How Sibur Holding became one of the largest and most important enterprises in Russia. The largest co-owner of Sibur transferred half of the shares to four companies. Which companies are included in Sibur holding

1) A call from a girl from a recruiting company (deleted), she offered a job in Sibur for a salary of 150,000 rubles, we talked for half an hour, verified my basic knowledge in petrochemistry and English language, promised to send online tests

2) They sent online tests (absolutely idiotic, I must say, and with a time limit), I failed them (as it turned out later, no one will show you the result right away...), the girl called back and offered to take them for me, she passed them for me so that I could continue to go through the stages, well, I was happy and thanked her. She promised that there were 2 more stages ahead, Sibur needed just such a special one. in the field of films, with experience in development own product etc. (apparently she was making noodles, and I was inspired like a fool)

3) I came to social security an hour and a half in advance (because motherfucker is important, I sat there preparing as if before an exam), I tried to get inside to wait there and not in the car, the terminal didn’t give me a pass, I sat like a fool and waited for an hour, half an hour before Social Security called everyone and said that the terminal does not issue a pass, although it should be time. The girl from (deleted) tried to help, HR Sibur called back at 9:03 (she just didn’t answer the phone until 9, you see), as a result, by this time the pass was activated

4) No one met me, didn’t offer me tea or coffee, I stomped into the office, 2 confused students were sitting there, in the end, after 15 minutes of waiting, they took me to some kind of meeting room

5) A MAXIMUM cold and distant girl sat in the meeting room and asked stupid questions (the boss, who was supposed to be at the interview, was 10 minutes late). As a result, they asked me a couple of stupid questions that were not related to the specifics of my future activities from the series “when will you get married?”, “How are you?”, when I tried to start a conversation on the topic of petrochemicals, they simply nodded their heads AND NOT ASKED A SINGLE QUESTION, although I had something to tell. The boss had to retell everything in a new way, what I had already been telling HR for 10 minutes... As a result, after 15 minutes of idiotic questions, they simply patted me on the shoulder and said, well, good luck, we’ll recruit you, do you have any questions? I say yes, there is a question, why the hell did I come to interview for a specific vacancy that requires specific skills and abilities, I told about your turnover, about new plant, about basic brands, about client base potential, and you asked me general abstract questions, to which I received an enchantingly stupid answer: “Well, we don’t hire anyone for a specific vacancy, first you need to understand what you can do and what you want, and we’ll think about where to place you.” I sit and think, yeah, that is, I will go to your stupid interviews for a month, and at the end you will offer me a job for 50,000 rubles and a basic position? In the end, I said goodbye and left, a week later they called back and said, “Well, you didn’t pass,” which I was rather glad about.

In short, it’s as disgusting as possible, I prepared for a week for the interview, arrived an hour and a half in advance, only to have some young marketing manager and slow HR dump me after basic questions, I had the feeling that they took me just for show, for statistics, and they would put me in the position some stupid friend or someone else.

P.S. To the boss’s only question about the future volumes of Sibur, I began to give calculations, a clear and specific answer, laid out in detail, including a bunch of variables, he listened, waved his hand at me and said, “I’ll give you a hint, volumes depend on capacity,” in short, it was just necessary to say like a fool “Your volumes will increase, you have built a new plant”, I completely fell out of this, I mentioned this twice during the interview, why should I ask a stupid question about a new plant if I am aware of its capacities even better than this boss?

The largest petrochemical holding in Russia. Full name - Public Joint Stock Company "SIBUR Holding". The headquarters is located in Moscow (the company is registered in Tobolsk)

"Story"

OJSC Siberian-Ural Petroleum and Gas Chemical Company was created by Decree of the Government of the Russian Federation of March 7, 1995. Initially, the company included the Sibneftegazopererabotka association (GPP Western Siberia), NIPIgazpererabotka (Krasnodar) and the Perm Gas Processing Plant.

"Themes"

"Owners"

The controlling stake in the company (50.2%) belongs to the chairman of the company's board of directors. 15.3% of the shares belong to the oil trader, 21.3% of the shares belong to the deputy chairman of the company’s board, 13.2% of the company’s shares belong to the current and former managers holding (, and), as well as from Deputy Chairman of the Board of Directors Alexander Dyukov. On December 17, 2015, a deal was closed to acquire a 10% stake in Sibur by the Chinese company Sinopec.

But on March 1, 2016, Trust carried out a reorganization, separating four new companies - Gamma LLC, Omega LLC, Sigma LLC and Prime LLC. With these companies, Trust shared part of its stake in Olefininvest, leaving itself a little more than half - 33.81% (this corresponds to 24.68% of Sibur shares): Gamma received 8.22%, Sigma and “Prime” - 6.85% each, “Omega” - 3.42% (all changes are disclosed in the SPARK-Interfax database).

All five companies that became co-owners of Sibur are fully controlled.

"Affiliated companies"

"Management"

1. Konov Dmitry Vladimirovich

Chairman of the Board of PJSC SIBUR Holding

2. Karisalov Mikhail Yurievich

Deputy Chairman of the Board of PJSC SIBUR Holding, Chief Operating Director of LLC SIBUR

"Board of Directors"

"News"

Sibur was offered to join a new gas chemical project in Siberia

The Irkutsk Oil Company invited Leonid Mikhelson's Sibur to participate in the construction of a gas chemical plant in Eastern Siberia. The company estimates the total budget of the project at 456 billion rubles.

