable and solvent, it has an advantage over other enterprises of the same profile in attracting investments, obtaining loans, choosing suppliers and selecting qualified personnel. Finally, it does not come into conflict with the state and society, since pays timely taxes to the budget, contributions to social funds, wages - to workers and employees, dividends - to shareholders, and banks guarantee the return of loans and the payment of interest on them.

The essence of solvencyorganizationsand indicatorsherestimates

Market economic conditions oblige the enterprise at any time to be able to pay off external obligations (ie, be solvent) or short-term obligations (ie, be liquid).

An enterprise is considered solvent if its total assets are greater than its long-term and short-term liabilities. An enterprise is considered liquid if its current assets are greater than its short-term liabilities. In addition, for the successful management of financial activities, cash (cash) is more important for an enterprise than profit, since their absence in bank accounts at some point can lead to a financial crisis.

A preliminary assessment of the financial position of the enterprise is carried out on the basis of the data of the balance sheet, as well as the Appendix to the balance sheet of the enterprise.

At this stage of the analysis, an initial idea of the enterprise's activities is formed, changes in the composition of the enterprise's property and their sources are identified, and relationships between indicators are established.

For the convenience of such an analysis, it is advisable to use the so-called compacted analytical balance - net, formed by adding homogeneous elements of balance sheet items in the necessary analytical sections (real estate, current assets, etc.).

The ability of an enterprise to pay its short-term obligations is called liquidity. In other words, an enterprise is considered liquid if it is able to meet its short-term obligations by realizing current assets.

The financial position of an enterprise is considered stable if it covers with its own funds at least 50% of the resources necessary for the implementation of normal economic activities, effectively uses financial resources, observes financial credit and settlement discipline, in other words, is solvent.

The financial position is determined based on the analysis of liquidity and solvency, as well as an assessment of financial stability. The task of analyzing the liquidity of the balance arises in connection with the need to assess the creditworthiness of the organization in the process of the relationship of the enterprise with the credit system and other enterprises.

During the analysis of creditworthiness, calculations are carried out to determine the liquidity of the enterprise, which is characterized by liquidity ratios:

1. Determination of the current liquidity ratio - shows what part of current liabilities for loans and settlements can be repaid by mobilizing all current assets, i.e. how many financial resources account for 1 rub. current liabilities.

2. Quick liquidity ratio - reflects the predictive capabilities of the organization, subject to timely settlements with debtors, and characterizes the expected solvency for a period equal to the average duration of one turnover of receivables.

3. Absolute liquidity ratio, calculated as the ratio of cash and marketable securities to short-term liabilities. Short-term liabilities of the enterprise, represented by the sum of the most urgent liabilities and short-term liabilities, include: accounts payable and other liabilities (taking into account the comment on the accounts payable and other liabilities ratio; this comment also applies to the short-term debt ratio); loans not repaid on time; short-term loans and borrowings. The absolute liquidity ratio shows what part of the short-term debt the company can repay in the near future.

4. The overall solvency ratio - shows how much own funds account for 1 rub. both short-term and long-term liabilities. This ratio reflects the prospective solvency when it is analyzed whether the organization is able to repay all types of obligations at its own expense.

The purpose of the analysis of the solvency of enterprises

One of the indicators characterizing the financial condition of an enterprise is its solvency, i.e. the ability to pay off their payment obligations with cash resources in a timely manner.

Solvency analysis is necessary not only for the enterprise in order to assess and forecast financial activities, but also for external investors (banks). Before issuing a loan, the bank must verify the creditworthiness of the borrower. The same should be done by enterprises that want to enter into economic relations with each other. It is especially important to know about the financial capabilities of a partner if the question arises of providing him with a commercial loan or deferred payment.

Solvency has a positive impact on the implementation of production plans and the provision of production needs with the necessary resources. Therefore, solvency as an integral part of economic activity is aimed at ensuring the planned receipt and expenditure of financial resources, the implementation of settlement discipline, the achievement of rational proportions of equity and borrowed capital and its most efficient use.

In order to survive in a market economy and prevent the bankruptcy of an enterprise, you need to know well how to manage finances, what the capital structure should be in terms of composition and sources of education, what share should be occupied by own funds, and which should be borrowed.

The main purpose of the analysis is to timely identify and eliminate shortcomings in financial activity and find reserves for improving solvency.

In doing so, it is necessary to solve the following tasks:

Based on the study of the cause-and-effect relationship between various indicators of industrial, commercial and financial activities, assess the implementation of the plan for the receipt of financial resources and their use from the standpoint of improving the solvency and creditworthiness of the enterprise.

Forecasting possible financial results, economic profitability, based on the real conditions of economic activity and the availability of own and borrowed resources.

