Section electronic money or payment systems. Electronic money and payment systems. Principles of functioning of electronic money systems

Term electronic money(and electronic cash, or digital cash) refers to transactions of funds made using electronic communications. Electronic money can be a debit or credit. Digital cash can be some kind of currency, and in order to start using it, you need to convert some amount of ordinary money into digital. This conversion is similar to buying foreign currency.

Electronic money:

- are not money, but are either checks, or gift certificates, or other similar means of payment (depending on the legal model of the system and on legal restrictions).

- can be issued by banks, NPOs, or other organizations.

The fundamental difference between electronic money and ordinary non-cash money: electronic money is a means of payment issued by any organization (a monetary surrogate), while ordinary money (cash or non-cash) is issued by the central state bank of a particular country.

The term electronic money is often inaccurately used in relation to a wide range of payment instruments based on innovative technical solutions in the field of retail payments.

Digital Cash

Digital cash is electronic money that will be issued by governments themselves.

Market of electronic money systems in Russia

2012: Yandex.Money rule the market

2011: Law 161-FZ "On the national payment system"

On September 29, 2011, the key for the industry was Federal Law No. 161-FZ "On the National Payment System" dated June 27, 2011, which enshrines the definition of electronic money (EMF), sets out the key requirements for the transfer of EMF, as well as for electronic money operators. If earlier activities were regulated by many laws and individual articles in various laws, then the Law "On the National Payment System" has become a single regulatory document for the entire industry of electronic payments.

2012

The system for identifying users of e-wallets may be tightened. This was announced in November 2012 by the head of the Bureau of Special Technical Events (BSTM) of the Ministry of Internal Affairs of Russia, Alexei Moshkov. According to Alexey Moshkov, the use of anonymous payment systems greatly facilitates the activities of fraudsters, since in a number of cases personification of the virtual wallet holder is difficult or impossible.

"Criminals use anonymous payment systems to collect and cash out funds, distribute and obfuscate financial flows. In addition, such virtual wallets are used to anonymously purchase prohibited goods and internal settlements between members of criminal groups."

Legal and economic status of electronic money

From a legal point of view, electronic money is an issuer's perpetual monetary obligations to bearer in electronic form, the issue (issue) of which is carried out by the issuer both after receiving funds in the amount of at least the volume of obligations assumed and in the form of a loan provided. Circulation of electronic money is carried out by assigning the right of claim to the issuer and gives rise to the latter's obligations to fulfill monetary obligations in the amount presented by electronic money. The accounting of monetary obligations is carried out in electronic form on a special device. From the point of view of their material form, electronic money represents information in electronic form that is at the disposal of the owner and stored on a special device, usually on a hard disk of a personal computer or a microprocessor card, and which can be transferred from one device to another using telecommunication lines and other electronic means of information transmission.

In an economic sense, electronic money is a payment instrument that, depending on the implementation scheme, has the properties of both traditional cash and traditional payment instruments (bank cards, checks, etc.): banking system, with traditional payment instruments - the ability to carry out settlements in non-cash form through accounts opened with credit institutions.

Types and classification of electronic money

There are 2 types of electronic money:

- Electronic issued payment certificates, or checks. These certificates have a certain denomination, are stored in encrypted form, and are signed with the electronic signature of the issuer. During settlements, certificates are transferred from one system participant to another, while the transfer itself can go outside the issuer's payment system.

- Entries on the current account of the system participant. Calculations are made by debiting a certain number of payment units from one account and depositing them to another account within the payment system of the e-money issuer.

Electronic money schemes:

- in which the technology of transferring information in electronic form is implemented monetary obligations issuer from one holder's device to another holder's device. These include Mondex (developed by Mondex International owned by 51% of MasterCard and 49% of the largest banks and financial institutions around the world) and eCash network product of Digicash.

Of the world famous electronic money operators, there are:

Unlike ordinary non-cash money, electronic money

Everything in this world is constantly changing, and of course money changes. People are gradually switching to e-currency. But not everyone knows what electronic money is and how to use it. Many people think that electronic money is ordinary paper money, which is used to simply pay for Internet services. In fact, electronic money is virtual, conventionally invented banknotes that have the power of real paper money.

Where does electronic money come from?

Like any money, electronic money needs to be earned. The Internet is an unlimited source of electronic real money earning. Everyone earns their money in their own way, someone writes articles to order, someone plays poker, someone who sells shampoo or candles, someone plays on the stock exchange.

What can you buy with electronic money?

Almost everything. On the Internet, you can buy a house, apartment, car, or just a pack of pasta with home delivery. If we talk about the Russian-speaking Internet, then we mainly buy electronic equipment, cell phones, books, bijouterie and cosmetics with the help of electronic money. In the west, many people have stopped going to regular stores altogether. Since it is more convenient to buy in virtual stores than in ordinary ones. A person simply visits the website of the store he needs, searches for the necessary product, compares prices with other stores, and then orders home delivery. Convenience is that, firstly, a person saves his time. For example, you can choose a sofa at lunchtime, after work, by this time, the sofa will have already been delivered to the customer's home, you can already relax on the new furniture.

