Berezkin grigory viktorovich children. Principled buyer. Media business - Komsomolskaya Pravda and RBC

In 1988 he graduated from the Faculty of Chemistry of Moscow University with a degree in petrochemistry. In 1991 he graduated from graduate school there, and in 1993 he defended his dissertation.

From 1991 to 1994 he worked at Moscow State University as a junior research assistant.

In 1992, [to clarify], together with Alexander Mamut and Vladimir Gruzdev, he founded the Slavyanka company on the basis of store No. 2 of the Oktyabrsky ORPO, which became the basis of the future Seventh Continent supermarket chain.

In 1993, after he started trading in oil, he met Roman Abramovich, who was involved in the supply of oil products from the Komi Republic.

Under the patronage of Roman Abramovich, in 1994 he became Deputy General Director of Komineft and at the same time its General Representative in Moscow. At the same time, he was in charge of Mesco, a joint venture between Komineft and RAO International Economic Cooperation, which was at the same time one of the key shareholders of Komineft.

In the same year, the KomiTEK holding was established on the basis of Komineft, the Ukhta Oil Refinery and Kominefteprodukt.

In 1995 he ran as an independent candidate for the State Duma of the Federal Assembly of the Russian Federation.

In 1996-1997, Berezkin headed Komi TEK - Moscow (KTM, the sales structure of KomiTEK), which, on behalf of Sibneft, exported oil from Noyabrskneftegaz.

In 1997, he consolidated the management levers of KomiTEK in his hands and became the Chairman of the Board of Directors of the company. In the same year, it acquired Evroseverneft (38%) and SB-Trust (29%), providing guarantees from the National Reserve Bank (NRB).

In 1997-1999, he worked as the chairman of the board of directors of ZAO AKB Ukhtabank.

From 1997 to 2005, Chairman of the Management Board of CJSC Evroseverneft (ESN).

In 1999, he organized the sale of the KomiTEK holding to LUKoil. The experience of Evroseverneft (the company of G.V. Berezkin) with KomiTEK has shown that external management carried out by a specially contracted third-party company is the only way to get the company out of the crisis and thereby reliably protect the rights of shareholders of the company faced with difficulties.

In 2000, it was decided to invite ESN Energo as a managing organization. The decision was made by the meeting of shareholders of JSC Kolenergo on June 14, 2000 in agreement with RAO UES of Russia. By this time, Kolenergo was in a pre-bankruptcy state: overdue accounts payable exceeded 1.3 billion rubles.

In 2003, ESN energo managed not only to stabilize the situation, but also to prepare JSC Kolenergo for reform. The introduction of an effective system of financial accounting and budgeting, streamlining of energy sales activities allowed the company to fully pay off overdue accounts payable and improve financial performance.

In 2003, Berezkin acquired a 5% stake in RAO UES, and a year later resold them to Gazprom for a profit.

From 2004 to 2007, member of the Board of Directors of RAO UES.

In 2006, he sold 49% of Rusenergosbyt (Russian Railways) to the Italian ENEL and more than 200 thousand clients, including the backbone corporations of Russia, small and medium-sized enterprises, and the population.

From 2006 to the present time, the chairman of the board of directors of the ESN group of companies.

In 2009, in partnership with Russian Railways, through the Energopromsbyt company, in which 49% belongs to the ESN group, acquired 76.92% of the shares of the TGK-14 energy company (enterprises are located in Transbaikalia).

Since 2010, he has been a member of the Board of Directors of Russian Railways, Chairman of the Electricity Commission under the Russian Union of Industrialists and Entrepreneurs.

Work in the Russian Union of Industrialists and Entrepreneurs

Since 2000, Member of the Board of the Russian Union of Industrialists and Entrepreneurs, since 2008 - Member of the Board of the RUIE, since 2010 - Chairman of the Electricity Commission under the RUIE.

