Rating of management companies in housing and communal services. Homeowners' association or management company - which is better? Management company and homeowners' association: pros and cons. What are the criteria for assessing the Criminal Code

Where heating, gas, water, light is carried out, of course, are very comfortable compared to your own home, where you have to think about all this. But at the same time, for the pleasure to be complete, the services provided must be monitored and properly managed. For this, apartment owners have the right to choose the most convenient form of government for them. In our article today we will try to find out: HOA or management company - which is better.

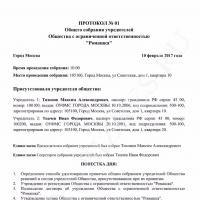

Management Company

This organization is a legal entity or individual entrepreneur managing the MKD. This business organization, which means its purpose is to make a profit.

The main document according to which the activity is carried out is the management agreement concluded with more than 50% of the home owners. The percentage is set by counting the area, not the number of owners.

The functions of the Criminal Code are to ensure the repair and maintenance of houses, in accordance with the requirements of technical regulations. In this case, the owners have the right:

- to receive information of interest to them within five working days after the request;

- information on the volume, list and quality of services provided;

- check the performance of work;

- demand the elimination of defects and monitor the completeness of the service provided;

- from the first quarter receive a report on the work performed from the managing organization.

On the other hand, the management company does not intend to reduce the cost of home maintenance. In addition, its financial activities are not always transparent to residents, although the latter are rarely interested in this. Moreover, this company employs many more employees than the HOA. Accordingly, on wages they will have more expenses. Therefore, the tenants have a legitimate question about which is more profitable - HOA or management company.

HOA

There can be only one HOA in one house. But one HOA can unite several houses. So, let's figure it out, HOA or management company: what's the difference?

Let's start with the fact that the HOA is non-profit organization, created in accordance with the norms of the Housing Code of the Russian Federation. At the meeting, the governing bodies are approved - these are the members of the board (who are elected for a period of not more than two years), and the general meeting. Financial plan for a year can only be approved at the general meeting. The report on its implementation is provided to the Auditing Commission. And the management of the HOA reports to the general meeting.

If the costs are allocated correctly, then funds will be collected when necessary. Financial activities Homeowners association is more transparent. After all, every resident can influence decisions on the improvement. Without intermediaries between the tenant and the contractor, deficiencies will be eliminated at a lower cost. On the other hand, some ad hoc jobs can be more expensive. Therefore, apartment owners will only benefit if the management of the HOA will consist of truly literate and caring people.

Management company or HOA: pros and cons

Supporters of the Criminal Code believe that the main advantage of their work is that they take into account the opinion of all owners living in the house. So, at least, the management companies themselves assert, although it is hard to believe in it. At the same time, experts unequivocally speak in favor of the Criminal Code in the sense that their services can be refused at any time if there are complaints about poor quality of service. But it will take more time.

On the other hand, it can be problematic for residents to obtain specific information about the organizations themselves, although the law prescribes such an obligation for the latter. Taking into account the fact that the Criminal Code is a commercial organization, that is, one whose main purpose is to make a profit, to give them full control it can be unprofitable.

So what to choose - HOA or management company?

Optimal form of government

Most experts agree that the best today is a mixed form of government. That is, this is not a HOA or a management company, but a homeowners' association and a management company. enters into a service agreement with the management company. Then all residents will know where the funds are going. Moreover, each of them has the right to ask the chairman for a report, and the latter must report. The HOA can also dispose of the property at its own discretion, as well as place billboards on the facades of the building.

We create an HOA

So, if you were faced with a choice: an HOA or a management company, and you decided to create an HOA, a number of the following steps must be taken to organize it.

An initiative group is being created from among the owners of residential premises of an apartment building. Any resident can act as an initiator. But for informational, organizational and campaigning activities to be crowned with success, you need to recruit such a number of people that will pull all the work.

Informing people about the essence of HOA

Next comes the legal and informational education of people by the initiative group. At this stage, you need to be able to easily answer the question of whether the HOA or the management company is better. And also to convince everyone of the benefits of the first option.

The answer is already contained in the organizational and legal form of the company: if the management company is a commercial organization, then the HOA is a non-commercial one. It turns out that the goals of the first are, first of all, making a profit, and the other is the solution of social, legal, managerial and similar problems.

