Programmatically targeted method of budgeting. The program-target method is one of the main instruments of the results-based budgeting. linking goals and activities planned and financed by the program-targeted method with strategic states

Targeted program budgeting of expenditures contributes to the observance of a unified approach to the rational use of funds both for solving the most acute problems of the state, region, municipality, and is an instrument for leveling the economic development of individual territories.

Measures to improve the budget process can have a local effect, and can lead to radical changes. These are the changes that result from the introduction of performance-based budgeting, or program-based budgeting, which fundamentally changes not only the content of all stages of the budget process, but also the very concept of public expenditure management.

Budgetary projections established for the medium term should be relatively constant, since they are a guideline for the authorities in developing programs and activities aimed at solving problems and achieving public policy goals. However, the adoption of multi-year budgets in itself does not guarantee the continuity and stability of fiscal policy if there are no sufficiently reliable forecasts of the parameters of economic and social development.

Methodological guidelines for the development and implementation of state programs determine the requirements for the development of projects and the preparation of reports on the progress of their implementation and performance assessment, as well as the procedure for monitoring their implementation by the Ministry of Economic Development. The list of state programs is formed on the basis of the goals and indicators of the Concept of long-term socio-economic development of the Russian Federation for the period up to 2020. The list contains the names of programs, responsible executors, co-executors, as well as the main directions of implementation for each of them.

The main features of the target-oriented method of public finance management and budgeting are:

- distribution of budget funds by projects and strategic areas, and not by type of costs;

- development of targeted programs taking into account the decrees of the head of state and government and in accordance with the declared strategic priorities;

- implementation of departmental control over the targeted and effective use of budget funds;

- reflection of the program budget not only through financial indicators, but also indicators of the effectiveness of socio-economic activities of ministries and departments.

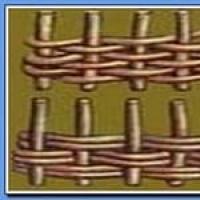

Figure 1. Building a budget model and assessing the effectiveness of projects

The main advantages in the implementation of software products are the monitoring of key indicators and the implementation of operational control at various levels.

Institutions financed from budgetary funds are called budgetary institutions.

The allocation of funds to these institutions is preceded by budget planning.

Basic methods of planning budget expenditures.

Program-target method of budget planning consists in the systematic planning of budget allocations in accordance with the approved target programs drawn up for the implementation of economic and social tasks.

This method of planning financial resources contributes to the observance of a unified approach to the formation and rational distribution of funds of financial resources for specific programs and projects, and their concentration and targeted use, and to improve control. All this increases the level of efficiency of the funds disbursement.

In the last decade, this method of budget planning and financing has been steadily expanding in our country. This is facilitated by the development and implementation of many federal and regional economic, social, environmental and other programs. It should be assumed that in the future this method will find more and more widespread use.

The amount of funds allocated for the implementation of activities and projects is determined on the basis of estimated planning and financing procedures. The calculations of estimates of budgetary institutions are based on volumetric performance indicators (the number of beds, the number of students, the number of groups, classes, etc.), the operating time of institutions and financial norms. When planning measures for social protection of the population (pensions, benefits, etc.), the number of recipients of these funds and the established payment rates are taken into account.

The essence of the program-target method of budget planning is the systematic planning of the allocation of budget funds for the implementation of target programs approved by law or a regulatory act.

A target program is understood as a complex document, the purpose of which is to solve a priority task for the state for a certain period of time.

share in the overall structure of budgetary expenditures.

The program-targeted method of planning expenditures contributes to the observance of a unified approach to the rational use of funds both for solving the most acute problems of the state, region, municipality, and is an instrument for leveling the economic development of individual territories.

Target programs are subdivided into:

Industry development programs;

Regional development programs;

Programs for solving social problems.

Target programs as a document contain a set of sections, including goals and objectives, expected results from implementation, program customer, executors, activities and measures by year of implementation and amount of funding in general and by year.

The normative method of planning expenses and payments is used mainly in planning funds for financing budgetary activities and in drawing up estimates of budgetary institutions.

The norms are established by legislative or by-laws.

Such norms can be:

monetary expression of natural indicators of meeting social needs (for example, the norms of expenditures on food for the population in budgetary institutions, providing them with medicines, etc.);

norms of individual payments (for example, salary rate, amounts of benefits, scholarships, etc.);

norms based on the average statistical values of expenditures over a number of years;

the material and financial capabilities of society in a specific period (for example, norms for the maintenance of premises, educational costs, etc.).

Norms can be obligatory (established by the government or territorial authorities) and optional (established by departments).

Budgetary norms can be simple (for certain types of expenses) and enlarged (for the totality of expenses or for the institution as a whole).

Based on natural indicators (the number of serviced persons, the area of the premises, etc.) and financial norms, budget estimates of expenses, which can be as follows:

Individual - are compiled for an individual institution or individual event;

Common - compiled for a group of similar institutions or events;

For centralized events- are developed by departments to finance activities carried out in a centralized manner (purchase of equipment, construction, repairs, etc.);

Consolidated - combine both individual estimates and estimates for centralized events, that is, these are estimates for the whole department.

The estimate of a budgetary institution reflects:

1) the details of the institution (its name, the budget from which funding is made, the signature of the person who approved the estimate, the stamp of the institution, etc.);

2) a set of expenses (salary fund, material costs, production and social development fund, material incentive fund, other funds);

3) a set of income (financing from the budget, additional paid services to the population, the provision of services under contracts with organizations, other receipts);

4) the performance indicators of the institution;

5) calculations and justification of expenses and income.

