The need for value and methods of normalization of working capital. Capital rationing. The need to clarify it is due to significant changes in technology and organization of production, delivery conditions, product range, changes in prices, tariffs

COURSE WORK

on academic discipline"Economics and organization of production"

Theme "Rationing of working capital at an industrial enterprise"

Annex 1……………………………………………………………………….38

Introduction

Working capital is one of constituent parts property of the enterprise, on which the rhythm, coherence and high performance of work depend. The development of market relations determines new conditions for managing working capital as well, forcing enterprises to change their policy in relation to working capital, look for new sources of replenishment, and find ways to accelerate the turnover of working capital. And since working capital includes both material and monetary resources, not only the process of material production, but also the financial stability of the enterprise depends on their organization and efficiency of use.

The presence of an enterprise with sufficient working capital of an optimal structure is a necessary prerequisite for its normal functioning in modern conditions. Therefore, the enterprise should carry out the rationing of working capital, whose task is to create conditions that ensure the continuity of production economic activity firms. This determines the relevance of this course work.

The problem of normalization of working capital and their optimization in an industrial enterprise was chosen as the subject of study of this course work.

The object of the study was the analysis of the working capital of the enterprise on the example of LLC "Plant of reinforced concrete products".

The purpose of this course work is to study the theoretical aspects of the regulation of working capital in an enterprise, to analyze working capital in an existing enterprise and to identify trends in the development of an enterprise based on data on the analysis of working capital in this enterprise.

In this regard, the following tasks were set:

· Consider the essence of the concept of working capital of the enterprise;

Consider the theoretical aspects of working capital rationing industrial enterprise;

· Carry out an analysis of the working capital of LLC Zavod ZHBI;

· Make an analytical conclusion.

1. Theoretical aspects normalization of working capital of the enterprise

1.1 General characteristics of working capital

An indispensable condition for the implementation of economic activity by the enterprise is the availability of working capital. Working capital is cash advanced to working capital and circulation funds to ensure a continuous process of production and sale of products.

The essence of working capital is determined by their economic role, the need to ensure production process, which includes both the production process and the circulation process. Unlike fixed assets, which repeatedly participate in the production process, working capital operates in only one production cycle and, regardless of the method of production consumption, fully transfers its value to the finished product.

William Collins defines the essence of current assets as "... short-term current assets of a firm that quickly turn over during the production period" .

A similar definition of working capital is given by Doctor of Economics, Professor Blank I.A.: these are assets that characterize "... the totality of property values of an enterprise that serve the current production and commercial (operational) activities and are fully consumed during one production and commercial cycle" .

G. Schmalen more accurately describes the process that working capital provides, in his opinion, “... working capital serves to create funds that are not designed for a specific period, but they directly provide for the process of processing and processing, sales of products, as well as the formation of monetary resources and their spending.

The composition and classification of working capital are given in Table 1 and Table 2, respectively.

Table 1. The composition of the working capital of an industrial enterprise

Inventories are objects of labor that have not yet entered the production process and are in the enterprise in the form of warehouse stocks. These include: raw materials, basic and auxiliary materials, purchased semi-finished products, spare parts for the repair of fixed assets, fuel, low-value and wearing items, inventory, tools, as well as special tools and devices, regardless of their cost, intended for the production of a limited batch of products or separate order. The need for inventories is due to the fact that the production process takes place continuously, and the receipt of raw materials, materials, components periodically.

Work in progress (WIP) (unfinished products) are objects of labor that have already entered the production process, but their processing has not been completed. In practice, as part of WIP, it is customary to consider semi-finished products of own manufacture, intended for further processing in other workshops of the same enterprise. Items of work in progress are at different stages of processing, workplaces, but are not yet ready for sale.

Deferred expenses (DBC) are the costs associated with the development of new types of products (payment to designers for the design of a new product, tools and fixtures, technologists - for the development of technological processes for manufacturing a new product, tools, fixtures). They are produced in planning period, are accumulated and are subject to repayment in the future when new products are sold, with the exception of those costs that are financed from profits, budget funds, or special funds.

Finished goods (FP) in the warehouses of the enterprise are products manufactured at the enterprise and subject to shipment to consumers.

Products shipped (PO), on the way, but not paid for by the buyer, that is, the company's current account has not yet received money from the buyer.

Free cash on the current account of the enterprise, at the cash desk, necessary for the purchase of materials, components, travel allowances, and so on.

Cash invested in shares, securities are shares acquired by an enterprise, securities of other enterprises, short-term banks (up to 1 year).

Table 2. Classification of working capital according to the balance sheet of the enterprise

| Working capital group | Balance asset items | accounting account |

| 1 | 2 | 3 |

| 1. Stocks | Productive reserves | 10,15 |

| Animals for growing and fattening | 11 | |

| Unfinished production | 20,221,23,29,44 | |

| Future spending | 97 | |

| Finished products | 43 | |

| Goods | 41 | |

| Continuation of table 2. | ||

| Goods shipped | 45 | |

| 2. Value added tax on acquired valuables | 19 | |

| 3. Accounts receivable | ||

| Settlements with debtors for goods and services | 62,76 | |

| Settlements with debtors on bills received | 62 | |

| Indebtedness of the founders on contributions to the authorized capital | 75 | |

| Advances issued to suppliers and contractors | 60 | |

| Settlements with subsidiaries | 76 | |

| 4. Short-term financial investments | 58 | |

| 5. Cash | ||

| At the register | 50 | |

| On current account | 51 | |

| On a currency account | 52 | |

| Other cash | 55,57 | |

It is necessary to distinguish between the concepts of the composition of working capital and the structure of working capital. The composition of working capital - elements of working capital assets and circulation funds. Structure - the relationship between individual groups, elements of working capital and their total volumes, expressed in shares or percentages.

The volume and structure of working capital of enterprises is significantly influenced in modern conditions by many factors, for example:

Features of manufacturing products - labor-intensive, material-intensive;

the type of production;

duration production cycle;

development period new products;

location of suppliers material resources and consumers of products, conditions of supply and marketing;

· quality of let out production;

solvency of the enterprise and buyers.

At enterprises, due to a decrease in the share of inventories and free cash, there is a change in the structure of working capital. In the structure of working capital - in stocks of inventory items, the largest specific gravity accounts for inventories and work in progress, and in them for raw materials, basic materials and purchased semi-finished products.

The structure of working capital of enterprises in various industries will be different. The analysis shows that the largest share, for example, of receivables is typical for enterprises of the electric power industry, mechanical engineering, and the smallest - for light and Food Industry, that is, enterprises working directly for the consumer.

Working capital is always in motion and goes through several stages of circulation, changing its shape.

On the funds (D) available on current account(or accounts), as well as at the cash desk, the enterprise acquires the material resources it needs for production. After the acquisition, the materials are not consumed immediately, some of them first settle in the form of inventories (PZ) in the warehouse, and the part that is put into production - in the form of backlogs of work in progress, finished but not yet sold products (GP). Having sold the finished product, the company returns to itself the money (D "), part of which was previously spent on the acquisition of material resources (D) necessary for production, while receiving a certain share of the profit (∆D). Due to part of the proceeds received from the sale of finished products, when purchasing new batches of material resources, the consumed means of production and objects of labor in the form of raw materials, materials, fuel, energy, depreciation, as well as wages and other costs are reimbursed.This completes the circulation of working capital at the enterprise.