More details on RBC:

Sibur explained its relationship with a company associated with the US minister

Sibur, commenting on reports of possible connections with US Secretary of Commerce Wilbur Ross, said that it was surprised by the “politically biased interpretation” in the published dossier on “paradise offshores”

In the “paradise offshores” they found a connection between the American minister and Sibur

US Secretary of Commerce Wilbur Ross owns a stake in Navigator Holdings Ltd, whose vessels were chartered by the Russian petrochemical holding Sibur.

SIBUR's revenue for the first half of the year increased to 212 billion rubles.

In the first half of 2017, SIBUR's revenue increased by 8.1% and reached RUB 212 billion. This is stated in a report published by the company's press service.

Cyprus SIXB Limited received at direct disposal a 10% stake in PJSC Sibur Holding

February 7. ejnews.ru. The basis for receiving shares is called “acquisition of a stake in the issuer,” the Russian company said in a statement. The date of occurrence of the grounds by which SIXB Limited acquired the right to dispose of 10% of the shares of Sibur is January 25, 2017.

On this day, Sibur announced that its shareholders and the Chinese investment Fund Silk Road Fund (SRF), after receiving all regulatory approvals, closed the deal for the fund to acquire a 10% stake in Sibur.

SIBUR and the NBA opened a court in Tyumen, reconstructed as part of a partnership to develop basketball in Russia

Tyumen, January 30, 2017. With the support of SIBUR, a sports ground for basketball competitions was reconstructed in Tyumen. The renovated hall is equipped with modern equipment in accordance with NBA global standards. Modernization gym in Tyumen is aimed at attracting more city residents, including SIBUR employees and their children, to basketball, one of the most popular sports in the world.

The Government Commission approved the purchase of a 10% stake in Sibur Holding by a subsidiary of the Silk Road Fund - FAS

Government Commission to Monitor the Implementation foreign investment in the Russian Federation, agreed on a transaction for the acquisition by a subsidiary of the Silk Road Fund of 10% of the shares of Sibur Holding ( largest producer liquefied hydrocarbon gases in the Russian Federation), reported the Federal Antimonopoly Service (FAS).

“Government Commission for Control over Foreign Investments in Russian Federation a transaction has been preliminarily agreed upon for the acquisition by a subsidiary of the Silk Road Fund (PRC), which is under the control of the People’s Republic of China, of a 10% stake in the Russian PJSC Sibur Holding,” the department said in a statement.

The wife of the new head of the FSO turned out to be a member of the board of Sibur

Director's wife Federal service Dmitry Kochnev’s security guard is Marina Vladimirovna Medvedeva, she is on the board of Sibur, Russia’s largest petrochemical company, Fontanka wrote on Thursday, May 26. This information was confirmed to RBC by an FSB interlocutor. A former colleague of Medvedeva at one of her places of work knows about the relationship between Kochnev and Medvedeva.

The FSO press service did not respond to RBC’s request sent on May 27. Sibur's director of corporate communications, Rashid Nureyev, told RBC that the company does not comment on issues related to the personal lives of top managers. Medvedeva herself did not respond to RBC’s request to answer questions transmitted through the company’s press service.

The wife of the new head of the FSO turned out to be a member of the board of the country's largest petrochemical holding Sibur.

According to RBC, last year Dmitry Kochnev’s wife earned the most among the FSO, FSB, SVR employees and members of their families.

Journalists began looking for information about the new head of the FSO on the same day it was announced that Kochnev would replace Yevgeny Murov, who had headed the department since the beginning of Putin’s first presidential term. On the same day, Fontanka wrote: Sibur board member Marina Medvedeva is the wife of the former head of the presidential guard, and now the head of a federal department. Information about the relationship between Kochnev and Medvedev was confirmed to the RBC publication by interlocutors at the FSB and the woman’s former colleagues at one of her previous places of work.

Timchenko sold 17% of SIBUR to the son of businessman Shamalov

Businessman Gennady Timchenko sold a 17% stake in the petrochemical holding SIBUR to the deputy chairman of the company's board, Kirill Shamalov, the son of the co-owner of Rossiya Bank and longtime acquaintance of President Vladimir Putin, Nikolai Shamalov. The deal was announced in a company statement. Shamalov's share in SIBUR is now 21.3%, Timchenko continues to own 15.3% of the shares.

SIBUR's net profit according to IFRS in the first quarter of 2014. increased by 3.6 times - to 56.8 billion rubles.

Quote.rbc.ru 06/10/2014 10:55

SIBUR's net profit international standards financial statements(IFRS) in the first quarter of 2014. increased by 3.6 times compared to the same period in 2013. and amounted to 56.8 billion rubles. This was said in a statement.

SIBUR and Gazprom Neft bought 50% of the Poliom plant

RBC 05/23/2014, Moscow 18:15:49 SIBUR and Gazprom Neft, two years after the start of negotiations, bought 50% of the Omsk enterprise Poliom from the Titan group.

Sibur will produce rubber in a joint venture with the Chinese

The Sibur company, co-owned by billionaire Gennady Timchenko (through companies controlled by him, he owns 32.3% of the company's shares), agreed with the Chinese corporation Sinopec to create a joint venture for the production of rubber. The company announced this on May 20. The agreement was signed in Shanghai during the state visit of Russian President Vladimir Putin to China.

