Individual entrepreneurs as subjects of business law. Individual entrepreneur as a subject of commercial law: master's theses, diploma and coursework on Commercial Law Individual entrepreneur as a subject of entrepreneurial activity

And receive profit from its activities or engage in individual activities without forming a legal entity.

In accordance with Article 23 of the Civil Code of the Russian Federation, a citizen has the right to engage in entrepreneurial activity without forming a legal entity from the moment of state registration as an individual entrepreneur. Any citizen has the right to conduct business, but not every citizen is able to exercise this right.

To acquire the status of an individual entrepreneur, a citizen must have the following general characteristics of a subject of civil law:- Legal capacity(the ability to have civil rights and bear responsibilities)

- Legal capacity(the ability to acquire and exercise civil rights through one’s actions)

- Have a place of residence(the place where the citizen resides permanently or primarily).

Only capable citizens can carry out entrepreneurial activities, that is, those who are able to independently perform legal actions, conclude and execute them, acquire property and own, use and dispose of it. As a general rule, civil capacity arises in full from the onset of adulthood (on reaching 18 years of age).

The status of an individual entrepreneur is acquired as a result of state registration citizen as an individual entrepreneur.

An unjustified refusal of state registration may be appealed by a citizen in an arbitration court. Refusal of state registration of an entrepreneur is allowed only in cases of discrepancy between the composition of the submitted documents and the composition of the information contained in them with the requirements of the Regulations on the procedure for state registration of business entities (No. 1482).

Property disputes between citizens registered as individual entrepreneurs, as well as between these citizens and legal entities are permitted arbitration courts, with the exception of disputes not related to the implementation of entrepreneurial activities by citizens.

An entrepreneur bears increased responsibility, unlike other citizens, since in accordance with the current legislation (Article 401 of the Civil Code of the Russian Federation), a person who fails to fulfill or improperly fulfills an obligation when carrying out business activities bears responsibility regardless of the presence of guilt. Creditors can also make claims against an individual entrepreneur for obligations not related to business activities (causing harm to the life, health or property of citizens or legal entities, collecting alimony, etc.).

An entrepreneur (individual) can work in any paid position in any private, state or public organization, unless this work or position is prohibited by law from combining this work with entrepreneurship. Unlike legal entities, the property of individual entrepreneurs, which constitute objects of commercial activity, can be passed on by inheritance and by will. But the right to engage in entrepreneurial activity does not pass by inheritance.

Individuals carrying out business activities without registration bear liability, including criminal liability, in accordance with the legislation of the Russian Federation. All income received from such activities is subject to collection to the state.

Commercial activity without forming a legal entity

Two groups of commercial entities

In accordance with Russian legislation, two groups of entities can engage in commercial activities:- citizens or individuals;

- legal entities.

The law establishes equal treatment of citizens and legal entities in determining their rights and obligations, in determining any conditions for doing business (commerce, entrepreneurship) that do not contradict the law.

The concept of an individual entrepreneur

Individual entrepreneur- a citizen engaged in entrepreneurial (commercial) activities without forming a legal entity.

A citizen can act in the market as an individual entrepreneur only from the moment of his state registration.

An independent type of individual entrepreneur is the head of a farm operating without forming a legal entity, who is also recognized as an individual entrepreneur from the moment of state registration of his farm.

Basic rights and obligations of an individual entrepreneur

Citizens registered as individual entrepreneurs have rights and obligations, including:- the right to create legal entities independently or jointly with other persons;

- are obliged to answer for their obligations with all their property;

- may be declared bankrupt by a court decision.

For activities carried out without forming a legal entity, the rules governing the activities of legal entities apply.

Associations of individual entrepreneurs

Engaging in entrepreneurial activity without forming a legal entity is possible not only by individual entrepreneurs, but also by their associations. Such an association is possible only on the basis of a simple partnership agreement. Under a simple partnership agreement, two or more persons pool their contributions and act together without forming a legal entity to make a profit or achieve another goal.

For the validity of this agreement, the simultaneous presence of three mandatory elements is necessary:- common goal;

- connection of deposits of individual entrepreneurs;

- joint activities to achieve the set goal.

When conducting common affairs, each partner has the right to act on behalf of all partners, unless the terms of the agreement provide for other conditions. Moreover, in relations with third parties, the authority of a partner to make transactions on behalf of all partners is certified by a power of attorney issued to him by the other partners.