At the meetings of the commission chaired by G.V. Berezkin, proposals were considered on amendments to legislative acts to ensure the effective development of the electric power complex of the Russian Federation, to exclude a significant increase in electricity prices for industrial consumers. They also discussed issues of the possibility of concluding and correct accounting in the trading system of the wholesale market of free bilateral contracts for the supply of electricity, participation in the wholesale market of end consumers, as well as independent energy sales companies on the territory of the non-price wholesale market. The possibility of normative consolidation of the right of consumers to choose a tariff for transmission services, as well as to exclude excessive penalties for exceeding the declared capacity value, was considered.

Own

Owned and controlled by Berezkin:

- 50.5% of shares in Rusenergosbyt (According to the directory of companies of the Business portal www.vedomosti.ru: Grigory Berezkin's ESN group (51%), ENEL (49%)).

- Uyarsk railway oil terminal (NT-service LLC).

- Engineering companies "Engineering Center UES" and "Energoauditkontrol".

- 38% of the shares of TGK-14 (through Energopromsbyt, where the ESN group of Berezkina owns 49%).

Among media assets:

- Publishing house "Komsomolskaya Pravda".

- RZD-Partner media company.

- Energy Today magazine.

- Metro newspaper.

Scandals

According to Novaya Gazeta, Grigory Berezkin has a very controversial reputation in business circles: for example, the former Minister of Fuel and Energy of the Russian Federation Viktor Kalyuzhny actually accused Grigory Berezkin of fraud related to oil production, which led to the abolition of the KomiTEK company: “Who in Komi before you were engaged in oil production? Grigory Berezkin, who in his entire life did not come close to a single well, but only manipulated cash flows. His team didn't give a damn about technical production - they created dozens of structures, pulled the whole KomiTEK apart! "

In 2002, the state decided to tighten control over the Yakut diamond mining concern ALROSA, but faced protests from local authorities. Grigory Berezkin tried to capitalize on this situation by starting negotiations on the acquisition of a 5% stake in ALROSA from the Fund for Social Guarantees for Servicemen under the Government of Russia. In response, the Ministry of Property Relations decided to completely liquidate the fund. The dispute continued until the end of 2002 and was resolved in favor of the state after the personal intervention of Alexei Kudrin.

Berezkin tried to acquire shares of the NTV channel, but in the end, Gazprom-Media gained control over the media. The Rusenergotelecom company, which is 75% owned by the ESN Group, is trying to seize the frequencies for the deployment of 4G communications in Russia. According to experts, the UST Group is trying to use administrative resources for the acquisition.

The Rusenergosbyt company, owned by Grigory Berezkin, supplied the Gazprom concern with electricity at a price 60% higher than the market value.

A family

He is married and has four children.

Grigory Berezkin owns a giant hangar in Moscow, where he stores dozens of vintage cars and a trampoline, on which he sometimes likes to jump.

Grigory Berezkin/ Grigory Berezkin

Source of wealth: electricity, investment

Place of residence: Moscow

Family status: married, four children

- Early 1990s Berezkin's company collected used cable, smelted copper and produced new cable, which was supplied to oilmen in exchange for their raw materials.

- Capital The ESN group, owned by Berezkin, owns Rusenergosbyt and other energy assets, the Komsomolskaya Pravda publishing house.

- Number Rus-Energosbyt has 200,000 clients (shareholders are the ESN group and Enel).

- Statistics The free Metro newspaper is the leader among daily newspapers in terms of audience in Moscow (1.1 million people). Komsomolskaya Pravda has “Tolstushka” - the second place among weekly newspapers in Russia (5.5 million people).

- Deal In the summer of 2012, Russian Railways sold its stake in TGK-14.

Right hand:

Mikhail Andronov

President of the Rusenergosbyt company

She has been working in Berezkin's structures since 2000. Supervises projects related to the electric power industry. Represented Berezkin's interests in RAO UES and its subsidiaries.

The name of the head of the ESN group of companies, Grigory Berezkin, is little known to the general public, although in the list of the richest people in Russia by Forbes magazine he has a fairly high rating with a personal fortune of $ 980 million. It should be noted that in the “golden Russian hundred” he is one of the youngest representatives of large Russian business.

