To Save and Preserve: What Happened to Ziyad Manasir's Construction Business. The Cyprus common fund of Timchenko and the Vorobyovs' clan "Stroytransgaz" will be divided into businesses

In August 2015, hundreds of former employees of Stroygazconsulting (SGK) from the Urals and Siberia received invitations to come to Novy Urengoy. In this northern city, Russia's unofficial gas capital, a construction company gathers its shift workers and distributes them to sites. The invitation was unexpected - for almost a year now, work under Gazprom's contracts had been suspended, construction equipment had been mothballed, and the shift workers themselves were doing household chores. The fact is that the former owner of SGK Ziyad Manasir deteriorated relations with the main customer, and Gazprom's construction projects had to be frozen. Under the new owners - Gazprombank and the UCP fund - Stroygazconsulting managed to renew old and get new projects. Therefore, an urgent mobilization of shift workers was announced.

According to Forbes calculations, at the end of 2015 the company received new contracts from Gazprom for 20 billion rubles - not bad compared to zero a year earlier, when the majority of the contracts went to Arkady Rotenberg's Stroygazmontazh and Gennady Timchenko's Stroytransgaz. In the next five years, the monopoly needs to build at least 6,000 km of gas pipelines, including the Power of Siberia and Nord Stream 2. And three large contractors are always better than two, said a source close to Gazprom.

Battle with the vultures

A few years ago, Stroygazconsulting was the largest construction company in Russia. She was building up power by leaps and bounds, the manager of one of Gazprom's subsidiaries told Forbes with admiration. SGK had about 60,000 employees and more than 16,000 units of construction equipment. Now the number of employees has decreased by almost three times. “We have many problems and difficult circumstances related to the history of the previous owners,” explains a source close to one of the new co-owners.

The key to the success of Stroygazconsulting's business is its relationship with Gazprom.

It is believed that they arose thanks to the former junior partners of Manasir: Pyotr Polyanichko is the son of a friend of one of the founders of Gazprom, Viktor Chernomyrdin, and Olga Grigorieva is the daughter of a friend of his youth, Vladimir Putin.

But the businessman himself had a different version of good relations with the gas monopoly. “After all, we started small and proved by deeds that we were ready for large projects,” he explained in an interview. One way or another, SGK from year to year received multibillion-dollar construction contracts from Gazprom. According to Forbes, from 2008 to 2012, their amount exceeded 800 billion rubles. And if in 2008 SGK's revenue amounted to 154.9 billion rubles, then in 2012 it grew 2.5 times.

But in 2013, everything changed. The flow of orders for construction from the concern fell sharply - to 35 billion rubles against 80 billion a year earlier. A significant part of Gazprom's orders now went to Arkady Rotenberg's Stroygazmontazh and Gennady Timchenko's Stroytransgaz. Why has the situation changed? Here is one of the explanations: in 2011, Alexander Ananenkov left the post of deputy chairman of the board of Gazprom, whose patronage was also associated with Manasir's successes. However, the businessman himself called this version in an interview with Forbes "nonsense."

Manasir tried unsuccessfully to turn the situation around. “Ziyad came from different directions and wanted to negotiate, but in response he heard“ no ”. Manasir simply could not believe it, ”recalls a source close to the company. Then the wounded founder of SGK took a risk - he complained about Gazprom to the presidential commission on the fuel and energy complex, which was headed by the head of Rosneft Igor Sechin. Manasir wrote that Gazprom is delaying payments under already concluded contracts, so the contractor had to continue construction at the expense of its own working capital and loans (the total cost is 150 billion rubles).

The owner of Stroygazconsulting tried to capitalize on the uneasy relationship between Sechin and Gazprom CEO Alexei Miller.

“It's a big chessboard, and Manasir made his move,” says a source close to the gas monopoly. The move turned out to be fatal - the complaint only exacerbated the situation. In 2014, SGK did not win a single tender from Gazprom, which immediately affected the company's financial position. At the end of 2013, SGK's revenue amounted to 259.7 billion rubles, and a year later it decreased to 140 billion rubles. At the same time, the company had a significant debt. According to SPARK-Interfax, at the end of 2014, long-term loans of SGK amounted to 57.7 billion rubles, and short-term loans and payables - 2 billion and 69 billion rubles, respectively.

Left without an influential customer, SGK became vulnerable - there were people who wanted to receive its assets for debts or without giving any reasons at all. And there was something to profit from: the company owned more than 300,000 sq. m of office space in Moscow City, railway carrier "Spetsenergotrans", construction equipment. “There were people who were going to take the company away from Manasir,” says the source of Forbes, but does not name their names. According to him, they believed that the owners of the shares were weak people (Manasir had about 58% of the SGK, top managers owned minority stakes - Forbes), they hoped to frighten some of them, and to come to an agreement with someone.

According to the interlocutor of Forbes, Manasir did not want to part with the company, but when he realized that this was inevitable, he began to look for an opportunity to receive compensation, and “certain paths” led him to Ruslan Baysarov, a friend of the leader of Chechnya, Ramzan Kadyrov.

In this matter, King Abdullah II of Jordan, with whom both Kadyrova and Manasir have special relations, could have been assisted by Manasir, a person close to the SGK suggests.

One way or another, in December 2013, the Tuva Energy Industrial Corporation (TEIC), owned by Baisarov, announced the purchase of 30% of SGK for an unimaginable $ 4.8 billion. In the summer of 2014, it became known that Baisarov plans to increase his stake in the company to 74%. The amount of the first deal seemed to be at least an order of magnitude overestimated, and the second deal was never closed. Nevertheless, Baysarov, who took over as chairman of the board of directors of SGK, frightened off those wishing to take away the business from Manasir. “In fact, Baysarov played the role of a“ roof ”and made it clear to everyone that it would not be possible to squeeze the company out so easily,” says a source close to Stroygazconsulting.

Under Baisarov, in January 2015, SGK made another attempt to negotiate with Gazprom. In a letter to Alexey Miller, SGK President Mikhail Yakibchuk wrote that the company was in a critical financial situation, due to lack of funding it was forced to stop work at Gazprom's construction sites and send employees on unpaid vacations. The company also asked to be included in Gazprom's investment program for 2015 and subsequent years. Miller did not respond to the letter.

In the spring of 2015, Baisarov and Manasir sold Stroygazconsulting to Gazprombank and Ilya Shcherbovich's UCP fund in equal shares. In April, the parties announced the purchase of 100% of the company. Gazprombank became a co-owner of SGK, counting on large contracts from Gazprom, a Forbes source explains. The purchase amount was not officially disclosed, the parties did not comment on the terms of the deal. Ruslan Baysarov said in an interview in winter 2016 that he considered the deal to be profitable: “Everything that I have invested has paid off.” Ziyad Manasir, having sold the company, moved to London, rarely visits Moscow and refuses to communicate with journalists, says a person close to the businessman's family. And with Baysarov he is now connected, it seems, not only by business relations.

In the spring of 2014, Manasir's eldest daughter, Helen, married Bulat Khunkayev, a young man whom one of Forbes sources called a distant relative of Baysarov, and another interlocutor named a person from the inner circle of this Chechen businessman.