In addition, the incoming funds are distributed to the Criminal Code according to established order... But in the HOA - by decision of the meeting of its members.

Homeowners' associations can also engage in entrepreneurial activity, but it is in the Criminal Code that it is the main type.

The received profit is distributed among the founders in the management company, and in the HOA it goes to the implementation of the statutory goals.

Working with people and recruiting

The next stage is preparatory work for the creation of the organization. For this:

- a register of owners is drawn up;

- the address of the HOA is determined;

- the Charter is being prepared;

- looking for candidates for the chairman, members of the board, auditing and counting commissions, chairman and secretary of the meeting;

- prepare ballots;

- notify about the holding of the meeting at least 10 days in advance;

- within the same period send this notification to the OMS.

Meeting on the creation of a homeowners association

- selection of the chairman and secretary of the meeting;

- counting commission;

- about the method of management;

- the Charter is approved;

- elect the chairman and other persons;

- a representative of the owners is appointed to register the HOA;

- choose the place where the information will be posted;

- choose a storage location for documents.

Other issues can also be resolved, depending on the needs of the house. However, if it was not possible to gather the tenants of the house at the general meeting, then an absentee vote is announced. For this, ballots are prepared, and each of the owners votes.

Finishing organizational work

- list of owners;

- the protocol of the counting commission;

- minutes of the general meeting.

Homeowners association is registered. To do this, a statement is submitted to the tax office with attachments to the charter, information about the voters, a receipt with paid state duty).

You should register with the statistics authorities, the Pension Fund, the FSS, the medical fund and make a seal.

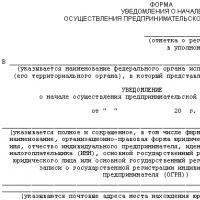

After that, you can start work, notifying interested parties about its beginning. For the organization you need:

- get technical documentation;

- draw up a register of property, examine it and draw up an appropriate act;

- study the rules for providing the population;

- study the rules for the provision of housing services;

- with the direct management of the HOA, it is necessary to conclude agreements with resource supply organizations, as well as to determine the organization with which the receipt of funds will be kept;

- and if management is carried out through the management company, then the HOA concludes an agreement with them.

And yet: HOA or management company - which is better?

What form of management to choose is up to the tenants. But lately, they are increasingly inclined towards a joint form of government. On the one hand, there are often cases when in a homeowners association with direct management, the opinion of the tenants is replaced by the opinion of one chairman.

On the other hand, it is not always the case that someone who is competent in technical matters is elected as chairman. But management companies employ specialists who often know better what is needed for a house at one time or another.

Conclusion

Having considered the question (HOA or management company - which is better?) And deciding in favor of this or that option, residents should understand that none of the forms of organization can be truly effective if residents themselves do not participate in the management process. When they remain indifferent, do not attend meetings and are not interested in current issues, the HOA organization often falls into decay, and the management company sometimes overstates the cost of its services.

Therefore, for the better functioning of the house, first of all, caring owners are important, who must understand that management comes from them, regardless of the chosen form, be it a HOA or a management company. It is then that the business in the house will flourish, and the tenants will be happy and happy to live in it.

From the moment of the privatization of the housing stock, all responsibility for the operation, improvement and repair of housing fell on the shoulders of the owners. Now not only the apartment, but also the house itself is taken care of by its tenants. The Housing Code of the Russian Federation provides for several forms of management of a residential building: direct management, the creation of an HOA and the conclusion of a service agreement with the Management Company.

Despite the fact that the opportunity to decide how to manage the house appeared for tenants for a long time, a typical situation remains when neighbors cannot agree and finally decide which way of managing is best for them. Often the reason for this is a lack of understanding of what is being offered. The acronyms sound intimidating; behind each of them, it seems, there is another fraudulent fundraising, it is not clear where disappearing. Initiative group sometimes it offers a reliable way of management, but there are those who, no matter what, want to leave everything as it is, although, as it really is, they also do not understand.

Let's try to understand the pros and cons of this or that form of management.

First of all, one should dwell on the varieties of forms of home management. What is behind the organization acronym? What functions of housing management does it carry out? For what can you ask her? It is the form of management that determines its functional responsibilities.

