Salavatsteklo OJSC intends to expand the production volumes of the Saratov subsidiary. Intensive stirrer of glass batch Sultanov radik irekovich salavatsteklo biography

So far, the Novosibirsk region has not managed to attract such an investor as Salavatsteklo. In the photo - ex-governor of the NSO Vladimir Gorodetsky (left), first deputy chairman of the government of the NSO Vladimir Znatkov (center), ex-head of the Legislative Assembly of the NSO Ivan Moroz (right).

What helps and what prevents the Novosibirsk Oblast (NSO) from attracting investors, what are the reserves for investment growth in the region, Continent Siberia found out using the example of Salavatsteklo JSC. This Bashkir company has so far failed to build a plant in the NSO, although the project was publicly announced under at least two Novosibirsk governors.

Recall that the Bashkir company Salavatsteklo, which owns up to 30% of the Russian flat glass market, announced plans to build a plant in the region back in 2011. The deadline for the project worth 10 billion rubles was postponed at least three times. Having studied the history of the issue, "KS" was unable to obtain comprehensive information about what objective reasons or someone's unsuccessful decisions prevented the construction of an enterprise with a capacity of 800 tons of sheet glass per day in Novosibirsk, but learned a lot of interesting details.

Ex-head of the Novosibirsk region Vladimir Gorodetsky

Ex-head of the Novosibirsk region Vladimir Gorodetsky After Gorodetsky's resignation, he spoke about the ongoing interaction in early October and. O. Deputy Governor of the Novosibirsk Region Sergey Semka, specifying that the government offers the investor to consider the possibility of locating production on the territory of the bankrupt plant "Sibselmash". The regional government says that the complexity of the site selection is due to the "unprecedented" requirements of the investor to the territory. In particular, in terms of power, electricity, lack of groundwater, soil hardness, the presence of non-public railway tracks adjacent to the main railway, a certain configuration of the site.

At the same time, a source close to the leadership of Salavatstekla told KS that, in his opinion, the "sluggish process" was slowed down for a long time not by the lack of a suitable territory that would meet the requirements for the production of sheet glass, but by the inaction of the responsible officials of the NSO government. “Russia is big, I don’t think it’s difficult to find a suitable place to build a plant. It’s more likely not about the platform, but about the attitude, ”the interlocutor summed up.

He noted that the last time the general director of Salavatstekla, Sergei Agureyev, was in Novosibirsk with a shareholder to inspect the site in the village of Gorny. “They arrived, and there is a large factory operating there, dust is all around ... In glass production at the stage of coating application, there must be medical conditions,” the source said.

A source of "KS", familiar with the situation, told about another scenario of events, noting that, according to him, the decisive argument was not the parameters of the site, but an unsuccessful meeting of the chairman of the board of directors of JSC "Salavatsteklo" Radik Sultanov with the ex-governor of the Novosibirsk region Vladimir Gorodetsky ... “Despite the fact that the investor makes a number of requirements that are difficult to comply with on one site, the Gorny Company settlement suited him. The region, in turn, was also interested in building a plant on this land, since Gorny, when an investor came in, could receive the status of the Territory of Advanced Development. This was beneficial to both parties. Business would receive unprecedented tax benefits, savings could be about 20% of the total investment in the project, "- said the source of the publication. According to the interlocutor of "KS", negotiations were already underway, the site was studied by the chief engineer and technologist of "Salavatstekla", a visit to the Novosibirsk region of the general director and the owner of the company and a meeting with the governor were planned. However, something went wrong. “After meeting with Gorodetsky, Sultanov, leaving the office, said that not a single governor had spoken to him like that,” a source familiar with the situation told KS. - After that, the delegation went to look at the site in a spoiled mood. It was clear that the investor changed his mind. And indeed, having arrived in Gorny, they said that the site was not suitable due to the strong dustiness, ”the source added. At the same time, it was not possible to find out the details of the course of the negotiations from the governor of the "KS" - Vladimir Gorodetsky refrained from commenting.