Secondly, no one presses on the buyer and does not try to foist unnecessary goods on him. That is, no consultant-seller will get on their nerves with their attempts to sell stale goods. Thirdly, any product, even a handkerchief, can be ordered with home delivery. In the United States, for example, in many electronic stores, delivery within the country is free. In our electronic stores, very expensive. The shipping cost is made up of the weight of the goods, commission for work and distance to the buyer. So, for example, if you buy the cheapest shampoo on OZON.RU for 100 rubles, then its delivery, for example, to Nizhny Novgorod, will cost 250 rubles. That is, 2, 5 times more expensive than the product itself. Of course, if the owners of online stores do not figure out how to reduce the cost of delivery, then it is unlikely that online purchases will be in great demand in Russia.

How to use electronic money?

There are special computer programs for working with electronic money. The program is very popular in Russia WEB MONEY... The so-called electronic wallet is downloaded from the site of the same name, installed on your home computer, wallets are created in the desired currency (rubles, dollars, euros, etc.), and then, you can use your money. The program is easy to use, although it has flaws in terms of money security.

How to transfer electronic money into real rubles.

In order to convert electronic currency into paper currency, you need to come to the exchange office with a passport, having previously sent the electronic payment and your secret password to the exchange office's wallet. At the exchange office, after you show your passport and name your secret password (you come up with this password and only you know too) the cashier will give you your legitimate real paper money, only take a commission for services, about 4% of the amount.

The advantages of electronic money.

With electronic money, you can top up the balance of your hundredth phone without leaving your home, and without any commission. Electronic money can be used to pay for the Internet, utility bills, any goods that are sold in online stores. Electronic money saves time, and sometimes some online stores offer discounts when paying with electronic money.

Economists believe that electronic money is the future. Since it is they who allow you to avoid queues at the bank, at the post office, in the store, and therefore save the most precious - our time.

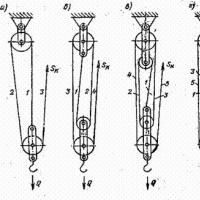

There are two main groups of electronic money, which are divided by the type of carrier (Figure 8).

Rice. eight

Smart cards are multi-purpose plastic cards with embedded chips (microprocessors).

A money file is written on their chip - the equivalent of money, previously transferred to the issuer of these cards. Bank customers transfer money from their accounts to smart cards, transactions on which are carried out within the limits credited to them. The mode of maintaining a personal account of a smart card differs from the mode of maintaining a personal account of traditional cards. An ordinary card itself does not contain information about the state of the account, it is only a tool for accessing the current account. At the moment the bank credits funds to the card account to which an ordinary payment card is linked, no crediting is made to the bank card itself. At the moment of replenishing the funds of the smart card, the balance on the personal account is reduced by the amount by which the card was replenished. Electronic cash appears on the card, as a result of which it becomes possible and safe (from the point of view of overdraft on the account) to authorize offline transactions. Examples of such cards are shown in Figure 9.

Rice. nine electronic money based on smart cards

Smart cards have their own advantages and disadvantages (Figure 10).

Rice. ten

ASSIST is an example of a successful payment system in Russia. She went through the stage of formation together with the famous and most popular online store in our country OZON.ru. Its uniqueness is that it provides modules for e-shops that help to accept all types of payment means - plastic cards, Yandex.Money, and WebMoney, as well as its own cards based on an assistid number. Thus, electronic money based on smart cards is a monetary value stored on multipurpose bank cards in virtual form. This cost can be used for payments in favor of the card issuer, individual or legal entity. Smart cards issued by non-banking organizations, such as telephone, medical, or transit cards, are now in widespread use. Usually these cards are used to pay for the services of only one company.

On the basis of networks (network-based) - this is electronic money operating on the basis of a software system presented in the form of a program or network resource. The data system makes extensive use of data encryption and electronic digital signature. This type of payment is widely used to pay for goods of online stores, services of workers at remote work or playing time in online games. An example of these systems is WebMoney, Yandex.Money, RUpay, E-gold, E-port, PayCash, MoneyMail, CyberPlat, Rapida, QIWI, Money @ Mail.Ru, etc.

This money is currently the most widespread, most convenient and secure means of payment.

On the basis of networks, fiat and non-fiat electronic money are distinguished (Figure 11).

Rice. eleven

Now let's look at fiat electronic money using PayPal as an example.

The PayPal payment system is quite well known in Russia, although it does not work with Russian clients. It is a debit system using the concept of electronic money.

