Basic production assets. Ministry of Education of Ukraine Forms of simple reproduction of fixed assets

It is worth saying that the policy in the field of reproduction of fixed assets should be carried out both at the macro and micro levels, since it is this policy that determines the quantitative and qualitative state of fixed assets.

Reproduction of fixed assets- ϶ᴛᴏ a continuous process of their renewal through the acquisition of new ones, reconstruction, technical re-equipment, modernization and overhaul, including the following interrelated stages (Fig. 6.):

- creation;

- consumption;

- depreciation;

- restoration and refund.

In the diagram, the stages of reproduction of fixed assets are divided into two parts. It is important to note that one part is ϶ᴛᴏ creation of fixed assets, which most often happens outside the enterprise. The creation of fixed assets in ϲᴏᴏᴛʙᴇᴛϲᴛʙii with their structure occurs in two areas: in the construction industry and mechanical engineering, including in instrument making. The second part - ϶ᴛᴏ stages, which are carried out within the enterprise.

The initial stage of reproduction of fixed assets, which is carried out at the enterprise, will stage of their acquisition and formation... It is worth saying that for a new enterprise, which is just being created, the formation process means construction of buildings and structures, purchase of equipment, which controls the technological process, cost and quality of products.

Figure № 6. Stages of reproduction of fixed assetsFor an operating enterprise, the formation of fixed assets includes, first of all, the following stages:

- an inventory of existing and used fixed assets in order to identify obsolete and worn-out elements of fixed assets;

- analysis of the existing equipment, technology and organization of production;

- selection (taking into account the specific specifics of production and the planned volume of production) of the volume and structure of fixed assets. Next comes the process of reinstalling existing equipment, purchasing, delivery and installation of new equipment.

Completes the reproduction of fixed assets the process of their restoration or reimbursement. Recovery of fixed assets can be carried out through repairs (current, medium and capital) at the expense of depreciation deductions, as well as through modernization and reconstruction.

Forms of simple and extended reproduction

There are various forms of simple and extended reproduction of fixed assets. Forms of simple reproduction- replacement of obsolete means of labor and major repairs, forms of expanded reproduction- new construction, expansion of existing enterprises, their reconstruction and technical re-equipment, modernization of equipment.

It is worth saying that each of these forms solves certain problems, has advantages and disadvantages. So, due to new construction, new enterprises are put into operation, on which all elements of fixed assets meet the modern requirements of technical progress. During the period when production is declining and many enterprises stop their activities, preference should be given to the reconstruction and technical re-equipment of existing enterprises.

Reconstruction most often it can occur in two ways:

- in the first variant, in the process of reconstruction according to a new project, the expansion and reorganization of existing structures, workshops, etc.

- in the second option, the main part of capital investments is directed to the renewal of the active part of fixed assets (machinery, equipment) using old industrial buildings and structures.

Usually the second variant of reconstruction in economic practice is called technical re-equipment. An increase in the share of equipment costs makes it possible, with the same volume of capital investments, to obtain a greater increase in production with significantly lower material costs and in a shorter time than the construction of new enterprises, and on the basis of increasing labor productivity and reducing the cost of production.

The form of expanded reproduction fixed assets will also be the modernization of equipment, which means its renewal in order to completely or partially eliminate the obsolescence of the second form and increase the technical and economic indicators to the level of similar equipment of more advanced designs.

Equipment modernization can be carried out in several directions:

- improving the designs of operating machines, increasing their operating characteristics and technical capabilities;

- mechanization and automation of machine tools and mechanisms, allowing to increase the productivity of equipment;

- transfer of equipment to software control.

Modernization of equipment is economically effective if, as a result of its implementation, the annual volume of production increases, labor productivity increases and the cost of production decreases. If it is necessary, the profitability of production would increase. The latter can be achieved if the relative increase in profit is greater than the increase in the cost of production assets as a result of the cost of modernization.

The main purpose of reproduction of fixed assets- providing enterprises with fixed assets in their quantitative and qualitative composition, as well as maintaining them in working order.

In the process of reproduction of fixed assets, the following tasks are solved:

- reimbursement of fixed assets retired for various reasons;

- an increase in the mass of fixed assets in order to expand the volume of production;

- improvement of the species, technological and age structure of fixed assets, i.e. raising the technical level of production.

The process of reproduction of fixed assets can be carried out from various sources.

It is worth noting that fixed assets for the reproduction of fixed assets at an enterprise can come through the following channels:

- as a contribution to the authorized capital of the enterprise;

- as a result of capital investments;

- as a result of a gratuitous transfer;

- due to the lease.

Quantitative characteristics of the reproduction of fixed assets during the year is shown in the balance sheet of fixed assets at initial cost according to the following formula:

Фк = Фн + Фв - Фл ,

- Фк - the cost of fixed assets at the end of the year;

- Фн - the cost of fixed assets at the beginning of the year;

- Фв - the cost of fixed assets put into operation during the year;

- Fl is the value of fixed assets liquidated during the year.

For a more detailed analysis of the process of reproduction of fixed assets, you can use the following indicators:

- the coefficient of renewal of fixed assets;

- the growth rate of fixed assets;

- retirement rate of fixed assets;

- capital-labor ratio;

- technical equipment, etc.

The dynamics of these indicators testifies to the reproduction policy that is carried out at the enterprise. Excluding the above, the problem of reproduction of fixed assets is solved by the implementation of the following depreciation, investment and tax policy.

Basic production assets- these are the means of labor employed in a specific process associated with the production of goods or services - the main component of the PTB. But the means of labor are extremely heterogeneous in composition and structure.

For analytical and statistical accounting and reporting, OPF is divided into groups:

- building;

- structures;

- transmission devices;

- cars and equipment;

- vehicles;

- instruments;

- production inventory and equipment;

- household inventory;

- working and productive livestock;

- perennial plantings;

- capital expenditures for land improvement (without structures);

- other fixed assets.

Each enterprise, manufacturing company has a very specific OPF structure, i.e. the percentage of the listed groups, determined not only by the specifics of the enterprise, its industry affiliation, but also by those natural and climatic conditions in which it operates - regional features. So, for enterprises located in the southern regions, there is no need for buildings that can protect against severe frost and snow, but special equipment is required to create normal conditions for those working in hot weather: heaters, fans, etc. Consequently, the structure of OPF enterprises depends on the specifics of their activities and regional characteristics and manifests itself in the predominance of those elements that best meet these characteristics. For example, for energy enterprises - buildings and structures; for mechanical engineering and metalworking - machinery and equipment, tools of automobile enterprises, vehicles, etc.

For a special sphere, such a clear division cannot be made, since the activities of economic entities in it are extremely heterogeneous. So, if for dry cleaning enterprises, for example, a group of machines and equipment will prevail in value, then for public catering enterprises this group will be close to the cost of buildings, while for consumer services enterprises a large share will fall on the building.

