Art 137 tk rf withholding. Deduction from employee salaries. deduction from wages

New edition Art. 137 of the Labor Code of the Russian Federation

Deductions from the employee's wages are made only in cases provided for by this Code and other federal laws.

Deductions from the employee's wages to pay off his debts to the employer can be made:

to reimburse the unearned advance paid to the employee on account of wages;

to repay an unspent and timely not returned advance payment issued in connection with business trip or transfer to another job in another locality, as well as in other cases;

for the return of amounts overpaid to the employee due to counting errors, as well as amounts overpaid to the employee, if recognized by the body for the consideration of individual labor disputes the employee's fault for failure to comply with labor standards (part three of Article 155 of this Code) or simple (part three of Article 157 of this Code);

upon dismissal of an employee before the end of the working year, on account of which he has already received an annual paid vacation, for unworked vacation days. Deductions for these days are not made if the employee is dismissed on the grounds provided for by paragraph 8 of the first part of Article 77 or paragraphs 1, 2 or 4 of the first part of Article 81, paragraphs 1, 2, 5, 6 and 7 of Article 83 of this Code.

In the cases provided for in paragraphs two, three and four of part two of this article, the employer has the right to make a decision to deduct the employee from the salary no later than one month from the end of the period established for the return of the advance payment, repayment of debt or incorrectly calculated payments, and provided that if the employee does not dispute the grounds and amount of the deduction.

counting error;

if the body for the consideration of individual labor disputes recognized the employee's guilt in failure to comply with labor standards (part three of Article 155 of this Code) or simple (part three of Article 157 of this Code);

Commentary on Article 137 of the Labor Code of the Russian Federation

Deductions from wages are made:

1) by virtue of the law - income tax and insurance contributions to the Pension Fund;

2) by court decisions - fines imposed in the administrative procedure, when serving correctional labor for committing a crime, when compensating for damage caused by the parties to the employment relationship;

3) by order of the employer.

The law establishes that deductions from wages at the initiative of the employer can be made only in the directly provided cases:

1) to reimburse the unearned advance paid to the employee against wages;

2) to pay off an unspent advance payment issued in connection with a business trip or transfer to another job in another locality, as well as in other cases;

3) for the return of amounts overpaid to the employee due to counting errors, as well as amounts overpaid to the employee, in case of failure to meet labor standards (part 3 of article 155 of the Labor Code of the Russian Federation) or downtime due to the fault of the employee (part 3 of article 157 Labor RF Code);

4) upon dismissal of an employee before the end of the working year, on account of which he has already received an annual paid vacation, for unworked vacation days. Deductions for these days are not made if the employee is dismissed on the grounds provided for in paragraph 8 of Part 1 of Art. 77 or clauses 1, 2 or clauses 4 of part 1 of Art. 81, clauses 1, 2, 5, 6 and 7 of Art. 83 of the Labor Code of the Russian Federation.

In all other cases, deductions are made by the employer bringing a claim to the court. In the cases listed above (with the exception of the collection of an unearned advance payment), the employer may issue an appropriate order no later than one month.

Wages overpaid to an employee (including in case of improper use labor legislation or other normative legal acts containing norms labor law), cannot be recovered from him, except for the cases:

counting error;

if the body for the consideration of individual labor disputes recognized the employee's guilt in failure to comply with labor standards (part 3 of article 155 of the Labor Code of the Russian Federation) or simple (part 3 of article 157 of the Labor Code of the Russian Federation);

if the salary was paid to the employee in excess in connection with his illegal actions established by the court.

Another commentary on Art. 137 of the Labor Code of the Russian Federation

1. Article 137 of the Labor Code of the Russian Federation establishes the grounds for deductions from the employee's wages. Deductions can be made only in cases stipulated by the Labor Code or other federal laws. The prohibition on deductions, in addition to the cases established by laws, ensures the protection of the wages of employees.

2. Contents of Art. 137 of the Labor Code of the Russian Federation complies with the provisions of the ILO Convention No. 95 "On the Protection of Wages". Article 8 of the Convention provides that deductions from wages are permitted under the conditions and within the limits prescribed by national legislation or determined in collective agreements or in decisions of arbitral tribunals. Workers should be advised of the conditions and limits of such deductions. It is important to emphasize that Russian legislation does not provide for the possibility of deductions from wages on the basis of a collective agreement, since such conditions would worsen the employee's position in comparison with that provided for by law.

Any deductions at the discretion of the employer associated with the assignment of a part of the production costs, satisfaction of claims from third parties to the employer or employee without judgment or the consent of the employee himself.

3. At present, other codes and federal laws establish the possibility of withholding from wages when collecting taxes from the income of individuals, when collecting administrative fines, fines as a criminal punishment, when serving a sentence in the form of correctional labor, when executing court decisions.

4. Deductions for the purpose of levying tax on personal income are made in accordance with the Tax Code. stipulates that the organizations from which the taxpayer receives income are obliged to calculate, withhold from the taxpayer and pay the amount of the accrued tax on the income of individuals. These deductions must be made directly from the taxpayer's income when actually paid. In this case, the withholding tax amount cannot exceed 50% of the payment amount.

5. In accordance with Art. 32.2 of the Code of Administrative Offenses of the Russian Federation, an administrative fine must be paid by a person brought to administrative responsibility by making or transferring the amount of the fine to a bank or other credit organization. In case of non-payment of the administrative fine on time, a copy of the decision on the imposition of a fine is sent by the judge (body, official) who issued the order to the employer at the place of work, held liable to withhold the amount of the fine from wages.

6. A fine as a criminal punishment is established by a court verdict. In accordance with Art. 31 of the Criminal Executive Code of the Russian Federation, a person sentenced to a fine is obliged to pay it within 30 days from the date the sentence enters into legal force. In case of non-payment of the fine, the penalty is voluntarily levied on the property of the convicted person, while if the amount of the fine does not exceed two minimum wages, in the absence of property or insufficient property to fully pay off the amount of the fine, the penalty may be levied on wages. Execution of the penalty in the form of a fine is imposed on the bailiffs-executors.

7. Detentions by virtue of a court decision are also made when an employee is serving correctional labor as a punishment for a committed criminal offense. The basis for making such deductions is the court's verdict. In accordance with Art. 40 of the Criminal Executive Code of the Russian Federation, deductions are made from the convict's salary in the amount established by the court verdict. Correct and timely deduction from the wages of the convicted person and transfer of the amounts of deduction to established order assigned to the employer. The procedure for making deductions is established by Art. 44 PEC.

8. Deductions from wages are also possible on the basis of enforcement documents - writs of execution issued on the basis of a decision, sentence, determination and order of courts (judges); amicable agreements approved by the court; court orders etc. In accordance with Art. 64 Federal law of July 21, 1997 N 119-FZ (as amended on November 3, 2006) "On Enforcement Proceedings" wages may be levied: when collecting periodic payments; when collecting amounts not exceeding two minimum wages; if the debtor does not have property on which a claim can be levied. Writs of execution and other writ of execution are sent to the employer for collection.

