Completing advance report

If necessary, some employees may be given funds for representative or business expenses of the enterprise. They have the right to receive money on the basis of the order of the head on accountable persons, if their full name. and the position are indicated in the list of people with such an opportunity.

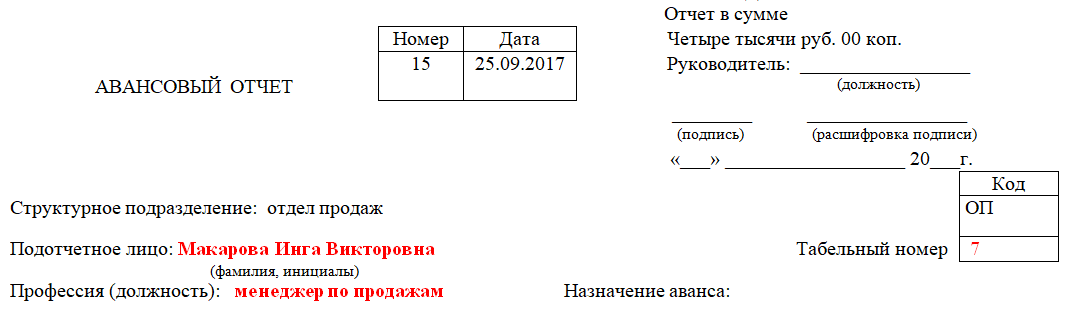

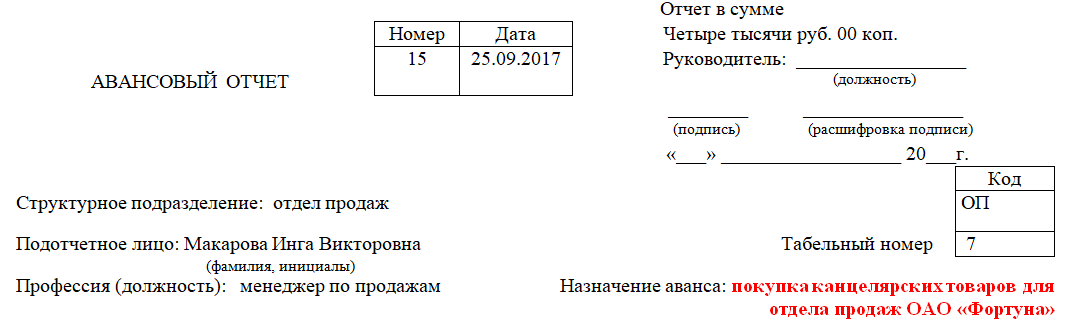

Document Form

The expenditure of money given to an employee in advance is confirmed using the primary accounting document - an advance report. The form is a unified form No. AO-1, one part of which is filled in by an employee, the other by an accountant.

Return of accountable amounts under the advance report

There are certain deadlines for the submission of an advance report by an accountable person, in which the employee is obliged to report on the funds spent.

After receiving the funds, the accountable person is obliged, within a period not exceeding three business days after the expiration date for which the funds were issued for the report, or from the day of starting work, to submit an advance report with the attached supporting documents (clause 6.3 of Directive No. 3210- U).

If the employee has not fully spent the money, an expense report is drawn up for the spent part, it indicates the amount of unspent money - this is the return of the accountable amounts according to the expense report.

It is also not uncommon for an employee to first spend their own money, then bring documents and receive a refund. In this case, he must apply to the accounting department with an application for reimbursement of expenses incurred. The accountant also makes such calculations using the advance report. Therefore, this situation can also be attributed to the return of accountable amounts under the advance report.

If the employee did not make any expenses at all, he returns the accountable amount to the cashier and does not draw up an advance report.

It must be remembered: if the deadline for submitting an advance report by an accountable person was not observed, this is considered a violation of cash discipline (Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

Filling order

Now consider in detail the procedure for filling out the document.