Partners bear joint liability for all common obligations, regardless of the grounds for their occurrence. Moreover, even if a person ceased his participation in the agreement, but the agreement between the remaining partners was not terminated, he is liable to third parties for general obligations that arose during the period of his participation in the agreement.

Types of individual entrepreneurs.

Types of individual entrepreneurs are presented in Fig. 1.Bankruptcy (insolvency) of an individual entrepreneur.

An individual entrepreneur may be declared bankrupt if he is unable to satisfy the demands of creditors for monetary obligations or fulfill obligations for mandatory payments within three months from the date of their execution and if the amount of his obligations exceeds the value of his property.

Insolvency (Bankruptcy) of an individual entrepreneur

An individual entrepreneur may be declared bankrupt by decision of the arbitration court in the event that he is unable to satisfy the claims of creditors related to his business activities. Also, an individual entrepreneur can voluntarily officially declare bankruptcy.

The grounds and procedure for recognizing an individual entrepreneur are established by Federal Law No. 127 “On Insolvency (Bankruptcy).

The basis declaring an individual entrepreneur bankrupt is his inability to satisfy the demands of creditors for monetary obligations or to fulfill the obligation to make mandatory payments.

Statement declaring an individual entrepreneur bankrupt can be filed by the debtor, creditor, tax and other authorized authorities for requirements for mandatory payments.

The entrepreneur is considered bankrupt and its registration as an individual entrepreneur loses force from the moment the arbitration court makes a decision to declare the individual entrepreneur insolvent and to open bankruptcy proceedings. The entrepreneur's licenses issued to him are revoked.

Out of court An entrepreneur is considered bankrupt after he officially declares his bankruptcy in the “Bulletin of the Arbitration Court of the Russian Federation” and the official publication of the state body for bankruptcy cases.

The debtor's declaration of bankruptcy and its liquidation shall indicate the period for filing claims of creditors and objections of creditors against the liquidation of the debtor, which cannot be less than two months from the date of publication of the said announcement.

An individual entrepreneur declared bankrupt cannot be registered as an individual entrepreneur within one year from the moment he was declared bankrupt.

The arbitration court sends a copy of the decision to declare the individual entrepreneur bankrupt and to open bankruptcy proceedings to the body that registered the citizen as an individual entrepreneur, and also forwards the decision to all known creditors.

Creditors' requirements Individual entrepreneurs are satisfied in accordance with the priority established by law at the expense of the property belonging to him, with the exception of property that cannot be foreclosed on in accordance with Federal Law No. 229 “On Enforcement Proceedings”.

The claims of creditors of each subsequent priority are satisfied after the last satisfaction of the claims of the creditors of the previous priority. If the amount is insufficient to fully satisfy all the claims of creditors of one priority, these claims are satisfied in proportion to the amount of recognized claims of each creditor of this priority.

After completing settlements with creditors, an individual entrepreneur declared bankrupt is considered free from fulfillment of remaining obligations related to his business activities, even if they were not declared to the arbitration court. Also considered repaid, regardless of whether they were actually satisfied, are claims for other obligations not related to business activities that were presented and taken into account by the court when declaring an individual entrepreneur bankrupt.

Exception made only for requirements on compensation for harm caused to life and health, and others personal requirements, which remain in force regardless of whether they were presented during the bankruptcy procedure, in the event that they remained unsatisfied.

Upon completion of the bankruptcy procedure, the bankrupt loses the validity of his registration as an individual entrepreneur and all subsequent disputes from that moment are resolved in the courts of general jurisdiction.

Subjects of economic (entrepreneurial) law are persons directly engaged in business activities, as well as government and local government bodies that regulate and control these activities.

Based on the above definition, the subjects of business law are:

individual entrepreneurs (individuals) - citizens and non-citizens of the Russian Federation;

legal entities (commercial and non-profit organizations), including foreign ones;

Russian Federation, its constituent entities and municipalities.

The most common business entities are individual entrepreneurs and legal entities. They play an important role in combining and using material resources, meeting society's needs for goods, works and services, and creating jobs. In accordance with the law, they are subject to state registration, have civil legal personality and independence, acting in economic transactions on their own behalf. The Constitution of Russia guarantees everyone the right to freely use their abilities and property for entrepreneurial and other economic activities not prohibited by law (clause 1 of Article 34).