Other plots proposed for construction were also not approved. In 2016, a delegation from the company arrived in the city to inspect the site next to the Novosibirsk artificial fiber plant. According to the source of "KS" in the company, the investor was going to agree, but it turned out that the defense plant had already bought these lands. Other territories also had their "surprises". “We saw the Industrial and Logistics Park (PLP),” said the source of the “KS”. - They wanted to offer the investor a plot on the other side, but it turned out that the construction of a large transport interchange was planned there. Accordingly, now it is too early to build something on this territory, since the boundaries of the transport hub are not yet clear. In addition, a pipe of a glass factory with a height of 80 meters may not meet the requirements of Tolmachevo airport, ”he added. The site of Sibselmash, which could suit the parties, did not work either. “Sibselmash has an owner, he said one thing at the meetings, but another thing turned out to be true,” a source of “KS” shared. - The owner of Sibselmash has other plans for the territory of the plant. Probably, all objects will be demolished for the construction of a residential complex, ”he suggested.

Another source of "KS", familiar with the situation, recalled that "Salavatsteklu" was offered territories and at a considerable distance from Novosibirsk. In particular, in Kuibyshev. “It is clear that all investors want to go to Novosibirsk, and the governor needs to develop the Novosibirsk region so that investors can enter small towns too,” the KS interlocutor responded with understanding about the choice of the administration.

At the same time, some of the deputies of the Legislative Assembly believe that the project under consideration has not yet been implemented due to the cool reception from Vladimir Gorodetsky.

“The meeting of the governor with the general director of the company Sergei Agureyev was scheduled, then postponed for two hours. Considering that the person flew in on purpose, such an expectation, I can assume, was not too pleasant for him, - said the interlocutor of "KS", who wished not to give his name. - The subsequent meeting left the businessman with an unpleasant aftertaste. Discussion of the project took no more than 15 minutes, the governor limited himself to general phrases, giving the order: "Yes, you do here." It turns out that the meaning of the visit was lost. Apparently, this greatly jarred Agureev. Probably, he thought: “If there is such an attitude at the stage of attracting investments, then what can be expected at the stage of implementation?” - suggested the interlocutor of “KS”. However, it is important to note that Continent Siberia itself did not confirm these details of the meeting.

Vladimir Gorodetsky (left) and Vladimir Znatkov. Photo from the archive "KS"

Vladimir Gorodetsky (left) and Vladimir Znatkov. Photo from the archive "KS" One of the deputies of the Legislative Assembly of the NSO also believes that in the actions of the economic block of the government "some kind of passivity can be traced." “There is no such methodology as, for example, in the Kaluga and Belgorod regions,” he says. - In other regions, investors from the moment they enter the region begin to "hug, drive to a restaurant" and offer all the best conditions. The authorities are responsible. If the project does not take place, it is punished very harshly there. Maybe this is not enough for us? " - he suggests. According to the deputy, several factors play a decisive role in working with investors. “I think there’s a little bit of everything here: the governor’s hands didn’t reach, and talked superficially ... I met and promised ... And the Ministry of Economic Development, on which the main thrust fell, - only good theorists, but not practitioners ... I came across the fact that they are simply for figures do not see significant cases, ”he said.

Regional Marketing Specialist Lada Yurchenko thinks , that in the region there is insufficient coordination of interaction between economic departments. « We have ineffectively built interdepartmental communications and the plans of different ministries are not balanced, - says Yurchenko. - There is no high-quality professional competition policy in the Novosibirsk region. No desire has been shown to implement a complex project in any area. Complex is one that considers economic development not as an end in itself, but as an instrument of social and territorial development. It is not in vain that the federal center demands project management. In Novosibirsk, this is not yet an accepted story, ”she added.

Deputy Chairman of the Committee on Budgetary, Financial and Economic Policy and Property of the Regional Legislative Assembly, Chairman of the Board of Directors of the Investment Development Agency of the Novosibirsk Region, Yuri Zozulya, is convinced that the Ministry of Economic Development "is not fulfilling its function." “They have learned to compose fantastic volumes about how wonderful our life will be, but, unfortunately, they don’t know how to really manage the economy,” said the source of the “KS”. “I believe that as long as there is such an ideology in the ministry, the region has no chances to get real development,” he said.

According to Yuri Zozuli, in order to reverse the situation, it is necessary to change the scenario from inertial to active. “We constantly say that it is necessary to actively search for investors. All this reminds of a story about halva. We often pronounce it, but it doesn't get sweeter in the mouth, - says Yuri Zozulya. - To move from words to deeds, you need real infrastructure, real mechanisms. It is necessary to determine what people are needed to work in this format, and also to determine what the region can offer. " The KS interlocutor is convinced that the Novosibirsk region should be one of the first in Russia that could implement a completely new innovative approach in terms of forming an investment package, including at the stage of bringing projects to commercialization - from a startup to large-scale production.

