How to open an MFO from scratch. Business idea: how to start an MFI business. Business - microloans to the salary of the population

A legal entity that conducts financial activities on a limited scale (the maximum loan / loan amount, for example, is 1,000,000 rubles), is called a microfinance organization or in abbreviated form MFO. The core activity of MFOs is the provision of microloans to individuals on the basis of special agreements.

What is the difference between an MFI and a bank

Before starting to study the question of how to open a microfinance organization, it is worth examining its main differences from a bank that issues microloans.

In addition to the reduced volume of loans provided, microfinance organizations have a number of characteristics that distinguish them from banks:

- The loan is issued only in national currency.

- This microfinance organization does not have the right to unilaterally make changes to the agreed or fixed interest rate, the procedure for defining obligations according to the agreement, the time of their validity, and the commission.

- An MFO does not have the right to impose any penalties on a borrower who has repaid a microloan in full or in part, ahead of schedule, if he has announced the corresponding intention.

- The MFI does not participate in the securities market.

- The MFO makes fewer claims to the borrower when providing microloans.

Why are these organizations so popular

The first MFIs began to appear in the legal lending market in 2011. Since then, the number of such organizations has grown steadily. This process can be easily explained by the fact that the state maintains minimal control over such organizations, as opposed to control over large banks. The main positive qualities of MFIs are:

- A relatively easy procedure for registering a legal entity on behalf of which the organization will conduct business.

- Convenient levers to control the work of a microfinance organization and soft economic performance.

- Lack of required insurance charges to special funds.

- Lack of conditions for the required possession of required reserves.

- Absence of any basic requirements for the size of equity capital.

Step by step instructions on how to open

The current legislation establishes that a microfinance organization has the right to open only a legal entity that is registered in the form of funds, institutions, with the exception of budgetary, autonomous non-trade organizations, partnerships, business companies or associations. The presence of a special license is not a prerequisite, it will be sufficient to have a certificate from the relevant Federal Service (FFMS) of entry into a special register, which the legal entity receives upon registration.

Registration of a legal entity

For example, let's take an LLC with one founder, who is the general director with the duties of the chief accountant. To register an MFO, we need:

- Company charter;

- The decision to establish an LLC;

- Form 11001;

- Order on the appointment of the General Director with the duties of the chief accountant;

- Statement on the taxation system (general or simplified);

- Receipt for payment of state duty;

- Request for a copy of the charter.

Obtaining the status of a microfinance organization

To implement this step, the following documents are required:

- Application for entering information about a legal entity in the state register of microfinance organizations, signed by the head of the legal entity or his authorized representative;

- A copy of the certificate of state registration of a legal entity;

- A copy of the decision to create a legal entity and copies of constituent documents;

- A copy of the decision on the election of the bodies of the legal entity, indicating their composition on the day of submission of the document to the authorized body;

- Information about the founders;

- Information about the actual address;

- (For legal entities with foreign founders) Extracts from the register of the country of origin of legal entities or any other document equal in legal force;

- Inventory of the submitted documents.

When filling out the settlement documents, you must specify the following details related to the payment of the state duty:

- Indicator of the basis of payment (106): "TP" - payments of the current year;

- Tax period indicator (107): "0";

- Document number indicator (108): "0";

- Document date indicator (109): "0";

- Payment type indicator (110): "GP" - payment of the duty;

- Two-digit status indicator (101): "01" - taxpayer (payer of fees) - legal entity;

- In field 104 of the settlement document, we indicate the indicator of the code of the budget classification of federal budget revenues administered by the FFMS.

The result of consideration of the application will be known within 14 working days after sending the documents. Approximately 10 days after the FFMS received your package of documents, you can search for your organization in this register.

Features of raising funds

In its financial activities, the MFO has the right, confirmed by law, to attract funds from certain categories of individuals: the founders of the organization, its members, investors. At the same time, there is no limit on the amount of funds raised. If another individual provides funds for a loan, subject to the conclusion of one agreement with one borrower, then their maximum amount is limited to 1.5 million.

If a private person credits funds to an MFO, then the income that this organization receives is subject to a mandatory taxation of 13%. In this case, the MFI withholds the required amount individually and pays off the state budget. The depositor receives his income in accordance with the agreement, except for the amount of personal income tax.