Old friend of Abramovich

Grigory Berezkin graduated from the Chemistry Department of Moscow State University in 1988. Lomonosov. He also worked there at the Department of Chemistry, Oil and Organic Catalysis. In 1993 he even defended his thesis in the specialty "Petrochemistry". But this was the end of his scientific career, and the take-off in the oil business began.

Berezkin entered the cohort of so-called external managers, of whom there were not so many in the early 90s. It was later, after the 1998 default, that they multiplied and, without creating any business of their own, began to saw the assets of the once powerful backbone banks and bankrupt enterprises.

Berezkin, on the other hand, was actively involved in management in the oil industry back in 1994 as Deputy General Director of the oil production company Komineft, and later, in 1997, as General Director of the KomiTEK-Moscow Joint Stock Company. In mid-1997, Grigory Berezkin was appointed chairman of the board of directors of NK KomiTEK. At the same time, the management company Evroseverneft headed by Berezkin was involved in managing KomiTEK in order to get the company out of the crisis, which in 1999 was renamed ESN.

It's time to note that Roman Abramovich was Berezkin's main partner in the oil business. According to the newspaper Moskovsky Komsomolets, having brought Abramovich closer to the Yeltsin “family”, Boris Berezovsky entrusted him with all the financial and raw material flows of Sibneft. First of all, Abramovich gave the entire export of Sibneft to the company KomiTEK-Moscow, which was headed by his old friend Grigory Berezkin, for a whole year.

"KomiTEK-Moscow" was famous at that time for the highest percentage of "shrinkage and shrinkage" in oil transportation. "Shrinkage and shrinkage" left a good residue in the pockets of the exporters themselves. The capital accumulated at the first stage was subsequently used to buy out a controlling stake in Sibneft. It turns out that if Abramovich, as is commonly believed, was the "wallet" of the Yeltsin "family", then Berezkin was Abramovich's "wallet"? Later, Abramovich and Berezkin seemed to quarrel over the fact that the latter went over to the side of LUKOIL.

The former head of the Ministry of Fuel of the Russian Federation, Viktor Kalyuzhny, once in one of his interviews (Novaya Gazeta dated 02/04/2004) described the oil period in the career of our hero: “Who in Komi used to be involved in oil production? Grigory Berezkin, who in his entire life did not come close to a single well, but only manipulated cash flows. His team didn't give a damn about technical production - they created dozens of structures, pulled the entire KomiTEK apart to shreds. "

However, a team of professional PR specialists have long convinced public opinion of the opposite. In particular, it was Grigory Berezkin who tirelessly increased and increased the capitalization of KomiTEK and brought it to the figure of half a billion dollars.

As a result, it seems that exactly this amount (details of the transaction have not yet been disclosed) for KomiTEK in 1999 was paid by the company LUKOIL. The deal took place despite the fact that KomiTEK under the management of Grigory Berezkin had large debts to local budgets and to Western creditors, and ended 1998 with losses. Nevertheless, the increase in LUKOIL's assets due to the takeover of KomiTEK and its subsidiaries amounted to more than 15 percent, proved oil reserves - more than 25. True, at the same time, LUKOIL got a four-billion-dollar debt of KomiTEK and two hundred million (in dollars ) foreign loans, as well as 700 hectares of unrefined land and 250 kilometers of pipelines, which required replacement of old pipes - the result of the "effective" management of Grigory Berezkin.

Be that as it may, the shareholders and the directorate of "KomiTEK" received a solid commission - about 30-40% of the transaction. The exact numbers have not yet been announced. In any case, it was enough for Grigory Berezkin to become the owner of one of the largest collections of antique and rare cars in Russia - about a hundred rarities.