Since various groups of OPF take unequal participation in production activities, it is customary in the economic literature and business practice to divide them into two large groups: active and passive. The active part is those elements of the OPF that are directly involved in the production of goods and services (machines, equipment, tools, vehicles, inventory involved in the technological process). Passive part OPF are those that do not participate in the production process, but create favorable conditions for it (workshop buildings - for workers and machinery (equipment), warehouse buildings - for employees and material values, etc.). Auxiliary equipment provides the necessary sanitary and hygienic working conditions and the fight (prevention) against force majeure situations.

Due to the extreme heterogeneity of the OPF elements, it is impossible to automatically assign all of them to one or another group on a common basis. For example, in addition to the main one, an enterprise may have fire-fighting, ventilation and other equipment that is not involved in the production process.

The classification of OPF according to the considered characteristics is not only theoretical, but also of great practical importance, determining the reproductive and technological structure of capital investments in the development of the production and technical base during planning - shifts in the investment and technical policy of the enterprise.

In turn, this policy can be focused on the extensive or intensive development of the enterprise.

Extensive planning development assumes that the volume of production and its technology remain unchanged for a sufficiently long period of time. This path is possible with a stable demand for goods and services and is typical, for example, for public catering establishments, consumer services for the population, trade and others that provide services. They are characterized by the replacement of physically obsolete equipment with a similar one, although in this case obsolescence can also be taken into account, and when replaced, a more economical in energy consumption, easier to operate and maintain, is installed.

Enterprises producing consumer goods tend to plan an intensive development path, which is often associated with the reconstruction and modernization of production, when the obsolescence of equipment is largely taken into account. More productive and modern machines and mechanisms are being replaced, allowing more efficient use of labor, material and financial resources of the enterprise. Therefore, when determining the investment policy, it is important not only to plan capital investments to improve the structure of the FTB, but also composition of OPF... Having determined, for example, that a large share of funds should be directed to the development of their active part, it is necessary to establish which elements should be purchased, in what quantity, in what time frame and in what sequence.

Analysis of the structure of fixed assets

The methodological basis for such an analysis is the division of the OPF into active and passive parts. It should be borne in mind that not all elements of these parts are equally involved in the production process and that they have a different effect on its performance. Therefore, for a more in-depth analysis of the structure of the OPF, it is advisable in their active part to single out and take into account separately the means of mechanization and automation of labor as the main element of the active part of the OPF.

The absolute indicators for the analysis of the structure of the OPF are:

- the cost of the OPF, determined as the residual value at the time of analysis (Фо);

- the cost of the active part of the OPF (Ft);

- the cost of the means of mechanization and automation of labor (FM), obtained by excluding from the value of Ft the cost of the remaining elements, also determined by their residual value.

Absolute indicators are supplemented by relative ones, which can be expressed as a percentage or in rubles of the cost per employee. These indicators include:

- capital-labor ratio(Fe), which can be calculated for all workers (including support personnel) - Fv 1 or only for workers directly involved in the production of goods and services - Fv 2:

- technical equipment of labor(FWT) reflects to a greater extent the influence of technical means on working conditions and production processes;

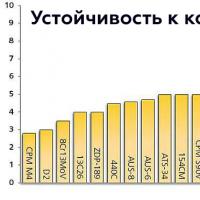

- mechanic-to-labor ratio(FVM) characterizes the progressiveness of the OPF structure, the level of mechanization and automation of labor of workers employed in the technological process of production, the advantages and disadvantages of investment policy.

The latter indicators, like the capital-labor ratio, can be calculated in relation to all workers or only to the main workers. In general, the indicators of the analysis of the structure of the OPF are presented in the table.

For more convincing judgments about the results, further directions of investment policy and the technological structure of capital investments, it is advisable to supplement the absolute and relative indicators specific... This is necessary, since the structure of the active part of the OPF should be progressive, that is, with a predominance of elements that have a direct impact on labor productivity.

For enterprises and organizations that pay due attention to long-term planning, have a business plan and constantly monitor and analyze the progress of its implementation, the results of the analysis of the OPF structure are required for the corresponding sections of the plan, which reflect the dynamics of the results of economic activities. For long-term planning, such areas act as a source of financial resources, profit growth and other financial and economic indicators that characterize the effectiveness of work and the effectiveness of decisions. It follows from this that the ultimate goal of analyzing the structure of the OPF in combination with the data of the analysis of other sections of the business plan should be the development of measures aimed at strengthening the action of factors that have a positive effect on the results of economic activity, and smoothing (warning) the influence of those factors that have a negative the effect. In this regard, forecasting possible risks and avoiding a crisis state of the enterprise acquire great importance for working in market conditions.

Reproduction of fixed assets

In modern conditions, the most effective reproduction structure of capital investments is the technical re-equipment and reconstruction of existing enterprises. These forms of reproduction of OPF are the most effective, since they are carried out in a fairly short time and with lower financial costs than such forms as reconstruction and new construction.

Technical re-equipment basically excludes construction work, ensuring the introduction of new technological means and technical processes in the shortest possible time and with a fairly quick return on capital costs. These two conditions make it possible to consider technical re-equipment as the most important form of reproduction contributing to the intensification of production, i.e. increasing the volume of work or services with the same number of personnel of the enterprise or maintaining the achieved results while reducing its number.

Technical re-equipment is carried out, as a rule, without expanding production areas in order to improve technical equipment and reduce manual labor in certain areas of production by introducing new technology, changing production technology on this basis, mechanizing and automating basic and auxiliary works, replacing old equipment with new ones. In this case, the costs are mainly associated with the replacement of equipment, i.e. the active part of the OPF, and the share of construction and installation work, as a rule, does not exceed 10% of capital investments provided for technical re-equipment.

Reconstruction- This is a partial or complete re-equipment and reorganization of the enterprise, carried out according to a single project. Reconstruction is carried out to solve one or more of the following tasks:

- increasing the capacity of the enterprise;

- change in the range of products;

- re-profiling of the enterprise.

Reconstruction is often carried out without expanding production areas, but if necessary, new ones are built and the existing main and auxiliary facilities are expanded. At the same time, morally and physically obsolete (worn out) mechanisms and equipment are replaced; mechanization and automation of production are carried out (especially "bottlenecks" in its technological conditions and auxiliary services). Most often, reconstruction is associated with a change in the profile of an enterprise and an orientation towards the release of new products at existing production facilities.

Usually, the results of reconstruction do not lead to an increase in the number of employees, but contribute to an increase in their labor productivity and an improvement in working conditions. During the reconstruction, measures are being taken to improve environmental protection (by reducing harmful emissions into the atmosphere and waste of the main production).

During reconstruction, as a rule, the share of costs for the active part of the OPF is lower than for technical re-equipment, since construction and installation work associated with the construction of buildings and structures attributed to the passive part of the OPF make up most of the cost of work.

Currently, new building materials and structures allow construction and installation work to be carried out in a shorter time frame and at lower costs, which reduces the cost of reconstruction of enterprises as a whole.

On the day of the beginning of reproduction, it is important to determine the state of the OPF and the degree of wear of their active part. This is characterized by a technical condition. The wear rate is determined by the formula

where P is the initial cost of the OPF, p .; О - residual value of OPF, p.

