We learn to draw up advance reports using examples (1C: Accounting 8.3, revision 3.0)

We learn to draw up advance reports using examples (1C: Accounting 8.3, revision 3.0)

2016-12-08T12: 30: 37 + 00: 00According to my observation, for novice accountants, the preparation of advance reports is a significant difficulty at first.

Today we will look at the basics of this case, as well as the most popular cases from life. We will put all experiments in 1C: Accounting 8.3 (revision 3.0).

So, let's begin

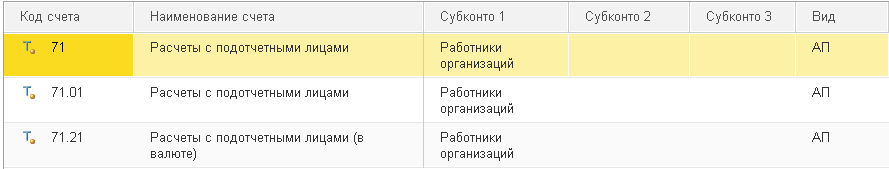

It's not for me to tell you that 71 accounts are responsible for settlements with accountable persons in the accounting department:

Issuance assets reflected to the employee on the debit of this account, and the write-off - on the credit.

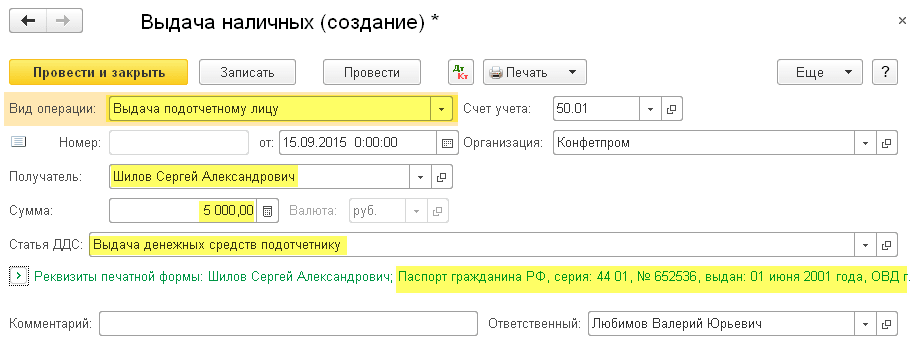

Well, for example, they issued 5000 against a report from the cashier:

Why did I say assets? This is because we can issue an employee:

- Cash (from the cash desk through the cash settlement center)

- Non-cash funds (transfer from the current account of the organization to the card account of the employee)

- Cash documents (for example, plane tickets for a business trip)

Let's take a look at each of the examples above.

Cash withdrawal from the cash desk

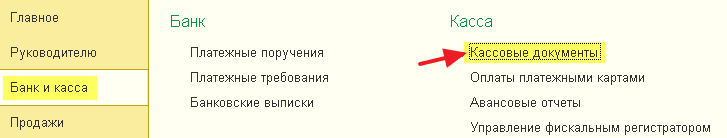

To issue an advance from the cash register, we draw up an expense cash order (in the top three this is the document "Cash withdrawal"):

In the form of an operation, we indicate "Issue to the accountable person":

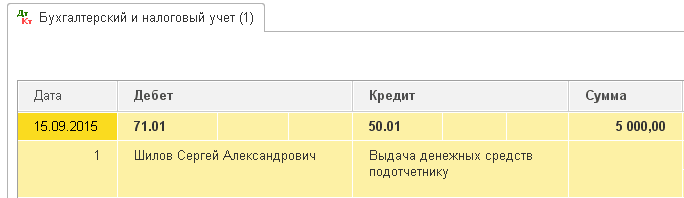

The wiring turned out like this:

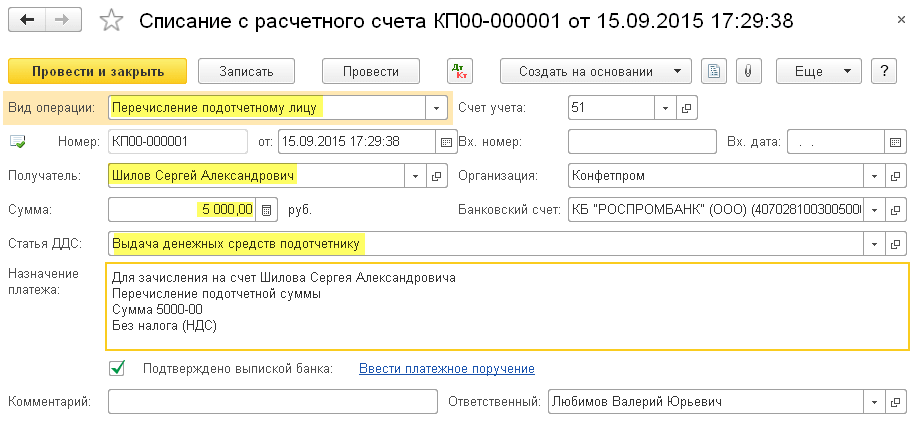

Issuance of non-cash funds

In this case, the funds are transferred to the employee's card account (the account to which the bank card is linked, with which the employee can withdraw this money).