PayPal has two main types of accounts: for US citizens and international (for non-US citizens). An account for US citizens provides more options, but requires disclosure of customer information, down to the taxpayer registration number. Quite a lot of foreign online stores and service companies are connected to PayPal. Therefore, some Russian citizens connect to the system by distorting their registration data (substituting non-existent addresses in Europe, the USA, etc.). This method is unsafe and is not recommended for use. The payment system has more than 100 million customers all over the world and accepts payments from credit cards "VISA", "MasterCard" and necessarily insures the payment. PayPal is the largest online payment system. A huge number of online stores and online auctions trade through it. A buyer who paid for a purchase through PayPal and was defrauded by the seller can open a dispute and request a refund from PayPal. That is why cases of fraud when working through this payment system are very rare. A large number of sites accept payments via PayPal and by credit card.

Also, fiat electronic money includes: the African payment system "M-Pesa" - this system operates in Kenya and Tanzania and is a provider of payment services and the Ukrainian electronic payment system GlobalMoney (GlobalMoney).

Now let's move on to looking at network-based non-fiat money. Electronic non-fiat money is an electronic unit of the value of non-state payment systems, respectively, emission, circulation and redemption occurs according to the rules of non-state payment systems.

Such electronic payment systems as WebMoney, Yandex.Money, Qiwi, RUpay, E-gold, E-port, PayCash, MoneyMail, CyberPlat, Rapida, etc. operate in Russia. Most of the systems are not anonymous or partially anonymous. Almost any online store offers payment for goods through these systems.

Each user chooses the most suitable option.

This can be compared, for example, with a cellular operator. In order to select the desired campaign, it is recommended that you familiarize yourself with all the proposed types of mobile operators, with their rules, with the size of the commission that they charge for the operation, in turn, some campaigns have bonuses for using their system.

Of course, often, users choose their most popular system and believe that it is better than the rest, the most optimal. Since in this kind of system there will be fewer problems with the input / output of funds, it is supported by many Internet resources. Such a system can be attributed to WebMoney. This system is the most popular on the Internet today and has a very high degree of protection, and therefore users practically do not worry about the safety of their money. It is gradually merging into the financial market - with the involvement of WebMoney, they are already holding auctions, selling shares, precious metals and many other operations.

The second most popular type of electronic money is the well-known Yandex.Money system. Its main difference from the WebMoney system is that it has one universal account, which is measured in rubles.

The next system QIWI Wallet is a payment system that allows you to make payments for services and money transfers from a mobile phone operating in the GSM standard. The system allows you to pay for a mobile phone, Internet access, Pay TV and many other services without interest and commissions anywhere where GSM phones work.

The legal space of the QIWI Wallet system is the Russian Federation. For settlements, the system uses the Mobile Wallet RUB electronic currency, the equivalent of Russian rubles.

Let's consider the above-mentioned most famous payment systems ("Webmoney", "QIWI", "Yandex.Money"): on what principle they operate, what functions they perform in comparison (table 7).

Table 7 Comparison of the most famous payment systems in the Russian Federation

|

Yandex money |

|||

|

Restrictions at the location of the client |

No restrictions, open for use, cross-border |

Instant payments regardless of location |

No restrictions |

|

Anonymity |

Not anonymous |

Restricted anonymous and identified |

Anonymously, except for entering a mobile phone |

|

Confidentiality |

Built-in message encryption algorithm. With its help, all users of the system have the opportunity to carry out correspondence through secure channels. |

Confidentiality is present, there is also protection for all payments |

Advanced software allows you to exercise control over each payment and ensure the safety of financial resources in the system |

|

Wallets |

WMZ - dollar wallets; WMR - ruble wallets; WME - wallets for storing euros; WMU - wallets for storing Ukrainian hryvnia. |

Same type of wallets: Yandex.Wallet and Internet.Wallet |

Single-type multi-currency wallets - support for various payment methods (cash, non-cash, electronic currencies, bank cards). |

|

Interest charged |

Transfer within the system - 0.8% (maximum 50 conventional units for WMZ, and WME, 1500 - for WMR, 250 for WMU, 100000 for WMB, 55000 for WMY and 2 for WMG,% charged by banks, terminals, etc. |

Transfer within the system - 0.5% Exchange of electronic money - 3% Replenishment of the wallet -% charged by banks, terminals, etc. |

Transfer within the system - 0% Transfer from a QIWI card - 0% Replenishment of the wallet - 0% (for deposits> 500 rubles),% charged by banks, terminals, etc. Commission for payment and transfer is 3% |

|

Peculiarities |

Various types of wallets: light, classic and others, the presence of the famous exchange office RoboxChange |

Client terminal-Java-application; banking system Contact |

Bank transfer system Contact, management of an Internet wallet from a computer using specialized software |

So, with the help of electronic money, you can make purchases in online stores, pay for receipts, mobile and city communications, programs, deposit money into an account in social networks, online games, buy coupons, air and railway tickets, make money transfers and much other.

