Can an entrepreneur temporarily stop working? How to suspend activities to avoid paying taxes and fees. ○ Is it possible to suspend activities

Temporary suspension of the activities of individual entrepreneurs is an issue that worries many entrepreneurs. The main reason why people decide to work separately and register themselves as individual entrepreneurs is to legalize their earnings.

Human factor

That is, behind an individual entrepreneur there is only a person and the problem is that he is a person and it is common for him to get sick, move, travel, he may not have the necessary resources, or during this period the demand for his services may disappear completely. Therefore, the law provides for the opportunity for entrepreneurs to suspend their work if one of these situations occurs.

The Tax Code does not provide for the possibility of stopping filing returns as a result of stopping business activity. This rule is the same for all individual entrepreneurs, regardless of what mode they use.

It is very important for individual entrepreneurs to know that this information is relevant at the moment, because previously it was possible to stop maintaining tax records when an individual entrepreneur suspended work and submitted a corresponding application to the Federal Tax Service. There also remains the need to make mandatory payments to the Pension Fund.

Return to contents

Procedural and legislative nuances

For those who are thinking about taking a break from work, it will be useful to know the procedural and legislative nuances of this decision. Because these nuances are such that if the current situation is not a short-term phenomenon, then it is much easier and cheaper to close the individual entrepreneur and not waste money.

For those who are thinking about taking a break from work, it will be useful to know the procedural and legislative nuances of this decision. Because these nuances are such that if the current situation is not a short-term phenomenon, then it is much easier and cheaper to close the individual entrepreneur and not waste money.

From a bureaucratic point of view, a temporary cessation of activity does not entail any changes in the documents that guide the individual entrepreneur in his work. That is, evidence state registration The individual entrepreneur, all his licenses, patents and other documents received specifically as an individual entrepreneur remain legitimate and can be used in the future.

As mentioned above, an individual entrepreneur who has temporarily stopped working does not stop paying taxes, fees and other mandatory payments, which must be paid regardless of whether he has income or not. However, an individual entrepreneur has some protection in tax matters, and there are restrictions on paying taxes that an individual entrepreneur who has temporarily stopped working does not pay. Individual entrepreneurs have this right under a simplified taxation system, and only on the condition that with the cessation of their work activity they ceased to receive any income.

If the entrepreneur still receives income (for example, under previously concluded agreements with clients), he retains all payment obligations.

Return to contents

Tax accounting

If an individual entrepreneur does not conduct business, he is still required to maintain reports required by law, submit declarations and other reports. If there are also employees, then his obligations as an employer are also not canceled for the period of termination of work. All his duties stipulated Labor Code, employment contracts and must be carried out without violating the rights of workers. That is, payment of wages must be carried out in any case, like any other guarantees.

If an individual entrepreneur does not conduct business, he is still required to maintain reports required by law, submit declarations and other reports. If there are also employees, then his obligations as an employer are also not canceled for the period of termination of work. All his duties stipulated Labor Code, employment contracts and must be carried out without violating the rights of workers. That is, payment of wages must be carried out in any case, like any other guarantees.

If a violation of the law occurs during this period, then the responsibility provided for existing entrepreneurs will be borne. An exception is made only for those individual entrepreneurs whose work stoppage was caused by illness or any other reasons that, by law, may temporarily limit his liability.

To the question of whether it is possible to suspend the activities of an individual entrepreneur, a clear positive answer can be given. However, this termination should be perceived more as a kind of vacation, during which most of the functions and responsibilities of the individual entrepreneur are retained, and not as a temporary cessation of obligations.

Return to contents

What reports need to be submitted?

Based on the above, we can conclude that an individual entrepreneur who has suspended work is not assigned any special status.

Based on the above, we can conclude that an individual entrepreneur who has suspended work is not assigned any special status.

That is, the procedural side of a temporary suspension simply does not exist. The tasks remain the same:

- submit reports on time

- pay taxes

- pay dues

The first document that needs to be submitted is information about average number workers. This data is submitted by all individual entrepreneurs without exception, even those who are not employers, therefore no exceptions were made for those who temporarily stopped working.

Information is submitted once for the expired tax period, that is, for the year, no later than January 20. The information form can be downloaded on the Internet or taken from your Federal Tax Service office.

