Marketing research of the baby food market. Modern problems of science and education

Market baby food increases positively. Even despite the general slowdown in consumption and the crisis of 2015 and early 2016, sales of baby food are increasing. Growth is driven by supply and demand drivers. This category Food Industry considered essential products, therefore baby food is absolutely well marketed through all retail and wholesale channels.

The baby food market is divided by type of product and by the age of the child.

The production of baby food is divided into several segments:

- Puree.

- · Kashi.

- Dairy and dairy products.

- Milk mixtures.

- · Children's juices.

- · Tea.

- water, etc.

Popular segments are purees (27.1%) and mixtures 20%, children's fermented milk products and fruit juices are in third place in popularity with shares of 17.2% and 16.2%. In fact, formulas and fermented milk products for children are specialized clinical nutrition, which is most in demand on the market.

Breast milk substitutes are the largest segment in monetary terms. But only because of the high price. As you can see, in physical terms, this is not the largest segment. But this segment is also the leader in terms of growth rates + 9.4% in 2015 in physical terms.

The segment of children's water is growing very actively - 11.3% in physical terms and 18.2% in money terms. And it has relatively less competition than in other baby food segments.

The growth of the market, as before, is provided to a greater extent (72%) due to imported products. The growth of Russian consumption in 2015 amounted to about 10-12%.

“...Given that the embargo in 2014 still did not affect baby food from Europe, then, undoubtedly, the leaders remained in the same composition:

In the first place is Switzerland (up to 40% of all imports).

On the second - the Netherlands (up to 25%).

On the third - Germany (up to 10%).

In 2014, the top three export countries of Russian baby food were: Kazakhstan - 50%, Ukraine - about 25%. Kyrgyzstan -15%”.

The competitive situation in the baby food market can be called quite tense. Several are leading domestic companies and importers. The market is consolidating, gradually trying on the Western model, when there are only a few large players on a national scale in the industry.

41 enterprises from 26 regions of Russia operate on the market. (Table 3.1).

Tab. 3.1. Enterprises focused on the production of baby food

|

Manufacturer |

Range |

|

|

JSC "Baby nutrition" Istra - Nutricia "(Moscow region) The Netherlands, Holland |

Frutapura Nutricia, Nutrilon, Toddler Baby, Ton-Ton |

Adapted milk formulas for baby food on a milk and soy basis of the following brands: Bebilak, Bebilak 2, Bebilak Soya, Baby with an improved recipe, Baby from 6 months old, Baby, Baby Istrinsky (instant). Enriched milk and dairy-free cereals "Nutritsia-Kid" (instant). |

|

CJSC "Company" Nutritek "(Moscow region) |

"Nutrilak", "Winnie", "Baby" |

Mixtures - breast milk substitutes, baby water, mashed potatoes, cereals. |

|

Nestle Russia LLC (Moscow region) Poland, USA, Switzerland, Netherlands |

Nestle, Nestogen, Gerber, Nan |

Dairy-free cereals, milk cereals, mixtures, mixtures with prebiotics, fruit and vegetable purees, meat purees and vegetables with meat. |

|

Russia - Kaliningrad, Germany, Austria |

Porridge, mixes, tea, puree |

|

|

Germany |

Basic and medicinal milk mixtures, herbal teas for babies and mothers, milk and dairy-free cereals, vegetable, fruit and meat purees, children's drinking water |

|

|

FrieslandCampina Netherlands |

Dairy mixes, milk. |

- The 4 largest brands are market drivers:

- Danone - dairy and sour-milk products,

- Nestle - mixtures, cereals,

- PepsiCo - juices,

- · Progress.

They produce 70% of baby food products.

Importers have occupied the niche of mother's milk substitutes by 90%, since there are practically no domestic producers in Russia. The root cause for this is that Russian raw materials for these products are not enough, and customs duties on imported raw materials higher fees on finished products.

New baby food production organizations for 2014 amounted to:

“...September 2014 - Danone bought and reconstructed a dairy plant in Yekaterinburg. Lines for the production of baby food were supplied. Investment level - more than 800 million rubles.

OJSC "Modest" in the Altai Territory. Serves the demand of the Altai Territory, Novosibirsk and Kemerovo regions. In 2014, the enterprise increased production capacity by 22.2%. Modernization of the lines cost more than 25 million rubles.

Nestle, city of Vologda. Launch of new lines - 20 types of baby cereals. Investments 2.5 billion rubles.

Enterprise "Leader-A", the city of Gudermes in Chechnya. In 2015, it was planned to open a shop for the production of baby food. The planned production capacity is 15,000 jars per hour.”

New businesses are opening up and global brands also invested in Russia in 2015 despite political problems in the country. There is a course towards full import substitution in the country, and for imported products, Russian production will slightly reduce the cost of their products. After all, the price influence makes readers reconsider their tastes and choose products that are by no means market leaders.

This is clearly seen, as at the beginning of 2015, the Internet showed the TOP-5 consumer preferences in the ratings:

- 1. Humana.

- 2. Darkness.

- 3. Friso.

- 4. Heinz.

- 5. Babushkino Lukoshko.

- 6. Nanny (Bibikol).

The products of Russian manufacturers are one and a half to two times cheaper than those of importers, so now the reader is increasingly trusting domestic manufacturers that meet the price-quality criteria.