Heading for Gazprom

What did Gazprombank and UCP get? A problem asset, a representative of one of the new owners of SGK is recognized. According to a representative of another co-owner, a queue of creditors and dissatisfied partners lined up for the new owners. Gazprombank, by the way, was also one of the major creditors of SGK. In 2015, Stroygazconsulting received 496 claims for 46.6 billion rubles, another 39 claims for 23.4 billion rubles were received by its subsidiary Gaztekhleasing. Baysarov and his managers came to the company to help Manasir in its protection, and they were not particularly involved in the business of Stroygazconsulting, says an interlocutor close to SGK. “Manasir went everywhere himself, at minus sixty he regularly ran to his construction sites, and Baisarov's managers did not even go to the sites,” says a representative of one of Stroygazconsulting's customers.

However, the interlocutor of Forbes, close to SGK, admits that Baysarov personally participated in one of the construction projects and even showed interest in him for some time. We are talking about the first section of the Central Ring Road (TsKAD) around Moscow, the tender for the construction of which SGK won in the spring of 2014 (the tender was held by Avtodor, the contract amount was 48.9 billion rubles). “This row was lobbied by Baysarov, - says the source of Forbes. - And he participated in the ceremony, and laid the capsule.

A year after the start of the project, the contract was transferred to Aras Agalarov's company Crocus International. SGK admitted that it could not fulfill its obligations under the long-term investment agreement, a representative of Avtodor explained to Forbes. According to an interlocutor close to the SGK, everything is much more complicated. “There was a whole tangle of problems,” the source recalls. “The company was not doing well, there were problems with obtaining a bank guarantee”. In addition, according to him, the new owners made it clear that the priority for the company should again be the construction of gas pipelines, and not road or other projects.

Now non-core (not related to gas construction) departments in SGK are being liquidated. The course towards Gazprom is also confirmed by the main personnel decision. In the summer of 2015, the company was headed by Stanislav Anikeev, a native of Gazprom. Already in the fall, the company again began to win tenders from Gazprom. And in February 2016, Anton Ray, the former co-owner of Argus Pipeline Service (now CJSC Stroytransgaz), came to SGK. Ray became the first deputy general director of SGK and oversees the production block. He has known Anikeev for a long time. In addition, ZAO Stroytransgaz, which belonged to him, was one of Gazprom's permanent contractors.

So far, the owners have been able to negotiate, but it is clear that "they are not from the same pod," said Forbes interlocutor, close to the company. A Forbes source familiar with the new owners of SGK says that UCP does not yet consider the investment in the former Manasir company successful. According to another interlocutor of Forbes, UCP may sell its stake in the foreseeable future.

Company: Northern Sea Route, Stroygazmontazh, Mostotrest, etc.

Customers: Gazprom, Avtodor, Rosavtodor, Administration of civil airfields, Rosmorport, etc.

The amount of state contracts: 286 billion rubles.

“If I had not been promoted as a friend of Putin, the business would have been worse,” Arkady Rotenberg said in an interview with Forbes. But things are going on as usual: for the second time he wins the rating of "kings of state orders". In 2007, he, the co-owner of the St. Petersburg bank "Northern Sea Route", created the companies "Stroygazmontazh" and "Trubny Metallorokat". A year later, the former bought five construction subsidiaries of Gazprom, won the largest contracts of the monopoly, and received some of them without a competition. Another company, SETP, controlled by Arkady and his brother Boris, became the main intermediary in the supply of pipes to Gazprom (according to the FAS, in 2010, the trader accounted for 90% of Gazprom's purchases of large-diameter pipes). The amount of state orders received by Rotenberg's firms during the four years of Dmitry Medvedev's presidency amounted to almost 900 billion rubles.

In 2012, Rotenberg was lucky again. In the summer, his companies received contracts for the reconstruction of Gazprom's gas pipelines for 17.5 billion rubles, and won a major contract for the Southern Corridor project worth 22 billion rubles.

Rotenberg's companies are building not only gas pipelines - the Mostotrest holding, in which Arkady Rotenberg and his son own about 26% of the shares, came out on top in terms of the volume of state contracts for the construction of roads and other infrastructure facilities. As a general contractor, Mostotrest is building a backup for Kurortny Prospekt in Sochi, the head section of the Moscow - St. Petersburg highway, and is participating in all megaprojects. The largest contract for 34.7 billion for the improvement of roads around Skolkovo was presented to Rotenberg's company in one of the last days in the role of the country's president, Dmitry Medvedev. Another contract for the section of the Moscow-St. Petersburg highway was won by Mostotrest in the Moscow government's competition in a fierce struggle with ARKS (co-owner Gennady Timchenko), having reduced the price from the initial 29 billion to 23 billion rubles.

In July 2012, Mostotrest announced that it intends to buy 60% of the small company National Chamber of Industry and Commerce (NITP). Valery Dorgan became the general director of the company; since 2010, he has held the position of Deputy Marketing Director of Mostotrest. The transaction amount was 510 million rubles. But in October, everything was revealed: in three days, NITP won eight contracts for the maintenance of the road network in the amount of 18.9 billion rubles. The customer was the Federal Highway Administration Central Russia, the very organization that Viktor Dorgan had headed for more than 10 years before moving to Mostotrest.

* Partner - Boris Rotenberg

Ziyad Manasir

Company: "Stroygazconsulting"

Customers: Gazprom, Rosavtodor

The amount of state contracts: 80 billion rubles.

Five years ago, Ziyad Manasir's Stroygazconsulting had practically no serious competitors in the Gazprom contract market. However, the closest friends of Vladimir Putin, Arkady Rotenberg and Gennady Timchenko, became interested in the construction projects of Gazprom, creating and taking control of the Stroygazmontazh and Stroytransgaz companies. The market has become cramped - the endless "system" and "gas" in the names of the main players speak about this.

At first glance, Manasir is doing very well. The company's revenue exceeds 330 billion rubles, last year it put into operation the most powerful compressor station in Russia, Portovaya, which drives gas for Nord Stream along the seabed. However, the largest contracts of Stroygazconsulting this year were the linear section and compressor stations of the second string of the Bovanenkovo - Ukhta gas pipeline. But these projects started many years ago. Construction of new fields, such as, for example, Bovanenkovskoye, has not begun. And the contract for the construction of the Kazachya compressor station, which is comparable in capacity to the Portovaya compressor station, was won not by Stroygazconsulting, but by Argus Pipeline.

Trying to diversify, the company wins tenders from Rosavtodor and is looking for other markets. At various times, the co-owners of Manasir's companies were the children of influential people. For example, Olga Grigorieva, daughter of Alexander Grigoriev (a KGB general and a friend of Putin), but she quit the number of shareholders. Now they are owned, according to the Unified State Register of Legal Entities, only by Ziyad Manasir himself and top managers.

Gennady Timchenko *

Company: OJSC Stroytransgaz

Customers: FGC, Olympstroy, Rosavtodor

The amount of state contracts: 51 billion rubles.

In an interview with Forbes, Gennady Timchenko talked about his plans to create one of the largest construction groups in Russia, which will build all possible infrastructure, including for the state. Now the businessman owns 80% of OJSC Stroytransgaz and 25% each in SK Most and the ARKS group. Timchenko assures that he owns options and intends to increase his stake in these companies. During the year, the businessman's companies won major government tenders for 30 billion rubles, with a third of Stroytransgaz contracts from FGC. This is not surprising, the former chairman of the board of Stroytransgaz Sergey Makarov said that projects in the field of energy construction bring the contractor about 60% of the proceeds.

