Functional responsibilities of the finance department. The financial department is a “litmus test” of an enterprise's efficiency. An auditor is coming to us

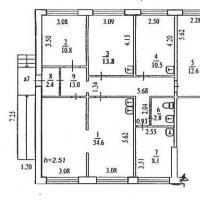

The structure of the financial and economic service, which is most typical for Russian enterprises, is presented in

In addition to the listed divisions, an analytical department, a tax planning department, a labor and wages department, etc. can be structurally distinguished as part of the financial and economic service of an enterprise.

A reservation should be made that the specified structure is typical for many, but not for all enterprises, therefore, it may be different at a particular enterprise. It is not the departments themselves that are important, but the functions they perform. The main functions performed by the financial and economic service of the enterprise are presented on.

Accounting department keeps track of the "fact". Its activity is oriented "to the past" (which is not reflected by the left arrow). The main task of the accounting department is the most accurate reflection of the "fact", bringing it to the user subdivisions.

By its very nature, accounting is not focused on the management of enterprise processes. Basic documents - reporting: balance sheet and profit and loss statement (financial results of the enterprise).

Economic Planning Department (PEO) plans the volume of production (based on the volume of sales) in general and by shop floor, as well as revenues, costs and use of profits, coordinates the pricing process at the enterprise. The main resulting document is a profit and loss plan and an analysis of its execution.

Financial department(DOF) develops and implements a plan for the movement of cash and other means of payment, analyzes its implementation, brings together (plans) cash receipts and payments on the basis of the data of the marketing department and other departments.

Question:

Which business unit deals with capital management? Accounting?- No, its main function is fact tracking.

PEO?- Only one of the components of liabilities is profit.

FO? - Only the movement of cash (payment) funds, sometimes - management of receivables and payables.

According to some experts, most Russian enterprises lack capital management (in particular, there are no divisions for which this task is the main one). Of course, the absence of a special unit does not mean that the function is not being fulfilled. However, the assignment of a significant function to other units with a different range of responsibilities, as a rule, leads to the crowding out of less “burning” tasks. A typical result of this distribution approach is functional responsibilities- "too many cooks spoil the broth".

Question:

If the company does not control the most important factor (indicator), and the aggressive "capitalist" environment is watching it (and looking for where to make money), will the company's capital increase or decrease?

Answer:

if it does, it is by accident or due to an extremely profitable market niche.

Rational structure of FES... Any of the main functions performed by the financial and economic service, be it profit management, cash flow management (CDM) or capital management, requires significant time and intellectual costs. In this regard, in the composition of the FES, it is advisable to separate the structural separate subdivisions specializing in performing one or another basic function of enterprise financial management ().

A possible structure of the financial and economic service of the enterprise, rational from the point of view of the division of functional responsibilities, is presented in. Naturally, this is just one of possible options, which should be linked to other functions performed by the financial and economic service, its divisions and personnel.

It is more expedient to subordinate the department of labor and wages to the personnel management service. The chief accountant often reports directly to the general director, but in practice it is more expedient to be operatively subordinate to one person - the financial director or the introduction of the position of “financial director - chief accountant”.

It is difficult to manage an enterprise, and one manager cannot do it. For this reason, numerous departments are created, one of the most important is the financial one. We can say that he is the heart of the entire organization. Let's consider the goals and functions of the finance department in more detail.

What does he do?

Each department is endowed with certain responsibilities, as for the finance department, they are as follows:

- This is the most important function. Employees monitor the implementation of plans, as well as their formation. The finance department should not only deal with analysis and accounting, but also control the execution of business processes in the organization.

- Money management. The second function of the department is the management of the company's finances. In addition, this includes monitoring the status of mutual settlements and creating a payment calendar. These responsibilities should not be underestimated, because they also support the finance department.

- Maintenance of tax and accounting records and their organization. There is no need to explain anything, and everything is clear.

It is important to note that some functions may be similar to those of a chief accountant, but this is not entirely true. It is necessary to clearly distinguish between them.

Differences

The chief accountant is responsible for maintaining tax and regulatory accounting that fully complies with the requirements of the law. He is obliged to timely form tax and accounting statements, reflect the facts economic activity organizations on accounting registers.

The functions of the financial and economic department, or rather its head, are that he plans the activities of the company, financial results... Moreover, the boss must do so that his actions do not contradict the legislation of our country, which is constantly changing. The direct responsibility of the organization's CFO is tax planning.

How do the chief accountant and the CFO interact, because their responsibilities are similar? This serious question cannot be answered so quickly. The accountant, according to the law "On accounting", must be subordinate to the general director of the enterprise, but he is also included in the area of responsibility of the financial director, which means that he must follow his orders. The faithful will obey both.

By the way, most often the responsibilities of the department do not limit the tasks that the director of the service faces.