“Then we will be able to secure investors on a fairly long-term basis. It will be interesting for them to come here. And what will we surprise you with? Benefits? Other subjects of the Federation also offer benefits in the same way. Today we do not have a unique mechanism that distinguishes us from other constituent entities of the Federation, ”Zozulya emphasizes.

Olga Molchanova

Olga Molchanova At present, the Salavatsteklo company, according to KS, decided to take a short pause and do not plan a visit to the region yet, but the NSO has not abandoned their intentions to implement the project.

Subscribe to the Continent Siberia channel in Telegram to be the first to know about key events in the business and government circles of the region.

Found a mistake in the text? Select it and press Ctrl + Enter

June 8, 2011

OJSC Saratovstroisteklo will receive investments in the amount of 4 billion rubles. The corresponding agreement was concluded between the government of the Saratov region and the management of Salavatsteklo OJSC (owner of 100% of the shares of the Saratov enterprise) during the visit of a delegation from the Republic of Bashkortostan to the region. The government hopes that thanks to the investment project, the amount of taxes collected from the JSC will grow fivefold. Observers are not confident that funds will remain in the region and do not consider the investment to be very large.

On Saturday, a delegation headed by President of Bashkortostan Rustem Khamitov arrived in Saratov on a one-day visit. One of the points of the meeting was the signing of an agreement between the regional government and the enterprise for 2011. In accordance with the document, during 2011 the enterprise will receive investments in the amount of 4 billion rubles. With the funds received, this year will begin construction of a high-tech and energy-intensive line for the production of flat glass with a capacity of 700 tons per day.

As Kommersant was told in the regional government, the joint obligations of the regional executive power and the management of Saratovstroisteklo, spelled out in the agreement, are aimed at ensuring the growth of the plant's production volumes by more than 25% against the 2010 level. The document was signed by the governor of the Saratov region Pavel Ipatov and the chairman of the board of directors of JSC Salavatsteklo Radik Sultanov in the presence of the President of Bashkortostan.

JSC "Saratovstroysteklo" is a specialized enterprise for the production of polished sheet glass with a thickness of 2 to 10 mm, which meets the highest international standards. The enterprise has trade relations with almost all regions of Russia and 20 countries of the CIS, Europe, Asia and Africa. At the end of 2010, the volume of commercial products at JSC Saratovstroisteklo amounted to more than 4 billion rubles (157.4% to the level of 2009). Over the five months of this year, the volume of production at the enterprise amounted to more than 2.4 billion rubles, which is 162% higher than the same level of the last year. The company employs 968 people. The average salary is over 22 thousand rubles.

The investor of the new production was Salavatsteklo OJSC. In June last year, the company bought out 100% of the shares of the Saratov enterprise, becoming the actual owner of the OJSC.

Full package of shares, i.e. 302.3 thousand ordinary registered shares worth 1,000 rubles each were acquired by a Bashkir company for $ 40 million (at the exchange rate on the date of the agreement - 1.16 billion rubles - Kommersant). Previously, the securities of the Saratov OJSC belonged to private individuals, the largest block of 28.53% of the authorized capital was owned by the chairman of the board of directors of the company Alexander Lieberman, another 37.5% of the shares belonged to Alfa Capital Holdings Limited (Cyprus). Before the sale, the share of JSC Saratovstroisteklo in the Russian market was 16%. Today Salavatsteklo occupies approximately 30% of the entire Russian glass market and 70% of the flat glass market.

As Kommersant was told in the Ministry of Industry and Energy of the Saratov Region, the decision to build a new line was made by the enterprise due to the fact that OJSC Saratovstroisteklo is currently operating two lines with a total capacity of 1140 tons of glass melt per day and the service life of one of them is about to expire in 2012. The start of the investment project is scheduled for the second half of this year. In 2012, the glass production line should be launched.

The installation of the furnace will allow restructuring the production; less profitable production facilities with high specific fuel consumption will be closed. So, in 2008, the launch of the first line for the production of flat glass with a capacity of 700 tons per day made it possible to reduce electricity costs by 15-20% and gas costs by 20%. The increase in production volumes will take place not earlier than in 2013, after the line reaches its design capacity.