According to paragraph 1 of Art. 23 of the Civil Code of the Russian Federation, a citizen has the right to engage in entrepreneurial activity without forming a legal entity from the moment of state registration as an individual entrepreneur (IP). State registration of an individual as an individual entrepreneur is carried out in the manner prescribed by Federal Law No. 129-FZ of August 8, 2001 “On State Registration of Legal Entities and Individual Entrepreneurs” (hereinafter referred to as the “Registration Law”). Individual entrepreneurship in agriculture is carried out in the form of a peasant (farm) enterprise. A farm is not a legal entity. However, in accordance with Art. 86.1 of the Civil Code of the Russian Federation, citizens conducting joint activities in the field of agriculture without forming a legal entity on the basis of an agreement on the creation of a peasant (farm) enterprise (Article 23) have the right to create a legal entity - a peasant (farm) enterprise. An entrepreneur is considered to be the head of a peasant farm, which may consist of one or more persons. Legal features for this type of individual entrepreneurship are established by Federal Law dated June 11, 2003 No. 74-FZ “On Peasant (Farm) Farming”. Citizens (as well as foreign citizens and stateless persons) who have reached the age of 18 years, as well as minors who got married before reaching the specified age, or who are emancipated, i.e. have the right to freely engage in entrepreneurial activities. declared fully capable by decision of the guardianship or trusteeship authorities or by court decision (Article 27 of the Civil Code of the Russian Federation). Minors can register as an individual entrepreneur with the written consent of one of the parents, guardians and trustees (clause “z”, clause 1, article 22.1 of the “Registration Law”). The law does not determine the age of such persons. For certain categories of citizens, federal laws establish a ban on carrying out entrepreneurial activities (for civil servants, military personnel, law enforcement officers, etc.). This restriction is caused by the need to protect the foundations of the constitutional system, morality, health, rights and legitimate interests of other persons, to ensure the defense of the country and the security of the state (Clause 3 of Article 55 of the Constitution of the Russian Federation).

Clause 4 art. 22.1 of the Federal Law of August 8, 2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs” state registration of an individual as an individual entrepreneur is not permitted if: his state registration in this capacity has not expired; a year has not passed since the date of the court’s decision to declare him insolvent (bankrupt) due to the inability to satisfy the claims of creditors related to his previously carried out business activities, or the decision to forcibly terminate his activities as an individual entrepreneur; the period for which the person is deprived of the right to engage in entrepreneurial activity by a court verdict has not expired.

State registration of an individual as an individual entrepreneur who intends to carry out certain types of business activities specified in clauses is not allowed. "to" clause 1 of this article (in the field of education, upbringing, development of minors, organization of their recreation and health, medical care, social protection), if this individual has or has had a criminal record, is or has been subject to criminal prosecution (for with the exception of persons against whom criminal prosecution was terminated on rehabilitative grounds) for crimes against life and health, freedom, honor and dignity of the individual (with the exception of illegal placement in a psychiatric hospital, slander and insult), sexual integrity and sexual freedom of the individual, against family and minors, public health and public morality, the foundations of the constitutional order and state security, as well as against public safety.

The rules of the civil code that regulate the activities of legal entities that are commercial organizations are applied to entrepreneurial activities of citizens carried out without forming a legal entity, unless otherwise follows from the law, other legal acts or the essence of the legal relationship.

Peculiarities of the activities and legal status of individual entrepreneurs: for state registration as an individual entrepreneur, “starting” (authorized, share, share) capital is not required, you only need to pay a state fee; during state registration, a smaller number of documents are drawn up (there are no minutes of general meetings, constituent documents, etc.); An individual entrepreneur is not required to keep accounting records (he only keeps tax records, reflecting business transactions in the “Book of Income and Expenses,” which is registered with the tax authority); Individual entrepreneurs bear a lighter tax burden, because for the main type of activity, he pays personal income tax (NDFL), the rate of which is significantly lower than the corporate income tax rate;

in relation to individual entrepreneurs, only the judicial procedure for collecting taxes is applied, and from legal entities taxes can be collected out of court;

for individual entrepreneurs there is an easier (compared to legal entities) transition to a simplified taxation system;

Individual entrepreneurs are not subject to the restrictions established by the Central Bank of the Russian Federation for cash payments;

An individual entrepreneur has the right, but is not obliged, to have a personal seal and a bank account;

Individual entrepreneurs have the right to use the labor of hired workers;

The individual entrepreneur is liable for his obligations with all the property belonging to him, with the exception of property that cannot be foreclosed on (the list is established by Article 446 of the Code of Civil Procedure of the Russian Federation).