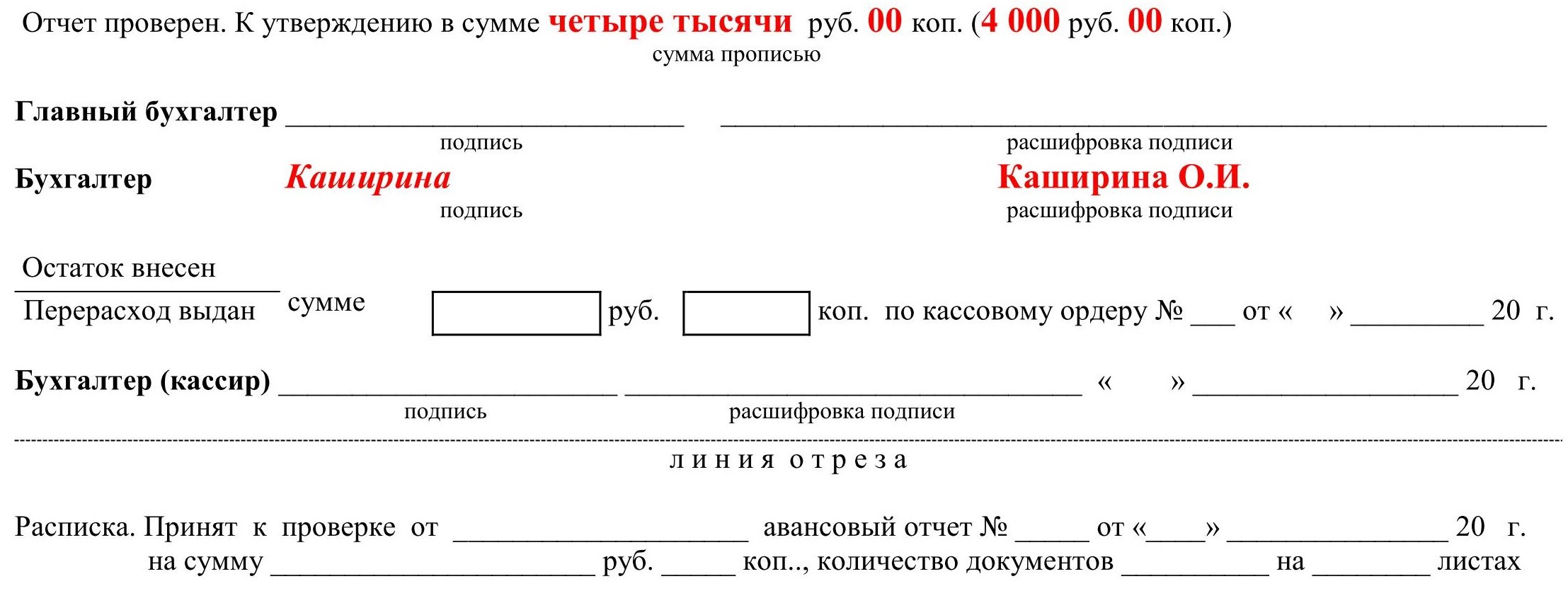

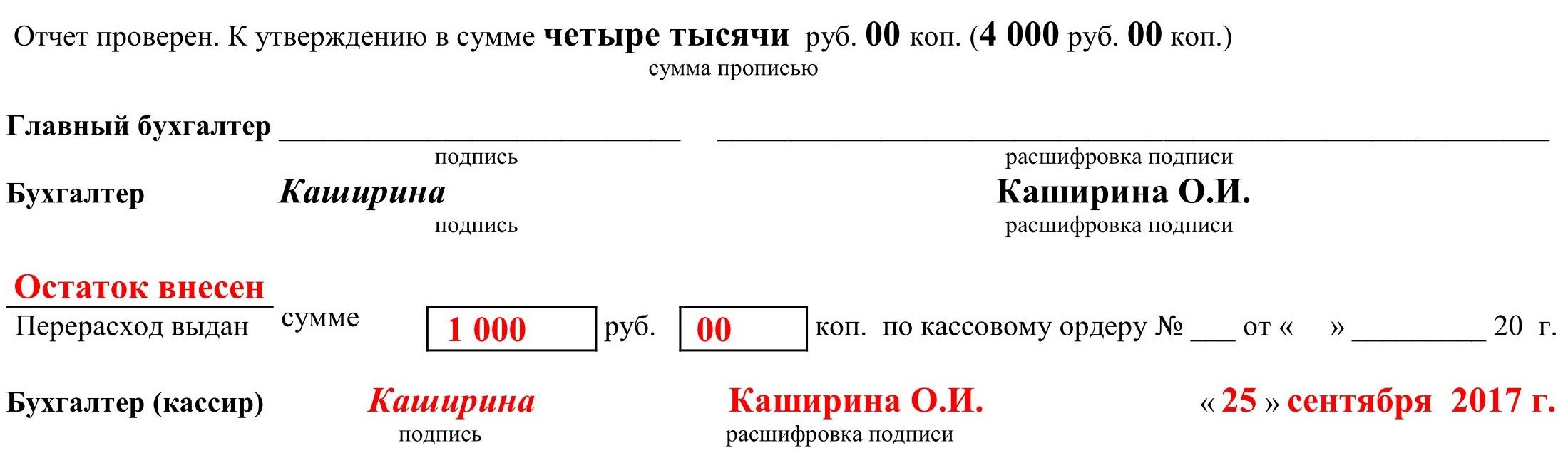

Filled in by an employee

Front side.

So, on the front side of form No. AO-1, the employee needs:

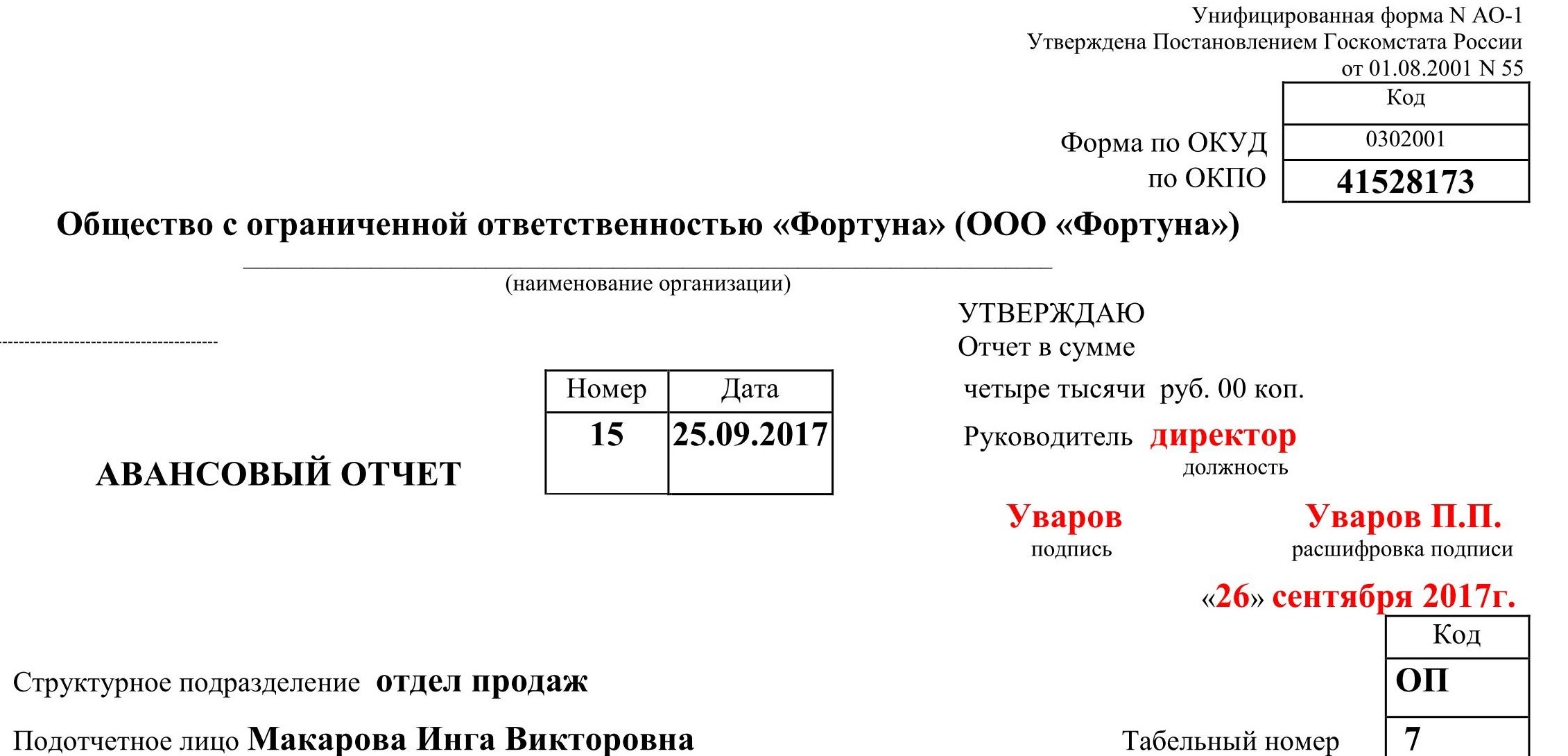

Indicate the company name and OKPO code.