Conducting business activities is a rather complex, multifaceted process, and also always risky, and therefore, due to a number of objective or subjective reasons, it happens that an individual entrepreneur is faced with a problem, as a result of which further business conduct is either not advisable at all, or the work of the enterprise must be suspended for some time.

Before making a decision acceptable to himself, an entrepreneur must know that the law Russian Federation there is no such thing as a “temporary suspension of activities” individual entrepreneur"(hereinafter referred to as individual entrepreneur) at the request of the owner himself. Accordingly, the activities of an individual entrepreneur can be terminated only by completely closing the enterprise, submitting an appropriate application to the tax authority at the place of its registration and completing all the formal accompanying procedures. In other words, an entrepreneur must remember that if for some reason (temporary lack of funds, illness, economic instability in the country, etc.) he cannot continue further activities, then simply “freeze” the work of his individual entrepreneur and move away from things won't work out for an indefinite period. Current codes and laws suggest that the activities of an entrepreneur can only be completely terminated - voluntarily or forcibly.

How to temporarily terminate the activities of an individual entrepreneur?

Since, as noted above, there is no such thing as a temporary suspension of the activities of an individual entrepreneur, and simply filing an application for suspension of business activities will not work, there are two possible options.

The first option is suitable for entrepreneurs who do not plan to engage in entrepreneurial activity in the coming months for a long period of time. In this case, only voluntary closure. Bearing in mind that you can voluntarily withdraw and register again an unlimited number of times, you can start the procedure for closing your individual entrepreneur, completely ceasing registration as an individual entrepreneur. An application for a complete application, in contrast to an application for suspension of an individual entrepreneur, exists and can be done as soon as the corresponding decision is made.

The second option is good for those who retire only temporarily, but do not want to lose their legal status as an individual entrepreneur, go through the closure procedure, and also in the future re-opening an individual entrepreneur. In this case, the profit-making activity itself simply ceases, but obligations to the state must continue to be fulfilled. The status of an individual entrepreneur is inherently indefinite, so formally there is no reason for the state itself to justify why you stopped receiving income, selling or buying - this issue concerns only you and the fact of temporary suspension of business activity does not need to be confirmed to anyone. At any time, right up to the very beginning of the existence of an individual entrepreneur, you can suspend your work activity for any period and as many times as you like, remembering only that without officially closing your individual entrepreneur, you retained all the obligations that you accepted during registration.

What responsibilities remain?

When choosing the second option, first of all, remember that you need to continue to submit reports to the Federal Tax Service, the Pension Fund and the Social Insurance Fund. Next are taxes and other payments. If the individual entrepreneur is on the general system (OSNO), then he submits zero tax returns, thereby showing the state the fact that the enterprise has no profit. If the individual entrepreneur is located on UTII, PSN or Unified Agricultural Tax, then the state does not care about the presence or absence of profit in this case; tax payments will need to be made in full, according to your taxation system and the rate established by local municipal authorities. In both cases, both for individual entrepreneurs on OSNO and for individual entrepreneurs under special taxation regimes, they will have to continue making payments to the Pension Fund (fixed fee) and the Social Insurance Fund.

In addition, if the company has hired employees, they will also have to continue to fulfill all obligations, that is, the duties of the tax agent, as well as the responsibilities of the employer, remain - which is a delicate point in terms of maintaining their jobs and wages. This issue must be resolved thoughtfully and taking into account the period for which activities are suspended, as well as what rights of workers need and can be preserved. Throughout the suspension, you must also continue to provide information on the average number of employees at the enterprise for each reporting period and maintain your income and expense journal.

Of course, such a scheme for suspending activities individual entrepreneurship brings little benefit, but still the main goal (temporary cessation labor activity while maintaining the status of an individual entrepreneur) will be achieved.

What if the individual entrepreneur is completely closed?

In case of complete cessation of the enterprise's activities, including the following stages.

Collection of documents:

- application for termination of activities as an individual entrepreneur, in connection with his decision to terminate (in form No. P26001, which can be downloaded on the official website of the Federal Tax Service http://reg.nalog.ru),

- a receipt confirming payment of the fee (currently the amount of the fee is 160 rubles),

- a document confirming the submission of information to the Pension Fund (according to the Federal Tax Service website, the latter is not mandatory).

