How to get an extract from the USRIP for individual entrepreneurs through the IFTS or MFC: step by step instructions

An extract from the USRIP is an extremely important document for an individual entrepreneur. Like a general civil passport - an identity card of an individual - it contains basic information about the individual entrepreneur and his activities. It is required when conducting transactions, obtaining loans, opening accounts, participating in government contracts and tenders, etc.

An extract for an individual entrepreneur has the right to request not only the entrepreneur himself, but also all interested parties: information from state registers is in the public domain. This is used by businessmen to check potential partners, customers and competitors. In the first case, an officially certified document on paper is required; in others, a copy of it will suffice. How to proceed to obtain an extract from the USRIP for individual entrepreneurs in different situations?

Extract from USRIP

There are 3 types of statements:

- in paper form with a blue seal of the tax service and the signature of an official. Such a document has legal significance. Upon request, it may contain information about the registration of the individual entrepreneur and his bank accounts;

- in electronic form with an enhanced digital signature of the Federal Tax Service. Has legal force;

- information copy of the document from the Unified State Register of Individual Entrepreneurs. Has no legal significance.

The first two documents are accepted in financial and government organizations: banks, funds, etc. The second will be useful for assessing a client, competitor, employer.

You can get an extract from the USRIP in different ways:

- visit the branch of the Federal Tax Service or the MFC;

- request online on the website of the tax service, the portal of public services or through other services integrated with the USRIP;

- order from an intermediary company.

The document has no expiration date. But since changes in the state register are displayed 5 days after they are made, the specified information is relevant during this period. Many financial and government organizations require that no more than a month elapse from the date of receipt.

Obtaining an extract through the IFTS or MFC

A paper extract from the USRIP for individual entrepreneurs is issued by tax inspectorates (local branches of the Federal Tax Service) and the MFC. To receive a document, you must prepare:

- an application and a copy of it to put down the date and mark the employee on acceptance;

- receipt of payment of state duty;

- a simple written power of attorney, if a representative acts on behalf of the individual entrepreneur and an extended extract is required indicating the place of residence of the entrepreneur and the numbers of his settlement accounts.

The application is made in free form to the address of the Federal Tax Service. In the "header" the full name of the individual entrepreneur, passport data, place of residence and e-mail are prescribed. In the main part, indicate the OGRNIP and TIN of the entrepreneur, the purpose of the document and special wishes: urgency, number of copies, method of receipt (in person or by letter):

"In the IFTS No. 24 in MoscowFrom Sergeev Ivan Sergeevich

Russian passport XX XX XXXXXX, issued ...

address:<…>

Statement

I ask you to provide 2 (two) copies of an extract from the USRIP of Moscow for an individual entrepreneur Sergeev Ivan Sergeevich indicating the place of registration of the IP for filing a claim with the arbitration court. Please send the completed documents to<…>. I enclose the original receipt for the payment of the state fee in the amount of 400 rubles. (for two copies).

OGRNIP: XXXXXXXXXXXXXXX

TIN: XXXXXXXXXXX

Signature, date.

When contacting the IFTS, documents are submitted at the registration window or receiving correspondence. The duty officer will notify when the extract is ready, put the date and number of the request on the copy of the application.

In many inspections, applications are accepted at a precisely defined time, often not the whole working day - this must be clarified by phone or on the website.

In addition to INFS, you can submit a request for an extract from the USRIP at the MFC. This is a kind of intermediary between entrepreneurs and the tax service. At the end of 2016, 113 centers operate in Moscow. Working on the principle of "one window", the MFC helps to avoid long queues. The procedure for applying and obtaining an extract is standard.

On the appointed day, you should go to the INFS or MFC with a passport.

Extract in electronic form from UKEP

Electronic statement - a pdf-document with an enhanced digital signature of the Federal Tax Service. To get it, you need to make a request:

- through the personal account of the taxpayer-IP on the service website ();

- using the service of the Federal Tax Service, which requires registration only by e-mail;

- on the portal of public services.

How to get an extract from the USRIP for individual entrepreneurs using the free service of the Federal Tax Service:

- Register in the FTS service using your e-mail, then log in.