SIBUR shareholders allocated additional dividends for 2013. RUB 6.38 billion based on RUB 2.93/share

Annual general meeting shareholders of SIBUR Holding approved the decision of the board of directors to allocate additional funds for the payment of dividends for 2013. 25% net profit according to international financial reporting standards (IFRS). This was said in a statement. A total of 6 billion 383 million rubles will be allocated for the payment of dividends. based on RUB 2.93. per share.

Foreign banks offered Sibur to pay extra for Ukrainian risks

Because of this, the holding did not agree on a syndicated loan in the amount of up to $1 billion

SIBUR: There are no problems with export supplies due to events in Ukraine

RBC 03/18/2014, Moscow 17:32:51 SIBUR does not see any logistical problems with export supplies in connection with the events in Ukraine. The head of SIBUR Dmitry Konov announced this today at a press conference, ITAR-TASS reports.

SIBUR will publish IFRS financial statements for 2013 on March 18.

Fitch confirmed SIBUR's rating at BB+ after the announcement of the acquisition of a stake in a joint venture with Rosneft

02/25/2014, Moscow 10:51:09 International rating agency Fitch Ratings has confirmed the long-term issuer default rating of OJSC SIBUR Holding at BB+ with a “stable” outlook, the agency said in a statement. Senior unsecured rating of 5-year bonds of SIBUR Securities Limited in the amount of $1 billion guaranteed by SIBUR and due in 2018. also confirmed at BB+ level. The short-term issuer default rating has been affirmed at B.

SIBUR will buy 49% in the Yugragazpererabotka JV from Rosneft

02/21/2014, Moscow 10:23:31 SIBUR will buy a 49% stake in the Yugragazpererabotka JV from Rosneft, bringing its own ownership to 100%. This is stated in a message from Rosneft.

Lapin from Sibur became director of business development for MMK

Director for Business Development and Performance Management of OJSC Magnitogorsk Iron and Steel Works» (MMK) Maxim Lapin, who served as director of planning and analysis at Sibur LLC, was appointed, MMK said in a statement

Sibur sold 100% of the shares of Plastic to investors for 575 million rubles

Petrochemical holding Sibur has closed a deal to sell 100% of the shares of Plastic OJSC (Uzlovaya, Tula region) to a group of private investors for 575 million rubles, Interfax reports with reference to the company’s message. Now the company plans to raise investment…

Sibur reduces dividends by 14% amid falling net profit

Shareholders of OJSC Sibur Holding approved the amount of dividends based on the results of the first half of 2013 in the amount of 2.93 rubles. per share, the company reports. Based on the results of work in the first half of 2012, the company paid dividends in the amount of 3.4 rubles.

SIBUR's net debt under IFRS in the first half of 2013. grew by 9.4% to RUB 90.149 billion.

SIBUR's net debt according to international financial reporting standards (IFRS) in the first half of 2013. grew by 9.4% to RUB 90.149 billion. as of June 30, 2013 against 82.424 billion rubles. at the end of 2012 This is stated in the company's materials. Compared to the figure as of March 31, 2013. (RUB 77.928 billion), SIBUR’s net debt increased by 15.7% by the end of the first half of the year.

Capital expenditures of SIBUR according to IFRS in the first half of 2013. increased by 11.8% - to 36.044 billion rubles.

Capital expenditures of SIBUR according to international financial reporting standards (IFRS) in the first half of 2013. increased by 11.8% compared to the same period last year - to 36.044 billion rubles. This is stated in the company's report. In the second quarter of 2013 they decreased by 28.5% by the second quarter of last year - to 14.537 billion rubles.

SIBUR's net profit according to IFRS in the first half of 2013. decreased by 13.9% - to 25.545 billion rubles.

SIBUR's net profit according to IFRS in the first half of 2013. decreased by 13.9% - to 25.545 billion rubles. This is stated in the company's report. Revenue decreased by 5% - to 130 billion rubles, operating profit decreased by 13.5% - to 32.733 billion rubles.

The share of the structure of L. Mikhelson and G. Timchenko decreased in SIBUR from 94.5% to 82.5%.

SIBUR received a notification from the owner of 100% of the shares of OJSC SIBUR Holding about a change in the structure of beneficial ownership in the SIBUR group. Indirect participation share of Edain Development Inc., whose beneficial owners are Leonid Mikhelson and Gennady Timchenko, in authorized capital companies decreased from 94.5 to 82.5% in favor of companies beneficially owned by the current and former management of SIBUR LLC and SIBUR Holding OJSC.

Vladimir Putin will hear business

Initially, it was planned that the president would go to visit Yuri Konov in the Gribanovsky district of the Voronezh region, reported RBC daily presidential press secretary Dmitry Peskov. But due to the distance of the journey (about 200 km from regional center) it was decided that he would come to Voronezh himself. By his decree, Putin returned the title of Hero of Labor on March 29, and on May 1, the first five laureates were awarded it, including Yuri Konov, a machine operator with 38 years of experience.

SIBUR's net profit according to RAS in 2012 decreased by 44.4% - to 55.268 billion rubles.

Net profit of OJSC SIBUR Holding according to Russian standards accounting(RAS) in 2012 decreased by 44.4% - to 55.268 billion rubles. against 94.591 billion rubles. a year earlier. This is stated in the company's report.

