Calculation of salary upon dismissal. What payments are due upon dismissal of one's own free will? Calculation procedure. How is compensation for unused vacation calculated?

When terminated by an employee employment contract the company is obliged to pay him a salary. In this case, wages are accrued for the days that the employee worked in the month of dismissal, and compensation is paid for unused vacation days. There are different reasons for dismissal, therefore, depending on them, the employee is assigned compensation payments or severance pay and also keep the average monthly salary. In this article, we will analyze how the calculation and payment of wages is carried out upon dismissal of an employee.

Payment of salary upon dismissal

The dismissal of an employee and the calculation of all payments is carried out on the basis of a special document - Order to terminate the employment contract. This document is published in a certain form, which is approved by the State Statistics Committee.

The departing employee must be paid:

- Salary for the days actually worked in the month of dismissal.

- Compensation for unused vacation.

- The average monthly wage (according to the Labor Code of the Russian Federation).

- Severance pay (according to labor law).

Deadlines for payment of final wages

For the final payment of wages upon dismissal, special deadlines are provided for, established by Article 140 of the Labor Code of the Russian Federation. These payments are made no later than last day work of the employee, that is, the day of dismissal. But there are exceptions here: for example, in the actual absence of an employee at work. However, in accordance with the law, he retains his position. If the employee did not work on the day of dismissal, then payments are made no later than the day following the employee's request for the final payment.

The figure below in the infographic shows the terms of payment of wages upon dismissal and the responsibility of the employer to the employee for the delay in payment.

Payment of wages upon dismissal of an employee: terms and responsibility of the employer

If the employee and his employer could not agree on the amount paid upon dismissal, then the employee has the right to file a complaint with labor inspection and apply to the courts with a claim against the employer.

Severance pay upon dismissal

According to Article 178 of the Labor Code of the Russian Federation, upon termination of an employment contract, an employee is paid a severance pay equal to the average monthly earnings. Also, the employee retains average earnings per month for the period of his further employment. Usually the term of such payments is no more than 2 months from the date of dismissal. They are paid for:

- with the liquidation of the organization;

- with a reduction in the company's staff.

Severance pay for the first month is issued to laid-off workers, regardless of their further employment. The average salary is paid to the employee in the second month only on the condition that he was not hired by a new employer. So that former employee paid the average monthly salary at the time of his employment for the second month, he needs to prove that he is not yet working. For this you can provide work book, which does not contain a record of accepting an employee for a new job.

There are also exceptional circumstances due to which the average salary is saved for the employee in the third month. This decision is made by the Employment Service, where the employee must register no later than 14 days after the dismissal. If this institution does not find him a job within 3 months, then the employee retains the average salary. To obtain it, the employee provides the employer with a certificate from the Employment Service and a work book.

According to the norms of labor legislation, severance pay can be paid in the amount of two weeks of average earnings. This happens when the employment contract is terminated in the following cases:

- if the employee disagrees, be transferred to another place of work;

- when an employee is drafted into the ranks of the armed forces or when he is transferred to an alternative service;

- upon recognition of an employee as incapacitated in accordance with the conclusion of a doctor;

- if the employee does not agree to continue his activity due to a change in the conditions specified in the employment contract.

Documents upon dismissal of an employee

The employer must provide the resigning employee with the following documents:

- certificate 2-NDFL;

- work book;

- a certificate of the amount of earnings required for the calculation of benefits;

The employee has the right to apply for the issuance of copies of documents related to work. These include:

- Copies of orders for hiring, dismissal or transfer to another place of work;

- Information about wages, paid insurance premiums and so on.

Example #1. Calculation and payment of salary upon dismissal

Employee Ivanov Aleksey Viktorovich quits on November 20, 2013 due to conscription into the army. You need to calculate the final salary.

First, we calculate the salary for an incomplete month:

Considering that the monthly salary is 30,000 rubles, then

ZP for November \u003d salary / number of work shifts x number of shifts worked \u003d 30,000.00 / 21x14 \u003d 20,000.00 rubles.At the time of dismissal, Ivanov A.V. 2 weeks of unused vacation, so he is entitled to compensation for it (KO).