Concept

We have already noted that the functions of the finance and economic department are quite extensive, but we have not yet defined this section. In fact, everything is simple. FEO is a structural entity that is engaged in the execution of managerial functions in an organization.

The number of employees of the entire enterprise and specifically the financial department is influenced by the nature of the activities performed, as well as the organizational and legal form.

The financial turnover, the number of payment documents for settlements with partners depend on the production volume and the nature of the organization's activities. This includes suppliers, customers, lenders, private banks, and the budget itself. The number and composition of FEO employees depends on how large-scale cash transactions are.

In the previous paragraphs, we have already mentioned that the financial control department plans the budget. In addition, he carries out analytical and operational activities.

About finance

What should be understood as the budget of the department under study? Experts note that in this case we are talking about:

- On the analysis of own needs of the turnover of the enterprise.

- About planning loans and finances. In this case, all necessary expenses.

- On identifying opportunities to finance the work of the organization.

- Participation in the preparation of a business plan.

- On the development of capital investment projects, taking into account all the features.

- On the design of cash plans.

- Participation in the planning and implementation of the organization's products.

- On the analysis of profitability and associated costs.

Thus, the budget is the entire cash flow generated by the department.

Operational work

The Financial Control Department carries out activities in this direction. The service is primarily concerned with performing various tasks. Among them:

- Ensuring replenishment of the budget through payments in set time... This also includes control over the payment of payments on loans - both long-term and short-term, the issuance of salaries to employees on time, all cash transactions.

- Payments to suppliers for work or goods.

- Coverage of costs incurred in plans.

- Registration of loans under contracts.

- Daily control over the sale of products, profits coming from them, and other sources of income of the organization.

- Control over the implementation of the requirements of the material plan and the entire material situation of the organization.

But the functions of the financial and economic department do not end there.

Control and analytical work

It has already been said above that FEO is engaged in constantly monitoring cash receipts. This responsibility is considered one of the most important functions of the finance and economic department. But it is not the only one, it is equally important to calculate the feasibility of using the enterprise budget and borrowed funds. The latter include bank loans.

Previously, all the duties of the FEO were performed by accountants. But over time, everyone became responsible for their own projects. This happened because the tasks of the department under study became more, which means that the time has come to branch out into an independent service. More tasks became after the emergence of non-profit organizations and a different organizational and legal form of the latter. It also left a trace that the objects of state and municipal property began to be transferred to private hands, and the growth of the independence of the subjects became more active.

If the company is small, then the accountant takes over the functions of the financial department of the organization. This is due to the fact that there are few employees at the enterprise and the turnover of funds, respectively, is small. But when it comes to a large organization or open or closed joint stock company, the functions of the department are performed by the service itself. This is due to the large turnover of funds and numerous employees.

Financial management

You can often hear this term, but it is not always clear what it is about. This is the name of the management of all profits and expenses. It is necessary in order to most effective way use funds from the budget of the enterprise and attracted from outside to increase the profits of the organization.

The functions of the financial department of the enterprise include the analysis of reports on several indicators, and at the same time a system for forecasting future income. FM develops the most profitable strategy and tactics for solving monetary issues. Due to this, the financial service of the enterprise is indispensable.

The responsibilities of the financial department of an enterprise are very diverse, as you have already seen. But the service was created primarily to ensure that the organization flourished and its profits grew.

What is financial work?

The functions and tasks of the FEO are closely intertwined, and therefore the management of the organization assigns to the employees of the service:

- Financing of business activities.

- Rational planning and use of funds from the enterprise budget and borrowed money.

- Conducting partnerships with business and financial and credit entities.

- Ensuring budget revenues on time, deductions to banks, payment for the work of employees and suppliers.

To summarize, it turns out that the financial service deals with the circulation of finance, while strictly planning where to spend the funds. This can also include partnering to increase commercial profits.

If there is no FEO

With the functions and tasks of the financial department, everything is more or less clear, let's move on to analyzing the situation when such a service is absent.

In the case of poorly established management accounting, the director receives data on losses and profits only after the month of closing the accounting period. That is, the boss cannot influence the situation in any way, which has a bad effect on the organization's work. How to be?

You need to plan everything correctly, it is desirable that there is a plan for each week. In this case, it is not necessary to wait for accounting readings, you can independently control costs, avoiding unnecessary spending.

Proper planning will be a great tool for your business to thrive.

Department structure

Like any service, the finance department has its own structure. It depends on the scale of the organization, the volume of production, the direction of activity and the goals of the enterprise.

The department is divided into the following divisions:

- Accounting. The main function is accounting, maintenance and reporting of the balance sheet. This also includes a statement of expenses and profits, preparation of general reporting in accordance with the requirements and legislation.

- Analytics department. These employees monitor the overall health of the enterprise and analyze financial data. Preparation of annual financial statements for both the company and the shareholders' meeting. The analytical department deals with the design of the investment fund and the financial performance of the organization.