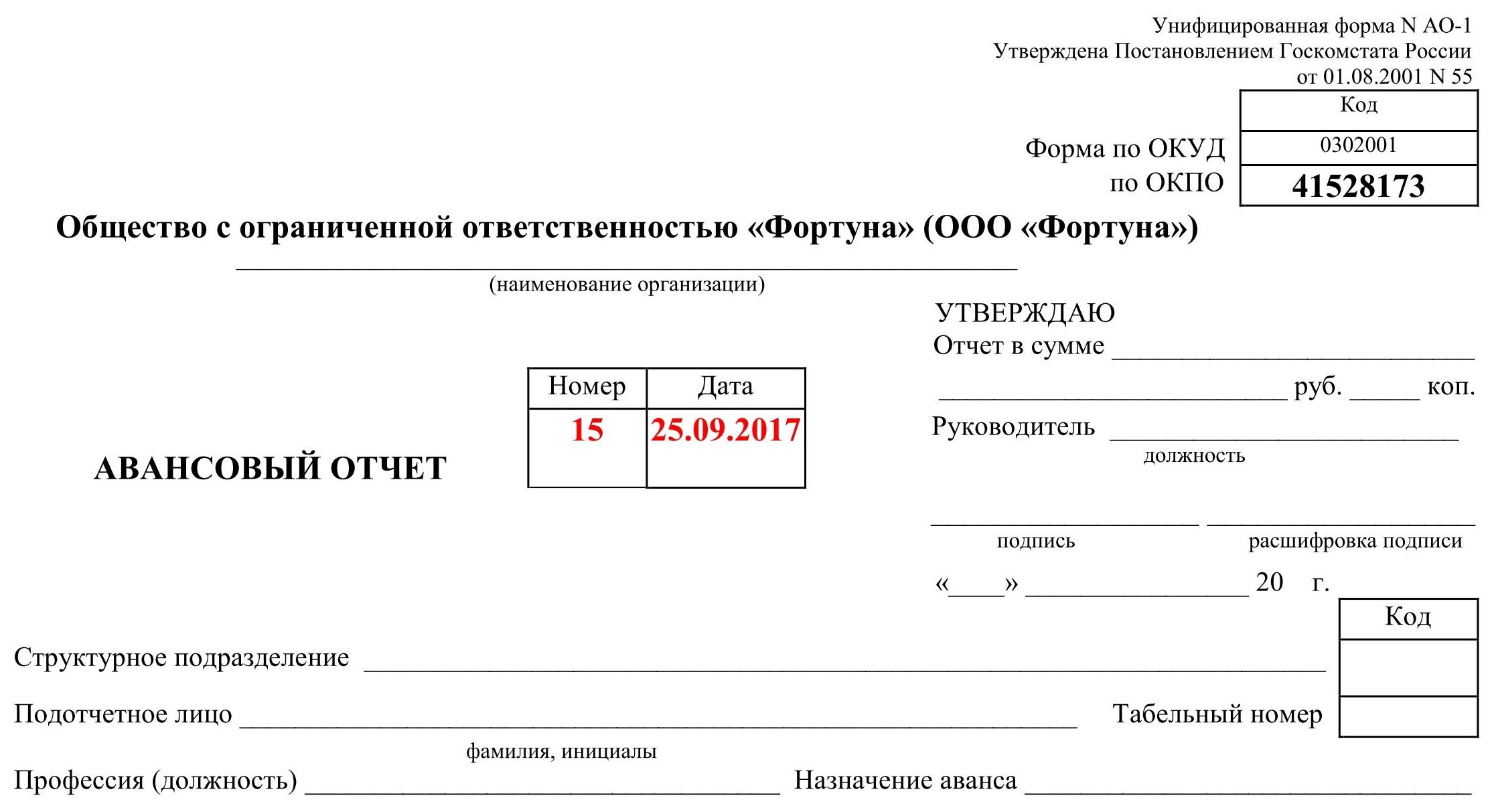

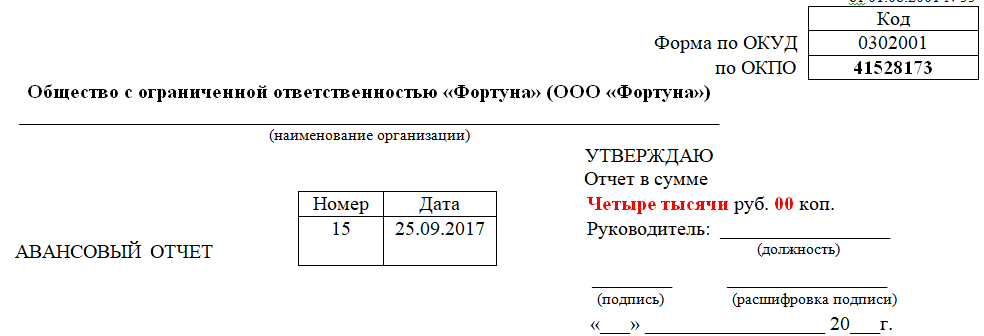

2. Put down the date of the document and assign a number.

3. In the column "report in the amount" we enter the amount that the employee spent on the household needs of the enterprise. For example, he was given five thousand rubles, and he spent four thousand. Therefore, in this column, he indicates four thousand.