All major ARKS state orders were won at the tenders of the Moscow government, in particular for the reconstruction of Kashirskoye, Dmitrovskoye highways and Balaklavsky avenues. And at the end of January, ARKS signed an agreement on cooperation with the Luzhniki sports complex in the framework of the reconstruction of the Big Sports Arena (the contract amount could be about 25 billion rubles).

* Partners in SK Most - Evgeny Sur and Vladimir Kostylev, partner in ARKS - Alexander Lavlentsev

Ivan Shabalov *

Company: "Pipe innovative technologies"

Customer: Gazprom

The amount of state contracts: 40 billion rubles.

Shabalov is a newcomer to the rating. He says that he started working with Gazprom even when the concern was headed by Rem Vyakhirev, and with the arrival of a new team, he turned out to be one of the largest intermediaries of the gas monopoly. Since 2005, Gazprom has been buying pipes not directly from manufacturers, but from traders. It was Shabalov who founded the Northern European Pipe Project (SETP), which in 2010 accounted for over 90% of pipe supplies to Gazprom. In the same year, Shabalov sold a controlling stake in the company to the Rotenberg brothers, the leaders of the Kings of State Order rating. Since 2004, he has been the head of the Pipe Producers Association, which includes both producers and a subsidiary of Gazprom. In 2012, another Shabalov's company, Pipe Innovative Technologies, took part in Gazprom's tenders, which received contracts worth almost 40 billion rubles. In February, his company won the SETP tender in a large contract for the purchase of pipes (the cost of lots is 3.9 billion rubles).

* Read the article about Ivan Shabalov on page 114

Anton Ray

Company: Argus Pipeline / Stroytransgaz

Customer: Gazprom

The amount of state contracts: 38 billion rubles.

The parent company Alkor Holdings, which owns Argus Pipeline Service, was founded by an American from the USSR, Michael Ray. According to the British registrar as of October 23, 2012, the company is controlled by his son, a Russian citizen, Anton Ray (80%), and Michael owns 20%. Alkor's revenue in 2011 amounted to $ 675.4 million (profit - $ 45.9 million). The company started its business in the early 1980s as a supplier of equipment for Soviet oil and gas builders. Since 1996, Gazprom has appeared among the customers. The company became a supplier of equipment for the construction of the Yamal-Europe gas pipeline, for the restoration of pipelines in the Baltics, Belarus and Ukraine. Argus Pipeline Service CJSC was founded by Anton Ray in Moscow in 2004, the company since 2006 began to engage in construction and installation work at large construction sites, including the ESPO, BTS-2 oil pipelines, Sakhalin - Khabarovsk - Vladivostok gas pipelines, the onshore part " Nord Stream ". Since 2011, Argus has been working directly with Gazprom. In March 2012, the company won a tender for the construction of the second string of the Bovanenkovo - Ukhta gas pipeline, and in the summer of 2012 received a large contract for the construction of the Kazachya compressor station (part of the Southern Corridor project). Shortly before that, Gennady Timchenko announced his interest in the company, who until now had no contracts from Gazprom. In July, Argus was renamed into ZAO Stroytransgaz, but the deal with Timchenko has not yet been closed. Details were not disclosed, but sources close to the companies say Anton Ray will remain one of the shareholders and managing partner.

Ziyaudin Magomedov

Company: "Stroynovatsiya", "Globalelectroservice", "Contact-S"

Customers: Transneft, Russian Railways, Federal Grid Company, Rosavtodor, Avtodor

The amount of state contracts: 31 billion rubles.

Ziyaudin Magomedov's companies continued to successfully receive large orders from the state in 2012. His Stroynovatsiya won several tenders, in particular for the reconstruction of the Moscow-Kholmogory highway, the M-29 Kavkaz highway from Krasnodar to the border with Azerbaijan, as well as for preparing the territory for the construction of the Central Ring Road. In 2008-2011, Magomedov's company took the second place in terms of the volume of large contracts for FGC: then, Globalelectroservice received 14 projects worth 60 billion rubles. Last year, another 10.5 billion rubles were added to them. Thus, the company won a tender for the supply of equipment for the construction of high-voltage lines Donskaya NPP - Borino. Magomedov earned his first budget money back in the early 2000s after meeting the then head of Transneft, Semyon Vainshtok. Stroynovatsiya has become one of the largest contractors for the monopoly. However, the company's prospects in the Transneft contract market look vague. In an interview with Kommersant, the president of Transneft, Nikolai Tokarev, said that a construction trust, Transneftstroy, had been created, which itself would be engaged in modernization and reconstruction of the monopoly's facilities.

Valery Markelov

Company: "Moboil"

Customer: Russian Railways

The amount of state contracts: RUB 29 billion.

A mysterious company that participated in all tenders and auctions for the supply of oil products and fuel to Russian Railways (the second participant was Resource Trading LLC by the Khalilov brothers). In 2012, Moboil was ahead of Rosneft, Surgutneftegaz, Gazprom Neft and TNK-BP in terms of the volume of won tenders for Russian Railways. Most recently, Moboil was a small trading company, but in 2011 the company's revenue grew sharply: from 1.18 billion rubles in 2010 to 16.2 billion rubles in 2011. At about the same time, the company changed owners: control in Moboil passed to ZheldorTransStroy LLC, which, according to SPARK, is owned by Valery Markelov, co-owner of Interprogressbank. His name was mentioned in connection with the 2008 scandal: an attempt was made on the life of the co-owner of Interprogressbank, German Gorbuntsov, who fled to London. He accused the partners in the bank, Markelov and Boris Usherovich, of involvement in it. Markelov did not respond to a request for Forbes. Another co-owner of the bank is Andrei Krapivin, advisor to the President of Russian Railways.

Mikhail Chigirinsky *

Company: LLC "MKM-Logistics"

Customer: Department of Housing and Communal Services and Improvement of the City of Moscow

In December 2012, an unknown company "MKM-Logistics" won one of the largest tenders of the year - "for the provision of services for the management of solid waste ... on the territory of the South-West Administrative District of Moscow." The company turned out to be the only participant in this contract, the execution of which will take 15 years. Until 2027, the company will provide separate waste collection, transportation, disposal and partial recycling.

According to SPARK, the company was founded in 2009 by Mikhail Chigirinsky and Hamlet Avagumyan. A source in the construction market for Forbes said that Mikhail is the son of the owner of the Snegiri-Development company, Alexander Chigirinsky, and the nephew of Shalva. Chigirinsky Jr. is 23 years old, he is a graduate of MGIMO. His peer Avagumyan is a student at the Finance Academy. A representative of MKM-Logistics categorically refused to provide information about the company and the identity of the owner. Chigirinsky himself, through his page on the social network, confirmed that he would not like to comment on anything.

Market participants told Forbes that the success story of MKM-Logistics began in the summer of 2011, when a member of the list of the richest and co-owner of Snegiri Development Roman Abramovich came to Moscow Mayor Sergei Sobyanin with a presentation of a new waste sorting complex. Former CEO of the company Olga Loginova confirmed the acquaintance of the founders of the company with Roman Abramovich, Abramovich's representative denies this.

