Calculation of vacation pay for a 6-day working week. Calculation of vacation pay for days not fully worked. Calculation of vacation pay in non-standard situations

All cases of determining the amount of average earnings provided for by the Labor Code of the Russian Federation are regulated by the Regulations on the peculiarities of the procedure for calculating the average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 (hereinafter referred to as the Regulations on average earnings). This document should also be followed when calculating vacation pay.

At first glance, the algorithm for calculating vacation pay is simple. The average daily earnings for paying for vacations provided in calendar days and for paying compensation for unused vacations is calculated by dividing the amount of wages actually accrued for the billing period by 12 and by the average monthly number calendar days(29.4). However, in practice, many nuances must be taken into account.

Billing period

Determine the number of days worked in billing period. It happens that one or more months of the billing period have not been fully worked out or time has been excluded from it in accordance with clause 5 of the Regulation on average earnings. In such a situation, the average daily earnings are determined by dividing the amount of actually accrued wages for the billing period by the amount of the average monthly number of calendar days (29.4) multiplied by the number of full calendar months, and the number of calendar days in incomplete calendar months (clause 10 of the Regulation on average wage).

In practice, situations arise when it is quite difficult to determine whether a month is fully worked out.

Situation 1

The employee was hired on January 11, 2009. Despite the fact that in January he worked all 16 working days, this month, when calculating the average earnings for vacation, is considered not fully worked. After all, calendar days are taken to calculate vacation pay, and the employee officially worked 21 calendar days attributable to the time worked in a given month.

Situation 2

The employee was granted part of the vacation, 7 calendar days (from August 30 to September 5, 2008). In October 2008, the employee took the rest of the leave.

Although the employee worked in August for the 21 working days assigned to him, this month for calculating vacation pay is recognized as not fully worked. After all, it has two days (August 30 and 31 - days off), for which the employee is counted average earnings. And they, in accordance with sub. "a" clause 5 of the Regulations on average earnings are excluded from the billing period.

Situation 3

For work in holidays On January 9 and 10, 2009, the employee was given two other days of rest, which he used on February 19 and 20, 2009.

In this case, an employee had overtime in January, and a defect in February. But both of these months for calculating vacation pay are considered fully worked out. Indeed, for a month in which there is processing, a separate calculation mechanism has not been established. Therefore, it is calculated as a month worked out completely.

As for February, the provision of days off, due to the employee, is not considered to be his release from work. Therefore, there is no reason to exclude them from the calculation period.

Situation 4

An employee with a summarized working day worked 100 hours according to the schedule in January, and 170 hours in February.

Situation 9

The employee has a summarized accounting of working hours with a accounting period of one month. Payment is made at an hourly rate. Working hours - 15 days of work and 15 days of rest. An employee in April 2009 was ill from the 11th to the 20th.

Separate calculations or a general calculation are made depending on whether the employee's main job and part-time work coincide, which, in accordance with clause 5 of the Regulation on average earnings, is excluded from the calculation of average earnings.

If, for example, an employee was sick, was on idle time or on vacation and missed both his main job and part-time work at the same time, you can make a general calculation.

In a situation where an employee was called to the military registration and enlistment office and was absent for his main job, but managed to go to part-time work that day, the billing period for these jobs will not coincide and two separate calculations will have to be made.

Vacation pay on working days

Leave in working days in accordance with Art. 291 of the Labor Code of the Russian Federation is provided to employees who have concluded labor contract for up to two months. They are provided with paid holidays or compensation upon dismissal at the rate of two working days per month of work.

Situation 11

The salary of an employee hired for two months (from September 1 to October 31, 2008) is 4,000 rubles.

According to the calendar of the six-day working week in September - 26 days, and in October - 27. The total amount of working days - 53. Total earnings - 8000 rubles. Vacation is supposed to last 4 days.

The average daily earnings are 150.94 rubles / day. (8000 rubles: 53 days), and the amount of vacation pay is 603.77 rubles. (150.94 rubles/day x 4 days).

In addition to the only leave mentioned by the Labor Code of the Russian Federation in working days, leave is still granted in working days for harmful working conditions. See the resolution of the USSR State Committee for Labor and the Presidium of the All-Union Central Council of Trade Unions of October 25, 1974 No. 298 / P-22 “On approval of the List of industries, workshops, professions and positions with harmful conditions labor, work in which gives the right to additional leave and a shorter working day.

In accordance with this document, for example, a doctor at an ambulance station is entitled to an additional vacation of 12 working days with a 6-day working week. However, in practice, employers often calculate this vacation in calendar days, providing the employee with 14 calendar days of vacation instead of 12 working days.

Situation 12

The doctor of the ambulance station and emergency care additional leave for difficult working conditions was granted from February 1, 2008 for 12 working days. In the billing period (February 1, 2007 to January 31, 2008), he was on sick leave from May 1 to May 10, 2007. Wage for the billing period, excluding payments for sick leave amounted to 95,000 rubles.

Let's calculate the number of working days falling on the hours worked according to the calendar of the 6-day working week. It will be the following number of days (by months): in 2007: February - 23, March - 26, April - 25, May - 18, June - 26, July - 26, August - 27, September - 25, October - 27 , November - 25, December - 25; January 2008 - 23.

The total amount of working days is 296.

The average daily earnings is 320.95 rubles. (95,000 rubles : 296 days).

The total amount of vacation pay for 12 working days amounted to 3851.40 rubles. (12 days x x RUB 320.95).

Now we calculate the same vacation for 14 calendar days.

The total number of calendar days will be 343.32 days (29.4 x 11 + 29.4: 31 x x 21). The average daily earnings will be 276.71 rubles, and the total amount of vacation pay - 3873.94 rubles.

This means that even an employee who is dismissed, for example, as having failed the test or for absenteeism, is entitled to monetary compensation for unused vacation.

Please note: compensation for unused vacation is also paid to employees who are dismissed from the organization in the order of transfer on the basis provided for in paragraph 5 of Art. 77 of the Labor Code of the Russian Federation.

The duration of the vacation, for which monetary compensation is paid, is determined in accordance with paragraph 35 of the Rules on regular and additional vacations, approved by the NCT of the USSR on 30.04.30 No. 169 (as amended on 03.03.2005).

