Seasonal work. Seasonal worker - personnel issues. Calculation of compensation for unused vacation to a seasonal worker

Seasonal work is recognized as work that, due to climatic and other natural conditions are carried out within a certain period (season), not exceeding, as a rule, six months.

Lists seasonal work, including certain seasonal works, which can be carried out during a period (season) exceeding six months, and the maximum duration of these separate seasonal works is determined by industry (inter-sectoral) agreements concluded at the federal level social partnership.

A COMMENT

Unlike the previous version of the article, which limited the duration of seasonal work to six months, new edition of this article provides that certain types seasonal work in its duration may exceed the specified period.

Significant changes have been made to the procedure for determining (approving) the list of seasonal work.

The article in the previous version contained a provision providing that the list of seasonal work is approved by the Government of the Russian Federation. It should be noted that the corresponding list of seasonal work in pursuance of Art. 293 of the Labor Code of the Russian Federation was not approved by the Government of the Russian Federation.

The amendments made to the commented article established that the lists of seasonal work, including individual seasonal work, which can be carried out during a period (season) exceeding six months, and the maximum duration of these individual seasonal work should be determined by sectoral (intersectoral) agreements, concluded at the federal level of social partnership.

Thus, this mechanism involves the adoption of an agreement signed by all-Russian associations of employers and trade unions with the participation of federal executive authorities. Such a list can also be developed and approved within the framework of the RTK.

Currently, there are decrees of the Government of the Russian Federation of 04/06/1999 No. 382 “On the lists of seasonal work and activities used for tax purposes” and of 07/04/2002 No. 498 “On approval of the List of seasonal industries, work in organizations of which during the full season when calculating the insurance period, it is taken into account in such a way that its duration in the corresponding calendar year is a full year.

According to the above decrees of the Government of the Russian Federation, seasonal work, in particular, includes work in forestry (forestation and reforestation, including soil preparation, sowing and planting forests, caring for forest crops), seasonal work in organizations for the production of meat products, poultry processing and the production of canned meat, crop production, fur farming, extraction, drying and cleaning of peat, etc.

However, it should be noted that these acts of the Government of the Russian Federation were adopted for purposes not related to the regulation labor relations.

Article 294 employment contract on seasonal work

The condition of the seasonal nature of the work must be specified in the employment contract.

Part two is no longer valid. - Federal Law of June 30, 2006 No. 90-FZ.

COMMENT 1.

The condition for the seasonal nature of the work is prerequisite employment contract, so the employee must be warned that he is being hired for seasonal work.

An indication that the employee has been hired for seasonal work must also be in the order (instruction) of the employer on hiring him.

Taking into account the changes made to the commented article by Federal Law No. 90-FZ of June 30, 2006, it can be assumed that an employment contract for seasonal work can be concluded for a period exceeding six months.

Lists of seasonal work, including individual seasonal work, which can be carried out during a period (season) exceeding six months, and the maximum duration of these individual seasonal work should be determined by sectoral (intersectoral) agreements concluded at the federal level of social partnership. 2.

The new wording removed from the content of the article the provision according to which, when hiring workers for seasonal work, the probation cannot exceed two weeks. However, this does not mean a ban on the possibility of establishing a test for an employee when hiring him for seasonal work.

When concluding an employment contract for a period of two to six months, the test cannot exceed two weeks (see part 6 of article 70 of the Labor Code of the Russian Federation and commentary thereto).

Thus, when an employee is hired for seasonal work for a period of up to six months, he may be placed on probation, which cannot exceed two weeks.

There are many businesses whose activities depend on the season. Accordingly, some personnel of such companies, due to natural conditions, can only work during a certain period of time, for example, exclusively in spring and summer. Ch. 46 of the Labor Code of the Russian Federation regulates labor relations with seasonal employees.

Definition and features

Art. 293 of the Labor Code of the Russian Federation gives a clear definition - seasonal work is considered to be work that, due to climatic conditions, is performed in a certain period of time.

Seasonal work according to the Labor Code of the Russian Federation has the following features:

- Work directly depends on the climate, it cannot be done year-round.

- Seasonal work, as a rule, does not exceed six months.

- Such work is stipulated by sectoral and intersectoral documents.

According to par. 2. Art. 293 of the Labor Code of the Russian Federation, lists of seasonal work may be valid for a season exceeding 6 months. The longest duration of seasonal work is determined by agreements that are concluded at the federal level of the social partnership.

Seasonal Workers' Guarantees

Seasonal workers are subject to general rights and guarantees determined by the Labor Code of the Russian Federation. However, the code also provides for a number of certain features for this category.