In the baby food market, the segment of products with an average price has an advantage.

In 2015, sales of middle segment brands in the baby food market amounted to about 50%. The entire middle segment mostly consists of Russian products.

An analysis of the average wholesale prices for baby food products for 2015, in general, showed an increase in prices by 6 - 10%. According to the employees of the Union of Consumers of the Russian Federation, we must be prepared that food prices will still grow by at least 1.5-2 times.

The baby food market in Russia, even in times of crisis, is growing dynamically. The main directions of development are import substitution. New production facilities for baby food are being opened, lines at existing enterprises are being modernized and expanded.

The growth of the market will also be driven by an increase in demand due to the rise in the birth rate and the increase in the number of children under 4 years of age. In addition, the employment of women and men has recently been growing, and, consequently, the material well-being of parents is improving. And this trend is changing the attitude of readers to baby food. mass production. Today, it is easier for a young family to buy ready-made food for a baby and save time on its own preparation.

The key problem in the Russian baby food market is still an acute raw material issue. According to Rosstat and the Federal Customs Service, in Russia, due to the depreciation of the ruble in 2015, prices for fish, fruits and vegetables supplied from abroad increased by 24%. Inflation affected not only imported food products, but also domestic products that are made from imported raw materials.

If, nevertheless, the embargo in 2016 affects the receipt of baby food from Europe, then the growth of domestic production indicators will have to increase. Firstly, foreign suppliers will acquire a Russian location and build factories in Russia in order not to lose market share. Secondly, small local enterprises will be able to provide narrow market niches.

As of the beginning of 2015, fruit purees, cereals, juices, dairy and fermented milk products were well-developed segments. There is room for development in the segments: dry mixes, vegetable puree and baby water.

The dry mix business is market niche with high entry barriers, not for small businesses - expensive equipment, and large competitors in the market who have built their factories in the Russian Federation, etc.

In the niche of children's waters, there are a large number of substitutes - manufacturers of ordinary drinking water.

Marketing research of the baby food market in Russia from SuccessBrandManagement. From the material you will learn the key parameters of the industry: market capacity, main players, forecasts, as well as how interesting this segment is for small businesses and whether it makes sense to engage in the production of baby food in the current market conditions.

The baby food market is growing positively. Even despite the general slowdown in consumption and the crisis of 2014, sales of baby food are increasing. Growth is driven by supply and demand drivers. This category of the food industry is an essential product, so baby food is best supplied with sales through all retail and wholesale channels.

Briefly about the market

The baby food market is segmented by product type and consumer age.

The production of baby food is divided into several segments:

- Dairy and dairy products

- Milk formulas

- Baby juices

- And etc.

Diagram 1. Production of baby food by segments, as of 2014, % of production, thousand tons. Source: According to Rosstat

In real terms, the leading segments are purees (27.1%) and mixtures of 20%, children's fermented milk products and fruit juices ranked third with shares of 17.2% and 16.2%. In fact, formulas and fermented milk products act as specialized clinical nutrition, which is most in demand on the market.

Breast milk substitutes are the largest segment in monetary terms, but only because of the high price. As you can see, in physical terms, this is not the largest segment. But this segment is also the leader in terms of growth rates + 9.4% in 2014 in real terms.

The segment of children's water is growing very actively - 11.3% in physical terms and 18.2% in money terms. And it has relatively less competition than in other baby food segments.

Juices and tea have the lowest growth rates (1.7% in real terms).

Market indicators

The growth of the market, as before, is provided to a greater extent (72%) due to imported products.

Diagram 2. Market volume, thousand rubles, 2011-14 Source: federal Service statistics and calculations SBMgroup.biz

The growth of Russian consumption in 2014 amounted to about 10-12%.

Import

Considering that the embargo in 2014 still did not affect baby food from Europe, then, undoubtedly, the leaders remained in the same composition:

- Switzerland (up to 40% of all imports)

- Netherlands (up to 25%)

- Germany (up to 10%)

They mainly import dry mixes and vegetable puree.

Export

In 2014, the top three export countries of Russian baby food were: Kazakhstan - 50%, Ukraine - about 25%. Kyrgyzstan -15%.

Competition

The competitive situation in the baby food market can be called quite tense. Several domestic companies and importers are leading here. The market is consolidating, gradually trying on the Western model, when there are only a few large players on a national scale in the industry.

41 enterprises from 26 regions of Russia operate on the market.

| Manufacturer | Range |

|

|---|---|---|

| JSC "Children's food" Istra- Nutricia» (Moscow region) Netherlands, Holland | Frutapura Nutricia, Nutrilon, Baby, Baby, Top Top | Adapted mixtures for baby food on dairy and soy base of the following grades: "Babylac", "Babylac 2", "Babilak soy", "Baby with an improved recipe", "Baby from 6 months", "Kid Instrinsky" (instant). Enriched milk and dairy-free porridge "Nutricia-Malyshka" (instant). |

| CJSC "Company" Nutritek " (Moscow region) | "Nutrilak", "Winnie", "Baby" | Mixtures - breast milk substitutes, baby water, purees, cereals, juices |

| Nestle Russia LLC (Moscow ob) Poland, USA Switzerland, Netherlands | Nestogen, Gerber | Dairy-free cereals Milk porridge Prebiotic Blends Single and multi-component purees Vegetable and fruit purees Puree with cottage cheese, yogurt, cream, Meat puree Vegetables with meat |