The regional government expects that as a result of the expansion of production, Saratovstroisteklo will pay five times more taxes compared to 2010. Employee salaries are projected to rise by at least 15%.

As the Minister of Industry and Energy of the Saratov Region Sergey Lisovsky explained to Kommersant, Salavatsteklo OJSC set a course for the modernization of production. Professor of the Volga Region Academy of Public Administration Alexander Stepanov is not sure that all the funds spent by the investor will remain in the region. According to him, it will depend on who will master the investment, especially if we take into account that Saratovstroisteklo OJSC belongs to Bashkir businessmen. “Those who signed the agreement on the part of our region should pay attention to all these factors,” says Mr. Stepanov. He also does not believe that the announced amount of 4 billion rubles is a very large investment project. “Some regions are developing several hundred billions each, but for us this is not bad either,” the professor noted.

Having invested 4 billion rubles in the Saratov region, Rustem Khamitov became an honorary professor at Saratov University. The investment agreement was signed during the visit of a government delegation led by the President of Bashkortostan.

In accordance with this document, a new glass-melting furnace with a capacity of 800 thousand tons of glass per year will be built in Saratov - investments during the year will amount to 4 billion rubles. “We are lucky that such people come to us with projects,” the governor of the Saratov region admitted. “We don’t feel sorry for” - the President of Bashkortostan Rustem Khamitov joked in response.

Rustem Khamitov was elected Honorary Professor of the Saratov State Social and Economic University. Here, at a meeting with teachers and students of the university, he was presented with a professorial robe and a professorial confederate uniform. As the university rector Vladimir Dinev noted, when Rustem Khamitov was elected as an honorary professor, the Academic Council was guided by the fact that many problems that Rustem Khamitov dealt with in his time are in the field of activity of this university.

At the end of the meeting, Rustem Khamitov presented the rector of the university with a sculptural image of Salavat Yulaev,.

During the visit, Rustem Khamitov visited the Bashkir courtyard in the ethnographic complex "National Village of the Peoples of the Saratov Region".

Representatives of the Kurultai Bashkirs of the Saratov region greeted the delegation of the republic with playing the kurai and national songs.

According to the chairman of the Executive Committee of the World Kurultai Bashkir Ilgiz Sultanmuratov, who is a member of the delegation, about four thousand Bashkirs live in the Saratov region.

Close ties are maintained between the Bashkirs of the Saratov region and the Republic of Bashkortostan, - noted Ilgiz Sultanmuratov. - In the near future, the Saratov Bashkirs will be guests of the Sabantuy in our republic.

Last year, the Minister of Culture of the Republic of Bashkortostan Ildus Ilishev gave a not rosy assessment to the Saratov Bashkirs at a scandalous meeting, accusing them of “raking up” the Bashkir forest and throwing between the two organizations “World Congress of Tatars” and “World Kurultai of Bashkirs”:

“I have so many questions about you Saratov residents, led by your boss, our entire forest has been raked up here, so sit down. I would ask more questions, what kind of Bashkirs you are there, a thousand times, I was there with you, in parallel you are all members of the World Congress of Tatars, and here you and there, as if you were standing ... I don’t know, and here alone foot, and there. And your genitals are hanging over the abyss. "

Maxim Averyanov, Ufa, Bashkiria - Bashkortostan

Rahmetov: Rating of Russian billionaires 2006, The richest Turkic-TatarsPLACE NAME YEAR OF BIRTH FROM PERSONAL BUSINESS: ASSETS, TRANSACTIONS, POSITIONS, DETAILS ASSESSMENT

BLN RUB. $ MILLION

25 URAL RAKHIMOV 1961 The son of the President of Bashkiria managed to accomplish what Moscow investors could not do - he privatized the local petrochemical complex "for himself" 72.0 2500

56 RADIK SHAIMIEV 1964 Nominally being an advisor to the CEO of TAIF Group, Radik Shaimiev (by the way, the European champion in autocross), according to the market, is among the shareholders of the regional holding 23.0 800

57 ALBERT SHIGABUTDINOV 1952 General Director of TAIF Group of Companies, which owns assets in the petrochemical complex, telecommunications, construction, banking, services, etc. 23.0 800

67 AIRAT KHAYRULLIN 1970 At the beginning of 2005, a State Duma deputy and owner of the Krasny Vostok group announced his readiness to sell the brewing business. A year later, Efes paid $ 390 million for it 20.3 705