There are three most common ways to manage an apartment building

Direct control

With this form of management, each owner of the premises, on his own behalf, concludes agreements with resource supplying organizations - for water supply, electricity, gas supply, etc. In this case, the agreement is considered valid if it was concluded by 50% of the owners. There is no required percentage - the contract can not be fulfilled. That is why this management method is chosen by residents of houses where there are no more than 12 apartments. Residents must approach their responsibilities responsibly and in a cohesive manner. Most often, the elected chairperson of the house will pay for the service. And the general housekeeping interests in organizations are defended by the senior in the house. They are not legal entities and work by proxy. Direct management is considered the most economical because there are no intermediaries. At the same time, it is the most fertile ground for all kinds of offenses. The manager of the house can evade reporting or provide fake documents and sales receipts, in a word, use machinations for their own profit.

Direct home management is one of the cheapest, but the most risky. Suitable for houses with a small number of apartments.

There are also a number of disadvantages of such management. Housing maintenance can be carried out both by the owners and by contractors involved in the facility. But if there are more than 12 apartments in the house, the owners are obliged to hire a management company, with which they conclude a contract for services and work (this contract is regulated by the Civil Code of the Russian Federation, and not Article 162 of the Housing Code of the Russian Federation). There are no clear definitions in the legislation on the terms of the contract for the maintenance of common property. Managing organizations can draw up a contract, taking into account, first of all, their own interests, and not the residents of the house. If the agreement on the part of the owners is not thought out, then even the State Housing Inspectorate will not be able to help. In addition, with this method of management, there is no authority to check the activities of the Criminal Code, provided for by housing legislation, since it acts as a contractor that performs the work. The frequency and form of the report of the managing organizations are not indicated.

No less interesting is the question of the quality of utilities. Responsibility for the maintenance of the networks, for their serviceability lies with the contractor. Resource-supplying organizations supply water and heat to the house. But if suddenly there is no water on the upper floors or radiators are poorly heated in corner apartments, then there is no one to be held responsible for this, such moments are not spelled out in the legislation. Direct management makes it difficult to protect the rights of residents.

HOA - homeowners' association

This business community can be compared to a certain elder who stands up for every corner of his house, scrupulously monitors the condition of the home, takes measures to eliminate faults and improve the quality of housing. More recently, you can find another abbreviation - TNS. In accordance with the amendments to the Housing Code, from September 1, 2014, all HOAs are registered as TSN (Real Estate Association). Already existing partnerships are not required to undergo re-registration, therefore, HOA remains in general use. You just need to remember that HOA and TSN are one and the same. As in any structure, the HOA activities have their pros and cons.

Homeowners' association advantages

With HOA, homeowners are directly involved in managing the house and solving major issues. This is a definite plus. The owners of apartments in the house know better what problems need to be solved in the first place, where, having united, to direct forces, on what to spend funds. Payment for the maintenance of the house comes from the money collected from the tenants. Once a year, a general meeting of residents is held, where the annual budget is approved, the amount of payments and contributions is set, decisions are made on the lease of non-residential areas of property. Further, during the year, the chairman and the elected board solve the tasks assigned to them. The Housing Code assigns a wide range of issues to the powers of the members of the HOA meeting (Housing Code (Chapter 13), § 1 Chapter 4 of the Civil Code of the Russian Federation).

The HOA has the right to choose the operating organization, control its work, and assess the quality of the services provided. In case of deficiencies, demand their elimination. In case of unsatisfactory cooperation with this or that organization, change it.

Another undoubted advantage is the right to dispose of places and common areas. At the discretion of the HOA, on the territory adjacent to the house, they can place children's playgrounds, sports, and also organize guest parking... Attics and basements are also operated by a joint decision. It is profitable to lease them, and with the funds received, as a rule, they spend renovation work in the house, thereby reducing tenant fees.

Municipalities can become another source of income. If there are non-privatized premises in the house, then the municipal structure is obliged to deal with their maintenance on the rights of owners. If they are not properly maintained, the HOA can enforce payments.

Art. 153 of the RF Housing Committee allows, on the initiative of the HOA, to build additional premises to the common property with the aim of their subsequent leasing and receiving additional income, thereby reducing the amount of contributions.

Another advantage of the HOA is the ability to refuse the services of the Home Maintenance Directorate. The owners of the apartments through the HOA themselves decide who to hire, that is, they solve the problems on their own. Conclude contracts with service personnel, with necessary organizations on favorable terms for yourself.