KO \u003d ZP for 12 months / (12 x * 29.4) * number of vacation days \u003d 30,000.00 / 29.4x14 \u003d 14285.71 rubles.Since Ivanov A.V. is drafted into the army, then according to the Labor Code of the Russian Federation he is entitled to 14 days of severance pay (SP).

VP \u003d average daily earnings during the year x 10 work shifts \u003d 1224.81 x 10 \u003d 12248.10 rubles.The amount of severance pay received is not subject to income tax.

The final calculation is determined by the formula: RFP + KO + VP - (ZP + KO)x13%Thus it is on the day of dismissal Ivanov A.The. will receive the final settlement of 42,076.67 rubles.

The term for payments upon dismissal is the last day of work (Article 140 of the Labor Code of the Russian Federation). If the employee did not work on the day of dismissal, then the issuance period is the day following the day the employee applied for the calculation. Failure to pay wages upon dismissal is punishable for the employer. Art. 236 of the Labor Code of the Russian Federation establishes the obligation of the organization, in case of late payment, to pay the employee compensation, which is equal to 1/300 of the current refinancing rate of the Central Bank of the Russian Federation (currently it is 8.25%) for each day of delay.

To determine the amount of compensation due, you must use the following formula:

K \u003d R: 100% x 1/300 x ∑ x D, where:

K - the amount of compensation;

R - refinancing rate;

∑ - amount of debt;

D is the number of days past due.

Upon dismissal, the employee must pay:

- salary for actually worked days;

- 13 salary (if prescribed in the collective agreement or in the provision on bonuses)

- compensation for vacations not used by the employee (Article 127 of the Labor Code of the Russian Federation);

- severance pay (upon liquidation of an organization and downsizing) (Article 178 of the Labor Code of the Russian Federation).

Calculation of wages upon dismissal

The calculation of wages also depends on the form of remuneration at the enterprise. It is made for all the days worked by the employee, while the day of dismissal is also included in the calculation. 13 salary is determined in proportion to the months that were worked out in the current year.

Calculation of compensation for unused vacations

To determine the amount of compensation for unused vacations by an employee, you should use the following formula:

Kotp \u003d Zav.dn. x Notp, where:

Notp - the number of vacation days, unused by the employee, is defined:

Notp = 2.33 x Nmonth, where

Nmonth - the number of months worked for which vacation was not granted.

A month worked more than half is taken into account.

Zsr.dn - the average daily salary, is determined by:

Avg.days = Year: 12 x 29.4, where

Year - the employee's income for the calendar year preceding the month of dismissal.

Payment of severance pay upon dismissal

In case of liquidation of an organization (clause 1, part 1, article 81 of the Labor Code of the Russian Federation) or in case of staff reduction (clause 2, part 1, article 81 of the Labor Code of the Russian Federation), the employee is obliged to pay:

- severance pay - one average monthly salary, issued on the day of dismissal;

- allowance for the period of employment - in the amount of one average monthly salary. Severance pay is issued two months after the dismissal;

- allowance for the period of employment - one average monthly salary, provided that the employee applied to the labor exchange within 14 days, but was not employed. In this case, the organization is obliged to pay benefits for the third time. The employee must present, in addition to the work book, an additional certificate from the employment service. In the northern regions, the average monthly earnings remain until six months of non-employment.

Non-payment or delay of salary upon dismissal

If the employer violated the deadlines for paying wages upon dismissal, as well as other prescribed payments, then the employee has the right to apply to the labor inspectorate (Article 356 of the Labor Code of the Russian Federation), the prosecutor's office or the court with a statement. So that the employer does not have grounds to declare that the employee himself did not appear for the calculation, it is necessary to contact him with a claim before applying to the justice authorities. Indicate in it: the date of dismissal, that they did not pay salaries and other payments, and the intention to apply to the courts of justice. It is written in two copies, one for the employer, and the second with the incoming registration number for the employee. You can also submit a claim by mail. by registered mail with notice. The labor inspectorate is obliged to consider the complaint within 30 days (clause 1, article 12 of the Federal Law No. 59).