When determining the number of vacation days for which it is necessary to pay the employee compensation upon dismissal, it must be taken into account that if the employee has worked less than half a month, the indicated time is excluded from the calculation, and if half or more than half a month has been worked, the specified period is rounded up to a full month. This is stated in paragraph 28 of these Rules.

Situation 15

The employee was hired on February 16, 2009. The first month of work, giving the right to leave, is the period from February 16 to March 15, 2009.

Situation 16

The employee worked at the enterprise from August 15, 2008 to August 17, 2009 and left. Took unpaid leave during the period of employment family circumstances 6 times, which in total amounted to 66 calendar days. How to calculate compensation for vacation upon dismissal?

According to Art. 121 of the Labor Code of the Russian Federation, the length of service giving the right to the annual basic paid leave includes time actual work minus the time of unpaid leave provided at the request of the employee, if their total duration exceeds 14 calendar days during the working year.

Since the total duration of unpaid leave has exceeded this limit, all 66 calendar days should be excluded from the total length of service, which is 12 months and 3 days.

As a result, the length of service giving the right to leave will be 9 months and 29 days. In this case, the number of days worked is more than half a month. Therefore, compensation should be paid for 10 months.

If, for example, the duration of vacation is set for the dismissed employee at 28 calendar days, compensation should be paid for 23.33 calendar days (28: 12 x 10).

The Federal Service for Labor and Employment, by letter No. 1133-6 dated July 26, 2006, clarified that it is not required to round the result to the nearest whole number of calendar days.

But if the employee worked not for 10 months, but for 11, he should have been compensated for 28 days of vacation. The fact is that, in accordance with clause 28 of the Rules, employees dismissed for whatever reason, who have worked with this employer for at least 11 months, subject to offset in the period of work giving the right to leave, receive full compensation.

The Labor Code of the Russian Federation prohibits not letting an employee go on vacation for two or more years in a row, even with the consent of the employee. However, it is still not uncommon for this to happen. However, this is a violation labor law and not tax. Consequently, the organization will be punished for this under Art. 5.27 of the Code of Administrative Offenses of the Russian Federation.

An accountant specializing in payroll is often faced with the accrual of vacation pay.

Moreover, there are such cases as granting leave to a part-time worker, a new employee who has not worked for six months from the date of entry to work, and other interesting points.

After reading this article, you will learn how to calculate vacation in 2019 and get acquainted with examples of calculating vacation pay.

Legislative regulation

most important normative document in terms of organization and remuneration is the Labor Code of the Russian Federation. To account for the vacation, a whole chapter at number 19 is allocated in it.

In addition, in order to regulate certain issues on granting leave to employees, federal laws and Decrees of the Government of the Russian Federation.

In particular, Decree No. 922"On the peculiarities of the procedure for calculating the average wage" of December 24, 2007 decides possible problems for calculating average earnings.

The basic local act at the enterprise is collective agreement, which is between the employees of the organization and the employer. It contains all the main nuances of providing annual leave. Besides, key points in granting leave to a particular employee are established in the employment contract.

Types of leave and conditions for its provision

The Labor Code of the Russian Federation guarantees employees of organizations the following types recreation:

The Labor Code of the Russian Federation guarantees employees of organizations the following types recreation:

- leave without pay.

The first two types of vacations are paid. Basic vacation given for 28 calendar days. An employee of the organization can go on vacation after six months of continuous work.

The employer has the right to send specialists of certain categories on vacation with their consent, without waiting for 6 months In the organisation.

- representatives of the weaker sex before and immediately after it;

- employees - adoptive parents of children under the age of 3 months;

- workers under the age of 18.

In subsequent years of work at the enterprise, the employee has a vacation at any time.

For certain professionals extended annual leave. It is provided on the basis of the Labor Code and other federal laws.

In particular, they are:

Additional holidays with preservation average salary established by the employees of the organization:

- for deviating from normal;

- for the special nature of the work;

- for the irregularity of the working day;

- for work in the regions of the Far North and areas equated to them;

- in other statutory cases.

In addition to the above, the collective agreement may provide for special additional holidays for the rest of employees.

How vacation days are calculated

If the employee's length of service is a full year with the employer, then calculate the number vacation days won't be too difficult. The duration of the vacation of a particular working person is prescribed in the employment contract when he is hired for a position. Usually, after a year of work in an organization, leave is provided in the number of days specified in this document, or half of it.

There are cases when an employee asks for leave before the end of the year of performance of his duties or decides to quit. In such cases, you have to calculate how many days of rest he is entitled to this employee.

It can be calculated from formula:

K \u003d (M * Ko) / 12,

- K is the number of vacation days due for the time that he worked in the organization,

- M - the number of months worked in full,

- Ko - the number of days of vacation established for the year of work.

For example. The continuous work experience of an employee in the organization is 7 months. The employment contract states that for the year of work he is entitled to 44 days of vacation. The number of vacation days that he is entitled to at this moment is: (7 months * 44 days) / 12 months = 25.67 days.

For example. The continuous work experience of an employee in the organization is 7 months. The employment contract states that for the year of work he is entitled to 44 days of vacation. The number of vacation days that he is entitled to at this moment is: (7 months * 44 days) / 12 months = 25.67 days.

When calculating vacation days, the number of months worked is required round up to whole month. According to the rules, rounding should be done as follows. Excesses that are less than two weeks are not taken into account. If the surplus is more than two weeks, then they must be rounded up to a whole month.

For example, an employee started work on April 8. Vacation asks from December 19 of the same year. It turns out that he worked in this organization for 7 months and 9 calendar days. These 9 days are discarded, since this number of days is less than half a month. The calculation is based on 7 months of continuous operation.

Usually, when calculating vacation days, a fractional number is ultimately obtained. To facilitate calculations, many accountants use rounding it to an integer, although the law does not stipulate that this action is mandatory. At the same time, it should be remembered that rounding should be done in favor of the employee, and not according to the logic of arithmetic.

For example, the number of vacation days that an employee is entitled to in the calculation was 19.31 days. Rounding results in 20 days.