Development of specific measures aimed at more efficient use of financial resources.

The analysis of the solvency of the enterprise is carried out not only by the managers and relevant services of the enterprise, but also by its founders, investors. In order to study the efficiency of resource use, banks to assess credit conditions, determine the degree of risk, suppliers to receive payments in a timely manner, tax inspectorates to fulfill the plan for receiving funds to the budget, etc. In accordance with this, the analysis is divided into internal and external.

Internal and external analysis of the solvency of enterprises

Internal analysis - is carried out by the enterprise services and its results are used for planning, forecasting and control.

Its goal is to establish a systematic flow of funds and place own and borrowed funds in such a way as to ensure the normal functioning of the enterprise, maximizing profits and avoiding bankruptcy.

External analysis - carried out by investors, suppliers of material and financial resources, regulatory authorities on the basis of published reports.

Its goal is to establish an opportunity to invest funds profitably in order to ensure maximum profit and eliminate the risk of loss.

An analysis of the solvency of an enterprise is carried out by comparing the availability and receipt of funds with payments of essentials. There are current and expected (prospective) solvency.

Current solvency is determined on the balance sheet date. An enterprise is considered solvent if it has no overdue debts to suppliers, bank loans and other settlements.

The expected (prospective) solvency is determined on a specific upcoming date by comparing the amount of its means of payment with the urgent (priority) obligations of the enterprise on this date.

To determine the current solvency, it is necessary to compare the liquid assets of the first group with the payment obligations of the first group. Ideally, if the coefficient is one or a little more. According to the balance sheet, this indicator can be calculated only once a month or quarter. Enterprises make settlements with creditors every day. Therefore, in order to quickly analyze the current solvency, daily control over the receipt of funds from the sale of products, from the repayment of receivables and other cash receipts, as well as to control the fulfillment of payment obligations to suppliers and other creditors, a payment calendar is drawn up, in which, on the one hand , cash and expected means of payment are calculated, and on the other hand - payment obligations for the same period (1, 5, 10, 15 days, month).

When analyzing solvency, in addition to quantitative indicators, one should study qualitative characteristics that do not have a quantitative change, which can be characterized as depending on the financial flexibility of the enterprise.

Financial flexibility is characterized by the ability of an enterprise to withstand unexpected interruptions in cash flow due to unforeseen circumstances. This means the ability to borrow from various sources, increase share capital, sell and move assets, change the level and nature of the enterprise in order to withstand changing conditions.

The ability to borrow money depends on various factors and is subject to rapid change. It is determined by profitability, stability, the relative size of the enterprise, the situation in the industry, the composition and structure of capital. Most of all, it depends on such an external factor as the state and direction of changes in the credit market. The ability to obtain credit is an important source of cash when it is needed, and is also important when a business needs to extend short-term loans. Pre-arranged financing or open credit lines (a loan that an enterprise can take out within a certain period of time and on certain conditions) are more reliable sources of obtaining funds when needed than potential financing. When assessing the financial flexibility of an enterprise, the rating of its bills, bonds and preferred shares is taken into account; limiting the sale of assets; the degree of randomness of spending; and the ability to respond quickly to changing conditions such as a strike, a drop in demand, or the elimination of sources of supply.

Conclusion

One of the most important criteria for the financial position of an enterprise is the assessment of its solvency, which is commonly understood as the ability of an enterprise to pay for its long-term obligations. Therefore, a solvent enterprise is one whose assets are greater than external liabilities.

The ability of an enterprise to pay its short-term obligations is called liquidity. An enterprise is considered liquid if it is able to meet its short-term obligations by selling current assets.

To assess the solvency of an enterprise in domestic practice, the value of net assets and their dynamics are studied. Net assets of the enterprise represent the excess of assets over liabilities taken into account.

The most general indicator of solvency is the coverage indicator (current liquidity), which is calculated as a quotient of current assets divided by short-term liabilities and shows whether the enterprise has enough funds that can be used to pay off its short-term liabilities within a certain period.

Bibliography

1. Anti-crisis management.: Textbook. - 2nd ed.: add. and revised / Ed. Prof. EM. Korotkov. - M.: INFRA - M, 2007. - 620 p.

2. Anti-crisis management. Theory and practice: a textbook for university students studying in the specialties of economics and management / V.Ya. Zakharov, A.O. Blinov, D.V. Khavin - M.: UNITY-DANA, 2007. - 287 p.

3. Blank I.A. Anti-crisis financial management of the enterprise. - K .: Elga, Nika-Center, 2006. - 672 p.

4. Fundamentals of anti-crisis management of enterprises: textbook. Allowance for students of higher education. textbook institutions / ed. N.N. Kozhevnikov. - 2nd ed. - M.: Ed. Centre. "Academy", 2007 - 496 p.

