How to order a tax extract from the EGRUL on the website of the tax service for free

Almost all legal entities repeatedly had to request an extract from the Unified State Register of Legal Entities. This document is needed to participate in auctions, to certify papers with a notary and when making real estate transactions. What is the Unified State Register of Legal Entities, where and how you can get an extract and why this document is so important, we will understand in this article.

Unified State Register of Legal Entities - what is it

The Unified State Register of Legal Entities is the Unified State Register of Legal Entities, i.e. the base of all organizations in Russia. The database is maintained by the Federal Tax Service of the Russian Federation. Each organization is assigned an individual identifier - OGRN, on the basis of which an entry is made in the Unified State Register of Legal Entities.

Why is an extract from this all-Russian register needed? Consider the most common cases of her requests:

- To open a bank account. The rules of credit institutions often contain a clause on extracting from the Unified State Register of Legal Entities. An extract is needed so that a bank employee can verify the authenticity of the identity of the head of the company, as well as other information he needs.

- For notarization by a notary of some documents related to the activities of the organization. An extract in this case is also required in order for the notary to verify the authenticity of the identity of the head, his powers, or the authenticity of the identity of the trustee.

- When making transactions related to real estate.

- When submitting documents for participation in a tender or public procurement. Moreover, during the main part of the bidding, an extract from the Unified State Register of Legal Entities may also be required, for example, when placing an order, when performing work or services. Moreover, for some types of tenders and auctions, it is sufficient to provide paper received no earlier than 6 months before the date of submission of the package of documents, and for some purchases this period should not exceed 30 days.

- When checking information about the organization. The information that is entered in the statement is available to everyone who wants to get acquainted with the basic data about the legal entity. For example, from an extract you can get information about where the organization is located, what is the size of its authorized capital, and who is its head. You can request a document on the official website of the Unified State Register of Legal Entities: egrul.nalog.ru by entering the TIN or PSRN of the desired organization.

If you need a paper version of the statement, then to obtain it, you must contact the tax service, having previously paid the fee. The procedure for obtaining an extract will be discussed below.

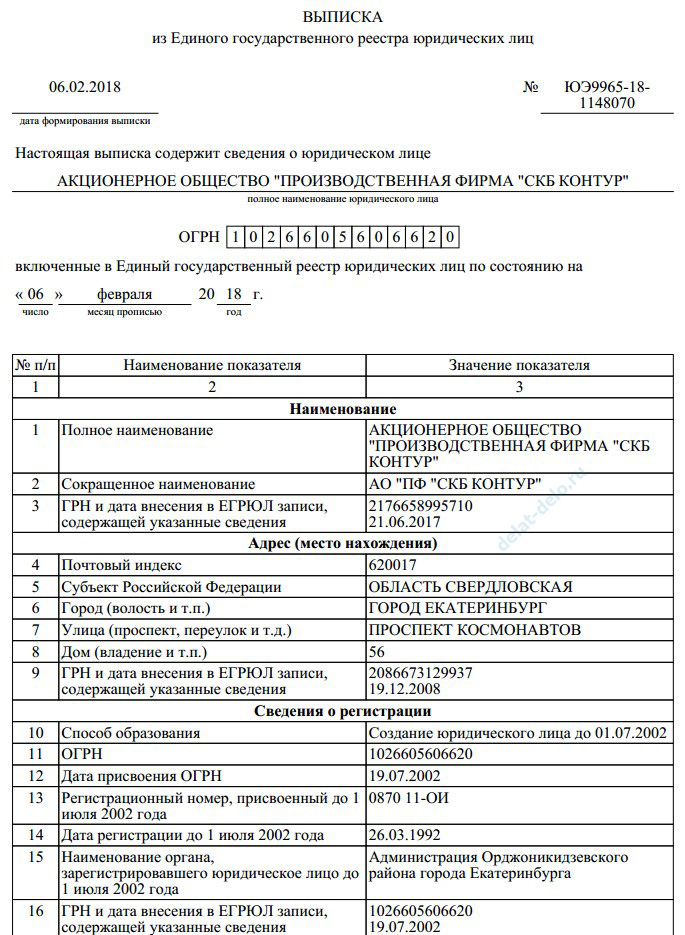

What information about the legal entity is contained in the extract of the Unified State Register of Legal Entities

The extract of the Unified State Register of Legal Entities contains all the basic information about the company. Let's look at what exactly can be learned from this document.