The owner of factories, newspapers, steam locomotives

The ESN group was created in 1990. He specializes in energy investments, crisis management and strategic management. Owns shares in ENEL ESN Energo, which manages the North-West CHPP, Rusenergosbyt company, and the Uyar oil loading station. The chairman of the board of directors of the group, Grigory Berezkin, is a member of the board of directors of RAO UES.

The UST claims that media is one of the priority areas of business development. Last year, it acquired the publishing house RZD-Partner, which owns the magazine of the same name, an Internet portal, the advertising agency Reklamotiv and the Sakvoyazh-SV magazine. These assets were merged into the Media Partner holding. "The acquisition of the KP is a new stage in the development of Media Partner, it will significantly increase its capitalization," the ESN said in a statement.

Publishing House "Komsomolskaya Pravda" publishes newspapers "Komsomolskaya Pravda", "Soviet Sport" and "Express Gazeta". The main asset of the publishing house is the Komsomolskaya Pravda newspaper with the largest circulation among the national Russian newspapers - 30 million copies a month. Its turnover in 2006 was, according to its own data, $ 130 million.

We talk about significant figures in Russian business. The hero of today's release is Grigory Berezkin, the owner of the ESN group of companies.

Grigory Berezkin was born on August 9, 1966 in Moscow. His father, Viktor Berezkin, was one of the most famous chromatographers (branch of organic chemistry - ed.) In Russia. The son began to work in the eighth grade, cleaning the underground passage on Gagarin Square. First, Grigory followed in his father's footsteps and graduated with honors from the chemistry faculty of Moscow State University with a degree in petrochemistry. Then he worked at the university, wrote a dissertation and defended it in 1993.

Berezkin came to business in 1989, when, together with friends at the university, he registered a cooperative and made IT systems for oil refineries in the Urals and Siberia. Then the first major project began - the cable business.

Sibkabel

Recycling cable for oil submersibles was a lucrative idea, as it was in short supply in Russia in the 90s. In some places, there was even nothing to replace the extraction with. Therefore, Berezkin invested the money earned on the cooperative in the project and equipped the Sibkabel plant, simultaneously collecting and processing cables throughout the country. He sold it in exchange for oil, becoming a trader. The business went on for two years.

This is how I got to know all the oil workers in the country. - says Berezkin in an interview with Kommersant. - This business grew very quickly, was successful, and just at the same time the possibility of privatizing oil companies opened up. A new market opened and I entered it.

In 1994 he became deputy general director of Komineft, and a year earlier he met Roman Abramovich. Berezkin's company exported oil from Sibneft, at the origins of which was Abramovich. In 1997, the state put Sibneft up for sale, and KomiTEK (Komineft's management company) took part in the tender. But Abramovich won, who bought the company and decided to trade oil on his own. This was the end of the partnership between him and Berezkin.

In 1998, Komineft's production exceeded 6 million tons, and soon the company was sold to Lukoil.

RAO UES of Russia

In the early 2000s, Grigory, whose team was structured into a separate management company, ESN, decided to participate in the reformation of RAO UES of Russia. He met with Anatoly Chubais, who entrusted him with the management of Kolenergo. As a result, the company entered the markets of Norway and Finland, and soon Berezkin registered the first energy sales company. In his management "Kolenergo" paid off accounts payable, increased capital investments. The first foreign energy company, the Italian Enel, was also involved in the industry. But the contract with RAO "UES of Russia" was signed for three years and ended in 2003, although Berezkin was a member of the board of directors before the abolition of the company.

5 facts about Grigory Berezkin:

1. Berezkin ranks 125th on the Forbes list.

2. For 2017, his capital is estimated at $ 800 million.

3. Rusenergosbyt supplies electricity to 68 regions of Russia.

4. Berezkin writes scientific articles on chemistry.

5. In 2017, Berezkin at Mikhail Prokhorov's RBC.

Gazprom

After working with Kolenergo, Berezkin took on a new project, now with Gazprom. He had an idea to buy shares in RAO UES, to which Gazprom agreed. At the same time, shares of subsidiaries of RAO UES were bought up, and Gazprom Energoholding was created.