Deadlines for filing a complaint with the justice authorities from the moment you receive a work book or a copy of the dismissal order:

- to the labor inspectorate - no later than three months (

Termination of an employment contract with an employee is always associated with a number of mandatory procedures for the management of the enterprise, and first of all, it entails the need to make a settlement upon dismissal. At the same time, the final amount should reflect not only wages for the days worked by the employee, but also compensation payments, including for unused vacation. In addition, depending on the reason for the dismissal, the employee may be paid severance pay at the time of settlement.

The Labor Code of the Russian Federation provides that in some cases the employer must transfer additional payments to the employee upon dismissal. According to Art. 178, severance pay is paid in the event of:

- liquidation of the enterprise;

- layoffs;

- employee's refusal to continue working significant change working conditions, transfer to another position or to an enterprise located in another area;

- conscription of an employee into the army or his transition to an alternative service;

- inability to continue work for health reasons.

The amount of severance pay depends on the reason for which the employee was fired, and can range from 2 weeks' wages to two (and sometimes three) months. If the employee was not paid upon dismissal or the amount due to him was not paid in full, this may entail bringing the employer to liability. The employee has the right to go to court and demand not only the amount due to him, but also compensation for its deduction (Article 236 of the Labor Code of the Russian Federation).

This procedure requires additional costs associated with the litigation. If it is proved that the calculation upon dismissal was not paid on time due to the fault of the employer, then he will bear not only liability but may also be subject to administrative or criminal liability. However, the decision of the issue through the court is a rather lengthy procedure. Therefore, it is better to resolve the question in advance: “How to get settlement after dismissal?”.

Retirement payouts

The termination of employment relations between the employee and the employer provides for the production of a full settlement between them. The amount of transfers depends primarily on the article under which the dismissal occurs and whether it provides for the payment of compensation. V general order an employee can count on:

- payment for actually worked days for the current reporting period;

- recalculation for unused vacation days for the entire period of work;

- severance pay (if in this situation it is provided).

When accruing settlements, wages are taken into account upon dismissal, together with all allowances due to the employee.

The legislation establishes strict requirements regarding the procedure for paying the calculation upon dismissal, as well as the time frame in which the company must transfer the funds due to the employee. In accordance with Art. 84.1 and Art. 140 of the Labor Code of the Russian Federation, a full settlement with a dismissed employee must be made on his last working day. If, for some reason, the employee did not work on the day of settlement, then payment after dismissal is made no later than the next day from the moment the request for settlement is received from him.

In accordance with Art. 236 of the Labor Code of the Russian Federation, in case of violation by the employer of the terms of payment of wages, including the dismissal of an employee, he bears liability in the form monetary compensation for each day of delay. It should be noted that the employee, when applying to the court, also has the right to demand that the amount of debt be indexed according to the current inflation rate.

In addition, the employer may be held administratively liable under Art. 5.27 of the Code of Administrative Offenses of the Russian Federation. In accordance with it, an individual entrepreneur or an official who is guilty of violating the terms of calculation upon dismissal will receive a fine of up to 5 thousand rubles. For legal entities, the amount is more significant - from 30 to 50 thousand rubles. In case of repeated violation, an increase in the amount of the fine or the issuance of a ban on the exercise labor activity in a leadership position. To bring the employer to administrative responsibility, the employee must contact the GIT department operating in the territory where the enterprise is located.

In particular severe cases, with a long delay in wages (from 3 months if part of it is not paid and from 2 months if the entire amount is withheld), the employer may be held criminally liable in accordance with Art. 145.1 of the Criminal Code of the Russian Federation. At the same time, a fine may be imposed on him with a ban on borrowing leadership positions, involvement in public works or imprisonment for up to 3 years.