Payment for the work of seasonal workers is stipulated in the employment contract and cannot be lower than the minimum, excluding bonuses and other additional payments. Also, seasonal workers have the right to claim payment for sick leave and count on vacation, like other workers. The actual terms of work are necessarily displayed in the work book and serve as the basis for calculating a pension.

In case of seasonal activity, in the sectors specified in the Government Decree of 04.07.2002 No. 498, work for the entire season is added to the length of service to calculate the pension of seasonal workers as for the year.

A seasonal worker has the right to claim vacation. For each month worked, he is entitled to two days of rest (Article 295 of the Labor Code of the Russian Federation). When calculating holiday amounts, average earnings taken over the last three months. If the duration of work of a seasonal worker is less than 3 months, the average earnings are taken for the hours actually worked.

Early termination of the employment agreement is allowed. If an employee decides to quit own will, he must inform the organization about it three days in advance. When reducing staff, the organization sends the worker a week's notice and is obliged to pay compensation in the amount of two weeks' average earnings (Article 296 of the Labor Code of the Russian Federation).

List of seasonal works

Lists of seasonal work are determined by sectoral and intersectoral agreements.

Thus, the list of seasonal work, approved by Decree of the Government of the Russian Federation No. 498 of 07/04/2002 (as amended on 06/10/2014) includes areas of activity where people work at certain times:

|

Industry |

Description |

|

Peat |

Bog activities, peat extraction and drying, equipment maintenance. |

|

logging |

Extraction of oleoresin, spruce sulfur, resin. |

|

Timber rafting |

Ejection of wood into water bodies, timber rafting, sorting in water, rolling out onto land, loading onto ships. |

|

Forestry |

Cultivation and restoration of the forest. |

|

Dairy |

Activities related to dairy products and canned products from it. |

|

Production and processing of meat products. |

|

|

Catching fish, seafood and their processing. |

|

|

Sugar |

Activities for the manufacture of granulated sugar and refined sugar. |

|

fruit and vegetable |

Growing and processing vegetables and fruits. |

There are also certain types of activities that are carried out regardless of industry affiliations:

- landscaping: pruning trees and gardening, snow removal;

- carrying out external repairs of buildings;

- blanks;

- labor associated with industrial mountaineering;

- laying and repair of roads.

For example, landscaping of the city is carried out exclusively in spring and summer, and snow removal in winter and early spring.

Labor legislation includes two types of seasonal work: up to six months and more than six months. The deadline applies to certain seasonal work established by law. Any lists of seasonal work are established at the federal level within the framework of the social partnership.

There are certain types of work that are performed only during certain periods of the year. Such work is usually called seasonal. The employment relationship between the employer and the subordinate is regulated in this case by a fixed-term employment agreement.

Read our article:

The contract specifies the duration of the season, working conditions and the amount of remuneration. When hiring a seasonal employee, a hiring order is necessarily issued and an entry is made in work book. Holidays for seasonal workers are also allowed. The day of dismissal of a seasonal employee is considered the last day of the fixed-term employment agreement.

In part 1 of Art. 293 TC, which can be performed only in a certain period of time. Such works are called. But how are such employees hired and fired? What is the procedure for granting leave for these employees?

Hiring a seasonal worker

The general procedure for hiring a seasonal employee is described in Art. 57 TK. If you miss information about the standard details and provisions that are contained in a typical employment contract, it is necessary to indicate the seasonal nature of the work.

Hiring a seasonal worker requires a conclusion. This rule is enshrined in Art. 59 TK. The period of validity of the agreement is allowed to be determined:

- specific calendar date;

- The start of a specific event.

When a company is hiring, it has the right to set . Such a period lasts no more than two weeks if a citizen is hired for a period of 2 to 6 months.

However, if the duration of such work exceeds six months, then according to Art. 70 of the Labor Code, the trial period should not. But if a person works in this company for no more than two months, it is forbidden to establish a trial period at all.

IN without fail the employment agreement should indicate the exact place of work of the seasonal worker.

Documents when hiring a seasonal worker

Every citizen who wants to get a job must present a certain list of documents. A list of these documents is contained in Art. 65 TK. According to this article, a potential employee presents:

- A document that allows you to identify his personality;

- work book;

- Certificate of compulsory pension insurance;

- For persons who may be called to military service, it is necessary to present documents of military registration;

- A document confirming the presence of education or possession of special skills, without knowledge of which it is impossible to perform official duties.

After that, it is carried out documenting labor relations.

Registration of a seasonal worker

Registration, as well as labor regulation, practically does not differ from hiring a specialist on an ongoing basis. Registration of an employee for seasonal work is carried out in the following order:

- The new employee gets acquainted with the Internal Regulations;

- The employer and employee sign an employment contract;

- An order is drawn up and issued on the admission of a seasonal worker, with which he must familiarize himself and sign it;

- An appropriate entry must be made in the employee's work book;

- Issued personal card employee.

