Can an un be engaged in foreign trade activities. Foreign economic activity. Types of foreign economic activity

Before answering the question of how to become a member of foreign trade activities in Russia, you should first decide what a foreign trade is. Foreign economic activity (FEA) is an enterprise's functions focused on the world market. In our case, the wed will be international trade(foreign trade activity).

Foreign economic activity participants are both legal entities and individuals (IP) engaged in foreign economic activity. Foreign economic activity participants can be:

- Importers - import to another country;

- Exporters - export from another country;

- Intermediaries - provide assistance in import and export;

- State - regulates foreign economic activity in the country;

- International organizations - regulate foreign economic activity;

- Currency control agents - exercise control over the observance of acts of currency legislation of Russia.

Russian legislation establishes that all persons have the right to import and export goods to the territory of the country. However, to speed up and simplify the customs clearance procedure, it is necessary to register as a foreign economic activity participant and receive the Foreign Economic Activity Criminal Code (registration card of a participant in foreign economic activity). Such a card serves as a means of identifying a foreign economic activity participant. It is also legally established that the absence of the Criminal Code of Foreign Economic Activity cannot be a reason for refusing to customs clearance... But if you have it, you will not always need to present the entire package of documents. All that is needed is this card and the documents required for customs clearance of a specific consignment of goods.

Registration of the UK foreign economic activity

The procedure for issuing an account card is quite complicated and requires the preparation of a large number of documents. You can prepare everything yourself or contact legal company... Upon presentation of all documents, the registration time should not exceed 5 calendar days.

The following documents are required for registration of the Foreign Economic Activity Management Code:

- Copy of the Articles of Association;

- Certificate of state registration subject (OGRN);

- Certificate of registration with the tax authorities (KPP / TIN);

- The decision to establish an LLC;

- Copy of an extract from a single state register legal entities;

- A copy of the certificate from the State Statistics Committee of the Russian Federation;

- Order on the appointment of the chief accountant;

- Originals of certificates of opening bank accounts;

- Appointment document general director;

- Copies of passports of the general director and chief accountant, certified by the seal of the organization;

- Lease agreement for premises at the legal address or certificate of ownership.

All copies of documents must be notarized.

can an individual entrepreneur with simplified taxation system receive goods from abroad and clear them through customs?

They must be presented at the customs post at the place of their state registration.

Before starting foreign economic activity on your own, you need to calculate the benefits of such an event and its feasibility, as well as all the nuances that you may encounter. It may be much more efficient to outsource this to another company.

Is it possible to keep records on the SP USN in foreign economic activity?

Answer

Organizations and individual entrepreneurs who are not entitled to use the simplified system are listed in paragraph 3 of Article 346.12 of the Tax Code of the Russian Federation. Among them, entrepreneurs engaged in foreign economic activity are not indicated. It means that engaged in foreign economic activity, you can apply the simplified tax system.

However, there is one caveat. It touches VAT which you will have to pay when importing goods... The fact is that organizations and entrepreneurs using the simplified taxation system are VAT payers for transactions related to the import of goods into the territory of Russia (clauses 2 and 3 of article 346.11 of the Tax Code of the Russian Federation).

but you will not be able to accept paid VAT for deduction(Subclause 1, clause 2, Article 171 of the Tax Code of the Russian Federation). VAT paid on import at customs, you will be able to include:

- when importing fixed assets - in their cost (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation);

- when importing goods, raw materials and materials:

- in the cost of goods, raw materials and materials, if you use the simplified tax system with the object of taxation income (subparagraph 3, paragraph 2 of article 170 of the Tax Code of the Russian Federation);

to the composition of expenses if you pay a simplified tax on the difference between income and expenses (subparagraph 8 of clause 1 of article 346.16 of the Tax Code of the Russian Federation).

Can an Individual Entrepreneur engage in foreign economic activity? For example, the SP is located on the simplified tax system. He buys goods in Europe from catalogs through mail, makes an order from an individual entrepreneur, FOREIGN ORGANIZATION SEND AN INVOICE FOR AN ADVANCE PAYMENT Ip pays for it through foreign currency accounts, and then receives the goods, it is cleared by a specialized organization here when the goods arrive. It is possible for an individual entrepreneur to do this. What are the restrictions on foreign economic activity for an individual entrepreneur in comparison with an LLC?

Answer

For individual entrepreneur there are no peculiarities, restrictions on foreign economic activity in comparison with legal entities... Changes for an individual entrepreneur applying the simplified tax system will occur in relation to the taxation of import transactions. Tax payers are not exempt from VAT when importing goods (works, services).

The rationale for this position is given below in the materials of the Glavbukh System

STS

The composition of the reporting of those who apply the simplification is very small. After all, entrepreneurs on such a special regime are exempted from paying:

- Personal income tax (in relation to their own income, not the income of employees);

- property tax of individuals;

- VAT (except for VAT payable when importing or importing goods, * when carrying out operations under agreements of joint activity, trust management of property, under concession agreements).