MFO creates the necessary and mandatory rules to comply with the rules for attracting funds to deposits: a sufficient level of equity capital (not less than 5%), liquidity, with an indicator of more than 70%. The set of own funds of a microfinance organization includes: the capital of the organization, reserves, loans provided by co-founders / shareholders (legal entities or individuals), as well as other loans that have been credited to the organization's account for a period of at least 3 years.

In the event that an MFI goes bankrupt, all claims for loans made by it will be satisfied only after all debts with all other creditors have been repaid. These conditions are unquestioning, they are a mandatory clause and are prescribed in all microloan agreements. The quarterly calculation of indicators is carried out on the basis of the financial statements of the microfinance organization itself, which is carefully prepared and submitted to the FSFM (this measure applies to all legal entities).

Interest man, usurer, spider - as soon as they did not name people who lend money at interest. Some with envy, and some with hatred, parting with the last property. But they agreed on one thing: such a business brings its owner a fabulous income! In the era of the developed banking sector, it is difficult to imagine that you can try to do something like that. And in vain, not so long ago in Russia was adopted federal law No. 151, which regulates the activities of microfinance organizations (MFOs) and brings illegal creditors out of the shadows. Let us consider in more detail whether it is profitable to lend in our time.

What it is?

MFO is a legal entity registered in one of the permitted forms of organization and entered in the State Register of MFOs. This business is registered when the issuance of loans is systematic, and the main income of the company is this activity.

In addition, the official status allows attracting investors who will invest at least 1.5 million rubles in the business (the lower limit according to the law). It will be possible to insure the risks of loan defaults. And the number of people willing to borrow will increase, because legally operating companies are more trusted.

Shouldn't we create an MFI?

It will be more difficult to open a car wash than to register an MFO. The activities of such organizations are not banking in the legal sense of the word, therefore it is not required to obtain licenses and have a multibillion-dollar authorized capital. Only the reporting form is somewhat more complicated than the standard form for entrepreneurs.

As a form of organization, the legislator offers us a number of different options, but the overwhelming majority of MFOs are registered as LLC. Therefore, the package of documents for filing with the tax office is exactly the same:

- Statement;

- Certificate of State Registration of a Legal Entity;

- Constituent documents;

- Decision on the creation of an organization and on the approval of constituent documents;

- Decision on the approval of the management bodies of the organization;

- Certificate of the address of the organization;

- Information about the founders;

- Payment of state fees;

- Extract from the Register of Foreign Legal Entities, if there are any among the founders.

The only thing, after registration with the Federal Tax Service, you need to send an application with copies of the above documents to the Central Bank of the Russian Federation (any nearest branch) with the requirement to include your organization in the unified register of MFOs. By the way, according to the law, you must post the terms of the loan on the Internet, but it is not specified that you need to have your own website, so at first you can rent a place on some third-party resource.

To get started, rent 3-5 square meters in a shopping center (3000 - 5000 rubles in the regional center). Buy a table (from 2000 rubles), a chair (from 700 rubles), a filing cabinet (from 3000 rubles), an MFP (from 3000 rubles) and bring a computer or laptop from home. As for advertising, everything is very individual, everyone has their own marketing budget. As you may have guessed, you yourself will do the work of the director, accountant and one of the employees. Since sometimes everyone needs to rest, we will hire a second employee. Qualifications are not important here, you can take a student of the 4th - 5th year of the institute, 15,000 rubles. he will be more than satisfied. As you can see, the start-up capital for arranging the point is penny. It is better to leave all other funds for loans, but at least 200,000 rubles should be allocated for these purposes. Then by the end of the year you can get 1 million rubles, subject to a rate of 2% per day and no return at the level of 30%.

An auditor is coming to us.

The microfinance market is currently very weakly regulated. Federal Law 151 does not contain strict sanctions against organizations, which is why many honest players complain about a large number of “illegal immigrants”. Although recently, the Central Bank of the Russian Federation has been paying close attention to small competitors of banks. In the second and third quarters of 2014, the electronic form for receiving reports by MFOs (personal account on the Central Bank's website) should be debugged, from July this year, Nabiullina's subordinates will be able to limit the maximum rates on unsecured loans and borrowings. And inflated interest rates are the main bread of MFIs. It is also necessary to prepare a decision of the "General Meeting of Participants" (founders) for each loan equal to or more than 10% of the authorized capital.