OPF are subject to wear both during operation and during inactivity - under the influence of atmospheric conditions and internal processes in the structure of materials.

Physical depreciation is determined as a percentage of the initial and replacement cost by examining the object and its most important units, and the depreciation of the active part of the OPF - by comparing the actual service life of Tf with the Tn standards.

Physical and moral deterioration can be complete or partial. Full wear requires replacement, and partial wear requires repair or modernization.

Constant wear and tear of the means of labor requires funds to compensate for wear and tear and their reproduction; this is done through depreciation.

Depreciation- this is the compensation in the monetary value of the depreciation of the OPF, a method of transferring the value of the fixed assets to the goods produced. The deductions to reimburse the worn out part of the fixed assets are called depreciation... They arise as a result of the distribution of the total cost of the object over the entire useful (standard) period of its service for the year. This value is expressed through the depreciation rate Na - the annual percentage of transferring the value of the fixed assets to the finished product:

where A is the amount of depreciation deductions for the year, p .; Fo - the initial cost of the OPF, p.

Reproduction of fixed assets is a continuous process of their renewal. The main goal of the reproduction of the production plant is to provide enterprises with fixed assets in their quantitative and qualitative composition, as well as to maintain them in working order.

In the process of reproduction of PF, the following tasks are solved:

1) reimbursement of retiring PF;

2) an increase in the mass of production facilities in order to expand the volume of production;

3) improvement of the species, technological and age structure of the PF, i.e. raising the technical level of production.

There are various forms of simple and extended reproduction of fixed assets. Forms of simple reproduction- repair, modernization of equipment and replacement of physically worn-out and technically obsolete means of labor.

Forms of expanded reproduction fixed assets:

Technical re-equipment (at a qualitatively new level) of the operating enterprise;

Reconstruction and expansion;

New construction.

The forms of restoration (reproduction) of fixed assets are shown in Figure 3.1.

The costs of repairing and modernizing the OS are reasonable only if the cost of acquiring a new object and the losses from under-depreciation of the old one are much higher than the costs of repairing and modernizing the OS.

By the volume of complexity, they distinguish between current (small), medium, capital and recovery.

Maintenance produced in the process of operating the OS without a long interruption in the production process. Replacement of individual parts, assemblies.

Major overhaul associated with a complete disassembly of the machine, replacement of all worn out parts and assemblies. It is carried out in accordance with the scheduled preventive maintenance schedules. Equipment after overhaul must fully comply with its technical characteristics.

If medium repair produced with a frequency of more than a year, it is close to major repairs, with a frequency of less than a year - to current repairs.

Refurbishment repair- This is a special type of repair caused by various circumstances: natural disasters, military destruction, prolonged inactivity of the PF.

Figure 3.1. Forms of restoration of fixed assets

The costs of all types of repairs are carried out at the expense of the repair fund. The repair fund is formed at the expense of deductions determined on the basis of the book value of fixed assets and the standards of deductions approved by the enterprise. If the company does not create a repair fund, then the costs of repairs are included in fixed costs.

The planning of the repair fund is carried out according to the following scheme:

1) the number of repairs for the entire service period is determined as an integer obtained by dividing the service life of the equipment by the duration of the overhaul period. Repairs occurring at the end of the last period of the equipment operation are not carried out. In addition, overhaul "absorbs" other types of repairs, if the time of their implementation does not coincide;

2) the cost of repairs for the entire service life of the equipment is calculated as the product of the complexity of one repair in units of repair complexity, costs per unit of repair complexity and the number of repairs for the entire service life of the equipment;

3) the annual amount of the repair fund for the unit and all equipment is calculated;

4) an estimate of the costs of the elements for the repair of equipment in the planned period is drawn up (for wages, material costs, etc.).

Modernization equipment is its improvement in order to prevent technical and economic aging and increase technical and operational parameters to the level of modern production requirements. It is carried out at the expense of the means of development of production from the profit of the enterprise.

According to the degree of renovation, they distinguish between partial and complex modernization (radical alteration). According to the methods and tasks of carrying out, modernization is distinguished: typical(massive changes of the same type in serial designs) and target(improvements related to the needs of a specific production).

Conditional savings or additional profit from upgrading:

DC =DP = (C1 - C 2)* V 2 ,

where DC is the reduction in production costs; DП - additional profit; С 1, С 2 - production cost before and after modernization; V 2 - the volume of production after modernization.

The material and technical basis of the production process at any enterprise is the main production assets. In a market economy, the initial formation of fixed assets, their functioning

look at abstracts similar to "Reproduction of fixed assets"

Ministry of Education of Ukraine

Dnipropetrovsk State University

Faculty of Radiophysics

Department of ASOI

on the discipline "Enterprise Economics" on the topic: "Reproduction of fixed assets"

| Completed | Checked |

| Senior group RS-97-1 | Assistant professor management |

| Nemtsev P.I. | Bondarenko I.I. |

Dnipropetrovsk

Introduction 3

Fixed production assets 4

Sources of financing for the reproduction of fixed assets. 7

Appointment of depreciation in simple and extended reproduction of fixed assets 12

The role of depreciation in the accumulation of fixed assets. 15

List of used literature 19

Introduction

The material and technical basis of the production process at any enterprise is the main production assets. In a market economy, the initial formation of fixed assets, their functioning and expanded reproduction is carried out with the direct participation of finance, with the help of which targeted monetary funds are formed and used, mediating the acquisition, operation and restoration of labor instruments.

In this essay, the methods of reproduction of OPF will be considered.

Basic production assets

The initial formation of fixed assets at newly created enterprises occurs at the expense of fixed assets, which are part of the authorized capital. Fixed assets are cash invested in fixed assets for production and non-production purposes.

OPF industry is a huge number of means of labor, which, despite their economic homogeneity, differ in purpose, service life. Hence, it becomes necessary to classify fixed assets into certain groups, taking into account the specifics of the production purpose of various types of assets.

Buildings are architectural and construction objects designed to create the necessary working conditions. The buildings include production buildings of workshops, depots, garages, warehouses, production laboratories, etc.

Structures - engineering construction objects intended for certain technological functions are necessary for the implementation of the production process with a change in the objects of labor. Facilities include pumping stations, tunnels, mats, etc.

Transfer devices with the help of which energy of various types is transmitted, as well as liquid and gaseous substances of oil, gas pipelines, etc.

Machinery and equipment, including:

Power machines and equipment intended for the generation and conversion of energy - generators, motors, etc .;

Working machines and equipment used directly for construction on the subject of labor or for its movement in the process of creating products or services, that is, for direct participation in technological processes (machine tools, presses, hammers, lifting and transport mechanisms and other basic and auxiliary equipment);

Measuring and regulating instruments and devices, laboratory equipment, etc .;

Computing technology is a set of tools designed for accelerated automation of processes associated with solving mathematical problems, etc.;

Other machinery and equipment.

Vehicles designed for the transport of goods and people within and outside enterprises.

All kinds of tools and fixtures attached to machines that serve to process the product (clamps, vices, etc.).