The approved estimates of budgetary institutions are their financial plans for a certain period of time.

Drawing up estimates of budgetary institutions allows you to solve the following tasks:

Providing budgetary institutions with state funding;

Analysis of estimated project expenditures and reports on the use of funds;

Control over efficient and economical spending of funds.

In accordance with the budgetary rights granted to the executive authorities, they have the right, when drawing up cost estimates for subordinate budgetary institutions, to increase, within the limits of the available budgetary funds, the norms of expenses for the maintenance of these institutions.

Improvement of budget planning and financial support of budgetary institutions should be facilitated by the transition to the formation of regional and local budgets on the basis of minimum state social standards, social and financial norms.

The main goal of any modern democratic state is to increase the quality and standard of living of the population, the main factor of which is effective public financial management and high-quality budget planning.

In most countries of the world, high-quality budget planning is understood as performance-based budgeting, the main instrument of which is the target-oriented method. The world experience of countries with a developed budget system (USA, Canada, Great Britain, Australia, France, Sweden) has shown that the large-scale application of the program-target method of budget planning increases flexibility in the management of budget resources, helps to minimize costs and improve the efficiency of public services, as well as provides greater transparency and openness of the budget. Due to this, the urgent and priority goal of the Government of the Russian Federation is the introduction of a program-targeted approach at all levels of the budget system. For regions and municipalities, the introduction of this method is of particular importance, since their services are as close as possible to the population and determine the quality of their life, and budgetary expenditures stimulate the development of the regional economy and social sphere. Therefore, consideration of the role of the program-target method and the study of the experience of its implementation in regional financial management is an urgent task of modern scientific research.

The transition to a new level of public finance management in the Russian Federation became possible thanks to the implementation of budgetary reforms from 1999 to the present. Their essence consists in shifting the emphasis of the budgetary process from "managing budget resources (costs)" to "managing results" by increasing the responsibility and expanding the independence of the participants in the budgetary process within the framework of medium-term targets. This is achieved by introducing results-based medium-term budgeting, which allows for the transition from budgeting with estimated financing of activities to budgeting for programs aimed at achieving measurable final socially significant results; from planning for one budget year to planning for three years. At the same time, the main tool for its implementation is the target-oriented method of budget planning.

Within the framework of this work, in view of the emergence of uncertainty associated with the introduction of the concept of "performance-oriented budgeting" (hereinafter RBB) into Russian practice, we will reveal the concepts and interrelation of RBB and the program-target method of budget planning.

In the economic literature, the concepts of "program budgeting" and "performance-based budgeting" are often equated. However, in our opinion, this is not entirely true, since "performance-based budgeting" is a broader concept. It is a method of planning, budget execution and budgetary control that ensures the distribution of budgetary funds based on the social significance of the expected and specific results of their use, taking into account the priorities of state economic policy. In turn, the planning of budget expenditures, with the aim of providing public goods, can be implemented using various methods of budget planning. Thus, the program-target method is one of the ways to implement a performance-based budgeting system.

The program-target method of budget planning is based on the systematic planning of the allocation of budget funds for the implementation of target programs approved by law or a regulatory act. The arsenal of the target-oriented method includes the following instruments: federal (long-term) target programs (hereinafter F (D) CP); departmental target programs (hereinafter VTsP); state programs (hereinafter referred to as GP), state programs of a constituent entity of the Russian Federation, municipal programs.

The program-targeted method of budgetary planning of expenditures contributes to the observance of a unified approach to the rational use of funds both for solving the most acute problems of the state, region, municipality, and is an instrument for leveling the economic development of individual territories.

The main prerequisites for the implementation of the program-target method in the budgetary practice of Russia in the 2000s. the following appeared:

- Expenditures for the 2000s grew significantly, but without linking to priorities, bargaining for resources and erosion of budget discipline took place.

- The incentives to increase budget expenditures remained, but conditions were not created to increase the efficiency of budget expenditures.

- Strategic planning was weakly linked to budget planning, and the structure and dynamics of expenditures were weakly linked to public policy objectives.

- Planning for program and non-program expenditures, as well as for capital and operating expenditures, was not methodologically linked.

Note that the active phase of the development of state programs in the Russian Federation began in the last five years in connection with the emergence of a regulatory and methodological framework, which includes:

- The procedure for the development, implementation and evaluation of the effectiveness of state programs (Decree of the Government of the Russian Federation of 02.08.2010 No. 588).

- Methodological guidelines for the development and implementation of state programs

(Order of the Ministry of Economic Development of Russia dated December 26, 2012 No. 817). - The list of state programs of the Russian Federation (order of the Government of the Russian Federation of 11.11.2010 No. 1950-r).

- Analytical distribution of federal budget expenditures by state programs (first formed in 2010 during the preparation of the draft Federal Law on the federal budget for 2011–2013).

- Federal Law of 07.05.2013 No. 104-FZ "On Amendments to the Budget Code of the Russian Federation in terms of improving the budget process and in certain legislative acts of the Russian Federation" ("program" budget and budget classification).

In accordance with Federal Law No. 104, as a result of the enactment of the new edition of Art. 179 of the Budget Code of the Russian Federation, which establishes the legal basis for the formation of state programs of the Russian Federation, state programs of the constituent entities of the Russian Federation, municipal programs, such concepts as FTP and VTsP have lost their relevance. Within the framework of the above law, FTP and VTsP, exactly like any other programs and their activities, the financial support of which is carried out at the expense of the budget, are subject to inclusion in the corresponding state program.