Identification of the company’s debts and their payment, if any. Particular attention should be paid to the payment of taxes, the obligation to pay which ceases in the event of successful closure of the individual entrepreneur from the date of filing the application for termination of activities. But until this moment, you need to fully pay all your tax obligations within the deadlines in which they were paid during the activity.

Submission of documents for closing the enterprise to the fiscal service authorities. To do this, you need to contact the Federal Tax Service at the place of registration of the enterprise (not at the place of registration!).

Both when opening an individual entrepreneur and when closing it, the Law “On State Registration” establishes a deadline for their implementation of 5 working days. Accordingly, within 5 days the Federal Tax Service will issue a certificate of state registration of termination of activities as an individual entrepreneur.

Expert opinion

Maria Bogdanova

More than 6 years of experience. Specialization: contract law, labor law, social security law, intellectual property law, civil procedure, protection of the rights of minors, legal psychology

It is possible to re-open an individual entrepreneur according to the new rules. From January 1, 2019, it will be possible to register as an individual entrepreneur and legal entity without paying a state fee if the package of documents required for state registration is submitted to the registration authority in electronic form. These changes have been made to clause 3 of Art. 333.35 Tax Code of the Russian Federation Federal law dated July 29, 2018 No. 234-FZ.

According to the amendments, the possibility of exemption from payment of state duty is established for state registration:

- creation legal entities(state duty is 4 thousand rubles);

- changes made to constituent documents, as well as liquidation of legal entities outside of bankruptcy proceedings (state duty - 800 rubles);

- creation of individual entrepreneurs (state duty - 800 rubles);

- termination of the activities of an individual entrepreneur (state duty - 160 rubles).

Prepare and send a kit to the registration authority necessary documents For state registration of legal entities and individual entrepreneurs, the Internet service of the Federal Tax Service of Russia “State registration of legal entities and individual entrepreneurs” will help.

By general rule, the Federal Tax Service authorities independently deregister individual entrepreneurs with the Social Insurance Fund, but only if there were no hired workers at the enterprise. If there were any, the individual entrepreneur must independently deregister with the Social Insurance Fund.

If the individual entrepreneur used cash register equipment, when closing it must be deregistered.

For entrepreneurs who have opened a bank account, next step it will be closed by contacting the bank and submitting an appropriate application. According to the Tax Code of the Russian Federation, after closing an account, you must notify the Federal Tax Service and extra-budgetary funds about this fact within 7 working days.

If a seal was used in business activities, it can be destroyed, for which you need to turn to the services of the same company that produces seals. The seal or stamp itself, an application for its destruction, a copy of the entrepreneur’s passport are submitted to the company, and after payment for the company’s services, the seal is destroyed.

Remember that documents regarding the previous activities of an individual entrepreneur, even if the activity is completely discontinued, should be stored for at least 4 years.

The reason for this requirement is the possibility of debt collection, even upon termination of activity, both by government authorities (taxes, fees, fines and penalties), and by contractors or former employees.

In addition, if the company has hired employees, they will also have to continue to fulfill all obligations, that is, the duties of the tax agent, as well as the responsibilities of the employer, remain - which is a delicate point in terms of maintaining their jobs and wages. This issue must be resolved thoughtfully and taking into account the period for which activities are suspended, as well as what rights of workers need and can be preserved. Throughout the suspension, you must also continue to provide information on the average number of employees at the enterprise for each reporting period and maintain your income and expense journal. Of course, such a scheme for suspending the activities of individual entrepreneurship brings little benefit, but still the main goal (temporary cessation of work while maintaining the status of an individual entrepreneur) will be achieved.

Suspension of the activities of an individual entrepreneur without closure: step-by-step instructions.

But until this moment, you need to fully pay all your tax obligations within the deadlines in which they were paid during the activity. Submission of documents for closing the enterprise to the fiscal service authorities.

To do this, you need to contact the Federal Tax Service at the place of registration of the enterprise (not at the place of registration!). Both when opening an individual entrepreneur and when closing it, the Law “On State Registration” establishes a deadline for their implementation of 5 working days.

Accordingly, within 5 days the Federal Tax Service will issue a certificate of state registration of termination of activities as an individual entrepreneur. As a general rule, the Federal Tax Service authorities independently deregister individual entrepreneurs with the Social Insurance Fund, but only if there were no hired employees at the enterprise.