What is taken into account when calculating

The Decree of the Government of Russia No. 922 dated December 24, 2007 considered issues related to the calculation of average daily earnings. It states that the calculation of the average salary per day must be carried out taking into account all payments that relate to remuneration for work.

To them relate:

To them relate:

- Wage. This official salary, tariff rate, payment at piece rates, payment as a percentage of revenue and others, including non-cash wages.

- Various allowances and surcharges. These are all kinds of incentive and compensation payments, northern coefficients and regional allowances.

- Performance bonuses and other rewards.

- Other types of payments related to remuneration for work.

To derive the average salary, you need to take only those accruals that were made for the actual time of work and for the work that was actually done. It follows from this that when calculating the average daily wage do not need to be taken into account the following charges:

- allowances and other payments financed from the Social Insurance Fund;

- payments made on the basis of average earnings (these include holiday payments, payment during a business trip);

- one-time bonuses not related to wages (bonus for certain holidays);

- gifts and financial assistance;

- other accruals not related to remuneration for work.

In a relationship work periods included in the vacation calculation, the same principle applies. The 12-month billing period includes only the time that the employee actually worked.

To calculate vacation from the total annual experience the following periods are discarded:

- the time when the employee retains the right to receive an average salary;

- the time the employee was on or at;

- days off with pay, which are allocated for the care of the disabled;

- the period of release of the employee from work (absenteeism, downtime, etc.).

Calculation order

The period for accrual of vacation pay is 12 months preceding the vacation.

There are situations when an employee of the organization does not have payroll accruals for this period of time, or he actually did not work at that time. In this case, it is necessary to take for the estimated time those 12 months that come before the estimated year. In the absence of accruals and days worked and 2 years before the vacation, the average daily salary is calculated based on the data of the month in which the employee goes on vacation.

At full time worked

The ideal case is when the employee for the entire billing period did not go on vacation and on sick leave. Then he will have fully fulfilled the norm of his working time.

In such a situation, vacation pay is accrued according to a specific formula:

Zd \u003d Zg / (12 * 29.3)

- Zd - average daily earnings,

- Zg - annual salary,

- 29.3 - the average monthly number of calendar days.

The annual amount of accrued remuneration for work is obtained as a result of summing up the accrued salary for the 12 months that precede the vacation.

With incomplete hours worked

The formula discussed above is not suitable for calculating vacation in situations where 12 billing months have not been fully worked out by the employee.

Here it is necessary to use another, more complex formula:

Zd \u003d Zg / (M * 29.3 + D * 29.3 / Dn)

- M - the number of months worked in full,

- D - the number of calendar days worked in unworked months,

- Days - the norm of calendar days in non-worked months.

Examples

Case 1. An employee wishes to go on vacation from February 20 for 15 days. From February of last year to January of this year, he worked without interruption. During this time, he was credited with 198,750 rubles, of which 13 thousand rubles is a bonus to professional holiday. When calculating vacation, the amount of this bonus must be deducted from the total earnings. It turns out 185,750 rubles. The average daily salary will be 185,750 / (12 * 29.3) = 528.30 rubles. As a result, the employee will receive 528.30 * 15 = 7924.50 rubles for 15 days of vacation.

Case 2. An employee takes a vacation from December for 21 days. In the billing period, he was on advanced training courses for two weeks in March and on vacation for 10 days in September. Data on his earnings and actual hours worked are given in the table.

| Month | Number of hours worked in calendar days | Working hours in calendar days | Amount of accrued wages | Additional payments |

|---|---|---|---|---|

| December | 31 | 31 | 20000 | |

| January | 31 | 31 | 20000 | |

| February | 28 | 28 | 20000 | |

| March | 17 | 31 | 27000 | 13000 rub. - travel expenses |

| April | 30 | 30 | 20000 | |

| May | 31 | 31 | 20000 | |

| June | 30 | 30 | 20000 | |

| July | 31 | 31 | 20000 | |

| August | 31 | 31 | 20000 | |

| September | 20 | 30 | 30000 | 18000 rub. - vacation pay |

| October | 31 | 31 | 20000 | |

| November | 30 | 30 | 20000 | |

| TOTAL: | 341 | 365 | 257000 | 31000 |

The calculation of average earnings will include wages in the amount of 257,000 - 31,000 \u003d 226,000 rubles. The norm of working hours in 10 months has been fully worked out. In March and September, he worked only 37 days at a rate of 61 calendar days.

It turns out that, on average, this employee receives per day: 226,000 / (10 * 29.3 + 37 * 29.3 / 61) = 727.20 rubles. The amount of vacation for 21 days will be: 727.20 rubles. * 21 days = 15271.20 rubles.

The rules and examples of calculations are presented in the following video:

How to determine the billing period for accrual of vacation pay?

What should be taken into account when calculating the average daily earnings?

Non-standard situations when calculating compensation for unused vacation: how to get out of the situation?

The procedure for granting leave

By providing the employee another vacation, the following must be taken into account:

- the duration of the vacation must be at least 28 calendar days, excluding holidays and non-working days;

- upon dismissal, the employee is entitled to monetary compensation for unused vacation;

- after one continuous year of work, leave can be granted to an employee without maintaining the six months prescribed by law;

- accrued vacation pay is issued to employees no later than three days before the start of the vacation;

- if the employee refuses to leave, he is entitled to compensation (issued upon a written application of the employee). It can be charged for several calendar periods. Replace monetary compensation main regular vacation is prohibited, but an additional one is possible - in the cases established by the Labor Code of the Russian Federation (hereinafter - the Labor Code of the Russian Federation);

3 cases when the replacement of vacation with compensation is unacceptable (Article 126 of the Labor Code of the Russian Federation):

the employee is a pregnant woman;

minor;

employed in work with harmful or hazardous conditions labor.

- vacation can be granted without fail every six months on the basis of a written application from the employee;

- at the request of the employee, vacation can be postponed, but not more than 2 times in a row;

- vacation can be divided into several parts with the condition that one part in any case will be at least 14 calendar days in a row.