9. The Labor Code provides for the possibility of deductions from wages to pay off the employee's debt to the employer in the cases specified in Art. 137 of the Labor Code, as well as in order to compensate the employee for property damage caused to the employer.

On the procedure for compensation by the employee for property damage caused to the employer, see Art. 248 of the Labor Code of the Russian Federation and a commentary to it.

10. An employee's debt to the employer may arise as a result of an advance payment to the employee against wages or in connection with a business trip or transfer to work in another locality. In the event that the employee did not work out such an advance or did not use the amount issued in advance for the purpose of a business trip or relocation to another locality and does not return it voluntarily, its amount may be withheld from the employee's salary.

For the amounts issued to an employee on business trips, see Art. 168 of the Labor Code of the Russian Federation and a commentary to it.

11. The employer's order to withhold the advance from wages can be made if two conditions are met:

The employee does not dispute the grounds and amounts of deductions;

The order was made no later than one month after the end of the period established for the return of the advance.

12. The employee's objections to the grounds and amounts of deductions must be expressed in writing. At the same time, he may refer to the illegality or unreasonableness of the return of the indicated amounts, as well as to the incorrect determination of their size.

13. The course of the monthly period starts from the day established for the return of the advance.

When returning an unused advance payment issued against wages, such a period is established by agreement of the parties. employment contract.

For an advance paid for a business trip, the return period is three days after the employee returns from a business trip (clause 19 of the Instruction on business trips, approved by the Decree of the USSR Ministry of Finance, the USSR State Committee for Labor and the All-Union Central Council of Trade Unions of the USSR and the All-Union Central Council of Trade Unions of the USSR on April 7, 1988 (Bulletin of the USSR State Committee for Labor. 1988 . N 8)).

14. Debts to the employer may also arise if the employee is paid excessive amounts due to an accounting error. A counting error should be understood as an error in arithmetic operations when calculating the amounts due to be paid. The employer's order to deduct the amounts overpaid due to an accounting error from wages is possible in the absence of a dispute with the employee about the grounds and amount of these deductions, provided that the order is made within a month from the date of payment of the incorrectly calculated amounts. If the employer misses the month, the amounts overpaid to the employee may be recovered in court.

Amounts overpaid due to misapplication of wage laws, collective bargaining agreements, agreements or employment contracts are not the result of a counting error and are not refundable.

15. Amounts overpaid to the employee are subject to withholding in the event that the body for consideration of the individual labor dispute recognizes the employee's guilt in failure to meet production standards or in idle time.

For wages in case of non-fulfillment of production standards, see Art. 155 of the Labor Code of the Russian Federation and a commentary to it.

For remuneration for idle time, see Art. 157 of the Labor Code of the Russian Federation and a commentary to it.

16. Amounts paid to the employee as payment for vacation are subject to withholding, in the event of his dismissal before the end of the working year for which the vacation was granted.

For the procedure for granting vacations, see her.

In case of dismissal of an employee before the expiration of the working year for which the leave was granted, deductions are made upon final settlement with the employee. This rule does not apply when an employee is dismissed on the following grounds:

If the employee refuses to transfer to another job, which is necessary for him in accordance with the medical certificate issued in accordance with the established procedure (clause 8 of article 77 of the Labor Code of the Russian Federation);

In connection with the liquidation of an organization or the termination of activities by an employer - an individual (clause 1 of article 81 of the Labor Code of the Russian Federation);

In connection with the reduction in the number or staff of employees (clause 2 of article 81 of the Labor Code of the Russian Federation);

With regard to the head of the organization, his deputies and the chief accountant - in connection with a change in the owner of the organization's property (clause 4 of article 81 of the Labor Code of the Russian Federation);

In connection with the call of the employee to military service or by sending him to an alternative civil service that replaces it (clause 1 of article 83 of the Labor Code of the Russian Federation);

In connection with the reinstatement of an employee who previously performed this work, by decision of the state labor inspectorate or the court (clause 2, article 83 of the Labor Code of the Russian Federation);

In connection with the recognition of the employee as completely incapacitated in accordance with the medical report (clause 5 of article 83 of the Labor Code of the Russian Federation);

In connection with the death of an employee or employer - an individual, as well as the recognition by a court of an employee or employer - an individual as deceased or missing (clause 6 of article 83 of the Labor Code of the Russian Federation);

Due to the onset of extraordinary circumstances that prevent the continuation labor relations(Clause 7, Article 83 of the Labor Code of the Russian Federation).

17. Amounts overpaid to the employee in connection with his unlawful actions established by the court are subject to withholding. For this type of deductions, Art. 137 of the Labor Code of the Russian Federation does not provide for special rules. Since the unlawfulness of the employee's actions was established by the court, the amount to be withheld is also established by the court. The deduction itself in this case is made according to the rules established for deductions on the basis of a court decision.

- Up

In practice, there are situations in which the organization must withhold a certain amount from the employee's salary. According to Art. 137 of the Labor Code of the Russian Federation, deductions from an employee's wages are made only in cases provided for by the Labor Code and other federal laws, namely the Tax Code, the Family Code, Law N 229-FZ. In this article, we will describe in detail the procedure for such deductions under various circumstances.

Labor Code

Article 137 of the Labor Code of the Russian Federation provides for the following cases when amounts are withheld from the employee's salary to pay off his debt to the employer.

Reimbursement of unearned advance paid on account of wages. So, the employer has the right to withhold the amount of the unearned advance payment not later than one month from the date of the expiration of the period established for its return, but provided that the employee does not dispute the basis and amount of the withholding of such advance payment. For withholding, the employer must obtain the written consent of the employee, as well as issue an appropriate order. Note that applications and orders do not have a unified form, but are drawn up arbitrarily.

Withholding an unspent and timely non-refunded advance payment issued in connection with a business trip or transfer to another job in another locality. Articles 168 and 168.1 of the Labor Code of the Russian Federation provide that in cases where: a) the employee is sent on a business trip; b) permanent job is carried out on the way or is of a traveling nature, - such an employee is entitled to reimbursement of travel expenses, renting accommodation, additional expenses associated with living outside the place of permanent residence (daily allowance, field allowance), and other expenses incurred with the permission or knowledge of the employer. In this case, the employer can issue cash to the employee under the report.

Recall that the procedure for issuing funds to employees is carried out in accordance with the Regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia in the territory Russian Federation dated 12.10.2011 N 373-P, approved by the Central Bank of the Russian Federation. According to clause 4.4 of this Regulation, cash is issued to the employee on account of his written application. Such an application is drawn up arbitrarily and in it the manager makes a record of the amount of cash and the period for which cash is issued. The same paragraph establishes that the accountable person is obliged, within a period not exceeding three working days after the day of expiration of the period for which cash was issued against the account, or from the day of going to work, to present the chief accountant or accountant, and in their absence, the head of the advance report with attached supporting documents.

For your information. The issuance of cash against the report is carried out subject to the full repayment of the debt by the accountable person for the amount of cash previously received for the report.