It is important to take into account that criminal liability provides for the presence of mercenary intent in withholding wages. Therefore, a person can be involved in it only after it has been proved that he has a personal interest in keeping the calculation upon dismissal. For example, the director of an enterprise delayed payments in order to misuse them.

Compensation for unused vacation upon dismissal

When paying money upon dismissal, you need to pay attention to important point: when calculating compensation for unused vacation, it is not the calendar year that is taken into account, but the working year starting from the day the employee is employed. The calculation is based on the average daily earnings of the employee, multiplied by the number of vacation days due to him. It is important to take into account that from this amount, in accordance with the current legislation, all mandatory deductions, as well as income tax, must be paid.

If the employee has a debt to the enterprise, the amount of debt is deducted from the amount of payments when calculating. The debt also includes vacation days taken on account, but actually not worked days of rest. To carry out such a deduction, it is necessary to calculate the actual hours worked in the current year.

Withholding for unworked vacation days is not made if:

- the company is liquidated;

- the employee is calculated due to the impossibility of continuing work for health reasons and refused to be transferred to another position;

- the worker was drafted into the army;

- the dismissal of the head or accountant is carried out in connection with the change of the owner of the enterprise;

- a former employee was reinstated to the position occupied by an employee (through a court or by decision of the labor inspectorate);

- employer - a private person, was recognized in in due course missing or deceased;

- dismissal occurs for reasons beyond the control of the parties or due to force majeure.

Let us consider in more detail how the employee is calculated upon dismissal, the timing of its implementation. Ivanov, an employee, worked at the enterprise for 4 years, after which he wrote a letter of resignation for own will. In this case, he is not paid severance pay or other additional payments. To make the final calculation, the accountant needs to calculate the amount of wages for the actually worked and unpaid time, and also take into account vacation compensation.

Ivanov's monthly salary at this enterprise is 20 thousand rubles. There are 22 working days in total this month. Accordingly, his daily earnings are 909.09 rubles (20 thousand rubles / 22 days). This month he worked 17 days. This means that for the time actually worked, he should be credited with 15,454.53 rubles. From this amount, all deductions required by law are made.

Since the beginning of his current working year, 2 months have passed, vacation days for which he did not use. According to the rule approved by law, in general terms, it is considered that an employee receives 2.33 vacation days for a month worked. Based on this, O the final calculation upon dismissal of employee Ivanov is as follows: 2.33 x 2 (months worked) x 909.00 (daily earnings) = 4236.36 rubles. In total, he should be paid: 4236.36 + 15454.53 = 19690.89 rubles "

Documents upon dismissal

According to Art. 84.1. Labor Code of the Russian Federation, the termination of labor relations between an employee and an employer is formalized by an appropriate order or instruction. This document must be formatted in accordance with the requirements for drafting personnel documentation, approved by the State Statistics Committee, in the form of T-8 and T-8a.

The employer is obliged to familiarize the employee with the order under the signature. The employee has the right to demand a duly certified copy of this document. If, for objective reasons, it is impossible to familiarize the employee with the order to terminate the employment contract, or he refuses to sign the document, a corresponding note is made on the order.

On the day of dismissal, the employer must not only make a full settlement with the employee, but also transfer the necessary documents to him:

- work book;

- certificate of form 2-NDFL;

- certificate of the amount of earnings for the calculation of benefits;

- duly certified documents related to the performance by the employee of his labor functions (at his request).

Particular attention of the staff of the personnel department must be paid to the timeliness of the issuance of a labor former employee. The legislator does not allow the retention of this document at the enterprise. If it is impossible for the employee to hand it over on the day of calculation, or he refuses to receive it, then the employer is obliged to send him a notification about the need to come to the enterprise for it or agree to send it by mail. After sending such a notice, the employer is released from any responsibility for withholding the work book.

After receiving a written request from former employee on the transfer of labor after dismissal, an authorized official this enterprise should give him this document no later than three days from the date of application.