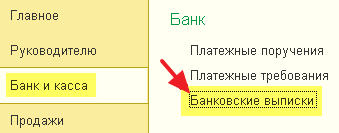

In the troika, this operation is drawn up with the usual document "Write-off from the current account":

Also, do not forget to indicate in the form of an operation "Transfer to the accountable person":

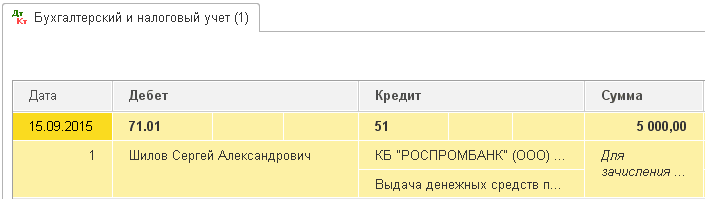

The wiring turned out like this:

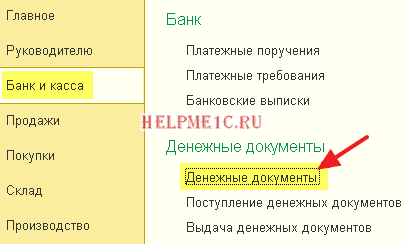

Issuance of cash documents

A monetary document can be, for example, an airplane ticket that the organization purchased for an employee who is traveling on a business trip.

After purchase, this ticket is recorded on account debit 50.03:

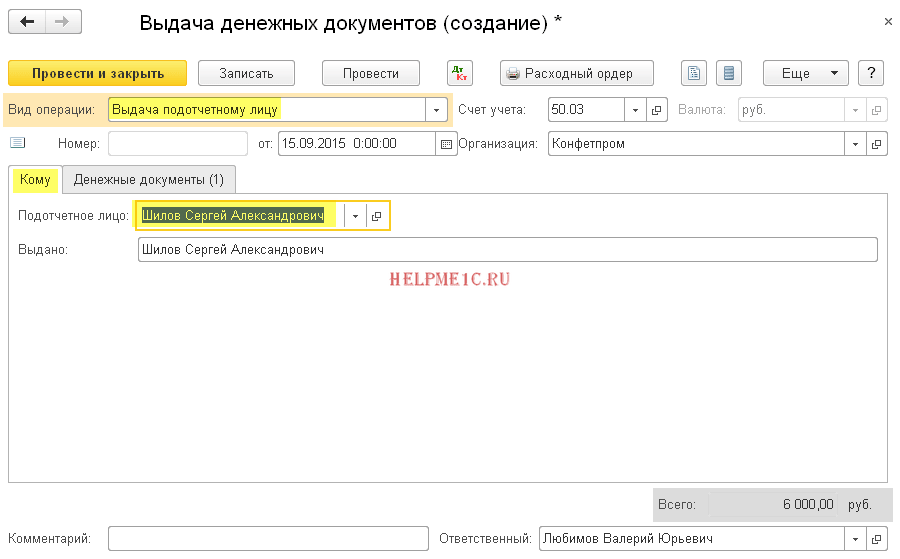

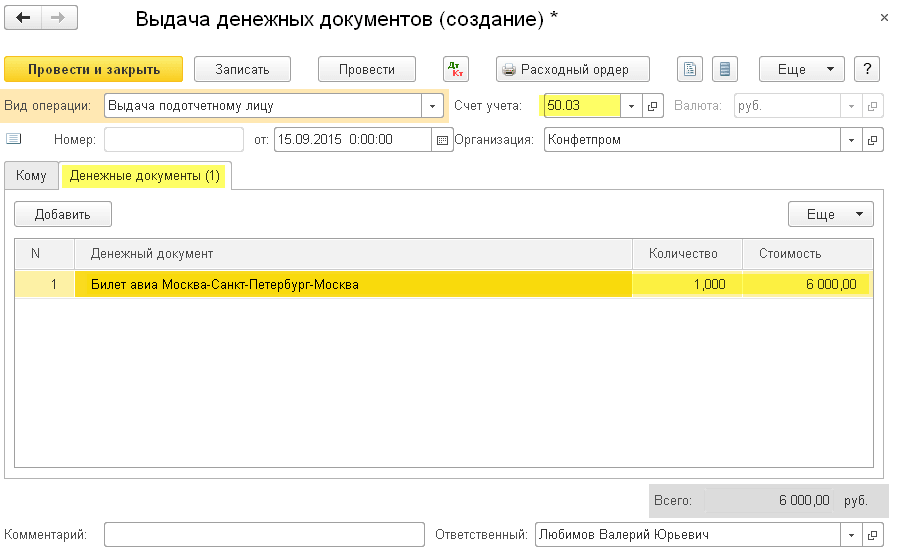

When issuing this ticket to an employee against a report (before a business trip), the accounting department draws up the document "Issuance of cash documents":

And on the tab "Cash documents" indicates this same ticket:

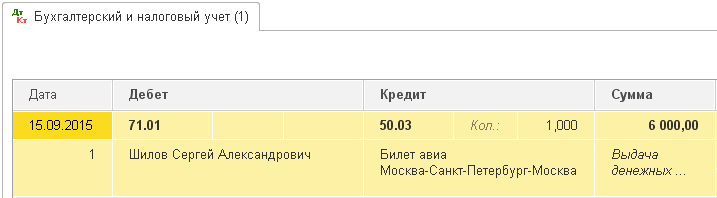

The posting turned out like this (they wrote off the ticket from the account 50.03):

I will separately mention:

- We have the right to issue a report only to the employees of the organization - to persons with whom we have concluded an employment or civil law contract.

- The list of such persons is approved by a separate order of the head.

- The same order stipulates the maximum period after which the employee must report to the accounting department; if the employee leaves for a business trip, then this period is automatically extended until his return.

Employee reports

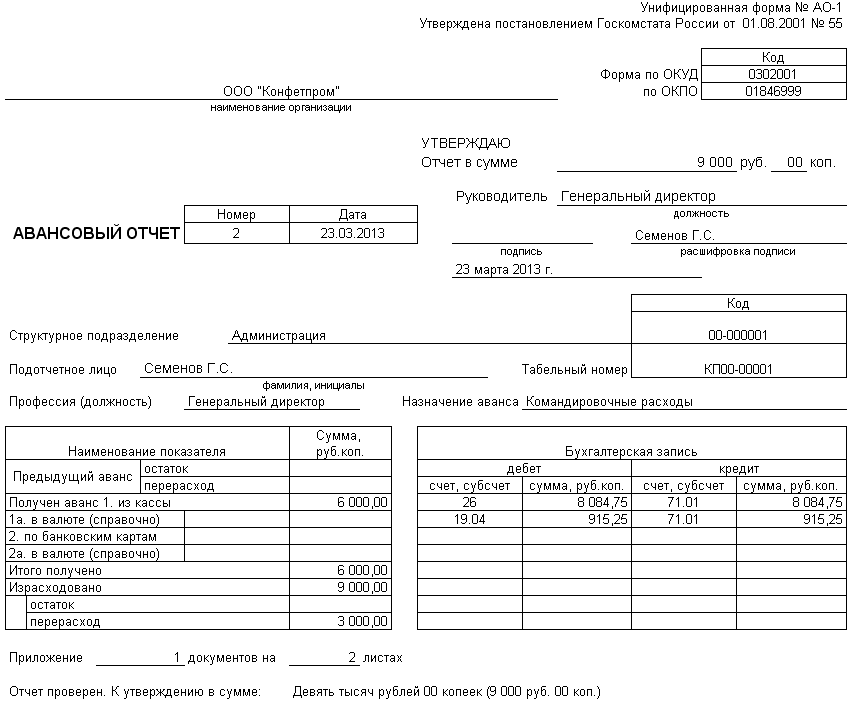

But after all, assets are issued to an employee for a reason, but for the fulfillment of a certain official assignment. Therefore, there comes a time when the employee must report to the accounting department in the form of AO-1.

This is a printed form in which it is indicated:

- everything that we gave to the employee against the account

- everything that he spent this money on (or did not spend, or maybe there was an overrun at all)

- this form is accompanied by supporting documents (checks, invoices, acts, tickets ...)

Here's an example of the AO-1 form:

This report (AO-1) is drawn up by the employee together with the accounting department and approved by the head. At the very bottom, the number of documents and sheets on which they are attached to the report is indicated (checks are usually stuck in whole bundles on A4 sheets).