Another merit of Berezkin is that the trading subsidiary of RAO UES Rusenergosbyt became an intermediary in the purchase of energy for Gazprom.

In 2006, Berezkin left Gazprom, a year later the company refused the services of Rusenergosbyt.

Russian Railways

While still working with Gazprom, Berezkin offered services to Russian Railways and in 2004 received the right to supply electricity to the company. In 2008, in partnership with Russian Railways, through Energopromsbyt, he acquired 76.92% of shares in the TGK-14 energy company, which was the only electricity supplier in the Trans-Baikal Territory and Buryatia. Since 2010, Grigory has been a permanent member of the Board of Directors of OAO Gazprom.

Today Berezkin owns 50.5% of shares in Rusenergosbyt. The company's sales volume has grown 2.5 times in ten years.

Grigory Berezkin with his wife. Photo:

Media business - Komsomolskaya Pravda and RBC

The media business has long attracted Berezkin. Therefore, in 2007, he bought out the main stake in Komsomolskaya Pravda. In addition to her, he owns part of the Metro newspaper, and this year Mikhail Prokhorov has RBK. Berezkin also tried to acquire the Russian Forbes, but the publication was received by the owner of Artcom Media Alexey Fedotov. In total, Berezkin owns five publications.

Berezkin does not stop doing science. He is a member of the Board of Trustees of Moscow State University, Ph.D. in chemistry.

Quotes

Who am I? Good question. I, like all of us, try to get to know this world, to understand it, to understand how it works. I would really like to contribute to it. I think I did it a couple of times. And the method of understanding the world most appropriate to my character is entrepreneurial activity. If I had lived at some other time, perhaps the method would have been different, but the meaning would have remained the same: all my life I have been creating something new. I am lucky, I have lived several lives. The life of a Soviet scientist at that time fascinated me a lot. And then I plunged into a completely different life, and business for me turned out to be more interesting than science.

There is actually a lot of money in the world for business development, the main thing is to find the right ideas.

The rate of development, for example, of the IT business is several times higher than that of the oil business. You are falling behind. The easiest way to shorten the distance and condense time is through the media. It is a useful connection to reality, a necessary umbilical cord that connects you to the world. Everyone is absorbing information. If you are in this chain closer to the center of the process, then there is more of it around you.

On June 16, 2017, ESN announced the purchase of control in RBC from Mikhail Prokhorov's ONEKSIM.

2007: Acquisition of the publishing house "Komsomolskaya Pravda"

As of 2007, the company specializes in energy investments, crisis management and strategic management. At this time, the company owns stakes in ENEL ESN Energo, which manages the North-West CHPP, Rusenergosbyt, and the Uyar oil loading station. The chairman of the board of directors of the group, Grigory Berezkin, is a member of the board of directors of RAO UES. Forbs magazine estimated his fortune at $ 830 million.

In early 2007, ESN became the owner of the publishing house "Komsomolskaya Pravda". The UST claims that media is one of the priority areas of business development.

"The acquisition of the KP is a new stage in the development of the Media Partner holding, it will significantly increase its capitalization," the ESN said in a statement.

The parties did not disclose the amount of the deal. According to Kommersant's information, Gazprom-Media has reached an agreement with Prof-Media on a price of $ 100 million for 60% of the publishing house. However, experts believe that the publishing house "Komsomolskaya Pravda" is much more expensive. Vadim Goryainov, co-owner of the Popular Press Publishing House, estimates the entire KP Publishing House at no less than $ 200 million: "And if the existing management is preserved, its value may rise to $ 1 billion in a few years."

At this time, the publishing house "Komsomolskaya Pravda" publishes the newspapers "Komsomolskaya Pravda", "Soviet Sport" and "Express Gazeta". The main asset of the publishing house is the Komsomolskaya Pravda newspaper with the largest circulation among the national Russian newspapers - 30 million copies a month. Its turnover in 2006 was, according to its own data, $ 130 million.