- Financial planning. The functions of the planning and finance department are to carry out the development of projects of different validity periods and manage the organization's budget.

- Tax planning. Employees are required to develop the correct tax policy, draw up reports and tax returns, and submit documents to certain authorities. Employees are also responsible for ensuring that taxes are paid in full on time. Also, the calculations of the main budget and other financial sources should be reconciled.

- Operations department. Service employees interact with debtors and creditors, banks and others financial institutions... Department employees control everything small groups workers on tax, payment and accounting discipline.

- Currency Control and Securities Section. The functions of the financial control department and this are different, and this is natural, because each division does its job. Here, employees form a package of securities, manage their movement. They make sure that all financial transactions are carried out in accordance with the laws of our country. It turns out that the enterprise is based on this department.

How many heads of the finance department, so many opinions about the structure of the service. Some decide to stick to the classic scheme, others recruit departments in accordance with the goals of the enterprise.

Staff

If we have clarified the functions of the financial department of the administration and other divisions, then we will proceed to the analysis of employees.

The service includes:

- Controller.

- Treasurer.

- Chief accountant.

- Director of Financial Estimates.

- The auditor.

- Administrator or tax manager.

- Planning Director.

Let's consider each employee in more detail.

What is a controller?

We have covered the main functions of the finance department, let's switch to employees. What does the controller do? The employee is obliged to maintain control within the department. It is also authorized to develop various cost accounting strategies in order to increase the profitability of production.

The employee transfers all the information received to the top: the general manager, the vice president of the company, the board of directors. He is also responsible for developing financial estimates.

An official is obliged to analyze the financial situation in the organization, assess the state, predict further events, and propose certain options that will only increase profitability.

In the corporation, the employee is appointed to the position of controller by the board of directors, while job duties are fixed in the charter of the organization. The appointment must also be supported by the president of the company, along with the finance committees.

What is the treasurer doing?

The Treasurer oversees the functions of the financial support department. He also works with corporate cash and securities. Everything monetary transactions, whether it is transfer, collection, investment, payment or loan of finance, is carried out by the treasurer. He reports to the vice president or president of the company. It is noteworthy that the latter is only in exceptional cases.

The employee interacts with banks and controls the credit and cash transactions of the organization. To correctly predict the financial situation, the treasurer works in tandem with the director of financial estimates. Sometimes the controller is connected.

The functions and tasks of the financial support department, at first glance, seem to be similar to other departments, but this is only an illusion. The same thing happens with the duties of a treasurer: if you dig deeper, you will find fundamental differences in the apparent similarity.

The treasurer is empowered to confirm with a signature all the organization's check documents, no matter about a large amount in question or small. We can say that he manages the cash desk and the amounts. Either subordinates do it with his knowledge.

Sometimes the treasurer is also the secretary who signs invoices, contracts, mortgages, certificates and other financial documents.

Treasurer plays important role in management system organization, but it is important to remember that he reports to the vice president.

Duties of the chief accountant

Above, we said that the functions of the accounting department and the finance department are very similar. Let's talk about the responsibilities that bind them. What does a chief accountant do? He has practically the same duties as the controller, only with a slight clarification - the chief accountant is subordinate to the latter, which means that his functions are less ambitious.

The employee is responsible for planning, developing and implementing strategies for accounting for the costs and expenses of the enterprise. Methods of effective audit are also in his competence. All of the above are rather side functions, while the maintenance financial statements and accounting is the main task.

The employee is obliged to prepare statistical and financial reports. They are subsequently received by the controller, manager or treasurer. But if the organization is small, then the functions of the financial and economic department at the enterprise, namely the controller and the chief accountant, are combined. This does not affect the productivity of work.

Who is a CFO?

Large companies also have such an employee. He deals with systematic reporting and financial estimates.

The director of financial estimates is subordinate to the controller, since he has functions similar to him. The manager is obliged to correctly assess the prospects and opportunities work force and raw materials. Based on the information received, the employee will form projects based on administrative and production financial estimates that are provided to the company's management.

In addition, the director is obliged to form the final versions of the estimate and show them to all department managers and chiefs.

Another task of the director of estimates is the timely proposal of improvement of both estimates and production plans.

An auditor is coming to us!

Everyone read a cult comedy at school, so there is a rough idea of who will be discussed. We note right away that the auditor does not have to be in the financial department of each enterprise. But if such a position is provided, then you need to know the responsibilities.

The primary task of this employee is to check the reports, or rather, how correctly they are being maintained. The auditor does not work alone, he has assistants, representatives of departments and employees of the office.

The auditor can obey anyone: from the controller to the board of directors and the president of the organization.

If one boss is dissatisfied with the work done or does not want to accept it, then the auditor can contact a higher manager.

Most often, it is this employee who works with accountants who audit the books of the organization.

Sometimes the positions of the auditor and the director of estimates are combined.