- Click on the "New Application" link.

- In after the form, enter the OGRNIP IP (if it is unknown, you can find it by TIN, full name on the same site).

- The generated statement will appear in the "List of applications" section.

Depending on the employment of the FTS service, preparation may take up to several hours. The file will be available for download for five days. To open it, special CryptoPro software version 3.6 and higher must be installed on the computer.

Terms and cost of issuing an extract

The cost of extracting from the USRIP depends on the speed of receipt. State duties are regulated by Decree of the Government of the Russian Federation No. 462 dated May 19, 2014:

The fee can be paid at any branch of Sberbank using the details of the IFTS or by bank transfer using a money transfer.

The original receipt of payment of the state duty is provided at the request of the applicant. The Federal Tax Service receives the necessary information about payments made from the Federal Treasury upon request. However, the receipt will shorten the preparation time for the statement.

Information extracts

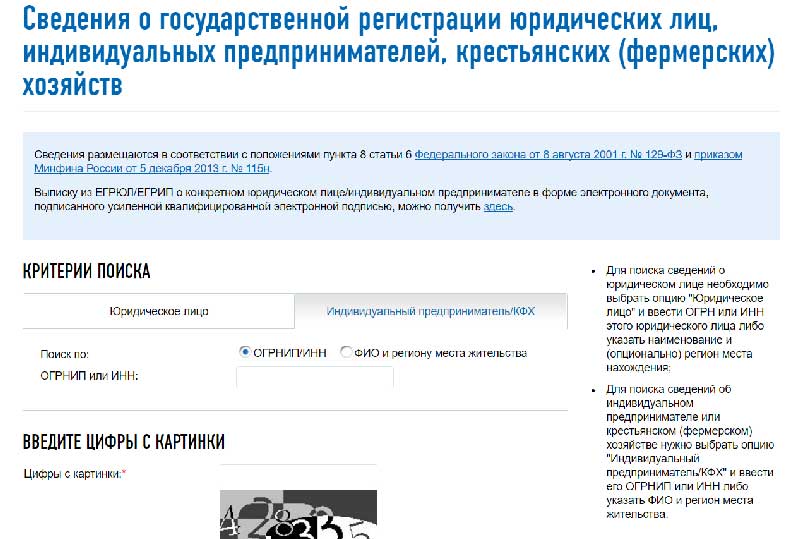

An information extract from the USRIP can be requested on the website of the Federal Tax Service of the Russian Federation at the link "Business Risks" - https://egrul.nalog.ru/. Registration is not required in this case. On the page that opens, select the legal form of the counterparty (IP), enter the TIN (OGRIP or full name and address) and captcha.

As a result, a pdf-file will be generated - a copy of the statement. It is not legally binding and can be used to verify contractors, business partners or competitors.

Services for the provision of extracts from the EGRIP are provided by many intermediary companies. The largest of them are Kontur-Focus (and its official partners) and Kommersant Kartoteka. In addition, such organizations offer their clients a wide range of services: constant access to services, competitive environment analytics, partner assessment, etc.

Intermediaries draw up an extract from the USRIP on their own behalf, signed by the tax service, then deliver the prepared document to the client. It will not contain information about the place of registration of the individual entrepreneur, his bank accounts (this information can be included at the personal request of the entrepreneur or his representative). Ordering an extract with delivery is convenient: it saves time waiting in lines. However, the cost of the document in 2– 3 times higher than the state duty.

According to forecasts, in 2017 it will be possible to submit an online application for an extract from the USRIP in paper form with the ability to pay for the service remotely, receive the document by letter or pick it up at a convenient time for the entrepreneur from the nearest MFC.

Ready-made business plan with calculations using the example of a web studio

Ready-made business plan with calculations using the example of a web studio Registration of an internal memorandum: sample document and drafting rules

Registration of an internal memorandum: sample document and drafting rules Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages

Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages Advance report is ... Advance report: sample filling

Advance report is ... Advance report: sample filling How to stitch documents with threads by hand?

How to stitch documents with threads by hand? Disciplinary sanction for non-fulfillment of official duties

Disciplinary sanction for non-fulfillment of official duties Binding your book

Binding your book