Negative sides of HOA

Of the minuses of the HOA's activities, several points can be distinguished. Most common reason negative attitudes towards homeowners' associations are high utility bills. In general, they are not at all higher than the city average. Simply, apart from utilities, the HOA is obliged to pay for the work of an accountant, lawyer, governing bodies, etc. All these points are taken into account when collecting mandatory membership fees.

The second point concerns the creation of the HOA itself. The Housing Code of the Russian Federation states that the number of members of an association of homeowners must exceed 50% of the total number of votes of owners of the premises of an apartment building. This means that the opinion of the majority of residents is taken into account. If there is a minority that is against, their point of view is not taken into account. They will have to come to terms with this situation.

Well, and one of the most important negative aspects of homeowners associations in the assessment of specialists remains the complexity of the form of government. Despite all of the above advantages, for beginners this form of management is overwhelming work. Many pitfalls at the initial stage of governance lead to great risks and mistakes. Homeowners' association is a team of educated, trained and close-knit individuals. They should be able to calmly, without emotion, agree on various issues: determining the amount of payments, charges, all kinds of mandatory minimum services and works, concluding contracts. We must be ready to make payments for those residents who are delaying them. As experts advise, there is no need to rush with this form of management. At the initial stage, it is worth working in cooperation with the Management Company. Controlling their work, understand all the features of this form of management, then switch to independent management in the form of HOA.

The apartment building is managed either with the help of the Management Company or through the creation of an HOA. Often they practice a joint form of government, when the HOA enters into an agreement for the provision of services with the management company.

Photo: novostroykin.ru

Management Company

Another form of management is through the Management Company. Her responsibilities include paying for the maintenance and repair of housing, and making payments for utilities. With this method of control, everything is extremely clear. The owners enter into an agreement with the best, in their opinion, company. She, with the help of her staff, fulfills the obligations under the contract. "Under the wing" of the UK is good, but not cheap. The intermediary charges money for his services. Consequently, owners often want to know if their funds are being spent correctly. They have every right to do so. The Management Company, in turn, must keep records and provide residents with access to the necessary information. Often they cooperate with the management company through the HOA. Owners who do not have management experience hire professionals, that is, the management company, transfer the management of the house to it, while they themselves remain as a control body in the person of the HOA. Members of the HOA have the right to approve the charter, elect the chairman, the board of the HOA, and conclude an agreement with the Management Company.

From all of the above, the following can be summed up. Direct home management is one of the cheapest, but the most risky. Suitable for houses with a small number of apartments. Management with the help of the Company Manager is convenient, comfortable, but requires control from the owners, which means that all the same, residents must choose a responsible group, or completely trust U.K. When managing a house with the help of a HOA, you need a strong, competent, professional manager. This type of management is suitable for those who are well-versed in housing matters, have a responsible team and an active, reliable chairman. When it is difficult to elect such a group of "top management" from the tenants of the house, they practice a joint form of government - the HOA concludes an agreement for the provision of services with the management company.

According to experts, in order not to get stuck at the initial stage of house management, there are several positions that must be observed.

- The initiative group must draw up a management agreement (it is necessary to ensure that it does not expire on time).

- The HOA board is elected for 2 years (powers must not be expired).

- The chairman of the HOA is registered with the tax office. Really present in the house. Is not an employee of the Criminal Code.

- The register of HOA members contains more than 50% of the owners of premises. This means that the HOA is legitimate, legal.

- There is a protocol on the choice of this control method.

Subject to these points, the group of the actual management of the house can safely work according to the HOA scheme, or conclude an agreement with the Criminal Code, which, in fulfilling its tasks, reports to the HOA. Together they participate in risks and, in fact, make their work transparent. In any case, the order in the house depends on the activity of homeowners, and on a competent approach to house management.

The services of professional management companies are becoming more and more in demand among the owners of commercial real estate in our country. This is evidenced by statistics: in Moscow and St. Petersburg since the beginning of 2011, the management market capacity has increased by more than 15%, and the demand for management companies' services in the regions is also gradually growing.