D" \u003d D + ∆D

Movement at the enterprise of working capital and circulation funds:

PZ - NP - GP - T,

where PZ - production stocks of material resources;

WP - backlog of work in progress (materials that are in the workshops of the enterprise in a state of processing (blanks, semi-finished parts subjected to turning, milling and other technological operations on the corresponding machines and lying in containers near these machines in anticipation of the next technological operation);

GP - marketing stocks of finished products;

T - goods - products manufactured by the enterprise (is the property of the enterprise until they are sold).

In order for the production process not to be interrupted, the enterprise needs to carry out planning of working capital by groups and control over maintaining their required level at each stage of the circulation. Working capital planning should include indicators of the initial and final levels of needs, as well as indicators of each significant change (growth, decrease) of this need within the planning period. For example, an enterprise will have to spend working capital not to pay for medium, identical deliveries, but to pay for a variety of deliveries - small and large, frequent and rare delivered by air, road, etc. Knowing with a certain probability the dynamics of future deliveries, the enterprise can more reasonably manage production and finance.

The basis for planning working capital of an enterprise is rationing.

1.2 Basic methods of normalization of working capital

Rationing of working capital solves two main problems. The first is to constantly maintain a correspondence between the size of the company's working capital and the need for funds to ensure the minimum necessary stocks of material assets. This task links the dependence of the volume of working capital on the level of stocks. At the same time, it is understood that for each enterprise it is necessary to establish such a standard so that during normal economic activity it does not experience financial difficulties to ensure the production and sale process. Another task is more complex: with the help of rationing, it is necessary to manage the size of stocks. Rationing is intended to stimulate the improvement of economic activity, the search for additional reserves, the formation of a reasonable combination of forms of supply, etc.

According to the principles of organization, working capital is divided into standardized and non-standardized.

Non-standardized working capital includes products shipped, on the way, but not paid for; cash on the current account, in cash. The level of these groups of working capital is more influenced by external factors than the production and economic activities of the enterprise. The legislative framework, as the basis of a contractual supply chain, should help reduce the amount of unpaid deliveries.

Normalized working capital includes all groups of working capital - these are production stocks, work in progress, deferred expenses; from the sphere of circulation - finished products in stock.

The value of normalized working capital must always meet the real needs of production. The enterprise determines the minimum but sufficient need for each of these groups of working capital and controls their level at each stage of movement, since large stocks of material assets require the diversion of funds from other purposes, warehouses, security, and accounting are necessary. If the standard is underestimated, the enterprise will not be able to provide production with the necessary reserves, pay off suppliers, workers, employees, etc. in a timely manner. If the standard is overstated, significant excess stocks arise, funds are frozen, which leads to losses. An overestimated standard contributes to a reduction in the level of profitability, an increase in the amount of payment for an increase in the value of the enterprise's property.

Rationing of working capital - the process of establishing norms and standards for a normalized group of working capital.

In the process of normalization of working capital, the norm and standard of working capital are determined.

The norm of working capital is a relative value corresponding to the minimum, economically justified stock of inventory items, set in days.

The working capital ratio is the minimum required amount of funds to ensure the economic activity of the enterprise.

In the practice of normalization of working capital, several methods are used:

direct account;

· analytical;

experimental laboratory;

reporting and statistical;

coefficient.

The analytical method for estimating the standard of working capital is established by the actual value of working capital for a certain period, taking into account the adjustment for surpluses and unnecessary stocks, as well as for changes in the conditions of production and supply. This method provides for the division of working capital into two groups:

dependent on changes in the volume of production;

independent of production volume.

The experimental laboratory method is based on measuring their consumption and volumes of products (works) produced in laboratory and pilot production conditions. Consumption rates are set by selecting the most reliable results and calculating the average value using the methods of mathematical statistics. The most appropriate scope of these norms: auxiliary production, chemical, technological processes, extractive industries and construction.

Reporting and statistical - based on the analysis of data from statistical (accounting or operational) reporting on the actual consumption of materials per unit of output (work) for the past (base) period. It is recommended for the development of both individual and group norms for the consumption of material and raw materials and fuel and energy resources.

With the coefficient method, the standard of working capital for the planned period is established using the standard of the previous period and taking into account adjustments for changes in the volume of production and for accelerating the turnover of working capital. The use of differentiated coefficients for individual elements of working capital is permissible if the standard is periodically updated by direct calculation.

The main method of normalization of working capital is the direct account method. When using the direct calculation method, the standard is calculated on the basis of the production program, production cost estimates, production process organization standards, logistics plan, portfolio of contracts and orders, production efficiency improvement plan.

The direct calculation method allows you to most accurately calculate the need for working capital and is used in the current financial planning when determining the standard for the main elements of working capital.

Other rationing methods are used in industry as auxiliary ones. The general standards of own working capital are determined in the amount of their minimum requirement for the formation of the stocks necessary for the fulfillment of plans for production and sale of products, as well as for the implementation of all types of calculations on time.

1.3 Working capital rationing process

The process of normalization of working capital includes:

1) the establishment of an economical order size for each type of consumed material resource;

2) calculation of one-day consumption (daily requirement) of each type of material resource;

3) calculation of the stock rate;

4) calculation of the norm of working capital by elements and working capital in general.

The Economic Order Quantity ensures a minimum annual cost of placing and fulfilling an order and holding stock. The costs of placing and fulfilling an order include the costs of finding a supplier, entering into a contract, monitoring the fulfillment of the order, the cost of its processing and delivery (if paid in excess of the purchase price). Inventory holding costs include all costs of warehouse operations (labor, warehouse equipment, warehouse repairs, electricity, etc.) and warehouse rental fees (if rented).

In the theory of inventory management, a mathematical calculation of the economic size of the order (maximum stock) of a material resource is given. The corresponding formula is as follows:

where G is the economic order quantity; C is the average cost of placing one supply lot; S is the annual volume of production needs for a given raw material or material; I - the cost of storing a unit of goods in the analyzed period.

The stock rate (NC) is the minimum required amount of stock of a material resource in a warehouse, ensuring the continuity of production. For material assets that are part of inventories, work in progress, deferred expenses, it is set in days. If the stock rate at the enterprise is defined as seven days, then this means that the enterprise must have a 7-day supply of materials.

The algorithm for calculating the stock rate of materials is represented by the formula:

The stock rate is made up of the current (, insurance (, transport ( and preparatory stocks (.

The current stock ensures the uninterrupted operation of the enterprise between the next supply of the resource, it changes from the maximum on the day of delivery to the minimum before the next delivery. The current stock is set based on the calculation:

![]()

where is the average supply cycle (interval between deliveries).

With uniform supply of materials according to the schedule and uniform consumption throughout the year, the average supply cycle is equal to:

where 360 is the number of days in a year; N is the number of deliveries per year;

where Q is the annual need of the enterprise for a material resource; G is the economic order quantity.

The calculated average intervals between deliveries are taken to calculate the norms of working capital for the formation of the current stock. The current stock rate fluctuates from the maximum level to zero. Schematically movement of stocks is presented on fig. 1.2.

Rice. 1.2 Scheme of movement of stocks

The maximum level of the current stock corresponds to the maximum size of the schedule, and the minimum can be conditionally taken equal to zero. At the moment when the stock reaches zero, the next batch of materials should go into production.