The state program is a system of measures and regulations that ensure the achievement of the priorities and goals of state policy in the field of socio-economic development. It consists of subprograms and federal target programs, which, in turn, are divided into departmental target programs and main activities and are embodied in the form of specific actions implemented within the framework of state (municipal) tasks. The division of the program into subprograms is carried out on the basis of the scale and complexity of the tasks solved within the framework of the state program. The structure of the state program is shown in Figure 1.

Scheme 1. The structure of the state program

Methodological guidelines for the development and implementation of state programs determine the requirements for the development of projects and the preparation of reports on the progress of their implementation and performance assessment, as well as the procedure for monitoring their implementation by the Ministry of Economic Development. The list of state programs is formed on the basis of the goals and indicators of the Concept of long-term socio-economic development of the Russian Federation for the period up to 2020. The list contains the names of programs, responsible executors, co-executors, as well as the main directions of implementation for each of them.

The Program for increasing the efficiency of budget expenditures defines the following general principles for the development and implementation of government programs:

- Formation of state programs based on clearly defined long-term goals of socio-economic development and indicators of their achievement.

- Determination of the executive authority responsible for implementation (achievement of final results).

- Establishment for state programs, as a rule, measurable results of two types: final, which characterize the satisfaction of the needs of external consumers, and direct, which reflect the volume and quality of public services, predicted under given conditions.

- Integration of regulatory (legal, enforcement and control) and financial (budget, tax, customs, property, credit, debt and foreign exchange) instruments to achieve the goals of state programs.

- Empowering executive authorities and their officials with powers necessary and sufficient to achieve the objectives of the programs in accordance with the principles and requirements of project management;

- Conducting a regular assessment of the effectiveness and efficiency of the implementation of state programs with the possibility of their correction or early termination, as well as establishing the responsibility of officials in the event of ineffective implementation.

The state program is a tool for linking budgetary and economic planning, therefore, it occupies a special place in state financial management. The model for the implementation of the state program is shown in Scheme 2.

Scheme 2. Model for the implementation of government programs

Thus, the peculiarities of state programs are that they:

- flow from a long-term development strategy and are a tool for achieving its goals;

- combine all policy instruments (regulation, budget expenditures) to achieve the goal;

- consist of subroutines, may include FTP;

- implemented by the responsible executor, co-executors who are responsible for their subprograms, and participants;

- state programs of the Russian Federation and the constituent entities of the Russian Federation, as well as municipal programs are linked to each other (subsidies).

In the constituent entities of the Russian Federation, the first large-scale attempts at practical application of the programmatic principles of budget planning are associated with the implementation in 2004-2010. programs for reforming regional finances, and then the programs to increase the efficiency of budget expenditures that came to replace them. The mentioned programs, in particular, contained sections providing for the use of RBB methods and tools, in many respects coinciding with the programmatic principles of budget planning. At present, the government bodies and the expert community have not clearly formed an unambiguous position on how the implementation of the program budget should be carried out at the regional and municipal levels. One of the most pressing issues in this regard is an unclear understanding of whether the constituent entities of the Russian Federation should repeat the design of state programs of higher authorities. There are different opinions on this issue: some experts hold the position that in the future regional and municipal programs should be as close as possible to federal programs. According to the opposite point of view, the regions need to focus, first of all, on their own priorities of socio-economic development, and therefore the programs should be different.

Note that the application of state programs by the constituent entities of the Russian Federation is carried out exclusively at the initiative of regional authorities. The current legislation does not contain obstacles to the implementation of this initiative, which is noted in the letter of the Ministry of Finance of Russia dated 02.04.2012 No. 02-16-03 / 1073 and is confirmed by the experience of a number of territories. In addition, paragraph 3 of Art. 184.1 of the Budget Code of the Russian Federation provides for the ability of state authorities of the constituent entities of the Russian Federation to independently determine the feasibility and timing of the transition to the formation of the budget in the program format. Thus, the constituent entities of the Russian Federation are independent in choosing the budget format. Thus, in the Republic of Karelia, the legal basis for the development of long-term targeted programs has been canceled.

It should be noted that, according to the study of the quality of financial management in the constituent entities of the Russian Federation, conducted by the Ministry of Finance of Russia at the end of 2012, in 38 regions the share of programmed budget expenditures was 50% or more (on average in Russia, this indicator is 46.9%) ... At the same time, in a number of constituent entities of the Russian Federation, the share of program expenditures remains at a low level and amounts to about 5%. The "advanced" regions are also distinguished, the share of program expenditures of which exceeds 80% of all expenditures of the regional budget, including the Republic of Karelia (Table 1).

Table 1

The share of the program part of the expenses of the "advanced regions"

Of the Russian Federation in the total volume of budget expenditures in 2012

The high share of the program part of budgetary expenditures in the above-mentioned constituent entities of the Russian Federation is one of the main characteristics of the efficiency of the use of budgetary resources and the high quality of state financial management. In addition, as the analysis shows, it largely determines the quality of regional finance management. Thus, according to the results of the monitoring of the financial position and quality of financial management of the constituent entities of the Russian Federation and municipalities by the Ministry of Finance of the Russian Federation in 2012, it was established that the above-named entities were classified as entities with high or adequate quality of regional finance management.