| Russia - Kaliningrad, Germany, Austria | ||

| Germany | Basic and therapeutic milk formulas Herbal teas for babies and mothers Dairy and non-dairy cereals Vegetable, fruit and meat purees Drinking baby water |

|

| FrieslandCampina Netherlands | Milk formulas |

|

| New Zealand | Nanny (Bibikol) | Milk formulas |

| CJSC "Heinz-Georgievsk" (Moscow region) | Milk formulas Puddings for pregnant and lactating mothers Dairy and non-dairy cereals Fruit, vegetable, dairy, yoghurt and meat purees cookies (6 cereals) Children's vermicelli |

|

| Faustovo Baby Food Plant LLC (Moscow region) | Grandma's basket | children food canned vegetables canned meat and vegetable |

| Unimimilk Company OJSC (Moscow region) | Bio Balance Prostokvashino Summer day | Biocurd Bioyogurt Juices and fruit drinks baby milk Meat puree Meat and vegetable puree vegetable puree Fruit and milk puree fruit puree |

| JSC "Gardens Pridonya" (Volgograd region) | "Golden Russia" "Gardens of the Don", "My", "Juicy World", "Diaper" | Juices, nectars, juice drinks Plant based puree cereal cocktails Baby purees Mineral water Dry instant cereals |

| OOO Ivanovo Baby Food Plant | Puree (fruit, fruit and vegetable, fruit with cottage cheese, with yogurt, with cream, vegetable, meat and vegetable, fish and vegetable) Porridges (dairy, dairy with fruits, low-allergenic cereals, cereals without milk) Juices (clarified, juices with pulp, nectars) |

|

| Experimental Baby Food Plant, Wimm-Bill-Dan Branch (Kursk region) | Sour-milk baby food vegetable puree Puree fruit and fruit and vegetable homogenized for the nutrition of young children Fruit juices reconstituted for nutrition of young children |

|

| bear cub | Dairy and sour-milk products |

The 4 largest brands are market drivers:

- Danone - dairy and sour-milk products,

- Nestle - mixtures, cereals,

- PepsiCo - juices,

- Progress.

They produce 70% of baby food products.

Importers have occupied the niche of mother's milk substitutes by 90%, since there are practically no domestic producers in Russia. The primary reason for this is that there is not enough Russian raw material for these products, and customs duties on imported raw materials are higher than those on finished products.

New baby food production organizations in 2014

- September 2014 - Danone bought and reconstructed a dairy plant in Yekaterinburg. Lines for the production of baby food were supplied. Investment level - more than 800 million rubles.

- OJSC "Modest" in the Altai Territory. Serves the demand of the Altai Territory, Novosibirsk and Kemerovo regions. In 2014, the enterprise increased its production capacity by 22.2%. Modernization of the lines cost more than 25 million rubles.

- Nestle, Vologda. Launch of new lines - 20 types of baby cereals. Investments 2.5 billion rubles.

- Enterprise "Leader-A", Gudermes in Chechnya. In 2015, it is planned to open a shop for the production of baby food. Planned production capacity - 15 thousand jars per hour.

New businesses are opening up, and global brands also invested in Russia in 2014, despite the political problems in the country. There is a course towards full import substitution in the country, and for imported products, Russian production will slightly reduce the cost of their goods. Still, price influence forces consumers to reconsider their tastes and choose products that are by no means market leaders.

This is clearly seen, as at the beginning of 2015, the Internet showed the TOP-5 consumer preferences in the ratings:

- Humana

- Friso

- Heinz

- Babushkino Lukoshko

- Nanny (Bibikol)

The products of Russian manufacturers are one and a half to two times cheaper than those of importers, therefore, now the buyer is increasingly trusting domestic manufacturers that meet the price / quality criteria.

Prices

In the baby food market, the segment of products with an average price has an advantage.

Diagram 4. Price segmentation of the baby food market in the Russian Federation, %, 2014

From July 2016 to June 2017, sales in the baby food market in Russia increased by 1.3% in physical terms, while a year earlier they decreased by 2.7%, according to. At the same time, sales growth rates in monetary terms slowed down: in July 2016-June 2017 - by 5.3%, a year earlier - by 9.7%. The reason for this was a noticeable slowdown in the growth of prices per unit of goods: from 11.5% to 2.3%.

The main contribution to recovery Russian market baby food was introduced by the category of dairy products for children, which occupies a share of 25.6% in kind and 23.9% in monetary terms - its sales increased by 11.1% and 10.9% in terms, respectively. A year earlier, the category's sales performance was -0.9% and +5.6%. The largest category in terms of sales in kind, ready-to-drink drinks (water, juices) accounted for 54.3%, and in monetary terms, the share of the category was 19%. From July 2016 to June 2017, sales of ready-made drinks for children decreased by 2.2% in physical terms and increased by 1.1% in monetary terms.

The largest category in terms of the share of sales in monetary terms is viscous baby food (mashed potatoes, ready meals) with a share of 24.5%, the share of the category in physical terms is 12.3%.