The order on registration of an employee for seasonal work is issued on form No. T-1. The order for hiring a seasonal worker is drawn up and issued after the conclusion of an employment agreement.

This document does not need to specify all the conditions for cooperation between the employer and the employee. It is enough to indicate the seasonality of work in the line "nature of work".

Seasonal workers on staff

The staffing table is a document that contains data on the number of posts. From this we conclude that seasonal workers in the staff list must be indicated, because new vacancies appear in the company for a certain period of time.

If the company has seasonal employees in the staffing table for the first time, then in staffing certain changes should be made. We are talking about adding new positions to this list.

In order not to make changes to the staffing table every time it becomes necessary to hire employees for a certain period, make a note in column No. 10. In this column, indicate the seasonal nature of such positions. After completion of work, these vacancies will be free.

Seasonal workers on vacation

According to Art. 122 of the Labor Code, an employee can go on vacation only after he has worked for the position for at least 6 months. Following this article, it turns out that seasonal workers in the vacation schedule can only count on vacation if they are hired for a period of more than 6 months.

When concluding an employment agreement for more than six months, the employee must be added to the vacation schedule. This is the difference between temporary and seasonal workers.

Leave for a seasonal worker

The right to leave for short-term employees is guaranteed by Art. 114 TK. For such employees, vacation is calculated according to the following scheme: for each month worked, the specialist has 2 days for vacation.

In addition to the mandatory annual leave, such employees are entitled to an additional period of rest. Additional leave is granted in the following cases:

- A citizen performs his official duties in dangerous or harmful conditions;

- The employee works on an irregular work schedule;

- The work is special;

- The employee works in the Far North or other areas that have been equated to this area.

It is worth noting that the head of the company has the right to independently provide his subordinates with additional holidays. The conditions, as well as the procedure for their provision, should be determined by the collective agreement or local regulations.

When can a seasonal employee go on vacation?

Part 2 Art. 122 of the Labor Code states that an employee can write an application for leave after he has worked at his current place of work for more than 6 months. This rule also applies to seasonal employees, because Chapter 46 of the Labor Code does not contain special rules for regulating working relations with this category of employees.

In the same article, TC in question that leave may be granted to such employee earlier. This is possible if the employer and the employee agree on the provision of such leave.

Vacation with subsequent termination of the employment contract

Upon termination of the employment agreement, the employee may first go on vacation, and only then quit. In this case, the day of dismissal will be considered the last day of vacation. This is stated in Part 2 of Art. 127 TK.

Most often, the vacation period with subsequent dismissal is provided when the rest time will partially or completely go beyond the duration of the employment agreement. This situation is allowed in Part 3 of Art. 127 TK. In this case, the last day of vacation will be considered the day of dismissal.

Leave procedure for a seasonal employee

To obtain permission to go on vacation, the employee must write a free-form application. His application is submitted to the head of the company for consideration.

If the employer agrees that the employee goes on vacation:

- He signs the employee's statement;

- Issues a vacation order.

The vacation order is issued on forms No. T-6 or T-6a.

Watch a video on the topic:

How is a vacation order issued?

When issuing a vacation order, certain difficulties may arise. The fact is that in the forms adopted by the state, data on holidays are indicated, which are calculated in calendar days. For vacation provided in working days.

In addition, a subordinate who performs seasonal work can draw up at the same time a paid annual vacation, And additional leave. And the duration of these types of holidays is determined in different ways.

If the company uses form No. T-6 for registration, then in this situation it is allowed to add a line where the number will be indicated vacation days. Other details in the order form do not change. It is also forbidden to delete details in the document.

The addition of a line in the order for granting leave to a seasonal specialist is drawn up by other documents of an organizational and administrative type. For example, the head of the company may issue an order to make such changes.

How to correctly calculate vacation pay for a seasonal employee

As mentioned in this article, paid annual leave is calculated in working days. To calculate the amount of vacation pay, you need to determine the size of the average daily earnings. Average daily earnings are calculated using the following formula:

Average daily wage.

In the event that the subordinate issued sick leave, went on a business trip, then when calculating vacation payments, such periods should be excluded. The amounts that were accrued for them by an accountant are also subject to an exception.

The employee has the right not to go on vacation. In this case, compensation will be paid to him.

Calculation of compensation for unused vacation to a seasonal worker

Calculation of compensation for unused vacation is carried out according to the rule: 2 working days are equated to each worked month. The following bases are used to calculate the compensation amount:

- Art. 139 TC;

- Regulations of the government of 24.12. 2007 "On the peculiarities of the procedure for calculating the average wages".

Consider how vacation compensation for seasonal workers is calculated using a real example.