In principle, MFIs can audit in the same way as any other organization. That is, having found violations of fire safety rules in the company's office, the inspector can close your business.

On their own.

Knocking out debt is strongly associated with the "dashing nineties". But lately, the media are increasingly full of reports of criminal ways to settle debt. Bandits again? No, this time they are legal, officially registered creditors.

Any founder of an MFO initially includes in the business plan 10% - 15% risk of loan default, and sometimes, reducing the time for checking the debtor and increasing the speed of issuing money, and all 30%! But, you must admit, even after calculating such a situation, I want to return everything back. MFIs often do not have a staff of lawyers and funds for the services of collectors, so they have to cope on their own. Well, what comes of this, we see in the news.

Large chains, along with banking institutions, prefer to resolve disputes with clients in a civilized manner: from bailiffs to collectors. The latter generally buy out debts from MFOs, however, from 3% of the value of the amount of liabilities. In 2013, the volume of repurchased debts increased by 66%! Considering the number of delays in such firms, cooperation with collectors will only grow stronger.

High risk, high margin.

If in Moscow or St. Petersburg MFOs are not very noticeable, in the regions they literally flooded the streets. In some cities there are more stalls a la "Dam money" than flower stalls! Not only the ease of registration attracts new entrepreneurs to this business, but also a lot of earnings. The average rate of return is 20%! What kind of activity can still bring a similar income with a minimum investment? However, the 10,000 rubles contributed for the creation of an LLC is clearly not enough, to start working it takes about 500,000 (according to the expert assessment of the Russian Microfinance Center). We should not forget about the high level of overdue debts among clients of such organizations.

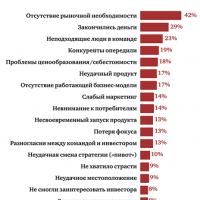

The most important thing is to calculate and understand in advance what you will have to do. According to statistics, every tenth registered MFO does not issue a single loan. A simple paperwork procedure ensures that many inexperienced businessmen enter the market, who, due to strong competition and a lack of working capital, quickly leave the microfinance industry. Some go bankrupt because of the development of an inefficient branch network instead of one successful office.

In light of the financial market clean-up and tightening of legislation, now is not the best time to create an MFI. If you are confident in yourself and potential investors are lining up, I advise you to organize a franchise business on a federal network. By the way, it is not necessary to wait for a benefactor with 1.5 million. You can create a pool of small investors, transferring funds to one of them, who will conclude a loan agreement. It is even better if he is an individual entrepreneur, then, being on the "simplified" system, the interest will have to deduct not 13% (income), but 6%. Try it, do not be afraid to take risks, because usurers have lived richly at all times.

Microfinance organizations are conquering the consumer lending market. More and more people are resorting to registration, and demand, as you know, gives rise to supply. The number of MFOs is growing, which means that such a business has great prospects.

What is the difference between MFIs and banks?

Entrepreneurs who are thinking about how to open microloans from scratch should first understand the terminology and legislation. According to Federal Law No. 151-F3 dated 02.07.2010, a microloan is a loan of up to 1,000,000 rubles provided to the population. Thus, the microfinance company is engaged in lending activities.

The ability to issue loans to individuals is provided only for companies that have one of the legal forms of ownership and are included in the state register. If an organization does not meet these basic criteria, it cannot be called an MFI and its activities are illegal.

Typical features of an MFO business:

- Microloans are issued only in national currency, rubles;

- The company does not have the right to change the terms of the microfinance agreement unilaterally;

- An MFI cannot conduct transactions in the stock market;

- Early repayment of a loan in an MFO should not be subject to a penalty, but on condition that the borrower has informed about his actions in advance;

- The loan amount is usually small - up to 30,000 rubles, the full repayment period is on average 30 days;

- For the use of the loan, interest is charged daily, which is higher than the rate on a bank loan. The amount of the loan cost is calculated by the MFI independently and can range from 0.5 to 4% per day;

- Requirements for the borrower are usually minimal: the age of majority and the presence of a passport of a citizen of the Russian Federation.