For this, there are two types of electronic money (smart card-based and network-based). Using existing types of electronic money is not difficult. It is enough to log into your account, select the desired operation, enter the required amount and make the payment

As a result, we can say that the choice of the system completely depends on the user, therefore, you should give preference to the campaign you like, pay with electronic money and not worry about their safety. With a careful attitude, they will not disappear anywhere!

With the development of credit circulation, electronic money appears that has certain advantages over paper:

- increasing the speed of transferring payment documents;

- simplification of the processing of bank correspondence;

- reducing the cost of processing payment documents.

In economic literature electronic money is defined as:

- money in computer memory accounts of banks, the disposal of which is carried out using a special electronic device;

- electronic storage of monetary value using a technical device;

- a new means of payment that allows making payment transactions and does not require access to deposit accounts;

- an indefinite monetary obligation of a financial and credit institution, expressed in electronic form, certified by an electronic digital signature and redeemed at the time of presentation with ordinary money, etc.

In international practice Are prepaid or value-storing financial products in which fund or value information is stored on an electronic device.

Electronic money - in a broad sense words are considered as a set of subsystems of cash (emission is carried out without opening personal accounts) and non-cash money (emission is carried out with the opening of personal accounts) or as a system of cash settlements through the use of electronic technology.

Electronic money - in a narrow sense represent a subsystem of cash issued into circulation by banks or specialized credit institutions. The main difference here is the optional use of a bank account when paying, when the operation is carried out from the payer to the recipient without the participation of the bank.

Properties of electronic money

The main characteristics of electronic money:

- the monetary value is recorded on an electronic device;

- it can be used for a variety of payments;

- payment is final.

Nevertheless, the question of the independent allocation of electronic money in a separate form remains controversial, as well as their definition, role in and function.

In modern times, electronic money is fiat money, have a credit base, perform the functions of a means of payment, circulation, accumulation, have a guarantee. The basis for issuing electronic money into circulation is cash and non-cash money. Electronic money acts as a monetary obligation of the issuer when servicing non-cash circulation as a requirement for it. They can be viewed as an element of the monetary aggregate. Automatic maintenance of bank accounts (crediting and debiting funds, transfers from one account to another, calculating interest, monitoring the status of settlements) is carried out electronically (electronic transfers). Electronic account access tools are constantly evolving, however, money is still presented in the form of account entries.

Properties of electronic money are based on both traditional monetary properties (liquidity, portability, versatility, divisibility, convenience) and relatively new ones (security, anonymity, durability). However, not all of them in the process of application meet the requirements of high liquidity and stable purchasing power, in connection with which the issue and use in circulation require a special order of regulation and control. Electronic access instruments are payment cards, electronic checks, and remote banking.

Calculations on the Internet. "Network" electronic money

These calculations are based on the concept of electronic cash. Electronic cash is digital cash in electronic form used in network settlements, which is electronic bills in the form of a set of binary codes existing on a particular medium, moved in the form of a digital envelope over the network. Electronic cash technology makes it possible to pay for goods and services in a virtual economy by transferring information from one computer to another. Electronic cash, like real cash, is anonymous and reusable, and digital banknote numbers are unique. They can be transferred from one person to another, bypassing the bank, but at the same time keeping them within the network payment systems. When paying for a product or service, digital money is transferred to the merchant, who either transfers it to a bank participating in the system to be credited to his account, or pays with it to his partners. Currently, various network payment systems are widespread on the Internet.

Yandex money. In mid-2002, Paycash entered into an agreement with Yandex, the largest search engine on the Runet, to launch the Yandex project. Money (universal payment system, created in 2002). The main features of the Yandex. Money:

- wire transfers between user accounts;

- buy, sell and exchange electronic currencies:

- pay for services (Internet access, cellular communication, hosting, apartment, etc.);

- transfer funds to a credit or debit card.

The commission for transactions is 0.5% for each payment transaction. When funds are withdrawn to a bank account or in another way, the Yandex.Money system withholds 3% of the amount of funds withdrawn, in addition, an additional percentage is charged directly by the transfer agent (bank, post office, etc.).

WebmoneyTransfer - the payment system, which appeared on November 25, 1998, is the most widespread and reliable Russian electronic payment system for conducting financial transactions in real time, created for users of the Russian-speaking part of the World Wide Web. Any person can become a user of the system. The means of calculation in the system are title units called WebMoney, or abbreviated WM. All WM are stored in so-called electronic wallets. The most common wallets are of four types:

- WMZ - dollar wallets;

- WMR - ruble wallets;

- WME - wallets for storing euros;

- WMU - wallets for storing Ukrainian hryvnia.