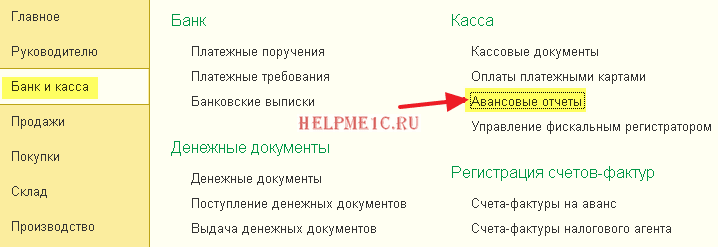

So, in order to print such a report (AO-1), to write off the debt on account 71 from the employee, and also to accept the expenses in the top three, there is a document "Advance report":

Let's take a quick look at its tabs:

Examples of advance reports from life

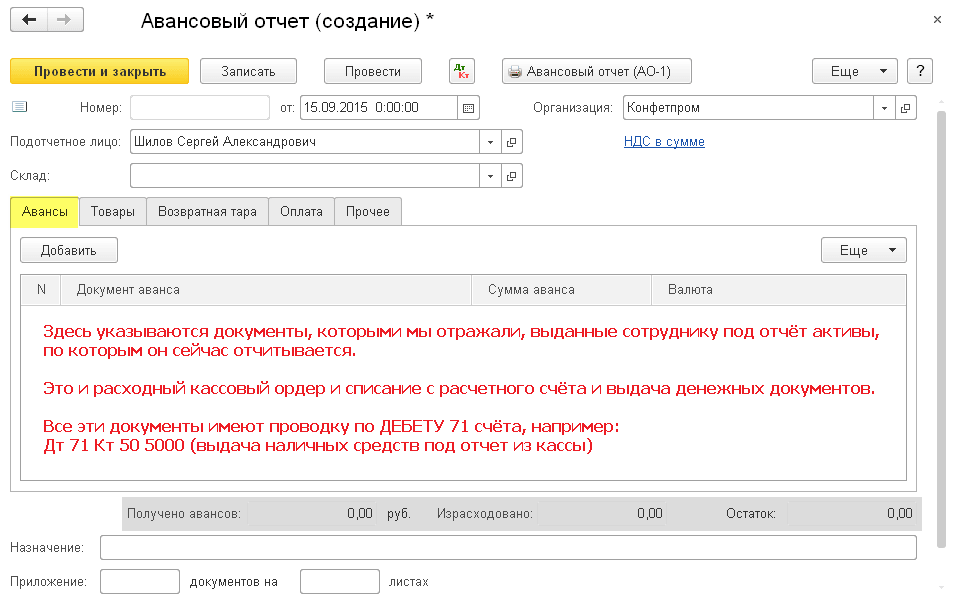

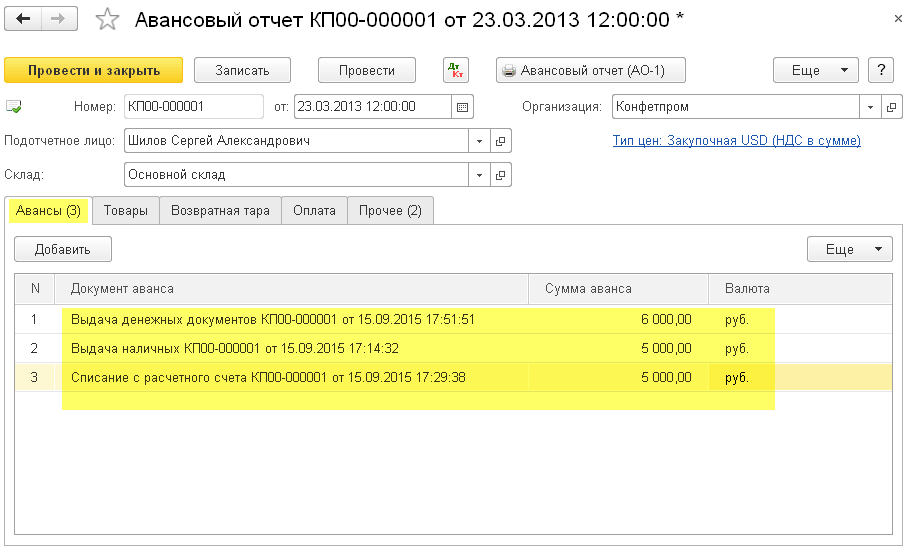

Fill in the "Advances" tab:

I must say that this tab is not displayed in any way in the document transactions, but only for the AO-1 printing form.