How to open an MFI

Those who decide to create an MFI can do it in 2 ways:

- Participate in a franchise, that is, use the promoted brand of one of the companies;

- Create your own organization.

Both paths have their own advantages and disadvantages. When working on a franchise, an entrepreneur requires less financial investment and effort. And such a business will start to bring profit faster. An obvious drawback is the need to regularly pay certain amounts (fixed or a percentage of the proceeds) to the parent company. In addition, many franchisees (buyers of a trademark) are very constrained when making decisions.

To open an MFI from scratch, you will need to create a business plan in which you need to calculate all the details of the work and the costs associated with them.

When preparing a project for an organization that provides microloans to the population, it is important to correctly calculate the costs associated with non-repayable funds. This figure is 10-20%, but it can easily change up or down. In companies that carry out minimal screening of borrowers, losses can be up to 30-40%, while with the help of a thorough scoring check, losses from non-repayment of funds can be reduced by up to 10%.

It is more profitable to issue loans for a short period, since the money is returned faster, which means that it can be used to issue a new loan.

The financial performance of an organization also depends on how it works with debtors. As a rule, MFIs, especially at the initial stages of their existence, do not make sense to maintain their own staff of lawyers and security personnel. In this case, non-repaid loans are sold to collection agencies with a deduction of a certain coefficient, the size of which depends on the profit indicators of the microfinance company.

Finally, thinking about how to open a business whose field of activity is microloans, you should immediately decide on the methods of checking the clients' solvency. For start-up organizations, inquiries to the Credit Bureau are usually associated with large financial expenses, since each of them has to be paid. At the same time, some borrowers will have to refuse a loan.

Calls to contact numbers, contacting the pension fund databases, etc. take a lot of time, but do not allow obtaining a reliable financial portrait of the borrower. The most expensive method of analyzing the data provided is scoring, which requires buying a special program. However, it allows you to save a lot of time when considering an application (a competitive advantage of the company) and reduce the costs of employee salaries, communication services, etc. Scoring takes 2-5 minutes on average.

Step by step actions

To open a microfinance organization from scratch, you need to draw up a business plan and prepare documents for registration. The procedure for creating an MFI is simple compared to the process for opening banks.

Microfinance firms have the right to independently regulate the size of their capital and, at the same time, not to form reserves for credit operations, and therefore not to deduct insurance payments to special purpose funds. The registration procedure for MFOs is carried out in a simplified form.

2 mandatory steps:

- Registration of the legal entity under which the company will operate;

- Obtaining MFO status in accordance with government regulations.

Neglect of one of the requirements means that the company will not be able to conduct its activities officially, that is, it will be outlawed with all the ensuing consequences.

The most common form of ownership when opening a company is a limited liability company (LLC), the head of which is also an accountant.

The law does not prohibit registering an MFO as an open or closed joint stock company. True, in this case, registration will be more laborious, since it will be necessary to prepare the charter, the decision of the founders to create a company, documents on the appointment of a director, an application for transfer to a simplified or ordinary form of taxation, etc.

Simultaneously with obtaining the status of a legal entity, the company must be entered in the state register. This implies the transfer of a package to the Federal Service for Financial Markets, which includes the following documents:

- Application for entering MFOs into the unified state register;

- A copy of the LLC registration certificate;

- Constituent documents (charter, order on the appointment of a director, etc.);

- Information about all owners of the MFO;

- Help, where the actual address of the location of the company is indicated;

- A receipt confirming the payment of the state duty;

- Inventory of the documents provided.

If the papers meet the requirements, then within 14 working days the MFO is included in the unified state register and a registration number is assigned to it.

In case of improper execution of documents, false information, authorized bodies may refuse to include MFOs in the state register. She can reapply the documents no earlier than in a year. In case of refusal to register, a written notice with a reason is provided.

To conduct legal activities, MFIs require documents to be submitted to regulatory authorities and clients:

- Certificate of state registration of legal entities faces;

- Documents regulating internal control procedures;

- Loan rules.

- Certificate of incorporation of the company into the unified state. register of MFOs;

As with any business, when starting a microfinance company, it is important to differentiate yourself from competitors. It is wise to focus on a specific market segment in an effort to gain leadership positions in it. It is useless to try to bypass everyone at once.