Payment system WebMoney Transfer allows you to:

- carry out financial transactions and pay for goods (services) on the Internet;

- pay for the services of mobile operators, Internet and TV providers, pay for subscriptions to the media;

- exchange WebMoney title units for other electronic currencies at a favorable rate;

- make payments by e-mail, use a mobile phone as a wallet;

- owners of online stores accept payment for goods on their website.

WM is a global information system for the transfer of property rights, open for free use by everyone. Using WebMoney Transfer, you can make instant transactions related to the transfer of property rights to any online goods and services, create your own web services and network enterprises, conduct transactions with other participants, release and maintain your own instruments.

There are several ways to top up a WM purse:

- by bank transfer (including through the Sberbank of the Russian Federation);

- by postal order;

- using the Western Union system;

- by exchanging rubles or currency for WM at an authorized bank or exchange office;

- by receiving WM from any of the system participants in exchange for services, goods or in exchange for cash;

- using a prepaid WM card;

- through the E-Gold system.

RUpay- the payment system, operating since October 7, 2002, is an integrator of payment systems, where payment systems and exchange offices are programmatically combined into one system.

Main features of RUpay payment system:

- making electronic transfers between user accounts;

- buy, sell and exchange electronic currencies with a minimum commission;

- make payments to other electronic payment systems: WebMoney, PayPal, E-gold, etc .;

- accept payments on your website in more than 20 ways;

- receive funds from the system account at the nearest ATM;

- manage your account from any computer connected to the Internet. "

PayCash- electronic payment system. It began its work on the Russian market in early 1998, and is positioned primarily as an affordable means of fast, efficient and secure cash payments on the Internet.

The main advantage of this payment system is the use of its own unique developments in the field of financial cryptography, highly appreciated by Western experts. PayCash payment system has a number of prestigious awards and patents, among which there is a "Certificate of Special Recognition of the US Congress". At the moment, such well-known payment systems as Yandex. Money (Russia), Cyphermint PayCash (USA), DramCash (Armenia), PayCash (Ukraine).

PayCash is based on digital cash technology. From the point of view of the user (seller or buyer), PayCash technology is a set of "electronic wallets", each of which has its own owner. All wallets are connected to a single processing center, where information from the owners is processed. Thanks to modern technologies, users can carry out transactions with their money without leaving the computer. The technology allows you to transfer digital cash from one wallet to another, store it in the Internet bank, convert, withdraw from the system to traditional bank accounts or other payment systems.

E- gold- an electronic payment system created in 1996 by Gold & Silver Reserve (G&SR). E-gold is an American electronic money settlement system, the main currency of which is precious metals - gold, platinum, silver, etc., and this currency is physically backed by the corresponding metal. The system is completely international, works with all currencies of the world, and anyone can get access to it. The banks of the USA and Switzerland are the guarantors of the reliability of this payment system. The main difference between the e-gold payment system is that all funds are physically backed by precious metals stored in the Nova Scotia bank (Toronto). The number of users of the c-gold payment system in 2006 amounted to about 3 million people. The main advantages of the e-gold payment system are as follows:

- internationality - regardless of the place of residence, any user has the opportunity to open an account in e-gold:

- anonymity - when opening an account, there are no mandatory requirements for specifying the user's real personal data;

- lightness and intuitiveness - the interface is intuitive and user-friendly;

- no additional software installation required;

- universality - the widespread use of this payment system allows it to be used in almost any financial transactions.

You can enter money into the system in two ways: receive a transfer from another participant, or transfer money in any currency to the E-gold system, using the mechanism described on the website, through a bank transfer.

You can receive or cash out money by ordering a bank transfer on the E-gold website, making a transfer to other systems (PayPal, WebMoney, Western Union) or to any credit or debit card.

Stormpay- payment system, opened in 2002. Any user can register in this system, regardless of their country of residence. One of the advantages of the system is its versatility and lack of reference to a specific geographic region, since the system works with all countries without exception. The account number in the Stormpay payment system is the email address. Its main drawback is the inability to convert funds from a Stormpay account to E-gold, WebMoney or Rupay. This payment system allows you to transfer funds to credit cards.

PayPal- electronic payment system, one of the most popular and reliable among foreign payment systems. By early 2006, it served users in 55 countries. PayPal was founded by Peter Thiel and Max Levchin in 1998 as a private company. PayPal provides its users with the ability to receive and send payments using e-mail or a mobile phone with Internet access, but, in addition, PayPal users have the ability to:

- send payments (Send Money): transfer any amount from your personal account. In this case, the recipient of the payment can be either another PayPal user or an unauthorized person;

- execute a request to receive a payment (Money Request). Using this type of service, the user can send letters to his debtors containing a request to make a payment (issue an invoice for payment);

post on the website special tools for accepting payments (Web Tools). This service is only available to Prime and Business account holders and is recommended for use by online store owners. In this case, the user can place a button on his website, by pressing which the payer goes to the website of the payment system, where he can perform the payment procedure (you can use a credit card), after which he returns to the user's website;

- use the Auction Tools. The payment system offers two types of services: 1) automatic distribution of requests to receive payment (Automatic Payment Request); 2) Auction winners can pay directly from the website where the auction is held (Instant Purchase for Auctions);

- carry out financial transactions using a mobile phone (Mobile Payments);

- perform simultaneous payments to a large number of users (Batch Pay);

- carry out a daily transfer of funds to a bank account (Auto-Sweep).