The experience of introducing the target-programmed method in the Republic of Karelia is interesting. The need to move to the formation of the budget of the Republic of Karelia in the program format was especially emphasized in the Program for increasing the efficiency of budget expenditures, approved by the order of the Government of the Republic of Karelia dated 31.12.2010 No. 659r-P. Over the past five years, there has been an active transition to the program principle of forming the budget of the Republic of Karelia. The Government of the Republic of Karelia is creating the necessary legal and regulatory framework for the transition to the "program" budget. The implementation of the program budget in the Republic of Karelia is carried out on the basis of the following principles:

- the formation of state programs is carried out on the basis of long-term goals of socio-economic development and indicators of their achievement, taking into account the provisions of strategic documents approved by the President of the Russian Federation, the Government of the Russian Federation, the Government of the Republic of Karelia, individual decisions of the Head of the Republic of Karelia and the Government of the Republic of Karelia;

- the most complete coverage of the spheres of socio-economic development and budgetary allocations of the budget of the Republic of Karelia;

- establishing measurable results of their implementation for government programs;

- integration of state regulatory (legal, law enforcement and control) and financial (budget, tax, property, credit, debt) measures to achieve the goals of state programs;

- determination of the executive authority of the Republic of Karelia responsible for the implementation of the state program (achievement of final results);

- whether the responsible executors and co-executors of the state program have powers that are necessary and sufficient to achieve the goals of the state program;

- conducting a regular assessment of the effectiveness of the implementation of government programs with the possibility of their adjustment or early termination.

By the order of the Government of the Republic of Karelia dated September 26, 2012 No. 574r-P, a list of 18 state programs of the Republic of Karelia was approved, grouped in four main directions; work has been organized on the preparation of state programs by the executive authorities of the Republic of Karelia:

- New quality of life (8 programs).

- Innovative development and modernization of the economy (6 programs).

- Security assurance (1 program).

- Effective state (3 programs).

The Law of the Republic of Karelia dated 20.12.2013 No. 1759-ЗРК "On the budget of the Republic of Karelia for 2014 and for the planning period of 2015 and 2016" provided for the distribution of budget allocations for two state programs approved at the time of the formation of the draft budget of the Republic of Karelia.

To date, the Government of the Republic of Karelia has approved the following state programs:

- "Development of the agro-industrial complex and hunting economy of the Republic of Karelia for 2013-2020".

- "Effective management of regional and municipal finances in the Republic of Karelia".

- "Development of civil society institutions and the development of local self-government, protection of human and civil rights and freedoms."

- "Promotion of employment of the population in the Republic of Karelia".

- "Program for the development of healthcare in the Republic of Karelia for 2013–2020."

According to the submitted to the draft budget of the Republic of Karelia for 2014 and for the planning period of 2015 and 2016. analytical distribution of budgetary allocations for state programs of the Republic of Karelia, budget expenditures of the Republic of Kazakhstan within the framework of state programs (taking into account the developed projects) make up more than 94% of the total budget expenditures. Analysis of the data showed that the largest share of program expenditures in the structure of the budget of the Republic of Kazakhstan in 2014 is occupied by expenditures on "Development of education" - 25, 81%, "Social support of citizens" - 25.50%, "Development of health care" - 19.11 %. This testifies to the social orientation of budget expenditures, reflects the desire to achieve the long-term goal of the socio-economic development of the republic, namely, to improve the quality of life of the population.

As a result of the study carried out in terms of the share of budget expenditures of a constituent entity of the Russian Federation planned within the framework of programs in the total budget expenditures of a constituent entity of the Russian Federation for 2012, the Republic of Karelia occupies a leading position in the Northwestern Federal District (Table 2).

table 2

The share of program expenditures in the total expenditures of the budgets of the constituent entities of the Russian Federation in the North-West Federal District in 2012

| The subject of the Russian Federation | The share of expenses formed within programs (%) |

| Republic of Karelia | 92 |

| Komi Republic | 74 |

| Arkhangelsk region | 19 |

| Vologodskaya Oblast | 14 |

| Kaliningrad region | 39 |

| Leningrad region | 17 |

| Murmansk region | 64 |

| Novgorod region | 51 |

| Pskov region | 26 |

| St. Petersburg | 21 |

| Nenets Autonomous Okrug | 36 |

| Average for the North-West Federal District | 41 |

As noted above, the implementation of high-quality budget planning largely determines the effectiveness of public administration and budget expenditures. Since the share of program expenditures in the overall structure of budget expenditures of the Republic of Kazakhstan exceeds 94%, this raises the question of assessing the quality of budget planning in the Republic: can a high share of program expenditures be considered as a criterion for the quality of budget planning? The answer to the question can be the analysis of monitoring the quality of financial management, carried out by the Ministry of Finance of the Republic of Kazakhstan. Annual monitoring of the quality of financial management in 2013 was carried out on the basis of six groups of indicators, the specific weight of which for 9 months of 2013 is as follows: budget planning - 23.3%; execution of the budget of the Republic of Karelia in terms of expenses - 31.3%; accounting and reporting - 16.4%; control and audit - 16.4%; execution of judicial acts - 8%; execution of the budget of the Republic of Karelia on tax and non-tax revenues - 4.6%.

As you can see, the greatest weight in assessing the quality of financial management is taken by the indicators "Budget planning" and "Budget execution in terms of costs". For 9 months of 2013, the average assessment of budget planning monitoring, taking into account the weight of the group in the assessment of the indicator, was 20.5 points (out of 23.3 points), and according to the indicators "Budget execution in terms of expenditures" was 23.3 points (out of 31, 3 points). The average final assessment of monitoring the quality of financial management for 9 months of 2013 was 84.5 points on a 100-point scale. Thus, we can conclude that the quality of financial management is largely determined and depends on the share of program costs. In Kazakhstan, this share is quite high, and accordingly, the quality of financial management is at a high level.