An extensive network, convenient remote microcrediting, and providing a loan in several ways will help to quickly go up the hill.

MFI offices should be opened in busy places with high client traffic. First of all, these are markets, shopping centers, train stations. Even small outlets opened in such places bring in large incomes compared to large branches in residential areas.

The microcredit business has been developing in Russia not so long ago, but it has already become a leader among consumers. Many people seek services from such institutions. But it is important to register it to start your own business. How to open an MFI is described in the article.

Types of MFOs

Each country has its own type of MFI. According to the legislation, the form of their registration is determined. The main feature of MFOs is considered to be a simplified lending system. These institutions are divided into the following types:

- Financial group.

- Entrepreneurship Support Fund.

- Credit union.

- Credit society.

- Credit agency.

- Credit cooperative.

Some MFIs are considered subsidiaries of banks. For the latter, such cooperation is beneficial. Banks are able to provide loans, the rates for which are significantly higher than those that it issues. But there is a risk of non-repayment of the issued loan. The activity of the MFO is controlled by the Central Bank of the Russian Federation. Any violations in the work of the institution lead to responsibility.

Differences between an organization and a bank

Both financial institutions are engaged in providing loans to citizens. How does an MFI differ from a bank? Their difference lies in the volume of loans provided. The differences are as follows:

- The loan is issued only in national currency.

- The IFR cannot unilaterally make changes regarding the rate, the procedure for defining obligations under the agreement, the time of their validity, and the commission.

- There is no right to impose fines on the borrower who has paid the microloan in whole or in part, ahead of schedule, if he has notified about it.

- The MFI does not participate in the securities market.

- The MFI has fewer demands on the client.

Such companies can be found in many cities. They have flamboyant ads to attract customers. Although there are differences between organizations, in general, other regions work according to the same principle.

Why are such institutions in demand?

The first organizations began to open in 2011. Since then, their number has increased. This is due to the fact that the state has little control over the activities of firms in comparison with large banks. The benefits of MFIs include:

- Simple registration of a legal entity from which the work will be carried out.

- Optimal leverage and mild economic performance.

- Insurance charges to funds are not required.

- Required reserves are not required.

- There are no requirements for the size of your capital.

Disadvantages of MFIs

This type of business has the following disadvantages:

- There is a risk of defaults when issuing loans. This must be taken into account when planning costs and making a profit.

- In case of violations during the activity, the imposition of sanctions and fines is expected.

Before opening a new MFI, you should familiarize yourself with the legal aspects of the activity and carefully study the information about the clients. Then the business will be really profitable.

Business founding options

How to open an MFO more profitable? There are 2 ways to start an activity:

- Franchise work.

- Independent activity - by opening an organization.

Both options are common in Russia. New MFOs are regularly opened on a franchise basis. This is a profitable option financially, which is why it is often chosen by aspiring entrepreneurs. A lot of work is done by the franchisor, who provides accounting and legal support, and provides funds.

Training of specialists is mandatory, which reduces the risks of non-return and increases the rate of return on the case. The disadvantages include high investments, although the price of the franchise is different. It is important to take into account the amount of contributions, return on investment, the level of participation of the franchisor in the work.

Another option is to set up a company yourself. This method takes more time, moreover, you need knowledge of working with borrowers, including problem borrowers. But with the investment of funds, there is the possibility of making a large profit, which remains with the owner. If there is no legal department and security service, work with problem debtors is transferred to collectors.

registration

How to open an MFI? The law states that such a company can be founded by a legal entity that is registered in the form of funds, institutions, excluding budgetary, autonomous non-trading organizations, companies. It is not necessary to obtain an MFI license. This requirement applies to banks. You just need to have about the entry in the register of the MFO. This document confirms the legality of the actions. After registration, you can start a business.

To open LLC "MFO", you must have:

- Of the company charter.

- Decisions to establish a company.

- Form 11001.

- The order on the appointment of the general director with the duties of the chief accountant.

- Taxation system statements.

- State duty receipts.

- Request for a copy of the charter.

Getting status

To register an MFO, the following documents are required:

- Application for entering information into the MFO register.

- (copy).

- The decision to create a legal entity and constituent papers (copies).