“Baby food is a category whose buyers are especially attentive to the composition, quality and brand. For our children, we want to buy safe and healthy products, created according to the latest standards and meeting all requirements. Therefore, new items in this category are quite successful. For example, such a relatively new segment for buyers as biolact: manufacturers claim that this fermented milk product is healthier than kefir or other products. As a result, according to Nielsen, sales of biolact grew by almost 70% in volume terms, while sales of traditional baby kefir are declining. by 11%. Thus, the issue of appropriate positioning and a strategic approach to the development of new products can significantly improve the position of the manufacturer in the market”,- comments Marina Lapenkova, retail audit expert Nielsen Russia.

Private brands are not as widely represented on the baby food market: in the category of drinks for children, their share is 6.2% in physical terms, in the categories of dairy products and viscous food, less than 1% in each.

Among channels, supermarkets have the largest share in sales of baby food - 36% in kind and 33% in monetary terms. They are followed by discounters - 25% in physical terms and 20% in monetary terms, hypermarkets (19% and 17% respectively) and specialized children's stores (13% and 25% respectively). The most noticeable growth in sales of baby food is observed in stores for children: + 14.3% in kind and 16.9% in monetary terms. Also, sales are growing in supermarkets: +6.9 and +7.7% respectively. In other channels, there is a decrease in sales of baby food.

«RUSSIAN BABY FOOD MARKET. MARKETING RESEARCH AND MARKET ANALYSIS Moscow, January 2010 CONTENTS I. INTRODUCTION II. CHARACTERISTIC..."

DEMO VERSION

RUSSIAN BABY FOOD MARKET.

MARKETING RESEARCH

AND MARKET ANALYSIS

Moscow, January 2010

I. INTRODUCTION

II. CHARACTERISTICS OF THE RESEARCH

III. ANALYSIS OF THE RUSSIAN BABY FOOD MARKET

1. General characteristics of the Market

1.1. Description of the subject of research

1.2.Indicators of socio-economic development

1.3 Description of the industry

1.4. Section Summary

2. Structure of the baby food market

2.1. Market segmentation by main types of products

2.2. Price segmentation and pricing in the Market Pricing in the Market Price segmentation of the Market Dynamics of consumer prices in the Market

2.3. Summary of the section

3.Main quantitative characteristics of the Market

3.1. Volume and capacity of the Market

3.2.Market Growth Rates

3.3. Summary of the section

4. Competitive Market Analysis

4.1. Competition in the Market

4.2. Description of profiles major players Market Wimm Bill Dann Company

Companies "PROGRESS"

Unimilk company

Nestle Nutricia (Danone)

4.3. Section Summary

5. Sales channels in the Market

5.1. Description of the retail segment

5.2. Stores specializing in the sale of food products

5.3. Outlets selling goods for children

5.4. Pharmacy chains

5.5. Section Summary

6. Analysis end users Market

6.1. Description of the consumer segment

6.2. Market Consumption

6.3. Consumer preferences in the market

6.4. Section Summary

7.1. Main Market Trends

7.2. PEST Market Analysis

7.3. Market risks and barriers

IV. RESEARCH SUMMARY

The development of the researched Market is influenced by many markets. The Russian baby food market is integral part Russian food industry. The food industry plays a huge role in the economy of any country. At present, the Russian food industry unites 25 thousand enterprises, and its share in the total Russian production is more than 10%. In January-May 2009, compared to the same period in 2008, the following main markets showed an increase in production: the market for meat and semi-finished meat products, the market for whole-milk products, the market for cheese and the market for cereals. However, production fell in most markets. The largest decline in production was shown by the market of canned fish and preserves, the market of powdered milk and cream and the market of tea. Thus, the main trends in the food industry were the growth of inflation, as a result, the reduction in the consumption of many categories of food products, the freezing of prices for socially significant products, and the tightening of competition.The baby food market can be conditionally divided into 2 main segments: basic food (milk formulas, cereals) and so-called complementary foods (vegetables, fruits, canned meat, juices, etc.). The share of complementary foods is over 30%, and the share of basic food is less than 70% (in monetary terms). V last years there has been a trend towards an annual reduction in the share of milk formulas and an increase in the complementary foods segment. So, a few years ago, the share of complementary foods was less than 25%.

Among the main segments of the Market by types of products, the following can be distinguished:

Puree Blends Yoghurts, curds and similar dairy products Juices Cereals Milk Kefir Biscuits Tea Water Muesli And other baby foods Chart. Share of baby food types in value terms Source: GfK Rus Baby Panel research data Puree is the largest segment of baby food (in value terms).

They are present with a significant proportion throughout the first three years of a child's life, reaching a maximum in the second year of life. Juices, cereals are also segments that have their own importance for 36 months. Other significant segments are either very important in the first year of life (formula - 41% of all costs for baby food in the first year of life), but lose their importance as the child grows, or, conversely, become more significant by the second and third year of the child's life ( all dairy products) It is customary to distinguish three main price segments on the baby food market: low price segment (products of Wimm-Bill-Dann, Unimilk and other domestic manufacturers), middle price segment (Heinz, Nutricia, Nestle), high price segment segment (Semper, Hipp, Gerber). Before the emergence of crisis phenomena in the economy, this segment accounted for about …% of the Market, but at the moment its share has significantly decreased. Thus, one can note a trend towards an increase in demand for domestic products and a reduction in the share of high price segments.

Average consumer prices for baby food rose in 2008 and 2009. Average prices for 1 kg of powdered milk mixtures for 11 months of 2009 amounted to … rubles.