Imagine that your company has entered into an employment agreement with an employee for seasonal work. The duration of the contract is 5 months - from May 1 to September 30. According to the agreement, a seasonal employee is paid a remuneration in the amount of 150 thousand rubles.

During this period, the subordinate worked 130 working days in terms of a 6-day work week:

- 27 days in May;

- 26 days in June;

- 28 days in July and August;

- 26 days in September.

It turns out that this employee worked 5 working months. In this regard, he can count on a vacation of 10 working days.

Now let's calculate the average salary: =. = 1,153.85 rubles.

After that, we can calculate the amount of payment:

1,153.85 rubles x 10 working days = 11,538.5 rubles.

Please note that the procedure for calculating compensation for vacation that was not used and the procedure for calculating vacation pay are identical.

Dismissal of a seasonal worker

It implies the conclusion of an employment contract for a short period. This document must indicate the date of completion of the contract. However, in some cases, it is impossible to say exactly when the execution of a particular work will be completed. For example, it is impossible to say when the field harvest will be completed. In this case, indicate a certain event that will mean the termination of the contract.

Termination notice for a seasonal employee

The employer is obliged to inform the subordinate about the expiration of the employment contract. He can do this:

- with the help of a notice, which is drawn up in any form;

- with the help of an order stating that the contract has expired.

Experienced personnel officers are advised to choose the first option. This will allow the employer to protect themselves from unexpected surprises.

Imagine that you issued an order to terminate the employment agreement with a female employee. And then they found out she was pregnant. By law, the head of the company must extend the term of the agreement. In this regard, in order not to get charged with an illegal dismissal attempt, it is better to first notify the subordinate about the termination of the contract.

How to issue a proper dismissal order

After the employee has been notified of the termination of employment with the company, it's time to process the order. This document has two forms approved by the state - No. T-8 and T-8a. The second form of the order is used only when it is necessary to terminate the employment relationship with several persons at once.

Please note that in the dismissal order it is important to focus on the seasonal nature of the work. The document should contain wording, the essence of which is that the fixed-term employment agreement is terminated due to the end of the work season.

What entry is made in the work book

The next step in the dismissal procedure is to make an appropriate entry in the seasonal employee's work book.

When labor agreements are terminated, an entry is made in the work book stating that the employee was dismissed due to the termination of the employment contract with reference to clause 2, part 1, article 77 of the Labor Code.

After an entry is made in the work book, the dismissed employee must familiarize himself with this entry and sign. The employee can put his signature under the signature of the employee personnel service. Another option is also possible - the employee makes his entry "Familiarized" and signs.

Do I need to work two weeks for a seasonal worker

The employment relationship with the employer is terminated on the last day of the fixed-term employment agreement. It follows that a seasonal worker does not need to work 14 days.

If the head does not intend to extend the period of the contract, he is obliged to notify the subordinate of the dismissal 3 calendar days before the expected date of termination of the agreement.

If an employee wishes to terminate the employment agreement ahead of schedule, he must also inform the employer of his decision 3 calendar days in advance. This is stated in Art. 296 TK.

"Payment: accounting and taxation", 2010, N 8

Seasonal work in itself is quite specific, because it is limited to a certain period of time. Labor relations with workers hired for seasonal work have certain features and are regulated by special norms of the Labor Code of the Russian Federation. What jobs are considered seasonal? What contract should be concluded with seasonal workers - fixed-term or indefinite? What are the features of hiring, dismissing such workers and providing them with vacations? These and some other questions will be answered in this article.

What are seasonal jobs?

Seasonal work is regulated by Ch. 46 of the Labor Code of the Russian Federation. In particular, Art. 293 of the Labor Code of the Russian Federation, their definition is given: seasonal work is recognized, which, due to climatic and other natural conditions, is performed during a certain period (season), not exceeding, as a rule, six months. But sometimes the season can last longer. In this case, the list of seasonal works, which can be carried out during a period (season) exceeding six months, is determined by sectoral (intersectoral) agreements concluded at the federal level of social partnership. The same documents also establish the maximum duration of these individual seasonal works.

For example, Industry agreement on the timber industry complex Russian Federation for 2009-2011, it is stipulated that the specific duration of the season is determined by the organizations together with the elected body of the primary trade union organization based on climatic conditions at the location of the organization in a separate specific region and is included in the terms of the collective agreement or is established in a local regulatory act (if there is no collective agreement), adopted taking into account the opinion of the elected body of the primary trade union organization. At the same time, the following are recognized as seasonal work in the forestry industry:

- rafting (dumping of wood into the water, primary and raft rafting, sorting on the water, rafting and rolling out of wood from the water);

- loading (unloading) timber onto ships.

Passenger transportation is also seasonal. At the same time, in the resort area, the summer-autumn period is considered a season, and when transported to recreation areas, holiday villages and gardening associations - from May to October<1>.