It is also very common practice for developers to create internal

Management company services are becoming more and more in demand

management companies that intensify competition in the market. Mostly, such companies are created for the purpose of managing financial assets, since the majority of owners in Russia are not yet ready to entrust their capital to a third-party management company. In addition, it is assumed that the independent management of the facility will allow the companies-owners to save a lot of money on the services of the management company. However, in practice, according to experts, it often turns out that the owners do not represent the full scale of the work performed by the management company. This leads to numerous errors and financial losses. Therefore, in the end, many property owners still turn to professional management companies for help.

The leading management companies manage objects of all segments of commercial real estate

The recognized leaders in the field of commercial property management are the Russian offices of the leading foreign companies... Their reputation, authority, experience in managing a large number of objects and the professionalism of their employees inspire the greatest confidence in the owners. In addition, an attractive factor for the clients of such companies is their use of advanced Western management technologies in their work, which provide ease of control and transparency of reporting for owners. Another important plus - in most cases, these companies provide not only management services, but also consulting and agency assistance.

CBRichardEllis (CBRE- the company, which many call the world leader in commercial real estate, is represented at Russian market since 1994. Over the years, the volume of areas managed by the company has exceeded 800,000 square meters, and the value of assets under the management of CBRE has reached $ 2.9 billion. CB Richard Ellis, in addition to all types of management (Asset management, Facility management, Propetry management and Building management), provides a whole range of services in the field of commercial real estate: consulting, agency, appraisal, research and investment. CBRE's clients include such large companies as Aeroflot, Yukos, Sberbank, Rosneft, General Motors and many others.

A dynamically developing company operates in an alliance with CBRE on the St. Petersburg market MarisProperties (Maris| CBRE) , also providing a full range of services for working with commercial real estate, including technical, operational, legal and financial management.

Company NAIBecar- the Russian subdivision of one of the generally recognized world leaders - NAIGlobal... NAI Becar operates in all segments of commercial real estate, at the moment the company manages over 1.1 million sq. M. areas in 20 cities of Russia. Apart from consulting and investment services, as well as real estate appraisal, the main focus of NAI Becar is property and asset management. Moreover, the company provides a full range of management services - Property management (management of lease relations), Facility management (facility operation), complex real estate management (PM and FM together), Asset management (trust management of financial assets).

In addition to the range of consulting and brokerage services in the field of commercial real estate, the Russian division of a global company Cushman & wakefield deals with asset management (Asset management) and construction management (Building management) at any stage life cycle objects. One of the leaders in Building management in Russia is also a group of companies GVA Sawyer operating in our market since 1993.

One of the world's leading consulting companies Colliers International has a subsidiary structure in its division - Colliers International FM specializing in the management and maintenance of office, retail and warehouse real estate. The abbreviation "FM" means that the company is engaged in Facility management, i.e. provides a full range of services for the maintenance and operation of the facility.

Management Company "Fragra" provides Facility and Propetry management services, i.e. its scope of activity includes not only the engineering and technical operation of the facility, but also administrative and legal management, in particular, financial, legal document flow, optimization commercial efficiency object. "Fragra" has been known on the Russian market since 1994, during which time more than 500 large companies have become its clients.

Hsg zander is also one of the few companies on the Russian market that deals only with integrated management commercial real estate. In Russia - since 1997, during this time the company managed more than 2.5 million sq. M. commercial space. In particular, HSG Zander, which provides Facility and Propetry management services, manages such large facilities as the Mercury City Tower in Moscow City and the White Square premium business center in the capital.

The methodology for assigning and updating ratings of reliability and quality of services to management companies is an Agency document containing a systematic approach to the qualitative assessment of management companies using a number of indicators grouped into six blocks.

These groups, according to the Agency, cover the most important aspects activities of management companies, affecting the ability to manage investments, as well as the quality of services provided, regardless of short-term trends in financial and operational performance of management companies.

The Agency carries out regular monitoring (current supervision) of the rated persons.

- Company and staff. The factors analyzed in this section include: the duration of the company, the influence of the owners on the development of the company, the experience and stability of the composition of key personnel, the main development strategy and the organizational structure.

- Market positions. The factors analyzed in this section include: the scale of the company's business, market share, areas of activity, sales network, characteristics customer base, product line, competitive advantages.

- Investment process. The factors analyzed in this section include: the size and dynamics of assets under management, assessment of the quality and risks of infrastructure, investment strategy and portfolio of financial investments.

