How to draw up a sales receipt for IP

Today we will talk about such an important component of trading as a sales receipt. What it is, the rules for registration, the requirements for maintaining such a reporting form - all of these issues need detailed and careful consideration. After all, such a financial document is becoming an essential attribute for modern business.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to know how to solve exactly your problem - contact the online consultant form on the left or call

8 (499) 350-44-96

It's fast and free!

General information and legal framework

In general, this form of reporting is a detailed description of the products you sold, indicating the specific date of sale and the name of the seller. To fix the transaction, the businessman will need to write out for the buyer commodity check. The form of this document should be drawn up in accordance with the requirements of the law. You can read about the rules for conducting reports of this kind in Federal Law No. 54 and a letter from the Ministry of Finance of the Russian Federation No. 16-00-17/2 of 01/05/2004 . True, there are certain nuances here.

All issues related to the issuance of sales receipts to buyers are regulated by the Federal Law No. 54 and the letter of the Ministry of Finance No. 16-00-17 / 2 of 01/05/2004

So, a cash receipt becomes a mandatory document for commercial activities, while a sales receipt becomes only an additional confirmation of the transaction, giving the buyer the right to replace or return the goods. Therefore, the question of most people whether a cash receipt is needed for a sales receipt should be answered in the affirmative.. Of course, this rule does not apply in cases where a businessman has the right to conduct business without using cash register. The reverse question, whether it is possible to work without such a document for the sale of goods, will require a more detailed explanation.

Today, an entrepreneur can do without filling out papers of this kind, but only if there is a CCP. In addition, some product groups require the mandatory completion of this reporting form. Among them are automotive equipment, motor vehicles, devices with a serial number, trailers, furniture and weapons. Of course, even when selling other goods, the seller is obliged to provide receipts for them also at the request of the buyer.

Of course, starting a business and planning to work on a UTII or a patent, a businessman needs to know how to properly draw up a sales receipt for an individual entrepreneur without a cash register. We will definitely give a sample form for this format of work a little lower in the review. True, it must be said that there are no too strict requirements for filling out the form. As a rule, indicating the basic data, the entrepreneur can add some additional positions. As for the specifics of use, today the need for such forms will be only for businessmen who have chosen the patent system, UTII or working on old-style cash registers. Although, of course, checks must be present at the enterprise without fail - after all, any buyer can ask to provide it to him.

The nuances of proper reporting

A typical form of a sales receipt for an individual entrepreneur involves the accurate filling of all positions of the form. Remember, corrections and blots are completely unacceptable here. However, an accidentally damaged copy must be kept in the store along with the rest of the issued forms. Of course, the seller should clearly and in detail describe all the goods purchased from him.

In general, only a cash receipt is mandatory for issuance, while a sales receipt is issued either at the request of the buyer, or in the absence of a cash register

In cases where the buyer wishes to purchase only one product name, the empty lines should be crossed out. This will protect you in the future from fraud by unscrupulous customers who fill in the columns on their own after making a purchase. When, on the contrary, there are not enough lines in the form to list all items, you can either continue writing on the next form, making a note, or write out each group of goods on a separate check.

Remember, the situation with the safety of duplicates is also quite important. Usually, a copy is made during product descriptions. Some forms allow you to get it right away, while in other situations you will have to duplicate the text. The original check should be given to the buyer, and the duplicate should be kept in a special book.

Another point is to supply the seal on the document. In general, a modern cash register allows you to get a cash receipt that describes the purchase in sufficient detail. When the buyer has enough of this paper, the individual entrepreneur simply puts his seal on it. The scheme for issuing sales receipts also works. However, for this category of entrepreneurs, it is legally allowed not to have a seal at all. In this case, it is permissible to give the form to the buyer, indicating in detail all the details of the businessman and the address of the store. Such forms are valid and are proof of the transaction. Again, entrepreneurship in the UTII regime becomes an exception here.