It should be noted that state registration as an individual entrepreneur loses its force with the death of an individual, the right to entrepreneurial activity is not inherited, only the property of the entrepreneur is inherited.

Related information.

Subjects of economic (entrepreneurial) law- these are persons directly engaged in business activities, as well as government and local government bodies that regulate and control these activities.

Based on the above definition, the subjects of business law are:

- individual entrepreneurs (individuals) - and non-citizens of the Russian Federation;

- legal entities (commercial and non-profit organizations), including foreign ones;

- Russian Federation, its constituent entities and municipalities.

The most common business entities are individual entrepreneurs and legal entities. They play an important role in combining and using material resources, meeting society's needs for goods, works and services, and creating jobs. In accordance with the law, they are subject to state registration, have civil legal personality and independence, acting in economic transactions on their own behalf.

The Constitution of Russia guarantees everyone the right to freely use their abilities and property for entrepreneurial and other economic activities not prohibited by law (clause 1 of Article 34).

Citizens (as well as foreign citizens and stateless persons) who have reached the age of 18 years, as well as minors who got married before reaching the specified age, or who are emancipated, i.e. have the right to freely engage in entrepreneurial activities. declared fully capable by decision of the guardianship or trusteeship authorities or by court decision (Article 27 of the Civil Code of the Russian Federation). Minors can register as an individual entrepreneur with the written consent of one of the parents, guardians and trustees (clause “z”, clause 1, article 22.1 of the “Registration Law”). The law does not determine the age of such persons.

For certain categories of citizens, federal laws establish a ban on carrying out entrepreneurial activities (for civil servants, military personnel, law enforcement officers, etc.). This restriction is caused by the need to protect the foundations of the constitutional system, morality, health, rights and legitimate interests of other persons, to ensure the defense of the country and the security of the state (Clause 3 of Article 55 of the Constitution of the Russian Federation).

Clause 4 art. 22.1 of the Federal Law of August 8, 2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs” state registration of an individual as an individual entrepreneur is not permitted if:

- his state registration in this capacity has not expired;

- a year has not passed since the date of the court’s decision to declare him insolvent (bankrupt) due to the inability to satisfy the claims of creditors related to his previously carried out business activities, or the decision to forcibly terminate his activities as an individual entrepreneur;

- the period for which the person is deprived of the right to engage in entrepreneurial activity by a court verdict has not expired.

State registration of an individual as an individual entrepreneur who intends to carry out certain types of business activities specified in clauses is not allowed. "to" clause 1 of this article (in the field of education, upbringing, development of minors, organization of their recreation and recovery, medical care, social protection), if this individual has or has had, is subject to or has been subject to criminal prosecution (with the exception of persons against whom criminal prosecution was terminated on rehabilitative grounds) for crimes against life and health, freedom, honor and dignity of the individual (with the exception of illegal placement in a psychiatric hospital, slander and insult), sexual integrity and sexual freedom of the individual, against family and minors , public health and public morality, the foundations of the constitutional order and state security, as well as against public safety.

The rules of the civil code that regulate the activities of legal entities that are commercial organizations are applied to entrepreneurial activities of citizens carried out without forming a legal entity, unless otherwise follows from the law, other legal acts or the essence of the legal relationship.

Features of the activities and legal status of individual entrepreneurs:

- for state registration as an individual entrepreneur, “starting” (authorized, share, share) capital is not required, you only need to pay a state fee;

- during state registration, a smaller number of documents are drawn up (there are no minutes of general meetings, constituent documents, etc.);

- An individual entrepreneur is not required to keep accounting records (he only keeps tax records, reflecting business transactions in the “Book of Income and Expenses,” which is registered with the tax authority, however, currently most individual entrepreneurs entrust accounting to third-party specialized companies -);

- Individual entrepreneurs bear a lighter tax burden, because for the main type of activity, he pays personal income tax (NDFL), the rate of which is significantly lower than the corporate income tax rate (more information about taxes for individual entrepreneurs at the link);

- in relation to individual entrepreneurs, only the judicial procedure for collecting taxes is applied, and from legal entities taxes can be collected out of court;

- for individual entrepreneurs there is an easier (compared to legal entities) transition to a simplified taxation system;

- Individual entrepreneurs are not subject to the restrictions established by the Central Bank of the Russian Federation for cash payments;

- An individual entrepreneur has the right, but is not obliged, to have a personal seal and a bank account;

- Individual entrepreneurs have the right to use the labor of hired workers;

- The individual entrepreneur is liable for his obligations with all the property belonging to him, with the exception of property that cannot be foreclosed on (the list is established by Article 446 of the Code of Civil Procedure of the Russian Federation).