* Partner - Hamlet Avagumyan

Vladimir Kostylev, Evgeny Sur *

Company: SK Most

Customers: Rosavtodor, Rosmorport

The amount of state contracts: 25 billion rubles.

The company "SK Most" Kostyleva and Sura is known as the general contractor for the construction of a giant cable-stayed bridge to the Russky Island in Vladivostok - with a span of more than a kilometer. The largest of the new contracts from SK Most is the reconstruction of the Roki tunnel on the border of Ossetia with Georgia. The three-kilometer tunnel, through which Russian tanks passed in 2008, was built 25 years ago, and, as stated on the company's website, the facility's engineering infrastructure is physically and morally outdated.

Kostylev and Sur met during the construction of the BAM, and at first their company specialized in railway bridges in the east of the country. In 2003, after the construction of the BAM was completed, they acquired the Bamtonnelstroy company, which had the largest fleet of tunnel boring shields in the country. These shields worked on the construction of tunnels for the combined road and railways in Olympic Sochi and are now piercing new lines of the Moscow metro.

* In 2012, Gennady Timchenko bought 25% of SK Most

Oleg Shishov

Company: NPO Mostovik

Customers: Rosavtodor, Construction Departments of Moscow, Omsk, Sochi, Rostransmodernizatsiya

The amount of state contracts: 20 billion rubles.

The largest construction holding company in the Omsk region began with a student design bureau, which was organized by a graduate and teacher of the Siberian Automobile and Road Institute Oleg Shishov. Now it is a company with a turnover of 30 billion rubles, among the objects - design and subcontracting of a bridge to the Russky Island in Vladivostok, a large ice arena and a bobsleigh track in Sochi and many structures in Omsk. Omsk Mayor Vyacheslav Dvorakovsky is the second after Shishov co-owner of the company with a 5.84% stake. Before heading the city, Dvorakovsky worked for the company as a chief engineer for many years.

The largest of the contracts in 2012 was the construction of railway parks and the development of the Novorossiysk station, the volume - 9.1 billion rubles. The Stroynovatsiya company of Ziyaudin Magomedov, co-owner of the Novorossiysk Commercial Sea Port, also participated in that tender, but lost. Magomedov tried to challenge the results of the competition in the Moscow Arbitration and even received a writ of execution prohibiting the customer from paying advances to Shishov's company. However, a month after this decision and before the consideration of Mostovik's appeal, representatives of Ziyaudin Magomedov's company withdrew the claim themselves.

"Companies"

"Themes"

"News"

The Timchenko family turned out to be the owner of 50% of a large contractor "Gazprom"

Businessman Gennady Timchenko told RBC that together with his family he owns "at least half" of one of the largest contractors of Gazprom - Stroytransneftegaz. It was previously known that Timchenko himself owns 31.5% in the company

Stroytransgaz will split into businesses

As it became known to Kommersant, the large contractor Stroytransgaz, controlled by businessman Gennady Timchenko, may be reorganized. In this case, it will become a holding structure, and its business will be divided into three areas - oil and gas, energy and construction. For some of them, the company may acquire partners, as well as new assets. A change of management is also expected: Stroytransgaz will be left by the chairman of the board, Sergei Makarov, and will be replaced by the co-owner of the tire company Kordiant, Vadim Gurinov.

link; http://www.kommersant.ru/doc/ 1992806

Gazprom Transgaz Tomsk takes over a project in Yakutia

Anton RAY, President of the Argus Group of Companies: “We were able to participate in many projects, starting with the Blue Stream, Sakhalin-1, Bovanenkovo-Ukhta projects. Rich experience in the supply of the most modern welding and control technologies and other construction technologies will allow us to cooperate with the company. ”By 2016, the gas pipeline should be put into operation. Deadlines are tight, the track is not easy. The corporate identity of Gazprom Transgaz Tomsk is to do everything on time and flawlessly, so that you can confidently engage in operation later. Training of personnel in working specialties - welders, pipelayers - is one of the components of successful results and one of the promising areas of cooperation between the two companies. And the technologies that Argus uses are focused on fast and high-quality work. This is how Gazprom Transgaz Tomsk sets the task.

link: http://www.vesti.tvtomsk.ru/news-15401.html

During the reorganization, Stroytransgaz may split the business by areas - newspaper

For the development of oil and gas construction, Stroytransgaz can attract a partner: according to one of the interlocutors of the publication, negotiations are underway to create a joint venture with the American Argus Pipeline. Most likely, this joint venture will be headed by the head of Argus Pipeline Ray Anton Michael. How the shares in the joint venture will be distributed, the interlocutors of Kommersant do not know.

link; http://www.oilcapital.ru/ company / 170538.html

Stroytransgaz claims to participate in the construction of South Stream

CJSC Stroytransgaz (until July 2012 known as Anton Ray's Argus Pipeline Service) may receive a contract from Gazprom worth 6.6 billion euros for laying the onshore sections of South Stream. As of August, the company has registered its Bulgarian, Serbian and Slovenian subsidiaries. The terms of reference for the construction of a gas pipeline in Serbia and Bulgaria are currently being prepared. Gazprom plans to announce a tender for laying these sections by the end of this year. Later, tenders will be held for the construction of the pipeline in Slovenia and Hungary.

link; http://pronedra.ru/gas/2013/ 08/21 / strojtransgaz-gazprom /

In a still whirlpool ... officials with "leftist" diplomas

Now, dear readers, you understand why the Argus company receives such preferences in Tomsk. Why impunity, why continuous violations during construction and why, with all this, everyone is silent. The newspaper asks questions related to safety during construction, and in response - only replies. And this is understandable - who will give the true answers? Who admits that we have a complete chaos going on? People value their jobs. How can you contradict Deputy Mayor Marchenko when he is on a short leg with Nikolai Nikolaychuk himself? Moreover, they are connected not only by working relations.

link: http://tn.tomsk.ru/archives/ 5342

Anton Ray - government orders for 38 billion rubles.

Since 1996, Gazprom has emerged among the customers. The company became a supplier of equipment for the construction of the Yamal - Europe gas pipeline, and for the renewal of pipelines in the Baltics, Belarus and Ukraine. Argus Pipeline Service CJSC was organized by Anton Ray in Moscow in 2004, the company since 2006 began to engage in construction and installation services at large construction sites, including the ESPO, BTS-2 oil pipelines, the Sakhalin - Khabarovsk - Vladivostok gas pipelines, the coastal share " Nord Stream ". Since 2011, Argus has been working directly with Gazprom.

link; http://samara.bezformata.ru/ listnews / anton-rej- gospodryadi-na-38-mlrd / 12767935 /

Argus Pipeline Service is considering the possibility of reconstruction of Tomsk ski jumps

The company "Argus Pipeline Service" is considering the possibility of implementing a social project for the overhaul or reconstruction of the springboards of the Children's and Youth Sports School No. 13. An off-site meeting on the implementation in Tomsk of an investment project for the restoration of ski jumps and the development of ski sports in the city was held today, March 15, under the leadership of the Deputy Mayor of Tomsk for Capital Construction Alexey Marchenko. The general director of the Argus Pipeline Service company Anton Michael Ray, the head of the department for youth affairs, physical culture and sports Dmitry Laptev, director of the Children's and Youth Sports School No. 13 Viktor Petrov took part in the meeting, according to the press service of the city administration.