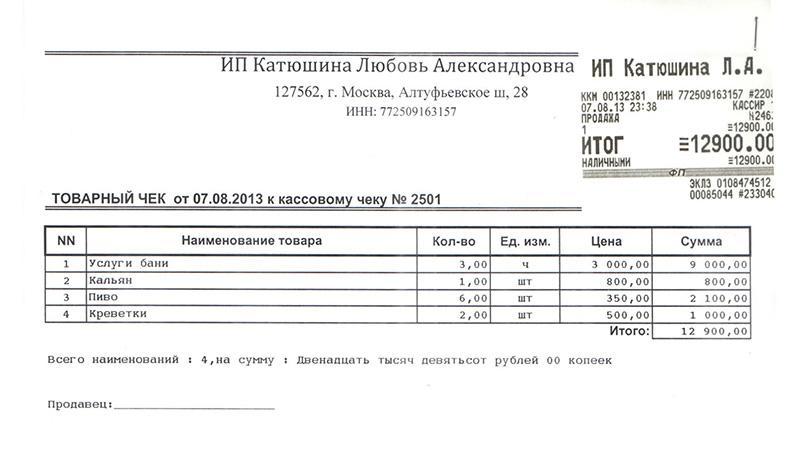

An example of issuing a sales receipt for services provided by the enterprise

Now let's talk about how to fill out a sales receipt for services. The template for this form will look the same as a regular form. True, in the column where the positions of the goods are indicated, the services rendered to the client should be listed. Other nuances of registration of such documents are not specified in the current laws of the Russian Federation.

What to include in your entries

It's time to learn how to correctly fill out the sales receipt form. A sample filling with all the explanations will be given a little lower, and now we will briefly describe the positions that need to be indicated. So, the forms should be numbered and be sure to indicate the date of purchase, as well as its name. In addition, a detailed description of each product item, a listing of the number of products, their price per copy and an indication of the total purchase amount will be mandatory.

According to experienced businessmen, the correct execution of sales receipts can save your company from various kinds of trouble with customers and the tax service.

Now let's talk about the details of a businessman, which is important to be included in the form. It is necessary to indicate the initials of the entrepreneur, TIN, address of the outlet. In addition, the signature of the seller or individual entrepreneur will also be mandatory, and in some cases, which will be discussed below, also a seal. As you can see, there are no particular difficulties in filling out a standard form. Let's take a closer look at the various variations of the design of these forms.

Filling methods

Today's opportunities and legislation allow you to write out such documents either using a PC or by hand. In the first situation, it is appropriate to make a sample file of an empty check and enter purchases there, printing out both ready-made copies. Of course, this will require the purchase of special licensed software.

If there is a cash register that issues checks with a detailed description of the goods and there are no forms of sales receipts, the entrepreneur can replace the latter with an act or a sales invoice

Manual filling involves buying forms made in a printer and filling them out with a ballpoint pen as needed. As you remember, the information in the form should be entered legibly, clearly and without blots. In addition, you will also need to issue a duplicate if the base type of forms does not provide this function by default.

In general, there should always be a certain number of blank copies in the store. After all, the buyer can ask to give him this document at any time.

True, sometimes an entrepreneur can make a mistake and forget to replenish stocks.In this case, experts recommend offering the client a reasonable alternative. It will be drawing up an act for a batch of purchased products with a detailed description of all positions, prices and an indication of the total cost. Of course, the details of the entrepreneur and the address of the store, as well as the signature and seal, will also be a prerequisite here.

Features of reporting on UTII and patent

Since we have already mentioned many times that this form of doing business by an entrepreneur has its own characteristics due to the ability to work without the use of cash registers, let us summarize the general conditions and rules for compiling such reporting documentation. So, let's first define the information that must be indicated in the form. The required details of a sales receipt without a cash order will be as follows:

- the name of the form;

- serial number;

- the date of the transaction;

- TIN of the entrepreneur;

- OGRN;

- legal address of a businessman (upon registration);

- point of sale address;

- entrepreneur's initials;

- signature of the official who conducted the transaction;

- customer details (optional, but desirable);

- product/service name;

- number of units of goods/services;

- article or product grade, when it is indicated by the manufacturer (if the column is missing, it is omitted);

- unit price of each item;

- the number of goods purchased;

- the amount of each product item;

- total total cost.