Manufacturing inventory to facilitate manufacturing operations

(work tables, workbenches), storage of liquid and bulk solids, labor protection, etc.

Household inventory.

Methods for assessing fixed assets depend on the sources of their income at the enterprise. So, the initial cost of fixed assets received from the capital investments of the enterprise includes the actual costs of their construction or acquisition, the cost of delivery and installation, as well as the amount

VAT. Fixed assets received from the founders of the JSC on account of their contributions to the authorized capital are assessed at the cost determined by the agreement of the parties. If used fixed assets are received free of charge from other enterprises or as a subsidy from government bodies, then they are valued at residual value.

At the time of the acquisition of fixed assets and their acceptance on the balance sheet of the enterprise, the value of fixed assets quantitatively coincides with the value of fixed assets. In the future, as the fixed assets participate in the production process, their value doubles: one part of it, equal to wear and tear, is transferred to the finished product, the other expresses the residual value of the existing fixed assets.

The worn-out part of the value of fixed assets transferred to finished products, as the latter is sold, gradually accumulates in monetary form in a special depreciation fund. This fund is formed through monthly depreciation deductions and is used for simple and partially expanded reproduction of fixed assets.

The direction of depreciation for the expanded reproduction of fixed assets is due to the specifics of its accrual and expenditure: it is charged during the entire standard service life of fixed assets, and the need to spend it occurs only after their actual retirement. Therefore, until the replacement of retired fixed assets, the accrued depreciation is temporarily free and can be used as an additional source of expanded reproduction. In addition, the use of depreciation for expanded reproduction is facilitated by scientific and technological progress, as a result of which some types of fixed assets can become cheaper, more advanced and more productive machines and equipment are put into operation.

Depreciation deductions are made by enterprises on a monthly basis according to the norms of the book value of fixed assets for individual groups or inventory items. During the year, the monthly depreciation amount is determined as follows: the depreciation deductions for the received objects are added to the amount accrued for the previous month and the depreciation amount for the retired objects in the previous month is deducted. At the same time, the amount of depreciation charges made in the last month is adjusted due to the expiration of the service life of fully depreciated fixed assets that month. Accrual of depreciation is terminated during the period of reconstruction or technical re-equipment of fixed assets with their complete stop. At this time, the standard term of their service is extended.

Depreciation deductions are also not made in the case of transfer of fixed assets to conservation.

Economically sound depreciation rates are essential. They make it possible, on the one hand, to ensure full reimbursement of the cost of fixed assets retired from operation, and on the other, to establish the true cost of production, a component of which is depreciation deductions. From the point of view of commercial calculation, both the underestimation of depreciation rates (because it can lead to a lack of financial resources necessary for the simple reproduction of fixed assets) and their unreasonable overestimation, which causes an artificial rise in the cost of production and a decrease in the profitability of production, are equally bad. The depreciation rates are periodically revised, as the service life of fixed assets changes, the process of transferring their value to the manufactured product is accelerated under the influence of scientific and technological progress and other factors.

Also, the revaluation of fixed assets is periodically carried out; its purpose is to bring the book value of fixed assets in line with current prices and reproduction conditions.

Depreciation deductions are made during the standard service life of fixed assets or the period for which their book value is fully transferred to production and distribution costs.

Depreciation deductions go to the current account and are spent directly from the current account to finance new capital investments in fixed assets or are directed to long-term financial investments, for the purchase of building materials, equipment, and intangible assets.

At the moment of disposal of an object from the enterprise, its initial cost is compared with the sum of accumulated depreciation charges. Result

(profit or loss) is charged to the financial results of the enterprise.

In business practice, different methods of calculating the depreciation fund are used: linear, regressive, accelerated depreciation. In this case, the depreciation rates are established either as a percentage of the book value of fixed assets, or in fixed amounts per unit of output; sometimes they depend on the amount of work performed.

With the linear method, depreciation is calculated at fixed rates during the entire period of productive use of fixed assets. The use of a straight-line depreciation method in conditions of stable prices for fixed assets was justified. But in conditions of rising prices, especially for newly introduced equipment, it is advisable to switch to the regressive method, in which the highest depreciation rate is established at the beginning of the depreciation period, and then it gradually decreases. In the context of inflation, the transition to the regressive method of calculating depreciation contributes to the timely accumulation of financial resources necessary for the renewal of fixed assets.

In accordance with the Regulation on the procedure for calculating depreciation for fixed assets in the national economy, many business entities are allowed to use the accelerated depreciation method. These include enterprises that produce computer technology, advanced types of materials, instruments and equipment, products for export, as well as those that massively replace worn-out and obsolete equipment.

The aforementioned enterprises received the right to calculate depreciation deductions based on the increased, but no more than two times, depreciation rate. This means that they define a new estimated useful life for their fixed assets, which allows for a complete transfer of amortized cost within a short period of time. Even more favorable conditions are provided for small enterprises in terms of reimbursement of the cost of labor tools: In the first year of operation of machinery and equipment, they can write off additionally as depreciation deductions up to 20% of the initial cost of fixed assets (with a service life of more than 3 years). This measure is aimed at stimulating the renewal of the production apparatus based on the latest achievements of science and technology, which is simply necessary due to the non-competitiveness of most domestic industrial goods.

In connection with the changes in prices for machinery, equipment and vehicles and estimated prices for construction and installation work, as well as in order to increase the share of depreciation deductions in the total value of own sources of financial resources of enterprises that ensure the reproduction of fixed assets, from January 1, 1992, introduced indexation of depreciation charges for all enterprises and organizations, regardless of ownership.

The mechanism for the formation and use of depreciation deductions, being an important link in the general system of reproduction of fixed assets, is at the same time an instrument for implementing the state structural policy in the field of industrial investments. Structural changes are achieved primarily through depreciation rates.

Sources of financing for the reproduction of fixed assets.

Sources of financing for the reproduction of fixed assets are subdivided into own and borrowed ones.

Reproduction has two forms: simple reproduction, when the costs of replacing the depreciation of fixed assets correspond to the amount of accrued depreciation; extended reproduction, when the cost of replacing the depreciation of fixed assets exceeds the amount of accrued depreciation.

Capital expenditures for the reproduction of fixed assets are long-term in nature and are carried out in the form of long-term investments for new construction, for the expansion and reconstruction of production, for technical re-equipment and for supporting the capacities of operating enterprises.

The sources of firms' own funds to finance the reproduction of fixed assets include:

Depreciation;

Depreciation of intangible assets;

Profit remaining at the disposal of the firm.

Adequacy of sources of funds for the reproduction of fixed capital is critical for the financial condition of the company.

Borrowed sources include:

Bank loans;

Borrowed funds from other companies;

Equity participation in construction;

Financing from the budget;

Financing from extrabudgetary funds.

The question of the choice of sources for financing capital investments should be resolved taking into account many factors: the cost of the attracted capital; the effectiveness of the return from it; the ratio of equity and borrowed capital; economic interests of investors and lenders.