91 Ilshat Khayrullin 1965 Brother of Ayrat Khairullin (No. 67) and before the sale of the business to the Turkish holding Efes Breweries Chairman of the Board of Directors of the Krasny Vostok - Solodovpivo brewing company 12.8 445

167 RAVIL MAGANOV 1954 Member of the Board of Directors of Lukoil. First Vice President of the company, responsible for the exploration and production of oil and gas. Owns 0.5% of Lukoil shares 7.3 255

238 AZAT KURMANAYEV 1961 Former President of Uralsib Bank. Sold the bank in 2003 to Nikoil structures. In the spring of 2005, he was deprived of his mandate as a deputy of the republican parliament due to absenteeism from meetings 4.3 150

272 RALIF SAFIN 1954 Member of the Federation Council from the Altai Republic, former vice-president of the oil company Lukoil. In 2003 he ran for President of the Republic of Bashkiria 3.7 130

358 RADIK SULTANOV 1965 Chairman of the Board of Directors of Salavatsteklo, through LLC RIA Company controls almost 59% of the shares of one of the largest manufacturers of glass and glass products 2.7 95

452 TIMUR GIZATULLIN General Director of Universal Trading. Owner of the Bashkir supermarket chain "Matrix" 1.7 60

505 SHAMIL SHAKIROV 1969 The president of the system integrator "Aiteco" was not mistaken, having made a bet on large corporate clients. Having accumulated experience, the company was able to work in the field of IT services and consulting 1.4 50

511 RUSTEM TEREGULOV 1968 Member of the Board of Directors of Vizavi Bank 1.4 50

630 TIMUR TIMERBULATOV 1954 Honorary President of the Conti Group of Companies. The Group advised Basic Element on the acquisition of the construction holding Glavmosstroy 1.0 35

The richest people in the CIS (except for Russia)

Place Name Country Condition ($ billion)

258 Rinat Akhmetov Ukraine 2.4

http://www.compromat.ru/main/top50/forbs2005.htm

Ramil Bignov - $ 50 million

| Asfandiyarov |

Russian billionaires rating 2006

Special project. "Finance." prepared the third annual rating of Russians, whose capital exceeds 1 billion rubles. The list has grown by one and a half times due to the billionaires from the "new economy".

Igor Terentyev

You are holding in your hands a special issue of the magazine dedicated to the largest owners of the Russian economy. How year and two years back we start with the phrase: "The more transparent the business environment is, the more accurate the rating will be." Another year has passed, during which several dozen Russian companies from various sectors of the economy disclosed information about their co-owners. The trend should continue in 2006 as well. Methodology for rating billionaires of the "Finance." somewhat differs from the classical scheme, according to which only the value of securities owned by a businessman is taken into account. We also count the income of a billionaire - dividends and money received from the sale of shares. Details with the methodology. This year, the rating includes 720 people, a year earlier - 468. The growth was mainly provided by the owners of the “new economy” companies, primarily retail and development, and the top managers of large commodity companies, whom the owners reward for loyalty, as well as fruitful work.

720 Russian billionaires control a total capital of more than $ 291 billion. The number of dollar billionaires has grown over the year from 39 to 50 people, of whom three have created businesses from scratch. They control assets worth $ 193.5 billion. Of the 720 billionaires, only 27 women owning a capital of $ 4.4 billion. 43% of this amount is controlled by Elena Baturina ($ 1.9 billion).

The "Magnificent Five", the new rating of billionaires has retained the status quo - the first five places remained with the same businessmen as a year ago. Moreover, none of them even changed places: Roman Abramovich, Oleg Deripaska, Mikhail Fridman, Vladimir Lisin and Viktor Vekselberg.

In 2005, Roman Abramovich ($ 18.7 billion) sold his largest asset, Sibneft. Since the countless list of enterprises owned by the governor of Chukotka together with partners is almost over, now his fortune will not increase at a galloping pace. Perhaps Roman Abramovich will turn into a rentier and live on interest, because the amount will run up in a year - hundreds of millions of dollars, which will be enough for Chelsea, Chukotka, and yachts.

In mid-January, the European Bank for Reconstruction and Development and the International Finance Corporation, in a joint press release, published information that Oleg Deripaska ($ 12.7 billion) is the owner of Basic Element and Russian Aluminum. The news did not become a revelation for the market, but Finans. and last year, when calculating the fortune of the aluminum tycoon, he proceeded from the premise that he controls the business 100%. The value of the aluminum giant is now estimated at $ 10 billion, and investors have the right to hope for an IPO of Rusal.