link; http://tramplin.perm.ru/news/ rus / 2011 / 2011_03_15_01.htm

Four "builders" of the bridge on Russky Island were included in the Forbes "Kings of the State Order" rating

The fourth place was taken by the newcomer of the rating Ivan Shabalov, whose "Pipe Innovative Technologies" received contracts from Gazprom for a total of almost 40 billion rubles. The fifth place was taken by the Russian Anton Ray. His company ZAO Stroytransgaz (until July 2012 - Argus Pipeline Service) received contracts from state-owned companies for 38 billion rubles.

link:

In the near future, a company will appear in Cyprus, claiming to become the largest private construction holding in the Russian Federation. Such powerful players of the profile market as Gennady Timchenko and the Vorobyev family decided to unite their funds and influence in it. The case also traces the interests of Sergei Shoigu and the previous leadership of St. Petersburg, relations with which the Vorobievs maintain through another member of the holding, Mikhail Kenin.

According to Vedomosti, Mikhail Kenin and Maksim Vorobyov will become Gennady Timchenko's partners in a new construction holding that will consolidate all the businessman's assets in this area, said Anton Kurevin, a spokesman for Timchenko's Volga Group asset manager. For this, Stroytransgaz Holding Limited (STGH) will be registered in Cyprus, which will receive 100% of OJSC Stroytransgaz and 25% each of GC "Arks" and GC "SK" Most ". In the future, STGH will also include 30% of CJSC Stroytransgaz, 100% of LLC Stroytransgaz-M and 25% plus 1 share of CJSC Stroyputinvest.

Volga Group (63%), Gazprombank (20%), Vorobiev (11.3%) and Kenin (5.7%) will become the owners of STGH after the transaction is completed. Gazprombank, which owned 20% in OJSC Stroytransgaz, leaves the OJSC and receives a similar share in STGH, having paid additional funds. The representative of Gazprombank could not clarify yesterday how much.

New partners

According to Kurevin, Vorobiev and Kenin bought out a stake from the Volga Group shareholders, the deal is cash and is in its final stage. A source close to one of the parties to the transaction says that Vorobyov paid about 1.5 billion rubles for his 11.3%. Based on this, Kenin could pay 0.75 billion rubles for his 5.7%.

The partnership between Vorobyov and Timchenko began in 2011, when Volga Resources acquired half of the company that owns a controlling stake in Russian Sea (a large fish importer set up by the Vorobyov family).

Vorobyov in an interview with the media said that he entered the construction business because, from his point of view, it is "globally underestimated." Vorobyov was previously a member of the board of directors of Stroytransgaz. A year ago, he said that Stroytransgaz had poor results (debts, unfinished projects) and he was invited as an independent director. However, in December, he announced his resignation from the council, explaining that he did not want to "give a reason for talking about a possible conflict of interest in the Moscow region" (on the eve of his brother Andrey appointed Acting Governor of the Region).

And in March this year, Kenin joined the board of directors of Stroytransgaz. Little is known about Kenin; he was always called “a good friend” of Maxim Vorobyov. An acquaintance of Kenin says that he often represents the interests of Vorobyov. Kenin is on the boards of directors "Russian Sea" and the companies whose stakes are now being transferred to STGH - IFSK Arks and USK Most.

One of Kenin's partners says that he lobbies, including at the federal level. “I don’t remember how he appeared and how we met him. He is such a pleasant person, business-like, calm, very sociable. He is a businessman, a Muscovite. He has a store, they bought very expensive, but good suits from him, ”- remembered Senator Yuri Vorobyov (father of Andrei and Maxim). An acquaintance of Kenin says that he is on friendly terms with Sergei Shoigu and Valentina Matvienko. This acquaintance could have left a mark on SPARK, where Kenin, along with relatives of Shoigu and Matvienko, is listed as the founder of two companies. For example, in 2006 at Barvikha 4, Irina Shoigu (wife), Sergei Matvienko (son), Kenin and Grand Land received 25% each. In the company "Discord City" Kenin is listed as a partner of Sergei Matvienko, real estate specialist Timur Klinovsky, founders of "Wimm-Bill-Dann" Gabriel Yushvaev and David Yakobashvili, and the same "Grand Land". Kenin was also a minority shareholder close to the St. Petersburg authorities Bank Saint Petersburg- until the second half of 2011

Vorobiev and Kenin "have experience in implementing construction projects," according to yesterday's release from Stroytransgaz. Of the serious development assets, Vorobyov and Kenin had a blocking stake in half in "Glavstroy SPB"(Vorobyov has already left the capital) and - Vorobyov has a share in SPB Renovation. There were also less serious assets. Vorobyov said that the above-mentioned "Grand Land" - "these are several development assets that came to us at different times", they "as an owner" are accompanied by his mother, Lyudmila Vorobyova .

Old idea

Timchenko began assembling the construction holding in 2008, when he acquired OAO Stroytransgaz. However, it turned out that the company was in a deplorable state: it had long ceased to be the largest contractor of Gazprom, and was replaced by Ziyad Manasir's Stroygazconsulting. Stroytransgaz tried to reorient itself to the oil industry, energy and foreign projects, but most of the contracts were executed at a loss. The contractor failed to achieve positive free cash flow. Net loss under IFRS in 2012 amounted to 7.6 billion rubles, and revenue fell from 48.1 billion to 26.3 billion rubles.

In 2011, Timchenko acquired 25% of a large Moscow company GK "Arks", specializing in infrastructure and engineering construction. And then - 25% of GC “SK“ Most ”, which builds railways and highways, bridges, tunnels, etc. The entrepreneur will help load these companies with orders - this is how market participants commented on these transactions. Both companies are now working for the mayor's office, which has a large-scale construction program. Arks portfolio since the end of 2010 has increased from 7.4 billion to 39.8 billion rubles. Most began building a 6.6 km section of the Tagansko-Krasnopresnenskaya metro line (the amount of the contract is about 28 billion rubles).

The deal on the purchase of 30% of CJSC Stroytransgaz (engaged in the construction of pipelines) has not yet been closed. A source close to the company says that CEO Anton Ray will remain one of the shareholders and managing partner of the company. In addition, the holding will include OOO Stroytransgaz-M (construction of oil and gas and petrochemical facilities), it was spun off from Stroytransgaz.

“All companies have expertise in their respective fields. This means that they can potentially win any tender, and with the addition of Timchenko's connections, this turns any holding company into a market leader, ”says Alexey Bezborodov, CEO of InfraNews.

Railways too

Stroytransgaz announced the purchase of one of the assets that will become part of the holding yesterday. Stroytransgaz Group buys back 25% plus 1 share of Stroyputinvest CJSC (railway construction) with an option to increase the stake up to 100%. CJSC Stroyputinvest belongs to the structures of Alexey Zolotarev and Vitaly Bril, said a representative of Stroytransgaz.