- Management and control methods. The factors analyzed in this section include an assessment of the risk management system and its independence, approaches to risk management, quality corporate governance, the level of information disclosure, procedures for making investment decisions, accountability and control over the implementation of the adopted strategy.

- Operational sustainability. The factors analyzed in this section include an assessment of funding sources, operating efficiency (historical indicators and trends), diversification of the revenue base, stability and diversification of the client base. The purpose of assessing the financial indicators of this block is to assess the resource base necessary to maintain the stability and quality of the investment process, and the degree of its compliance with business objectives, the scale and specifics of the company's activities, taking into account the proposed investment products.

- Service quality assessment. The factors analyzed in this section include: quality and loyalty of the customer base, quality of investment products, quality of customer service, control and management of reputation, professional achievements of the company.

Year of foundation: 2005

Headquarters: Moscow

Management: Oksana Kuchura (pictured) and Dmitry Klenov

Offices abroad: Cyprus, Luxembourg

Entry threshold:$ 10 million

UFG Wealth Management calls itself the first independent family office in Russia. It was founded by Oksana Kuchura in 2005 as an independent family wealth management unit within UFG Asset Management. A year later, partner Dmitry Klenov, who is in charge of legal practice, joined the company. Now under her management and consulting the assets of several dozen clients for $ 750 million Florian Fenner is co-owner of the company. The German manager Fenner became a partner of UFG in 2002 at the invitation of the founders of the brand - Charles Ryan and former Finance Minister Boris Fedorov, who died in 2008.

Year of foundation: 1991

Headquarters: Moscow

Management: Andrey Zvezdochkin

Offices abroad: Switzerland, Cyprus, Netherlands

Entry threshold:$ 0.5 million

Aton is one of the oldest Russian investment companies... In 2000, she launched an asset management business, which is now the main activity. In 2006, the founder and owner of the company, Evgeny Yuryev, sold the Aton institutional business to Unicredit bank for $ 424 million, and in 2010 he revived the company under the same name. The direction of work with large private capital has existed since 2009. Target clients - owners of assets up to $ 20 million - can get advice on the organization of funds, international taxation and inheritance. By 2015, the group's client assets exceeded $ 2 billion.

3. Oracle Capital Group / "Third Rome"

Year of foundation: 2002

Headquarters: Luxembourg

Management: Yuri Gantman

Offices abroad: Switzerland, Great Britain, Cyprus, Bahamas

Entry threshold:$ 1 million

The multi-family office serves clients from Russia and the CIS countries, including through offices in Moscow and Alma-Ata. The company does not disclose its founders, has Russian-Kazakh roots and a European board of directors, which includes seven Englishmen. Among them are the ex-minister in the government of Tony Blair, the former head of KPMG for the CIS and former director the alternative investment sector of the London Stock Exchange. In 2013, the company entered into a strategic alliance with Russian company"Third Rome", having bought a blocking stake from its founder Andrey Movchan and Alexander Smuzikov's fund. The Third Rome, created in 2009 by immigrants from Renaissance Investment Management, continues to operate under its own brand.

Year of foundation: 2003

Headquarters: Moscow

Management: Rustam Iseev

Offices abroad: Great Britain

Entry threshold:$ 1 million

The GHP Group has two key partners: Fleming Family & Partners co-founder Mark Garber and former JP Morgan Capital Markets CEO Ian Hannam. They have known each other since the 1990s, when they arranged the sale to the Fleming family of the Russian investment bank UCB, owned by Garber and Hans-Jörg Rudloff. In 2012 they bought Russian business FF&P with the Fleming family to work together in wealth management and private equity in emerging markets. GHP Group owns about 20% of the shares of the FESCO transport holding, controlled by the Summa group of Ziyaudin Magomedov.

Year of foundation: 2008

Headquarters: Moscow

Management: Andrey Gaek

Offices abroad: Cyprus

Entry threshold:$ 1 million

The group of companies was founded by top managers of the investment division of Nomos Bank together with the ICT group of billionaire Alexander Nesis. Later, his share was bought by Andrey Gayek, who became the controlling shareholder. He calls the group an investment boutique for private and institutional clients. He specializes in brokerage, bond strategies and private equity. It manages $ 1.2 billion of private clients' funds. The group's clients are conservative investors, business owners in Russia and abroad, according to the conclusion of the international rating agency Standard & Poor’s.