5. Utkin E.A. Crisis management. - M.: Tandem, EKMOS, 2000.

Similar Documents

The essence of solvency, its importance for assessing the sustainability of the organization's development. Brief financial and economic characteristics of the organization. The main directions of increasing the stability of the financial condition of the organization and its solvency.

term paper, added 11/02/2013

Theoretical bases of carrying out the analysis of liquidity and solvency of the enterprise. Consideration of the cash flow method to determine the solvency of the enterprise. Evaluation of the solvency of the enterprise based on the study of cash flows.

abstract, added 10/12/2011

The concept of solvency and the conditions for its provision. Current and prospective solvency. Analysis of the financial condition of the enterprise and determination of the probability of its bankruptcy. The most important indicators of liquidity. organization's cash flow.

term paper, added 01/30/2011

The economic essence of the concepts of "solvency" and "liquidity of the balance of the enterprise". Features of the rating assessment of the financial condition of the organization according to the ranking system. Development of measures to improve the creditworthiness of the enterprise.

term paper, added 08/25/2010

Estimation of bankruptcy probability according to Altman's five-factor model. Fundamentals of the organization's solvency. Analysis of the financial condition based on reporting data: balance sheet liquidity, profitability indicators, profit and loss statement of the enterprise.

test, added 09/23/2011

Essence, concept and meaning of financial stability and solvency. Basic methods of financial analysis and system of indicators. Characteristics of the enterprise JSC "Energo". Analysis of financial stability, solvency and liquidity of the enterprise.

thesis, added 06/01/2009

Analysis of the financial and economic state of the enterprise. The value of the analysis of solvency and liquidity of the enterprise. Solvency ratios of the enterprise. Analysis of the financial stability of the enterprise. Methods for diagnosing the probability of bankruptcy.

term paper, added 03/30/2011

term paper, added 11/15/2010

The concept of solvency, the factors of its change, the liquidity of the enterprise and balance. The meaning of creditworthiness and a system of indicators for its assessment. Factors of change in the investment attractiveness of business entities, assessment of the risk of bankruptcy.

term paper, added 11/07/2009

The concept of the solvency of the enterprise, the methodology for its assessment. General analysis of the financial condition of the organization, its significance and objectives. Study of cash flows of an economic entity and balance sheet liquidity indicators. Reasons for financial difficulties.

In conditions of mass insolvency and the application of bankruptcy procedures (insolvency) to many enterprises, an objective and accurate assessment of the financial and economic state is of paramount importance. The main criterion for such an assessment is the indicators of solvency and the degree of liquidity of the enterprise.

There are no unambiguous interpretations of the concepts of liquidity and solvency of an enterprise in the literature. Liquidity comes from the Latin "liquidus", which means fluid, liquid, i.e. liquidity gives this or that object a characteristic of ease of movement, movement. The term "liquidity" was borrowed from the German language at the beginning of the 20th century. The liquidity of an enterprise in the literature is most often understood as its ability to cover its obligations with assets, the period of transformation of which into cash corresponds to the maturity of obligations.

In the economic literature, different authors interpret the concept of liquidity in their own way. For example, Lyubushin N.P. believes that liquidity is the ability of an organization to quickly meet its financial obligations, and, if necessary, quickly realize its funds. Bank V.R., speaking of the liquidity of an enterprise, means that it has working capital in an amount that is theoretically sufficient to repay short-term obligations, albeit with a violation of the repayment periods stipulated by contracts. According to Kovalev V.V. liquidity is a property of the assets of an economic entity, namely mobility, mobility, which consists in their ability to quickly turn into money.

Thus, the following principle is generally accepted: the faster an asset of an enterprise can be converted into money without loss of value, the higher its liquidity. Therefore, most authors associate liquidity with the state of the asset, which can ensure the short-term solvency and creditworthiness of the enterprise, as well as the repayment of borrowed funds. Some experts, for example, Krinina M., associate liquidity with the current solvency of an enterprise.

Solvency is considered through the prism of the company's cash and cash equivalents sufficient to pay its obligations in each period under consideration. Accordingly, the main signs of solvency are the absence of overdue accounts payable and the availability of sufficient funds in the current account.

An analysis of the work of foreign and domestic scientists-economists made it possible to identify the following approaches to determining the essence of the concept of "solvency". So, supporters of the first approach - Danish scientists J. Worst and P. Reventlow - define solvency as "the ability to withstand losses." Thus, they emphasize the presence of a certain potential in the enterprise, which gives it the opportunity to cover losses. However, the authors do not take into account that the enterprise, first of all, should be able to meet the requirements of counterparties and pay for their needs, and not focus on losses and their repayment.