Upon termination of an employment relationship, an organization or enterprise must calculate the salary upon dismissal with an employee. In connection with the dismissal, employees are paid wages for the days worked in the month of dismissal and compensation payments for unused vacation. Depending on the reasons for the termination, the employee may also be assigned severance pay or compensation payments due to the termination of the employment relationship, as well as retain the average monthly wages.

The basis for formalizing the dismissal of an employee, including the basis for calculating all payments that he is entitled to by law, is the Order to terminate the employment contract with the employee. This order is issued in a certain form of maintaining personnel records. It is approved by the State Statistics Committee (f. T-8, T-8a). As a general rule, upon dismissal, an employee is paid:

1. Salary for working days that were actually worked out in the month of dismissal, for example, when an employee is dismissed at his own request.

2. Compensatory payments for unused vacation.

3. Severance pay (in cases established by labor legislation).

- work book;

- upon a written application of the employee, copies of documents related to work are issued: copies of orders for admission, dismissal, relocation; salary certificates, accrued and actually paid insurance premiums, etc.

An example of the calculation of wages upon dismissal

On November 19, 2015, Sergey Nikolayevich Fedorov, an employee, resigned due to a call to military service. Calculate final salary.

To begin with, we calculate wages for an incomplete month:

Based on the fact that the monthly salary is 25 thousand rubles. , then

Salary for November \u003d monthly salary / number of work shifts x number of shifts worked

ZP for November = 25,000.00 / 20x13 = 16,250.00 rubles.

At the time of dismissal, Fedorov S.N. two weeks of unused vacation, so he is entitled to compensation for unused vacation.

Vacation compensation (KO) \u003d RFP for 12 months / (12 * 29.43) * number of vacation days

KO \u003d 25000.00 / 29.43x14 \u003d 11945.39 rubles.

Since Fedorov S.N. is drafted into the army, then according to the Labor Code of the Russian Federation, he is entitled to two weeks of severance pay.

Severance pay (SP) = average daily earnings for the year x 10 work shifts

Average daily earnings: salary for the previous 12 months / 12 / 29.3

25000 / 29.3 \u003d 853.24 rubles.

VP \u003d 853.24 x 10 \u003d 8532.40 rubles.

This severance pay is not subject to income tax.

Final settlement \u003d ZP + KO + VP - (ZP + KO) x13%

On the day of dismissal Fedorov S.N. will receive the final settlement in the amount of 35448.85 rubles.

Labor relations that may arise between an employee on the one hand, and an employer on the other, which include individual entrepreneurs and other enterprises, are regulated by special labor legislation (Labor Code of the Russian Federation). One of the ways to terminate one's labor activity is the employee's departure of his own free will. The main issue that will be of interest to both the individual entrepreneur and the employee is the procedure and terms for calculating the dismissal of an employee at his own request.

Calculation procedure

After a person has decided to stop his labor activity at the enterprise, while he wants to do it of his own free will, his employer must understand that in this case there are some obligations.

The first thing that the employee and his employer need to pay attention to is the calculation that must be made. This includes the following amounts:

- payments for all days of unused vacation;

- payment for days worked, as well as other amounts that were accrued, but for some reason not paid to the employee.

The second issue that will be raised is the timing of the calculation in case of dismissal of an employee of his own free will. In 2019, the rules labor law actually haven't changed. According to them, the full calculation, in case of dismissal of one's own free will, should take place as follows:

- if the employee was at work, then on the last day he is given a work book, and a calculation is made after the dismissal of his own free will;

- if on the last day a person was not at work (sick leave, vacation), then the settlement with him will be made only after he appears at the enterprise, that is, after a certain time period.

It should be remembered that the procedure for settlement with an employee who wrote a statement that he wants to quit of his own free will is clearly regulated by the current legislation. If the deadline is violated, then various financial sanctions may be imposed on the individual entrepreneur, who acts as an employer, after applying to the labor rights inspectorate, the prosecutor's office or the court.

It is important to know that the procedure for dismissal of one's own free will is a separate article on termination of employment, and in this case, both parties have clear rights and obligations that must be used.