Despite the large number of advantages of introducing program budgeting, the experience of several years of developing government programs has revealed the existence of a number of objective and subjective reasons complicating the reform of the budgetary system of Russia, including at the regional level. Let us consider which of the problems associated with the transition to the program budget are typical for the Republic of Karelia (Table 3).

Table 3

Limitations and problems in the implementation of the program budget in the Republic of Kazakhstan

| Limitations / problems in the implementation of the program budget by the constituent entities of the Russian Federation | Limitations / problems in the implementation of the program budget in the Republic of Kazakhstan |

| Challenges in linking program budgets and strategic planning documents | At the regulatory level of such a problem does not exist, but from the point of view of application practice, it was revealed that the goals of the long-term strategy of socio-economic development were not fully reflected, reinforcement in the expenditure side of the budget |

| Lack of a resource base, for example, for the implementation of the concept of socio-economic development (government programs should be developed "for the money" that exists) | The problem exists |

| Uncontrolled expansion of the number of targeted programs, which often overlap in goals, objectives, indicators and main activities | There is no such problem in the Republic of Karelia, since the principle of “non-overlapping” of programs in terms of goals and objectives is clearly observed. |

| The problem of reflecting the participation of regions in the implementation of federal programs, and municipalities - in the implementation of regional | The problem exists |

| The problem of uncertainty about the place of cerebral palsy and VTsP in the program budget | The problem exists, and today it has been solved in this way: cerebral palsy is included in the structure of state programs as a subprogram |

| The problem of the formation of non-program costs | In the Republic of Karelia, non-program costs include management costs |

| The need to restructure the functioning of the organ system - "reformatting the brain" | The problem exists |

| Lack of a specific structure of state programs: should regions and municipalities repeat the design of state programs of higher levels of government | The problem exists: the solution is "shouldn't" |

| The mechanism for providing interbudgetary transfers has not been worked out (It is not clear how to provide subsidies, grants for equalization within the framework of one program at the federal and regional levels, or in another way?) | The problem exists |

| Uncertainty of the procedure for assessing the effectiveness of program implementation | The problem doesn't exist |

Summarizing the foreign and Russian practice, it is possible to formulate a number of requirements, the observance of which will ensure the effectiveness of the application of the program-target method of budget planning:

- Programs should contain achievable, accurate and consistent indicators of immediate and final results.

- These indicators should be linked to strategic goals and objectives.

- The programmatic classification should cover all budgetary expenditures.

- It is necessary to organize an effective system of control over the achievement of the results planned by the programs with the establishment of the responsibility of the heads of state authorities and local self-government.

The solution of these tasks in the future will create an opportunity to expand the horizon of the program-target method of budget planning, which will further ensure the continuity and stability of budgetary policy, as well as increase the efficiency of budget expenditures.

Thus, the use of the program-target method of budget planning plays an important role in the state financial management of the region. The experience of implementing this method in the Republic of Karelia allows us to conclude that there is a direct relationship between the efficiency of the use of budgetary resources, the quality of public financial management and the use of the program-targeted method of budget planning. Implementing the program budget is a complex and lengthy process. In Russia, it may take even longer than many European countries took. When introducing it, the subjects are faced with a large number of problems and limitations, which allows us to conclude that the formation of an integral system of public finance management has not yet been completed. Not all of the tools that contribute to the quality improvement of public finance management are working to their full potential. Nevertheless, already at this stage of implementation of the program budget, one can speak of its positive impact on the state financial management of the region.

Of particular difficulty is not so much a change in the technological component as a change in the approach of persons involved in the budgetary process, from the formal use of programs to substantiate the effectiveness of their activities and to obtain increased funding for their use for the structural restructuring of the regional economy, the identification of the competitive advantages of the territory and their development, but also optimization of existing costs. It is obvious that the success of the implementation of this method is primarily due to the fact that it should be carried out within the framework of broader transformations both in the field of public finance management and in the field of public administration in general. Only in this case it can become not only a way to optimize the budgetary system, a mechanism for managing the territory, but also a catalyst for the growth of its competitiveness.

LIST OF SOURCES AND REFERENCES

- Order of the Government of the Russian Federation of June 30, 2010 No. 1101-r "On approval of the program of the Government of the Russian Federation to improve the efficiency of budget expenditures for the period up to 2012 and an action plan for its implementation in 2010" [Electronic resource]. URL: http://www.garant.ru/products/ipo/prime/doc/6639347/, free (date of treatment 09/15/2014).

- Order of the Ministry of Economic Development of Russia dated December 26, 2012 No. 817 "On the approval of Methodological guidelines for the development and implementation of state programs of the Russian Federation" [Electronic resource]. URL: http://www.garant.ru/products/ipo/prime/doc/70198158/, free (date of treatment 09/14/2014).

- Letter of the Ministry of Finance of the Russian Federation of April 2, 2012 No. 02-16-03 / 1073 "On the legal grounds for the approval of the higher executive bodies of state power of the constituent entities of the Russian Federation of the procedures for the formation and implementation of state programs of the constituent entities of the Russian Federation" [Electronic resource]. URL: http://base.garant.ru/70199776/, free (date of treatment 09/15/2014).