It should be noted that state registration as an individual entrepreneur loses its force with the death of an individual, the right to entrepreneurial activity is not inherited, only the property of the entrepreneur is inherited.

Legal science has developed its own criteria for determining the subject of law, which include, firstly, the sign of a person’s isolation from others, his autonomy, secondly, identifiability, individualization, and thirdly, volition. The fourth sign of a subject of law, the manifestation of oneself externally as a participant in legal relations, legal communication, presupposes the recognition of a person as a party to legal relations. The fifth sign involves the expression of an attitude towards a person as the most important social and legal value.

If the moment of a person's birth marks the emergence of a legal personality, then the death of a person, as is usually considered, ceases the existence of a legal personality. At the same time, the termination of a person’s legal personality and the termination of legal capacity are usually considered as identical concepts. Arkhipov S.I. in this regard, he notes that legal capacity as a person’s ability to be a subject of law actually ceases with the death of a person, but only for the future, as the ability to make legal decisions and perform legal actions in the future. As for the legal will expressed before the death of a person, it retains a connection with the legal order system, is supported and ensured by it. Indeed, one can agree with this, since this can be evidenced, for example, by the institution of inheritance by will. Thus, different views are highlighted on the moment of termination of the existence of a subject of law of an individual. At the same time, the law establishes that a citizen’s legal capacity is terminated by death. At the same time, protection of the honor and dignity of a citizen is permitted at the request of interested parties even after his death. Accordingly, such a citizen continues to have the right to the protection of intangible benefits: honor and dignity.

The legal capacity of a legal entity, as noted earlier, terminates from the moment an entry is made about its exclusion from the unified state register of legal entities.

Let us summarize some of the above discussions.

A subject of law is an individual or organization that has a set of rights and obligations enshrined in law and is capable of entering into legal relations.

The most frequently used division of subjects of law into individuals (individuals, people) and legal entities. In this case, the following division criteria are distinguished:

Natural or artificial (rational) character, their natural or artificial nature;

- “individual-collective” criterion for dividing subjects of law;

Criterion of primacy and derivativeness;

A criterion for dividing individuals and legal entities by quantity, the number of individuals forming the legal personality (according to the human substrate).

At the same time, the identification of other subjects of law besides a legal entity and an individual is noted as inappropriate, leading to the fact that the legal personality is torn into pieces by industry legislation.

At the same time, it seems to us most appropriate to distinguish individuals and legal entities depending on their natural or artificial nature. Citizens (individuals) are natural subjects of law; they arose and exist regardless of belonging to certain forms of political societies. In contrast to this category of subjects are legal entities (organizations), which are artificial subjects and can only exist where law exists. This is also confirmed by the moment of emergence of these two categories of subjects and the moment of termination of their legal capacity.

The subject of law has its own legal properties and characteristics. The most important properties of a subject of law are legal capacity and capacity.

In support of the above arguments, it should be noted once again that the termination of the existence of a natural person is associated with natural processes; the moment of termination of a legal entity is regulated by law.

Thus, at this stage we have come to the conclusion that law distinguishes between natural and artificial subjects: individuals and legal entities, respectively.

INDIVIDUAL ENTREPRENEUR AS A SUBJECT OF CIVIL LAW

2.1. The concept of an individual entrepreneur

Based on the above-mentioned system of studying the subject of civil law, consideration of the issue of an individual entrepreneur as a subject of civil law should begin with the definition of this concept.

Individual entrepreneurs are citizens engaged in entrepreneurial activities and registered in the prescribed manner.

Danilina I.E. gives a broader definition of an individual entrepreneur, which is understood as a capable citizen who independently carries out business activities at his own peril and risk and under his personal property responsibility and is registered for these purposes in the prescribed manner. This definition is closely related to the definition of entrepreneurial activity contained in Article 2 of the Civil Code of the Russian Federation.