If there were any, the individual entrepreneur must independently deregister with the Social Insurance Fund.

Is it possible to suspend the activities of an individual entrepreneur? possible options

If the individual entrepreneur used cash register equipment, it must be deregistered when closing. For entrepreneurs who have opened a bank account, the next step will be to close it by contacting the bank and submitting an appropriate application.

According to the Tax Code of the Russian Federation, after closing an account, the Federal Tax Service and extra-budgetary funds must be notified of this fact within 7 working days. If a seal was used in business activities, it can be destroyed, for which you need to turn to the services of the same company that produces seals.

The seal or stamp itself, an application for its destruction, a copy of the entrepreneur’s passport are submitted to the company, and after payment for the company’s services, the seal is destroyed.

Suspension of the activities of individual entrepreneurs

In fact, an individual entrepreneur has the right only to completely cease the existence of the status. If a businessman wants to officially suspend work for a short period of time, then this option is not suitable.

Attention

You will have to go through registration procedures twice - to close the individual entrepreneur and before re-opening the business. Suspension of activity may represent its unofficial, but real termination - the individual entrepreneur retains its status, but does not conduct business and does not receive profit.

Even this period is accompanied by the responsibilities of the entrepreneur:

- timely submit reports and declarations to government agencies;

- make mandatory contributions for yourself to the Pension Fund and the Federal Compulsory Medical Insurance Fund.

Before choosing this method of suspension, you can determine whether it is profitable, since the businessman will not receive profit from the enterprise, but the costs will remain the same.

Sometimes, in order to prevent ruin or losses, wait for a more favorable time, or have time to solve personal problems that interfere with running a business, it is simply necessary to take some time out.

- Is it really necessary to close the case for this?

- And if you plan to return, will you have to go through the opening procedure again?

- What is the most profitable and easier thing for a private entrepreneur to do in such a situation?

- How to properly document such a process?

- What are the options for non-compliance with the “protocol” and what are the consequences for the business owner?

Will the law allow “hiding for a while?” An individual entrepreneur is called that because he conducts business at his own peril and risk, according to his own understanding, reporting to the law in deadlines and deducting dues and taxes.

Suspension of the activities of individual entrepreneurs (2018)

Info

There is no way to be an individual entrepreneur and retire for an indefinite period. Current codes and laws suggest that the activities of an entrepreneur can only be completely terminated - voluntarily or forcibly.

Content

- How to temporarily terminate the activities of an individual entrepreneur?

- What responsibilities remain?

- What if the individual entrepreneur is completely closed?

- Temporary suspension of the activities of individual entrepreneurs

How to temporarily terminate the activities of an individual entrepreneur? Since, as noted above, there is no such thing as a temporary suspension of the activities of an individual entrepreneur, and simply filing an application for suspension of business activities will not work, there are two possible options. The first option is suitable for entrepreneurs who do not plan to engage in entrepreneurial activity in the coming months for a long period of time.

Is it possible to suspend the activities of an individual entrepreneur without closing it?

Yes, they will also have to file a tax return, but since there is no activity, the income will be reported as zero. In this case, taxes will not be payable, only a fixed contribution to the Pension Fund will remain. An entrepreneur must decide for himself whether these funds and hassles are worth the status of an individual entrepreneur. Typically, it is not that difficult for entrepreneurs to file a zero return and secure their future pension. And they can return to activity whenever they wish. An “empty” declaration (the so-called zero), even if submitted for a long time, will not have any consequences for the businessman. Single tax payer, think twice For those entrepreneurs who are on the general taxation system, the suspension of activities will be unprofitable.

How to suspend the activities of an individual entrepreneur

Documents must be sent within the deadlines established by law. This requirement is relevant even if there is no income during the break (declarations may be zero).

- Transfer of information on the average number of employees. An entrepreneur must remember his responsibility to employees if the individual entrepreneur acts as an employer. People who are officially employed have certain rights. It is prohibited to ignore them in case of suspension of activities. Otherwise, the individual entrepreneur may face problems.

- Maintaining an accounting book where profits and expenses are recorded.

This is necessary to solve two problems - providing peace of mind and maintaining records.