The right to the first annual leave at a new place of work arises for an employee after six months of continuous work in the company (part 2 of article 122 of the Labor Code of the Russian Federation). However, in agreement with management leave may be granted in advance.

Note!

The right to leave with duration labor activity less than 6 months must be provided:

minors (Articles 122, 267 of the Labor Code of the Russian Federation);

women before maternity leave or immediately after it or at the end of the leave associated with caring for a child (Articles 122, 260 of the Labor Code of the Russian Federation);

employed who have adopted a child under the age of 3 months;

in other cases provided for by law.

Vacations are granted on the basis of the vacation schedule. In accordance with the requirements of the legislation, the vacation schedule indicates the procedure and time for granting vacations to employees for the next year. It must be approved no later than December 17 each year.

The employee about the start time of the upcoming vacation must be notified against signature no later than two weeks before it starts (part 3 of article 123 of the Labor Code of the Russian Federation).

Vacation pay formula

Situation 1. The billing period has been fully worked out

In this case, the following formula is used to calculate vacation pay:

The amount of vacation pay \u003d Average daily earnings × Number of calendar days of vacation.

Average daily earnings (ZP avg) is calculated by the formula:

ZP cf \u003d ZPf / 12 / 29.3,

where ZP f - the amount of actually accrued wages for the billing period;

12 - the number of months that must be taken when calculating vacation pay;

29.3 is the average number of days in a month.

The coefficient of 29.3 is applied only in the month that is fully worked out in the billing period.

Example 1

Suppose an employee of an institution goes on vacation from 07/01/2015 for 28 calendar days. The billing period for accruing vacation is from 07/01/2014 to 06/30/2015. The worker worked it out completely. During this period, the employee was accrued wages accepted for calculation in the amount of 295,476 rubles. Calculate the amount of accrued vacation pay for 28 calendar days:

(295,476 rubles / 12 months / 29.3) × 28 = 23,530.51 rubles.

______________________

In fact, it rarely happens that an employee has fully worked out the entire billing period: during the year he may be on sick leave for some time, on a business trip, regular vacation, leave without pay, etc.

Situation 2. The billing period has been partially worked out

Suppose that the employee has not worked the whole month. In this case, the number of calendar days in an incomplete calendar month must be recalculated using the formula:

D m \u003d 29.3 / D to × D neg,

where D m - the number of calendar days in an incomplete month;

D to - the number of calendar days of this month;

D otr - the number of calendar days falling on the time worked in a given month.

To calculate the average daily earnings for vacation pay in the event that one or several months of the billing period were not fully worked out or the time when the average earnings were accrued to the employee was excluded from this period, the formula is used:

ZP sr \u003d ZP f / (29.3 × M p + D n),

where ZP cf - average daily earnings,

ZP f - the amount of actually accrued wages for the billing period,

M n - the number of full calendar months worked,

D n - the number of calendar days in incomplete calendar months.

Example 2

The employee went on another vacation lasting 28 days from 09/07/2015. In the billing period from 09/01/2014 to 08/31/2015, he was on sick leave from March 16 to 19, 2015, and from April 23 to 28 he was on a business trip.

In the billing period, the employee was paid a salary in the amount of 324,600 rubles. (excluding sick leave and travel allowances).

Calculate vacation pay.

First, let's determine the number of calendar days falling on hours worked in March and April 2015:

- in March: 29.3 / 31 × (31 - 4) = 25.52;

- in April: 29.3 / 30 × (30 - 6) = 23.44

Determine the average earnings for vacation pay:

324 600 rub. / (29.3 days × 10 + 25.52 + 23.44) = 949.23 rubles.

The amount of accrued vacation pay will be:

RUB 949.23 × 28 days = 26,578.44 rubles.

_______________________

Calculation of vacation pay in non-standard situations

Situation 3. In the month of the billing period, the employee has no income, but there are counted days (New Year holidays)

Suppose the epidemiologist Ilyin S.A. goes on additional leave from 08/03/2015 for 14 calendar days. The settlement period is from 08/01/2014 to 07/31/2015. During this period, he was already on vacation from 9 to 31 January 2015.

The employee does not have accruals in January, and the days of this month (there are 8 of them in our case), which were not included in the vacation period, should be taken into account.

In view of the foregoing, we determine the number of calendar days for calculating additional leave.

First, let's calculate the number of calendar days in the billing period:

(29.3 × 11 months + 29.3 / 31 × 8) = 329.86.

The accrued salary for the billing period without vacation pay is 296,010 rubles. Calculate the amount of vacation pay due:

296,010 / 329.86 × 14 = 12,563.33 rubles

__________________

Situation 4. An employee takes a vacation immediately after the decree

According to the rules, vacation pay is calculated based on the salary for the 12 months preceding the vacation. If a woman takes another paid leave immediately after parental leave, then, accordingly, income for Last year she does not have. In this situation, to calculate the vacation, one should take 12 months preceding the period that is excluded from the billing period, that is, 12 months preceding her decree (Regulation on the features of the procedure for calculating the average wage, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 (in edited on 10/15/2014)).

If the employee had no earnings at all (for example, the employee goes on vacation immediately after being transferred from another institution), vacation pay is calculated based on the salary.

Determining the amount of vacation pay with an increase in wages

An increase in salary affects the calculation of vacation pay if this happens:

- before or during the holiday;

- during or after the billing period.

If the salary was increased for all employees of the institution, then before calculating the average earnings, its rate and all allowances to the rate, which was set in a fixed amount, should be indexed.

The salary increase period affects the indexation order. Payments are usually indexed by the increase factor. To determine the amount of vacation pay, we find the coefficient (K):

K \u003d Salary of each month for the billing period / Monthly earnings on the date of departure for the next vacation.

If the salary has risen during the vacation, only a part of the average income needs to be adjusted, and it should fall on the period from the end of the vacation to the date of the increase in earnings; if after the calculated period, but before the start of the vacation, the average daily payment should be adjusted.

Situation 5. The salary was increased after the billing period, but before the start of the vacation.

Chemist-expert E.V. Deyeva was granted the next main leave from 10.08.2015 for 28 calendar days. Monthly salary - 25,000 rubles. The billing period - from August 2014 to July 2015 - has been fully worked out.