Turning to earlier sources, we can conclude that one of the broadest definitions was the definition contained in the RSFSR Law on Enterprises and Entrepreneurial Activities of December 25, 1990. Citizens of the Russian Federation, foreign citizens, and stateless persons engaged in such activities were recognized as individual entrepreneurs. They act using property that belongs to them by right of ownership or by the right of economic management (at that time it was allowed to use the right of economic management in relation to the property of not only enterprises, but also citizens). The director of an enterprise was interpreted in the law in question not as an entrepreneur, but as an official heading the enterprise.

In modern literature, when defining the concept of an individual entrepreneur, it is indicated that in order to disclose it it is necessary to understand the essence of the concept of “subject of civil law”. This issue was raised by us in previous discussions. In this case, an individual entrepreneur is defined as a business entity. The study of a business entity presupposes preliminary knowledge of the status of a subject of civil law, the legal regime of which fully applies to the business entity. In other words, before becoming a subject of entrepreneurial activity, a person is a subject of civil law. Zhilinsky S.E. a business entity, which is an individual entrepreneur, means a subject of civil law who, at his own risk, carries out independent activities aimed at systematically making a profit from the use of property, the sale of goods, the performance of work or the provision of services, and who is registered in this capacity in the prescribed manner law order .

The Civil Code does not provide a specific definition of an individual entrepreneur, limiting itself to the definition of entrepreneurial activity. Thus, the definitions existing in the doctrine are, one way or another, related to the definition of this particular type of activity.

In our opinion, it would be advisable to introduce an article into the Civil Code containing, if not the definition of an individual entrepreneur, then at least its characteristics, similar to Article 48 of the Civil Code of the Russian Federation, which reflects the characteristics of a legal entity.

An individual entrepreneur is an individual who has the legal status of an individual entrepreneur in accordance with state registration in this capacity, carries out business activities and has a set of rights and obligations determined by the specifics of the activity, capable of being a plaintiff and defendant in court.

2.2. The emergence and essence of the legal status of an individual entrepreneur

The starting point from which the activity of an individual entrepreneur begins is considered to be the moment of state registration as an individual entrepreneur.

The procedure for state registration of an individual entrepreneur as a business entity, which, as we established above, is, first of all, a subject of civil law, has a constitutive significance. In other words, the status of an individual entrepreneur arises only after registration. However, the constitutionality of registration was somewhat shaken with the adoption of the first part of the Civil Code, according to paragraph 4 of Article 23 of which an individual entrepreneur does not have the right to refer in relation to transactions concluded by him to the fact that he is not an entrepreneur, since he has not passed state registration. The court may apply to such transactions the rules on obligations associated with carrying out business activities.

Table of contents

Task 1. 3

Task 2. 12

Task 4. 14

List of sources and literature 17

Task 1.

Individual entrepreneurs as subjects of entrepreneurial activity. The procedure for registering business activities without forming a legal entity, the procedure and consequences of its termination.

An individual entrepreneur is an individual registered in the prescribed manner and carrying out entrepreneurial activities without forming a legal entity.

The restrictions on acquiring the status of an individual entrepreneur are as follows.

1. Age. Citizens (as well as foreign citizens and stateless persons) who have reached the age of 18, as well as minors who got married before reaching this age, or who are emancipated, have the right to engage in entrepreneurial activity. declared legally competent by decision of the guardianship or trusteeship authority or by court decision (in accordance with Article 27 of the Civil Code).

Minors have the right to acquire the status of an individual entrepreneur and register as such with the written consent of their parents, adoptive parents, and trustees (Article 22.1 of the Registration Law). The law does not determine the age of such persons. In our opinion, it should be set at 16 years. It is from this age that tax, administrative liability, and criminal liability for economic crimes begin. Please note that an individual who has reached the age of 16 can become a member of a farm. The written consent of the parents must be considered not only as a condition for registering a minor entrepreneur, but also as a permanent consent for him to carry out transactions in the process of carrying out entrepreneurial activities. Otherwise, according to Art. 26 of the Civil Code, a minor entrepreneur (aged 14 to 18 years) will be required to obtain written consent from parents, adoptive parents, and trustees for most transactions. He will not be able to independently obtain a loan, tax credit, act as a supplier, contractor, etc. It seems that on this issue it is necessary to amend Art. 26 of the Civil Code of the Russian Federation or at least an explanation from higher judicial authorities.