The average prices for canned vegetables in 2009 amounted to … rubles, for canned fruit and berries – … rubles. The increase in prices for each of the categories of products amounted to more than …%. Price growth rates for separate categories baby food will increase depending on the level of inflation and on the prices of raw materials for the production of a particular baby food product.

– – –

In 2008, the volume of the Russian baby food market in value terms amounted to $... billion, having increased by $... billion compared to the previous year. According to experts' forecasts, in 2009 the Market will grow not so significantly and its volume will be about $. .. billion

In 2008, the volume of the Market in volume terms amounted to … million tons and grew by only … million tons compared to the previous year. According to the forecasts of the same source, the volume of the Market will grow in 2009 to … million tons.

The main factors behind the significant growth of the Market in 2006-2008 were an increase in the birth rate, an increase in the income of Russians, as well as a change in their lifestyle and consumer culture. However, in 2009 the crisis contributed to a reduction in the consumption of baby food.

The geographical features of the Russian market are also observed: the most significant share of the volume retail sales belongs to large cities. Even in the Central region, more than a third of the total turnover comes from trade in Moscow.

The capacity of the Russian Baby Food Market is about … bln USD. According to Market Analytics, the Market's capacity in real terms is … million tons.

– – –

Over the past few years, the market as a whole has been demonstrating very high growth rates at a level not lower than …%. At the same time, some leading companies developed with a significant advance of the market – revenue growth rates amounted to about …-…%.

In general, the market for baby food among the group from 0 to 36 months has shown significant growth rates in recent years. For example, in the 1st quarter of 2008 it increased by 42% in physical terms compared to the 1st quarter of 2007. Among the factors of growth are both the growth of the birth rate and the growth target audience, respectively, and directly growth of consumption. In the 4th quarter of 2008 the market continued to show growth in relation to the 4th quarter of the previous year, but stagnated in relation to the 3rd quarter of 2008.

Market conditions are affected by the current macroeconomic conditions causing a decline in the birth rate, as well as a decrease in purchases by children's institutions due to a reduction in government subsidies in the field of health care. The slowdown in value growth is facilitated by the transition of consumers from premium brands to cheaper products. According to the Ministry of Health and Social Development, the number of newborns has been declining for the second month in a row. Demographers predict an even greater decline by autumn. The first signs of the crisis appeared in Russia at the end of the summer of 2008. The crisis affected the birth rate exactly 9 months later. In April, according to the ministry, the number of newborns decreased by 5.4% compared to March, from 151 thousand to 142.8 thousand. In May, the decline continued to 135.2 thousand.

Competition in the Market

At the moment, the production of baby food in Russia is at a fairly high level and fully withstands competition from Western enterprises.

Imported products in the Russian Federation are mainly represented by adapted dry mixes, vegetable and fruit purees, and the positions of Russian players are strongest in the segment of baby juices, meat purees, liquid and pasty dairy products - in a number of categories they have long occupied more than 90% of the market. In general, imported products occupy about …-…% of the Market in the Market. At the same time, its share has been declining in recent years due to the active development of local producers.

The market is very attractive due to high profitability. a maximum of ten manufacturers operate on European markets. In Russia there are more than twenty of them, although the volume is much smaller.

According to various estimates, according to the results of 2008, the share of the largest players: WBD, Progress (Lebedyansky), Unimilk, Nestle, Nutricia (Danone), accounts for about …% of the market in monetary terms and about …% in real terms . According to experts' forecasts, the trend towards consolidation will intensify.

Among the most prominent foreign participants in the Russian baby food market, researchers name the companies Nestle (Switzerland), Hipp (Austria), Nutricia (Holland), Kolinska (Slovenia), Heinz (Germany).

According to expert opinions, the baby food segment will remain one of the most dynamic in the food market even in the face of a decrease in effective demand.

Description of the profiles of the largest players in the Market Wimm Bill Dann Company

http://www.wbd.ru/ About the company Wimm-Bill-Dann is the market leader in dairy products and baby food in Russia and one of the leading players in the soft drinks market in Russia and the CIS countries. at the company's processing plants. The history of the company began in 1992, when Wimm-Bill-Dann launched juices in packages.

Activities

Production and sale:

dairy products;

Baby food;

Soft drinks.

Diagram. The structure of income from various activities of Wimm Bill Dann

74,2% 16,8% 9,0%

– – –

Source: research by TOP-EXPERT agency Assortment portfolio and brand portfolio in the baby food segment A wide range of baby food under the Agusha brand

Geography of activities Wimm-Bill-Dann has created a unified production network in the regions of Russia and the CIS countries, becoming a nationwide Russian manufacturer. Now the Wimm-Bill-Dann group of companies includes 37 manufacturing enterprises in Russia, Ukraine and Central Asia.

Performance Indicators WBD ranks first in terms of market share in real terms – …% (in 2008 WBD increased its market share by 4% in monetary terms and by …% in real terms).

In 2008 the company's sales in the baby food segment grew by more than …%, in the dairy products and drinks segment only by …% and …% respectively. Based on the results of the first quarter of 2009, the sales growth amounted to …%.

The company's share in the dairy products market is …%.

18,000 people work at the enterprises and trade branches of the company.