Calculate the amount of vacation pay:

(25,000 rubles × 12) / 12 / 29.3 × 28 cal. days = 23,890.79 rubles.

In August 2015, all employees of the institution received a 10% salary increase, therefore, the salary increased taking into account indexation:

(25,000 × 1.1) = 27,500 rubles.

The amount of vacation pay after adjustment will be:

RUB 23,890.79 × 1.1 = 26,279.87 rubles.

Situation 6. Increase in salary during the billing period

Technician Sokolov I.N. goes on the next main vacation lasting 28 calendar days from 10/12/2015. The settlement period for accrual of vacation pay is from 10/01/2014 to September 2015 inclusive.

Technician salary - 22,000 rubles. In September, it was increased by 3300 rubles. and amounted to 25,300 rubles. Let's define the increase factor:

25 300 rub. / 22 000 rub. = 1.15.

Therefore, wages need to be indexed. We expect:

(22,000 rubles × 1.15 × 11 months + 25,300) / 12 / 29.3 × 28 = 24,177.47 rubles.

We determine the amount of compensation for unused vacation days paid by dismissal

Upon dismissal, the employee has the right to count on compensation for the days of unused vacation.

To determine the number of unused calendar days of vacation, the following data is required:

- duration of the employee's vacation period (number of years, months, calendar days);

- the number of vacation days that the employee earned during the period of work in the organization;

- the number of days used by the worker.

The only valid regulatory document explaining the procedure for calculating compensation for unused vacation remains the Rules on Regular and Additional Vacations, approved by the NCT of the USSR on April 30, 1930 No. 169 (as amended on April 20, 2010; hereinafter referred to as the Rules).

Determine vacation time

The first working year is calculated from the date of employment to this employer, subsequent - from the day following the day of the end of the previous working year. In the event of dismissal of an employee, his vacation period ends. Employee getting settled on new job, from the first day of work, he again begins to earn vacation experience.

Calculate the number of vacation days earned

The number of vacation days earned is determined in proportion to the vacation experience as follows:

For your information

Usually the last month of vacation experience is incomplete. If 15 calendar days or more have been worked in it, then this month is rounded up to a whole month. If less than 15 calendar days have been worked, the days of this month do not need to be taken into account (Article 423 of the Labor Code of the Russian Federation (hereinafter - the Labor Code of the Russian Federation)). (clause 35 of the Rules)

The number of vacation days set for each month of the year is calculated depending on fixed duration holidays. So, for each fully worked month, 2.33 days of vacation are due, for a fully worked year - 28 calendar days.

Cash compensation for everything unused days annual paid vacations that an employee has received since the start of work in an organization is paid only upon dismissal of the employee (Article 127 of the Labor Code of the Russian Federation).

Question on topic

How to compensate for unused vacation days to an employee who quits without having completed the accounting period?

An employee who has not worked in the organization for a period that gives the right to full compensation, upon dismissal, has the right to proportional compensation for calendar days of vacation. Based on clause 29 of the Rules, the number of days of unused vacation is calculated by dividing the duration of the vacation in calendar days by 12. This means that with a vacation duration of 28 calendar days, 2.33 calendar days must be compensated. days for each month of work included in the length of service giving the right to receive leave (28 / 12).

__________________

Unlike the next vacation, which is provided in whole days, vacation days are not rounded up when calculating compensation for unused vacation.

Absenteeism, vacation provided without pay, exceeding 14 days, reduce the vacation period (Article 121 of the Labor Code of the Russian Federation).

Note!

Employees with whom civil law contracts are concluded are not entitled to compensation for unused vacation, since the norms of the Labor Code of the Russian Federation do not apply to them.

We determine the period for payment of compensation for vacation upon dismissal

Borisov P.I. was accepted into the organization on 12/08/2014, dismissed on 09/30/2015. In June 2015 he was on leave for 14 days, and in July 2015 he was on leave without pay for 31 calendar days. The period of work in the organization was 9 months 24 days. Since the duration of the vacation at its own expense exceeded 14 calendar days per working year, the total length of service must be reduced by 17 calendar days (31 - 14). This means that the vacation period will be (9 months 24 days - 17 days).

Since 7 calendar days are less than half a month, according to the rules, they are not taken into account. It follows from this that only 9 whole months will be counted in the length of service giving the right to leave.

The employee used two weeks of the main vacation, he does not need to pay compensation for them. In this case, the employee is entitled to compensation for 6.97 calendar days (9 months × 2.33 - 14 days).

Determine the amount of compensation

Example 3

The employee got a job in the organization on 01/12/2015, and on 06/29/2015 he quit. His salary was 40,000 rubles. Determine the amount of compensation accrued upon dismissal.

From January 12 to June 11, the employee worked five full months. June is counted as a whole month, since 18 calendar days were worked from June 12 to June 29, which is more than half of the month (clause 35 of the Rules). As a result, we take 6 months for the calculation.

Compensation is due for 14 calendar days (28 / 12 × 6).

The billing period from January 12 to May 31, 2015 consists of 4 whole months (February, March, April, May):

29.3 × 4 = 117.2 days

Determine the number of days to calculate in January:

29.3 / 31 x 20 = 18.903.

Total in the billing period:

117.2 + 18.903 = 136.103 cal. days

Salary for the billing period:

40,000 × 5 = 200,000 rubles

Calculate the amount of compensation:

200 000 rub. / 136.103 × 14 days = 20,572.65 rubles.

Example 4

The employee was hired on 06/01/2013 with a salary of 30,000 rubles, and on 10/09/2015 he quit.

In October 2014, the employee took regular annual leave of 28 calendar days. For this month, he was credited with 29,050 rubles.

From 06/01/2013 to 10/09/2015 28 months and 9 days worked, rounded up to 28 months (9 days less than half a month).

Determine the number of vacation days set for the entire period:

28 months × 2.33 = 65.24 days

But 28 days have already been used, so you should compensate:

65,24 - 28 = 37,24 days

The billing period is 12 months before the vacation, in our example - from 10/01/2014 to 09/30/2014. During this period, a total of 320,012.48 rubles was accrued, to calculate the average daily earnings, you need to take the amount without vacation pay:

320,012.48 - 29,050 = 290,962.48 rubles

To calculate the actual hours worked, we take 11 fully worked months and 3 calendar days in October 2014 (31 - 28 vacation days).