Mikhail Fridman ($ 11.4 billion) decided not to use the services of the EBRD to disclose information about the ownership structure of Alfa Group. The market got some of the information from an interview with the Wall Street Journal, in which Mikhail Fridman said that his share in the group exceeds 40%. And from the investment memorandum of Alfa-Bank it became known that Mikhail Fridman, German Khan ($ 4.05 billion) and Alexei Kuzmichev ($ 4.05 billion) own 77.1% of the shares of ABH Holdings, which owns ABH Financial Ltd. The latter, in turn, controls Alfa-Bank.

Previously, the same 77.1% of shares in Alfa Finance Holdings (AFH) were owned by CTF Holding. In turn, AFH owned the offshore companies ABH Financial Ltd, Alfa Petroleum Holdings and Alfa Telecom, to which all financial, oil and gas and telecommunications assets were registered, respectively.

From the memorandum of Alfa-Bank it follows that ABH Holdings belongs to private individuals. If we compare the old and new ownership structures, it turns out that individuals owned shares not only in the bank, but also in oil and gas and telecommunications companies. True, the composition of Alfa Telecom (now Altimo) shareholders was somewhat broader due to a group of minority shareholders, including Senator Gleb Fetisov ($ 85 million).

Thanks to the clearer ownership structure of Alfa Group (although it is still not completely transparent), Petr Aven ($ 1.41 billion) and Andrey Kosogov ($ 1.02 billion) have appeared among the dollar billionaires.

In 2005, Novolipetsk Metallurgical Plant placed its shares on the London Stock Exchange, having previously disclosed its share capital structure. Vladimir Lisin sold part of the securities, but he still controls about 82% of NLMK.

Alfa Group's partner in the TNK-BP oil company, Renova holding, is in no hurry to disclose the names of the owners. But several sources unofficially told the Finance magazine at once that about 90% of the capital belongs to Viktor Vekselberg ($ 8.1 billion). The remaining 10% of the shares are owned by members of the supervisory committee of the group Alexander Zarubin, Vladimir Kremer and Evgeny Olkhovik. However, minority shares were enough to estimate the fortune of each at $ 300 million.

Riddles of "black gold", despite the fact that the total number of dollar billionaires for the year increased from 39 to 50, the rating "lost" one of them. The head of Surgutneftegaz, Vladimir Bogdanov ($ 145 million), after each publication where he occupied the top places in the lists of the richest people, declared that this was not true. And now we completely agree with him. Undoubtedly, the head of Surgut is rich: his 0.3% at the time of the appraisal was worth $ 145 million. The controlling stake in Surgutneftegaz is still in the air: it is listed on structures close to the company itself. But 2005 showed that he could be brought back to earth quickly enough. Avtovaz, which has a similar picture of property, came under the control of the state-owned Rosoboronexport.

The situation with Yukos, or rather, with its main shareholder, the Menatep group, is no less confused than with Surgutneftegaz. Two former co-owners of the holding, Mikhail Khodorkovsky and Platon Lebedev, are serving sentences in correctional institutions. In January 2005, 59.5% of the shares of the Menatep group were transferred from Mikhail Khodorkovsky to Leonid Nevzlin ($ 420 million). Previously, 50% were owned by the trust, and another 9.5% belonged to prisoner # 1.

It is impossible to accurately assess the current state of Mikhail Khodorkovsky or Platon Lebedev, but we believe that their capital is no less than $ 35 million. After they are released, we can expect that they will receive back part of what remains of the Yukos-Menatep group ... We have estimated the other four shareholders of the holding in accordance with their stakes in the capital of Menatep.

This year, the rating of billionaires was replenished with five more shareholders of the Alliance group (the main assets are oil refineries). From corporate documents it follows that the widow of the founder of the company Madina Bazhaev controls 82.8% of the shares. But, in fact, she is a nominal holder, since the securities belong to the entire Bazhaev family. Not knowing the exact distribution of shares in the family, we "divided" the shares equally among its key members. Therefore, the list includes Isa, Mavlit, Madina, Musa Bazhaevs ($ 415 million each). In addition to them, the ranking also includes two key top managers of the group - Arsen Idrisov and Sergey Chizhov (140 million each).