The cycle of fixed assets includes 3 phases of depreciation, amortization and reimbursement. Depreciation and amortization occur in the process of production use of fixed assets, and compensation - as a result of their creation and restoration. As they are used, the elements of the means of labor are physically worn out, and their technical properties deteriorate. The so-called mechanical wear occurs, as a result of which the means of labor lose their ability to participate in the manufacture of products. In other words, their use value decreases. Fixed assets are subject to physical wear and tear not only as a result of their productive use, but also under the influence of the forces of nature. Both in the process of functioning and in inactivity under the influence of atmospheric conditions, gradual, destructive actions of natural metabolism, metal corrosion, wood decay occur, that is, individual parts of fixed assets are deformed and destroyed. The means of work can also be damaged as a result of such extraordinary circumstances as fires, floods, earthquakes and other natural disasters.

The amount of physical wear and tear of fixed assets depends on the quality of their manufacture, technical parameters incorporated in the process of creation and predetermining durability. In addition, the level of physical wear and tear of fixed assets depends on the degree of their utilization in the process of productive use. The greater the shift in the work of the equipment and the more intensive its workload in time and in terms of power, the higher the level of wear. Along with this, wear depends on the skill level of the workers, compliance with the appropriate operating conditions, protection from adverse environmental conditions, the quality of care and the timeliness of repairs.

Along with physical wear and tear, means of labor are subject to moral wear and tear, at which machines and equipment, which are still quite suitable in terms of material condition, become unprofitable in operation in comparison with new, more efficient models of technology. There are two forms of obsolescence. The first is when, as a result of scientific and technological progress, which determines the growth of labor productivity in industries that produce the means of production, machines of this kind are produced at lower costs. When the production of new, cheaper machines becomes mass production, the cost of existing labor instruments similar in technical characteristics decreases. Indeed, at any given moment, the value of goods is determined not by individual costs, but by the amount of socially necessary labor time for its production. New machines of a similar design are produced cheaper and therefore transfer less of the cost to the finished product, which makes them more efficient in operation and stimulates the early replacement of old equipment.

The second form of obsolescence is a decrease in the cost of functioning means of labor as a result of the introduction of new, more progressive and economical technology into production. New machines can be more productive, that is, more products can be produced on them per unit of time. Changes in quality characteristics and consumer properties of manufactured products are possible. One of the advantages of the new equipment may be the provision of opportunities for the introduction of more advanced technology, which leads to the saving of material resources and an improvement in working conditions. An increase in the efficiency of new types of equipment can also be the result of saving production space, better reliability and economy in operation, greater maintainability, etc. As a result, the operation of old machines becomes unprofitable, which necessitates their early replacement.

The use of obsolete, although physically not yet worn-out equipment leads to a relative increase in production costs, hinders the improvement of technological processes. A problem arises: to incur losses from the early replacement of obsolete means of labor and to obtain savings from the introduction of more advanced technology or to operate obsolete equipment until its cost is completely written off, but at the same time lose the possibility of increasing production efficiency in the future. As a rule, comparisons testify in favor of the early replacement of machines with the aim of technical improvement of production, the effect of which is much greater than the losses before the early write-off.

If the basis of physical deterioration is the influence of material factors of the external environment and internal metabolic physical and chemical processes that destroy the materials from which the means of labor are created, then the basis of both forms of obsolescence is scientific and technological progress. It predetermines both the cheapening of the means of labor and the emergence of new types of technology and products. In accordance with the nature of the reasons, the loss of the use value and the value of the means of labor as a result of physical and moral depreciation is carried out differently. If physical wear and tear occurs, as a rule, evenly as the fixed assets are used or the gradual influence of the forces of nature, then due to the unevenness of scientific and technological progress, certain types of means of labor are unevenly subject to moral wear. Thus, it has the greatest influence on the active part of fixed assets, since changes in the design of machines and equipment are more dynamic compared to the improvement of the structures of buildings and structures. The impact of obsolescence is uneven in various sectors of the national economy. It is especially noticeable in industries that determine scientific and technological progress. The second form of obsolescence has the most significant impact in the first period of the introduction of new technology; as innovations become widespread, its impact gradually decreases.

Wear is not identical to wear. All created fixed assets, both active and inactive, are subject to wear and tear, regardless of their participation in the production process (production and non-production).

Wear is an objectively existing phenomenon. Wear is an economic process, a reflection of wear and tear in economic reality. Wear and tear, or economic depreciation, is the process of loss of value by means of labor. Deterioration can be caused by both physical and obsolescence.

Wear is the basis of depreciation. Depreciation does not occur during the formation of the depreciation fund, but during its subsequent use to replace obsolete equipment and in the course of overhaul and modernization.

The depreciation charge is the portion of the cost that is carried over to the product.

Its movement is included in both the production process and the circulation process.

Monetary depreciation fund is the financial result of accumulation of successively carried out depreciation deductions. It is formed only after the sale of finished products.

Depreciation can be defined as the process of gradual transfer of the cost of labor instruments to the cost of finished goods. Depreciation deductions are that part of the cost of means of labor, which in each new cycle of enterprise assets, as they wear out and continues to move as part of a new value, first in the form of work in progress, then as part of the cost of finished products, and after its sale is accumulated in the reserve fund cash intended to reimburse the advanced costs of fixed assets.

Thus, the difference between depreciation and depreciation of fixed assets is clearly outlined. If wear is a loss of use value, and hence the value of means of labor, then depreciation means the process of transferring value to a finished product. Both processes, despite their difference, are inseparable as two sides of the same phenomenon. Therefore, depreciation deductions, reflecting the value of the transferred value, simultaneously show the degree of depreciation of fixed assets.

The movement of depreciation covers the stages of production and circulation of products manufactured on this equipment for the entire period of its operation. This process does not coincide with the reimbursement of fixed assets, which is broader in scale than depreciation by the amount of the period for creating new capacities to replace the retired ones. The period of incarnation of the means of the depreciation fund in new instruments of labor, in our opinion, cannot be included in the process of depreciation, this is a new, independent stage in the circulation of funds. The task of depreciation is to reimburse the costs incurred in fixed assets, accumulate and return the invested funds, not to ensure the reproduction of production potential.

The amount of depreciation should correspond to the real frequency of the fixed assets used in the formation of new value.If this is not achieved when constructing the depreciation rates, and less or more funds are written off for depreciation than is objectively necessary, there is an overflow of funds from the compensation fund into the accumulation fund or vice versa. At the same time, the reliability of accounting for financial sources of reproduction is violated, and, consequently, the possibility of managing their rational spending becomes more complicated. Such deviations should be neutralized by timely adjustment of depreciation rates. More depreciation can not be written off on products and less should be written off than is due to the real costs of fixed assets for production. Depreciation rates should be structured to ensure full reimbursement of advanced fixed asset investments, regardless of future renovation needs. If, after the expiration of the turnover period of fixed assets, the price of a unit of production capacity increases, then additional resources to create new funds to replace the retired ones must be found at the expense of the national income accumulation fund. Depreciation should not predetermine the possibilities for the future development of production.