<1>Clause 3.12 of the Federal Industry Agreement on Automobile and Urban Ground Passenger Transport for 2008 - 2010 (registered by the Letter of Rostrud dated March 25, 2008 N 1558-TZ).

Industry tariff agreement in the housing and communal services of the Russian Federation for 2008 - 2010<2>it has been established that the duration of seasonal work in the life support systems of the population is determined by the period of provision of the relevant services. The peculiarity of such seasonal work is provided for by regional industry tariff agreements and collective agreements of organizations. Also, this Agreement establishes a list of seasonal works, which can be carried out during a period (season) exceeding six months, which includes the production, transmission and sale of heat energy. The duration of these works is determined by the heating period, approved by the executive authorities of the constituent entities of the Russian Federation. If the duration of seasonal work is exceeded for a period of more than six months due to climatic and other natural conditions, and if these works are not included in the specified list, the employer has the right to conclude a new fixed-term employment contract with the employee for the required period for the provision of housing and communal services.

<2>The term of this Agreement has been extended until 01/01/2014 by the Agreement of the parties dated 02/19/2010.

As is often the case, along with the recently issued documents, the old ones continue to be valid. regulations that have not lost their force. For example, you can use:

- The list of seasonal work, approved by the Decree of the NCT of the USSR of October 11, 1932 N 185;

- The list of seasonal industries whose work in organizations during the full season when calculating the insurance period is taken into account so that its duration in the corresponding calendar year is a full year, approved by Decree of the Government of the Russian Federation of 04.07.2002 N 498 (hereinafter - Decree N 498) ;

- The list of seasonal jobs and seasonal industries, work in organizations of which, regardless of their departmental affiliation, during the full season is counted in the length of service for assigning a pension for a year of work, approved by Resolution of the Council of Ministers of the RSFSR of 07/04/1991 N 381 (hereinafter - Resolution N 381);

- The list of seasonal industries and activities used when granting a deferral or installment plan for tax payment, approved by Decree of the Government of the Russian Federation of 04/06/1999 N 382.

Traditionally seasonal are:

- agricultural work (harvesting of agricultural products, fur farming);

- crop production;

- extraction, drying and cleaning of peat, repair of equipment in the field;

- field forest inventory work, sowing and planting forests, work in forest nurseries;

- extraction of precious metals and precious stones;

- logging, rafting, afforestation and reforestation;

- production of dairy and meat canned food;

- fishing and seafood production and processing;

- production of sugar, canned fruits and vegetables, etc.;

- production of products from natural fur;

- dredging and bank protection works.

So, based on the foregoing, we can say that seasonal work includes work that, due to climatic or other natural conditions, is performed only during a certain period and cannot be performed during the entire calendar year. By general rule the duration of the season cannot exceed six months.

We conclude an employment contract

A feature of seasonal work is their specific duration, therefore, in order to perform them in a certain period (season), fixed-term employment contracts are concluded with employees. Recall that the contract must be executed in writing, and the condition on the seasonal nature of the work must be indicated in it by virtue of Art. 59 of the Labor Code of the Russian Federation. In addition, the condition on the seasonality of work must be reproduced in the order for employment (Article 68 of the Labor Code of the Russian Federation).

In accordance with the requirements of Art. 57 of the Labor Code of the Russian Federation in the employment contract, you must specify the period of its validity or specific dates for the start and end of work. But, since the term of the season sometimes depends on natural and climatic conditions (for example, on the weather) and it is not always possible to determine its duration in advance, the term of the employment contract may not be specified in the text. One thing is obvious: an employment contract for seasonal work, as a general rule, cannot last more than six months (another period is established by social partnership agreements concluded at the federal level).

According to the general rule enshrined in Art. 65 of the Labor Code of the Russian Federation, in order to conclude an employment contract, an employee must present the necessary documents:

- passport or other identity document;

- a work book, except for cases when an employment contract is concluded for the first time or an employee goes to work on a part-time job;

- insurance certificate of state pension insurance;

- military registration documents - for those liable for military service and persons subject to conscription for military service;

- a document on education, qualifications or the availability of special knowledge - when applying for a job that requires special knowledge or special training.

Sometimes the question arises: do the rules for concluding an employment contract apply through the actual admission to the performance of seasonal work? We answer. Indeed, the provisions of Art. 67 of the Labor Code of the Russian Federation, it is determined that an employment contract that is not properly executed is considered concluded if the employee has started work with the knowledge or on behalf of the employer or his representative. But we believe that when applying for seasonal work, this rule cannot be applied. Let's explain why. Persons hired for seasonal work must be warned about this when concluding an employment contract. And with the actual admission to work, it may turn out that the employee will not know about the seasonality of his work. If actual tolerance to the performance of seasonal work is carried out, then it will be quite difficult for the employer to prove in the future that he wanted to hire a seasonal worker, and as a result, the employment contract can be qualified as concluded for an indefinite period.