Specialist about the procedure: video

The procedure for dismissal at will

An employee who decides to break off his relationship with the employer, through dismissal of his own free will, must follow the following algorithm:

- First, he applies with a corresponding application to the personnel department, or directly to a private entrepreneur. In the application, the period after which the employee will no longer return to work must be indicated.

- In turn individual entrepreneur either a guide legal entity, will take into account the period after which the employee will not go to work workplace, and look for an appropriate replacement.

- On the last day of work, the individual entrepreneur or the accounting department and personnel of the enterprise must give the employee his work book, with all the necessary entries, and also make a calculation.

An example of a resignation letter would be as follows:

- in the upper right corner, a “cap” is written, where the name of the employer is indicated, as well as the personal data of the director;

- then personal data of the employee and his position are written;

- lower center, you need to write "Statement";

- this is followed by a text indicating that the employee wishes to quit of his own free will, and also prescribes the period after which he will no longer go to work;

- then the date of writing is put, and the person signs.

When all issues are agreed, the employer must issue special order on personnel, in which indicate that a person is subject to dismissal from a specific date, and indicate in it what amount he is entitled to as compensation.

Wherein self employed must understand that upon dismissal, a person must familiarize himself with this order and put his signature in it. A copy of it is issued only at the personal request of the employee, after signing all the necessary papers.

This sample application is universal and can be handwritten or typed. This document is the basis for the dismissal of an employee.

On the last day of work, with him, as indicated above, all payments due to him must be made.

It is important to know that there are situations in which a person wants to quit while on sick leave or vacation. This practice sometimes confuses entrepreneurs. There is nothing wrong with this. It's just that the employee writes in a statement that the last day of his work will be the date of exit from vacation or sick leave.

In this case, the calculation period, as well as other legal subtleties, will be carried out after leaving the sick leave or vacation.

Development and its accounting in the final calculation in 2019

The Labor Code of the Russian Federation provides for a 14-day period for working out when an employee is dismissed at his own request. In cases of dismissal of an employee whose labor Relations with the employer were urgent, that is, they were concluded for a certain period, the time of working off will depend on the term of the employment contract. Employment contracts for a period of less than two months have a shorter working period, which is set at 3 days.

A similar three-day period is also established in the event of dismissal of an employee hired with a probationary period.

An extended period of working out is provided for retiring senior employees. So, directors, chief accountants, etc. the processing time is one month.

Any period of working off can be reduced or not applied at all in case of mutual consent of the leaving employee and the head of the enterprise. He can shorten its duration with his visa.

Important! Working off is a full-fledged working time, and absenteeism is absenteeism with all the ensuing consequences.

Conditions that exclude processing are:

Transfer of a spouse to a place of work in another locality(certificate-call is provided);

Admission to study at the full-time department (based on the enrollment order);

An employee's first retirement. This right can only be exercised once. In case of re-employment and subsequent dismissal the pensioner will be required to undergo a full work-out, if required by the management of the enterprise.

In cases of dismissal of an employee due to the fault of the enterprise: delays in the payment of wages, lack of normal working conditions, etc.

Days worked are paid according to general rules, in accordance with tariff scale, salary, etc.

Calculation of payments for unused vacation

In 2019, the procedure for making compensation payments to those who leave of their own free will has not changed at all compared to 2018.

Vacation pay example:

- if the length of the vacation is 28 days, then for each full month worked, the worker can count on 2 calendar days holidays;

- 6 months worked from the last vacation, after which a letter of resignation was written, which means that compensation will be for 12 days of unused vacation.

Such an example is universal and can be applied to the calculation of any vacation pay. A sample miscalculation can be found in the Government Decree on the procedure for calculating the average daily wage and vacation pay.

There are cases when the vacation period is reduced to 26 days. Then an integer number will not be obtained for one month (for example, 1.8 days will come out). In this case, everything is rounded up to a whole number - 2, and the calculation takes two days.

This must be remembered. Since in case of incorrect payment of vacation pay, a person can file a complaint with various state bodies, which can fine an individual entrepreneur or other business entity.