Safety stock is created in cases of violation of planned delivery dates. It is calculated from the average deviations of the actual delivery times from the planned ones or is taken at the level of 50% of the current stock rate at short intervals. A safety stock is created in case of unforeseen deviations in supply:

![]()

The transport stock is created for the time that material assets are in transit from paying the bill to their arrival. Its value is determined by the difference between the number of days the goods run from the supplier to the consumer and the number of days of workflow, taking into account the payment of the invoice.

The preparatory stock is determined on the basis of the timing associated with determining the time for unloading, warehousing and preparation for production. It provides for the time for acceptance, unloading, sorting, storage of material assets, execution of warehouse documents and preparation for production.

The working capital ratio is the minimum need for working capital for the normal operation of an enterprise, which ensures the creation of the necessary stocks of material resources in monetary terms. The sum of the norms of working capital for all types of material resources gives the general norm of working capital. It consists of the sum of private standards:

where - the standard of working capital in inventories; - standard of working capital in work in progress; - the standard of working capital in the expenses of future periods; - standard of working capital in finished products.

1) Rationing of working capital in inventories begins with the determination of the average daily consumption of raw materials, basic materials and purchased semi-finished products in the planned year. The average daily consumption is calculated by groups, and in each group their most important types are distinguished, which make up approximately 80% of the total value of the material assets of this group. Unrecorded types of raw materials, basic materials and purchased products and semi-finished products are classified as expenses for other needs.

The standard of working capital in inventories is calculated by the formula:

![]() ,

,

where is the average daily consumption for each type of material.

The average daily consumption of material resources is the quotient of dividing the sum of all planned annual expenditures of raw materials by the number of working days in a year:

where P is the amount of material consumed in the reporting period; T - the duration of the reporting time period.

2) Work in progress includes products that are at various stages of processing - from the launch of raw materials, materials and components into production until acceptance by the department technical control finished products. Work in progress is determined by the amount of advanced cash invested in the cost of raw materials, basic and auxiliary materials, fuel, electricity, depreciation and other expenses. All these costs for each product increase as you move along the process chain.

The standard of working capital in work in progress is calculated by the formula:

where - the average daily volume of products at the production cost; - the duration of the production cycle for the manufacture of products; - the coefficient of increase in costs, reflecting the degree of readiness of products.

The average daily volume of output at production cost is calculated by the formula:

![]()

where Q is the output for the specified reporting period; - unit cost of production; T - reporting period of time.

The duration of the production cycle for manufacturing a unit of production is calculated by the formula:

The cost escalation factor is assumed to be:

![]() ,

,

where a - costs incurred at a time at the beginning of the production process; b - subsequent costs until the end of the production of finished products (costs not included in the composition).

3) Deferred expenses include expenses incurred in a given year, but repaid, that is, included in the cost of production in subsequent years. They are uneven.

The standard of working capital in deferred expenses is calculated by the formula:

![]() ,

,

where P is the carry-over amount of deferred expenses at the beginning of the planning year; P - deferred expenses in the planned year; C - deferred expenses to be written off to the cost of production of the planned year.

4) The next element of the working capital ratio is the working capital ratio for finished products, which includes products for which the production cycle has ended, they are accepted by the technical control department and handed over to the finished product warehouse. The working capital rate for finished products is determined by the time from the moment the products are accepted to the warehouse until the customer pays for them and depends on a number of factors:

the order of shipment and the time required for the acceptance of finished products from the shops;

the time required for the acquisition and selection of products up to the size of the shipped lot and in the assortment according to orders, orders, contracts;

time required for packaging, labeling products;

· the time required for the delivery of packaged products from the warehouse of the enterprise to the railway station, pier, etc.;

time of product loading vehicles;

time of storage of products in the warehouse.

The working capital ratio for financing finished products in stock is determined by the formula:

![]() ,

,

where NZ - the norm of the stock of working capital in finished products; q is the daily volume of shipped finished products in in kind; - unit cost of shipped products.

Calculations of the norms of working capital - time-consuming work. With the unchanged range of products and stability of prices for raw materials, materials, components, enterprises adjust the standard of the previous year for a change in the volume of production.

An economically justified standard of working capital allows you to organize working capital in such a way that in the process of their use, each ruble invested in turnover ensures maximum return. This standard makes it possible to analyze the state and level of use of working capital, to provide a system for monitoring them and the normal economic activity of an industrial enterprise, subject to constant sources of working capital coverage.

2. Analysis of the normalization of working capital of JSC "Plant of reinforced concrete products"

2.1 Brief description of the enterprise

Limited Liability Company "Reinforced Concrete Products Plant" was established on January 11, 1993.

Legal address: Russian Federation, Udmurt Republic. Izhevsk, st. Novosmirnovskaya, 22

Today it is a diversified enterprise, with its own established infrastructure, which has its own fleet of vehicles, loading equipment, access railways and carries out the entire complex of manufacturing and delivery of products to its customers.

ZhBI Plant LLC manufactures products with a product range of over 200 items. Directions:

· products for civil and industrial construction;

· production for arrangement of oil and gas fields.

The production of concrete weighting agents for oil and gas pipelines is one of the main activities of the plant.

The plant produces up to 50 types of concrete weights for main pipelines - these are: prefabricated ring weights of the UTK type, female type, UBO brands, as well as weights of the UBKM, UBK and UBP brands used when balancing pipes when crossing rivers and water barriers, as well as on swampy areas. All weights meet quality standards.

It is the only Russian manufacturer of reinforced concrete for the construction of main oil and gas pipelines with a diameter of 325 to 1420 mm.

Thanks to this, the plant participated in deliveries to all major construction of oil and gas pipelines in Russia from St. Petersburg to Sakhalin, including the regions of the Far North and South of the country.

The main customers of these products of the plant are the largest oil and gas companies in Russia, such as Gazprom, Lukoil, Tatneft, Transneft, Surgutneftegaz and Podvodtruboprovodstroy.

The success of the company, achieved over the past 12 years, is due to a strict approach to the quality of manufactured products, as well as to the competent management of the plant, which clearly knows that success requires quality and knowledge of the market situation. The plant successfully operates its own laboratory for product quality control, constantly expanding the range and market for manufactured products. The volume of production of reinforced concrete products is growing, as is the geography of their supplies.

The plant is continuously increasing production capacity, while introducing new technologies, mastering new products for civil, industrial construction, as well as the energy complex, which indicates the stability of the plant in the housing construction market.

ZhBI Plant LLC consists of two autonomous production facilities, each of which has its own mortar concrete unit, finished product warehouse, precast concrete production workshops, wall panels and so on, for the manufacture of reinforcing cages, masonry mesh, sections for the repair of metal molds. The plant has its own railway access roads, which make it possible to ship up to 650 tons of products and receive up to 350 tons of cement per day.

The company has its own vehicles to ensure the production of inert materials and transportation of products. Shipment of products can be carried out simultaneously from five points.

The experimental group operating at the plant is engaged in the introduction of new machines and equipment, which allows increasing the quantity and improving the quality of products.

The factory operates:

· the production and technical department, which deals with the planning of production, providing production with working drawings for the manufacture and shipment of products, control of the standard consumption of materials during production;

Department of the chief technologist, introducing new technologies in the manufacturing process.