Note! If an employee is hired for a season not exceeding two months, according to the rules of Part 4 of Art. 70 of the Labor Code of the Russian Federation, a test cannot be assigned to him.

The test condition (if any) must also be included in the employment contract. Until 2006 in art. 294 of the Labor Code of the Russian Federation contained a restriction: the probationary period should not exceed two weeks. Now seasonal workers are subject to the general rules on probation established by Art. 70 of the Labor Code of the Russian Federation: the test period cannot exceed three months. When concluding an employment contract for a period of two to six months, the probation may not exceed two weeks.

Features of granting leave

For seasonal workers special rule about granting leave. In particular, employees employed in seasonal jobs are provided with paid leave at the rate of two working days for each month of work (Article 295 of the Labor Code of the Russian Federation). If an employee has worked half a month, then he is given one working day for vacation. Recall that, as a general rule, established by Art. 115 of the Labor Code of the Russian Federation, the duration of annual paid leave is 28 calendar days.

The average daily wage for paying for vacations granted in working days, in the cases provided for by the Labor Code, as well as for paying compensation for unused vacations, is determined by dividing the amount of accrued wages by the number of working days according to the six-day calendar. working week(Article 139 of the Labor Code of the Russian Federation).

Typically, seasonal workers do not enjoy paid vacations, and receive compensation for it upon dismissal. When calculating compensation, the legislator also deviated from the general norms, according to which employees are entitled to compensation in the amount of 2.33 days for each full month worked. In this case, two business days are taken to calculate it.

In addition, employees can write an application for leave with subsequent dismissal according to the rules of Art. 127 of the Labor Code of the Russian Federation. In this case, the day of dismissal will be the last day of vacation. Despite the fact that the vacation time goes beyond the term of the employment contract (and may go beyond the six-month period), the contract will not go into the category of indefinite.

If the employee is entitled to additional paid leave (for example, for work with harmful and hazardous conditions labor, irregular working hours), they must be calculated according to the general rules.

Features of termination of an employment contract

Recall that an employment contract for the performance of seasonal work is urgent, therefore, the rules of Art. 79 of the Labor Code of the Russian Federation: an employment contract concluded for the performance of seasonal work during a certain period (season) terminates at the end of this period (season). But other grounds for terminating the employment relationship are not ruled out.

For example, seasonal workers can terminate the employment contract of their own free will before the expiration date. The employee must notify the employer of such a desire not 14 calendar days in advance, as established by Art. 80 of the Labor Code of the Russian Federation, and not less than three calendar days. The employee must do this in writing, for example, in a statement. The notice period for dismissal begins on the next day after the employer receives the letter of resignation (Article 80 of the Labor Code of the Russian Federation).

Leaving without good reason work by a person who has entered into a fixed-term employment contract, before the expiration of the contract or before the expiration of the notice period for early termination of the employment contract, is considered absenteeism (clause "d", clause 39 of the Decree of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 N 2 "On the application by the courts of the Russian Federation Labor Code Russian Federation").

For the employer, some terms are also determined with a deviation from the general norms. In particular, in accordance with Art. 296 of the Labor Code of the Russian Federation about the upcoming dismissal due to the liquidation of the organization, reduction in the number or staff of employees, the employer must notify seasonal workers at least seven calendar days in advance (usually this period is two months). The employer must also do this in writing. With such a notice, you need to familiarize the employee against signature. Please note that upon termination of the employment contract in this case, by virtue of Art. 296 of the Labor Code of the Russian Federation, a seasonal worker is entitled to severance pay in the amount of a two-week average salary. But the preservation of the average earnings for the dismissed seasonal workers for the period of employment, Art. 178 of the Labor Code of the Russian Federation is not provided.

There are no other features of terminating an employment contract with seasonal workers; for other reasons, termination of employment relations is carried out in general order. For example, when dismissing a seasonal worker at the initiative of the employer for absenteeism, the procedure for bringing to disciplinary responsibility, provided for in Art. Art. 192, 193 of the Labor Code of the Russian Federation. Also, the employment contract may be terminated due to circumstances beyond the control of the parties, established by Art. 83 of the Labor Code of the Russian Federation (for example, the death of an employee).

How is the seasonal service for pension calculated?