The procedure for withholding in this case is similar to the procedure for withholding an unearned advance. Note that the monthly period for withholding these amounts begins to run after three working days from the day set for the employee to return unspent funds.

Refund of amounts overpaid to an employee due to counting errors or if the body for the consideration of individual labor disputes recognizes the employee's guilt in failure to comply with labor standards (part 3 of article 155 of the Labor Code of the Russian Federation) or simple (part 3 of article 157 of the Labor Code of the Russian Federation). Article 137 of the Labor Code of the Russian Federation establishes that wages overpaid to an employee (including due to incorrect application of labor legislation or other regulatory legal acts containing labor law norms) cannot be recovered from him, except for the following cases:

- a counting error was made. In the Definition of the RF Armed Forces of 20.01.2012 N 59-B11-17 it is said: from the literal interpretation of the norms of the current labor legislation, it follows that an error in arithmetic operations (actions related to counting) is considered to be counting, while technical errors in including those committed through the fault of the employer, are not countable;

- the body for the consideration of individual labor disputes recognized the employee's fault for failure to comply with labor standards (part 3 of article 155 of the Labor Code of the Russian Federation) or simple (part 3 of article 157 of the Labor Code of the Russian Federation). Recall: Part 3 of Art. 155 stipulates that in case of non-fulfillment of labor standards, non-fulfillment of labor (official) duties through the fault of the employee, the payment of the standardized part of the earnings is made in accordance with the volume of work performed. Article 157 establishes the procedure for payment of downtime, according to which downtime due to the fault of the employee is not paid;

- the salary was overpaid to the employee in connection with his illegal actions established by the court.

In the event that there was a counting error, the withholding is made no later than one month from the date of the expiration of the term for incorrectly calculated payments and provided that the employee does not dispute the grounds and amount of the withholding.

If the employee is found to be guilty of failure to comply with labor standards or simple, then the deduction is made within one month from the date of entry into force of the decision of the labor dispute committee or the court.

Deductions from wages upon dismissal of an employee before the end of the working year on account of which he has already received annual paid leave, for unworked days of vacation. In accordance with Art. 122 of the Labor Code of the Russian Federation, paid leave should be provided to the employee annually. In this case, the right to use leave for the first year of work arises after six months of continuous work with of this employer... By agreement of the parties, the employee may be granted a paid leave before the expiration of six months. Thus, in the event of dismissal, the employer has the right to withhold part of the vacation pay provided in advance.

However, in Art. 137 of the Labor Code of the Russian Federation provides for cases when withholding is not made. This is a situation when an employee leaves for the following reasons:

- refusal to transfer to another job that is necessary for him in accordance with a medical certificate issued in the manner prescribed by federal laws and other regulatory legal acts of the Russian Federation, or the employer does not have an appropriate job (clause 8, part 1 of article 77 of the Labor Code of the Russian Federation);

- liquidation of an organization or termination of activities by an individual entrepreneur (clause 1 of part 1 of article 81 of the Labor Code of the Russian Federation);

- reduction in the number or staff of employees of the organization, individual entrepreneur(Clause 2, Part 1, Article 81);

- change of the owner of the organization's property (in relation to the head of the organization, his deputies and the chief accountant) (clause 4 of part 1 of article 81);

- conscription for military service or sending it to an alternative civilian service replacing it (clause 1 of part 1 of article 83 of the Labor Code of the Russian Federation);

- reinstatement at work of a person who previously performed this work, by decision of the state labor inspectorate or the court (clause 2, part 1, article 83);

- recognition of the employee as completely incapable of labor activity in accordance with the medical report (clause 5 of part 1 of article 83);

- death of an employee or employer - an individual, as well as recognition by a court of an employee or employer - an individual as deceased or missing (clause 6, part 1, article 83);

- the onset of extraordinary circumstances that prevent the continuation of labor relations (military action, catastrophe, natural disaster, major accident, epidemic and other extraordinary circumstances), if this circumstance is recognized by the decision of the Government of the Russian Federation or the state authority of the constituent entity of the Russian Federation (clause 7, part 1 of article 83).

The amount of deductions from wages. By virtue of Art. 138 of the Labor Code of the Russian Federation, the total amount of all deductions for each payment of wages cannot exceed 20%, and in cases stipulated by federal laws - 50% of the wages due to the employee. In case of deduction from salary according to several executive documents, 50% of his income must be retained for the employee in any case.

Note! The restrictions established by Art. 138 of the Labor Code of the Russian Federation, do not apply to deductions from wages when serving correctional labor, collecting alimony for minor children, compensation for harm caused to the health of another person, compensation for harm to persons who have suffered damage in connection with the death of a breadwinner, and compensation for damage caused by a crime. The amount of deductions from earnings in these cases cannot exceed 70%.

We also note that deductions from payments that, in accordance with federal law, are not subject to collection are not allowed. Currently, the list of such incomes is established by clause 1 of Art. 101 of Law N 229-FZ. These include:

1) sums of money paid in compensation for harm caused to health;

2) sums of money paid in compensation for harm in connection with the death of the breadwinner;

3) sums of money paid to persons who have received injuries (wounds, injuries, contusions) when they perform official duties, and members of their families in the event of the death (death) of these persons;

4) compensation payments at the expense of funds federal budget, budgets of the constituent entities of the Russian Federation and local budgets to citizens in connection with caring for disabled citizens;

5) monthly cash payments and (or) annual cash payments accrued in accordance with the legislation of the Russian Federation specific categories citizens (travel compensation, purchase of medicines, etc.);

6) maternity (family) capital funds provided for by Law N 256-FZ;

7) and others.

As for the recovery of alimony in favor of minor children, as well as for obligations to compensate for harm in connection with the death of the breadwinner, the restrictions on the foreclosure established by paragraphs 1 and 4 of part 1 of Art. 101, do not apply to these amounts (part 2 of article 101 of Law N 229-FZ).

Recovery of the amount of damage from the employee in favor of the employer. If the employee is found guilty of causing damage to the employer, the amount of the damage caused can be collected from him that does not exceed the average monthly earnings (Article 248 of the Labor Code of the Russian Federation). To do this, it is necessary to issue an order no later than one month from the date of the final determination by the employer of the amount of such damage. If the monthly period has expired or the employee does not agree to voluntarily compensate for the damage caused, and the amount of damage subject to recovery exceeds the perpetrator's average monthly earnings, then recovery can be carried out only through the court.

Article 248 also provides that an employee who is guilty of causing damage to the employer may voluntarily compensate it in whole or in part. By agreement of the parties to the employment contract, compensation for damage with payment by installments is allowed. For this, the employee must submit a written application to the employer - a commitment, which indicates the amount of damage and specific payment terms. In addition, with the consent of the employer, the employee can transfer to him equivalent property to compensate for the damage caused or repair the damaged property. Compensation for damage is made regardless of whether the employee is brought to disciplinary, administrative or criminal liability for actions or omissions that have caused damage to the employer.