Advantages Large underutilized production capacity, which gives the potential for growth without additional capital investments;

Higher quality of manufactured products compared to competitors;

High degree of innovation;

Ability to develop new products and professional marketing;

Strong and diversified product brands;

Stable access to sources of raw materials;

Focus on new product development;

Modern production base and technologies;

Availability of opportunities to attract external financing.

Development Plans WBD's strategy is to produce products in the region where they are consumed.

The company's development program involves an increase in the number of regional enterprises.

Range of all largest manufacturers is quite wide and includes all possible products: complementary foods, dairy products, juices, purees, water, cereals and much more. Wimm-Bill-Dann sells the entire range of baby food products under the Agusha brand, PROGRESS sells the main range under the FrutoNyanya brand, also some types of the company's products are sold under the Malysham brand, and mineral water - under the brand "Lipetsk Buvet". "Unimilk"

sells baby food under the brand "Tma", Nestle - under the brands NESTLE, NAN, NESTOGEN. Nutricia sells the widest range of products under the eponymous brand, milk formulas under the Nutrilon and Malyutka brands, and cereals under the Malyutka brand.

Description of the retail segment

To date, the main channel for the sale of goods for children are traditional network enterprises. retail. According to market experts, they account for about …-…% of sales of goods for children. The remaining volumes are distributed through other channels.

Diagram. Where to buy baby food by frequency and cost per purchase

Source: GfK Baby Panel study data

It should be noted that specialized children's stores show the highest growth rates, and if this trend continues, this channel may soon become a leader. The channel's success consists of two components - a fairly high frequency of purchases in this channel (6.6 times per quarter, that is, 2 times a month), as well as the highest purchase costs in this channel, that is, the maximum purchase volume is in specialized children's stores. Other channels for the sale of baby food include dairy kitchens, kiosks at children's clinics, and others.

Outlets selling goods for children

The level of competition in the children's goods market has not yet reached its peak, but at the moment it is significant. Competition is present in every segment of children's goods, but it is more felt in the work of multidisciplinary multi-product stores. In the Russian regions, the level of competition is much lower than in Moscow and St. Petersburg. According to experts' forecasts, saturation of the children's goods market in Moscow may occur within the next 3-5 years. Market saturation in the regions of Russia in the next 5 years is not predicted by experts.

Trends in work, planning of further activities for specialized stores are characterized by the desire to further narrow their specialization, or to reach a new level of work that does not imply further development of the retail store network.

In the segment of large broad chain stores, there is an opposite trend of further development of the chain, both by attracting new consumers and by expanding product line provided by stores. There is a significant development of the regional policy of companies - the main players in the market.

The network segment, in turn, is also quite fragmented - today in Russia there are about ... chains of children's goods stores. However, there are a number of leading companies. Thus, the leader in the retail chain segment for the sale of goods for children is " Child's world”, which in 2008 occupied about …% of the children's goods market.

According to the market research conducted by its players, in Moscow network retail already occupies …%, the rest is accounted for by unorganized retail and open-air markets. In million-plus cities, the share of network retail is …%. In cities with a population of 100-200 thousand people - only ...%.

Description of the consumer segment

The consumers of the Market's products are children aged 0 to 3 years. According to the 2002 census, the number of children aged 0 to 4 was about 6.4 million.

Human. In 2007, this figure was 7.2 million people. Thus, an important factor influencing the development of the Market is the growth of the birth rate.

Market Consumption

The Russian baby food market is characterized by an extremely low level of consumption compared to some European countries and the USA. In Russia, this indicator is only ... kg per year per child and is significantly inferior to the indicators of Western European countries, where on average there is at least 22 kg of baby food per child.

Diagram. Level of consumption of baby food in some countries of the world, kg per child per year Source: Euromonitor International, 2008, FSGS, 2009 , consumption will grow significantly. In the long term, the Market growth rate will be at least …% per year.

– – –

In the first 3 years, baby food occupies a leading position in the structure of spending on goods for children (excluding durable goods) - 29.2%, as well as clothes and shoes - 27%. The third place in terms of expenses for children from 0 to 3 years is occupied by diapers - 21.8%.

Diagram. Structure of costs for goods for children under 3 years old Source: GfK Rus Baby Panel study data At the same time, in the first year of a child's life, diaper costs account for over 30% of all costs for a child, and 26% for food. This is due to the virtual absence of food costs in the first six months of a child's life while breastfeeding, while the same period is the period of the most active use of diapers. As the child grows, the cost of food increases, while spending on diapers steadily decreases.

Diagram. The frequency of purchases of baby food among buyers with children of different age categories of children, once a quarter Source: GfK Rus Baby Panel research data On average, 120 rubles are spent on one purchase in Russia (the maximum again falls on the second year of life). Of course, in Moscow they spend more on one purchase - 214 rubles and buy more often - 21 times per quarter (7 times per month), which makes the Moscow market very attractive for manufacturers. At the same time, in recent years, there has been an increase in the cost of baby food among Russian consumers.

– – –

Barriers to entry of a new player into the market may be the following factors:

Absence own funds On the background financial crisis there is difficulty in attracting borrowed funds, which may lead to the inability to enter the Market or invest a significant amount of resources in the development of the company, expansion of production, and so on.

Narrow assortment There is a high probability that entering the Market with a narrow assortment, a new player may not be able to withstand the competition of large players with a wide assortment.