Market participants note that Komsomolskaya Pravda is incomparable in terms of business size with the existing assets of the UST, and they believe that this acquisition is political in nature. “Komsomolskaya Pravda is a very good direction of investment, it is an unequivocal market leader, whose share is constantly growing,” noted Mr. Goryainov. “But, unfortunately, no one considers it as a business, but only as a political asset. its political influence is comparable to Channel One. "

In this case, Grigory Berezkin's interest in the media business coincided with the interests of the Kremlin, says Marina Pereverzeva, vice-president of the Guild of Periodicals Publishers. “In fact, RZD-Partner already manages the media assets of Russian Railways, and when the state monopoly is privatized, the ESN group is obviously preparing to buy out other media assets of the OJSC (for example, the newspaper Gudok.-Kommersant),” she said. "and distribution opportunities of Russian Railways, they will receive one of the largest media holdings."

Ms. Pereverzeva recalled that at the World Newspaper Congress, foreign journalists were outraged by the fact that the KP had passed under the control of Gazprom.

“When a private person acquires the most circulated newspaper formally, the Russian authorities can no longer be accused of establishing total control over the media,” concludes Marina Pereverzeva. Viktor Shkulev, chairman of the board of directors of the publishing house Ashet Filipaki Shkulev, agrees with her, adding that in this way the authorities are creating an alternative media asset concentration center for Gazprom-Media under the control of the second most important state monopoly - Russian Railways. "Grigory Berezkin is close to Yakunin (the head of OJSC-Kommersant), he was entrusted with creating the second pole of mass media concentration," Mr. Shkulev is sure

Surname: Berezkin

Name: Gregory

Middle name: Viktorovich

Position: Chairman of the Board of Directors of the ECN Group of Companies

Biography:

In 1988 he graduated from the Faculty of Chemistry of Moscow University with a degree in petrochemistry. In 1991 he graduated from graduate school there, and in 1993 he defended his dissertation.

From 1991 to 1994 he worked at Moscow State University as a junior research assistant.

In 1992, together with Alexander Mamut and Vladimir Gruzdev, he founded the Slavyanka company on the basis of store No. 2 of the Oktyabrsky ORPO, which became the basis for the future Seventh Continent supermarket chain.

In 1993, after he started trading in oil, he met Roman Abramovich, who was involved in the supply of oil products from the Komi Republic.

In 1994, under the patronage of Abramovich, he became deputy general director of Komineft and at the same time its general representative in Moscow. At the same time, he was in charge of Mesco, a joint venture between Komineft and RAO International Economic Cooperation, which was at the same time one of the key shareholders of Komineft.

In 1995 he ran as an independent candidate for the State Duma of the Federal Assembly of the Russian Federation.

In 1996-1997, he headed KomiTEK-Moscow (KTM, the sales structure of KomiTEK), which, on behalf of Sibneft, exported oil from Noyabrskneftegaz.

In 1997, he consolidated the management levers of KomiTEK in his hands and became the Chairman of the Board of Directors of the company. In the same year, it acquired Evroseverneft (38%) and SB-Trust (29%), providing guarantees from the National Reserve Bank (NRB).

1997-1999 - Chairman of the Board of Directors of CJSC JSCB Ukhtabank.

From 1997 to 2005, Chairman of the Management Board of CJSC Evroseverneft (ESN).

In 1999, he organized the sale of the KomiTEK holding to LUKOIL. The experience of Berezkin's Evroseverneft with KomiTEK has shown that external management carried out by a specially contracted third-party company is the only way to get the company out of the crisis and thereby reliably protect the rights of shareholders of the company faced with difficulties.

In 2000, it was decided to invite ESN Energo as the managing organization of Kolenergo. The decision was agreed with RAO UES of Russia. By this time, Kolenergo was in a pre-bankruptcy state: overdue accounts payable exceeded 1.3 billion rubles.

In 2003, ESN Energo managed not only to stabilize the situation, but also to prepare JSC Kolenergo for reform.