Note! Compensation for damage is made regardless of whether the employee is brought to disciplinary, administrative or criminal liability for actions or omissions that have caused damage to the employer.

tax code

By virtue of paragraph 1 of Art. 226 of the Tax Code of the Russian Federation Russian organizations, from which or as a result of relations with which the taxpayer received income, are obliged to calculate, withhold from him and pay the amount of tax calculated in accordance with Art. 224 of the Tax Code of the Russian Federation, taking into account the specifics provided for by this article. In this case, organizations act as tax agents. They are required to withhold the accrued tax amount directly from the taxpayer's income when they are actually paid. In this case, the withholding is carried out by the tax agent at the expense of any money paid by him to the taxpayer, when the money is actually paid to the taxpayer, or on his behalf to third parties. The withheld tax amount cannot exceed 50% of the payment amount (clause 4 of article 226).

Tax agents are obliged to transfer the calculated and withheld tax no later than the day of actual receipt of cash from the bank for the payment of income, as well as the day of transfer of income from the accounts of tax agents in the bank to the taxpayer's accounts or, on his behalf, to the accounts of third parties in banks. In other cases, tax agents transfer the specified tax amounts no later than: the day following the day the taxpayer actually received the income - for income paid in cash; the day following the day of actual withholding of the calculated amount of tax - for income received by the taxpayer in kind or in the form of material benefit (clause 6 of article 226).

The Tax Code provides that if it is impossible to withhold the tax from the taxpayer, the tax agent is obliged, no later than one month from the end of the tax period in which the relevant circumstances arose, to notify the taxpayer and the tax authority at the place of his registration in writing about the impossibility of withholding tax and the amount of tax. At the same time, the form of notification of the impossibility of withholding tax and the amount of tax and the procedure for submitting it to the tax authority are approved by the federal executive body authorized to control and supervise taxes and fees (clause 5 of article 226 of the Tax Code of the Russian Federation). Currently, this form is approved by the Order of the Ministry of Finance of the Russian Federation and the Federal Tax Service of the Russian Federation of November 17, 2010 N ММВ-7-3 / [email protected]"On approval of the form of information on the income of individuals and recommendations for filling it out, the format of information on the income of individuals in electronic form, reference books."

Family code

This code provides for the recovery of alimony for minor children. Article 81 of the RF IC says that in the absence of an agreement on the payment of alimony, the court collects them monthly from the parents: for one child - 1/4, for two children - 1/3, for three or more children - half of the earnings and (or) other parental income. In this case, the types of earnings and (or) other income that parents receive in rubles and (or) in foreign currency and from which the alimony collected for minor children is withheld in accordance with Art. 81 of the RF IC are determined by the RF Government (Art. 82 of the RF IC). At present, the List of types of wages and other income, from which alimony for minor children is withheld, is approved by Decree of the Government of the Russian Federation of July 18, 1996 N 841 (hereinafter - List N 841). According to clause 1 of List N 841, alimony for the maintenance of minor children is deducted from all types of wages (monetary remuneration, maintenance) and additional remuneration both at the main place of work and for part-time work, which parents receive in cash (rubles or foreign currency) and in kind.

Such collection is made after deduction (payment) of taxes from this salary and other income in accordance with tax legislation (clause 4 of List N 841). With regard to persons sentenced to correctional labor, the recovery of alimony under court orders is made from all earnings minus the deductions made by the verdict or court order. From convicts serving sentences in correctional colonies, penal colonies, prisons, educational colonies, as well as persons in drug addiction departments of psychiatric dispensaries and inpatient medical institutions, alimony is collected from all earnings and other income minus deductions for reimbursement of expenses for them. content in these institutions.

Other federal laws

Law N 255-FZ: withholding overpaid benefits for temporary disability, pregnancy and childbirth, childcare. In accordance with paragraph 4 of his Art. 15 amounts of benefits for temporary incapacity for work, for pregnancy and childbirth, monthly allowance for childcare, overpaid to the insured person, cannot be collected from him, except for the following cases:

- counting error;

- bad faith on the part of the recipient (submission of documents with deliberately incorrect information, including certificates (certificates) about the amount of earnings, on the basis of which the indicated benefits are calculated, concealment of data affecting the receipt of benefits and its amount, other cases).

In this case, withholding is made in the amount of not more than 20% of the amount due to the insured person for each subsequent payment of benefits or his salary. Upon termination of the payment of benefits or earnings, the remaining debt is collected in court.

Law N 81-FZ: withholding overpaid amounts of state benefits to citizens with children. According to Art. 19 of Law No. 81-FZ, overpaid amounts of state benefits to citizens with children are withheld from the recipient only if the overpayment occurred through his fault (provision of documents with deliberately incorrect information, concealment of data affecting the right to assign state benefits to citizens with children , calculus of their sizes). Deductions are made in the amount of not more than 20% of either the amount due to the recipient for each subsequent payment of state benefits to citizens with children, or the recipient's salary in accordance with the requirements of the labor legislation of the Russian Federation. Upon termination of the payment of benefits, the remaining debt is recovered from the recipient in court.

Amounts overpaid to the recipient through the fault of the authority that assigned the state benefit to citizens with children are not subject to withholding, except in the case of an accounting error. In this case, the damage is recovered from the guilty persons in the manner prescribed by the legislation of the Russian Federation.

Law N 229-FZ. Article 98 of this law establishes the procedure for imposing a penalty on wages and other income of the debtor. Such collection is carried out in following cases:

- execution of executive documents containing requirements for the collection of periodic payments;

- collection of an amount not exceeding RUB 10,000;

- the absence or insufficiency of the debtor's funds and other property to fulfill the requirements of the court order in full.

Clause 3 of this article establishes that persons who pay the debtor wages or make other periodic payments, from the date of receipt of the executive document from the claimant or the bailiff-executor, are obliged to withhold funds from the wages and other income of the debtor in accordance with the requirements contained in the executive document ... In this case, this collection must be carried out within three days from the date of payment. Transfer and transfer of funds are made at the expense of the debtor.

As for the amount of deduction from wages, in accordance with paragraph 1 of Art. 99 of Law N 229-FZ, it is calculated based on the amount remaining after withholding taxes. In this case, the deduction can be no more than 50% of the salary (clause 2 of article 99). However, this limitation does not apply in case of collection:

- alimony for minor children;

- compensation for harm caused to health;

- compensation for harm in connection with the death of the breadwinner;

- compensation for damage caused by the crime.

In these cases, the amount of deduction from wages and other incomes of the debtor-citizen cannot exceed 70% (clause 3 of article 99 of Law N 229-FZ).

In addition, according to paragraph 4 of Art. 99 persons who pay the debtor wages, pensions, scholarships or make other periodic payments must inform the debtor about the change of place of work, study, place of receipt of the pension and other income to the bailiff-executor and (or) the recoverer and return the executive document with a mark about penalties made.