Analysis financial results economic activities of LLC "Plant of reinforced concrete products" for 2007-2009. presented in table 2.1.

Table 2.1. Analysis of the financial results of ZhBI Plant LLC

| Indicator | 2007 | 2008 | 2009 | Deviation in absolute values 2007 by 2006 | Deviation in absolute values 2008 by 2007 |

Income and expenses from ordinary activities Revenue (net) from the sale of goods, products, works, services (net of VAT, excises and similar obligatory payments) |

|||||

| Production cost | 38227 | 42536 | 58782 | +4309 | +16246 |

| Gross profit | 4169 | 5649 | 6933 | +1480 | +1284 |

| Selling expenses | 102 | 110 | 170 | +8 | +60 |

| Management expenses | - | - | - | - | - |

| Profit (loss) from sales | 4067 | 5539 | 6763 | +1472 | +1234 |

Other income and expenses Interest receivable |

|||||

| Percentage to be paid | - | - | - | - | - |

| Other income | 100 | 745 | 625 | +645 | -120 |

| other expenses | 1279 | 2390 | 2985 | +1111 | +595 |

| Profit (loss) before tax | 2990 | 4004 | 4573 | +1014 | +569 |

| Deferred tax assets | - | - | - | - | - |

| Deferred tax liabilities | - | - | - | - | - |

| Current income tax | 717 | 960 | 1098 | +243 | +138 |

Net income (loss) reporting period |

2273 | 3044 | 3475 | +771 | +431 |

| Permanent tax liability | - | - | - | - | - |

Profit from sales increased in 2009 compared to 2007 by 2764 thousand rubles, the increase was due to an increase in the cost of production by 4309 thousand rubles. and an increase of 5797 thousand rubles. sales proceeds.

In the same period, commercial expenses increased by 8 thousand rubles.

Compared to 2008 profit from sales increased by 1284 thousand rubles. In 2008 in relation to 2007 there was an increase in profit in the amount of 1480 thousand rubles.

2.2 Analysis of working capital LLC "Plant of reinforced concrete products"

The structure of working capital of LLC Zavod ZHBI for 2007-2009 presented in Appendix 1.

From the presented structure, we can conclude that there is a trend of increasing the volume of working capital. In 2008 working capital of JSC "Plant of reinforced concrete products" in comparison with 2007. increased by 2774 thousand rubles. And in 2009 the volume of working capital increased by 4391 thousand rubles. compared to 2008

IN overall structure working capital account for the largest share of inventories. In the period from 2007-2009. there is a decrease in the share of stocks in the structure of working capital.

The growth of accounts receivable negatively affects the financial condition of the enterprise. Increases the risk of an increase in the percentage of non-return, LLC "Plant of reinforced concrete products" needs to take measures to reduce receivables.

One of the main conditions for the financial well-being of the enterprise is the inflow of funds to cover its obligations. The absence of his minimum required cash reserve is indicative of his serious financial difficulties. Excessive amounts of cash indicate that the company actually suffers losses associated, firstly, with inflation and the provision of money, and, secondly, with the lost opportunity to place and receive additional income.

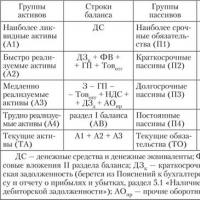

Also, working capital differs in the degree of liquidity.

The liquidity of assets is the reciprocal of the time required to turn them into money, that is, the less time it takes to turn assets into money, the more liquid they are. Allocate:

· The most liquid assets (cash, short-term financial investments);

Quickly realizable assets (accounts receivable, goods shipped, other current assets);

· Slowly sold assets (reserves).

In table. 3.3. presents an analysis of the composition and structure of working capital LLC "Reinforced Concrete Products Plant" in terms of liquidity for 2007-2009.

| Working capital group | The composition of the included items of the balance sheet asset | 2007 | 2008 | 2009 | Absolute deviation |

|

| 2008 by 2007 | 2009 by 2008 | |||||

1.Most liquid assets (thousand roubles.) |

1.1.Cash |

|||||

2.Fast realizable assets (thousand roubles.) |

2.1. Accounts receivable 2.2. Goods shipped 2.3.Other current assets |

|||||

3. Slowly realizable assets (thousand roubles.) |

3.1.Stocks | 2415 | 3223 | 4122 | +808 | +899 |

| Total: | 3882 | 5572 | 9121 | +1690 | +3549 | |

From the analysis of the composition and structure of the company's working capital, it can be seen that in 2008. compared to 2007 the value of the most liquid assets increased by 625 thousand rubles, and in 2009 compared to 2008 increased by 2418 thousand rubles.

Considering fast-moving assets, it can be seen that accounts receivable in 2009. decreased compared to the previous year, and other current assets in 2009. increased by 289 thousand rubles. compared to 2008

The liquidity ratio of working capital characterizes the state of working capital, it is equal to the ratio of the amount of short-term financial investments and cash to the result of the second section of the balance sheet "Current assets".

This ratio shows how cash in the composition of working capital tends to decrease or increase. This coefficient should tend to increase, any decrease in it leads to the current solvency and bankruptcy of the enterprise.

At LLC Plant of Reinforced Concrete Products as of January 1, 2009. the liquidity ratio of working capital was 0.17, and at the end of the year 0.37. Since there is an increase in the coefficient, the company restores solvency.

The coefficient of provision of reserves and costs with own sources of formation is considered as the ratio of the difference in the results of the third section of the balance sheet "Capital and reserves" and the first section "Non-current assets" to the amount of reserves.

The normative value of the coefficient is greater than or equal to the period from 0.6 to 0.8. It characterizes the ability of the enterprise to finance its own economic activity. At high values of the coefficient, a positive trend in financial and economic activity is revealed, that is, reserves and costs are fully covered own funds. At the beginning of the reporting year, it is equal to 0.95, and at the end of 0.87, that is, the enterprise independently finances its economic activities.

The coefficient of autonomy of sources of formation of reserves and costs is calculated as the ratio of the difference between the third section "Capital and reserves" and the first section "Non-current assets" and the difference between the third section and the first section plus the result of the fourth section "Long-term liabilities" and line 610 "Loans and credits". It reflects the share of working capital in the total amount of the main sources of inventory and costs. If the coefficient of autonomy of the sources of formation of reserves and costs is more than 0.5, then the enterprise has financial stability. At LLC "Plant of reinforced concrete products" at the beginning of 2009. the coefficient of autonomy of sources of formation of reserves and costs is 1.0, and at the end of the year it was 0.99. This shows that the main source of inventory and costs are own working capital, the company is financially stable.

Analysis of the composition and structure of working capital by investment risk is shown in Table 2.3.

|

From the analysis of working capital with minimal investment risk, it can be seen that the funds in 2008. increased by 625 thousand rubles. compared to 2007 And in 2009 the increase amounted to 2418 thousand rubles. This is due to the fact that a large amount of money is in the current account of the enterprise. Considering working capital with low investment risk in 2008. Compared to 2007, you can see:

· increase in accounts receivable by 276 thousand rubles. due to advance payment for gas and the gap between payment and receipt of funds to the current account;

· increase in inventories by 940 thousand rubles. due to a sharp change in prices for raw materials;

· reduction of finished product balances by 57 thousand rubles. due to more effective work sales.