Tax Administrator

We can already see that sometimes there is duplication of functions of departments of finance, but this does not apply to the tax administrator. The employee is subordinate to the treasurer, but the controller can also give him tasks. Indeed, in order to resolve tax issues, you need to interact with both the general accounting department and the audit department.

The administrator is obliged to carry out insurance transactions. If the company is large, then there is an administrator for each type of operation. Well, if the enterprise cannot boast of scale, then one person is responsible for everything.

By the way, in large organizations, the administrator reports directly to the financial committee or the president of the company.

Planning director

We have already explained above what functions of the finance and analytical department exist, but do they coincide with the responsibilities of the director of planning?

Of course, this is his direct field of activity. Even if the position as such in the enterprise is not provided, the function is performed by some other employee.

The position of a director is considered prestigious, because he interacts directly with the company's managers. As a rule, the chief accountant or the director of estimates can be promoted to the planning director.

The employee develops financial plans, defines target areas in different areas.

If a decision is made to buy a new branch or liquidate an enterprise, the opinion of the planning director must be taken into account. He assesses not only the economic situation of the organization, but also calculates the state of the market in the future and the present.

The functions of a finance chief and a director are very similar, but the similarity does not end there. Basically, the planning director deals with the work of all of the above employees, the same rule works in the opposite direction. If the position is not provided for by the scale of the enterprise, the responsibilities are divided among themselves by the controller, the head of the FEO and the director of estimates.

Naturally, the functions of the head of the financial and economic department will be broader than those of other employees. After all, the responsibility is primarily borne by the leadership.

What kind of committee did we mention in the title? What is it for, what is it in charge of? Recently, he has acquired the functions of a financial control department that solves the most important strategic tasks. In other words, every serious decision at the enterprise is the result of the work of the financial committee.

The board of directors decides on the creation of such a body. Meetings are only organized if there is a reason for discussion on the agenda. The chairman can be either a member of the board of directors or the financial manager or president of the organization. If the company is small, then the committee includes all responsible officials.

But this activity is not the main one. In addition to all of the above, the committee performs the functions of the financial security department. After all, it is he who gives consent to large loans, having previously calculated all the risks.

If everything is more or less clear with the positions, then let's move on to the directions of the department's activities.

How does it work?

To manage the enterprise, the CFO applies different methods... This could be:

- Taxation.

- Lending.

- Self-financing.

- Planning.

- Self-insurance. This is what the formation of reserves is called.

- Cashless payment system.

- Insurance.

- Leasing, trust, factoring, pledge and other operations.

Any of the methods provides for the possibility of conducting financial transactions.

The work of the department is directed in three directions:

- Management of financial turnover at the moment.

- Planning financial resources... This includes expenses, capital, income.

- Control and analysis of all monetary transactions.

How is the budget developed?

To do this correctly, there is a lot of data to consider. Among them:

- Forecasts and information about the profitability of a service, product or job.

- Permanent and total costs... The analysis must be done for each individual product, because this is the only way to find out the profitability.

- Variable production costs in each product group.

- Forecast for changes in the organization's assets, sources of investment, current indicators, profitability of turnover assets.

- Tax solvency of the company, loans, deduction of funds to non-budgetary organizations.

- Forecasting the profitability of barter work, drawing up reports after analyzing the profitability.

- General position affairs in the organization. This includes equipment wear, the composition of some funds, their profitability and the percentage of renewal.

To successfully manage your company's budget, you need to consider the following:

- Using accounting and reporting methods.

- Analysis of the firm's potential.

- Development of a funds management system.

- Accounting for the structure of personnel.

- Preparation of budget funds for use and reporting on them.

First, a budget director is appointed, who brings everything to life. The employee is engaged in coordinating the activities of the substructures and services of the enterprise.

If the organization has a budget director, then it is he who heads the finance committee.

Regulatory document

Any field of activity has its own law. In our case, this is the "Regulation on the financial department at the enterprise." It fixes all the important points of personnel management and document management. The financial director is developing the document.

Components of the Regulation:

- Organizational and functional structure of the financial service. Presented by a block diagram that best represents the department with all divisions.

- The number of staffs and structures of the financial department. Expressed in a table showing all departments, the number of employees, officials.

- Main tasks and target areas. The goals of the enterprise and the objectives of each department depend on the development strategy of the organization.

- Function matrix. A table containing the names of the functions vertically. In the horizontal line are written the names of employees of organizational units and managers who are responsible for the performance of a particular function. Using the table, you can easily track the workload of each department and make redistribution.

- The order of interaction of employees of the financial department. Usually, internal order is established between employees of the same department and between several divisions of the finance service. The external order is established separately, which regulates interaction with public or private organizations, clients. The basis is the structural peculiarity of the enterprise, the tasks and goals of the departments, as well as the traditions of the company.