- Name of the organization. The name of the company is written in the extract in all registered variations. Thus, the document can contain both the full and abbreviated name, as well as the name of the company in a foreign language.

- The organizational form of the company (JSC, LLC, etc.), as well as how the organization was formed (sometimes the form of company formation is not creation from scratch, but reorganization).

- Legal address. So, some companies have different actual, legal and postal addresses.

- Contact information, such as a phone number.

- The amount of the authorized capital. The minimum authorized capital for an LLC is 10,000 rubles. The authorized capital determines the minimum amount of the company's property, which can be used to cover the losses of creditors in the event of the company's bankruptcy.

- The date the company was founded.

- Information about all the founders of the company (full name, share in the authorized capital). If the founders are not only individuals, but also legal entities, and data on the founders-legal entities are also registered.

- Information about the person who can represent the interests of the company without a power of attorney. Most often this is the director of the company.

- Activity data.

- Information about whether the company is currently in the process of liquidation or, for example, reorganization.

- Company licenses.

- Information about branches and other departments of the organization.

- Individual tax number of the company and the date of its issue.

- OKVED codes.

Record sheet

Starting from 04.07.2013 the procedure for confirming the fact that information about a legal entity is included in the Unified State Register of Legal Entities has completely changed. Until July 2013, when registering an organization, or when making changes to its data, the Federal Tax Service issued a special certificate. Now the records of the Unified State Register of Legal Entities have taken the place of the evidence.

What is on this sheet? First of all, all the information about what and when was changed in the constituent documents, as well as on the basis of what the changes were made. If the record sheet is issued during the registration of the company, then it contains the initial information about the constituent documents.

For example, if the general director of the company has changed, then the new record sheet of the Unified State Register of Legal Entities will contain information about the old director, as well as the date of taking office and data about the new head. If you have lost the Unified State Register of Legal Entities, then you should not worry: you can always request it again. Moreover, a sheet is sometimes required in order to conclude a particularly large deal, or to sign an agreement for a very long period.

The difference between an extract from the Unified State Register of Legal Entities and a record sheet is that the extract contains exclusively all information about the organization, while the record sheet contains only key data about the company, and it is he who confirms the fact of registration of the company, or changes that have come into force .

How to get a tax extract from the Unified State Register of Legal Entities by TIN with a signature through the website of the Tax Service

In some cases, it is sufficient to provide information from the Unified State Register of Legal Entities / EGRIP in the form of an electronic document. To obtain such a document, you will have to perform the following step-by-step algorithm of actions:

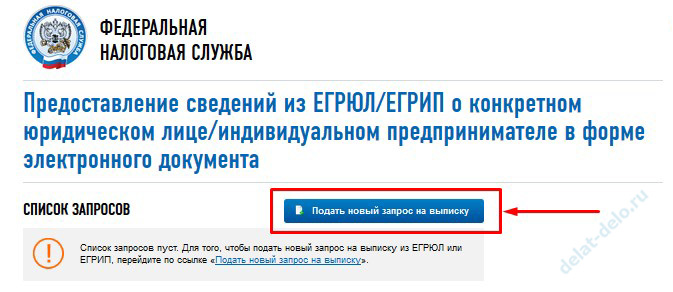

- Go to the service "Providing information from the Unified State Register of Legal Entities / EGRIP in the form of an electronic document" on the official website of the Tax Service of the Russian Federation - https://service.nalog.ru/vyp/ and enter your personal account of a taxpayer of an individual or legal entity.