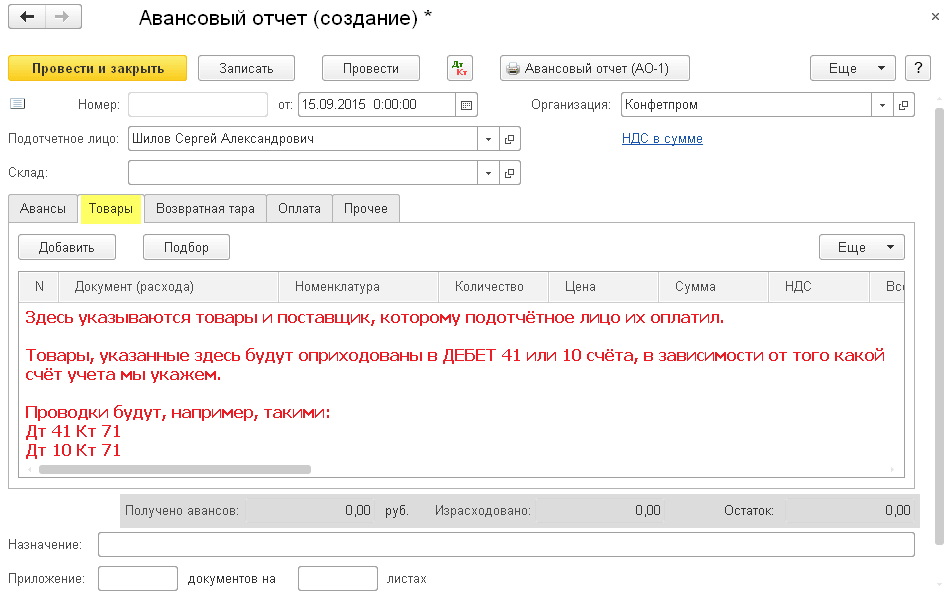

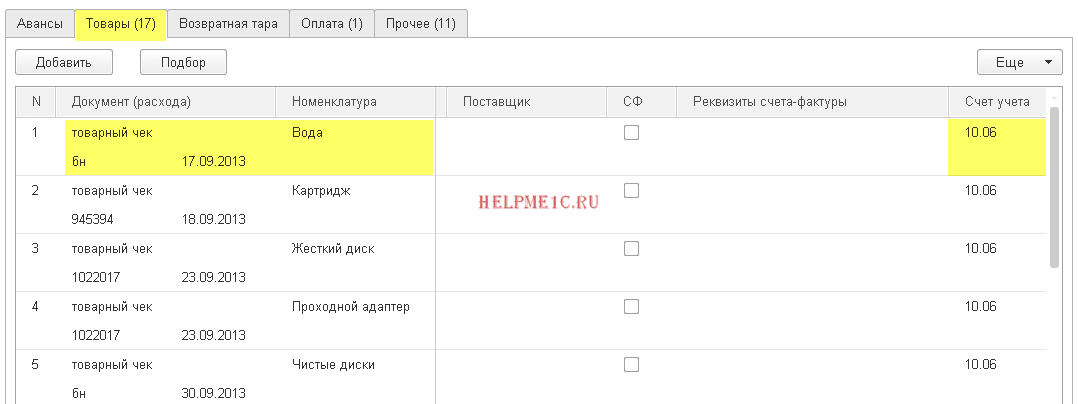

Fill in the "Products" tab (bought a bunch of everything and put it in the top ten):