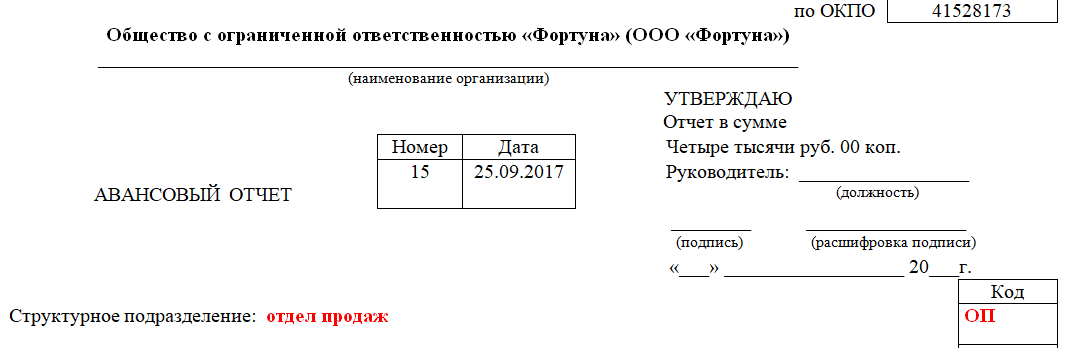

4. Specify the name and code of the structural unit.

5. After that, we indicate the full name. accountable person, his personnel number and profession (position).

6. Enter the purpose of the advance.

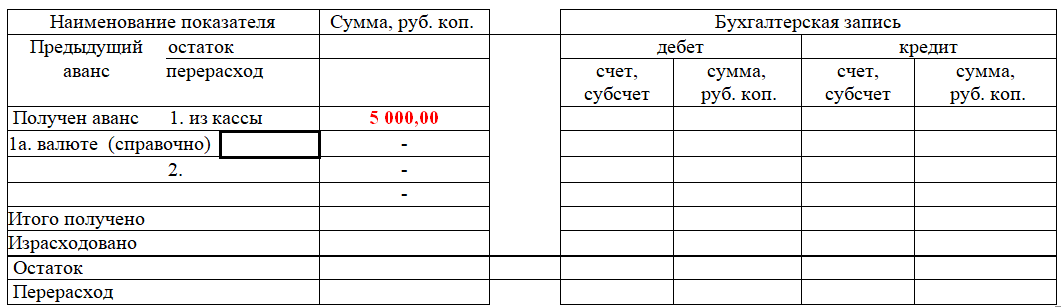

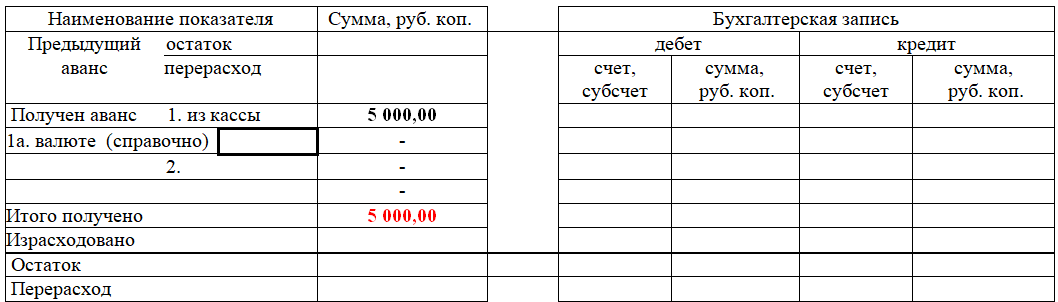

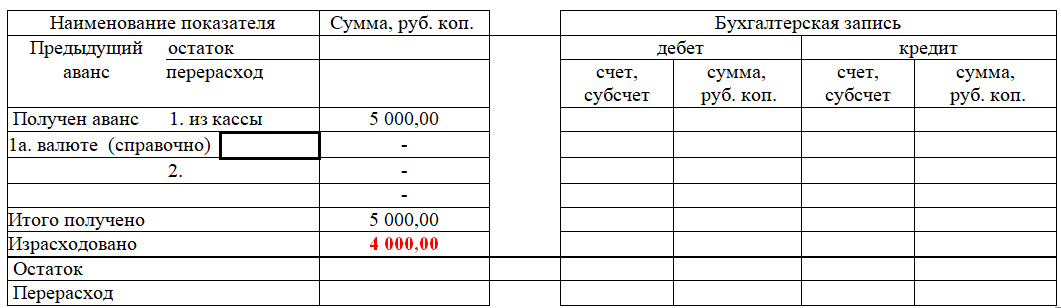

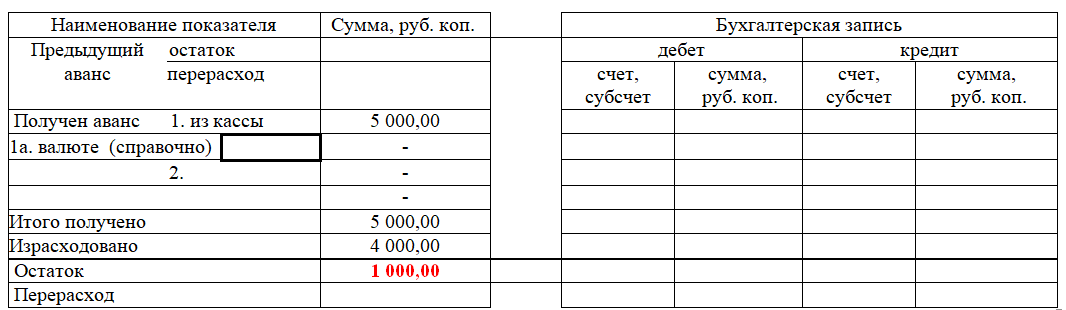

7. On the left side of the table located on the front side of the form, indicate the amount received from the cash desk of the enterprise (or to a bank card). If necessary, indicate the amount of money issued in foreign currency.

8. Specify the total amount of funds received.

9. We indicate the amount spent on the economic needs of the enterprise.

10. Specify the size of the balance.

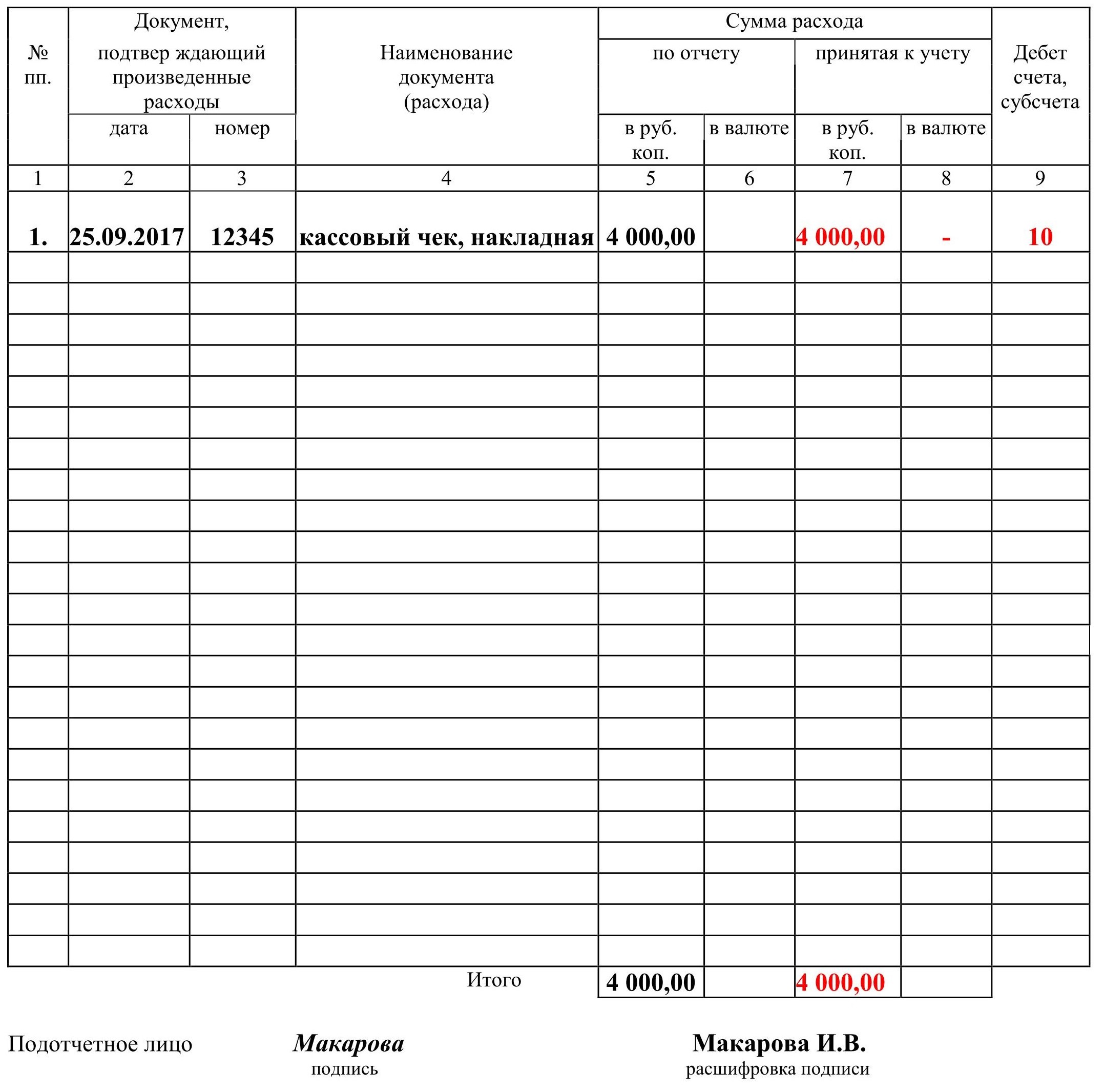

Reverse side.