Having replaced the management of SIBUR, he no longer wants his subsidiary to go bankrupt

» Not long ago, the head of Gazprom, Alexey Miller, called the bankruptcy of SIBUR the only possible way gain control over it. But after yesterday's meeting of SIBUR shareholders, Gazprom's position changed. Having established control over the subsidiary, the management of the gas company is ready to make peace with SIBUR’s creditors.

SIBUR places 5-year Eurobonds for $1 billion.

01/24/2013, Moscow 12:03:57 SIBUR is placing five-year Eurobonds worth $1 billion with a spread of 300 basis points to average market swaps, a source in the financial market told RBC.

Investors believed in Sibur

Sibur Holding has closed the book of applications for participation in the placement of its debut Eurobonds. The issue volume is an impressive $1 billion, and the rate of return does not exceed 3.9%.

Moody's upgrades Sibur's rating to Ba1

Sibur will buy 25% of the Zaikinsky GPP from TNK-BP

In 2013, the petrochemical holding Sibur will buy from TNK-BP a 25% stake in the Zaikinsky gas processing enterprise (GPP) in Orenburg region, according to a joint press release from the companies.

SIBUR Holding in mid-2013 will begin developing the final investment decision for the Zapsibneftekhim-2 project.

06/21/2012, St. Petersburg 09:30:58 SIBUR Holding OJSC plans to to begin developing a final investment decision on the project for the construction of the Zapsibneftekhim-2 petrochemical complex in the Tyumen region. The president of the company, Dmitry Konov, told reporters about this. “In mid-2013 we will develop feed ( design work) project, and after that we will begin to develop the final investment solution,” he said. D. Konov refused to name the expected amount of investment in the project, and also said that today, as part of the St. Petersburg Economic Forum, SIBUR plans to sign a contract with Linde AD for the design of pyrolysis production within the framework of Zapsibneftekhim-2. All other agreements within the project have already been signed.

Sibur refused to build a “pipe to the Baltic”

Sibur Holding abandoned plans to build a product pipeline from Western Siberia to the Baltic at a cost of $5 billion. The pipeline was conceived to transport the feedstock of petrochemicals - a wide fraction of light hydrocarbons (NGL) for 5.5 million tons per year.

SIBUR sold 100% of OJSC SIBUR-Russian Tires

MOSCOW, January 10 - RIA Novosti. On December 29, 2011, SIBUR Holding closed the deal to sell 100% of SIBUR-Russian Tires OJSC to a group of investors, including the management of SIBUR-Russian Tires and its CEO Vadim Gurinov, SIBUR said in a statement.

Sibur sells non-core assets in parts

To increase returns, the petrochemical holding Sibur will sell its non-core assets for the production of mineral fertilizers and the production of tires in parts. This was stated by the general director of the company Dmitry Konov.

Gazprom, Novatek and Sibur are struggling with the problem of non-removal of goods from factories in the Urals Federal District

Gazprom, Novatek and Sibur are faced with the problem of non-removal of cargo via railway from its factories in Ural federal district, writes Kommersant.

Mikhelson and Timchenko divided Sibur

The new owners of Sibur Holding were announced today by Dellawood Holdings Limited. She became the owner of 100% largest player on the Russian petrochemical market. At the same time, in Dellawood itself the largest owner is the founder and head of Novatek Leonid Mikhelson, he has 57.5%. Oil trader Gennady Timchenko has 37.5%. Another 5% belongs to the managers of Sibur (Dmitry Konov, Mikhail Karisalov and Mikhail Mikhailov), as well as to the deputy chairman of the board of directors, Alexander Dyukov.

Gennady Timchenko joined SIBUR

The main owner of NOVATEK, Leonid Mikhelson, decided to share another major project with his company partner Gennady Timchenko. Together, businessmen bought 95% of SIBUR. The remaining 5% was received by Dmitry Konov, Alexander Dyukov and two more vice-presidents of the company. At the same time, Leonid Mikhelson did not rule out the inclusion of “strategic partners of NOVATEK”, for example the French Total, among the shareholders of SIBUR.

L. Mikhelson and G. Timchenko bought 95% of SIBUR Holding

A company controlled by NOVATEK shareholders Leonid Mikhelson and Gennady Timchenko, Dellawood Holdings Limited, acquired a 95% stake in SIBUR Holding CJSC. This is stated in the message of Dellawood Holdings Limited.

SIBUR changed owners

Cyprus Dellawood Holdings Ltd. announced the acquisition from Gazprombank of a 49.98% stake in ZAO SIBUR Holding, the largest player in the Russian petrochemical market. Together with the stake of Dellawood's 100% subsidiary Miracle CJSC, this amounts to 100% authorized capital SIBUR. The Russian FAS previously allowed the consolidation of 100% of Dellawood.

Battle for Sibur

It is difficult to say what prevented him from expanding into the oil sector. Either new prospects beckoned, or old worries weighed down. The fact is that on December 20, 1998, the Prosecutor General's Office opened a criminal case into the theft of about $20 million from the state oil company Rosneft (which acted as a guarantor for the supply of oil from Kazakhstan). In 1995, the offshore company Rosetto Hendels GmBH, controlled by Yakov Igorevich, did not pay for the oil delivered to it. The case was then put on hold, but during an additional check of the GUEP of the Ministry of Internal Affairs it turned out that the co-owner of the Liechtenstein company, along with Goldovsky, is... First Deputy Chairman of the Board of Gazprom Alexander Pushkin! It was Pushkin, as they say in Gazprom, who insisted on allocating “for Goldovsky” that same loan of 120 million dollars for the purchase of Sibur, which, by the way, has not yet been returned to Gazprombank.