- Results of assessing the quality of regional finance management in 2012 [Electronic resource]. URL: http://minfin.ru/ru/budget/regions/monitoring_results/monitoring_finance/index.php?id_4=20235, free (access date 04.10.2014).

- Order of the Ministry of Economic Development of the Republic of Karelia dated 01.04.2013 No. 70-A "Guidelines for the development, implementation and evaluation of the effectiveness of state programs of the Republic of Karelia" [Electronic resource]. URL: gov.karelia.ru/gov/Legislation/docs/2013/04/70-a_2.doc, free (date of access 09.19.2014).

- Analytical note "On the results of the annual monitoring of the quality of financial management, carried out by the chief administrators of the budget of the Republic of Karelia, for 2013" [Electronic resource]. URL: http://minfin.karelia.ru/201-6/, free (date of treatment 09/04/2014).

- Order of the Government of the Republic of Karelia dated September 26, 2012 No. 574r-P [Electronic resource]. URL: minfin.karelia.ru/assets/Byudzhetnaya-reforma/perechen.doc, free (date of treatment 09/04/2014).

- Foreign experience of program-target management of state expenditures and the possibility of its adaptation in Russia [Electronic resource]. URL: http://www.rane-brf.ru/conference/2012/marusova.pdf, free (date of treatment 09/13/2014).

- Review of international experience in the implementation of performance-oriented budgeting [Electronic resource]. URL: http://www.rostu-comp.ru/content/view/143/, free (date of access 09.24.2014).

- Starodubrovskaya I. V. Results-based budgeting at the regional and municipal levels: approaches and recommendations. Moscow, 2008. (Scientific works / Institute of Economics in Transition. Period; No. 119Р). Adj. : Experience of RBB implementation in Cherepovets / Ananenko S. A.

REFERENCES

- Order of the Government of the Russian Federation on June 30, 2010 N 1101-r “On Approval of the Program of the Government of the Russian Federation to Improve the Efficiency of Budget Expenditures for the Period up to 2012 and an Action Plan for its Implementation in 2010 ". ... // URL: http://www.garant.ru/products/ipo/prime/doc/6639347/ (accessed 09/15/2014).

- Order of the Ministry of Economic Development of Russia on December 26, 2012 No. 817 "On Approval of Guidelines for the Development and Implementation of State Programs of the Russian Federation". // URL: http://www.garant.ru/products/ipo/prime/doc/70198158/ (accessed 09/14/2014).

- Letter from the Ministry of Finance of April 2, 2012 N 02-16-03 / 1073 "On Approval of the Legal Basis for the Supreme Executive Authorities of the Subjects of the Russian Federation the Order of Formation and Implementation of State programs of Subjects of the Russian Federation ". // URL: http://base.garant.ru/70199776/ (accessed 09/15/2014).

- The Results of Evaluation of the Quality of the Regional Finance in 2012. / Ministry of Finance of the Russian Federation. URL: http://minfin.ru/ru/budget/regions/monitoring_results/monitoring_finance/index.php?id_4=20235 (accessed 10/04/2014).

- Order of the Ministry of Economic Development of the Republic of Karelia from 01.04. 2013 number 70-A, "Guidelines for the Design, Implementation and Evaluation of the Effectiveness of State Programs of the Republic of Karelia". // URL: gov.karelia.ru/gov/Legislation/docs/2013/04/70-a_2.doc (accessed 09.19.2014).

- Policy Paper "On the Results of the Annual Monitoring of the Quality of Financial Management Exercised by the Executive Head of the Budget of the Republic of Karelia for 2013". / Ministry of Finance of the Russian Federation. URL: http://minfin.karelia.ru/201-6/ (accessed 09/04/2014).

- Decree of the Government of the Republic of Karelia from September 26, 2012 N 574r-P. / Ministry of Finance of the Russian Federation. URL: minfin.karelia.ru/assets/Byudzhetnaya-reforma/perechen.doc (accessed 09/04/2014).

- International Experience Program and Target Public Expenditure Management and its Adaptability in Russia. / Bryansk Branch of the Russian Academy of National Economy and Public Administration under the Government of the Russian Federation. URL: http://www.rane-brf.ru/conference/2012/marusova.pdf (accessed 09/13/2014).

- Review of international experience in implementation of Performance-based budgeting. ... URL: http://www.rostu-comp.ru/content/view/143/ (accessed 09.24.2014).

- Starodubrovskaya I. V. Performance-based budgeting, regional and municipal levels, approaches and recommendations. M .: IET, 2008.184 p.: Ill. (Proceedings / Inst. Of Economy in Transition. No. 119R). Appendix.: Experience of implementing PBB in Cherepovets / Ananenko S. A.

The Republic of Karelia is classified as a subject with an appropriate quality of regional finance management.

Calculated according to the data of the Ministry of Finance of the Republic of Karelia.

Effective use of budgetary funds is an important problem, especially in conditions of limited budgetary resources. In these conditions, the priority task is to determine the priorities in the distribution of their budgetary resources, to identify sources of financing of expenditures and to control the targeted and effective use of funds. Achievement of these tasks is possible with the use of the program-target method of forming the budget of the ttu.

The program-target method of budgeting was first proposed in. USA in the middle

1960. It was applied in. Ministry of Defense Minister. Robert. McNamara, who borrowed this system from the Ford automobile company, which he previously headed. To the President. The United States has succeeded in this method, and all ministries have been transferred to this method of generating funds. The practice of the target-oriented planning method gradually spread to other countries of the region.