Subtleties of closing an individual entrepreneur If the break is a year or more, a complete cessation of activity would be a justified step. In this case, the entrepreneur must take several steps.

How can you temporarily suspend the activities of an individual entrepreneur?” - a question that individual entrepreneurs often face when difficulties arise in business or they want to take a short vacation. Many people believe that an individual entrepreneur has only two options - active work or its complete cessation in case of failure. But practice has shown that proper suspension of activities allows you to rethink many issues, and then resume the enterprise without the need to waste time and money. What options are there? To pause entrepreneurial activity, you can use one of two ways:

- Voluntary closure of individual entrepreneurs. This option is suitable for businessmen who do not plan to restart their business for an extended period. Subsequently, the individual entrepreneur has the right to register and close as many times as necessary.

Suspension of the activities of an individual entrepreneur

If you decide to suspend your activities for a short period of time, then further actions depend on the tax regime you are in. OSNO and simplified tax system are those systems in which taxes are deducted depending on the income generated by the business. There will be no income, and there will be no payments to the tax service. However, you are required to submit declarations, even if they are zero. The law allows you to open and close an individual entrepreneur an unlimited number of times, and the status of an entrepreneur is unlimited. The tax regimes of UTII, Unified Agricultural Tax and PSN provide for fixed payments, therefore the temporary suspension of the activities of individual entrepreneurs does not affect them in any way - payments must be made regularly. If you work in the UTII mode, you can submit an application to the Federal Tax Service to be deregistered as a payer of this tax. As soon as the activity is resumed, re-submit the application for registration for the payment of imputation.

How to temporarily suspend the activities of an individual entrepreneur

Taxation of individual entrepreneurs From the moment of assignment of OGRNIP until the date of loss of individual entrepreneur status, an individual entrepreneur retains certain financial responsibilities before the domestic budget. The specific fiscal burden directly depends on the taxation system used by the individual entrepreneur:

- if an individual applies the OSN or simplified tax system, then obligations to calculate and pay taxes arise during the actual implementation of activities;

- citizens using UTII or PSN make fiscal contributions to the budget, regardless of the fact of doing business;

- All existing individual entrepreneurs must submit tax reports, even if they are temporarily not involved in business operations.

It should be especially emphasized that any person with a state of emergency status annually transfers insurance contributions to extra-budgetary funds.

Drawing up an application. When closing an individual entrepreneur, the established application form P65001 is used. The document can be filled out by hand (in black ink in capital letters) or on a computer (Courier New font, 18).

The application will need to indicate your full name, INN and OGRNIP, as well as contact information and the method of submitting the document to the tax office. When submitting an application in person, the signature is placed in the presence of a Federal Tax Service employee.

✔ Providing a receipt for the fee. In addition to the application, a receipt for payment of the state fee is required. Its size is 160 rubles. You can generate a receipt on the official website of the Federal Tax Service. To do this you will need to fill in the required information. You can also get it at your local branch. tax office. The receipt is paid at bank branches, in the Internet banking system or through a terminal. ✔ Extract from the Pension Fund.

For many entrepreneurs, the pressing question is whether it is possible not to resort to bankruptcy proceedings, but to take a break from their activities.

Sometimes, in order to prevent ruin or losses, wait for a more favorable time, or have time to solve personal problems that interfere with running a business, it is simply necessary to take some time out.

- Is it really necessary to close the case for this?

- And if you plan to return, will you have to go through it again?

- What is the most profitable and easier thing for a private entrepreneur to do in such a situation?

- How to properly document such a process?

- What are the options for non-compliance with the “protocol” and what are the consequences for the business owner?

Will the law allow “laying low for a while”?

An individual entrepreneur is called that because he conducts business at his own peril and risk, according to his own understanding, reporting to the law within the established time limits and deducting required contributions and taxes. What is the strategy for doing business in private company, LLC or for a single businessman, the law does not regulate. Therefore, in case a situation arises when an entrepreneur does not consider it possible to temporarily engage in his “brainchild,” Russian legislation does not provide for special regulations.

Therefore, when asked whether it is possible to temporarily suspend the activities of an individual entrepreneur, the law does not give a positive answer. Whether or not to act in the interests of the business, whether to take any actions to make a profit or leave everything as it is is a personal decision of an individual entrepreneur. Until the enterprise is deregistered, it is considered operating, just as all licenses, permits, patents and certificates remain valid.