In 2003, Berezkin acquired a 5% stake in RAO UES, and a year later resold them to Gazprom for a profit.

2004-2007 - Member of the Board of Directors of RAO UES.

In 2006 he sold 49% of Rusenergosbyt (Russian Railways) to Italian ENEL and more than 200 thousand customers.

Since 2006 - the chairman of the board of directors of the ESN group of companies.

In 2009, in partnership with Russian Railways, through the company Energopromsbyt, in which 49% belongs to the ESN group, acquired 76.92% of the shares of the energy company TGK-14 (Transbaikalia).

Since 2010 - member of the Board of Directors of Russian Railways, Chairman of the Electricity Commission under the Russian Union of Industrialists and Entrepreneurs.

He is married and has four children.

Source: Wikipedia

Dossier:

In 1993, Berezkin met Roman Abramovich, who was then engaged in the Komi oil trading business. In the second half of 1994, the shareholders of Komineft, Ukhta Oil Refinery and Kominefteprodukt approved the merger within the KomiTEK holding. Komineft itself already had a high status of a special exporter, and KomiTEK - the status of a government agent for the provision of oil products to the Komi Republic, the Arkhangelsk Region and the Nenets Autonomous District. The business relationship between Berezkin and Abramovich has passed the test of time. In 1996-1997, Berezkin headed KomiTEK-Moscow (KTM, the sales structure of KomiTEK). Berezkin's team worked directly for Sibneft, helping to establish new sales schemes. First of all, Roman Abramovich - for a whole year - gave all of Sibneft's exports to KTM. Grigory Berezkin brought the coefficient of "shrinkage and waste" when preparing oil for transportation to 0.88. That is, the KTM CJSC headed by Berezkin attributed 12% of all exported oil to losses (usually this figure does not exceed 4-6%). The capital accumulated thanks to Berezkin's efforts was subsequently used to buy out a controlling stake in Sibneft by Roman Abramovich and Boris Berezovsky.

Source: Slon.ru, 18 May 2009

September 15, 1999, when Berezkin organized the first merger in Russia of two Russian oil companies, NK KomiTEK and NK LUKOIL. According to media reports, this merger was part of a multi-step operation to redistribute the Russian oil industry. The operation was accompanied by the seizure of Transneft by riot policemen under the leadership of Semyon Vainshtok (at that time, vice-president of LUKOIL), the transfer of control over Purneftegaz to Roman Abramovich and the receipt of large monetary compensation by the ubiquitous Boris Berezovsky.

Grigory Berezkin, who played the role of a bargaining pawn in that game, received 120 million dollars for the correct vote of the shareholders of KomiTEK OJSC. The largest oil and gas asset in Komi, the purchase of which immediately increased LUKOIL's reserves by 25%, was "leaked" by Berezkin for an amount that was not serious even for that tough time - $ 500 million.

The general director of dace group llc smbat harutyunyan, the prison trade house

The general director of dace group llc smbat harutyunyan, the prison trade house Yakunin left, Rabinovich stayed

Yakunin left, Rabinovich stayed Rabinovich mikhail daniilovich

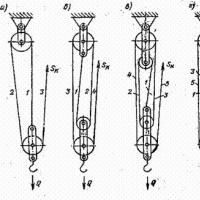

Rabinovich mikhail daniilovich Lifting loads without special equipment - how to calculate and make a chain hoist with your own hands

Lifting loads without special equipment - how to calculate and make a chain hoist with your own hands New details about Dimona's "charity" empire

New details about Dimona's "charity" empire Principal Buyer

Principal Buyer Edward cypherin biography. New Russian. How Eduard Shifrin, having earned $ 1 billion from Ukrainian steel, got involved in development in Russia. Eduard Shifrin and withdrawal of money

Edward cypherin biography. New Russian. How Eduard Shifrin, having earned $ 1 billion from Ukrainian steel, got involved in development in Russia. Eduard Shifrin and withdrawal of money