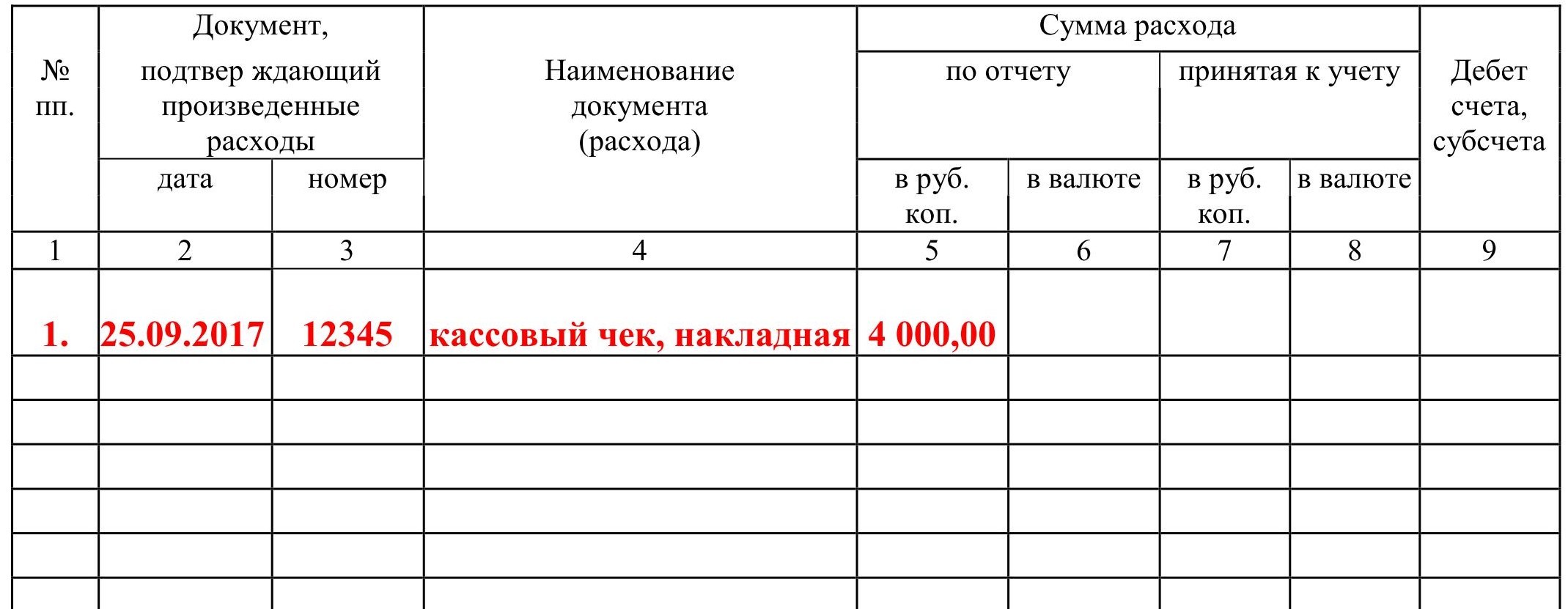

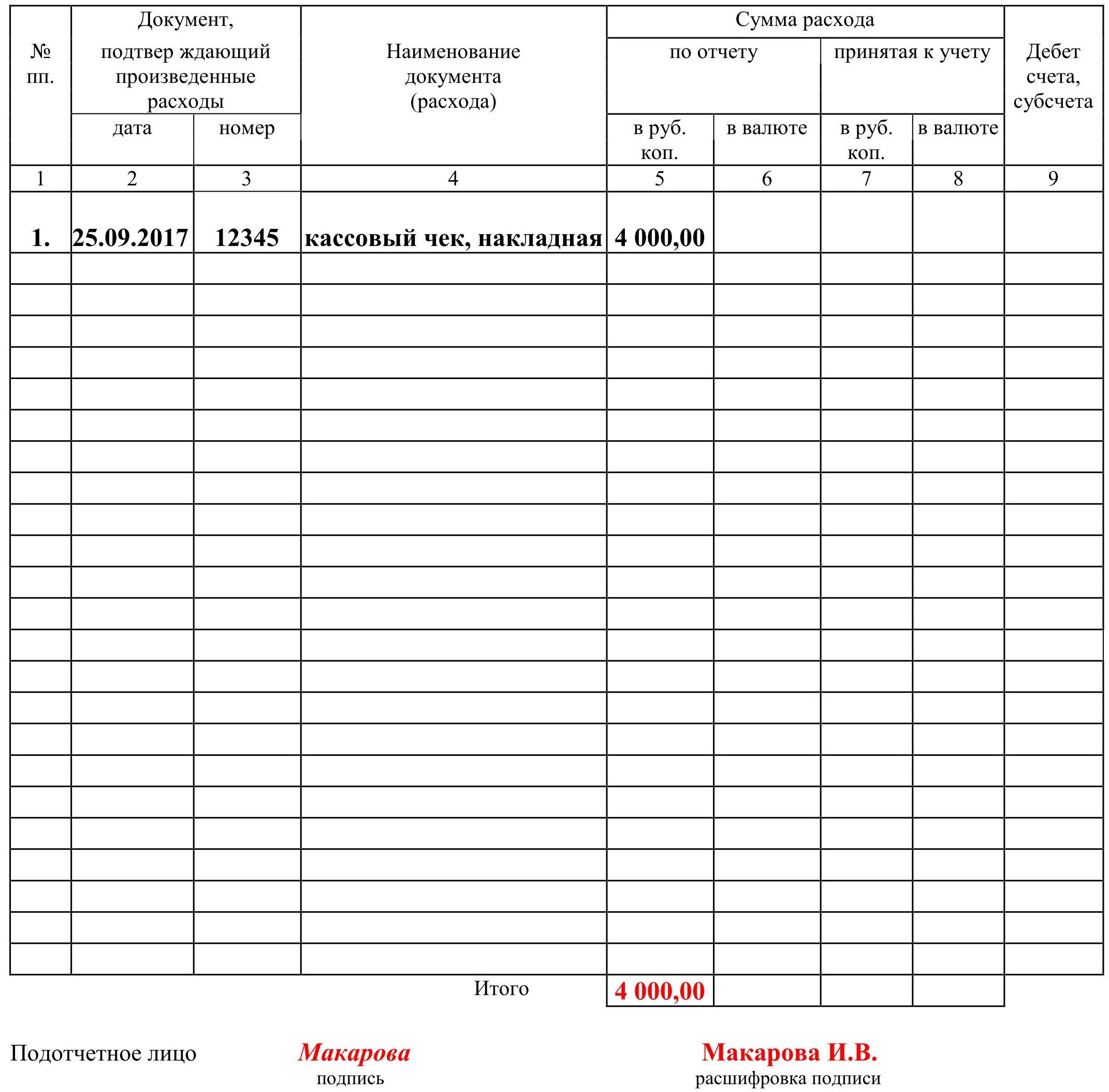

11. On the reverse side of the form in columns 1-6, the employee must list all documents (commodity, cash receipts, etc.) confirming the expenses incurred by the employee, indicating the amounts spent. Documents must be numbered according to the order in which they are listed in the advance report.

Now about what information the employee should enter in the appropriate columns:

- 1 - p / p number assigned to the document confirming the expenses;

- 2 - date of drawing up the check;

- 3 - check number;

- 4 - the name of the document confirming the expenses;

- 5 - the amount of the incurred expense in rubles is entered here;