Low degree of consumer loyalty

Consumer loyalty is made up of the following components:

o Level of knowledge o Distribution quality o New product quality trademark significant advertising support may be required to achieve the required level of knowledge. The cost of distribution is constantly rising, and the necessary scale of distribution is achieved over time. At the same time, you can make significant investments in distribution and promotion, but because of a poor-quality product, the buyer will not buy it a second time.

Risks for companies existing in the market may be:

A high level of competition that could adversely affect financial results or lead to a loss of market share or exit from the market.

Lack of funds (investments) to maintain its position and increase its market share, it is necessary to spend a lot on promotion and advertising, ensuring the necessary volume of production, as well as access to the regions and markets of other countries.

Rising prices for raw materials, which can lead to an increase in the company's costs.

– – –

Diagram 1. Dynamics of GDP for the period 2002-2008 in nominal prices, billion rubles

Diagram 2. Inflation rate for the period 2003-2008

Diagram 3. Dynamics of the average monthly nominal accrued wages, rub.

Diagram 4. Dynamics of real disposable cash income population in 2008, % to the corresponding periods of 2007-2008

Diagram 5. Dynamics of the number of unemployed for 2008-2009, million people

Diagram 6. Dynamics of retail trade turnover for the period 2006-2009, billion rubles.

Diagram 7. The share of types of baby food in value terms Diagram 8. Dynamics of prices for powdered milk formulas for baby food for the period 2005-2009, rubles per 1 kg ., rubles per 1 kg Diagram 10. Market volume in value terms for the period 2003-2008 and forecast for 2009, $ mln.

Diagram 11. Volume of the Market in physical terms for the period 2003-2008. and forecast for 2009, mln. tons

Chart 14. Places of baby food purchases by frequency and cost per purchase , % of the total population Diagram 18. The structure of the population by gender, % of the population Diagram 19. The structure of the population of Russia by territory Diagram 20. The level of consumption of baby food in some countries of the world, kg per child per year Diagram 21. Structure of costs for goods for children under 3 years Diagram 22. % of buyers of baby food among parents of children of different age categories Diagram 23. Frequency of purchases of baby food among buyers with children of different age categories of children, once a quarter Diagram 24. Costs per purchase of baby food nutrition among buyers with children of different ages categories Table 1. Output of the most important types of food industry products Table 2. Share of types of baby food in value terms Table 3. Comparative characteristics largest players (manufacturers) of the Russian baby food market Table 4. Places of purchases of baby food by frequency and cost per purchase retail companies(retail outlets specializing in the sale of food products) Table 6. Comparative characteristics of the largest operators in the retail market for the sale of children's goods commercial market medicines, I half of 2008

“The world is changing Change with us 2014 Annual Report Last year's report demonstrates how UniCredit's innovative products and ideas help our customers and businesses respond to the changing world. We have developed new comprehensive products and services that meet the modern needs of our customers and demonstrate...”

"INTERNATIONAL CENTER FOR INNOVATIVE RESEARCH "OMEGA SCIENCE" SCIENTIFIC ASPECTS OF MODERN RESEARCH Collection of articles of the International Scientific and Practical Conference May 28, 2015 Ufa RIO ICII "OMEGA SCIENCE" UDC 001.1 BBK 60 Managing editor: Sukiasyan Asatur Albertovich, candidate of economics..."

Candidate of Sociological Sciences, Senior Lecturer...»

“Lyubov Rybakova: Retailers are changing IT costs for IT investments Increasing competition, active expansion of networks and the struggle for a client stimulate demand for IT among Russian trading companies. Some of them perceive investments in Information Technology as an investment...

«Energy Sector Reform in Eastern Europe Working Papers WP-EE-11a Economic aspects of the development of nuclear energy in Belarus Ina Rumiantseva and Christian von Hirschhausen Reprint from Energy Conference of the German Economic Team (GET) in Minsk, Belarus, November 2005 DREWAG-Chair for Energy Economics Dresden University of Technol...»

“Agriculture Alexander Barannikov Fish farm SIA „Strum” RESEARCH and TECHNOLOGY – STEP into the FUTURE 2009, Vol. 4, No 5 1. EXECUTIVE SUMMARY The business plan introduces Sturm to potential investors...”

In Russia, the age of children who are fed special baby food has greatly increased. Previously, special cereals and canned baby food were included mainly in the diet of children under the age of 1 year. At the present time, industrial baby food is increasingly used in feeding children up to 3 years of age and older.

This trend is driven by a number of factors. First of all, the growing need of the population for a high-quality and healthy product against the backdrop of a deteriorating environmental situation. An important role is also played by the healthy lifestyle promoted by experts and advertising.

The survey data showed that the consumer, when choosing baby food, increasingly prefers the reputation of a baby food manufacturer. The modern consumer pays attention to the name, position in the market, the marketing policy of the manufacturer. The role of brands is growing. A high understanding is given to the safety and quality of baby food, as well as the taste preferences of the child.

Consumer research allows you to identify and explore the whole range of factors that guide consumers when choosing goods (gender and age characteristics, social status, income, education). Individual consumers act as objects. The subject of the study is the motivation of consumer behavior in the market and the factors that determine it; the structure of consumption, provision with goods, trends in consumer demand are being studied. In this case, it becomes possible to develop ways to provide choice certain product consumers.

10 pharmacies located in different parts of the city were analyzed.

Of the 150 people surveyed in the city of Moscow (pharmacy visitors), 93.2% were women and only 6.8% were men.