To adequately reflect the process of transferring the cost of equipment to the manufactured product by depreciation, it is necessary to solve two problems: to give a reliable estimate of this cost and to properly organize the procedure for writing it off to prime cost using depreciation rates. Not the part of the cost of the machines at which they were acquired several decades ago should be transferred to the manufactured product, but the part that they possess at any given moment in time. Depreciation should be charged not from the original, but from the replacement cost of the means of labor. Moreover, for the reliability of depreciation, it is important to revalue fixed assets as often as possible.

Depreciation charge in our country for a long period of time was subdivided into full restoration and overhaul.

At the same time, preliminary standardization of capital repair costs as part of depreciation contradicts its essence. Depreciation is a gradual repayment of investments made in fixed assets at the expense of the cost of production, and the use of funds for capital repairs in relation to the moment of depreciation is, as a rule, an element of the costs of the future period. In other words, the costs for the purchase of new equipment and for its repair are fundamentally different.

Hence the difference in how the costs of full refurbishment and overhaul are financed. If the reimbursement of funds advanced to fixed assets presupposes the regular inclusion of a corresponding share of depreciation of fixed assets in the price of created products, then to finance repairs, like other elements of current production costs, no preliminary rationing is required as part of depreciation rates. These costs should be directly included in the cost of production as needed for repairs.

If the costs of capital repairs are necessarily included in the cost of production through the depreciation rates, then there is no incentive to reduce them. If these costs are included in the cost of production as needed, without prior rationing, then, if there is economic feasibility, there is an interest in replacing outdated equipment with new ones without performing ineffective repairs.

Appointment of depreciation in simple and extended reproduction of fixed assets

For economic purposes, the depreciation fund must accumulate financial resources for the simple reproduction of fixed assets, that is, ensure the replacement of retired means of labor. Statistics show that the annual depreciation charges significantly exceed the corresponding disposal of fixed assets. The excess of the accrued depreciation of the annual disposal of fixed assets has a steady upward trend. In this regard, in the economic theory and practice of management, there is an opinion about the natural nature of the redundancy of depreciation in comparison with the need for funds to restore worn-out assets and the possibility of its withdrawal for accumulation.

The question of the possibility of using depreciation deductions for expanded reproduction is one of the most difficult and debatable. It has been discussed in the economic literature for many years, but has not been finally resolved. The opinion is expressed according to which the depreciation fund cannot serve as a source of accumulation of fixed assets. At the same time, most economists argue that in modern conditions, depreciation deductions are naturally a source of expanded reproduction of fixed assets, a source of their accumulation. Many researchers, while recognizing the direct economic purpose of the depreciation fund as a source of simple reproduction, do not exclude at the same time the possibility of using it for expanded reproduction.

In connection with the growth of production potential, the need to intensify its use puts forward special requirements for the policy of reimbursing the means of labor, the shortcomings of which are currently manifested in a decrease in the rate of replacement of worn-out assets, the accumulation in some sectors of the national economy of a significant amount of obsolete equipment with all the ensuing negative consequences. Therefore, the rational use of the depreciation fund is a significant reserve for increasing production efficiency. The apparent excess of the accrued depreciation amounts of the needs for reimbursing the retired means of labor, the natural formation in the depreciation fund of a permanent surplus of funds, which can allegedly be used for accumulation, is explained, as a rule, by the action of two factors - scientific and technological progress and the peculiarities of the circulation of fixed assets. In connection with scientific and technological progress, labor productivity is growing, so the cost of reproduction of fixed assets should decrease. As a result, less funds are required to reimburse their use-value than those accumulated in the depreciation fund. In other words, in order to restore the aggregate capacity of the retired instruments of labor, it is necessary to spend less funds than is provided for by the depreciation rates. The restoration of the used means of production in their previous size leads to an increase in their capacity and capacity. In this case, the amount of accumulated depreciation makes it possible to meet the needs of not only simple, but also extended reproduction.

However, the effect of scientific and technological progress is not the result of the turnover of the reimbursement fund. It is formed as a result of additional investments from the accumulation fund in the development of science and technology and is the result of the use of a pure product.

If, as a result of scientific and technological progress, the cost of reproduction of a unit of production capacity decreases, then the depreciation fund must be reduced by an appropriate amount. Otherwise, the depreciation mechanism will not be linked to the actual value transfer process. If more funds are sent from the volume of the product produced to the compensation fund than is determined by the actual costs of production, then the result is an underestimation of the value of the national income. In this case, the depreciation fund accumulates, along with the funds necessary to reimburse the means of labor, and part of the accumulation fund. And, conversely, with an increase in the cost of reproduction of a unit of production capacity, a corresponding increase in the amortization fund is necessary. Otherwise, he cannot fully cover the needs for reimbursement of means of labor.

If the initial cost of the means of labor, based on which

"the amount of depreciation is calculated, coincides with the replacement cost, and the depreciation rates correctly reflect the possible service life of fixed assets, and these periods are met, then the depreciation fund can only meet the needs of simple reproduction. If these conditions are not met, then the size of the depreciation fund deviates from the needs of the normal If the depreciation fund has accumulated a part of the funds that, if the depreciation was correctly calculated, should have entered the accumulation fund, then their surplus can be withdrawn to expand production. Insufficient accrual of funds to the compensation fund must be replenished from the accumulation fund. Thus, the surplus in the depreciation fund is not the result of scientific and technological progress, but is formed due to the shortcomings of the depreciation accrual system.

In conditions of a decrease in the rate of accumulation of fixed assets, the amortization fund, with its partial withdrawal, still meets the needs of compensation.

The withdrawal of surplus amortization amounts really does not prejudice simple reproduction. However, making additional investments from the accumulation fund, one should focus not on simple, but on expanded reproduction. Therefore, before removing the apparent excess of depreciation, it is necessary to determine how this will affect the rate of expansion of production, provided for by additional investments.

Making additional capital investments in any economic link, it makes no sense to partially withdraw it - the means of depreciation for the accumulation of the potential of other links of production.

When investing capital funds, we assume a certain rate of expansion, while withdrawing depreciation, we reduce the rate provided. This means that if a certain economic link has reached a state in which it fully satisfies social needs, and it becomes possible to reduce the rate of expanded reproduction in this link, then this should be done not by withdrawing the depreciation fund, but by reducing funding from the accumulation fund.

Thus, depreciation in itself cannot be a source of accumulation of fixed assets, either in simple or extended reproduction. The constant excess of the accrued depreciation of the annual disposal of fixed assets with expanded reproduction is natural. It is due to the additional attraction of funds and represents the accumulated depreciation of newly introduced fixed assets. Removal of the visible excess of depreciation is unacceptable, as it complicates the reproduction process. If the depreciation process matches the actual value transfer process, the depreciation fund should only be used for its intended purpose. The accrued depreciation should remain entirely at the disposal of enterprises and be directed by them to finance the simple reproduction of fixed assets.

The role of depreciation in the accumulation of fixed assets.

The processes of accumulation and replacement of fixed assets are closely interrelated.