SIBUR plans to process 19 billion cubic meters in 2012. m PNG

In 2012, SIBUR Holding enterprises plan to process 19 billion cubic meters of associated petroleum gas (APG). This was announced by the senior executive vice president of the company, Vladimir Razumov, writes Rupec.ru.

"Sibur Holding"- the largest petrochemical holding in Russia. Full name - Public Joint Stock Company "SIBUR Holding". The headquarters is located in Moscow (the company is registered in Tobolsk).

Encyclopedic YouTube

1 / 2

✪ Dmitry Konov, Chairman of the Board of SIBUR LLC: Global energy markets

✪ Labor safety quest - Sibur

Subtitles

Story

OJSC "Siberian-Ural Petroleum and Gas Chemical Company" was created by the Decree of the Government of the Russian Federation of March 7, 1995. Initially, the company included the association Sibneftegazopererabotka (GPP of Western Siberia), NIPIgazpererabotka (Krasnodar) and the Perm Gas Processing Plant.

The process of negotiations with creditors regarding the terms of debt restructuring lasted more than six months and ended on September 10, 2002 with the signing of a settlement agreement. According to some reports, the decisive factor in this was forceful pressure and the subsequent arrest of the then co-owner of Sibur, Yakov Goldovsky (the arrest was carried out in the reception room of the chairman of the board of Gazprom, Alexei Miller). After the transfer of Sibur shares to Gazprom, Goldovsky was released, lived for some time in Austria, but then returned to the Russian petrochemical business (Dzerzhinsk enterprise Korund).

2005: transfer (of assets) from AK SIBUR to SIBUR Holding.

In July 2005, SIBUR established AKS Holding OJSC (the legal successor of which is today's SIBUR) to “cleanse” the holding company of debts in the amount of 60 billion rubles, most of which is due to the debt to the parent company. The shares of 26 petrochemical enterprises belonging to SIBUR were transferred to the balance sheet of this OJSC. In December 2005, AKS Holding was renamed SIBUR Holding.

In 2007, Gazprom sold shares of Sibur to Gazfond as part of an exchange for energy assets owned by this structure. Both Gazprombank and Gazfond also left the Gazprom group.

Tire business

In 2002, in order to organize centralized sales of products from Sibur tire enterprises, SIBUR - Russian Tires LLC was created. During three years, from 2002 to 2005, the company systematically developed its sales and production activities and in the spring of 2005 introduced its first “name” products to the market - tires for trademarks Cordiant and Tyrex. In February 2007 the company changed organizational form and acquired its current name OJSC SIBUR - Russian Tires.

In 2008, Sibur planned to merge SIBUR - Russian Tires with Amtel-Vredestein, but the deal did not take place due to the crisis. At the end of December 2011, Sibur completely parted with control over OJSC SIBUR - Russian Tires, selling 75% of the shares to the company's management and the remaining shares to partners general director Gurinov's company.

Mineral fertilizers

At the end of 2011, SIBUR sold its assets in the mineral fertilizer business to Uralchem (Minudobreniya, Perm) and the Siberian Business Union (Nitrogen, Kemerovo, and Angarsk Nitrogen Fertilizer Plant, Perm). Angarsk).

Mergers and acquisitions

Reorganization of share capital

On December 23, 2010, it was announced that Gazprombank would sell 50% of the company to the structures of Leonid Mikhelson, co-owner and chairman of the board of the gas company Novatek.

In September 2011, after receiving permission from the FAS, Mikhelson’s structures purchased additional shares and his share exceeded 50%.

In November 2011, Sibur Limited became a 100% shareholder of Sibur, final beneficiaries which are the shareholders of OJSC Novatek: Leonid Mikhelson and Gennady Timchenko. The beneficiaries of the remaining 5.5% of the authorized capital of Sibur Limited were Sibur managers Dmitry Konov, Mikhail Karisalov, Mikhail Mikhailov, as well as deputy chairman of the board of directors Alexander Dyukov. In 2013, the main shareholders of Sibur reduced their stake in the company to 82.5%, and the share of current and former management increased to 17.5%.

In 2014, the structure, the founder and owner of which is SIBUR Deputy Chairman of the Board Kirill Shamalov, acquired 17% of SIBUR shares, the beneficial owner of which was previously Gennady Timchenko.

On December 17, 2015, a deal was closed to acquire a 10% stake in SIBUR by the Chinese company Sinopec, which valued the entire Russian company at $13.4 billion. In January 2017, a deal was closed to acquire the same share by the Silk Road Fund. In April 2017, Kirill Shamalov sold a 17% stake to Leonid Mikhelson. After this, the shares of the company's shareholders looked like this:

Management

The Chairman of the Board of Directors of the company is Leonid Mikhelson.

General directors of the company:

Activity

The raw materials basis of Sibur's business is the processing of associated petroleum gas in Western Siberia and the production of liquefied hydrocarbon gases. Hydrocarbon raw materials are processed into synthetic rubbers (plants in Togliatti, Voronezh and Krasnoyarsk) and polymers (Sibur-Neftekhim in Dzerzhinsk, Nizhny Novgorod region, Sibur-Khimprom in Perm, Tomskneftekhim, etc.).