When assessing the pension rights of insured persons, when assigning a labor pension to them, the total length of service is taken into account. Mostly periods labor activity included in such length of service are calculated on a calendar basis according to their actual duration. But for some activities, exceptions are made. In particular, according to paragraph 2 of Art. 12 federal law dated 17.12.2001 N 173-FZ "On labor pensions in the Russian Federation" when calculating the length of service, periods of work during the full navigation period on water transport and during the full season in organizations of seasonal industries determined by the Government of the Russian Federation are taken into account with such a calculation, so that the duration of the insurance period in the corresponding calendar year is a full year. Currently, the PFR uses Decree N 498, according to which the List of such seasonal industries includes:

- peat industry (bog preparation, extraction, drying and harvesting of peat, repair and maintenance technological equipment in the field);

- logging industry (extraction of resin, barras, stump resin and spruce sulfur);

- rafting (dumping of timber into water, primary and raft timber rafting, sorting on the water, rafting and rolling out timber from the water, loading (unloading) timber onto ships);

- forestry (forestation and reforestation, including soil preparation, sowing and planting forests, caring for forest crops, work in forest nurseries and field forest management);

- butter and cheese and dairy industries (seasonal work in organizations for the production of dairy products and in specialized organizations for the production of canned milk);

- meat industry (seasonal work in organizations for the production of meat products, poultry processing and the production of canned meat);

- fishing industry (seasonal work in organizations for catching fish, catching whales, sea animals, seafood and processing these raw materials, in fish and culinary, canning, fish flour, fat-and-fat organizations and refrigerators in the fishing industry, in aerial reconnaissance);

- sugar industry (seasonal work in organizations for the production of granulated sugar and refined sugar);

- fruit and vegetable industry (seasonal work in organizations for the production of canned fruits and vegetables).

Work for a full season at enterprises of the seasonal fisheries, meat and dairy industries, at enterprises of the sugar and canning industries is counted in the length of service for assigning a pension for a year of work starting from the 1967 season (clause 2 of Resolution N 381).

For employees of enterprises - shipowners of the fishing fleet of the fishing industry By Decree of the Ministry of Labor of Russia dated December 28, 1994 N 87 "On the adjustment average headcount employees of enterprises (associations) - shipowners of the fishing fleet of the fishing industry" provides that since 1994, if the actual number of hours worked is exceeded against the normal number of working hours at enterprises (associations) - shipowners of the fishing fleet, where, due to the Putin (seasonal) nature of work the summed accounting of working hours was established, the average number of employees of these enterprises for the reporting period, when calculating the normalized amount of labor costs, is adjusted by a coefficient characterizing the ratio of the number of hours actually worked to the normal number of working hours established by law. reporting remains the same.

T.V. Shadrina

Journal Expert

"Salary:

Accounting

and taxation"

Labor relations of employees may be established for the performance of temporary work. In such cases, the employment contract is concluded for a period of up to two months. This category of workers is called temporary workers. Limiting the duration of their work for a period of up to two months entails a number of features. First of all, when concluding an employment contract, they are oriented in advance to the fact that their work is temporary. Secondly, it is precisely with the short period of time for which these workers are hired that Art. 289 of the Labor Code of the Russian Federation does not provide for a test when applying for a job. Given the temporary nature of the work, these employees, with their written consent, may be involved in work on weekends and non-working days. holidays. This work is compensated in cash at least twice. It also provides for the right of these workers to annual paid leave, and in reality this is the payment of compensation upon their dismissal at the rate of two working days for one month of work (Article 291 of the Labor Code of the Russian Federation). When terminating an employment contract at the initiative of a temporary worker, he is obliged to notify the employer, as well as seasonal workers, three calendar days in advance. In the event of their early dismissal due to the liquidation of the organization, reduction in the number or staff of employees, they must be warned by the employer in writing against signature at least three calendar days in advance. In case of dismissal on the specified grounds, the severance pay to an employee who has concluded an employment contract for a period of up to two months is not paid.

Labor relations of employees who have concluded an employment contract for a period of up to two months are regulated general rules The Labor Code of the Russian Federation, including the norms on a fixed-term employment contract, with certain exceptions, the features established in Ch. 45 of the Labor Code of the Russian Federation. As already noted, they are probationary period, attraction to work on weekends and non-working holidays, paid holidays, some aspects of the termination of an employment contract.

It should be borne in mind that the term of the employment contract - up to two months - is the limit. By agreement of the parties to this agreement, it can be any, but not more than the established limit.

Features of labor regulation of employees who have concluded an employment contract for a period of up to two months are established not only by the Labor Code of the Russian Federation, other legislative and regulatory legal acts containing norms labor law, but also collective agreements, agreements, local regulations.

Employees who have concluded an employment contract for a period of up to two months are also subject to the features enshrined in the norms of the Decree of the Presidium of the Supreme Soviet of the USSR of September 24, 1974 No. 311-IX “On the working conditions of temporary workers and employees” (as amended on April 4 1991), to the extent that it does not contradict the Labor Code of the Russian Federation (part 1 of article 423 of the Labor Code of the Russian Federation). Moreover, this act has not yet been recognized as not valid on the territory of Russia (in contrast to a similar act on seasonal workers).