In conclusion, we note that in accordance with Part 3 of Art. 17.14 of the Code of Administrative Offenses of the Russian Federation in the event of a violation by a person who is not a debtor (in our case, an employer) of the law on enforcement proceedings, expressed in failure to comply with the legal requirements of the bailiff, refusal to receive confiscated property, providing inaccurate information about the property status of the debtor, loss of enforcement document, untimely dispatch of a writ of execution, an administrative fine is imposed:

- for officials - in the amount of 15,000 to 20,000 rubles;

- on legal entities- from 50,000 to 100,000 rubles.

Deductions from the employee's wages are made only in cases provided for by this Code and other federal laws.

Deductions from the employee's wages to pay off his debts to the employer can be made:

to reimburse the unearned advance paid to the employee on account of wages;

to pay off an unspent and timely not returned advance payment issued in connection with a business trip or transfer to another job in another locality, as well as in other cases;

for the return of amounts overpaid to the employee due to counting errors, as well as amounts overpaid to the employee, if the body for consideration of individual labor disputes recognizes the employee's guilt in failure to comply with labor standards (part three of Article 155 of this Code) or simple (part three of Article 157 of this Code) Code);

upon dismissal of an employee before the end of the working year, on account of which he has already received an annual paid vacation, for unworked vacation days. Deductions for these days are not made if the employee is dismissed on the grounds provided for by paragraph 8 of the first part of Article 77 or paragraphs 1, 2 or 4 of the first part of Article 81, paragraphs 1, 2, 5, 6 and 7 of Article 83 of this Code.

In the cases provided for in paragraphs two, three and four of part two of this article, the employer has the right to make a decision to deduct the employee from the salary no later than one month from the end of the period established for the return of the advance payment, repayment of debt or incorrectly calculated payments, and provided that if the employee does not dispute the grounds and amount of the deduction.

Wages overpaid to an employee (including in case of incorrect application of labor legislation or other regulatory legal acts containing labor law norms) cannot be collected from him, except for the following cases:

counting error;

if the body for the consideration of individual labor disputes recognized the employee's guilt in failure to comply with labor standards (part three of Article 155 of this Code) or simple (part three of Article 157 of this Code);

if the salary was paid to the employee in excess in connection with his illegal actions established by the court.

Comments to Art. 137 of the Labor Code of the Russian Federation

1. In accordance with the SK (Art. 81), in the absence of an agreement on the payment of alimony, alimony for minor children is collected by the court from their parents on a monthly basis in the amount of: for 1 child - 1/4, for 2 children - 1/3, for 3 or more children - 1/2 of the earnings and (or) other income of the parents. The size of these shares can be reduced or increased by the court, taking into account the material or marital status parties and other noteworthy circumstances.

The types of earnings and (or) other income that parents receive in rubles and (or) in foreign currency and from which the alimony collected for minor children is withheld in accordance with Art. 81 SK, are determined by the Government of the Russian Federation.

Article 83 of the UK establishes the recovery of alimony for minor children in a fixed amount.

In the absence of an agreement between the parents on the payment of alimony for minor children and in cases where the parent who is obliged to pay alimony has irregular, varying earnings and (or) other income, or if this parent receives earnings and (or) other income in whole or in part in kind or in foreign currency, or if he does not have earnings and (or) other income, as well as in other cases, if the collection of alimony in proportion to the earnings and (or) other income of the parent is impossible, difficult or materially violates the interests of one of the parties, the court has the right to determine the amount of alimony collected on a monthly basis in a fixed sum of money or simultaneously in shares (in accordance with Article 81 of the SK) and in a fixed sum of money.

The size of the fixed sum of money is established by the court based on the maximum possible preservation of the child's previous level of support, taking into account the material and family situation of the parties and other noteworthy circumstances.

If there are children with each of the parents, the amount of alimony from one of the parents in favor of the other, less well-off, is determined in a fixed amount of money collected monthly and appointed by the court in accordance with paragraph 2 of Art. 83 SK.

2. Decree of the Government of the Russian Federation of July 18, 1996 N 841 approved. The list of types of wages and other income, from which alimony for minor children is withheld (see clauses 1 - 4 of the List - not provided).

3. Indication Federal Service employment of Russia dated March 30, 1993 N P-7-10-307 "On the procedure for withholding alimony according to executive documents transferred to the enforcement authorities public service employment "established the procedure for withholding alimony under executive documents, transferred for the production of collection to the bodies of the state employment service.

When the child reaches the age of majority and in the absence of alimony arrears, the writ of execution is returned to the court that made the decision. If the unemployed has a debt, the writ of execution remains in the employment center until it is paid off.

4. The procedure for foreclosure on wages and other types of income of the debtor is determined by the Federal Law of October 2, 2007 N 229-FZ "On Enforcement Proceedings".

5. In Art. 8 of Convention No. 85 of the ILO states that deductions from wages are allowed only under the conditions and within the limits established by the legislation of the country or determined in a collective agreement or a decision of the arbitration body. Deductions from wages in favor of the employer, his representative or intermediary, providing direct or indirect remuneration in order to obtain or maintain a job, are prohibited (Article 9).

The full text of Art. 137 of the Labor Code of the Russian Federation with comments. New current edition with additions for 2019. Legal advice on Article 137 of the Labor Code of the Russian Federation.

Deductions from the employee's wages are made only in cases provided for by this Code and other federal laws.

Deductions from the employee's wages to pay off his debts to the employer can be made:

to reimburse the unearned advance paid to the employee on account of wages;

to pay off an unspent and timely not returned advance payment issued in connection with a business trip or transfer to another job in another locality, as well as in other cases;

for the return of amounts overpaid to the employee due to counting errors, as well as amounts overpaid to the employee, if the body for consideration of individual labor disputes recognizes the employee's guilt in failure to comply with labor standards (part three of Article 155 of this Code) or simple (part three of Article 157 of this Code) Code);

upon dismissal of an employee before the end of the working year, on account of which he has already received an annual paid vacation, for unworked vacation days. Deductions for these days are not made if the employee is dismissed on the grounds provided for by paragraph 8 of the first part of Article 77 or paragraphs 1, 2 or 4 of the first part of Article 81, paragraphs 1, 2, 5, 6 and 7 of Article 83 of this Code.

In the cases provided for in paragraphs two, three and four of part two of this article, the employer has the right to make a decision to deduct the employee from the salary no later than one month from the end of the period established for the return of the advance payment, repayment of debt or incorrectly calculated payments, and provided that if the employee does not dispute the grounds and amount of the deduction.

Wages overpaid to an employee (including in case of incorrect application of labor legislation or other regulatory legal acts containing labor law norms) cannot be collected from him, except for the following cases:

counting error;

if the body for the consideration of individual labor disputes recognized the employee's guilt in failure to comply with labor standards (part three of Article 155 of this Code) or simple (part three of Article 157 of this Code);

if the salary was paid to the employee in excess in connection with his illegal actions established by the court.

Commentary on Article 137 of the Labor Code of the Russian Federation

1. According to Part 1 of Art. 8 of ILO Convention No. 95 "Concerning the Protection of Wages" (1949), deductions from wages are permitted under the conditions and within the limits prescribed by national law or determined in a collective agreement or in a decision of the arbitral tribunal.