- 6 - fill in if necessary. It indicates the amount of expenses incurred in foreign currency;

- the line "Total" indicates the total amount of expenses.

12. After the employee has filled in the required fields, he must put his signature on the form with a transcript. Next, you need to transfer the document to the accounting department. The accountant will check the correctness of filling.

Filled in by an accountant

Front side.

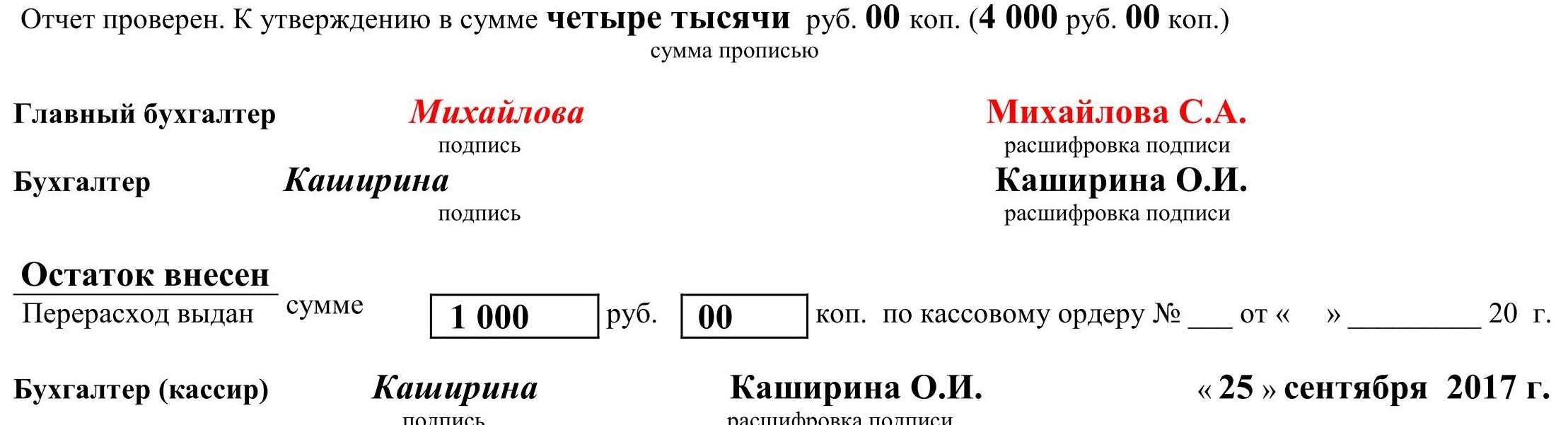

13. After receiving the form, the accountant must make sure that it is filled out correctly. If no errors are found, the accountant makes an entry about this in the “report verified” column and puts his signature.

After that, the accountant proceeds to further fill out the form.