In Ukraine, this method was first introduced in the 2002 budget. Article 10. of the Budget Code defines legally the application of the program-target method in the formation of the budget for the cabinet. Ministers of Ukraine by order No. 538-r of September 14, 2002 approved. The concept of applying the program-target method in the budget process. This document defined the goals and basic principles of applying the target-programmed method, its elements and stages of implementation. Concepts.

The essence of the program-target method of budgeting

The use of the target program method in budgeting not only radically changed the ideology of the budget process, but also made it possible to increase its efficiency, because:

The budgeting process begins with a focus on the results to be achieved in the public sector;

And then - on the resources needed to achieve these results

When using traditional budgeting methods, attention was focused on resources, while results were not paid attention to. Let's look at an example. The main item of expenditure of budgetary institutions that perform work and provide services to the population is the payment of wages. In the absence of funds for the acquisition of materials and energy resources, the question becomes if it is impossible for the institution to fulfill its f. UNSC, then what to pay wages for? the opportunity not only to raise their wages, but also to increase the result of their activities. It is this approach in the formation of the expenditure side of the budget that is used in the target-oriented method and planning of expenditures.

So, the essence of the program-target method is as follows:

1. The emphasis is shifted from the need for funds necessary for the state to perform its functions, to what results are expected from the use of budget funds, that is, on ensuring the efficiency of the use of budget funds (that is, from the economic category, for example, wages with goals for which the managers are asking for funding).

2. The introduction of this method changes the nature of the discussion of fiscal policy: the focus is shifted from monitoring the implementation of obligations to ensuring efficiency. When developing a budgetary policy, first of all, the factor is taken into account: what will society get for the money, what does it spend?

The question is not about the correctness of the use of funds in the execution of the budget, but about how effectively the funds are spent in achieving the goals of state policy

3. Evaluation and examination of programs is a mandatory component of the program-target method

4. In analytical terms, the program-target method introduces elements of the analysis of comparing costs and achieved results into the budget process

Even before the introduction of the program-target method, as the main method of budget planning since 2002, some of its elements have already been applied in the budget process, in particular:

1). Since 1998, budget requests have been introduced in the established form, in which the main administrators of budget funds must necessarily reflect:

The main purpose of the activity;

Target for the planned year;

The analysis of the performance results achieved in the last year was carried out;

Forecast of expected performance results in the current year;

Justification of the distribution of the maximum volume of costs by functional classification codes and areas of activity

2). The names of individual codes of functional classification, used for one main manager, today, by their characteristic, can be the names of budget programs

3). The main administrators of budgetary funds had the opportunity to reallocate their expenses in order to ensure their priority

(both at the stage of forming a draft budget when preparing a budget request, and at the stage of budget execution when drawing up a budget list and in the process of the current allocation of funds)

... Programmatic target method of budgeting is the grouping of various budgetary expenditures into separate programs in such a way that each item of expenditure is assigned to a certain type of program

As a rule, each program is a fiscal obligation of one main manager of budgetary funds, the effectiveness of which is assessed in terms of achieving the goals of the program.

... Program is a set of interrelated measures aimed at achieving a single goal, the implementation of which is proposed and carried out by the manager of budgetary funds in accordance with the functions assigned to him

The main characteristic features of the budget program:

1) is not limited in time;

2) one budget program is carried out by one manager of budget funds and has no analogues;

3) the name of the budget program should reflect the main essence of the program, that is, reflect the direction of use of budget funds;

4) in terms of its content, the budget program should belong to one section of the functional classification

... For example the program "Training of personnel for the agro-industrial complex in higher educational institutions" refers to one function "Education" and the subfunction "Higher education", and its name reveals the main content of the program;

5) the budget program should be clear, specific and understandable for the broad masses;

6) the components of the program can have subroutines, i.e. minor activities related to the program

Earlier, the article-by-article method of budgeting was used. The program-target method is the formation of a budget not by functions, but by programs, the codes of the program classification should not be associated with the codes of the functional classification, which makes it possible to present the budget in the context of functions. The functional classification of budget expenditures is used exclusively in analytical and statistical documents.

Linking the code of a specific budget program to the corresponding code for the functional classification of budget expenditures is used to:

Drawing up a consolidated budget;

Implementation of macroeconomic analysis;

Formation of state policy in the spheres of the economy;

International comparisons of costs by function. When applying the line-by-line budget planning method

was carried out only for a year. The programmatic approach promotes a strategic approach, i.e. planning budget expenditures for several years. Thanks to this method, it became possible to implement medium-term budget planning. The purpose of introducing the program-target method in the budget process is to establish a direct link between the allocation of budget funds and the results of their use.

Thanks to budget planning for targeted programs, transparency of budget spending is ensured in comparison with the line-item method, which did not make it possible to understand what exactly is being financed under the family or other function.

For several years, reforms in the budgetary sphere have been implemented in Russia. The constant process of reforming public finances is a natural reaction to the demands of society in terms of improving the quality of public services. Recently, at all levels of government, active steps have been taken to move to a program-targeted method of public finance management. The transition to the program budget allows you to focus on achieving the goals and objectives of socio-economic development, to ensure the connection between the amount of funding and the results achieved, to increase the efficiency of budget expenditures and to create a transparent and understandable system for presenting the budget.