Thus, in the billing period:

29.3 × 11 + 3/31 = 322.397 cal. days

The average daily salary will be:

RUB 290,962.48 / 322.397 = 902.50 rubles / day.

Therefore, compensation for unused vacation should be accrued in the amount of:

902.50 × 37.24 = 33,609.10 rubles

conclusions

The legislation prohibits not to grant vacation for two years in a row, to replace the next basic vacation lasting 28 calendar days with monetary compensation.

The employee must be warned about the start date of the vacation two weeks before the start of the vacation, vacation pay must be issued no later than three days before the start of the vacation.

Vacation can be divided into parts, but with the condition that one part of it must be at least 14 calendar days in a row.

Vacation pay is calculated in calendar days. If non-working holidays fall on the vacation period, these days are not paid, and the vacation is extended.

In accordance with paragraph 8 of Art. 255 of the Tax Code of the Russian Federation, for the purpose of taxing profits, only that amount of compensation for unused vacation, which is calculated in accordance with generally established rules, can be recognized as expenses. Rounding the number of days of unused vacation up will result in an overstatement of the amount of payments made in favor of the employee and an underestimation of the tax base for income tax, and rounding down (from 2.33 days to 2 days) will lead to the payment of a smaller amount to the employee, than required by law.

S. S. Velizhanskaya,

Deputy Chief Accountant of the FFBUZ "Center for Hygiene and Epidemiology in Sverdlovsk region in the Oktyabrsky and Kirovsky districts of the city of Yekaterinburg"

The length of leave granted to all employees annually is typically 28 calendar days. For some categories of employees, leave must be provided not in calendar days, but in working days. In the article, we will consider in detail who is granted vacation in working days in 2020, as well as the features of calculating vacation pay and compensation for unused vacation for such employees.

Who is granted vacation on working days

- Those who have concluded an employment contract for up to 2 months, leave or its compensation upon dismissal is provided to them based on their 2 working days for 1 month of work (See also article ⇒);

- Employed in seasonal work, vacation is calculated on the basis of 2 working days for 1 month of work;

- working for harmful working conditions they are granted additional leave.

Important! On working days, leave is granted certain categories workers such as conscripts, seasonal workers and hazardous workers.

Leave for seasonal workers

Labor legislation stipulates only the number of vacation days per month of work, how such vacation is provided is not indicated. Accordingly, the employer has the right to provide it without waiting for the end of the employment contract. In this case, the following conditions must be observed:

- Compensation must be paid for all holidays that the employee did not use;

- An employee may be granted unused leave with further dismissal;

- Vacation from subsequent dismissal can be provided with going beyond the fixed-term contract. The day of dismissal is considered the last day of vacation.

At the end of the period specified in the employment contract, the employee is provided with:

- Or vacation followed by dismissal;

- Or compensation.

The procedure for calculating vacation pay

From the calculation period, you need to exclude the time:

- Saving the average salary for the employee, excluding breaks in feeding the child;

- Disability benefits or BiR payments;

- Downtime due to the fault of the employer or reasons beyond his control;

- Strikes in which the worker did not take part, but could not work because of them;

- Additional days off to care for a disabled child or a disabled child;

- Other time off from work, with or without pay.

Important! The average daily earnings for holidays in working days is calculated as the sum of the amount of wages actually accrued divided by the number of working days in a six-day working week.

An example of calculating vacation pay for employees under a fixed-term contract

The employee got a job under a fixed-term employment contract from 06/01/2017 to 07/31/2017, that is, for 2 months. The employee wrote an application according to which he was granted leave for 2 days, from 07/01/2017 to 07/02/2017. The salary for June was 35,000 rubles. Calculate vacation pay for an employee.

Leave is granted to the employee in working days, the calculation is made as follows:

We calculate the average daily earnings, based on the fact that in June there are 25 working days with a six-day working week (according to the production calendar):

35,000 / 25 = 1,400 rubles

Vacation pay will be:

2 x 1,400 = 2,800 rubles.

Additional leave for those working in hazardous conditions

The minimum number of days that are provided for work under harmful conditions is 7 days.

Important! If the organization has not carried out special assessment working conditions, then the duration of the allowance is determined in accordance with the List ( approved by the Decree of the USSR State Committee for Labor No. 298 / P-22 dated 10.25.2004).

How to determine the length of service for additional leave under harmful working conditions

In the experience that gives the right to extra days leave includes time actually worked at work in harmful or dangerous conditions. Article 121 of the Tax Code of the Russian Federation, which defines this right, does not provide for periods that need to be excluded from the total experience of such work. That is, when calculating from the total length of service of an employee, only those periods of work are excluded when he did not work in harmful or dangerous conditions.

The procedure for calculating the length of service for such employees of the Labor Code is not provided, therefore, Instruction No. 273 / P-20, approved in 1975, is still used. It is applied in the part that does not contradict the current legislation, namely, Article 423 of the Labor Code of the Russian Federation.

On the basis of this instruction, additional leave may be granted to an employee in the prescribed amount, when during the working year he worked in harmful conditions for at least 11 months. If he worked less than the specified number, then the allowance is granted to him in proportion to the time he worked. The length of service is determined as the number of days worked per year divided by the average monthly number of working days. Remainder of days that is less than half of the average monthly number of working days is excluded, and more than half is rounded up to the nearest full month. In this case, the employee is counted only those days when he worked in the specified conditions for at least half of the working day.

An example of calculating additional leave for workers in hazardous conditions

The employee has been working under harmful conditions since 09/20/2016. Additional leave is set in the organization equal to 7 calendar days. The employee was granted an additional allowance from 08/01/2017. During the working period before the vacation, the employee had a sick leave - 10 days in November 2016. He was also granted annual paid leave - 14 working days in May 2017.

Let's calculate how many days of additional allowance the employee is entitled to on 08/01/2017.

Number of working days in 2016: 73 working days - 10 sick days = 63 days;

Number of working days in 2017: 138 working days - 14 vacation days = 124 days.