Then click on the “Submit a new request for an extract” button.

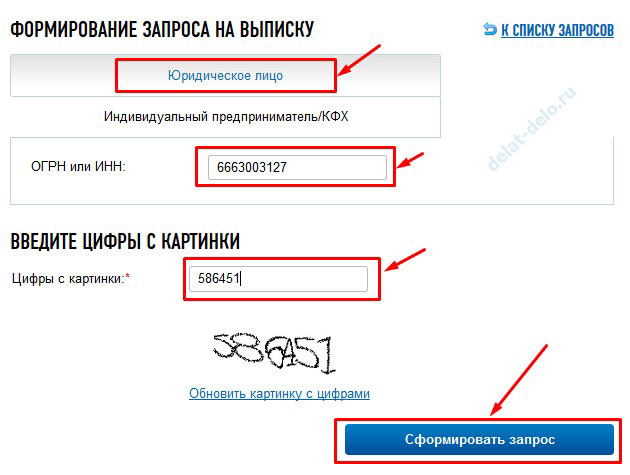

- To generate a request for an extract, select the "Legal entity" section and enter the OGRN or TIN of the organization we need. Enter the captcha and click the "Create Request" button.

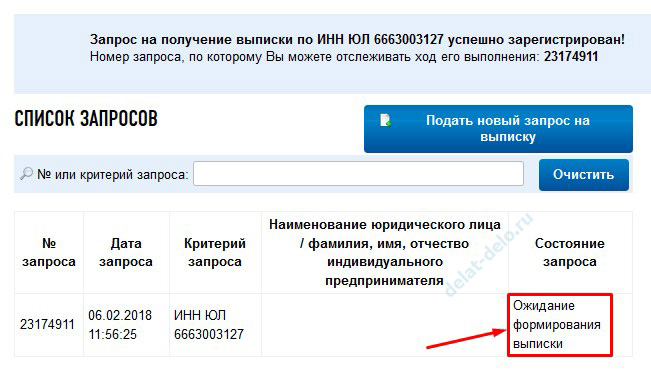

- After that, our request for an extract from the Unified State Register of Legal Entities by TIN will be registered and will go into the state "Waiting for the generation of an extract".

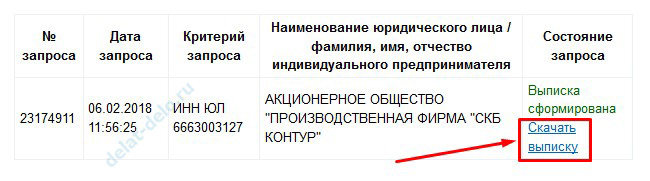

- After some time (from several minutes to 24 hours), the status of the request will change to “Statement generated” and under this inscription there will be a link by clicking on which you can download an extract from the Unified State Register of Legal Entities.

- The downloaded statement is a PDF file

A record sheet is sometimes called a standard statement, and a standard statement is called an extended statement. An extended extract, as a rule, is provided for participation in tenders, in courts and other important cases with counterparties.

You can also get the document through the MFC. To do this, you need to submit the same documents as when receiving an extract through the Federal Tax Service: a receipt for payment of the state duty and an application. As with the standard procedure, the state duty is 200 rubles for a non-urgent receipt of a document and 400 for an urgent one.

Ready-made business plan with calculations using the example of a web studio

Ready-made business plan with calculations using the example of a web studio Registration of an internal memorandum: sample document and drafting rules

Registration of an internal memorandum: sample document and drafting rules Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages

Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages Advance report is ... Advance report: sample filling

Advance report is ... Advance report: sample filling How to stitch documents with threads by hand?

How to stitch documents with threads by hand? Disciplinary sanction for non-fulfillment of official duties

Disciplinary sanction for non-fulfillment of official duties Binding your book

Binding your book