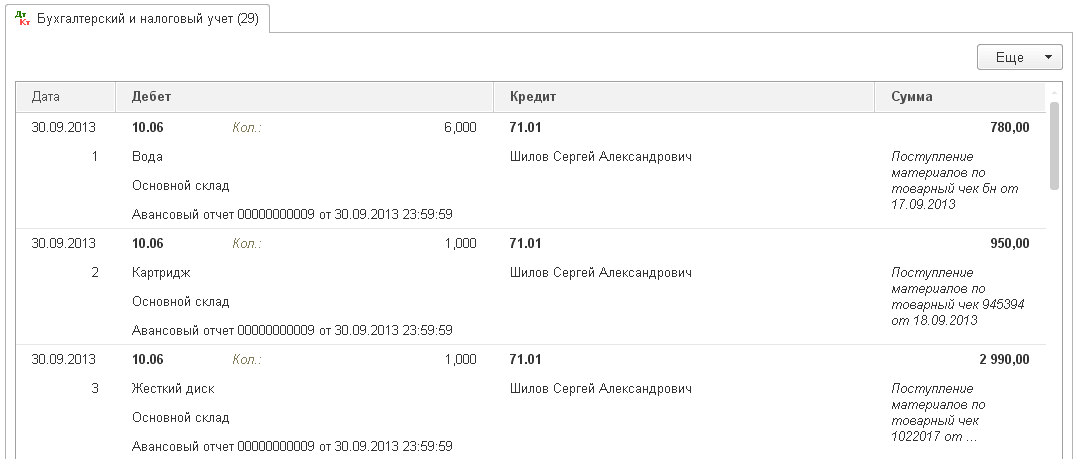

Here are the entries for this tab:

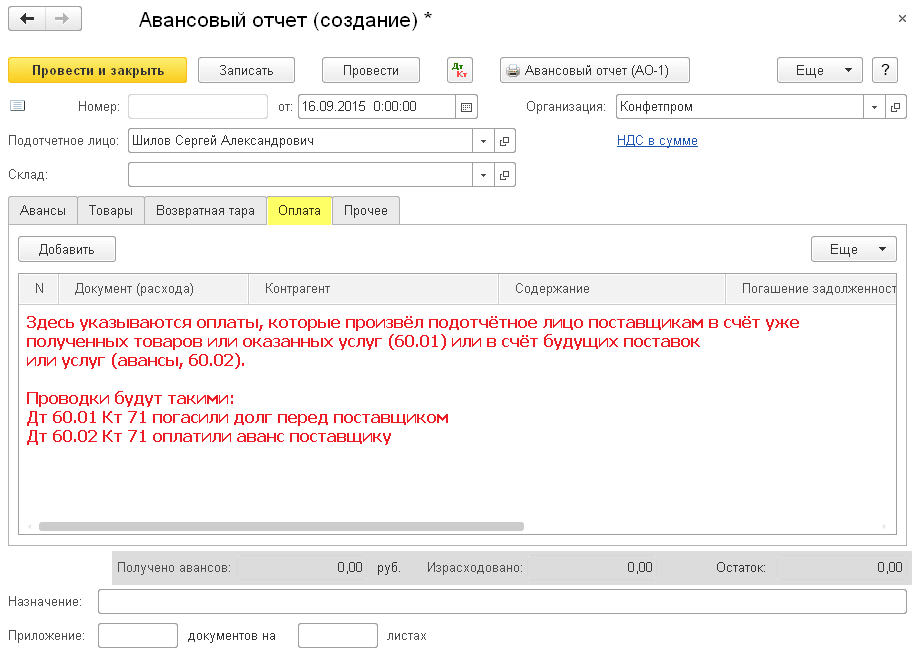

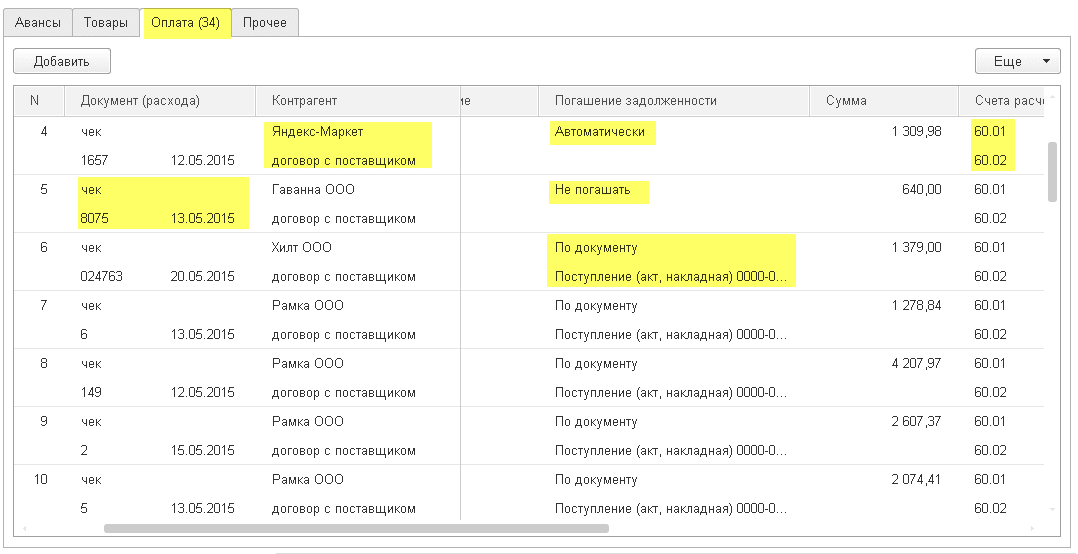

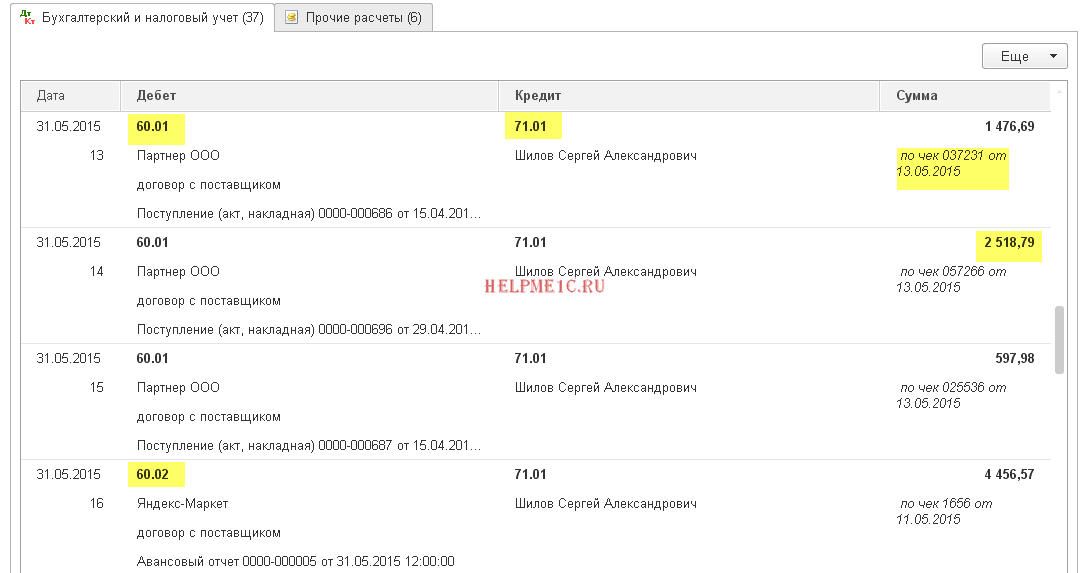

Fill in the "Payment" tab (we extinguish the debt to suppliers, or pay an advance):

Here are the postings:

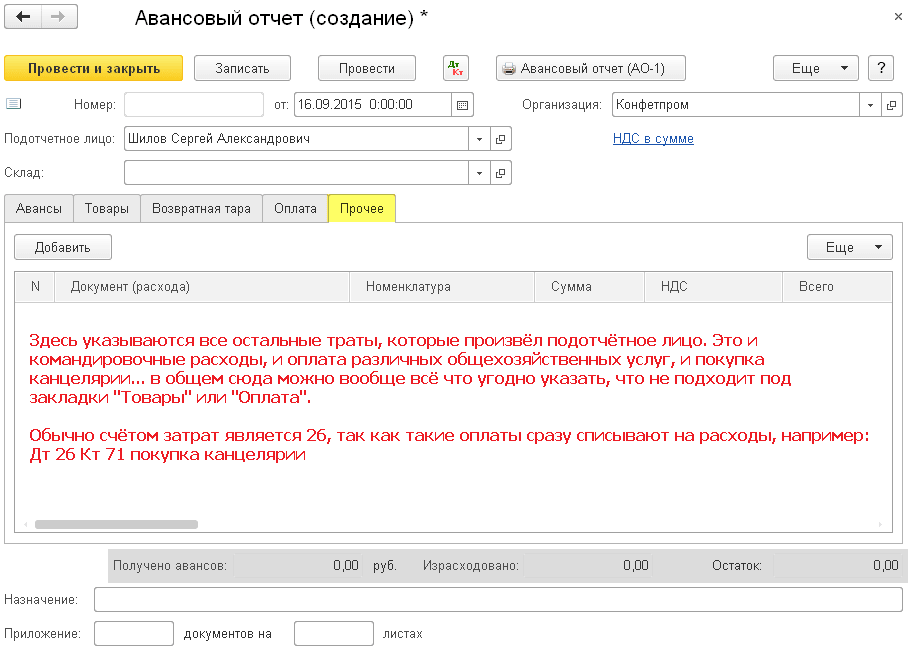

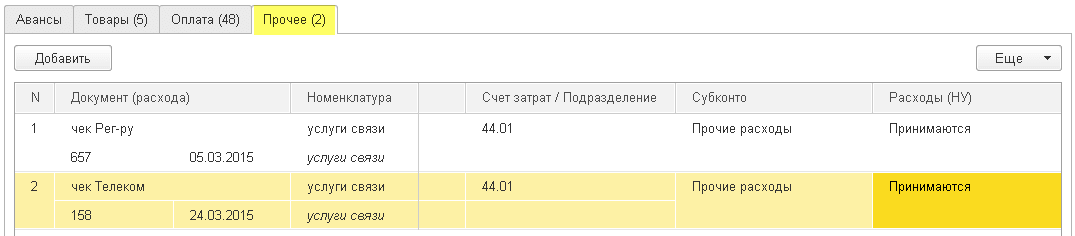

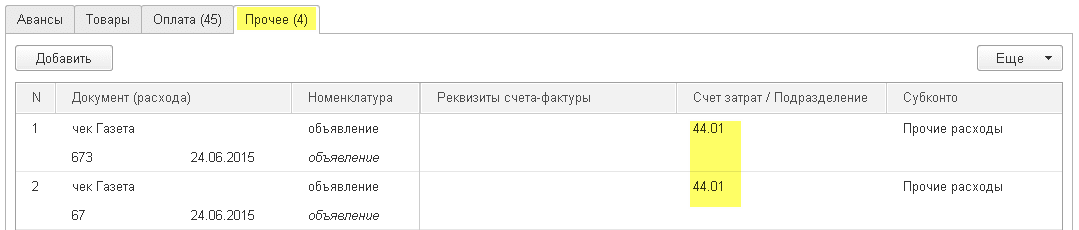

Examples of filling in the "Other" tab.

Payment for communication services:

Payment for advertisements in the newspaper:

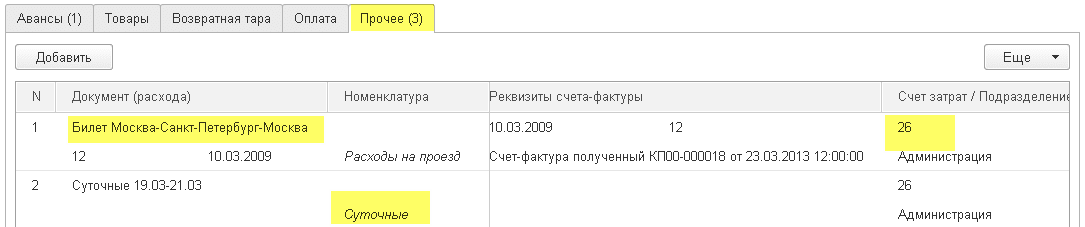

Write-off of daily allowance and debt for travel tickets:

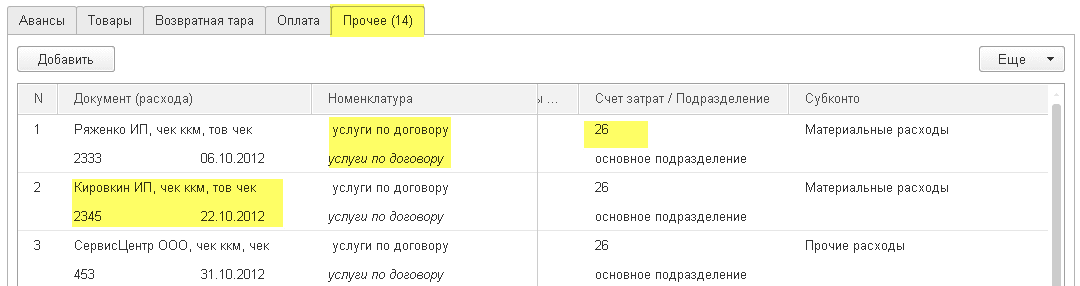

Payment for some services (immediately write off to 26):

By the way, on the "Goods" and "Other" tabs there is a checkbox "SF", if you put it, then the invoice received will be entered on this line.

A ready-made business plan with calculations using the example of a web studio

A ready-made business plan with calculations using the example of a web studio Registration of an internal memo: a sample document and rules for drawing up

Registration of an internal memo: a sample document and rules for drawing up Break even. Formula. An example of calculating a model in Excel. Advantages and disadvantages

Break even. Formula. An example of calculating a model in Excel. Advantages and disadvantages Advance Statement is ... Advance Statement: Sample Filling

Advance Statement is ... Advance Statement: Sample Filling How to sew documents by hand with threads correctly?

How to sew documents by hand with threads correctly? Disciplinary Action for Failure to Perform Official Duties

Disciplinary Action for Failure to Perform Official Duties Binding your book

Binding your book