French scientists J. Depellens and J. Jobard argue that "an enterprise that has positive working capital is solvent (that is, there are own sources of working capital)" . From this definition it follows that the solvency is determined by the composition of the working capital of the enterprise. At the same time, a large part of own current assets is the basis of the solvency of the enterprise.

According to the Russian scientist V.V. Kovaleva's solvency is the willingness to repay accounts payable upon the maturity of payment by current cash receipts. In turn, Berdnikova T.B. believes that solvency is the ability of an enterprise to timely and in full make settlements on short-term obligations to counterparties. Bank V.R. adheres to a different point of view. and Taraskin A.V. , the authors argue that solvency means that the enterprise has cash and cash equivalents sufficient to settle accounts payable requiring immediate repayment.

Savitskaya gives the following definition: “Solvency is the ability to pay off your payment obligations with cash resources in a timely manner” . Here, emphasis is placed on the timeliness of repayment of obligations in cash, although obligations can be paid both non-cash and with the help of other financial instruments. A similar point of view is shared by Gilyarovskaya L.T. and Ignatov A.P. .

From the point of view of economists M.S. Abryutina and A.V. Grachev "solvency means the sufficiency of liquid assets to repay at any time all of its short-term obligations to creditors." The concept of “liquid assets” already appears here, and the authors note that their size should be sufficient.

A somewhat different point of view is held by E.I. Utkin, who agrees that the assessment of solvency is one of the most important criteria for the financial condition of an enterprise. However, by solvency, he understands the ability of an enterprise to pay off its long-term obligations in a timely manner and in full.

A. D. Sheremet believes that "the solvency of an enterprise is defined as the ability to cover all its obligations (short-term and long-term) with all assets" . This definition, in contrast to the above, is more precise, since it takes into account all types of obligations and it indicates how the final result is achieved. However, it cannot be called complete, since the specifics of the reproduction process at the enterprise are not taken into account.

Within the framework of this approach, D.S. Molyakov and E.I. Shokhin argue that solvency is the most important indicator characterizing the financial condition of an enterprise; indicates that the company is able to timely satisfy all payment requirements of suppliers arising from previously concluded contracts, pay off loans and borrowings received, pay wages to employees, and also make payments to budget and extra-budgetary funds.

The shortcomings of all the considered interpretations of solvency are taken into account in the definition of A.M. Podderegina, which characterizes it as the ability of an enterprise to fulfill its obligations in a timely manner and in full, which arise from credit and other monetary transactions, have certain payment terms.

Thus, the solvency of Western scientists is determined by the availability of their own working capital and the ability to cover losses. In contrast, Russian economists define solvency as the ability of an enterprise to fulfill its obligations (short-term - V.V. Kovalev, M.M. Kreinina, M.S. Abryutina and A.V. Grachova; long-term - E.I. Utkin; all obligations - A.D. Sheremet, D.S. Molyakov, E.I. Shokhin, A.M. Podderegin).

It should be noted that, considering the content of the concept of "solvency", some scientists and specialists, on the one hand, identify it with liquidity, and on the other hand, point to their differences.

The concept of liquidity characterizes the potential ability of an enterprise to pay for its obligations, and the concept of solvency - a real opportunity to fulfill its obligations.

The deterioration of the solvency and liquidity of the enterprise is an early and first symptom of the onset of a financial crisis, which may result in bankruptcy. For its timely prevention, it is necessary to develop a system for assessing the level of solvency and liquidity, which makes it possible to obtain reliable information about the financial condition of the enterprise, identify the reasons for its deterioration and determine the ways out of the financial crisis.

Consequently, competent liquidity and solvency management just the same implies an integrated approach, taking measures to ensure that the enterprise has a constant, stable solvency.

Similar information.

Oblivion factions and guilds

Oblivion factions and guilds Cleaner: the one who cleans the bloody footprints after the murders Whom to kill after

Cleaner: the one who cleans the bloody footprints after the murders Whom to kill after BCG matrix: construction and analysis in Excel on the example of an enterprise

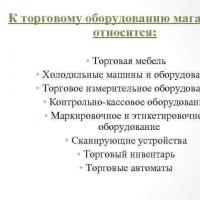

BCG matrix: construction and analysis in Excel on the example of an enterprise Classification and main types of commercial equipment on the example of LLC "Golden Troika"

Classification and main types of commercial equipment on the example of LLC "Golden Troika" Dragonborn Walkthrough Where to buy a seal of death card in Skyrim

Dragonborn Walkthrough Where to buy a seal of death card in Skyrim Morrowind Vivec Fighters Guild Walkthrough

Morrowind Vivec Fighters Guild Walkthrough Artistic woodcarving

Artistic woodcarving