At present, numerous program documents are considered as tools of program-targeted budgeting, for example, reports of administrators of budgetary funds on the main directions of their activities and expected results, targeted programs, registers of expenditure obligations of public law education, registers of public services, state assignment. However, the listed tools are not combined into a single mechanism for program-targeted budgeting, are not built into the budget process. To transfer the formation of the draft budget, its execution, reporting on budget execution, financial control to the program-target principle of budgeting, it is necessary to determine a list of long-term goals of socio-economic development of public law education, sources of funding for measures to achieve them, specific results of achieving these goals.

The use of program-target principles in the budgetary process of a municipality makes it possible to determine approaches to solving the following problems:

- distribution of budgetary resources according to strategic goals;

- provision of services for which the population is really in demand;

- control over the costs of public services by choosing the most economical way of providing them;

Comparison of expenditure programs and selection of the most economical of them based on the results of evaluating the effectiveness and efficiency of expenditures;

- increasing the transparency and validity of budget expenditures;

- determination of the positive social effect of the service, and not just the cost of its provision;

Shifting the emphasis from external control over targeted spending of funds to increasing internal responsibility and internal control over cost effectiveness;

- taking into account the consequences of the made expenditure decisions.

Measures to improve the budget process can have a local effect, and can lead to radical changes. It is to such changes that the introduction of performance-based budgeting, or program-targeted budgeting, leads to fundamental changes not only in the content of all stages of the budget process, but also in the very concept of managing public (municipal) expenditures.

State target programs are an effective tool for implementing state policy in priority areas of socio-economic development. In the context of limited budgetary funds, the issue of the formation of priority areas for the implementation of state target programs is of paramount importance. The attempts made in recent years to switch from traditional (item-by-item) to program-target budgeting have shown that the lack of legislatively established priorities for the development of new target programs is the main problem that impedes the effective implementation of the target-program method in the budget process.

In Russian economic science, there is no specific scientific approach to the mechanism for optimizing the budget process through program-targeted budgeting with a built-in system of financial management tools. The need to achieve long-term goals of the socio-economic development of Russia in the context of a slowdown in the growth of budget revenues and an increase in requirements for the effectiveness of the activities of public authorities makes it even more urgent to develop a system of measures to modernize the financial management of public law education.

The use of the program-target method in budgeting will not only radically change the ideology of the budget process, but will also increase its efficiency, because:

¾ the budgeting process begins with a focus on the results to be achieved in the public sector;

¾ and then - on the resources needed to achieve these results.

When using traditional methods of budgeting, attention was focused specifically on resources, while the results were not paid attention to.

Target program budgeting to one degree or another involves not only adjusting the content and duration of individual stages of the budget process, but also changing accounting principles (transition from cash accounting to accrual method) and the budget planning horizon (multi-year budgeting).

Performance-based budgeting will allow municipalities to stop the practice of costly financing and select priority spending areas in accordance with the goals and objectives laid down in the strategic development plan of the municipality.

Despite the obvious advantages of the described approach to managing budget expenditures, the introduction of a performance-based budgeting system is associated with a number of problems, including:

1) the difficulty of quickly achieving clear results in the form of improving the quality of budget services;

2) the need for significant time and financial costs for the development of quantitative indicators for assessing costs, as well as the need to change the form of reporting data, etc .;

3) the difficulty of studying the opinion of the population about the provided budgetary services;

4) the complexity of formalizing the results and socio-economic (social) effect of budget services;

5) striving, in a number of cases, to achieve a certain quantitative value of the indicator as an end in itself, which does not take into account the relationship between the indicator and the desired social effect;

6) the complexity of determining the relationship between the resources expended and the results obtained.

The transition to target program budgeting is a complex and rather lengthy process. The duration of the transition is associated with the need to solve a number of problems. For many municipal services, quantitative measures of their performance are not obvious. The development of municipal minimum social standards will contribute to solving this problem.

Well-designed budgeting will allow solving many problems in the management of a municipal formation, including optimizing budget resources, increasing the efficiency of the functioning of local governments and the quality of services provided, identifying and monitoring financial flows of enterprises subordinate to the structural divisions of the municipal administration, strengthening labor motivation, linking the motivation system with the results achieved.

Literature:

1. Gareeva, L.M. Evaluation of the efficiency of the activity of municipal bodies on the basis of the system of budgeting, oriented to the result [Text] / L.M. Gareeva, V.P. Kuleshov // "Dny vědy - 2012" Dil Ekonomické vědy - p.49.

2. Ivanchina, E.N. The relevance of the transition to the program budget at the regional and local levels [Text] / E.N. Ivanchina // Finance.-2011.-№6.-p.79.

3. Klimanov, V.V. On the formation of a budgetary strategy at the regional and municipal levels [Text] / V.V. Klimanov // Finance.-2011.-№2.-p.9.

4. Kurchenko, L.F. Development of departmental programs for target program budgeting[Text] / L.F. Kurchenko // Finance.-2012.-№2.-p.21.

5. Nesterenko, T.G. Fiscal Reform: No Alternatives to Moving Forward[Text] / T.G. Nasterenko // Finances.-2012.-№4.-p.3.

Interaction of the library with cultural institutions

Interaction of the library with cultural institutions Training seminar "Promotion of library services (Brand technologies in libraries)

Training seminar "Promotion of library services (Brand technologies in libraries) National library of latvia or castle of light

National library of latvia or castle of light Beautiful wishes for a good morning and a nice day

Beautiful wishes for a good morning and a nice day Trial sport Trial sport

Trial sport Trial sport How to fire a school principal

How to fire a school principal How to make a basket of vines with your own hands: the easiest way (MK)

How to make a basket of vines with your own hands: the easiest way (MK)