Break-even point and how to calculate it?

The calculation of such an indicator is important for almost any enterprise. Whether it sells finished products or produces its own. After all, you need to know when an open enterprise or a store will recoup the money invested in it and start making a profit.

What is a break-even point and what does it show

This indicator is important not only for the company, but also for potential investors. After all, they first of all look at this indicator, since it is important to determine when the company will begin to generate income and thereby tell about its attractiveness in terms of investment. So this indicator significantly influences the decision on the investment of financial assets.

The break-even point shows the volume of sales of products at which profit is equal to the cost of goods. Profit is determined by the difference in terms of expenses and income per unit of production.

The break-even point indicator is determined in monetary value and in kind. Considering the value of this indicator, one can understand how much it will be necessary to produce products, provide services or fulfill orders in order to cover the initial costs and get zero profit. So the break-even point in the result shows how income is compared with expenses.

When this point is overcome, the company makes a profit, and if it is not reached, it receives fixed costs.

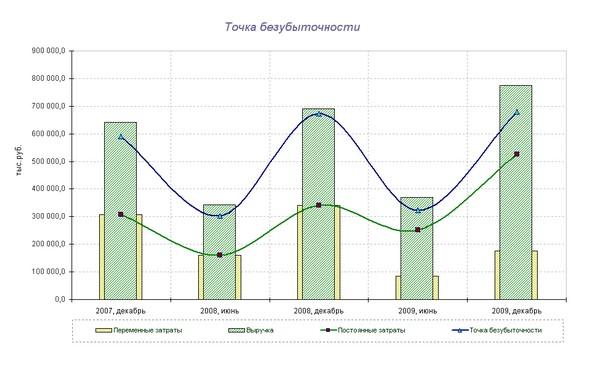

Indicator T.B. the company is necessary to determine the financial stability of the company. For example, if this indicator is constantly increasing, then this is a clear signal that the company has problems with making a profit. Do not forget that T.B. may change as production or turnover expands. Basically, with such indicators, it decreases.

To summarize, the calculation of such an indicator gives the following possibilities:

- Decide whether it is worth investing your money in this project if its payback comes after the release of several batches of products;

- Identify possible problems at the enterprise associated with the constant change of TB;

- You can find out the dependence of the volume of sales on the formation of the price of products. Thus, you can calculate how much to reduce or increase sales depending on price changes;

- Calculate by what allowable value it is necessary to reduce the profit in order not to be at a loss.

In addition, in large manufacturing enterprises, this indicator serves as the main criterion for pricing its products. This indicator is also taken into account when deciding on the introduction of discounts on products.

T.B. it is also necessarily indicated in the developed business plans for the opening of a new production or retail outlet.

Break-even point - how to calculate?

Before starting the calculation of the break-even point, you will first need to consider the costs of your enterprise. They will need to be distributed between constants and variables. This action will affect the accuracy of subsequent calculations.

Permanent include:

- Depreciation costs (included in the cost of the product itself);

- Salary of administration personnel (with all deductions and payments);

- Rent;

- Purchase of raw materials.

Variables include:

- Purchase and repair of components;

- Fuel and other combustible materials required to support the production process;

- The salary of the main workers.

Note that fixed costs cannot depend on the amount of volume and sales. In addition, these expenses will not practically change over time. In order for them to change, the following points must be changed:

- An increase or decrease in production at the enterprise;

- Opening or closing an additional department, workshop, production line;

- Increase or decrease in rental fees;

- Big inflation.

However, at the same time, they may not change at all with an increase in the volume of production. Therefore, such costs are attributed as temporarily constant per unit of goods produced.

Calculation formula

Such an indicator is calculated using the following formula:

TB = Pos.Z.? (Doh.-Per. Z.)

- T.B. - break even;

- Pos. Z. - Fixed costs;

- Doh. - Income;

- Per. Z. - Variable costs.

Using the data obtained as a result of the calculation using this formula, you can get the indicators of the critical sales volume in a numerical value.

To calculate this indicator already in financial terms, you must have the following expressions in the data:

- Pos. Z. - fixed costs;

- Doh. - Income;

- Per. З. - variable costs.

To calculate this indicator in monetary format, you will need to calculate the margin income. Marginal income is the difference between income and variable costs. It is determined by the following formula:

M = Doh. -Per. Z.

The required margin ratio is calculated using the following formula:

After calculating this indicator, you can finally start calculating TB in monetary format:

T.B. den. = Pos. Z.? KM

Using this formula, you will get the value at which your revenue will cover the cost of production needs.

In order to better understand this material, it is better to consider this indicator using an example.

Examples of calculating the break-even point

For the first example, it is best to consider a clothing store, because thanks to its work, T.B. for him it is calculated only in the financial version.

For a clothing store located in a shopping center, the following items can be attributed to fixed costs:

- Premises rental;

- Employee salary;

- Salary insurance contributions;

- Payment of utility services;

- Payment for advertising companies.

In our example, you can see that the fixed costs in this store will be equal to 336,000 rubles. And his income will be about 2,300,000 rubles. So, let's calculate the margin income:

KM = 1,800,000? 2,300,000 = 0.78 rubles.

T.B. den. = 336,000? 0.78 = 430,769 rubles.

This indicator tells us that the store will need to sell its products in the amount of 430,769 rubles in order to reach self-sufficiency. We can also find out that this store has a so-called capital stock, this indicator tells how much you can reduce your income so as not to go into fixed costs.

Consider a second example against the backdrop of a manufacturing enterprise.

Basically, all enterprises that produce their products are made so as to create only one type of product. Thanks to this, their costs are the most optimal. At the same time, T.B. is calculated for this kind of product in numerical form.

The price of one manufactured product is 350 rubles

Let's calculate TB. for the enterprise using the initial data:

T.B. = 265000? 350-280 = 3785

This value means how many units of production must be produced by the enterprise in order for its costs to go to zero. If the output is large, then the enterprise will begin to receive its profit.

This indicator as a whole is an important criterion for further planning the possible volumes of production or sales of goods. In addition, this value gives an understanding of how large the difference between costs and incomes from one unit of production. With the help of which it is possible to better control changes in price formations.

In addition, this indicator is of paramount importance for investors, because it is how they judge the attractiveness of investing in an idea or company.

In contact with

A ready-made business plan with calculations using the example of a web studio

A ready-made business plan with calculations using the example of a web studio Registration of an internal memo: a sample document and rules for drawing up

Registration of an internal memo: a sample document and rules for drawing up Break even. Formula. An example of calculating a model in Excel. Advantages and disadvantages

Break even. Formula. An example of calculating a model in Excel. Advantages and disadvantages Advance Statement is ... Advance Statement: Sample Filling

Advance Statement is ... Advance Statement: Sample Filling How to sew documents by hand with threads correctly?

How to sew documents by hand with threads correctly? Disciplinary Action for Failure to Perform Official Duties

Disciplinary Action for Failure to Perform Official Duties Binding your book

Binding your book