- Resolution of disputes and conflicts. If a conflict arises, an appeal must be filed. For this purpose, a separate chain has been developed: “CEO - Director of Finance - Head of Department - Employee”. The same scheme applies in case of questions from ordinary employees. By the way, questions can relate to tasks, solutions, incentives, compensations, as well as various proposals that will increase the profitability of the enterprise.

- Establishing indicators for assessing the performance of the financial service. This paragraph indicates the indicators, the observance of which indicates the successful work of the department. It is important that the indicators are specific and measurable. If the formulations are vague, then they cannot serve as a kind of measure.

- Final provisions. Here are the main requirements for the preparation of these Regulations, the terms of acceptance by the employees of the departments, the storage rules. Consent to the Regulations must be given general director organizations and employees of the personnel department.

As you can see, the work of the enterprise is accompanied by organizational difficulties that must be overcome. But a person who knows the functions of the financial department of an enterprise is not afraid of any obstacles.

The main functions of the finance department are to find ineffective processes and develop ideas for increasing profits. Read what other tasks the financial service solves, which divisions are part of it, and also download the regulations on the financial department.

The finance department can be compared to an oracle. Top manager asks questions:

- What is the forecast for the company's activities for three years?

- What can I do to improve my financial situation?

- Which divisions have performed better and worse this year?

- How much money do I need to implement the project and where can I get it?

Download and take to work:

How to calculate the optimal number of finance staff

If there are too few employees in the finance department, they cannot cope with the volume of work. A lot - they stand idle and eat up the company's money. To avoid such problems, determine the optimal number of subordinates.

Functions and tasks of the finance department

To determine how many specialists should work in the financial department of the enterprise, and what kind of specialists they should be, the diagram of functions and objects of the financial department will help.

|

Functions / Objects |

Planning |

Operational activities |

Analysis |

Creation / development |

|

Income and expenses |

Income and expense budget Business planning |

Coordination of applications for expenses, |

||

|

Price |

Calculation of the price of products from the cost price |

Daily, weekly and monthly reporting |

Plan-fact analysis, identification of inefficiency |

Regulations, procedures, forms, software |

|

Reporting (local, IFRS) |

Performing a broadcast RAS-IFRS |

Internal audit (see how to do it), analysis of key financial ratios |

Regulations, procedures, forms, software |

|

|

Management reporting |

Planned reporting package for internal and external users |

Reporting, passing audits |

Analysis of key financial ratios |

Regulations, procedures, forms, software |

|

Cash |

Cash flow budget Payment schedule |

Coordination of applications for payments, Payment registers, Fundraising |

Plan-fact analysis, identification of inefficiency |

Regulations, procedures, forms, software |

|

Working capital |

Payment schedule, Working capital plan |

Control of DZ and KZ by the terms of debt, Time deposits |

Working capital structure, liquidity |

Regulations, procedures, forms, software |

|

Tax |

Tax budget |

Optimization schemes |

||

|

Contracts |

Maintaining a portfolio of contracts |

Harmonization |

Financial chapters of contracts |

|

|

Capital investments |

Investment plan |

Approval of investment applications |

Analysis of fixed assets, depreciation |

|

|

Financial investments |

Search and planning of the best forms of investment |

Investment management |

Analysis of investment projects |

Investment portfolio, regulations, software |

|

Business processes |

Calculation of the cost of business processes |

Control and optimization of processes in finance |

Financial business processes |

|

|

Calculation of planned KPIs |

Daily, weekly and monthly reporting |

Calculation of actual KPIs, payments |

KPI system |

The list of functions and objects is so extensive that at first glance it seems to be a third staffing table you need to give it to the financial service. But this is not the case.

Let us consider each object and its functions sequentially and determine which employee should perform them.

The first block of company finance

Income and expenses

Financial Controller. The person who starts the finance department. The one who is the first to be hired in the finance department, and as it grows, he often becomes the chief financial officer.

In small companies, the financial controller often creates management accounting from scratch, develops the documents, analytics and processes by which the accounting should be kept. In medium-sized companies, financial controllers are actively involved in further improving management accounting, and the daily routine tasks are performed by financial analysts subordinate to them.

IN large companies financial controllers and financial analysts work in dedicated divisions - financial control departments by line of business (by product, region, type of expense, etc.), where they are engaged in planning, accounting and analysis within their line of business. Sometimes it becomes necessary to bring planning into a separate function and create planning department, or the budgeting department.

Price

Pricing functions are not very different from calculating income and expenses. Therefore, they are carried out either by the same financial controllers, if the enterprise is small, or by the Pricing Departments. All pricing and maintenance activities pricing policy is carried out jointly with the Commercial Department, because financiers can give only one of the terms of the price - cost and profit, the second term - the market, not in their competence

Reporting (local, IFRS)

Local reporting is, of course, the responsibility of the accounting department. Whereas accounting in accordance with IFRS often engaged by a financial controller, an IFRS specialist, or entire departments of IFRS.

If an enterprise for one reason or another needs a planned reporting package, then specialists of the financial control department can also make it on the basis of the BDR, BDDS and the investment budget.