Performance indicators

Processing more than half of Russian associated petroleum gas, Sibur produces more than a quarter of all liquefied petroleum gases in Russia, from 30 to 49% different types synthetic rubbers, a sixth of all Russian polyethylene, as well as a significant part of other petrochemical products. The total number of employees at the holding's enterprises is about 28 thousand people (2016).

Hydrocarbon raw materials

Basic enterprises providing raw materials:

- JSC "SiburTyumenGas" (Nizhnevartovsk, Khanty-Mansiysk Autonomous Okrug-Ugra);

"Vyngapurovsky Gas Processing Plant" - a branch of JSC "SiburTyumenGas" (Noyabrsk, Yamalo-Nenets Autonomous Okrug);

"Muravlenkovsky Gas Processing Plant" - a branch of JSC "SiburTyumenGas" (Muravlenko, Yamalo-Nenets Autonomous Okrug);

- "Yuzhno-Balyk Gas Processing Plant" - a branch of JSC "SiburTyumenGas" (Pyt-Yakh, Khanty-Mansiysk Autonomous Okrug - Yugra);

- LLC "Nizhnevartovsk GPK" (Nizhnevartovsk, Khanty-Mansiysk Autonomous Okrug-Ugra);

LLC "Belozerny GPK" (Nizhnevartovsk, Khanty-Mansiysk Autonomous Okrug-Ugra);

LLC "Nyagangazpererabotka" (Nyagan, Khanty-Mansiysk Autonomous Okrug-Yugra).

The company's gas processing enterprises processed 21.5 billion m3 of APG in 2015, 3% more than in 2014, maximizing their design capacity and increasing the recovery rate of target hydrocarbons.

- Enterprises in Tobolsk are united into the Tobolsk industrial site, which includes:

- SIBUR Tobolsk (formerly Tobolsk-Neftekhim LLC)

- "TTETS"

- Polymer business

The company's polymer production activities are supervised by the Directorate of Basic Polymers and the Directorate of Plastics, Elastomers and Organic Synthesis.

- Enterprises of the Directorate of Basic Polymers:

- LLC "RusVinyl" (Kstovo)

- LLC "BIAXPLEN" (Kursk, Zheleznodorozhny, Balakhna, Tomsk, Novokuybyshevsk)

- LLC "Sibur-Kstovo" (Kstovo, Nizhny Novgorod region)

- Tomskneftekhim LLC (Tomsk)

- Enterprises of the Directorate of Plastics, Elastomers and Organic Synthesis:

- OJSC "Sibur-Neftekhim" (Dzerzhinsk, Nizhny Novgorod region)

- CJSC "Sibur-Khimprom" (Perm) OJSC "POLIEF" (Blagoveshchensk, Bashkortostan) OJSC "Sibur-PETF" (Tver)

LLC "SIBUR GEOSINT" (Uzlovaya)

- LLC "SIBUR Togliatti" (Tolyatti)

- In 2010, the largest private Indian company RELIANCE INDUSTRIES and Sibur agreed to create a joint venture to produce butyl rubber in India. In February 2013, the companies began construction of the plant.

- In 2011, China Petroleum and Chemical Corporation (Sinopec Corp.) and Sibur entered into a Memorandum of Understanding on the possible creation of two joint ventures for the production of nitrile butadiene rubber in Krasnoyarsk (Russia) and Shanghai (China).

- NPP Neftekhimiya - plant for the production of polypropylene brand "Kaplen" (Moscow, Moscow Refinery).

Sibur Holding is a Russian company known throughout the world. It collects and processes petroleum products, produces rubber, plastic, polyethylene and supplies both to Russia and abroad. The company invests in various projects and conducts joint projects with foreign partners. Known for advanced corporate culture and care and employees

Brief information:

- Company name: Siberian-Ural Petrochemical Company

- Legal form activities: Public joint stock company

- Kind of activity: Main directions:

gas processing;

gas fractionation;

polymerization

- Revenue for 2016: RUB 411.8 billion

- Beneficiary: Leonid Mikhelson (48.5% shares)

- Number of staff: about 28 thousand employees, the total number of employees is more than 88 thousand.

- The site of the company: www.sibur.ru

Sibur Holding has been the largest oil company for several years now. chemical industry Russia. The company produces more than 25% of liquefied hydrocarbons in the Russian Federation and holds significant shares in the production of petrochemical products, including polyethylene and rubbers. The history of the organization begins in 1995; since its creation, it has united a large number of different companies.

History of origin

The Siberian-Ural Petroleum and Gas Chemical Company was created in 1995, initiated by the Russian Government. At the beginning, it united several gas processing plants in Western Siberia, a company and a gas processing plant in Krasnodar and Perm, respectively.

During the first few years, the company demonstrated steady growth in activity (even despite stagnation in Russian economy) and in 1998 it was privatized by a number of owners, the main one of which was the Gazprom structure.

Over the next three years, the management team under the leadership of General Director Yakov Goldovsky was able to carry out a number of mergers and the inclusion of new organizations. Sibur's assets included most of Russia's petrochemical enterprises, and already in 2001 the holding became the largest in its industry.

The year 2002 was marked by negotiations and the process of debt restructuring due to the bankruptcy procedure initiated by Gazprom. The company did this in response to Goldovsky’s attempts to deprive it of the status of the main shareholder and control over part of the holding’s assets. Yakov, using legal possibilities, tried to dilute the share of Gazprom and deprive it of the right to manage and block management decisions.