A registered businessman is a private entrepreneur until he has completed the actions prescribed by law to deprive himself of this status, that is, not.

NOTE! The law allows the procedure for closing and opening an individual entrepreneur to be carried out an unlimited number of times.

The report won't wait

Since the activity is not officially closed, it does not matter to the state whether there are any movements to make a profit; this is the competence of the business owner.

Once an enterprise is officially listed as operating, it must report on its activities, even if there is no activity. The entrepreneur’s obligation to the insurance and pension funds, as well as to the tax authorities, cannot be canceled. If they work for a businessman wage-earners or are simply on staff, they will have to continue to accrue the guaranteed wages.

Tax reporting, as well as due contributions, must be submitted on time. If an entrepreneur, having stopped working, simply stops submitting declarations and paying due fees, he will be charged not only fines, but also late fees. Penalties, by the way, can be calculated. In this case, the court will not be on the side of the businessman, since the law considers his enterprise to be “living” until it is officially closed.

Who benefits more?

An entrepreneur who decides to temporarily retire is faced with a choice of two options:

- without actually working, continue to report to the state on time and pay the required fees;

- officially close the individual entrepreneur according to the procedure prescribed by law and be free in your actions until the subsequent opening again, if such a decision is made.

Are you a “simplifier”? It's easier for you

The first option will be more profitable for businessmen whose work is based on a simplified taxation system. Yes, they will also have to file a tax return, but since there is no activity, the income will be reported as zero. In this case, taxes will not be payable, only a fixed contribution to the Pension Fund will remain. An entrepreneur must decide for himself whether these funds and hassles are worth the status of an individual entrepreneur. Typically, it is not that difficult for entrepreneurs to file a zero return and secure their future pension. And they can return to activity whenever they wish.

An “empty” declaration (the so-called zero), even if submitted for a long time, will not have any consequences for the businessman.

Single tax payer, think twice

For those entrepreneurs who are on the general taxation system, the suspension of activities will be unprofitable. The businessman will not make any actual profit, and the expenses will remain the same, because the collections will be stable, no matter what.

It is worth considering what will outweigh: constant reports and payments that cannot be canceled, or the hassle and fees associated with the procedure for closing and, if necessary, subsequent opening of an individual entrepreneur.

The period for which the entrepreneur plans to leave the activity also matters. If there is a long period of expected inactivity, it would be more advisable to close the enterprise. Nothing will prevent you from reopening if the entrepreneur’s plans change.

Documents and registration

What statements can official authorities expect from an entrepreneur who is suspending activities? None, since formally there is no work stoppage. An application to suspend the activities of an individual entrepreneur cannot be written if there are no legal grounds for such an act. What documents can you expect? tax authorities from a non-working entrepreneur, except for a tax return?

- Application for closure. If the tax authorities receive any legal application from the entrepreneur, it can only be form P65001, in which the entrepreneur asks to close the individual entrepreneur. It doesn’t matter if you fill out the form on a computer or by hand, the main thing is that it is free of blots, errors and corrections.

- Certificate from the Pension Fund of Russia. This application must be accompanied by a certificate from the Pension Fund stating that you are registered there and are paying the required contributions. If the businessman did not manage to receive such a certificate, the tax office will request it from the Pension Fund itself.

IMPORTANT! Tax authorities are not interested in debt to the Pension Fund, if any, since these are different departments. The required contributions can be made later, the main thing is that this happens without delay according to pension legislation, if you do not want to pay a fine.

What's next?

- After 5 days, the tax office will issue the entrepreneur with a certificate stating that from now on he is former entrepreneur: the activities of his individual entrepreneur have been terminated.

- After another 12 days, he will need to report to the Social Insurance Fund and notify the Pension Fund of the termination of his status.

- If a current account has been opened, care must be taken to close it, otherwise it will be charged a monthly maintenance fee, even if no more funds are received into it.

- If the entrepreneur had for settlements cash machine, it must be deregistered, otherwise a fine will be charged.

And I want to work again!

The law provides an individual entrepreneur with the opportunity to decide for himself whether he wants to carry out entrepreneurial activities, and how soon to return to it, if this issue is resolved. The period between closing and opening an individual entrepreneur can be absolutely any. Re-registration takes place according to the established procedure with the same tax authority.