In the future, the possibility of obtaining interest for keeping money on the account is being considered.

Moneybookers- electronic payment system, opened in 2003. Despite its relative youth, it successfully competes in many areas with such a giant as PayPal. The main advantage of this payment system is its versatility. Moneybookers is easy to use for both individuals and owners of online stores and banks. Unlike PayPal, the Moneybookers payment system serves users in more than 170 countries, including Russia, Ukraine and Belarus. Moneybookers features:

- no additional software installation is required for operation;

- the user's Moneybookers account number is their email address;

- the minimum transfer amount to Moneybookers is 1 euro cent (or its equivalent in another currency);

- the ability to automatically send funds on a schedule without user intervention;

- the system commission is 1% of the payment amount and is deducted from the sender.

If a couple of decades ago we would have been informed that in the future humanity will be able to use for calculations not only "real", but also electronic money, most likely would be skeptical about this forecast. Meanwhile, today use of electronic money is perceived as a completely common fact - with their help you can pay for goods and services, receive wages or, on the contrary, pay remuneration to an employee, engage in charitable activities and carry out many other financial transactions. Today electronic money systems varied. Each of them has its own characteristics, advantages and disadvantages. And since a modern person definitely cannot do without using electronic money, it is important to know how payment systems of this type function, when and how they can make our life easier, and what types of electronic money exist today ...

We learned about such a term as "electronic money" relatively recently.

Their rapid development began in 1993, and after 10 years, according to research, electronic money began to be used in 37 countries of the world.

This is not surprising, because they allow you to quickly carry out mutual settlements with correspondents who can be located almost anywhere in the world. Electronic money in Russia quickly gained popularity, because with their help you can significantly reduce the time and effort spent on making transfers and payments. So, relatively recently, it became possible to purchase goods for electronic money in online stores, to pay phone or Internet bills. Now these means of payment are in no way inferior to their "real" counterparts - such money has a similar value, although at a certain stage of settlement they do not have any material expression.

Electronic and non-cash funds: is there a difference?

A very common misconception is the identification of electronic and non-cash money. In fact, this is not the case. Electronic money does not act as a substitute for conventional funds. They are issued in the same way as non-cash money. The only difference is that a specialized organization takes part in this process, and in the case of non-cash money, the central state bank acts as an issuer.

Also, electronic money should not be confused with credit cards. By themselves, cards act as ways of using the client's bank account, and all transactions in this case are made using ordinary money. As for electronic money, they act as a separate means of payment.

Advantages and Disadvantages of Electronic Money

Of course, many will be interested in why it is necessary at all electronic payment systems and electronic money, if they are connected with cash or non-cash funds only indirectly and, at first glance, do not differ from them in any way? Meanwhile, electronic money has a large number of undeniable advantages:

1. Unity and divisibility - the use of electronic money makes it possible to dispense with the issue of change.

2. Low cost of issue - there is no need for minting coins, issuing banknotes and the cost of paint, paper, metals and other materials in this regard.

3. High level of portability - unlike cash funds, the amount of electronic money is not related to its weight or dimensions.

4. Ease in the settlement process - there is no need to recount electronic money, since this process is automatically carried out using a payment instrument.

5. Simplicity in organizing the physical security of electronic means of payment.

6. Reducing the impact of the human factor - the moment of payment is always recorded by the electronic system.

7. Saving space and time - electronic money does not need to be packaged, transported, counted or left in storage.

8. Inability to hide funds from taxation - we are talking about payments made through fiscalized acquiring devices.

9. Qualitative homogeneity - electronic money cannot be damaged, such as banknotes or coins.

10. Ideal preservation - electronic money can preserve its qualities for a long period of time.

11. High level of security - electronic money is protected from denomination, counterfeiting or theft, which is ensured by electronic and cryptographic means.

12. Exchange of electronic money for cash is simple - today electronic money can be withdrawn to a bank card or account, as well as received in cash using the services of specialized organizations.

But, like any other type of means of payment, electronic money also has a number of disadvantages:

1. Lack of stable legal regulation - today many countries have not yet fully determined the status of electronic money and, therefore, have not developed a number of laws that could regulate the process of mutual settlements carried out through the use of electronic payment systems.