- The decision of the election of the bodies of the legal entity (copy).

- Information about the founders.

- Actual address data.

- List of documents.

The decision on the application is made 14 days in advance. After 10 days after the FFMS receives the documents, you can find your organization in the register.

Raising money

It is important to know not only how to open an MFI, but also how to raise money. Institutions can be individuals: founders, participants, investors. At the same time, there is no limit on the amount of money attracted. If another person issues funds for a loan, subject to the conclusion of an agreement with one borrower, then the maximum amount is 1.5 million rubles.

If a private person transfers money to an MFO, then a 13% tax is deducted from the organization's income. In this situation, institutions withhold the amount individually and settle with the state budget. The depositor is given income, except for personal income tax.

The organization creates rules for deposits:

- Equity capital - not less than 5%.

- Liquidity - from 70%.

The own funds of MFOs in Moscow and other regions include capital, reserves, loans. When a company goes bankrupt, loan claims are satisfied only after all debts are paid off. These conditions are considered unquestioning, binding and specified in all contracts. Quarterly calculations are carried out according to financial statements, which are submitted to the FSFM.

Investments and profit

To achieve a quick return on investment, it is necessary to draw up a business plan for the organization. To open a business, costs are required:

- Capital investments.

- The capital for issuing loans is 900 thousand rubles.

- Purchase of equipment - 100 thousand rubles.

- Purchase of inventory - 50 thousand rubles.

Current costs include:

- Office rent - 20 thousand rubles.

- The salary for 4 employees is 120 thousand rubles.

- Advertising - 50 thousand rubles.

- Expenses - 30 thousand rubles.

The amount of capital investments will amount to 1 million 50 thousand rubles, and current costs - 220 thousand rubles. The costs may be different, it all depends on the case, but for this example it will be possible to calculate all the nuances. If you wish, you can organize an MFI under a franchise on favorable terms.

Business plan

When opening an MFO, one should take into account:

- Expenses for the maintenance of the company, including office rent, repairs, salaries.

- Initial investment.

- Staffing table.

- Advertising.

- Losses.

- Payback period.

- Profitability.

MFI business is profitable, but at the same time it has a lot of competition. Therefore, the management of the company needs to stay ahead of rivals. This is achieved through advertisements that tell you about promotions and special offers. An important aspect is the high-quality work of employees, which automatically promotes the business.

Risk accounting and work with debtors

Lenders have always been successful. Now a lot of people apply to MFIs to get money, although the rates there are quite high. It is necessary to focus on people who are new to the financial sector. You should offer urgent loans when a person needs funds here and now.

Almost all MFIs provide money with a passport. This loyalty increases the volume of profits, but also the risks grow, as clients may not return the debt. Therefore, the rates are quite high. To stay profitable, risk is included in the bet. It is determined when drawing up a business plan.

It is important to consider the following nuances:

- If the borrower is carefully checked, then the budget will include about 10% for the risk of non-repayment.

- When providing loans with credit history checks, the risk of non-repayment is 10-20%.

- Urgent microcredits, issued with a passport, have a high percentage of risk - 30-40%.

Recoverability and profit are determined based on how the work with debtors will be carried out. As a rule, small firms do not have a personal security service and lawyers. Therefore, it will be difficult to return funds. There will be no such questions regarding the franchise. When working independently, debts are sold to collectors, but their cost will be less than the entire amount of the debt.

Thus, when opening an MFO, it is important to think over many nuances in order to establish a profitable business, to take into account all the risks. With a competent approach to business, it will be possible to conduct successful activities of the institution, which will only develop over time.

It will not be a revelation if we say that the financial condition of the majority of the population is far from stable. Therefore, in recent years, the number of organizations involved in issuing loans to the population has sharply increased. If only five or six years ago it was exclusively the prerogative of banks, today the situation is exactly the opposite.

Often, people prefer to borrow money from MFIs, since they do not require a whole bunch of documents.

In a word, today we will consider the simplest business plan for a microfinance organization. If you have the funds for the initial start, then the prospects are quite decent.

Development prospects

In general, the prospects for the development of this kind of business are very optimistic. In 2012 alone, its turnover increased by 50%, and at the end of 2013 - by 60%. The total volume of the loan market is estimated by experts at more than 60 billion rubles annually.