In 2009 analysis of working capital with low investment risk, compared to 2008, showed:

· reduction of accounts receivable by 57 thousand rubles. due to advance payment for gas only for 1 month in advance;

· increase in inventories by 679 thousand rubles. due to the continued sharp change in commodity prices in the market;

· an increase in the balance of finished products by 181 thousand rubles. due to unbalanced work of production and sales.

For working capital with high and medium investment risk in 2008. there was a decrease by 75 thousand rubles. and 19 thousand rubles. respectively. And in 2009 on the contrary, there is an increase in these indicators by 39 thousand rubles. and 289 thousand rubles. respectively.

Accelerating the turnover of working capital (assets) reduces the need for them, allows enterprises to release part of working capital, either for non-production or long-term production needs of the enterprise, or for additional output.

As a result of the acceleration of turnover, the material elements of working capital are released, less stocks of raw materials, materials, fuel, work in progress are required, and, consequently, the monetary resources previously invested in these stocks and backlogs are also released.

The rate of turnover of funds is a complex indicator of the organizational and technical level of production and economic activities. The increase in the number of revolutions is achieved by reducing the production time and the circulation time. Production time is due technological process and the nature of the technology used. To reduce it, it is necessary to improve its technology, to mechanize and automate labor.

The total turnover of all working capital consists of the private turnover of individual elements of working capital. The speed of both general turnover and private turnover of individual elements of working capital is characterized by indicators:

1. The turnover ratio, or turnover rate, is calculated as the ratio of the cost of goods sold to the average balance of all working capital:

The turnover ratio shows the number of complete turnovers (times) made by working capital for the analyzed period of time. With an increase in the rate, the turnover of working capital accelerates.

2. The duration of one turnover is the duration of a complete circuit, performed from the first phase (acquisition of materials) to the last - the sale of finished products. Measured in days, calculated as the ratio of the average balance of material assets for the period ( to one-day revenue (

Reducing the turnover time leads to the release of funds from circulation, and its increase leads to an additional need for working capital.

Table 3.5 shows an analysis of the state of inventory turnover at Zavod ZHBI LLC.

Table 3.5

| Indicators | 2007 | 2008 | 2009 | Absolute deviation | |

| 2008 by 2007 | 2009 by 2008 | ||||

| 1. Material costs as part of the cost of sales, thousand rubles. | 23571 | 30619 | 42604 | +7048 | +11985 |

| 2. Cost of goods sold, thousand rubles. | 38227 | 42536 | 58782 | +4309 | +16246 |

3. Average balances, thousand rubles. production stocks Inventory of finished goods |

|||||

| 4. Inventory turnover ratio | 18,2 | 17,13 | 17,94 | -1,07 | +0,82 |

5. Period of storage of stocks, days production stocks Inventory of finished goods |

|||||

From table 3.5 we see that material costs increased by 7048 thousand rubles. and 11985 thousand rubles. in 2008 and 2009 respectively with respect to the previous year. This was influenced by rising prices for materials and an increase in output.

In turn, the growth of material costs affected the growth of the cost of goods sold. In 2008 the cost of goods sold increased by 4309 thousand rubles. compared to 2007 and in 2009 in relation to 2008 for 16246 thousand rubles.

The average balance of inventories increased in 2008. compared to 2007 by 484.5 thousand rubles, and in 2009. by 853.5 thousand rubles. compared to 2008 This indicates the need to increase the safety stock in order to ensure uninterrupted supply of production with the necessary raw materials and materials when the production and sales program changes.

Average balances of stocks of finished goods in 2008 compared to 2007 increased by 7512 thousand rubles. due to the imbalance of production and marketing activities, and in 2009. decreased by 7232.5 thousand rubles. as a result of increased demand and successful sales activities.

Shelf life of stocks of finished products in 2008. compared to 2007 increased by 55.4 days, and in 2009. compared to 2008 decreased by 55.65 days, which indicates effective management sales of finished products, the storage period of inventories in 2009 also decreased. compared to 2008 by 0.94 days, and in 2008. there was a slight increase (1.24 days) compared to 2005, which means that the uninterrupted process of production and sale of products is carried out at LLC Plant of Reinforced Concrete Products.

There was a decrease in inventory turnover in 2008. compared to 2007 1.07 times, and in 2009. an increase of 0.82 times compared to 2008.

In 2009, the activities of LLC "Reinforced Concrete Products Plant" turned out to be profitable. The company is solvent and financially stable. The output increased by almost 12% and the sold products increased by 38%.

Analysis of working capital showed that there is a trend of growth in the volume of working capital. In 2008 working capital of LLC "Reinforced Concrete Products Plant" in comparison with 2007. increased by 2774 thousand rubles. And in 2009 the volume of working capital increased by 4391 thousand rubles. compared to 2008

In the overall structure of working capital, the largest share is occupied by inventories. In the period from 2007-2009. there is a decrease in the share of stocks in the structure of working capital.

From the analysis of the composition and structure of the company's working capital, it can be seen that there is an increase in the most liquid assets, in 2008. their growth amounted to 625 thousand rubles, and in 2009. 2418 thousand rubles

The change in the speed of working capital was achieved as a result of the interaction of two factors: an increase in revenue and an increase in the average balance of working capital.

Conclusion

Rationing of working capital plays an important role in the activities of the enterprise, since working capital is an important part of the property of the enterprise. They are necessary to ensure an uninterrupted production process and the possibility of its continued existence. Rationing of working capital is necessary to ensure the effective functioning and stability of working capital, which testify to a stable, well-established process of production and marketing of products.

The presence of a sufficient amount of working capital at the enterprise is a necessary prerequisite for the normal functioning of the enterprise in a market economy.

Having analyzed in this term paper production and economic activities of the enterprise OJSC "Plant of reinforced concrete products", the author made a conclusion about the current state of the enterprise and its policy regarding the regulation of working capital.

In order to increase the efficiency of the use and rationing of working capital LLC "Plant of reinforced concrete products" is proposed:

1. strengthen internal control for the safety and rational use of materials, fuel, electricity in the manufacture of the company's products;

2. to improve methods for analyzing the effectiveness of working capital, for this purpose, to carry out operational control over the compliance of the balances of inventories in warehouses with their minimum standards, to constantly monitor the state of receivables, preventing an increase in its terms against contracts;

3. to mechanize accounting operations in more labor-intensive areas of accounting: cash, settlement operations, accounting for materials of finished products in the shops and warehouses of the enterprise;

4. invest money in the production of new products that are in demand in the local and other markets;

5. form a policy for the use of working capital in general and develop measures for their optimization.

Thus, the choice of an enterprise development strategy and improvement of its performance indicators depends on the market situation, the principles adopted at the enterprise corporate culture and above all from the specifics of the enterprise. In different sectors of the market, and depending on whether the company is developing, is in a phase of relative stability or in a pre-crisis state, different methods of normalizing working capital should be applied.

List of used literature

1. Abryutina M.S., Grachev A.V. Analysis of the financial and economic activities of the enterprise: Educational and practical guide. – M.: Business and Service, 2000.

2. Bagiev G.L., Asaul A.N. Organization of entrepreneurial activity. Tutorial. - St. Petersburg: SPbGUEF, 2001. 231s.

3. Bakanov M.I. Sheremet A.D. Theory of economic analysis. - M.: Finance and statistics, 2003. - 651 p.

4. Zaitsev N.L. Economics and Organizations: A Textbook for High Schools. 2nd ed., revised and enlarged. M.: Publishing house "Exam", 2005. 624 p.