At the end of the year, a settlement agreement was concluded, Goldovsky, the general director and co-owner, was arrested. Tellingly, this happened on the threshold of the office of Alexey Miller, chairman of the board of Gazprom.

Active development of the holding

Soon, Dmitry Mazepin was first appointed to the post of general director, and a little later Alexander Dyukov, and the Group of Companies continued to expand and diversify production. It was decided to start manufacturing tires on the basis of the new company Sibur-Russian Tires: in 2002-2005, the entire infrastructure and technological chain were created, original products appeared - Cordiant and Tyrex tires are now known not only in Russia, but also in all over the world.

In the summer of 2005, to improve financial performance and the overall balance sheet, the AKS Holding joint-stock company was formed, to which Sibur's assets were transferred. This was done to resolve the company’s situation with debts of about 60 billion rubles. In fact, a reorganization took place: after a few months, AKS Holding turned into Sibur Holding. The owners were Gazprombank - 75% - and other structures of Gazprom - 25%.

After 2 years, Gazprom, in the course of an agreement with NPF Gazfond, exchanged its stake in assets in the energy sector.

In 2008, shortly before the global economic crisis, the holding was negotiating with Amtel-Vredestein, wanting to merge its Sibur-Russian Tires enterprise with it, but events in the global economy did not allow the deal to be completed.

Briefly. Amtel-Vredestein is a Russian-Dutch tire manufacturing company headquartered in the Netherlands. At the end of the 2000s, it was considered one of the European leaders in the field of tire production. The deal with Sibur Holding did not take place due to the problems of Amtel-Vredestein (loss for 2007 - $243 million). Declared bankrupt in the spring of 2009.

Since 2009, the management of the Sibur Holding Group of Enterprises began to implement plans to expand production.

Figure 1. Sibur Holding DGP plant.

Source: TEMPO plant

- In winter, a 50% stake in the Biaxplen company, a major consumer of polypropylene and a manufacturer of BOPP films, was acquired. Together with this company, the production of polymer film was organized at a plant in the Samara region, purchased in 2010 from Novatek.

- In 2010, through a subsidiary, the holding bought a 7% stake in Mezhregionenergosbyt, a large Russian energy supplier. One of the main tasks of the latter is to sell electricity to Gazprom enterprises.

- In the summer of 2011, he acquired a full stake in the acrylic acid manufacturer, Akrylat.

Also in 2011, several asset sales transactions took place:

- Sibur sold its own assets in the mineral fertilizer business. Buyers: Siberian Business Union, Uralchem;

- sold the entire stake in the Sibur-Russian Tires company, distributing it among its management.

The holding continued to develop steadily: revenue for 2011, compared to 2010, increased by 31.9%, reaching RUB 248.6 million.

Transactions on sale of shares and capital reorganization

In 2010, Gazprombank sold most of its ownership - 50% of shares to the structures of the Novatek company of entrepreneur Leonid Mikhelson. Less than a year later, with the permission of the Federal Antimonopoly Service, the businessman purchased additional shares and received ownership of a share of over 50%.

From this time on, Mikhelson became the main beneficiary of the Group. In 2011, 100% of the bonds belonged to his structure Sibur Limited, but in subsequent years the share capital was redistributed in favor of management and specific managers.

A 10% stake was acquired by the Chinese company Sinopec in 2015.

Briefly. Sinopec Corp. - one of the most large enterprises China in the oil and chemical industry: second place after PetroChina. Engaged in exploration, field development, refining and sales of oil and petroleum products.

In 2016, at the request of the FAS, it began trading gas on the commodity and raw materials exchange in St. Petersburg. The federal regulator made this decision, considering that Sibur Holding was inflating prices for liquefied gas.

In 2017, the position of Chairman of the Board of Directors continues to be held by Leonid Mikhelson, Chairman of the Board is Dmitry Konov, and Chief Operating Officer is Mikhail Karisalov.

Performance indicators of Sibur Holding

The companies that are part of Sibur, in addition to working in the petrochemical industry, operate in the fuel and raw materials sector:

- collect and process APG (associated petroleum gas), and also purchase it from third-party oil companies in Russia;

- process hydrocarbon raw materials, which are produced at the holding plants and partner enterprises. Apply different kinds processing, including fractionation. Their logistics companies provide transportation to the destination;

- are engaged in the promotion and sale of products from the fuel and raw materials sector (gas, naphtha, hydrocarbons of various fractions, ethers, etc.) in Russia and on the international market.

The success of the enterprise is evidenced by results achieved And completed projects.

- It ranks first in terms of scale and volume of APG processing in the country (24 billion cubic meters in 2015).

- Manufactures about 40% of rubber materials and plastics in the Russian Federation.

- Engaged in the production of hydrocarbon gases, the share in Russia is over 25%.

- Creates about 15% of polyethylene in the country.

Figure 2. View of the Sibur Holding plant.

Source: website " Progressive technologies»

The geography of the location of Sibur enterprises is throughout Russia. Factories are located in Western Siberia, Voronezh, Yekaterinburg, Krasnoyarsk, Perm, Tolyatti, Tomsk, etc. Products are manufactured at 26 production sites, used in Russia and exported to more than 70 countries around the world to 1,400 large consumers.