Determine the number of months of work under harmful conditions:

2016: 63 days / (247 working days per year / 12 months) = 3.06 months;

2017: 124 days / (247 working days per year / 12 months) = 6.03 months.

Total number of months: 3.06 + 6.03 = 9 months.

The number of vacation days will be:

7 days / 12 months x 9 months - 0 used days of allowance = 5.25 days

We round in favor of the employee, we get 6 days.

When calculating the total period of annual leave, the main vacation is added to the additional one.

When vacation is partially (completely) calculated in working days, its duration is calculated as follows: from the date that falls on the beginning of the vacation, the days of the main vacation (for example, 28 calendar days) are counted, and then the days of additional allowance in working days, which were determined based on the six-day working week , after which they determine the end date of the vacation, or its last day. The total number of days obtained is converted into calendar days. They are the total duration of the annual paid leave provided to the employee.

The legislative framework

| Legislative act | Content |

| Article 291 | "Paid holidays" |

| Article 295 of the Labor Code of the Russian Federation | "Paid holidays for seasonal workers" |

| Decree of the Government of the Russian Federation No. 922 of December 24, 2007 | "On the peculiarities of the procedure for calculating the average wage" |

| Decree of the USSR State Committee for Labor No. 298 / P-22 of October 25, 2004 | "On approval of the list of industries, jobs and positions with harmful working conditions" |

Each employee has a different situation: someone wants to take a vacation immediately after parental leave, someone works part-time, someone has a salary increase and bonuses. All these situations must be taken into account when calculating vacation pay. In the article we will consider examples of calculation. In addition, you will find convenient formulas for calculating vacation pay in non-standard situations.

To confidently calculate average earnings in the most difficult situations, register for the online course "".

Calculation of vacation pay for part-time work

Part-time employees are also entitled to 28 days off. This is confirmed by Art. 93 of the Labor Code of the Russian Federation, which prohibits the introduction of any restrictions for citizens who work in a mode other than the standard one.

Vacation pay for part-time work is calculated in the generally established manner (that is, for the last 12 calendar months by dividing the amount of accrued wages by the number of months of the billing period and by 29.3).

Example

Since August 15, 2017, the employee has been granted a regular vacation of 28 calendar days. Salary -18 000 rubles. From July 1, 2017, a four-day working week was established for him with a payment of 14,400 rubles per month.

Let's define the billing period: August 2016 - July 2017

The amount of vacation pay will be: (18,000 x 11 + 14,400) / 12 / 29.3 x 28 = 16,914.68 rubles

Calculation of vacation pay for salary increases

An increase in salaries (tariff rates) is taken into account when calculating average earnings (in particular, when calculating vacation pay) only if it was carried out in relation to all employees of the organization (clause 16 of Regulation No. 922).

Please note: if indexation did not affect at least one employee, then when calculating the average earnings of absolutely all employees, such a salary increase is not taken into account.

An increase in wages affects the calculation of the amount of vacation pay if the increase has occurred:

- In the billing period;

- After the billing period, but before the start of the vacation;

- During vacation.

In such cases, a special boost factor must be used. The formula for calculating the coefficient of increase in tariff rates (indexation coefficient):

Rate increase factor (indexation factor) = New salary (tariff rate) / Salary (tariff rate) before increase

Example

1. Wages increased in the billing period

The employee goes on vacation from October 20, 2017 for 28 calendar days. Salary - 20,000 rubles. Billing period: October 2016 - September 2017. From September 01, 2017, the salary of an employee has been increased by 3,000 rubles and amounted to 23,000 rubles

Boost ratio: 23,000 / 20,000 = 1.15

Vacation pay: (20,000 x 1.15 x 11 + 23,000) / 12 / 29.3 x 28 = 21,979.52 rubles.

2. Wages increased after the billing period, but before the start of the vacation. In this case, you need to adjust the average daily earnings.

The employee goes on vacation from October 20, 2017 for 28 calendar days. Salary - 20,000 rubles. Billing period: October 2016 - September 2017. Since October 01, 2017, the salary has been increased by a factor of 1.2.

The amount of vacation pay without recalculation: (20,000 x 12) / 12 / 29.3 x 28 = 19,112.63 rubles

Vacation pay: 19,112.63 x 1.2 = 22,935.16 rubles

3. Wages increased during the holiday period. In this case, it is necessary to adjust that part of the vacation pay that falls on the vacation period from the date of the salary increase ( tariff rate) until the end of the holiday.

The employee goes on vacation from October 10, 2017 for a duration of 14 calendar days. Salary - 20,000 rubles. Billing period: October 2016 - September 2017. Since October 16, 2017, the salary has been increased by a factor of 1.2.

For simplicity of the example, let's assume that the billing period has been worked out completely.

Average daily income: (20,000 x 12) / 12 / 29.3 = 682.59 rubles

We calculate vacation pay for 6 calendar days of vacation before the salary increase (from October 10 to October 15, 2017) based on the actual average earnings, that is, without taking into account the salary increase:

682.59 x 6 = 4,095.54 rubles

Vacation pay for the remaining 8 calendar days of vacation (from October 16 to October 23, 2017) is accrued based on the actual average earnings, adjusted for a salary increase factor of 1.2:

Average daily income: (20,000 x 12 x 1.2) / 12 / 29.3 = 819.11 rubles

819.11 x 8 = 6,552.88 rubles

Vacation pay: 4,095.54 + 6,552.88 = 10,648.42 rubles

Calculation of vacation pay in the presence of bonuses in the billing period

Bonuses when calculating vacation pay and compensation for unused vacation are taken into account in the manner prescribed by paragraph 15 of the Regulations on the peculiarities of the procedure for calculating the average wage, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

That is, bonuses for determining the amount of vacation pay are taken into account as follows:

- Monthly bonuses- all bonuses actually accrued in the billing period are taken into account, but not more than one for each indicator for each month of the billing period.

- Quarterly (semi-annual) bonuses- all actually accrued in the billing period for each indicator are taken into account. If the duration of the period for which they are accrued exceeds the duration of the billing period, then the premiums are taken into account in the amount of the monthly part for each month of the billing period.