What laws govern the activities of such organizations?

To regulate them, the Government of the Russian Federation adopted a special Federal Law “On Microfinance Organizations”. The law says that an entrepreneur, guided by a loan agreement, can give a client up to one million rubles inclusive.

Please note: this contract is fully governed by the provisions of the Civil Code of the Russian Federation. When drawing up a business plan for a microfinance organization, be sure to familiarize yourself with its provisions in this area.

In principle, there are no tangible obstacles to organizing this kind of business.

We note right away that the most suitable organizational and legal form of ownership will be an LLC. Of course, an individual entrepreneur is also suitable, but in light of the fact that the amount of income can significantly exceed the level to which you can count on simplified taxation schemes, there will not be much benefit from this.

Important! There is a unified Federal Register of Microfinance Organizations, in which your company must be registered. Please note that if this condition is not met, all your activities will be completely illegal.

What documents do I need to submit?

In order for your company to be officially registered in the Registry, you will need to submit the following documents to any of its regional offices:

- Application for listing you.

- Notarized copies of documents on the organization of your company, as well as all the constituent documents of the organization.

- A copy of the decision of the founding council of the company (remember that our business plan for a microfinance organization involves the organization of an LLC).

- A similar copy of the CEO's decision.

- Complete information about all members of the organization.

- All data on her whereabouts.

- If the founder is a citizen of another country, then an extract from the Register of Foreign Legal Entities will be required.

- It is imperative to attach a receipt for payment of the state fee, the amount of which today is one thousand rubles.

Other information

You can find all samples of the above documents in the corresponding appendix to the order of the Ministry of Finance No. 26n dated March 3, 2011. Within 14 working (!) Days, a decision is made to enter the organization into the Register or refuse, which you must be officially informed about.

Note! Only from the moment you receive the notification, you receive legal status and can deal with issuing loans to the population. We have already mentioned that any such activity without proper permission is always considered illegal. In this case, you will have to pay a fine, the amount of which is 30 thousand rubles.

Some important nuances

The law says that you cannot issue loans to the population in the amount of more than one and a half million rubles, you cannot be a guarantor in banks. It is strictly forbidden to issue loans in any foreign currency, play on the stock markets, as well as demand interest payments in case of early loan repayment. It is forbidden to collect more than a million rubles of debt from clients, even if the sum of all penalties and fines is greater.

As in the previous case, all these violations face a fine of 30 thousand rubles. But it is much more dangerous for unscrupulous lenders that a client of an organization that has violated at least one of the rules for conducting its activities can achieve through a court that the contract is invalidated. In this case, he is released from all obligations to repay the loan.

Activity risks

It is easy to guess that any business plan of a microfinance organization should take into account the fact that the organization of such an enterprise will always be associated with certain industry risks. Here are the main ones:

- many clients do not repay loans;

- there is administrative responsibility for failure to comply with the basic regulatory requirements of the law;

- the client may not return the loan if the court proves the illegality of the accrual of interest.

The main costs of the organization

Of course, our business plan for an MFI also takes into account the basic costs of organizing it. Often the most significant expense is buying or renting a suitable office.

As a rule, it is located in a business center. However, the cost of rent may be low, since it will be quite enough to rent an office of 30 square meters. The cost of the premises depends entirely on your region.

You will definitely need to purchase all the necessary furniture, office supplies, computers and all the necessary software. To work in the office, you will need to hire at least two managers who will draw up contracts with clients, as well as one security guard.

Before opening a microloan company, it is also advisable to hire a professional accountant with experience. The attention of auditing auditing companies to you will always be quite high, and therefore all documents that reflect your activities should always be in perfect order.

What you need to open a hookah lounge, and how to do it correctly

What you need to open a hookah lounge, and how to do it correctly How to start a business and choose donut equipment

How to start a business and choose donut equipment Opening a company in Montenegro Open a company in Montenegro

Opening a company in Montenegro Open a company in Montenegro The carpentry shop as a business

The carpentry shop as a business How to choose a business direction?

How to choose a business direction? Sample business plan of a dental office

Sample business plan of a dental office Five best business ideas that brought millions What business to open so as not to go bankrupt

Five best business ideas that brought millions What business to open so as not to go bankrupt