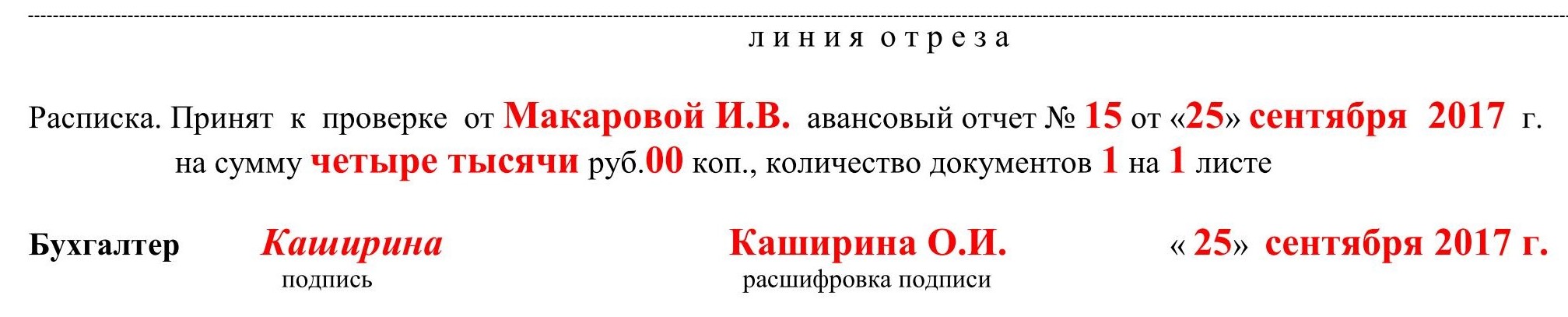

15. The accountant fills out the tear-off part of the form, signs it and hands it over to the employee

Reverse side.

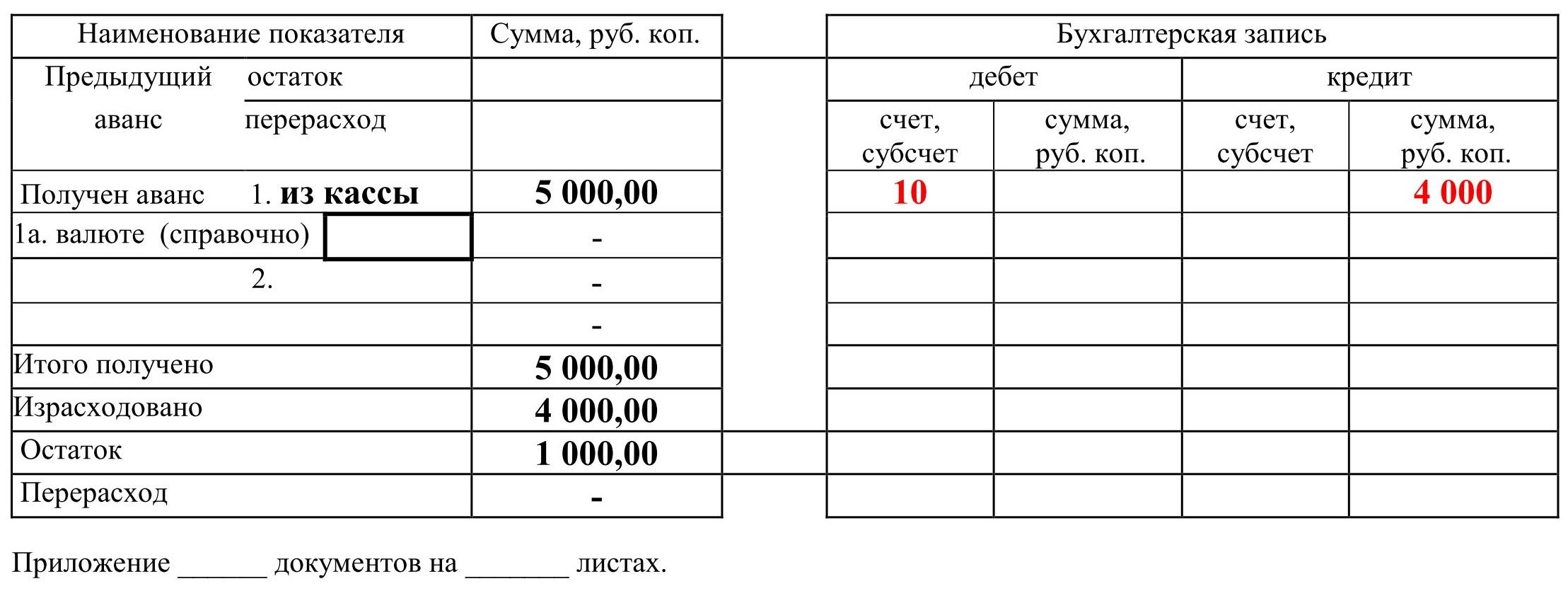

16. The accountant records information in columns 7 and 8. Here the amounts of expenses accepted for accounting are indicated. Column 9 indicates the numbers of accounting accounts that are debited for the amount of expenses. The amounts indicated by the employee and the accountant must be the same.

After that, the accountant fills in the front side of the expense report.

Front side.

17. On the front side in the right table, the accountant enters the following information:

- balance or overspending of the previous advance;

- the amount of the advance received from the cash desk of the enterprise;

- the amount of money spent;

- balance or overrun of advance amounts;

- accounting entry - information is taken from the data in column 9, which is located on the reverse side.

19. The director approves the document and returns it to the accounting department. After that, it is stored in the accounting department of the company for 5 years. After this period, it is destroyed.

You can download a sample from our website.

Ready-made business plan with calculations using the example of a web studio

Ready-made business plan with calculations using the example of a web studio Registration of an internal memorandum: sample document and drafting rules

Registration of an internal memorandum: sample document and drafting rules Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages

Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages Advance report is ... Advance report: sample filling

Advance report is ... Advance report: sample filling How to stitch documents with threads by hand?

How to stitch documents with threads by hand? Disciplinary sanction for non-fulfillment of official duties

Disciplinary sanction for non-fulfillment of official duties Binding your book

Binding your book