Year of foundation: 2009

Headquarters: Moscow

Management: Andrey Nikityuk

Offices abroad: Switzerland, UK, Italy

Entry threshold: not disclosed

The founder of the company, Vincenzo Trani, came to Russia in 2001 to develop small business lending at KMB-Bank, established at the initiative of the EBRD. He is still supporting small businesses through a small fund Mikro Capital. However, his main business is General Invest. The company provides wealth management, family office and broker services on international platforms. Trani is the Honorary Consul of the Republic of Belarus in his native Naples. According to Trani, he is well acquainted with Silvio Berlusconi, but leaves the circumstances of their acquaintance a secret.

Year of foundation: 2003

Headquarters: Zurich, Switzerland

Management: Sinan Bodmer

Offices abroad: Switzerland, UK, Cyprus, Singapore, New Zealand

Entry threshold: not disclosed

Marcuard Heritage, which manages $ 3 billion in wealthy client assets, is closely tied to Russia. Its two founders, Sinan Bodmer and Adrian Guldener, have worked with Russian clients at UBS. The third partner, ex-head of Credit Suisse First Boston, Hans-Jörg Rudloff, pioneered the investment banking business in Russia, where he co-founded UCB bank in the early 1990s. The Financial Times describes him as one of the few Western investment bankers trusted by President Vladimir Putin. As the chairman of Barclays Capital, the investment banker in 2006-2013 served as an independent director of Rosneft. Rudloff is a relative of the Marcuard family, whose ancestor founded the eponymous family banking house in Switzerland back in 1746.

Year of foundation: 2007

Headquarters: Moscow

Management: Alexey Golubovich

Offices abroad: Great Britain, Latvia

Entry threshold: not disclosed

Arbat Capital emerged from the small family office of Alexey Golubovich, former boss investment management Bank "Menatep" and the director of strategic planning and Yukos corporate finance. In 1997-2007 the company was called "Russian Investors" and since then has retained most of its partners and clients. In 2011, the company abandoned the brokerage business and asset management. Arbat Capital is currently developing investment strategies for high net worth individuals and hedge funds in the markets of Europe, America and developing countries. Consulting assets exceed $ 500 million.

Established: 1995

Headquarters: Moscow

Management: Dmitry Bugaenko, Alexey Gnedovsky

Offices abroad: Cyprus

Entry threshold:$ 0.1 million

Veles Capital is one of the oldest investment groups in Russia, controlled by Dmitry Bugaenko and Alexey Gnedovsky. The total amount of assets under management is RUB 21 billion. She specializes in brokerage, bills of exchange and private equity. The group has invested in the industry of Tatarstan and Ukraine, as well as in rental real estate, including shopping center"Atruim" in Moscow. The private capital management department has existed in the company since 2006. His key clients with assets ranging from $ 500,000 to $ 20 million, the company offers a mix of brokerage services, asset management and additional services from legal and tax advice, as well as trust and fiduciary services.

Year of foundation: 2009

Headquarters: Zurich, Switzerland

Management: Joseph Meyer

Offices abroad: Switzerland

Entry threshold: not disclosed

In the Swiss Axioma Wealth Management, only the Swiss founder Josef Meyer, whose activities are mainly related to Russia. In the mid-1990s, his company began by advising regional businesses on export finance At the same time, private clients began to trust him with asset management. In 2008 he started working for a Swiss subsidiary management company Elena Baturina's Alliance Continental. Later he bought this company together with his partner Igor Vasiliev from Alfa-Bank, who headed the direction of operations in the money markets there. On its basis, Axioma has grown, which manages up to $ 500 million in private capital and provides family office services to clients.

From a student of a FZU school to a director and a minister (Hero of Socialist Labor V

From a student of a FZU school to a director and a minister (Hero of Socialist Labor V Law on public organizations of the Russian Federation

Law on public organizations of the Russian Federation Votkinsk machine-building plant: history, products, address Votkinsk machine-building plant

Votkinsk machine-building plant: history, products, address Votkinsk machine-building plant Founder's decision to appoint a director of sample ltd

Founder's decision to appoint a director of sample ltd Sample notification of the start of business

Sample notification of the start of business What is a journal-order accounting system in accounting

What is a journal-order accounting system in accounting Journal-order: sample filling

Journal-order: sample filling