2. The need to use special handling and storage tools.

3. The impossibility of recovering the monetary value in the event of the physical destruction of the electronic money carrier - however, cash is not without this disadvantage.

4. Lack of recognition - the amount of electronic money cannot be determined without special technical means.

5. There is a high probability that the personal data of the payers can be tracked by fraudsters.

6. Low level of security - in the absence of the necessary security measures, it is quite easy to steal electronic money directly from the owner's account

Forms of electronic money

It is believed that modern electronic money can exist in two main forms: based on networks and based on smart cards. There are also such forms of electronic money as fiat and non-fiat money. The former are a kind of money of a certain payment system and are expressed in the form of one of the state currencies.

Since it is the state in its laws that obliges citizens to accept fiat money for payment, their emission, redemption and circulation is carried out in accordance with the rules of the current legislation and the central bank.

As for non-fiat money, it acts as a unit of value for non-government payment systems. Such electronic money is a type of credit financial means and is regulated by the rules of non-government payment systems, which are different in each country.

Types of electronic money

The types of electronic money are quite diverse. A few years ago, there were a limited number of payment systems in the world. Today their number is constantly growing. For convenience, all electronic money and systems should be divided into domestic and foreign ones.

Electronic money in Russia is represented by the following systems:

1. Webmoney - perhaps today it is one of the most popular payment systems that work with electronic money.

The system does not impose any restrictions, allows instant money transfers, and to complete a transaction it is not at all necessary to open a bank account or provide full information about yourself. System users can carry out correspondence and conduct transactions through secure channels by creating electronic wallets WMZ (dollars), WMR (rubles), WME (euros) and so on. The level of security when making transactions using Webmoney is quite high. However, users' wallets are often hacked by hackers. It is very difficult to return the funds later - with the exception of cases when the owner of the account or the management of the system is looking for the criminal in hot pursuit. Needless to say, it's not easy? But, at the same time, Webmoney constantly informs users about the measures they can take to protect themselves. And they really "work".

2. Yandex money is another popular payment system, which is in many ways similar to Webmoney.

Yandex money allows you to make instant payments within the limits of the system. The ability to manage the wallet directly from the official website, a high degree of protection and confidentiality, the speed of settlements between users of the system - these are the main advantages thanks to which Yandex money gained popularity in Russia.

3. RBK Money is a kind of prototype of the Rupay payment system.

Electronic money transfer in this case is carried out instantly. All funds are equivalent to a ruble, and you can withdraw them to a bank card or account. To complete the transaction, a mobile phone, computer, communicator is used. The main advantage of RBK Money is the ability to make payments for utilities, telephone, Internet quickly and easily.

4. ASSIST is a system created by Reksoft, which is a leader in the field of system integration and consulting in the development of software solutions and implementation of information technologies.

One of the main tasks of this system is to provide credit card payments when making purchases in the Ozon online store. True, the development of electronic money subsequently led to the fact that ASSIST began to be used to pay for goods and services of a different nature.

Less well-known, but no less popular in Russia are also considered:

5. CG PAY

6. CHRONOPAY

7. CYBERPLAT

8. E-PORT

9. MONYMAIL

10. RUNET

11. SimMP

12. Z-PAYMENT

13. PILOT

14. TELEBANK

15. RAPID

16. RAMBLER

As for foreign types of electronic money and payment systems that work with them, their choice is also great:

1. PayPal is a large debit electronic payment system that allows you to work with 18 national currencies. Since 2002, PayPal has been a division of the well-known eBay company.

PayPal payments are made over a secure connection. The registration procedure provides for the transfer of a small amount of money from the user's card to the account. Once the identity of the account and card holder has been verified, the funds will be returned. Registration and transferring funds using PayPal are free. The commission is paid only by the recipient of the payment, and its amount depends on his country of residence and status in the PayPal system.

2. Mondex - this system was developed by British banks and operates mainly in Europe and Asia.

Mondex assumes the issuance of a special smart card to the client, on which there is a chip - a kind of analogue of an electronic wallet. It is on it that electronic cash is stored - cash, which in the system acts as a cash equivalent. The advantages of electronic cash are the ability to make purchases via the Internet, store electronic money in five currencies at once, transfer funds to a correspondent without intermediaries. Mondex money is accepted by many restaurants, shops, airlines, hotels, petrol stations - 32 million businesses worldwide that operate in the field of trade and services.

3. Visa Cash is a prepaid smart card that allows you to quickly and easily pay for minor expenses. With Visa Cash, you can pay for cinema or theater tickets, telephone calls, newspapers, goods and services. The convenience of using Visa Cash is that you can quickly transfer a fairly large amount from your personal bank account to it.