When segmenting by age of the respondents, 4 groups were identified: up to 25 years old, 25-40 years old, 40-55 years old, over 55 years old. It turned out that the bulk of consumers aged 25 to 40 years was 61.3% and 30.7% of respondents under the age of 25 years. Respondents aged 40 to 55 years - 7.3%, and over 55 years old - 0.7%. This implies that almost all buyers are young parents.

We also segmented the average income per 1 family member. It turned out that 47.3% of the respondents have an income of 5 to 10 thousand rubles. per 1 family member, 50% of respondents have income per 1 family member from 10 to 15 thousand rubles. And only 2% of respondents have an income of up to 5 thousand rubles and 0.7% - more than 15 thousand rubles. This analysis contributes to the formation of a range of baby food depending on family income. It was also found that only 2% of respondents buy baby food every day, 65.3% of respondents buy baby food once a week, the rest buy as needed.

The next stage of the study was to establish the dynamics of calls to the pharmacy over time. The peak of applications for baby food falls on the time from 14.00 to 17.00 when the pharmacy is open from 8.00 to 20.00 ( average two business weeks).

During the day, different types of food are in unequal demand. The frequency of shopping for various baby foods per hour is as follows:

- more than three times: cereals, milk mixtures;

- 2 - 3 times: vegetable, fruit, cottage cheese puree;

- · 1 - 2 times: fruit juices, puree;

- 1 time: meat puree, compotes, baby water.

In the process of work, the pharmacist maintains a constant dialogue with the pharmacy visitors. So, the most frequently asked questions to the pharmacist were highlighted:

- - how to use baby food;

- - what types of baby food are presented by different manufacturers;

- - side effects of baby food;

- - dependence of quality on the price of the product;

- - from what age can one or another baby food be used;

- - how to store baby food after opening at home.

In order to give qualified advice, a pharmacist needs to constantly improve, study the market for new products, take Active participation in training and extracurricular activities.

The baby food market is characterized by a fairly large variety and a significant number of producing countries. It was revealed that the majority of consumers prefer to buy baby food of a domestic manufacturer - 62.7%, and 37.3% of buyers - foreign. The analysis of food products of various types for children in 10 pharmacies in Moscow showed that the highest specific gravity accounts for the sale of milk formulas (36%) and vegetable purees (21%), the lowest indicator is baby water (4%). The research results are shown in Figure 1.

Figure 1 Shares of various types of baby food sold through the pharmacy network

We also studied consumer preferences as one of the factors influencing the formation of the assortment of pharmacies.

The following factors influence the choice of baby food products (Figure 2):

Figure 2 Analysis of factors influencing the formation of a pharmacy assortment

When choosing baby food, 79% of buyers are guided by the composition (in particular, the absence of preservatives and artificial additives), 82% - by hypoallergenicity, 76% of buyers are concerned about the enrichment of the product with vitamins, minerals and live cultures, 69% of consumers proceed from the taste preferences of the child. The biggest indicator is the quality of the product (93%).

Genetically modified ingredients (GMIs) are of particular concern to consumers. The first side effect of baby food containing GMI is food allergies. Enzymes in genetically modified soy have the ability to suppress enzymes in the digestive tract of a child. As a result, the food is not digested completely.

According to the results of the study, more than 70% of respondents consider transgenes to be harmful to health (however, less than 45% of respondents do not know what they are). At the same time, only 41% of respondents are aware that some products contain genetically modified additives.

Price research is aimed at determining such a level and price ratio that would make it possible to obtain the greatest profit at the lowest cost. Baby food is in a wide price range. Analysis of baby food for the study period was carried out according to the following criteria: baby food worth up to 100 rubles; from 100 to 250 rubles; from 250 to 500 rubles; from 500 to 1000 rubles; from 1000 rub. and higher. The ratio of the value of sales is shown in Figure 3.

Figure 3 The ratio of sales of baby food depending on the cost

During the study period, the largest share was in children's food products costing up to 100 rubles. In second place were baby food costing from 250 to 500 rubles, in third - baby food costing from 100 to 250 rubles. These data can also be used in the formation of the assortment of baby food.

The pharmaceutical market in Moscow has a sufficient range of food products for children, which allows you to meet the needs of any customer. The study of consumer motivations made it possible to determine the socio-demographic portrait of the consumer, to identify the main factors influencing the purchase of baby food, taking into account the safety of their use.

The success story of a famous tailoring magazine

The success story of a famous tailoring magazine Thesis plan abstract. How are abstracts written? What are abstracts and how not to make mistakes when writing them? Conference report

Thesis plan abstract. How are abstracts written? What are abstracts and how not to make mistakes when writing them? Conference report What is "gold" and "blue" watches in photography

What is "gold" and "blue" watches in photography How to make money with advertising on a car and what you need for this Examples of detailed, information-rich advertising

How to make money with advertising on a car and what you need for this Examples of detailed, information-rich advertising Quadratic and cubic functions

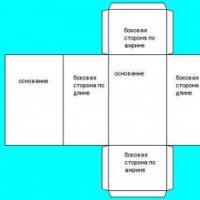

Quadratic and cubic functions How to make a paper prism

How to make a paper prism Everything you need to know about the prism for passing the exam in mathematics (2020)

Everything you need to know about the prism for passing the exam in mathematics (2020)