Arkady Rotenberg topped the ranking of the largest state contractors Forbes - 2013

Original of this material© "Russian Forbes", 03/19/2013, Arkady Rotenberg topped the rating of the largest state contractors Forbes

Nadezhda Ivanitskaya

State economy

The rating of state contractors is an accurate indicator of real processes in the Russian economy. Now the main competitor of the friends of the authorities is the state itself. There are industries traditionally closed to private investors, for example, space. The subsidiaries of Roskosmos went to 230 billion rubles, of which about 100 billion goes to the mega-project for the construction of the Vostochny cosmodrome. The state company Rostelecom received 13 billion rubles without a competition to organize a video broadcast of the presidential election. The state order system is inert: from year to year all tenders for printing documents are received by the Federal State Unitary Enterprise Goznak (12 billion rubles), and letters are sent by the Russian Post.One of the main trends in 2012 is the strengthening of the role of subsidiary state-owned companies, which are increasingly outplaying even influential businessmen in competitions. Sometimes the latter are simply kicked out of there. For example, "Transmashholding" Iskander Makhmudov and Andrey Bokarev, after litigation, lost a major tender for the supply of high-speed trams for Moscow to the state-owned Uralvagonzavod (8.5 billion rubles). Another example: Transneft, according to its President Vladimir Tokarev, sees no reason to attract private contractors and is going to build and modernize on its own (Transneftstroy). Some companies, for example Rostekhnologii or Rostelecom, are already mastering practically the entire investment program themselves.

Maybe in this way state monopolies are protected from "gray" competition and corruption? Here are some interesting stories.

The two largest tenders of Russian Railways were won by the subsidiaries of the monopoly: BetElTrans OJSC (126.6 billion rubles, a five-year contract for the supply of sleepers) and the Kaluga plant Remputmash (89 billion rubles, a five-year contract for the supply of equipment). Shortly before this, Russian Railways announced its intention to sell 50% minus two shares in each of these companies. In this situation, both contracts are similar to pre-sales preparation. After all, multi-year contracts with companies were concluded after the announcement of the sale of shares. There have already been precedents: before the sale of a 75% stake minus two shares owned by Russian Railways, OJSC Zheldorremmash entered into a five-year contract with the monopoly for the maintenance of locomotives, which then essentially went to Transmashholding, which bought this stake in 2012 for 7.9 billion rubles.

A new way of using large sums has appeared in construction. Previously, billions of dollars in contracts were allocated for the construction or repair of roads, but now a new item has been added - maintenance. Starting in October 2012, Rosavtodor divisions began to conduct tenders for the right to "carry out work on the maintenance of existing federal highways." For example, on October 15, 10 contracts were signed for the maintenance of almost 2,000 km of roads, the total amount of contracts is 12 billion rubles. The contracts were concluded for the period 2012–2018, while previously they were only annual. The winners were mainly state DRSU (road repair construction departments). But this innovation was also mastered by the leader of the rating of state contractors.

Unlike last year When Forbes studied all government orders over 1 billion rubles, in this rating we lowered the bar to 300 million rubles. However, outside of our attention were contractors who collect their billions "drop by drop", crushing large lots. The most reliable way to avoid public attention is to disguise or simply not publish information about public procurement.

On January 1, 2012, Federal Law No. 223 came into force, according to which state-controlled corporations are required to post all information about procurement on their website. Many state-owned companies actually began to publish the procurement plan and the tenders themselves. For example, this was done by Rostekhnologii, which could not find data on purchases last year. In some cases, the system is convenient and allows you to search by price and time - as, for example, on the official government website or at Rosatom and Avtodor. But this is rather an exception. FSK, Transneft, Rostelecom and RusHydro do not have the ability to search for tenders by price. FGC lists the winner with the bid amount in the tender card, while Transneft and Rostelecom have to open the attached scanned documents in order to receive this information.

However, the primacy in this secret competition still belongs to Gazprom. Gazprom makes extensive use of the open request for proposals form; when many procurement notices are published, the price of the work is not indicated. The Gazprom press service declined to comment on this. Georgy Sukhadolsky, executive director of the National Association of the Procurement Institute, says that the absence of an initial price does not violate the law in itself, since the “information on price” that Federal Law No. 223 prescribes to indicate is not the price itself. Gazprom's modesty is understandable given the volume of its contracts. The first places in the "Kings of the state order" rating were taken by businessmen mastering the contracts of the gas monopoly. The top five includes the founder of the main company of the Rotenberg empire, SETP, Ivan Shabalov, who became the discovery of this rating.

Hiding sensitive information, another state-owned company, Rosneft, took a different path. A description of the lots is published on its website, but neither the cost nor the winners are reported (there is one exception - a subsidiary of RN-Yuganskneftegaz). The fact is that the “granddaughters of the state”, one of which is “Rosneft”, was granted a deferral to disclose information until January 2013.

This delay for the "granddaughters" of the state led to amusing consequences. So, at the end of December, Voentorg OJSC (subsidiary "Oboronservice"), which is engaged in the provision of consumer services for the Ministry of Defense, urgently distributed a two-year contract for catering for military personnel(according to Forbes, about 100 billion rubles). That is why, despite the amount of won state orders, which even builders and pipe manufacturers would envy, you will not find in the ranking Evgeniya Prigozhina, the owner of the "Concord" company.

How we considered the rating

When compiling a rating of state contractors, we calculated budget purchases, which in 2012 amounted to about 6 trillion rubles. Another 7 trillion rubles, according to the Ministry of Economic Development, is spent by state-owned companies and state corporations. In the course of our work, we analyzed 2,140 contracts signed in 2012 for the amount of over 3 trillion rubles. We took into account only large contracts - more than 300 million rubles. Some of them have already been paid for, and some have been concluded for many years in advance.We analyzed all budget contracts posted on the official government website Zakupki.gov.ru, as well as contracts of state corporations and state-owned companies (Rosatom, Olympstroy, the Fund for Assistance to Housing and Communal Services Reform, Rostekhnologii, Rosavtodor), as well as natural monopolies ( Gazprom, Russian Railways, Transneft, FGC, Rostelecom, RusHydro, Inter RAO). Since some companies do not fully disclose information, we collected some information based on messages from news agencies, press releases and statements from officials.

In our calculations, we did not take into account companies that receive government orders through subcontracting. In addition, we did not calculate the shares of shareholders in the winning companies (some of the participants in the list do not disclose ownership structures or belong to offshore residents), except for cases when several co-owners of one company were included in the top ten independently of each other.

The calculations were made with the assistance of the Fabrikant and B2B-Center electronic trading platforms.

1. Arkady Rotenberg *

|

|

Company: Northern Sea Route, Stroygazmontazh, Mostotrest, etc.

Customers: Gazprom, Avtodor, Rosavtodor, Administration of civil airfields, Rosmorport, etc.

“If I had not been promoted as a friend of Putin, the business would have been worse,” Arkady Rotenberg said in an interview with Forbes. But things are going on as usual: for the second time he wins the rating of "kings of state orders". In 2007, he, co-owner of the Northern Sea Route bank, created the Stroygazmontazh and Trubny Metallokat companies. A year later, the former bought five construction subsidiaries of Gazprom, won the largest contracts of the monopoly, and received some of them without a competition. Another company, SETP, controlled by Arkady and his brother Boris, became the main intermediary in the supply of pipes to Gazprom (according to the FAS, in 2010, the trader accounted for 90% of Gazprom's purchases of large-diameter pipes). The amount of state orders received by Rotenberg's firms during the four years of Dmitry Medvedev's presidency amounted to almost 900 billion rubles.