Wholesale and Retail

In the previous rating, the magazine "Finance." wrote that the list was significantly replenished by representatives of non-resource industries. But almost all of them were in the "basement", closing the table, because a year ago, having before our eyes only the fact of the IPO of "The Seventh Continent", we quite conservatively estimated the cost of retail chains. The fears have now been dispelled. Fast-growing retail is a favorite of investors. The cost of retail chains grew by leaps and bounds throughout the year. Sometimes so quickly that investors overvalued the business. In particular, in December, Pyaterochka's shares fell 30% due to the fact that the company's growth forecasts did not materialize.

But there is still a blank spot in retail. We are talking about companies that sell mobile phones and digital devices. Business owners also refuse to talk about business valuation. Co-owner of Euroset Evgeny Chichvarkin ($ 330 million) told Finance magazine: "I don't know how much the company costs." And Dixis shareholder Andrey Shlykov ($ 65 million) believes that “there are different estimates, but there is no price as such. When someone pays at least some money for someone, then we will find out the real figure. "

We are optimistic about the prospects for mobile retail. First, although the market growth is slowing down, its volume has increased by tens of percent annually. Secondly, the average cost of a phone is constantly growing, which should have a positive effect on the profitability of the business. And thirdly, companies in an established market are forced to go for restructuring (get rid of unprofitable stores, build more profitable supply chains, etc.), which will undoubtedly increase their value.

Methodology for rating billionaires of the "Finance" magazine

At the first stage of preparing the rating, the magazine "Finance." determines the circle of persons applying for a place in the rating. The selection is carried out by analyzing the market position of the companies. At the second stage, states are assessed. The amount of capital is made up of the value of enterprises in which the entrepreneur owns shares, and other income (sale of business, dividends, wages, etc.) received during the active activity of the person on the list. Capitalization of companies whose shares are traded on stock exchanges is calculated as of December 31, 2005. At the third stage, an analysis is carried out for billionaires who own various assets in order to exclude from the capital the funds (income) spent on the purchase of new assets, the value of which was taken into account in the second stage. This technique allows the most accurate determination of a person's condition, in contrast to the standard technique, in which only the stock price is assessed. In preparing the rating, data from companies, the Central Bank, the Federal Financial Markets Service, analytical reports from leading investment companies and banks, anonymous expert assessments of billionaires and observers are used. The priority for the analysis is the assessments announced publicly. In cases where the exact share of a person in ownership is not officially known, the magazine "Finance." resorted to assessing this share by indirect indications. If the distribution of shares among managers is not known reliably (including by indirect evidence), then the securities were recorded in the first person of the company. When evaluating a family business, the magazine "Finance." was guided by the following principles. If the exact distribution of the authorized capital is not known, then the value of the joint venture created by the brothers was divided equally between them, and the value of the business, which is jointly run by the father and son, was assigned to the head of the family. The size of the fortunes of billionaires is an expert estimate of the "Finance" magazine, which can only be used informally. Estimates of fortunes are made in US dollars. The ruble estimates are based on the conversion at the Central Bank exchange rate as of December 31, 2005 ($ 1 = 28.78 rubles). Places from 571 to 640 in the rating are occupied by persons whose condition, for various reasons, is difficult to accurately assess, but it is estimated at no less than 1 billion rubles.

The general director of dace group llc smbat harutyunyan, the prison trade house

The general director of dace group llc smbat harutyunyan, the prison trade house Yakunin left, Rabinovich stayed

Yakunin left, Rabinovich stayed Rabinovich mikhail daniilovich

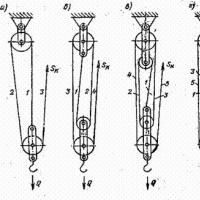

Rabinovich mikhail daniilovich Lifting loads without special equipment - how to calculate and make a chain hoist with your own hands

Lifting loads without special equipment - how to calculate and make a chain hoist with your own hands New details about Dimona's "charity" empire

New details about Dimona's "charity" empire Principal Buyer

Principal Buyer Edward cypherin biography. New Russian. How Eduard Shifrin, having earned $ 1 billion from Ukrainian steel, got involved in development in Russia. Eduard Shifrin and withdrawal of money

Edward cypherin biography. New Russian. How Eduard Shifrin, having earned $ 1 billion from Ukrainian steel, got involved in development in Russia. Eduard Shifrin and withdrawal of money