Differentiation between them is very problematic, which causes a lot of opposite conclusions when analyzing the same economic phenomena. Thus, the study of statistical indicators of the reproduction of fixed assets by some researchers led to the conclusion that there is a process of overaccumulation and the created production capacity is excessive in comparison with the real possibilities of society. Other economists argued that the processes of accumulation are undergoing a crisis, that the country is lagging behind the industrialized powers in terms of the actual amount of accumulation per capita. Therefore, an increase in the rate of accumulation is an urgent vital necessity.

Reimbursement and accumulation of fixed assets can be analyzed by studying the structure of sources of financing capital investments, as well as by studying the indicators of the balance of fixed assets, reflecting the trends of their input, disposal and depreciation. Let us consider both directions in order to identify the existing correlations of compensation and accumulation and their influence on each other.

The sources of financing for capital investments are a part of the national income reimbursement fund, which includes depreciation for renovation, and a part of the accumulation fund used to create fixed assets. Thus, gross capital investment consists of depreciation-financed costs and so-called net capital investment, which is the source of national income. The resources of the depreciation fund should reflect the cost of replacing the depreciation of the means of labor, and net capital investments - the accumulation process.

In the structure of sources of financing capital investments, the share of depreciation naturally increased. This is an objective trend caused by the growth of production potential. After all, the larger the volume of basic fonts, the more funds are needed for their annual reimbursement.

The use of depreciation resources for accumulation is illegal. In essence, depreciation is only a source of simple reproduction. If the process of accrual of depreciation corresponds to the process of transferring value, the depreciation fund can only serve as a source of reimbursement of means of labor. The diversion of its resources for accumulation leads to significant losses of living and materialized labor. The long-term withdrawal of renovation resources in favor of the accumulation of means of labor has led to the accumulation of an excess demand for compensation, which can now be realized only if the resources of the accumulation fund are temporarily used.

Thus, the analysis of the sources of financing of capital investments indicates a discrepancy between the real processes of accumulation and reimbursement of the financial resources intended for them. The amount of accumulation exceeds the resources of the national income intended for these purposes, which occurs to the detriment of normative compensation.

Let's analyze the same processes in a different way. Let us consider the ratio of accumulation and replacement of means of labor on the basis of indicators of the balance of fixed assets. Let us compare the annual commissioning of fixed assets with the accrued depreciation.

Comparison of the input and depreciation of fixed assets at the global level is illegal, in reality, as a rule, they are not observed in terms of object compliance. The commissioning of new capacities is by no means always carried out precisely in those sectors of the national economy where, judging by the accumulated wear and tear, this is primarily necessary. In other words, the capital investment and depreciation processes are not directly superimposed.

So, determining the scale of accumulation of fixed assets by

Comparisons between the commissioning of new facilities and depreciation at old production facilities are incorrect. An increase in the proportion of wear and tear in comparison with the scale of commissioning of fixed assets cannot indicate an increase in investment costs for compensation, but only reflects an increase in the tendencies of aging of means of labor.

Accrued depreciation is only a potential financial resource for compensation, although it is not always spent for its intended purpose.

Comparison of depreciation with the introduction of fixed assets rather characterizes the prevailing contradiction between their accumulation and replacement. This comparison only confirms that in some parts of production extremely worn-out assets, supported by repairs, accumulated, the further operation of which threatened to catastrophe, while in others additional capacities were introduced. Thus, there was a polarization of the processes of accumulation and aging of the created production potential.

The simple reproduction of fixed assets should be prioritized in investment policy, and the possibilities of productive accumulation should be determined according to the residual principle, strictly in accordance with that part of the national income resources that society is able to use to expand the created potential. Direction of net capital investment, i.e. costs from the accumulation fund should be regulated by economic methods in a centralized manner. This is necessary, since enterprises are not able and fully enough to take into account all the promising changes in social needs. Depending on the dynamics and structure of the population, the prospects for scientific and technological progress, the assumed restrictions on raw materials and fuel and energy resources, the possibilities of cooperation with other regions and other factors, priorities in the allocation of accumulation resources should be determined, With the help of tax and credit policies, these priorities should be implemented ...

Thus, a contradictory situation has developed in the national economy with the reproduction of daily funds. Due to the extensive focus of the investment policy, most of the resources were used for the accumulation of fixed assets for many years. A stable priority was established for new construction, and the reconstruction of the existing production was carried out insufficiently. Numerous government decrees have failed to reverse this trend. The needs of simple reproduction were determined by the residual method, which led to the withdrawal of depreciation funds from enterprises and their use for accumulation. As a result, the production and technical potential has grown to incredible proportions, but it is extremely worn out and ineffective. Older factories require large expenditures to maintain obsolete facilities. New industries, created to a large extent at the cost of infringing on the needs of reproduction at old enterprises, cannot develop effectively due to a lack of material and labor resources.

Excessive accumulation that does not correspond to the real possibilities, the objective conditions of the functioning of the economy, does not give the expected effect, but causes an increase in losses. There was neither normal use of the created potential, nor effective accumulation in the country. Both processes mutually infringed upon each other. It is necessary to normalize the process of reimbursement of means of labor and completely transfer it to a market basis, which will make it possible to improve the created production potential in a timely manner, taking into account the dynamic structure of current demand. Such a procedure, along with an approximation to the structure of needs, should also ensure a significant increase in the efficiency of existing capacities.

The process of production accumulation in the current crisis situation must be strictly controlled by society. To expand production, it is inadmissible to attract neither the resources of the consumption fund nor the means of compensation. The limited resources of accumulation, conditioned by the investment opportunities of the society, should be centrally regulated and controlled taking into account the future needs.

The main production assets of enterprises make an economic cycle, consisting of the following stages: wear and tear, depreciation, accumulation of funds for the complete restoration of fixed assets, their replacement by capital investments.

All objects of fixed assets (PF) are subject to physical and moral deterioration, i.e. under the influence of various factors, they lose their properties, become unusable and can no longer perform their functions. Physical wear and tear can be partially reimbursed through repair, reconstruction and modernization. Obsolescence is manifested in the fact that fixed assets in all their characteristics are inferior to the latest models. Therefore, from time to time there is a need to replace fixed assets, especially their active part.

Moreover, in the modern economy, the main factor determining the need for replacement is obsolescence.

Bibliography

1. Gruzinov V.P. and other Economics of the enterprise: a textbook for universities. / Ed. V.P. Gruzinova. M .: Banks - exchanges, UNITI, 1998.

2. Zaitsev N.A. The economy of an industrial enterprise. M .: "INFRA - M",

1998.

Introduction

Fixed assets are the most significant part of the property of the enterprise and its non-current assets.

Fixed assets are divided into production and non-production:

Fixed production assets are that part of the means of production that fully participates in a number of production cycles, while maintaining their completely natural form, possessing value and gradually transferring it to the newly created product. These include those means of labor that are directly involved in the production process (machinery, equipment, etc.), create conditions for its normal implementation (industrial buildings, structures, etc.) and serve to store and move objects. Functioning in the field of production.