5. Drury K. Management and production accounting. – M.: UNITI, 2003. p.354.

6. Kovalev V.V. The financial analysis: Methods and procedures. - M.: Finance and statistics, 2001. p.298.

7. Krum E.V. Economics of the enterprise: Textbook.-method. allowance for advanced training and retraining of teachers and specialists of the education system. Minsk: RIVSH, 2005. 152 p.

8. Markaryan E.A., Gerasimenko G.P. Economic analysis of economic activity. - Rostov-on-Don: Phoenix, 2005. 560 p.

9. Savitskaya G.V. Analysis of the economic activity of the enterprise, - M .: New knowledge. - 2003. - 560 p.

10. Sheremet A.D. Comprehensive economic analysis of the enterprise (questions of methodology), - M .: Infra-M. - 2002. - 473 p.

11. Economics of the enterprise (firm): Textbook / Ed. prof. O.I. Volkova and Assoc. O.V. Devyatkin. 3rd ed., revised and enlarged. M.: INFRA-M, 2002. 601 p. (series "Higher education").

12. Enterprise Economics: Textbook / Ed. A.E. Karlika, M.L. Schuchhalter. M.: INFRA-M, 2004. 432 p. (Higher education).

13. Economics, organization and planning industrial production: Textbook. allowance for students of secondary special. textbook institutions / T.V. Karpey, L.S. Lazuchenkova, V.S. Korzhov, L.A. Selkin; Under total ed. T.V. Karpey. Ed. 3rd fix and supplemented. Mn.: Design PRO. 2003. 272 p.

14. Abalkin N. Qualitative change in the structure of the financial market and the flight of capital from Russia // Questions of Economics. - 2000. - No. 2. – P.11.

15. Agaptsov S.A. Russian industry will revive if it is helped. // Business Volga region. - 1998. - No. 43 - P.3.

16. Radionov R.A. New approaches to the regulation of working capital at the enterprise // Financial management. 2005. No. 3. S.21-33.

Any production process in the enterprise will be the result of a connection work force with the means of production, which are represented by fixed and circulating capital. Working capital is a key element of production, providing it with the necessary financial resources and determining the continuity of the enterprise.

working capital represent the amount of funds advanced to create working capital assets and circulation funds.

Revolving production assets- ϶ᴛᴏ part of the means of production, which once participates in the production process, immediately and completely transfers ϲʙᴏ value to manufactured products and in the production process changes (raw materials, materials) or loses (fuel) ϲʙᴏ its natural-material form. These include: raw materials, basic and auxiliary materials, components, unfinished products, fuel, packaging, clothing, deferred expenses, etc.

circulation funds include funds servicing the process of selling products (finished products in stock; goods shipped to customers but not yet paid for by them; funds in settlements; cash in the cash desk of the enterprise and in bank accounts) It is worth noting that they do not participate in the production process, but necessary to ensure the unity of production and circulation.

The share of working capital and circulation funds in the structure of working capital depends on the sectoral affiliation of the enterprise, the duration of the production cycle, the level of specialization and cooperation, and other factors.

Current assets of the enterprise are in constant motion and function simultaneously in two areas: the sphere of production and the sphere of circulation. During the production cycle, they go through three stages circuit:

- first stage(supply) involves spending money and supplying objects of labor. At the ϶ᴛᴏ stage, there is a transition of working capital from the monetary form to the commodity one;

- on the second stage(production) working capital enters production, eventually turning into finished products;

- third stage(sales) occurs when finished products are sold to consumers. Circulating assets move from the sphere of production to the sphere of circulation and again change their form - from commodity to monetary.

Based on all of the above, we come to the conclusion that the funds make one turn, then everything repeats again: the funds from the sale of products are directed to the purchase of new objects of labor, etc.

In the process of movement, working capital is simultaneously at all stages and in all forms, as a result of which the continuity and rhythm of the production process at the enterprise is achieved. The duration of working capital at each stage of the circulation is not the same and depends on the technological properties of raw materials and finished products, the duration of the production cycle, the characteristics of logistics and marketing of products. So, for example, the seasonality of the receipt of raw materials in certain industries (fruit and vegetable industry) causes a delay in working capital at the first stage of the circulation; in industries with a long production cycle (shipbuilding) there is a delay in working capital at the second stage of the circulation in the form of work in progress; uneven sales of products causes the accumulation of funds in the third stage of the cycle.

In the practice of economic work, to study the composition and structure, working capital is classified according to several criteria.

By spheres of turnover (by economic content) working capital is divided into working capital assets (field of production) and circulation funds (sphere of circulation)

Separate parts of working capital have different purposes and can be used in different ways in production and economic activities, therefore they are classified on the following items.

Revolving funds:

- production stocks - raw materials, basic and auxiliary materials, purchased semi-finished products, fuel, containers, spare parts;

- work in progress and semi-finished products of own production;

- future spending. Funds of circulation:

- finished products in warehouses;

- products shipped but not paid for;

- funds in settlements;

- cash on hand and in accounts.

Price work in progress consists of the cost of consumable raw materials, basic and auxiliary materials, fuel, energy, water, part of the cost of the OPF transferred to the product, as well as wages accrued to employees. the size of the backlog of work in progress depends on the duration of the production cycle and the size of the lot.

The costs of developing new products, preparatory and other work, designed for a long time, are future spending and written off to the cost of production in the future. Their need is caused by the work related to the financing of promising changes in the structure of products, technology, etc.

By scope of normalization current assets are divided into standardized and non-standardized. Standards are established for normalized working capital, i.e., minimum sizes (working capital in inventories) company accounts)

According to the sources of formation current assets are divided into own and borrowed. Own - ϶ᴛᴏ current assets that are in constant use of the enterprise. These include funds that an enterprise is allocated during its organization (authorized capital), deductions from profits, stable liabilities (for example, wage arrears to personnel) resources, which is covered by borrowed funds (for example, bank loans)

The presence of own and borrowed funds in circulation is explained by the peculiarities of the organization of the production process. Each enterprise faces the task of maintaining the optimal proportion between its own and borrowed funds, which characterizes the financial stability of the enterprise. It is believed that a constant minimum amount of funds to finance the needs of production is provided by own working capital. Temporary need for funds arising under the influence of reasons dependent and beyond the control of the enterprise is covered by borrowed funds.

Under working capital structure the ratio of their individual elements in the totality is understood. It is worth noting that it depends on the sectoral affiliation of the enterprise, on the level of specialization and cooperation, on the quality and competitiveness of the products, the duration of the production cycle, the pace of scientific and technological development of the enterprise. At enterprises with a long production cycle (for example, in heavy engineering, shipbuilding), the share of work in progress is large; in the light and food industries, where the production cycle is relatively short, the structure of working capital is dominated by inventories with a low share of work in progress; there is no unfinished product in the electric power industry at all; at the enterprises of the mining industry, a significant share of deferred expenses.