In 2012, Rotenberg was lucky again. In the summer, his companies received contracts for the reconstruction of Gazprom's gas pipelines for 17.5 billion rubles, and won a major contract for the Southern Corridor project worth 22 billion rubles.

Rotenberg's companies are building not only gas pipelines - the Mostotrest holding, in which Arkady Rotenberg and his son own about 26% of the shares, came out on top in terms of the volume of state contracts for the construction of roads and other infrastructure facilities. As a general contractor, Mostotrest is building a backup for Kurortny Prospekt in Sochi, the head section of the Moscow - St. Petersburg highway, and is participating in all megaprojects. The largest contract for 34.7 billion for the improvement of roads around Skolkovo was presented to Rotenberg's company in one of the last days in the role of the country's president, Dmitry Medvedev. Another contract for the section of the Moscow - St. Petersburg highway was won by Mostotrest at the Moscow government competition in a fierce struggle with ARKS (co-owner Gennady Timchenko), having reduced the price from the initial 29 billion to 23 billion rubles.

In July 2012, Mostotrest announced that it intends to buy 60% of the small company National Chamber of Industry and Commerce (NITP). Valery Dorgan became the general director of the company; since 2010, he has held the position of Deputy Marketing Director of Mostotrest. The transaction amount was 510 million rubles. But in October, everything was revealed: in three days, NITP won eight contracts for the maintenance of the road network in the amount of 18.9 billion rubles. The customer was the Federal Highway Administration Central Russia, the very organization that Viktor Dorgan had headed for more than 10 years before moving to Mostotrest.

* Partner - Boris Rotenberg

2. Ziyad Manasir

|

|

|

Company: Stroygazconsulting

Customers: Gazprom, Rosavtodor

Five years ago, Ziyad Manasir's Stroygazconsulting had practically no serious competitors in the Gazprom contract market. However, the closest friends of Vladimir Putin, Arkady Rotenberg and Gennady Timchenko, became interested in the construction projects of Gazprom, creating and taking control of the Stroygazmontazh and Stroytransgaz companies. The market has become cramped - the endless "system" and "gas" in the names of the main players speak about this.

At first glance, Manasir is doing very well. The company's revenue exceeds 330 billion rubles, last year it put into operation the most powerful compressor station in Russia, Portovaya, which drives gas for Nord Stream along the seabed. However, the largest contracts of Stroygazconsulting this year were the linear section and compressor stations of the second string of the Bovanenkovo - Ukhta gas pipeline. But these projects started many years ago. Construction of new fields, such as, for example, Bovanenkovskoye, has not begun. And the contract for the construction of the Kazachya compressor station, which is comparable in capacity to the Portovaya compressor station, was won not by Stroygazconsulting, but by Argus Pipeline.

Trying to diversify, the company wins tenders from Rosavtodor and is looking for other markets. At various times, the co-owners of Manasir's companies were the children of influential people. For example, Olga Grigorieva, daughter of Alexander Grigoriev (a KGB general and a friend of Putin), but she quit the number of shareholders. Now they are owned, according to the Unified State Register of Legal Entities, only by Ziyad Manasir himself and top managers.

3. Gennady Timchenko *

|

|

|

Company: OJSC "Stroytransgaz"

Customers: FGC, "Olympstroy", Rosavtodor

In an interview with Forbes, Gennady Timchenko talked about his plans to create one of the largest construction groups in Russia, which will build all possible infrastructure, including for the state. Now the businessman owns 80% of OJSC Stroytransgaz and 25% each in SK Most and the ARKS group. Timchenko assures that he owns options and intends to increase his stake in these companies. During the year, the businessman's companies won major government tenders for 30 billion rubles, with a third of Stroytransgaz contracts from FGC. This is not surprising, the former chairman of the board of Stroytransgaz Sergey Makarov said that projects in the field of energy construction bring the contractor about 60% of the proceeds.

All major ARKS state orders were won at the tenders of the Moscow government, in particular for the reconstruction of Kashirskoye, Dmitrovskoye highways and Balaklavsky avenues. And at the end of January, ARKS signed an agreement on cooperation with the Luzhniki sports complex in the framework of the reconstruction of the Big Sports Arena (the contract amount could be about 25 billion rubles).

* Partners in SK Most - Evgeny Sur and Vladimir Kostylev, partner in ARKS - Alexander Lavlentsev

4. Ivan Shabalov

|

|

|

Company:"Pipe innovative technologies"

Customer: Gazprom

Shabalov is a newcomer to the rating. He says that he started working with Gazprom even when the concern was headed by Rem Vyakhirev, and with the arrival of a new team, he turned out to be one of the largest intermediaries of the gas monopoly. Since 2005, Gazprom has been buying pipes not directly from manufacturers, but from traders.

It was Shabalov who founded the Northern European Pipe Project (SETP), which in 2010 accounted for more than 90% of pipe supplies to Gazprom (data from the FAS). In the same year, Shabalov sold a controlling stake in the company to the Rotenberg brothers, the leaders of the Kings of State Order rating. Since 2004, he has been the head of the Pipe Producers Association, which includes both producers and a subsidiary of Gazprom.

In 2012, another Shabalov's company, Pipe Innovative Technologies, took part in Gazprom's tenders, which received contracts worth almost 40 billion rubles. In February, his company won the SETP tender in a large contract for the purchase of pipes (the cost of lots is 3.9 billion rubles).

5. Anton Ray

|

|

|

Company: Argus Pipeline / Stroytransgaz

Customer: Gazprom

The parent company Alkor Holdings, which owns Argus Pipeline Service, was founded by an American from the USSR, Michael Ray. According to the British registrar as of October 23, 2012, the company is controlled by his son, a Russian citizen, Anton Ray (80%), and Michael owns 20%. Alkor's revenue in 2011 amounted to $ 675.4 million (profit - $ 45.9 million). The company started its business in the early 1980s as a supplier of equipment for Soviet oil and gas builders. Since 1996, Gazprom has appeared among the customers. The company became a supplier of equipment for the construction of the Yamal-Europe gas pipeline, for the restoration of pipelines in the Baltics, Belarus and Ukraine.

Argus Pipeline Service CJSC was founded by Anton Ray in Moscow in 2004, the company since 2006 began to engage in construction and installation work at large construction sites, including the ESPO, BTS-2 oil pipelines, Sakhalin - Khabarovsk - Vladivostok gas pipelines, the onshore part " Nord Stream ". Since 2011, Argus has been working directly with Gazprom.

In March 2012, the company won a tender for the construction of the second string of the Bovanenkovo - Ukhta gas pipeline, and in the summer of 2012 received a large contract for the construction of the Kazachya compressor station (part of the Southern Corridor project). Shortly before that, Gennady Timchenko announced his interest in the company, who until now had no contracts from Gazprom. In July, Argus was renamed into ZAO Stroytransgaz, but the deal with Timchenko has not yet been closed. Details were not disclosed, but sources close to the companies say Anton Ray will remain one of the shareholders and managing partner.