2. Health status in itself is not an obstacle to state registration of a person as an individual entrepreneur. But persons recognized as incompetent (they do not independently participate in transactions, transactions are carried out on their behalf by their guardians - Article 29 of the Civil Code of the Russian Federation), or persons limited in legal capacity by a court decision, who independently have the right to carry out only small everyday transactions, do not have the right to engage in entrepreneurial activity (Article 30 of the Civil Code of the Russian Federation). The Registration Law does not directly indicate grounds for refusal to register citizens as individual entrepreneurs, such as incapacity and limited legal capacity. But this does not mean that they cannot be denied registration on these grounds. The legislation on state registration consists of the norms of the Civil Code of the Russian Federation, the Law on Registration of Legal Entities and Individual Entrepreneurs and other regulatory legal acts of the Russian Federation issued in accordance with them (Article 1 of the Law on Registration). From the meaning of the above provisions of the Civil Code - Art. Art. 26, 29, 30 Civil Code of the Russian Federation, art. 22.1 of the Law on Registration it follows that the incapacity and limited legal capacity of citizens, as obvious obstacles to engaging in entrepreneurial activity, should be considered as grounds for refusal of registration. It seems, however, that in the Registration Law these facts should be indicated as circumstances impeding registration, as well as a mechanism for identifying and verifying these circumstances impeding registration. It must be borne in mind that there are also restrictions (contraindications) for persons who are capable, but suffer from various serious diseases, to work at heights, underground, work that requires quick reaction and caution (in transport, in security with weapons, etc.). But such circumstances that impede the performance of specific work are identified not at the time of registration, but upon receipt of a driver’s license, license to carry a weapon, and, in certain cases, upon certification of specialists and issuance of a license.

3. It is prohibited for citizens holding positions in connection with their state civil service to engage in entrepreneurial activity (Article 17 of the Federal Law of July 27, 2004 “On State Civil Service in the Russian Federation”). When the General Prosecutor's Office of the Russian Federation checked compliance with anti-corruption legislation in the authorities of the constituent entities of the Russian Federation in 2004, it was found that almost everywhere officials are engaged in commercial activities, participate in the management of various kinds of structures, and derive other benefits from their position. However, the Registration Law does not provide for such grounds for refusal of registration as the performance by a person of the duties of an official in the public service system. That is why there are so many violations in this......

List of sources and literature

1. Constitution of the Russian Federation. Adopted by popular vote on December 12, 1993. // Russian newspaper. 1993. No. 237;

2. Civil Code of the Russian Federation (parts one and two) // Collection of Legislation of the Russian Federation dated December 5, 1994, No. 32, Art. 3301, Collection of Legislation of the Russian Federation dated January 29, 1996 No. 5, Art. 410.

3. Belyaeva O.A. Business law of Russia. – M., 2011. – 415 p.

4. Bykov A.G. Entrepreneurial Law – M., 2011. – 325 p.

5. Business law / Ed. N.I. Klein. M., 2011. 418 p.

6. Business law of the Russian Federation / Ed. E.P. Gubina, P.G. Lakhno. - M.: Yurist, 2011. – 458 p.

History of Citizen Watches Citizen watches - a Japanese miracle of precision

History of Citizen Watches Citizen watches - a Japanese miracle of precision Organization of development of new products Organization and planning of production

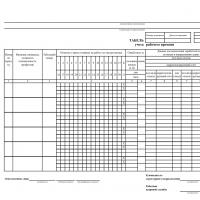

Organization of development of new products Organization and planning of production Guidelines for the use of time sheets

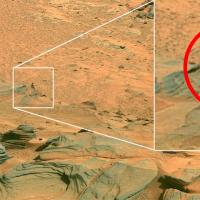

Guidelines for the use of time sheets High resolution photo of the surface of Mars (43 photos) Images of Mars by NASA

High resolution photo of the surface of Mars (43 photos) Images of Mars by NASA Job description of production manager (chef)

Job description of production manager (chef) Presentation - corrosion of metals and methods of protection against corrosion Chemical corrosion is caused by interaction

Presentation - corrosion of metals and methods of protection against corrosion Chemical corrosion is caused by interaction Management forces you to go to cleanup, threatening to fire you if you don’t show up. Cleanup on a day off.

Management forces you to go to cleanup, threatening to fire you if you don’t show up. Cleanup on a day off.