Internal auditing of local financial statements can be confusing to the financial controller. Or create an internal audit department. It all depends on the scale, of course.

External audits are usually carried out by a strong alliance between the chief accountant and the financial control department.

Analysis of key financial indicators and writing analytical notes are usually performed by the same financial controllers.

Management reporting

Maintaining management reporting- this is entirely the area of responsibility of the finance department. Accordingly, the full cycle from planning to analyzing the results obtained lies with the financial controllers. Or, if there is a dedicated unit, on the staff of the Management Reporting Department.

Second block of company finance

Cash

If in the calculation of income and expenses the chief was the financial controller, then in cash management the key figure was the treasurer. DS short-term planning tools - payment calendar, and medium-term - the cash flow budget is in his area of responsibility. Every day, he coordinates applications for payment and forms registers of payments, monitors the profitable placement of DS on time deposits.

In small companies, the same financial controller may be the treasurer. But such a combination is effective only if the company conducts no more than 30 operations daily and it has well-automated business processes in finance.

The union of the treasurer and the accountant works well in the payment area for medium-sized enterprises, and for large ones it is necessary to create a treasury department.

Working capital

Working capital management is a related area to cash management, so the treasurer also deals with it. With large companies, it is advisable to allocate the control of accounts receivable to a special department.

Additional and related functions

Tax

The functions of the financial control department may include reducing the tax burden by developing methods for optimizing and planning tax schemes. In fact, this is a related function of the chief accountant, but it all depends on the distribution of responsibilities in the enterprise.

In large holdings, it is advisable to create a position of a tax consultant or a tax department.

Contracts

In business sectors based on contractual activities with buyers and suppliers, it is essential to establish financial specialists' control over newly entered contracts. On the one hand, this will reduce the number of financial errors when concluding a contract, such as:

- Incorrect calculation of amounts and tariffs.

- Incorrect payment term.

- Lack of price indexation for long-term contracts.

- Existence or vice versa not including penalties.

- Etc.

On the other hand, this will allow financiers to include new contracts in planning, remove key data from them, and maintain a portfolio of contracts.

Capital investments

At a certain stage of development, it becomes obvious for an enterprise that fixed assets need to be managed especially carefully, because their cost is enormous. And with the help of competent management, you can save a significant amount on payments, taxes and free up funds for working capital. Management capital investments the financial control department or a dedicated unit is also in charge.

Financial investments

When an enterprise has free cash or retained earnings that can generate additional income, the task of the financier becomes a profitable investment.

On a small scale, the financial director is playing off the management of financial investments. And when the volumes grow, it is advisable to allocate an Investment Analyst under the management or create an investment department

Business processes

In process-oriented companies there is always an acute question: "Who will participate in the development of processes from the company?" Due to their mentality, financiers are usually good at this and are willingly included in various project teams. In addition, debt financiers need to be aware of the underlying business processes in order to know where to go for information.

KPI

It is a very common practice to appoint the finance department as responsible for calculating KPIs, especially if they (KPIs) are not numerous and not complex. In the opposite case, this is the area of responsibility of a dedicated unit of the KPI department.

But the development of KPIs should not be completely delegated to financiers, because in the end you will get good KPIs for a stagnating business, but not for rapid development.

Financial department structure

The structure of the finance department depends on the specific task of the company's development. The unit has basic functions (budgeting, management accounting, internal control, financial reporting) and there are additional ones. The latter may differ depending on the priorities of the current stage of the company's development.

table... An example of the structure and staff of the financial service of the enterprise

|

Name of structural divisions and positions |

Structural strength |

|

|

acting |

reserve |

|

|

CFO |

||

|

Financial Controlling Department |

||

|

Head of department - specialist in management accounting |

||

|

Financial Manager for Budgeting and Planning |

||

|

Financial specialist of the 2nd category |

||

|

Financial analyst |

||

|

Treasury Department |

||

|

Head of Department - Treasurer |

||

|

Loan Officer |

||

|

Financial specialist 1st category |

||

|

Control and audit department |

||

|

Head of department - chief auditor |

||

|

Accounting and reporting department |

||

|

Head of department (chief accountant) |

||

|

Deputy Chief |

||

|

Accountant |

||

|

Accountant-cashier |

||

|

IT support service |

||

|

Head of department |

||

|

Programmer |

||

|

Financial block |

||

We've covered most of the functions of the finance department, and we hope this article will help you create an efficient, non-bloated department.

I. General Provisions

1. The head of the finance department belongs to the category of managers.

2. A person with a higher professional (economic or engineering and economic) education and work experience in the specialty in the field of organization is appointed to the position of the head of the financial department. financial activities at least 5 years.