Results and conclusions

- It is impossible to suspend the activities of an individual entrepreneur without ceasing to fulfill obligations to the state.

- An entrepreneur who is not conducting business must retain all the statuses and powers of an employer:

- submit a tax return with a zero profit column;

- to pay single tax, if provided for by registration;

- pay a fee to the Pension Fund;

- continue to keep a ledger of expenses and income;

- submit data on the number of staff;

- pay wages if employees are not fired.

Until the official termination of activities, the entrepreneur must fulfill certain obligations to the state, funds and counterparties. There is only one way out of this situation - closing the individual entrepreneur and subsequent re-opening when activity resumes. A citizen can carry out these manipulations endlessly. Return to content ○ Is it possible to simply “not work”? A businessman may not actually operate, but he will not receive an exemption from his obligations under the law. He will also have to:

- Provide reports, declarations and other documentation to government agencies.

- Transfer mandatory contributions for yourself to the Pension Fund and the Federal Compulsory Medical Insurance Fund.

Thus, despite the lack of profit, you will still have to pay the prescribed insurance premiums. If this is not done, the citizen will be held administratively liable.

Suspension of the activities of an individual entrepreneur without closure: step-by-step instructions.

How can you temporarily suspend the activities of an individual entrepreneur?” - a question that individual entrepreneurs often face when difficulties arise in business or they want to take a short vacation. Many people believe that an individual entrepreneur has only two options - active work or its complete cessation in case of failure. But practice has shown that proper suspension of activities allows you to rethink many issues, and then resume the enterprise without the need to waste time and money.

What options are there? To suspend business activities, you can use one of two ways:

- Voluntary closure of individual entrepreneurs. This option is suitable for businessmen who do not plan to restart their business for an extended period. Subsequently, the individual entrepreneur has the right to register and close as many times as necessary.

Is it possible to suspend the activities of an individual entrepreneur without closing it?

There are situations when running a business is temporarily impossible for some reason. Is it possible to suspend the activities of an individual entrepreneur for this period without closing it with the tax office? Does such a procedure exist? Let's look into this in the article. Contents of the article ○ Legislation in the field of entrepreneurial activity.

○ Is it possible to suspend activities? ○ Is it possible to simply “not work”? ✔ Maintaining the tax burden.✔ Obligations to the Pension Fund. ○ Is closing an individual entrepreneur an option? ✔ Putting things in order.✔ Drawing up an application.✔ Providing a receipt for the fee.✔ Extract from the Pension Fund.

Suspension of the activities of individual entrepreneurs

Federal Law No. 129 of 08.08.2001 “On state registration of legal entities and individual entrepreneurs”: State registration when an individual terminates his activities as an individual entrepreneur in connection with his decision to terminate this activity is carried out on the basis of the following documents submitted to the registration authority:

- An application for state registration signed by the applicant in the form approved by the federal executive body authorized by the Government of the Russian Federation.

- Document confirming payment of state duty.

Please note that applications for temporary suspension of activities are not provided for by law. Return to contents ○ Is it possible to suspend activities? So, an individual entrepreneur cannot suspend activities for a short period of time.

Suspension of the activities of an individual entrepreneur

If an entrepreneur, having stopped working, simply stops submitting declarations and paying due fees, he will be charged not only fines, but also late fees. Penalties, by the way, can be calculated directly on our website. In this case, the court will not be on the side of the businessman, since the law considers his enterprise to be “living” until it is officially closed.

Who benefits more? An entrepreneur who decides to temporarily retire is faced with a choice of two options:

- without actually working, continue to report to the state on time and pay the required fees;

- officially close the individual entrepreneur according to the procedure prescribed by law and be free in your actions until the subsequent opening again, if such a decision is made.

Are you a “simplifier”? It's easier for you The first option will be more profitable for businessmen whose work is based on a simplified taxation system.

What's next?

- After 5 days, the tax office will issue the entrepreneur with a certificate stating that from now on he is a former entrepreneur: the activities of his individual entrepreneur have been terminated.

- After another 12 days, he will need to report to the Social Insurance Fund and notify the Pension Fund of the termination of his status.

- If a current account has been opened, care must be taken to close it, otherwise it will be charged a monthly maintenance fee, even if no more funds are received into it.