Management is committed to sustainable development and this is reflected in its growing turnover, despite current geopolitical restrictions on funding and operations from Western countries.

Changes in key financial indicators are shown dynamically in the diagram.

Tax deductions in Russian budget in 2016, including income tax, amounted to 15.2 billion rubles.

Large projects

The holding is constantly investing and developing new projects both in Russia and other countries.

In 2012, a joint venture was created with an Indian company; Sibur received a share of 25.1%. The goal is to create a facility in India for processing raw materials and producing BC (butyl rubber) with a capacity of more than 100 thousand tons per year.

In 2014 in Nizhny Novgorod region was launched new complex for the production of PVC. The opening ceremony was attended by Russian President Vladimir Putin. In the same year, construction began on the largest petrochemical enterprise in Russia in Tobolsk - Zapsibneftekhim. This large-scale project is still under construction; large-sized equipment was already installed in 2016.

Interesting fact. The complex was built using the latest Western technologies and equipped with high-quality installations made in the Netherlands and Great Britain. They provide high performance per year: 500 thousand tons of propylene and polypropylene, 1.5 million tons of ethylene and polyethylene.

In 2015, Sibur specialists began operating a new gas processing plant (GPP) in the Khanty-Mansi Autonomous Okrug. Prime Minister Dmitry Medvedev took part in the launch ceremony via teleconference.

In 2016, production capacity was increased at several sites:

- the infrastructure for the collection and processing of APG at the plant in Yakutia was expanded;

- the receiving capacity of the compressor station in Tyumen was increased;

- increased gas fractionation capacity at the facility in Tobolsk;

- The production of polyethylene and polypropylene in Tomsk was modernized.

Sibur Holding invests in scientific developments; in 2016, this amount amounted to about 600 million rubles. Research is aimed at creating new products, more effective technologies. The range of products offered is expanding, including through the creation of our own products.

Characteristics of the structure of PJSC SIBUR Holding

In theory, the structure of an enterprise is understood as the composition and relationship of its internal links: workshops, sections, laboratories and other divisions that make up a single economic entity. There are general, industrial and organizational structure enterprises.

Under general structure enterprise is understood as a complex of production and non-production divisions, their connections and ratios in terms of the number of employees, area, and throughput.

At the same time, production units include workshops and areas in which the main products, materials, semi-finished products, spare parts are manufactured, various types of energy are generated, and various types of repairs are carried out.

The organizational structure of enterprise management is an ordered set of management services, characterized by certain relationships and subordination. The group of managers and specialists, who are responsible for the development and implementation of management decisions, constitutes the enterprise management apparatus.

As of December 31, 2014, assets under the control of the Company were distributed between three business divisions - directorates:

· Directorate of hydrocarbon raw materials

· Directorate of synthetic rubbers

· Directorate of plastics and organic synthesis

Each directorate is responsible for the production and financial results of the enterprises it supervises and the total financial results Companies across the entire range of products within its area of responsibility.

In addition, two property-separate and operationally independent holdings have been created within the structure of PJSC SIBUR Holding - a holding for the production of tires and rubber products (JSC SIBUR - Russian Tires) and a holding for the production of mineral fertilizers (JSC SIBUR - Mineral Fertilizers).

The holding for the production of tires and rubber products was created on the basis of OJSC SIBUR - Russian Tires. This holding includes following companies:

OJSC "Omskshina"

JSC "Yaroslavl Tire Plant"

OJSC "Ural Tire Plant"

· JSC "Voltyre-Prom"

OJSC "Saransk plant "Rezinotekhnika""

· JV CJSC "Matador-Omskshina"

JSC Sibur-Volzhsky

JSC Volzhsky Nitrogen-Oxygen Plant

A holding company for the production of mineral fertilizers was created on the basis of Open joint stock company"SIBUR - Mineral Fertilizers" (JSC "SIBUR - Mineral Fertilizers"). As of December 31, 2014 This holding includes the following enterprises:

§ OJSC “Azot”, Kemerovo

§ OJSC "Mineral Fertilizers", Perm

§ CJSC "Angarsk saltpeter"

§ Angarsk Nitrogen Fertilizer Plant LLC

§ SMU Biysk LLC

§ SMU-Angarsk LLC

§ SMU-Perm LLC

§ SMU-Tyumen LLC

This structure makes it possible to combine centralized coordination of activities with decentralized management, according to which authority to resolve current and a number of tactical issues is transferred to the directorate level (for example, related to the selection of product buyers and raw material suppliers, as well as ensuring stable operation production capacity). The structure of PJSC SIBUR Holding, see APPENDIX A.

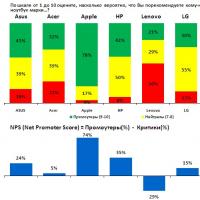

We track customer loyalty

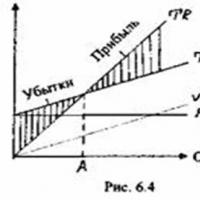

We track customer loyalty What is the profitability threshold?

What is the profitability threshold? Where to work with a sociologist's education

Where to work with a sociologist's education Rituals to get your enemy fired from work How to get your boss fired

Rituals to get your enemy fired from work How to get your boss fired 301 83 unified technological system

301 83 unified technological system License for passenger transportation

License for passenger transportation Offers are of the following types

Offers are of the following types