Non-productive fixed assets are fixed assets that are not directly involved in the production process (residential buildings, kindergartens, schools, etc.), but which are under the control of industrial enterprises. Functioning in the sphere of meeting the social, domestic and cultural needs of workers. / 1.p. 71 /

Fixed assets are means of labor that repeatedly participate in the production process, while maintaining their natural form, and their value is transferred to the manufactured products in parts as they wear out. These include: buildings, structures, various machines and equipment, instruments and tools, production and household inventory, land owned by the enterprise, on-farm roads and other fixed assets.

Excessive aging of the OPF should not be allowed, since the results of the enterprise's work depend on this.

Basic production assets, depending on the degree of their impact on the subject of labor, are divided into active and passive:

Active funds include funds that, in the production process, directly affect the subject of labor, modifying it (machinery and equipment, measuring and adjusting devices, vehicles).

All other fixed assets can be classified as passive, since they do not directly affect the object of labor, but create the necessary conditions for the normal course of the production process (buildings, structures, etc.). / 2.p. 59 /

1. Theoretical part

1.1 Ways of reproduction of fixed assets

Reproduction of fixed assets is a continuous process of their renewal through the acquisition of new, modern technologies, modernization and overhaul.

The main goal is to maintain fixed assets in working order.

In the process of reproduction of fixed assets, the following tasks are solved:

Reimbursement of fixed assets retired for various reasons;

Increasing the number and mass of fixed assets in order to expand the volume of production;

Improvement and enhancement of the technical level of production;

The process of reproduction of fixed assets can be carried out from various sources. Fixed assets for reproduction at an enterprise can come through the following channels:

As a contribution to the authorized capital;

As a result of capital investments;

As a result of the donation;

Rent. / 3 /

The quantitative characteristics of the reproduction of fixed assets during the year is reflected in the balance sheet of fixed assets at their full initial cost according to the following formula:

F k. = F n. + F in. - F. l.

where Ф к. - the cost of the OF at the end of the year;

F n. - the cost of the OF at the beginning of the year;

F in. - the cost of the OF, put into effect during the year;

F. l. - the cost of fixed assets liquidated during the year.

For a more detailed analysis, the following indicators are used: the rate of renewal of the fixed assets, the coefficients of disposal of the fixed assets,

where K obn. - update rate,%;

Ф к. - the cost of OF at the end of the year, rubles.

To select. - the rate of retirement of fixed assets,%.

Exceeding the value of K obn. compared to K select. indicates that there is a process of renewal of fixed assets.

Fixed assets at the enterprise in the course of their operation are constantly worn out, and to maintain them in working condition, it is necessary to periodically repair them.

There are types of repairs: restoration, current, capital, modernization.

Refurbishment is a special type of repair caused by various circumstances: natural disasters (fire, flood, etc.), military destruction. Refurbishment is carried out at the expense of special funds of the state.

Current repairs are minor repairs and are carried out without a long interruption in the production process. With minor repairs, individual parts and assemblies are replaced.

Modernization is a technical improvement of fixed assets in order to eliminate moral deterioration and improve technical and economic indicators to the level of the latest equipment.

Overhaul is a significant repair of fixed assets and is associated with a complete disassembly of the machine, replacement of all worn out parts and assemblies.

The cost of repairs depends on physical and moral deterioration, the quality of the repairs carried out and the level of qualifications of the personnel serving the machinery and equipment.

Wear and tear is understood as the loss of fixed assets involved in the production process, their initial characteristics due to their operation and natural wear and tear.

The level of physical depreciation of fixed assets depends on: The initial quality of fixed assets;

The degree of their exploitation;

The level of aggressiveness of the environment where OPF are used;

Service personnel level;

Timely implementation of scheduled preventive work, etc.

Obsolescence is depreciation, loss of value before their physical wear and tear, and the end of their physical service life.

Obsolescence manifests itself in two forms:

The first form of obsolescence is that there is a depreciation of machines of the same design that were produced earlier, due to the reduction in the cost of their reproduction in modern conditions.

The second form of obsolescence is that there is a depreciation of old machines, physically still fit, due to the emergence of new, more technically advanced and productive machines that are replacing the old ones.

At each enterprise, the process of physical and obsolescence of fixed assets must be controlled. The main goal of this department is to prevent excessive physical and moral deterioration of fixed assets. This process is managed through the implementation of a certain policy of reproduction of fixed assets. /5.p. 44 /

1.2 Sources of funding

Investments are financed by savings, the sources of which are limited. These include:

State savings (part of budgetary funds going to investments, plus funds from the excess of income over expenditures, directed to the capital market);

Investments - long-term capital investments in various sectors of the national economy with the aim of making a profit. Distinguish between real (invested in the means of production), financial (purchase of bonds and other securities)

Enterprise savings - depreciation funds and redistributed profits;

Bank loans;

Savings of the population (households);

External savings - an inflow of foreign capital.

Currently, most of the volume of investments in fixed assets is carried out by enterprises (83%), including 20% - at the expense of attracted funds. More than half of these investments are made by federal natural monopolies.

The volume of enterprises' own funds allocated for investment purposes is provided mainly through depreciation deductions. In all developed countries, depreciation is considered as the most important source of investment funds for companies.

Bank loans are another significant source of investment resources. However, high bank interest and the instability of the banking system scare away entrepreneurs in our country.

Savings of the population (in the form of deposits in banks, securities, cash, etc.), which form the basis of long-term investments throughout the world, are relatively small in Russia and, most importantly, are not accumulated by the banking system, i.e. "Do not work" as a means of investment. Nevertheless, if favorable conditions are created, the population's free funds can be invested in the real sector of the economy. In the meantime, the share of the population's funds directed directly to the investment sector is extremely insignificant. The fact is that private investors make investment decisions, focusing mainly on two parameters - profitability and risk, and the latter is extremely high in our country.

Measures should be taken to ensure the flow of funds from the population, as well as some specific features of this source of investment:

The monetary funds of the population will serve as a reliable source of credit resources only if the savings of citizens become massive, indicating a sufficiently high standard of living for the majority of the population, which, unfortunately, has not yet been observed.

Savings of the population are a very unstable monetary resource, subject to large fluctuations depending on real changes in the economic environment, but also on speculative factors.

For the population, investing in securities of enterprises is unattractive, since they (securities) are not able to provide even a minimum level of profitability for small private investors.

In conditions of inflation and general socio - economic instability, the possibilities of attracting funds from the population for a long time have sharply decreased.

Comments Off Order 8 tsz ojsc rzd read

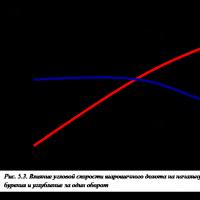

Comments Off Order 8 tsz ojsc rzd read Peculiarities of determining the cruising speed when drilling with shells cs How to calculate the mechanical speed of drilling

Peculiarities of determining the cruising speed when drilling with shells cs How to calculate the mechanical speed of drilling Automated electric drive course of lectures

Automated electric drive course of lectures Powder steel crucible cpm s30v

Powder steel crucible cpm s30v How to open a medical center from scratch?

How to open a medical center from scratch? Comic, funny scenes for teenage and adult audiences

Comic, funny scenes for teenage and adult audiences Diploma templates blank download

Diploma templates blank download