- Annual bonuses- are taken into account regardless of the time of accrual of remuneration.

Bonuses for anniversaries and holidays are taken into account when calculating vacation pay if they are provided for by the wage system and accrued in the billing period (Letter of the Ministry of Labor of the Russian Federation dated 03.08.2016 No. 14-1 / OOG-7105).

When accruing bonuses based on the results of work for the year, if the year has been worked out in full, the amount of the accrued bonus is taken into account when calculating the average wage, in full. If the year is not fully worked out, then the bonus is taken into account in proportion to the time worked in the billing period (Letter of the Ministry of Health and Social Development of the Russian Federation dated 05.03.2008 No. 535-17).

Bonuses taken into account in the calculation = Bonuses accrued to the employee in the billing period / Number of working days in the billing period x Number of days actually worked in the billing period

Example

The employee was granted another paid leave from January 09, 2017 for 28 calendar days. The billing period is from 01/01/2016 to 12/31/2016 (247 business days). In August 2016, the employee did not work, as he was on annual paid leave lasting 28 calendar days: from August 01, 2016 to August 28, 2016 (20 working days).

During the billing period, the following bonuses were accrued to the employee:

- monthly bonuses, excluding actual hours worked: 5,000 rubles

- quarterly bonuses, excluding hours actually worked: 10,000 rubles for the 1st quarter of 2016 accrued in April 2016; RUB 10,000 for the 3rd quarter of 2016 was accrued in October 2016.

- annual bonus for 2016, excluding actual hours worked: 25,000 rubles accrued in February 2017

The amount of bonuses taken into account when calculating the average daily earnings for vacation pay is:

(5,000 x 12 + 10,000 x 2 + 25,000) / 247 x 227 = 96,497.98 rubles.

Calculation of vacation pay after parental leave

If an employee goes on annual paid leave immediately after parental leave, then in accordance with clause 6 of the Regulations on the peculiarities of the procedure for calculating the average wage, if in the billing period there were no incomes included in the calculation of average earnings for paying holidays, then the specified period must be replaced for 12 months preceding the month in which the employee went on maternity leave (Letter of the Ministry of Labor of the Russian Federation of November 25, 2015 No. 14-1 / B-972).

The period of being on leave to care for a child is not counted in the length of service giving the right to annual paid leave, and maternity leave is counted in the length of service.

Vacation pay in this situation will be calculated based on earnings for the 12 months preceding the maternity leave.

Example

The worker was:

- on maternity leave from April 2014 to August 2014,

- on leave to care for a child up to three years, from August 2014 to June 2017.

After the end of parental leave, the employee took a leave of absence for 28 calendar days.

Since in the billing period the employee did not have income included in the calculation of average earnings for calculating vacation pay, the period of 12 months preceding maternity leave, from April 2013 to March 31, 2014, must be taken to calculate vacation pay.

Salary of an employee - 20,000 rubles

Vacation pay: 20,000 x 12 / 29.3 / 12 x 28 = 19,112.63 rubles.

Calculation of vacation pay with summarized accounting of working hours

With the summarized accounting of working time, vacation pay and compensation payments for unused vacation must be calculated based on the average hourly earnings according to the formula:

Average hourly earnings \u003d Wages actually accrued for the billing period / Number of hours actually worked for the billing period

Average earnings for the period:

Average Earnings = Average Hourly Earnings x Number of Scheduled Hours Worked by the Employee in the Payable Period

Example

The organization maintains a summarized record of working time at a 40-hour working week. Accounting period- 1 month. On January 16 and 17, 2017, the employee was in business trip. These days must be paid to him at the rate of his average earnings. Monthly salary: 50,000 rubles. Billing period: January 2016 - December 2016.

The number of working hours in the billing period is 1974 hours.

Earnings for the year: 50,000 × 12 = 600,000 rubles

Average hourly earnings: 600,000 / 1974 = 303.95 rubles / hour

The number of working hours in the period for which the average salary is paid:

40 hours / 5 days × 2 days = 16 hours

For 2 days during which the employee was on a business trip, he must be paid:

303.95 × 16 = 4,863.20 rubles.

Calculation of vacation pay for seasonal work and short-term employment contracts

Employees who have concluded an employment contract for a period of up to two months (Article 291 of the Labor Code of the Russian Federation) and are employed seasonal work(Article 295 of the Labor Code of the Russian Federation), vacation is paid at the rate of two working days per month of work. Article 139 of the Labor Code establishes that for such categories of workers, the average daily wage is determined by dividing the amount of accrued wages by the number of working days according to the calendar of the six-day working week.

Average daily earnings = Earnings included in the calculation / Number of working days according to the calendar of the six-day working week

Example

A fixed-term employment contract was concluded with the employee for two months - from March 1 to April 30, 2017. The employee has the right to leave in the amount of four days (2 months x 2 days). The amount taken into account for vacations is 100,000 rubles.

The number of working days according to the calendar of the six-day working week in the billing period was:

- March - 26 days;

- April - 25 days;

The total number of working days is: 26 + 25 = 51 working days

Average daily earnings: 100,000/51 = 1,960.78 rubles

Vacation pay: 1,960.78 x 4 = 7,843.12 rubles.

60 431 views

To display the form, you must enable JavaScript in your browser and refresh the page.

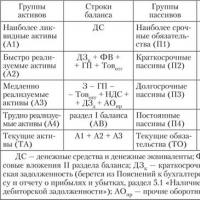

The essence and significance of the liquidity and solvency of the enterprise

The essence and significance of the liquidity and solvency of the enterprise Thesis work Improving the sales management system at Fap LLC The sales department does not have a sales process scenario

Thesis work Improving the sales management system at Fap LLC The sales department does not have a sales process scenario Object and subject of personnel management

Object and subject of personnel management How glass is blown

How glass is blown How to plan enterprise sales: methods and analysis

How to plan enterprise sales: methods and analysis How does a veterinary clinic work - home veterinary care How to open your own veterinary clinic

How does a veterinary clinic work - home veterinary care How to open your own veterinary clinic Selling candy as a business

Selling candy as a business