This is stated in paragraph 3 of Article 346.11 of the Tax Code of the Russian Federation.

This means that reporting on personal income tax (in relation to their income) and VAT, which is handed over entrepreneurs on a common taxation system, they do not need to pass.

Instead of these taxes, merchants on a simplified tax system pay a single tax and rent single tax declaration with simplified taxation(Article 346.23 of the Tax Code of the Russian Federation). Report on data books of income and expenses.

Oleg Khoroshy

State Adviser of the Tax Service of the Russian Federation, II rank

Question:

Individual entrepreneurs without employees apply the simplified tax system. He is engaged in the sale and maintenance of software. The software manufacturer is a third-party organization, the SP is a dealer.

IP has appeared potential client from Belarus, who wants to purchase software, and some services to customize it. So far, the deal is one-off.

Can an individual entrepreneur carry out such transactions with clients from Belarus? What are the features of drawing up such contracts? What currency are transactions made in? Do I need a separate checking account for these transactions? What steps need to be taken to implement this deal?

Answer:

Can I carry out such transactions at all?

An individual entrepreneur has the right to cooperate with foreign customers and buyers, including from Belarus, is not prohibited.

What are the features of drawing up such contracts?

The issue of drafting a contract refers to legal issues and is not included in the regulations of the consulting service, unfortunately, I cannot provide you with full advice on this issue. On the issue of concluding a contract, it is advisable to consult with a lawyer specializing in contract law in foreign economic activity.

What currency are transactions made in?

At any. You can accept payments in rubles or in other currencies, there are no restrictions.

Do I need a separate checking account for these transactions?

It all depends on your bank. Some banks have an automatic conversion service upon receipt of payment in foreign currency to the ruble account of the individual entrepreneur. In some, in order to receive payment in foreign currency, it is required to open a foreign currency account. Therefore, you need to obtain information on this issue directly from the servicing bank.

What steps do I need to take to complete this transaction?

When selling goods (software) abroad or providing services, including Belarus, no additional documents and reporting are required. The transaction is executed in the same way as when selling goods / services to Russian clients.

Conclude an agreement or issue an invoice for payment to the client, where you indicate the details for the transfer. A foreign buyer pays for the product / service (transfers money to the account of the individual entrepreneur). You write out invoices to the buyer for the goods sold or an act of acceptance and transfer for software, an act of rendering services.

In case of receipt of payment from a foreign client in foreign currency, the income must be reflected in the ruble equivalent as of the date of receipt of payment from the foreign buyer.

In this case, incomes expressed in foreign currency are accounted for in aggregate with incomes in rubles. To include income under the simplified tax system, you must first of all find out the exchange rate of the Central Bank of the Russian Federation as of the date of receipt of currency on the transit currency account, convert the currency into rubles and make an entry in the Money section. The Central Bank rate for each day can be clarified at the bank.

Upon receipt of payment from a foreign counterparty to the settlement account, there is a possibility of currency control by the bank, i.e. the bank will need to provide documents confirming the transaction (contracts, invoices or acts). For more detailed information on currency control, I recommend contacting your bank directly.

In the service, the functionality for foreign contractors has not yet been developed. The development is on track, but unfortunately, I can't tell you the exact timing.

You can use this option:

- In the Contractors tab add foreign partner, but specify all its data in the "Name" line.

- after that you will be able to generate primary documents with the counterparty in the service and enter the data into the Money tab.

I attach an example of reflection in the service of a foreign counterparty.

Unfortunately, I will not be able to advise you in detail on this issue, since it relates to export-import operations, and according to the regulations of the bukh. consultations, answers on foreign economic activity in our section are not provided. Thank you for understanding.

The general director of dace group llc smbat harutyunyan, the prison trade house

The general director of dace group llc smbat harutyunyan, the prison trade house Yakunin left, Rabinovich stayed

Yakunin left, Rabinovich stayed Rabinovich mikhail daniilovich

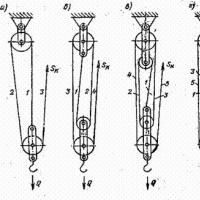

Rabinovich mikhail daniilovich Lifting loads without special equipment - how to calculate and make a chain hoist with your own hands

Lifting loads without special equipment - how to calculate and make a chain hoist with your own hands New details about Dimona's "charity" empire

New details about Dimona's "charity" empire Principal Buyer

Principal Buyer Edward cypherin biography. New Russian. How Eduard Shifrin, having earned $ 1 billion from Ukrainian steel, got involved in development in Russia. Eduard Shifrin and withdrawal of money

Edward cypherin biography. New Russian. How Eduard Shifrin, having earned $ 1 billion from Ukrainian steel, got involved in development in Russia. Eduard Shifrin and withdrawal of money