4. E-gold is an international payment system that involves investing money in precious metals.

By playing on gold courses, you can receive electronic money and carry out various financial transactions with their help. The main advantages of the E-gold system are anonymity, transnationality and a profitable affiliate program. At the same time, a commission is charged for keeping money in the system every month. The same goes for transfers - you will have to pay a certain percentage for each transaction. You can always top up your account using transfers from Yandex-money, Webmoney, etc. Also, electronic money exchangers can cope with this function.

In addition, among the well-known foreign Internet payment systems are:

5. CASHKASSA

6. ALERTPAY

7. EASYPAY

8. EMONEY

9. LIBERTY

10. MONEYBOOKERS

11. CHECKFREE

12. CYBERMINT

13. DATACASH

14. DIGITCASH

15. EPASPORTE

16. FETHAND

17. GOLDMONEY

18. GOOGLE-CHECK

19. NETCASH

20. PAYMER

21. PECUNIX

If you decide to use e-money: some tips for beginners

The first thing you need to remember is that electronic money is quite “real” and losing it can be very harmful to you.

That is why, do not be lazy to study the instructions of a specific payment system, pay the utmost attention to ensuring the security of your account or account. Sometimes it is easier to purchase a special anti-virus program or utility to detect hacker attacks than to later lose a large amount of money, which will simply be stolen from the account.

Second, study the conditions for withdrawing, depositing and exchanging electronic money.

Each payment system offers the user its own terms. Today, the exchange of electronic money within two systems or currencies is quite possible to carry out on favorable terms. The same applies to the deposit and withdrawal of electronic means of payment. In the first case, you can use terminals, and in the second, you can transfer money to a card, bank account or receive it in cash by contacting specialized organizations.

And finally, third - do not give up the opportunity to use electronic money.

Today they are successfully used in various countries of the world as a means of payment for goods, works, services. Experts already say that in the coming years the number of people using electronic money for payments will steadily grow. This is not surprising, because you only have to try to carry out any financial transaction using electronic money once, and you will also understand that it is convenient and simple!

Electronic money today: news of legislation

Until a few years ago, electronic money was not equated with their paper counterpart. However, in connection with the expansion of the scope of their use, new ideas about means of payment have appeared, and it became necessary to regulate such relations by law. So on June 27, 2011, Russian President Dmitry Medvedev signed a new one, which will make it possible to regulate the procedure for making payments using electronic money.

This bill was adopted in December last year, but due to the amendments that were made to it over a long period of time, the document was signed only in June 2011. The main purpose of the Law "On the National Payment System" is to establish requirements for payment systems in the field of their functioning and organization.

The draft law describes the rules for transferring funds, and also introduces the concept of "clearing center". In this status, the organization acts, which ensures the acceptance for execution of applications of the payment system participants at the time when they transfer their funds using electronic forms of payment. In addition, through the law, 3 types of means of payment are introduced that can be used in the process of electronic settlements (the properties of the systems are also listed below):

1. Non-personalized electronic means of payment:

- the user is not identified;

- the maximum balance at any time is 15 thousand rubles;

- the limit on the turnover of funds per month is equal to 40 thousand rubles;

- use for mini payments.

2. Personalized electronic means of payment:

- identification of the client is carried out;

- the maximum amount of funds on the account is 100 thousand rubles per month.

3. Corporate electronic means of payment:

- can be used by legal entities with their preliminary identification;

- the maximum balance of funds at the end of the working day is 100 thousand rubles;

- will allow the acceptance of electronic money as payment for services and goods.

It should be noted that the law "On the National Payment System" will have an impact on the regulation of mobile payments. The operator of the electronic payment system will be able to conclude an agreement with a cellular operator. Based on this, he will receive the right to increase the balance of electronic funds of an individual who is a subscriber of this operator, at the expense of funds paid to the operator in advance. We can even say that the new bill has created all the conditions for using a mobile phone as a device for making payments of various types.

In general, it can be noted that every year electronic payment systems and electronic money are becoming more and more popular. Do not miss the opportunity to feel the comfort of using them, because electronic payments can really make the payment process more convenient!

The general director of dace group llc smbat harutyunyan, the prison trade house

The general director of dace group llc smbat harutyunyan, the prison trade house Yakunin left, Rabinovich stayed

Yakunin left, Rabinovich stayed Rabinovich mikhail daniilovich

Rabinovich mikhail daniilovich Lifting loads without special equipment - how to calculate and make a chain hoist with your own hands

Lifting loads without special equipment - how to calculate and make a chain hoist with your own hands New details about Dimona's "charity" empire

New details about Dimona's "charity" empire Principal Buyer

Principal Buyer Edward cypherin biography. New Russian. How Eduard Shifrin, having earned $ 1 billion from Ukrainian steel, got involved in development in Russia. Eduard Shifrin and withdrawal of money

Edward cypherin biography. New Russian. How Eduard Shifrin, having earned $ 1 billion from Ukrainian steel, got involved in development in Russia. Eduard Shifrin and withdrawal of money