- If an entrepreneur had a cash register for payments, it must be deregistered, otherwise a fine will be charged.

And I want to work again! The law provides an individual entrepreneur with the opportunity to decide for himself whether he wants to carry out entrepreneurial activities, and how soon to return to it, if this issue is resolved. The period between closing and opening an individual entrepreneur can be absolutely any.

Legislation on the suspension of business activities The current regulations regulate in detail the procedure for liquidating the status of an individual entrepreneur. The standards are enshrined in the Civil Code of the Russian Federation and Federal Law No. 129. A break from work on a voluntary basis is not regulated by the legislator. An application form for temporary suspension of activities has not been developed.

In fact, these actions are the right of an individual entrepreneur. He can do business or not. Individual entrepreneur status is unlimited. An entrepreneur can be deprived of it only in cases established by law. Absence real profit and work is not grounds for liquidation of an individual entrepreneur. From a bureaucratic point of view, the fact of temporary termination of a businessman’s work has no significance. Acts presented to the entrepreneur during the period of operation retain their legitimacy.

Attention

Practical experience of business suspension Entrepreneurs do not always suspend their activities correctly. Most often, they simply retire - they close a store, an enterprise, etc. Bureaucratic procedures are not followed. This mistake is fraught with fines and sanctions.

This situation ends after the businessman receives notifications from public services with the requirement to transfer the declaration, pay fees, etc. It will not be possible to challenge the decision of the tax inspectorate or extra-budgetary funds. The actions of public services, in this case, do not contradict current legislation.

Alternative option When an individual entrepreneur wants to stop working for a long time, he has the right to eliminate this status.

In fact, an individual entrepreneur has the right only to completely cease the existence of the status. If a businessman wants to officially suspend work for a short period of time, then this option is not suitable. You will have to go through registration procedures twice - to close the individual entrepreneur and before re-opening the business.

Suspension of activity may represent its unofficial, but real termination - the individual entrepreneur retains its status, but does not conduct business and does not receive profit. Even this period is accompanied by the responsibilities of the entrepreneur:

- timely submit reports and declarations to government agencies;

- make mandatory contributions for yourself to the Pension Fund and the Federal Compulsory Medical Insurance Fund.

Before choosing this method of suspension, you can determine whether it is profitable, since the businessman will not receive profit from the enterprise, but the costs will remain the same.

Is it possible to suspend the activities of a private enterprise without closing it?

The procedure involves the following steps:

- preparation of an application and a package of documented information;

- payment of state duty;

- transfer of collected data to the tax service;

- Receipt of the finished certificate after 5 working days.

The process is the same as when opening an individual entrepreneur. Based on the results, changes are made to the Unified State Register of Individual Entrepreneurs. From this moment on, the businessman should not conduct business activities.

Actions to implement it can be considered illegal and sanctions can be imposed on the offender. This option will allow you to avoid the cost of fees and payments. Individual entrepreneurs are exempt from the obligation to submit reports and pay contributions to the treasury.

He just needs to liquidate the case correctly. Otherwise, there will be fines and sanctions from the state. Important! The legislator does not limit the right individuals for multiple opening and closing of individual entrepreneur status.

Returning household appliances Is it possible to return money to appliances?

Returning household appliances Is it possible to return money to appliances? New blog of Oleg Lurie What to do if they want to squeeze out the project

New blog of Oleg Lurie What to do if they want to squeeze out the project Participation in tenders: step-by-step instructions, necessary documents, conditions Participation of individual entrepreneurs in tenders

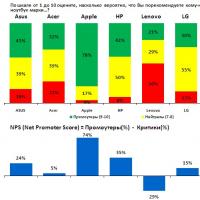

Participation in tenders: step-by-step instructions, necessary documents, conditions Participation of individual entrepreneurs in tenders We track customer loyalty

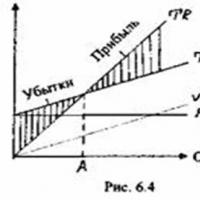

We track customer loyalty What is the profitability threshold?

What is the profitability threshold? Where to work with a sociologist's education

Where to work with a sociologist's education Entrepreneurial environment and its structure Entrepreneurial environment as a system of relations

Entrepreneurial environment and its structure Entrepreneurial environment as a system of relations