Based on the provisions of Part 1 of Art. 137 of the Labor Code of the Russian Federation, deductions from the wages of an employee are made only in cases provided for by the Labor Code of the Russian Federation and other federal laws (see the RF IC, Federal Law "On Enforcement Proceedings", Federal Law of May 19, 1995 N 81-FZ "On State Benefits to Citizens having children ", Federal Law" On compulsory social insurance in case of temporary disability and in connection with motherhood ", Federal Law" On Trade Unions "). Moreover, such deductions can be carried out both in favor of the employer and in favor of other persons.

So, for example, in accordance with Article 109 of the RF IC, the administration of the organization at the place of work of a person obliged to pay alimony on the basis of a notarized agreement on the payment of alimony or on the basis of a writ of execution must monthly withhold alimony from wages and (or) other income of the person, obliged to pay alimony.

Taking into account the analysis of the current legislation, M. Volkova indicated that deductions from the employee's wages must be made in the following sequence:

- withholding personal income tax;

- the requirements for enforcement orders are met;

- the rest of the deductions are made.

________________

See: Volkova M. Types of deductions from wages of workers // Institutions of culture and art: accounting and taxation. 2012. N 9.C.50.

2. At the same time, part 2 of the commented article defines the grounds for deductions made by the employer's decision to pay off the employee's debt, and contains an exhaustive list of such grounds.

Deduction from the employee's wages is made by the employer to reimburse the unearned advance paid to the employee against wages.

Withholding is also made to repay an unspent and timely not returned advance payment issued in connection with a business trip or transfer to another job in another locality, as well as in other cases.

The letter of the FSS of Russia dated April 14, 2015 N 02-09-11 / 06-5250 contains explanations about the calculation of insurance premiums in such situations. The FSS of Russia explains that the monetary funds issued for the report, for which the employee has not submitted an advance report in a timely manner, are recognized as the employee's debt to the organization and these amounts can be withheld from the employee's salary. If the employer withholds the above funds from the employee's salary on the basis of the commented article, the object of taxation on insurance premiums does not arise. In the event that the employer decides not to withhold the aforementioned amounts, these amounts are considered payments in favor of employees within the framework of labor relations and will be subject to insurance premiums in accordance with the generally established procedure. If the employee submits an advance report with supporting documents (with copies of sales receipts for the purchase of goods, works (services), invoices, invoices), in the case when the organization has already accrued insurance premiums for the mentioned amount of payments, the organization has the right to recalculate the base for calculating insurance contributions and amounts of assessed and paid insurance premiums.

The employer can make deductions from the employee's wages in order to return the amounts overpaid to the employee due to counting errors, as well as amounts if the body for the consideration of individual labor disputes recognizes the employee's guilt in failure to comply with labor standards or idle time.

Deductions can also be made for unworked vacation days when an employee is dismissed before the end of the working year for which he has already received an annual paid vacation.

Deductions for these days are not made if the employee leaves for the following reasons:

- the employee's refusal to transfer to another job that is necessary for him in accordance with a medical certificate issued in the manner prescribed by federal laws and other regulatory legal acts of the Russian Federation, or the employer does not have the appropriate job ();

- liquidation of the organization (clause 1, part 1, article 81 of the Labor Code of the Russian Federation);

- reduction in the number or staff of the organization's employees (clause 2, part 1, article 81 of the Labor Code of the Russian Federation);

- change of the owner of the organization's property (this applies to the head of the organization, his deputies and the chief accountant) ();

- conscription of an employee for military service or sending him to an alternative civilian service replacing it (clause 1 of part 1 of article 83 of the Labor Code of the Russian Federation);

- reinstatement at work of an employee who previously performed this work, by decision of the state labor inspectorate or the court (clause 2, part 1, article 83 of the Labor Code of the Russian Federation);

- recognition of the employee as completely incapacitated in accordance with the medical report (clause 5, part 1, article 83 of the Labor Code of the Russian Federation);

- death of an employee, as well as recognition by the court as dead or missing (clause 6, part 1, article 83 of the Labor Code of the Russian Federation);

- the onset of extraordinary circumstances that prevent the continuation of labor relations (military action, catastrophe, natural disaster, major accident, epidemic and other extraordinary circumstances), if this circumstance is recognized by a decision of the Government of the Russian Federation or a government body of the corresponding constituent entity of the Russian Federation (clause 7, part 1 of Art. . 83 of the Labor Code of the Russian Federation).

3. The employer has the right to make a decision on deduction from the employee's salary no later than one month from the end of the period established for the return of the advance payment, repayment of arrears or incorrectly calculated payments.

In this case, the specified decision is made by the employer in the absence of disagreements with the employee on the grounds and amount of retention.

Making deductions from an employee's wages to pay off his debts to the employer is a right, not an obligation of the latter.

According to Art. 9 of ILO Convention No.95, any deductions from wages are prohibited, the purpose of which is to pay directly or indirectly to the employee, the employer, his representative or any intermediary (such as a recruiting agent work force) for receiving or maintaining the service.

4. Within the meaning of Part 4 of Art. 137 of the Labor Code of the Russian Federation under overpaid wages means a payment that should not have taken place, but was actually made.

Wages overpaid to an employee cannot be recovered from him. This rule applies even if such payment was made due to improper application of labor legislation or other regulatory legal acts containing labor law norms.

The exceptions are cases when:

- excessive wages were charged due to an accounting error;

- the body for the consideration of individual labor disputes recognized the employee's guilt in failure to comply with labor standards or simple;

- the salary was paid to the employee unnecessarily in connection with his illegal actions established by the court.

Provided by Part 4 of Art. 137 of the Labor Code, legal norms are consistent with the provisions of ILO Convention No. 95 (Art. 8), Art. 1 of Protocol No. 1 to the Convention for the Protection of Human Rights and Fundamental Freedoms, mandatory for application by virtue of Part 4 of Art. 15 of the Constitution of the Russian Federation, art. 10 of the Labor Code of the Russian Federation and contain an exhaustive list of cases when it is allowed to collect overpaid wages from an employee.

Another commentary on Art. 137 of the Labor Code of the Russian Federation

1. Deductions from the employee's wages may be made only in cases provided for by the Labor Code or other federal laws. The prohibition on deductions, in addition to the cases established in the laws, ensures the protection of the wages of employees.

2. The content of the commented article complies with the provisions of the ILO Convention No. 95 "On the Protection of Wages" (adopted in Geneva on July 1, 1979). Article 8 of the said Convention provides that deductions from wages are permitted under the conditions and within the limits prescribed by national legislation or determined in collective agreements or in decisions of arbitration courts. Workers should be advised of the conditions and limits of such deductions. It is important to emphasize that Russian legislation does not provide for the possibility of deductions from wages on the basis of a collective agreement, since such conditions would worsen the employee's position in comparison with that provided for by law.