6. Ziyaudin Magomedov

|

|

|

Company:"Stroynovatsiya", "Globalelectroservice", "Contact-S"

Customers: Transneft, Russian Railways, Federal Grid Company, Rosavtodor, Avtodor

Ziyaudin Magomedov's companies continued to successfully receive large orders from the state in 2012. His Stroynovatsiya won several tenders, in particular for the reconstruction of the Moscow-Kholmogory highway, the M-29 Kavkaz highway from Krasnodar to the border with Azerbaijan, as well as for preparing the territory for the construction of the Central Ring Road.

In 2008–2011, Magomedov's company took the second place in terms of the volume of large contracts for FGC: then, Globalelectroservice received 14 projects worth 60 billion rubles. Last year, another 10.5 billion rubles were added to them. Thus, the company won a tender for the supply of equipment for the construction of high-voltage lines Donskaya NPP - Borino.

Magomedov earned his first budget money back in the early 2000s after meeting the then head of Transneft, Semyon Vainshtok. Stroynovatsiya has become one of the largest contractors for the monopoly. However, the company's prospects in the Transneft contract market look vague. In an interview with Kommersant, the president of Transneft, Nikolai Tokarev, said that a construction trust, Transneftstroy, had been created, which itself would be engaged in modernization and reconstruction of the monopoly's facilities.

7. Valery Markelov

|

|

|

Company:"Moboil"

Customer: Russian Railways

A mysterious company that participated in all tenders and auctions for the supply of oil products and fuel to Russian Railways (the second participant was Resource Trading LLC by the Khalilov brothers). In 2012, Moboil was ahead of Rosneft, Surgutneftegaz, Gazprom Neft and TNK-BP in terms of the amount of Russian Railways' tenders won.

Most recently, Moboil was a small trading company, but in 2011 the company's revenue grew sharply: from 1.18 billion rubles in 2010 to 16.2 billion rubles in 2011. At about the same time, the company changed owners: control in Moboil passed to ZheldorTransStroy LLC, which, according to SPARK, is owned by Valery Markelov, co-owner of Interprogressbank. His name was mentioned in connection with the 2008 scandal: an attempt was made on the life of the co-owner of Interprogressbank, German Gorbuntsov, who fled to London. He accused the partners in the bank, Markelov and Boris Usherovich, of involvement in it. Markelov did not respond to a request for Forbes. Another co-owner of the bank is Andrei Krapivin, advisor to the President of Russian Railways.

8. Mikhail Chigirinsky *

|

|

|

Company: LLC "MKM-logistics"

Customer: Department of Housing and Communal Services and Improvement of the City of Moscow

In December 2012, an unknown company "MKM-Logistics" won one of the largest tenders of the year - "for the provision of services for the management of solid waste ... on the territory of the South-Western Administrative District of Moscow." The company turned out to be the only participant in this contract, the execution of which will take 15 years. Until 2027, the company will provide separate waste collection, transportation, disposal and partial recycling.

According to SPARK, the company was founded in 2009 by Mikhail Chigirinsky and Hamlet Avagumyan. A source in the construction market for Forbes said that Mikhail is the son of the owner of the Snegiri-Development company, Alexander Chigirinsky, and the nephew of Shalva. Chigirinsky Jr. is 23 years old, he is a graduate of MGIMO. His peer Avagumyan is a student at the Finance Academy. A representative of MKM-Logistics categorically refused to provide information about the company and the identity of the owner. Chigirinsky himself, through his page on the social network, confirmed that he would not like to comment on anything.

Market participants told Forbes that the success story of MKM-Logistics began in the summer of 2011, when a member of the list of the richest and co-owner of Snegiri Development Roman Abramovich came to Moscow Mayor Sergei Sobyanin with a presentation of a new waste sorting complex. Former CEO of the company Olga Loginova confirmed the acquaintance of the founders of the company with Roman Abramovich, Abramovich's representative denies this.

* Partner - Hamlet Avagumyan

9. Vladimir Kostylev (pictured), Evgeny Sur *

|

|

|

Company:"SK Most"

Customers: Rosavtodor, Rosmorport

The company "SK Most" Kostyleva and Sura is known as the general contractor for the construction of a giant cable-stayed bridge to the Russky Island in Vladivostok - with a span of more than a kilometer. The largest of the new contracts from SK Most is the reconstruction of the Roki tunnel on the border of Ossetia with Georgia. The three-kilometer tunnel, through which Russian tanks passed in 2008, was built 25 years ago, and, as stated on the company's website, the facility's engineering infrastructure is physically and morally outdated.

Kostylev and Sur met during the construction of the BAM, and at first their company specialized in railway bridges in the east of the country. In 2003, after the construction of the BAM was completed, they acquired the Bamtonnelstroy company, which had the largest fleet of tunnel boring shields in the country. These shields worked on the construction of tunnels for the combined road and railways in Olympic Sochi and are now piercing new lines of the Moscow metro.

* In 2012, Gennady Timchenko bought 25% of SK Most

10. Oleg Shishov

|

|

|

Company: NPO "Mostovik"

Customers: Rosavtodor, Construction Departments of Moscow, Omsk, Sochi, Rostransmodernizatsiya

The largest construction holding company in the Omsk region began with a student design bureau, which was organized by a graduate and teacher of the Siberian Automobile and Road Institute Oleg Shishov. Now it is a company with a turnover of 30 billion rubles, among the objects - design and subcontracting of a bridge to the Russky Island in Vladivostok, a large ice arena and a bobsleigh track in Sochi and many facilities in Omsk.

Omsk Mayor Vyacheslav Dvorakovsky is the second after Shishov co-owner of the company with a 5.84% stake. Before heading the city, Dvorakovsky worked for the company as a chief engineer for many years.

The largest of the contracts in 2012 was the construction of railway parks and the development of the Novorossiysk station, the volume - 9.1 billion rubles. The Stroynovatsiya company of Ziyaudin Magomedov, co-owner of the Novorossiysk Commercial Sea Port, also participated in that tender, but lost. Magomedov tried to challenge the results of the competition in the Moscow Arbitration and even received a writ of execution prohibiting the customer from paying advances to Shishov's company. However, a month after this decision and before the consideration of Mostovik's appeal, representatives of Ziyaudin Magomedov's company withdrew the claim themselves.

The general director of dace group llc smbat harutyunyan, the prison trade house

The general director of dace group llc smbat harutyunyan, the prison trade house Yakunin left, Rabinovich stayed

Yakunin left, Rabinovich stayed Rabinovich mikhail daniilovich

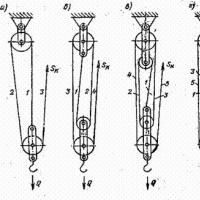

Rabinovich mikhail daniilovich Lifting loads without special equipment - how to calculate and make a chain hoist with your own hands

Lifting loads without special equipment - how to calculate and make a chain hoist with your own hands New details about Dimona's "charity" empire

New details about Dimona's "charity" empire Principal Buyer

Principal Buyer Edward cypherin biography. New Russian. How Eduard Shifrin, having earned $ 1 billion from Ukrainian steel, got involved in development in Russia. Eduard Shifrin and withdrawal of money

Edward cypherin biography. New Russian. How Eduard Shifrin, having earned $ 1 billion from Ukrainian steel, got involved in development in Russia. Eduard Shifrin and withdrawal of money