3. Appointment of the head of the financial department and exemption from

4. The head of the finance department should know:

4.1. Legislative and regulations regulating production and economic activities.

4.2. Regulatory and methodological materials concerning the financial activities of the enterprise.

4.3. Prospects for the development of the enterprise.

4.4. The state and prospects for the development of financial markets and sales markets for products (works, services).

4.5. Basics of production technology.

4.6. Organization of financial work at the enterprise.

4.7. The procedure for drawing up financial plans, forecast balances and budgets of funds, plans for the sale of products (works, services), profit plans.

4.8. The system financial methods and levers to manage financial flows.

4.9. The procedure for financing from the state budget, short-term and long-term lending to an enterprise, attracting investments and borrowed funds, using own funds, issue and purchase of securities, accrual of payments to the state budget and state off-budget social funds.

4.10. Distribution order financial resources, determining the effectiveness of financial investments.

4.11. Rationing working capital.

4.12. The procedure and forms of financial settlements.

4.13. Tax law.

4.14. Financial accounting and reporting standards.

4.15. Economy, organization of production, labor and management.

4.16. Accounting.

4.17. Computer facilities, telecommunications and communications.

4.18. Fundamentals of Labor Law.

4.19. Advanced domestic and foreign experience in improving the financial performance of an enterprise.

4.20. Labor protection rules and regulations.

7. The head of the finance department manages the department employees.

8. During the absence of the head of the financial department (business trip, vacation, illness, etc.), his duties are performed by a deputy (in the absence of such, a person appointed in established order), which acquires the corresponding rights and is responsible for the proper performance of the duties assigned to him.

II. Job responsibilities

Head of Financial Department:

1. Organizes the management of the movement of financial resources of the enterprise and regulation financial relations arising between business entities in the market conditions, in order to make the most efficient use of all types of resources in the process of production and sale of products (works, services) and to maximize profits.

2. Provides the development of the financial strategy of the enterprise and its financial stability.

3. Supervises the development of projects of long-term and current financial plans, forecast balances and budgets of funds.

4. Ensures that the approved financial indicators are communicated to the divisions of the enterprise.

5. Participates in the preparation of draft plans for the sale of products (works, services), capital investments, scientific research and development, planning the cost of production and profitability of production, leads the work on the calculation of profit and income tax.

6. Determines the source of financing for the production and economic activities of the enterprise, including budget financing, short-term and long-term lending, issue and purchase of securities, leasing financing, raising borrowed funds and using own funds, conducts research and analysis of financial markets, assesses the possible financial risk in relation to to each source of funds and develops proposals for its reduction.

7. Carries out investment policy and asset management of the enterprise, determines their optimal structure, prepares proposals for the replacement, liquidation of assets, monitors the portfolio of securities.

8. Analyzes and evaluates the effectiveness of financial investments.

9. Organizes the development of standards for working capital and measures to accelerate their turnover.

10. Provides:

10.1. Timely receipt of income, registration of financial, settlement and banking operations in a timely manner.

10.2. Payment of invoices to suppliers and contractors.

10.3. Repayment of loans.

10.4. Payment of interest, wages to workers and employees.

10.5. Transfer of taxes and fees to federal, regional and local budgets, to state off-budget social funds, payments to banking institutions.

11. Analyzes the financial and economic activities of the enterprise.

12. Participates in the development of proposals aimed at ensuring solvency, preventing the formation and elimination of unused inventory, increasing the profitability of production, increasing profits, reducing the cost of manufacturing and selling products, strengthening financial discipline.

13. Exercises control over:

13.1. Implementation financial plan and budget, product sales plan, profit plan and other financial indicators.

13.2. Termination of production of products that are not available for sale.

13.3. Correct spending of money.

13.4. Purposeful use of own and borrowed working capital.

14. Provides accounting for the movement of funds and reporting on the results of financial activities in accordance with the standards of financial accounting and reporting, the reliability of financial information.

15. Controls the correctness of the preparation and execution of reporting documentation, the timeliness of its provision to external and internal users.

16. Participates in holding meetings-seminars (studies) with employees of the main accounting department and the financial department of the enterprise.

17. Participates in the development of proposals for the social protection of employees of the enterprise.

18. Provides protection of information resources containing their own information of limited access and obtained from other organizations.

III. Rights

The head of the finance department has the right to:

1. To act on behalf of the department, to represent the interests of the enterprise in relations with other structural divisions of the enterprise and other organizations on financial issues.

2. Install job responsibilities for subordinate workers.

3. Submit proposals for improving the financial and economic activities of the enterprise for consideration by the management.

4. Submit to the director of the enterprise:

4.1. Ideas about the appointment, relocation and dismissal of employees of the finance department.

4.2. Offers:

On the encouragement of distinguished workers;

Bringing to material and disciplinary responsibility violators of production and labor discipline.

6. Participate in the preparation of draft orders, instructions, instructions, as well as estimates, contracts and other documents related to the activities of the financial department.