Analysis of the structure of working capital at the enterprise is of great importance, since it will be a kind of mirror, in which the financial condition of the enterprise is demonstrated. Thus, an excessive increase in the share of receivables, finished products, work in progress indicates a deterioration in the financial condition. Accounts receivable characterizes the diversion of funds from the turnover of a given enterprise and their use by debtors in this turnover. The unsatisfactory organization of the marketing of finished products leads to an increase in the share of finished products in the warehouse (overstocking), the diversion of a significant part of working capital from circulation, a decrease in sales volume, and, consequently, profit. On the contrary, a well-organized product marketing system, the release of goods on consumer orders, and an established shipping mechanism do not allow working capital to linger at the ϶ᴛᴏth stage of the circulation.

The organization of working capital at the enterprise includes determining the need for working capital, their structure, sources of formation of working capital and managing the use of working capital (increasing their turnover)

Rationing of working capital

From the standpoint of production efficiency, the volume of working capital should be optimal, that is, sufficient to ensure an uninterrupted production process, but at the same time minimal, not leading to the formation of excess stocks, freezing funds, increasing production costs and product sales. The need to form working capital in optimal size is caused by the fact that between the time of consumption of material resources in production and the receipt of sales proceeds, there is a time lag, which depends on many internal and external factors. The amount of working capital sufficient for the normal functioning of the production process and the sale of products is established by normalizing working capital, which will be the basis for their rational use.

Rationing of working capital- ϶ᴛᴏ the process of determining the minimum, but sufficient for the normal course of the production process, the amount of working capital in the enterprise.

In a market economy, the value of working capital rationing is very high: enterprises must independently establish and control the working capital standard, since in the end, the efficiency of the enterprise and its financial position(solvency, stability, liquidity) Understating the amount of working capital entails an unstable financial situation, interruptions in the production process and, as a result, a decrease in production volume and profitability. Material published on http: // site

On the contrary, an overestimation of the size of working capital freezes funds in any form (warehouse stocks, suspended production, excess raw materials and materials), thereby preventing investments in the expansion and renewal of production.

In the practice of intra-production planning, enterprises use the following methods of normalization of working capital.

Analytical the method involves the calculation of the need for working capital in the amount of their actual average balances, taking into account the growth in production in the planning period. A detailed analysis of the effectiveness of the use of working capital in the base period is preliminary carried out, factors and reserves for accelerating their turnover will be eliminated. It is used at enterprises, in the structure of working capital of which a large share is occupied by inventories.

coefficient the method is based on dividing the elements of working capital into two groups depending on the change in the volume of production. The current assets included in the first group depend on the volume of production. The calculation of the need for them is carried out by an analytical method based on their size in the past period and the expected growth in production (raw materials, materials, finished products, work in progress) the second group includes deferred expenses, spare parts, low-value and wearing items, i.e. all types working capital, the value of which does not depend on changes in the volume of production. Rationing of working capital of the second group is made on the basis of actual average balances for the previous period.

Method direct account consists in calculating the need for normalized working capital for each of their elements. The advantage of the ϶ᴛᴏth method lies mainly in the fact that it allows you to accurately determine the need for working capital. At the same time, it is quite laborious, requires highly qualified economists, and is mainly used with a narrow range of material resources. The method is used to clarify the need for working capital of an existing enterprise or when organizing a new enterprise, when there are no statistical data, no rhythmically operating production, or a formed production program yet.

The direct counting method requires the determination of stock rates and average daily consumption for certain types working capital. When normalizing working capital, it is extremely important to take into account the dependence of norms and standards on the duration of the production cycle, the conditions of logistics (intervals between deliveries, the size of the supplied batches, the remoteness of suppliers, the speed of transportation) and the conditions for the sale of products.

The methodology for calculating the need for working capital using the direct account method is presented below.

General working capital ratio is the sum of private standards:

Ntot = Np. h + Hn. n + Hg. n + Nb. R,

where Npz is the standard of production reserves;

Nn. n - the standard of work in progress;

Ng. p - the standard of finished products;

Nb. p - normative expenses of future periods.

all components of the general norm of working capital must be presented in monetary terms.

Inventory standard is determined by the formula:

Np. h = Qday * N,

where Qday- average daily consumption of materials, rub.;

N- the stock rate for this element of working capital, days.

The working capital stock rate is the period (number of days) during which working capital is diverted into production inventories. The reserve rate consists of the current, preparatory, insurance, transport and technological reserves:

N = Nt. h + Np. h + Nstr + Ntr + Ntechn.

Note that the current stock- the main type of stock, ensuring the continuity of the production process. The size of the current stock is affected by the frequency of deliveries under contracts and the volume of consumption of materials in production. It is worth noting that it is usually accepted at the level of half the average interval between deliveries. The average interval between equal deliveries (supply cycle) is determined by dividing 360 days by the number of planned deliveries.

Insurance, or warranty, stock necessary in case of unforeseen circumstances (for example, in case of short supply of raw materials) and is traditionally set at 50% of the current stock, but may be less than the ϶ᴛᴏth value depending on the location of suppliers and the likelihood of interruptions.

Transport stock is created only in case of exceeding the terms of cargo turnover in comparison with the terms of document circulation. Document flow - the time for sending settlement documents and handing them over to the bank, the time for processing documents in the bank, the time for the postal run of documents. In practice, the transport stock is determined on the basis of actual data for the previous period.

Note that the technological reserve created during the preparation of materials for production, including analysis and laboratory testing. Note that technological stock is taken into account only if it is not part of the production process.

Preparatory Stock is established on the basis of technological calculations or by means of timing and refers to materials that cannot immediately go into production (wood drying, grain processing)

In some cases, a seasonal stock rate is also established, when the type of harvested resources (sugar beet) or the method of delivery (by water transport) is seasonal.

Working capital ratio for work in progress is determined by the formula:

Nn. n = Vd. Tts. Book. h,

where Vday is the planned average daily volume of output at production cost;

Tts - the duration of the production cycle, days;

Knz - the coefficient of increase in costs.

At enterprises with uniform output, the cost increase coefficient can be determined by the formula:

where but- costs incurred at a time at the beginning of the production process (raw materials, basic materials, semi-finished products);

in- subsequent costs until the end of the production of finished products (for example, wage, depreciation deductions)

Working capital ratio for deferred expenses is determined by the formula:

Nb. R = P + R - S,

where P is the carry-over amount of deferred expenses at the beginning of the planned year (taken from the balance sheet);

P - deferred expenses in the coming year (determined on the basis of the plan for the scientific and technical development of the enterprise);

C - deferred expenses to be written off to the cost of production of the coming year in ϲᴏᴏᴛʙᴇᴛϲᴛʙii with a planned estimate of production costs.

Working capital ratio for stocks of finished products:

Ng. p \u003d Vday (Tf. p + To. d),

where Tfp is the time required to form a batch to send the finished product to the consumer, days;

Tod - the time required to complete the documents for sending the goods to the consumer, days.

As mentioned above, the total standard of working capital at the enterprise is equal to the sum of the standards for all elements. General norm of all working capital in days is established by dividing the general standard of working capital by the average daily output of marketable products at production cost.

Indicators of the effectiveness of the use of working capital and ways to accelerate turnover

The efficiency of the use of working capital is characterized by a system of indicators. Do not forget that the most important criterion for the intensity of the use of working capital will be the speed of their turnover. The shorter the period of turnover of funds and the less they are at various stages of turnover, the more efficiently they can be used, the more money can be directed to other purposes of the enterprise, the lower the cost of production.

The efficiency of the use of working capital is characterized by the following indicators.