Any deductions at the discretion of the employer related to the imposition of part of production costs on the employee, satisfaction of claims from third parties to the employer or employee without a court decision or the consent of the employee are not allowed

3. At present, other codes and federal laws establish the possibility of deduction from wages when collecting taxes from the income of individuals, when collecting fines as a criminal punishment, when serving a sentence of correctional labor, when executing court decisions.

4. Deductions for the purpose of levying tax on personal income are made in accordance with the Tax Code. Article 226 of the Tax Code provides that the organizations from which the taxpayer receives income are obliged to calculate, withhold from the taxpayer and pay the amount of the accrued tax on the income of individuals. These deductions must be made directly from the taxpayer's income when actually paid. In this case, the withholding tax amount cannot exceed 50% of the payment amount.

5. A fine as a criminal punishment is established by a court verdict. In accordance with Art. 31 PEC sentenced to a fine is obliged to pay it within 30 days from the date of entry into force of the verdict or in another period, if the court decided on the installment plan. A convicted person who has not paid the fine within the prescribed period is recognized as maliciously evading payment of the fine, and if the fine is established as additional type punishment, the bailiff-executor carries out the collection of a fine in a compulsory manner (Art. 32 of the PEC). In this case, one of the measures of compulsory execution is the foreclosure on wages in accordance with Ch. 12 of the Federal Law of October 2, 2007 N 229-FZ "On Enforcement Proceedings".

6. Detentions by virtue of a court decision are also made when an employee is serving correctional labor as a punishment for a committed criminal offense. The basis for making such deductions is the court's verdict. In accordance with Art. 40 PECs, deductions are made from the convict's salary in the amount established by the court's verdict. The correct and timely deduction from the wages of the convict and the transfer of the amounts of deduction in the prescribed manner are entrusted to the employer. The procedure for making deductions is established by Art. 44 PEC.

7. Deductions from wages are also possible on the basis of enforcement documents - writs of execution issued on the basis of a decision, sentence, determination and order of courts (judges); amicable agreements approved by the court; court orders, etc. In accordance with Art. 98 of the Federal Law "On Enforcement Proceedings" collection on wages may be levied in the execution of enforcement documents containing a requirement to collect periodic payments; when collecting amounts not exceeding 10 thousand rubles; in the absence or inadequacy of the debtor's funds and other property to fulfill the requirements of the court order in full. Writs of execution and other writ of execution are sent to the employer for collection.

8. The Labor Code provides for the possibility of deductions from wages to pay off the employee's debt to the employer in the cases specified in Art. 137 of the Labor Code, as well as in order to compensate the employee for property damage caused to the employer.

On the procedure for compensation by the employee for property damage caused to the employer, see Art. 248 TC and commentary to it.

9. An employee's debt to the employer may arise as a result of an advance payment to the employee against wages or in connection with a business trip or transfer to work in another locality. In the event that the employee did not work out such an advance or did not use the amount issued in advance for the purpose of a business trip or relocation to another locality and does not return it voluntarily, its amount may be withheld from the employee's salary.

For the amounts issued to an employee on business trips, see Art. 168 TC and commentary to it.

10. The employer's order to withhold the advance from wages can be made if two conditions are met: 1) the employee does not dispute the grounds and amounts of the deductions; 2) the order is made no later than one month from the date of the expiry of the period established for the return of the advance.

The employee's objections to the grounds and amounts of deductions must be expressed in writing. At the same time, he may refer to the illegality or unreasonableness of the return of the indicated amounts, as well as to the incorrect determination of their size.

The course of the monthly period starts from the day set for the return of the advance.

When returning an unused advance payment issued against wages, such a period is established by agreement of the parties to the employment contract.

For an advance paid for a business trip, the return period is three working days after the employee returns from a business trip (clause 26 of the Regulations on the specifics of sending workers on business trips, approved by the Government of the Russian Federation of October 13, 2008 N 749).

11. Debts to the employer may also arise if the employee is paid excessive amounts due to an accounting error. A counting error should be understood as an error in arithmetic operations when calculating the amounts due to be paid. The employer's order to deduct the amounts overpaid due to an accounting error from wages is possible in the absence of a dispute with the employee about the grounds and amount of these deductions, provided that the order is made within a month from the date of payment of the incorrectly calculated amounts. If the employer misses the month, the amounts overpaid to the employee may be recovered in court.

Amounts overpaid due to improper application of pay law, collective agreement, agreement or employment contract, as well as errors of an organizational and technical nature (for example, when re-transferring funds to the employee's bank account ). See also Definition of the RF Armed Forces of January 20, 2012 N 59-B11-17.

12. Amounts overpaid to the employee are subject to withholding if the body for consideration of the individual labor dispute recognizes the employee's guilt in failure to meet production standards or in idle time.

For wages in case of non-fulfillment of production standards, see Art. 155 TC and commentary to it.

For remuneration for idle time, see Art. 157 TC and commentary to it.

13. Amounts paid to the employee as payment for vacation are subject to withholding, in the event of his dismissal before the end of the working year for which the vacation was granted.

For the procedure for granting vacations, see Art. 122 TC and commentary to it.

In case of dismissal of an employee before the expiration of the working year for which the leave was granted, deductions are made upon final settlement with the employee. This rule does not apply when an employee is dismissed on the grounds provided for in clause 8 of Art. 77, clauses 1, 2, 4 of Art. 81, clauses 1, 2, 5 - 7 of Art. 83 TC.

14. Amounts overpaid to the employee in connection with his unlawful actions established by the court are subject to withholding. For this type of deductions, the commented article does not provide for special rules. Since the unlawfulness of the employee's actions was established by the court, the amount to be withheld is also established by the court. The deduction itself in this case is made according to the rules established for deductions on the basis of a court decision.

Consultations and comments of lawyers on Art 137 of the Labor Code of the Russian Federation

If you still have questions about Article 137 of the Labor Code of the Russian Federation and you want to be sure of the relevance of the information provided, you can consult the lawyers of our website.

You can ask a question by phone or on the website. Initial consultations are held free of charge from 9:00 to 21:00 daily Moscow time. Questions received from 21:00 to 9:00 will be processed the next day.

Labor Code of the Russian Federation:

Article 137 of the Labor Code of the Russian Federation. Limitation of deductions from wages

Deductions from the employee's wages are made only in cases provided for by this Code and other federal laws.

Deductions from the employee's wages to pay off his debts to the employer can be made:

to reimburse the unearned advance paid to the employee on account of wages;

to pay off an unspent and timely not returned advance payment issued in connection with a business trip or transfer to another job in another locality, as well as in other cases;

for the return of amounts overpaid to the employee due to counting errors, as well as amounts overpaid to the employee, if the body for consideration of individual labor disputes recognizes the employee's guilt in failure to comply with labor standards (part three of Article 155 of Article 157 of this Code);

upon dismissal of an employee before the end of the working year, on account of which he has already received an annual paid vacation, for unworked vacation days. Deductions for these days are not made if the employee is dismissed on the grounds provided for by paragraph 8 of the first part of Article 77 or paragraphs 1, 2 or 4 of the first part of Article 81, paragraphs 1, 2, 5, 6 and 7 of Article 83 of this Code.