7. Interact with the heads of all structural divisions on the financial and economic activities of the enterprise.

8. To give the heads of the structural divisions of the enterprise instructions on the issues of proper organization and conduct of financial work.

9. Sign financial documents as authorized by the director of the organization.

10. Visa all documents related to the financial and economic activities of the enterprise (plans, reports, etc.).

11. Independently conduct correspondence with the structural divisions of the enterprise and other organizations on issues that are within the competence of the department and do not require the decision of the director of the enterprise.

12. Submit proposals to the director of the enterprise on bringing officials to financial and disciplinary responsibility based on the results of inspections.

Home> Public reportTasks and functions

financial and economic department

Tasks of the financial and economic department:- Organization of accounting and reporting of the Office, control over the efficient use of material and financial resources. Formation of complete and reliable information about the property status, income and expenses of the Office. Providing information necessary for internal and external users of financial statements to monitor compliance with legislation Russian Federation when carrying out business operations by the Office. Prevention of negative results of economic activities of the Office and identification of on-farm reserves to ensure it financial sustainability... Control over the safety of cash and material assets in the places of their storage and operation; Organization of work to mobilize federal budget revenues administered by the Office.

- Drawing up an estimate of the income and expenses of the Department by sources of financing: - at the expense of the federal budget within the limits of the annual limits of budgetary obligations brought by the chief administrator; and funds received from extrabudgetary sources; Formation of a draft cost estimate and calculations to it for planning periods the work of the Office; Control over the effective spending of funds in accordance with the allocated appropriations and their intended purpose according to the approved cost estimates, taking into account the changes made to them in the prescribed manner; Submission of timely, complete and reliable accounting, financial, statistical and tax reporting in a timely manner to the relevant authorities; Implementation of accrual and timely transfer of taxes and payments to the budget and off-budget funds; Participation in the development of guidance and guidance documents of the Office in the field of accounting; Participation in the procedures for placing orders for the supply of goods and the performance of services for the needs of the Office; Implementation of economic analysis of economic and financial activities of the Office according to accounting data in order to identify on-farm reserves, eliminate losses and reduce costs; Participation in the preparation of draft contracts, agreements concluded by the Department with individuals and legal entities, verification of documents received for payment, in terms of their financial and economic feasibility; Organization of accounting for property, liabilities and business operations (accounting for fixed assets, inventory, cash payments by suppliers, accountable persons) and timely reflection on the accounts of accounting transactions related to their movement; Analysis of the effectiveness of the use of material assets; Control over the safety of fixed assets and other material assets in the places of their storage and operation; Registration of materials on shortages and theft of funds and inventories, control over the transfer, if necessary, of these materials to investigative and judicial authorities; Participation in the preparation and conduct of an inventory of property and material values, funds and obligations. Control over the timely and correct reflection of the inventory results; Conducting briefing of materially responsible persons on the safety of valuables in their custody; Participation in commissions for writing off fixed assets and inventories; Registration of acts of reconciliation with suppliers and contractors, taking measures to collect accounts receivable and pay off accounts payable for material values, work performed and services rendered. Control over the expenditure of funds issued to accountable persons; Implementation of payroll for employees of the Office. Analytical accounting of deposited wages and control over its payment; Carrying out operations for the receipt, accounting, issuance and storage of funds with the obligatory observance of the rules ensuring their safety; Accounting for budget revenues in the context of the codes of the budget classification of the Russian Federation, administered by the Office; Preparation of documents for the return of overpaid payments to the budgets of the Russian Federation, the administration of which is entrusted to the Department; Registration of notifications to clarify the type and affiliation of payment for receipts of income to the budget in the context of the administered codes of the budget classification; Forecast of cash receipts to the federal budget by codes of the budget classification of the Russian Federation, administered by the Office; Use of modern automation tools and software products 1C "Accounting", 1C Wage and frames "" External contour "," Administrator D "; Ensuring the safety of accounting documents and submitting them in the prescribed manner to the archive; Organization of interaction with credit institutions on issues related to the administration of income; Participation in the work on the coverage of the activities of the Office in funds mass media; Coordination and control over the activities of the territorial divisions of the Office on issues referred to the jurisdiction of the department; Consideration of appeals of individuals and legal entities, public authorities, bodies local government on issues within the competence of the department; Formation of the established reporting on the subject of the Department's activities; Implementation within the limits of its other functions in accordance with the goals and objectives.

What you need to open a hookah lounge, and how to do it correctly

What you need to open a hookah lounge, and how to do it correctly How to start a business and choose donut equipment

How to start a business and choose donut equipment Opening a company in Montenegro Open a company in Montenegro

Opening a company in Montenegro Open a company in Montenegro The carpentry shop as a business

The carpentry shop as a business How to choose a business direction?

How to choose a business direction? Sample business plan of a dental office

Sample business plan of a dental office Five best business ideas that brought millions What business to open so as not to go bankrupt

Five best business ideas that brought millions What business to open so as not to go bankrupt