It is important to know that the above Government Decree, as well as Labor Code, penalties are prescribed for late settlement with the worker. He may demand compensation for late payment, as well as a penalty, which will be equal to the key rate, which is determined by the Central Bank of our country.

During the year it is constantly changing, and this must be monitored.

The procedure for other payments upon dismissal in 2019

After writing a letter of resignation, individual entrepreneurs and other employers must understand that, in addition to vacation pay, they must also make other legal payments by the due date. The wage bill has not changed much and may consist of different constituent parts, an example of the payment of bonuses for the anniversary of the enterprise.

Therefore, when accounting and personnel service begins to calculate the necessary payments after dismissal, they can make a mistake that can lead to the imposition of penalties on the enterprise. To prevent this from happening, it is important to understand which payments are included in the settlement and which are not.

Components of wages that are included in the example of calculating compensation in 2019:

- accruals that are paid for the qualifications of an employee;

- salary indexation;

- amounts that are paid extra for various difficult working conditions, harmfulness;

- compensations that are paid for work in difficult climatic conditions (for example, the north);

- payment that is aimed at various incentives for employees (for example, bonuses and other similar accruals).

As an example, you can refer to regulations, which regulate the procedure for remuneration, and the constituent elements from which the mandatory and additional wage funds are formed.

These components of the salary, in without fail are taken into account and paid on time after writing a letter of resignation of their own free will.

Other accruals that are not included in the mandatory wage fund, but can be paid by the employer on their own, are of a one-time nature, and they do not need to be taken into account when paid on time after dismissal.

An example of such a calculation is as follows:

- the employee's salary consists of a salary of 15,000 rubles, a bonus of 5,000 rubles, an additional payment for harmful conditions 5,000 rubles, additional payment for work in harsh climatic conditions 10,000 rubles;

- the total salary is 35,000 rubles, and was accrued for April 2019;

- the employee worked 3 days in April, and filed a statement in which he asked to be fired of his own free will, indicating that he would work for another 2 weeks (including days off), as required by labor legislation;

- this means that his compensation will be as follows: in April, 21 working days, and the employee, taking into account the days off, worked 13 days, which means that he is entitled to 35,000/21 = 1667 rubles in one day, and 1667x13 = 21671 rubles in 13 days.

Thus, the calculation of compensation upon dismissal on wages will take place.

In principle, such calculations are present in various Decrees of the Government of our country, which regulate the issues of compensation for employees who leave their jobs.

You should also pay special attention to the solution of the following question. There are cases when during the year, or another period of work, some wage arrears may arise before the employee. In this case, this debt must be indexed and paid upon dismissal.

It is important to know that if an individual entrepreneur is not able to hire a lawyer or a professional accountant, and tries to solve such processes on his own, then he must definitely familiarize himself with the sample of the above calculation, or turn to professionals for this question. This is necessary to avoid subsequent questions from regulatory authorities.

When calculating the dismissal of an employee, an individual entrepreneur, or another person who is engaged in economic activity, must pay the employee compensation for the days of unused vacation for the entire period of work, as well as wages for the time he was at work.

Related posts:

No related entries found.

Where can I place free advertising on the Internet?

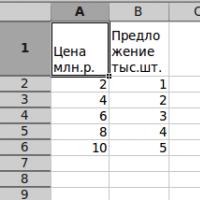

Where can I place free advertising on the Internet? Proposal: supply factors, law The law of supply in brief

Proposal: supply factors, law The law of supply in brief "soft" corruption How to determine if there is nepotism in the administration

"soft" corruption How to determine if there is nepotism in the administration The SEVCO WMS computer system is a powerful and flexible warehouse management tool

The SEVCO WMS computer system is a powerful and flexible warehouse management tool How to open a nightclub from scratch: a business plan to help a beginner

How to open a nightclub from scratch: a business plan to help a beginner Different structure and density

Different structure and density Best-selling goods in Russia: statistics

Best-selling goods in Russia: statistics