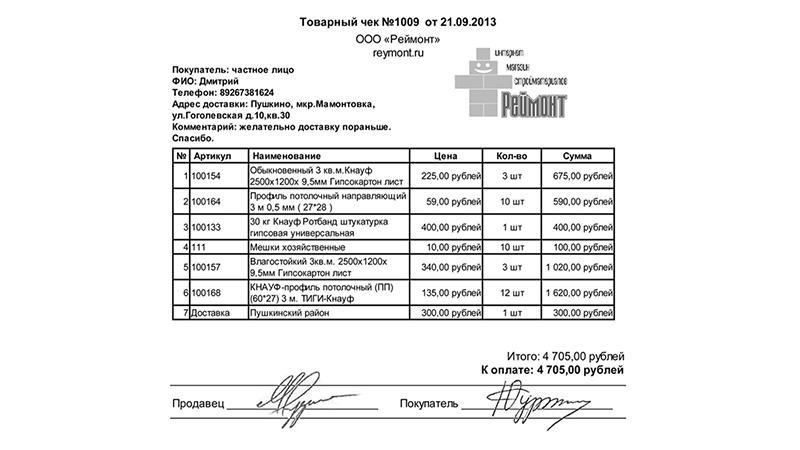

A sample of filling out a sales receipt for an individual entrepreneur working without a cash register

In addition, the seal of the entrepreneur will be required here - after all, this form will become the only evidence of a commercial transaction. In addition, such a form also becomes a strict reporting form.

An example of filling out a form for an enterprise that does not use CCP

Salesman(here we indicate the initials and address of the store)

TIN(write a twelve-digit number)

OGRN(mandatory to fill in with the legal address of the businessman and his passport data)

Sales receipt No. ______ (documents are numbered in the order of transactions)

"_____" ______ 20 ______ (indicate the date the buyer purchased the product)

___________________________________ (full name of the buyer)

Total: (write the purchase amount in words here)_____ rub. ______ kop. (here we duplicate in numbers)

M. P. __________ (signature) ___________________ (initials and position of the person who conducted the transaction)

Something like this looks like a sample of filling out a sales receipt form without a cash receipt. As you can see, there are no particular difficulties in filling out this form, and for an experienced seller, the buyer's request for the issuance of such a document will not pose any problems.

Details of the form for businessmen who have chosen the simplified tax system / unified social tax

Since this format of work implies the mandatory use of cash registers, the requirements for issuing sales receipts will be much softer here. Indeed, in such a situation, this form becomes just an addition to the printout of the CCP form and the cash receipt order. As a rule, businessmen working under such a taxation scheme have the right to issue such forms only at the request of the buyer and not leave a seal on them.

The utmost attention and accuracy when filling out a sales receipt is the main condition for the seller

As you can see, maintaining this documentation, with rare exceptions, is not mandatory. However, nevertheless, the careful filling of these forms will help the businessman to protect himself from possible problems with unscrupulous clients. In addition, these simple steps help to simplify the internal reporting of receipts and sales of goods.

All issues related to the issuance of sales receipts to buyers are regulated by Federal Law No. 54 and the letter of the Ministry of Finance No. 16-00-17 / 2 dated 01/05/2004 KKT

Ready-made business plan with calculations using the example of a web studio

Ready-made business plan with calculations using the example of a web studio Registration of an internal memorandum: sample document and drafting rules

Registration of an internal memorandum: sample document and drafting rules Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages

Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages Advance report is ... Advance report: sample filling

Advance report is ... Advance report: sample filling How to stitch documents with threads by hand?

How to stitch documents with threads by hand? Disciplinary sanction for non-fulfillment of official duties

Disciplinary sanction for non-fulfillment of official duties Binding your book

Binding your book