In the cases provided for in paragraphs two, three and four of part two of this article, the employer has the right to make a decision to deduct the employee from the salary no later than one month from the end of the period established for the return of the advance payment, repayment of debt or incorrectly calculated payments, and provided that if the employee does not dispute the grounds and amount of the deduction.

Wages overpaid to an employee (including in case of incorrect application of labor legislation or other regulatory legal acts containing labor law norms) cannot be collected from him, except for the following cases:

counting error;

if the body for the consideration of individual labor disputes recognized the employee's guilt in failure to comply with labor standards (part three of Article 155 of this Code) or simple (part three of Article 157 of this Code);

if the salary was paid to the employee in excess in connection with his illegal actions established by the court.

Return to the table of contents of the document: Labor Code of the Russian Federation in the current edition

Comments on Article 137 of the Labor Code of the Russian Federation, judicial practice of application

- Deduction for unworked vacation days upon dismissal of an employee. Arbitrage practice

- Statement of claim for the recovery of unlawfully withheld amounts from wages from the employer

- other examples of claims in the section"Claims for the collection of funds from the employer and from the employee"

Clarifications of the Supreme Court of the Russian Federation in reviews of practice

The Review of Judicial Practice of the Supreme Court of the Russian Federation for the third quarter of 2013 "(approved by the Presidium of the Supreme Court of the Russian Federation on 02/05/2014) contains the following clarifications:

In the event of an employee's dismissal before the end of the working year, on account of which he has already received an annual paid vacation, the debt for unworked vacation days is not subject to collection in court, including if during the calculation the employer was unable to withhold this amount from the payable wages payment due to its insufficiency.

In accordance with the fifth paragraph of Part 2 of Art. 137 of the Labor Code of the Russian Federation, deductions from the employee's wages to pay off his debts to the employer can be made upon dismissal of the employee before the end of the working year on account of which he has already received annual paid leave, for unworked vacation days.

According to Part 4 of Art. 137 of the Labor Code of the Russian Federation, wages overpaid to an employee (including in case of incorrect application of labor legislation or other regulatory legal acts containing labor law norms) cannot be recovered from him, except in cases of: counting error; if the body for the consideration of individual labor disputes recognized the employee's guilt in failure to comply with labor standards (part 3 of article 155 of this Code) or simple (part 3 of article 157 of the Code); if the salary was paid to the employee in excess in connection with his illegal actions established by the court.

Similar provisions are provided for by Part 3 of Art. 1109 of the Civil Code of the Russian Federation, limiting the grounds for collecting wages provided to a citizen as a means of subsistence, as unjust enrichment in the absence of his dishonesty and counting error.

Provided by art. 137 of the Labor Code of the Russian Federation, art. 1109 of the Civil Code of the Russian Federation, legal norms are consistent with the provisions of Art. 8 of the Convention of the International Labor Organization of July 1, 1949 N 95 "Concerning the protection of wages", Art. 1 of Protocol No. 1 to the Convention for the Protection of Human Rights and Fundamental Freedoms, mandatory for application by virtue of Part 4 of Art. 15 of the Constitution of the Russian Federation, art. 10 of the Labor Code of the Russian Federation, and contain an exhaustive list of cases when it is allowed to collect overpaid wages from an employee.

Thus, the current legislation does not contain grounds for recovering the amount of debt in court from an employee who used the vacation in advance, if the employer, in fact, during the calculation could not make a deduction for the unworked vacation days due to insufficient amounts due in the calculation (Clause 5 of the Review of Judicial Practice of the Supreme Courts of the Russian Federation for the third quarter of 2013 "; approved by the Presidium of the Supreme Court of the Russian Federation on 02/05/2014).

The Review of Legislation and Judicial Practice of the Supreme Court of the Russian Federation for the second quarter of 2010 (approved by the Decree of the Presidium of the Armed Forces of the Russian Federation of September 15, 2010 contains the following clarifications:

Wages overpaid to an employee through no fault of his own and not due to a counting error shall not be subject to collection in favor of the employer

The review of the Supreme Court of the Russian Federation provides an example of resolving a dispute on the recovery of overpaid wages to an employee. The following is indicated.

Having recognized that the sum of 59210 rubles 73 kopecks is unjust enrichment, the court disregarded that these funds were paid to the plaintiff as wages.

The Supreme Court of the Russian Federation, disagreeing with this conclusion, indicated that according to Art. 137 of the Labor Code deductions from the employee's wages are made only in cases provided for by this Code and other federal laws

Wages overpaid to an employee (including in case of incorrect application of labor legislation or other normative legal acts containing labor law norms) cannot be collected from him, except for the following cases: counting error; if the body for considering individual labor disputes has found the employee to be guilty of failure to comply with labor standards or simple; if the salary was paid to the employee in excess in connection with his illegal actions established by the court.

Provided by art. 137 of the Labor Code, legal norms are consistent with the provisions of the International Labor Organization Convention of July 1, 1949 N 95 "Concerning the protection of wages" (Art. 8), Art. 1 of Protocol No. 1 to the Convention for the Protection of Human Rights and Fundamental Freedoms, mandatory for application by virtue of Part 4 of Art. 15 of the Constitution of the Russian Federation, art. 10 of the Labor Code and contain an exhaustive list of cases when it is allowed to collect overpaid wages from an employee, including if the mistake was the result of incorrect application of labor legislation or other regulatory legal acts containing labor law norms. Such cases, in particular, include cases when the wages were paid to the employee in excess in connection with his illegal actions established by the court, or as a result of an accounting error (clause 5 of the Review of legislation and judicial practice of the Supreme Court of the Russian Federation for the second quarter of 2010; approved . By the Decree of the Presidium of the RF Armed Forces of 15.09.2010).

The general director of dace group llc smbat harutyunyan, the prison trade house

The general director of dace group llc smbat harutyunyan, the prison trade house Yakunin left, Rabinovich stayed

Yakunin left, Rabinovich stayed Rabinovich mikhail daniilovich

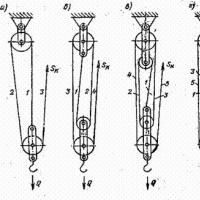

Rabinovich mikhail daniilovich Lifting loads without special equipment - how to calculate and make a chain hoist with your own hands

Lifting loads without special equipment - how to calculate and make a chain hoist with your own hands New details about Dimona's "charity" empire

New details about Dimona's "charity" empire Principal Buyer

Principal Buyer Edward cypherin biography. New Russian. How Eduard Shifrin, having earned $ 1 billion from Ukrainian steel, got involved in development in Russia. Eduard Shifrin and withdrawal of money

Edward cypherin biography. New Russian. How Eduard Shifrin, having earned $ 1 billion from Ukrainian steel, got involved in development in Russia. Eduard Shifrin and withdrawal of money