For employees who have concluded an employment contract for a period of up to two months, there is only one way to involve them in work on weekends and non-working holidays - their written consent is required. Moreover, it is not necessary to comply with the conditions and restrictions fixed in Art. 113 of the Labor Code of the Russian Federation. It is allowed to involve these workers to work on the specified days only within the period of validity of the relevant employment contract (up to two months). Work on weekends and non-working holidays is compensated in cash at least twice the amount (Article 29 of the Labor Code of the Russian Federation).

In accordance with Art. 293 of the Labor Code of the Russian Federation, seasonal work is recognized as work that, due to climatic and other natural conditions, is performed during a certain period (season) not exceeding six months. Currently, the List of seasonal jobs and seasonal industries approved by the Decree of the Council of Ministers of the RSFSR No. 381 of July 4, 1991, as well as the List of seasonal industries approved by the Decree of the Government of the Russian Federation of July 4, 2002 No. 498 are in force. Examples of seasonal work, provided for by these Lists, is work in peat extraction, logging and timber rafting, enterprises of seasonal fisheries, etc. An employment contract is concluded with employees who enter seasonal work, in which the seasonal nature of the work assigned must be indicated. In contrast to the previous procedure, when concluding an employment contract with an employee hired to perform seasonal work, a probation may be provided that does not exceed two weeks. The employment contract must specify a period of work not exceeding the duration of the season (six months) (Article 294 of the Labor Code of the Russian Federation). The employee receives compensation for vacation upon dismissal. Based on the fact that workers employed in seasonal work, in accordance with Art. 295 of the Labor Code of the Russian Federation, paid vacations are provided for each month of work, the employee, having received compensation for the vacation, uses it, as a rule, during the off-season.

A feature of the employment contract with seasonal workers is that the employment contract with seasonal workers can be terminated at the initiative of the employee with a warning of at least three calendar days, and in case of dismissal due to the liquidation of the organization, reduction in the number or staff of employees, the employer is obliged notify the employee in writing at least seven calendar days in advance. In addition to the warning, the employer, upon termination of the employment contract with a seasonal worker for the indicated reasons, is obliged to pay a severance pay upon dismissal in the amount of two weeks of average earnings.

According to Part 1 of Art. 293 of the Labor Code of the Russian Federation, seasonal work should be considered work that, due to climatic and other natural conditions, is performed during a certain period (season), which, as a rule, does not exceed six months. Thereby general rule about a six-month restriction on seasonal work seems to remain, but it is allowed to be extended in the manner prescribed by Part 2 of Art. 293 of the Labor Code of the Russian Federation.

Lists of seasonal work, including individual seasonal work, which can be carried out during a period (season) exceeding six months, and the maximum duration of these individual seasonal work are determined by sectoral (intersectoral) agreements concluded at the federal level of social partnership

Based on the content of Art. 293 and 294 of the Labor Code of the Russian Federation, workers should be classified as seasonal if three conditions are simultaneously present: a) work must be included in a special list of seasonal work; b) it must not exceed maximum duration certain period (season); c) the condition on the seasonal nature of the work must be indicated in the employment contract itself. Then the employee is subject to the features contained in the relevant norms of Ch. 46 of the Labor Code of the Russian Federation.

Features of labor regulation of workers employed in seasonal work are established not only by the Labor Code of the Russian Federation, other legislative and regulatory legal acts containing labor law norms, but also by collective agreements, agreements, local regulations.

The conditions, the observance of which is necessary for the recognition of an employment contract as concluded specifically for the performance of seasonal work, and an employee as seasonal, are contained in Art. 293 of the Labor Code of the Russian Federation.

In accordance with Art. 295 of the Labor Code of the Russian Federation, seasonal workers are provided with paid vacations at the rate of two working days for each month of work.

About freaks and people: indecent pictures of Diane Arbus

About freaks and people: indecent pictures of Diane Arbus How to take amazing photos

How to take amazing photos How to photograph waterfalls How to photograph a fountain with a DSLR

How to photograph waterfalls How to photograph a fountain with a DSLR About Steve McCurry and his photos

About Steve McCurry and his photos How I became a photographer (and what it takes)

How I became a photographer (and what it takes) How to take pictures with an external flash

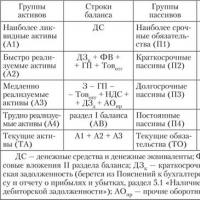

How to take pictures with an external flash The essence and significance of the liquidity and solvency of the enterprise

The essence and significance of the liquidity and solvency of the enterprise