Working capital turnover ratio(Kob) shows the number of turnovers made by working capital for the analyzed period (quarter, half year, year) It is worth noting that it is calculated as the ratio of the volume of products sold to the average balance of working capital for the reporting period:

The higher the turnover ratio, the more efficiently the company uses working capital.

It can be seen from the formula that an increase in the number of turnovers indicates either an increase in the volume of sales with a constant balance of working capital, or a release of a certain amount of working capital with a constant sales volume, or characterizes a situation where the growth rate of sales volume exceeds the growth rate of working capital. Acceleration or deceleration of the turnover of working capital is determined by comparing the actual turnover ratio with its value according to the plan or for the previous period.

Duration of one turn in days shows how long working capital makes a full turnover, i.e., they return to the enterprise in the form of proceeds from the sale of products. is calculated by dividing the number of days in the reporting period (year, half year, quarter) by the turnover ratio:

Substituting its formula instead of the turnover ratio, we get:

in the practice of financial calculations, for simplicity, when calculating the duration of one turnover, the number of days in a month is assumed to be 30, in a quarter - 90, in a year - 360.

Load factor of funds in circulation characterizes the amount of working capital advanced for one ruble of proceeds from the sale of products. By analogy with the capital intensity of fixed assets ϶ᴛᴏt, the indicator represents the working capital intensity, i.e. the cost of working capital (in kopecks) per one ruble of sold products:

The load factor will be the reciprocal of the turnover ratio, which means that the lower the load factor of funds in circulation, the more efficiently working capital can be used at the enterprise.

In addition to the considered general indicators of turnover of working capital, in order to identify specific reasons for the change in total turnover, indicators of private turnover are determined, which reflect the degree of use of working capital at each stage of the circulation and for individual elements of working capital (calculated similarly to the above formulas)

The effective use of working capital consists not only in accelerating their turnover, but also in reducing the cost of production and sales of products due to the saving of individual elements of working capital (raw materials, materials, energy). consider material consumption of products(Me) - the ratio of the amount of material costs to the volume of output or sales of products:

Particular indicators of material intensity will be raw material intensity, metal intensity, electrical intensity, fuel capacity and energy intensity; when calculating them, the numerator reflects the amount of consumed raw materials, metal, electricity, fuel and energy of all kinds in physical or value terms.

The inverse indicator of material consumption is material return, kᴏᴛᴏᴩaya is determined by the formula:

The better raw materials, materials, semi-finished products, energy can be used, the lower the material consumption and the higher the material efficiency.

Based on the analysis of the effectiveness of the use of working capital, ways to accelerate their turnover. The acceleration of turnover is achieved by various activities at the stages of formation of inventories, production and sale of finished products.

Management of the use of working capital involves the implementation of the following ways to accelerate turnover:

- intensification of production processes, reduction of the duration of the production cycle, elimination of various kinds of downtime and interruptions in work, reduction of the time of natural processes;

- economical use of raw materials and fuel and energy resources: the use of rational consumption rates for raw materials and materials, the introduction waste-free production, the search for cheaper raw materials, the improvement of the system of material incentives for saving resources. All of the above measures will reduce the material consumption of products;

- improvement of the organization of the main production: acceleration of scientific and technical progress, the introduction of advanced technology and technology, improving the quality of tools, equipment and fixtures, the development of standardization, unification, typification, optimization of forms of organization of production (specialization, cooperation, rationalization of interfactory relations);

- improvement of the organization of auxiliary and service production: complex mechanization and automation of auxiliary and service operations (transport, storage, loading and unloading), expansion of the warehouse system, application automated systems warehouse accounting;

- improving work with suppliers: bringing suppliers of raw materials, materials and semi-finished products closer to consumers, reducing the interval between deliveries, speeding up workflow, using direct long-term relationships with suppliers;

- improvement of work with consumers of products: bringing consumers of products closer to manufacturers, improving the settlement system (dispensing products on a prepaid basis, which will reduce accounts receivable), increasing the volume of products sold due to the fulfillment of orders through direct communications, careful and timely selection and shipment of products by batches and assortment , reduction of stocks of finished products due to improved planning of the shipment of finished products;

- the use of logistics approaches in procurement management, organization of production, in the field of marketing of finished products, which will reduce the duration of the circulation of working capital and reduce production and sales costs.

1. Working capital will be an important part of the capital of the enterprise and ensure the smooth functioning of the production process. It is worth noting that they are constantly in motion, successively passing through the stages of circulation and changing their ϲʙᴏ form.

2. Working capital is classified according to a number of criteria: by sphere of turnover, by elements, by belonging, by standardization coverage, by sources of formation.

3. The basis for the rational use of working capital is considered to be their rationing - the determination of the minimum necessary, but sufficient for an uninterrupted production process.

4. The criterion for the effectiveness of the use of working capital will be their turnover. The faster working capital goes through all stages of circulation and returns to the enterprise in the form of sales proceeds, the more efficiently they can be used.

5. Management of the use of working capital involves a constant search for factors and reserves to accelerate their turnover.

To ensure the uninterrupted production and sale of products, as well as for the effective use of working capital at enterprises, their rationing is carried out. Rationing is the establishment of norms for the consumption of resources for a product. With its help, the total need of the enterprise for working capital is determined.

Consumption rates are considered to be the maximum allowable absolute values of the consumption of raw materials and materials, fuel and electrical energy for the production of a unit of output.

Rationing the consumption of certain types of material resources provides for the observance of certain scientific principles. The main ones should be: progressiveness, technological and economic feasibility, dynamism and ensuring the reduction of standards.

When planning the need for working capital, the following rationing methods are used:

1. Method of direct counting- scientifically based calculation of standards for each element of normalized working capital, taking into account changes in the level of organizational and technical development of the enterprise, transportation of goods and materials, and the practice of settlements with counterparties. This method is considered the main one in the industry.

2. Analytical- the OBS standard is established in the amount of their average actual balances for a certain period, taking into account the adjustment for surpluses and unnecessary stocks, as well as changes in the conditions of production and supply. This method is used in those enterprises where the funds invested in material assets and costs have a larger share in the total amount of working capital.

3. Ratio- consists in adjusting the working capital standards in force in the previous period in accordance with changes in the volume of production and the acceleration of the turnover of the OBS. At the same time, inventories are divided into those that depend directly on changes in production volumes (raw materials, materials, costs of work in progress, finished products in stock) and those that do not depend on it (spare parts, deferred expenses, low-value items).

For the first group, the need for working capital is determined based on their size in the base year and the growth rate of production in the next year. For the second group, the demand is planned at the level of their average actual balances over a number of years.

4. Experimental laboratory– is based on measurements of OBS consumption and volumes of manufactured products in laboratory and pilot production conditions. Consumption rates are set by selecting the most reliable results and calculating the average value using the methods of mathematical statistics. This method is applied in chemical production, construction, extractive industries and auxiliary production.

5. Reporting and statistical- based on the analysis of data from statistical (accounting or operational) reporting on the actual consumption of materials per unit of output for the past (base) period. It is used to develop norms for the consumption of material and raw materials and fuel and energy resources.

Rationing begins with determining the average daily consumption of raw materials, basic materials and semi-finished products (Rsut) in the planning period:

where P is the volume of material consumption for the period, rub.;

T is the period of time.

Working capital rate (N a.obs) - the value corresponding to the minimum, economically justified volume of reserves. It is usually set in days.