How to get an extract from the register if you want to do it quickly online and for free + detailed instructions + useful tips

How to get an extract from the Unified State Register of Legal Entities online - for free via the Internet in 5 minutes, many people ask this question, because it is required at almost every step.

Most often, extracts are required for interaction with government agencies, when processing various documents or passing inspections, and organizations today have often begun to check their partners.

In fact, there are several options for obtaining statements, but there are not as many options to get them for free and quickly as it might seem at first glance. Let's take a closer look at this topic today.

What data contains an extract from the Unified State Register of Legal Entities

Unified State Register of Legal Entities- is a single information base, a state register of all legal entities registered in the territory of the Russian Federation, which is maintained by the tax service.

An extract from the unified state register is an official document that confirms the legal existence of a legal entity.

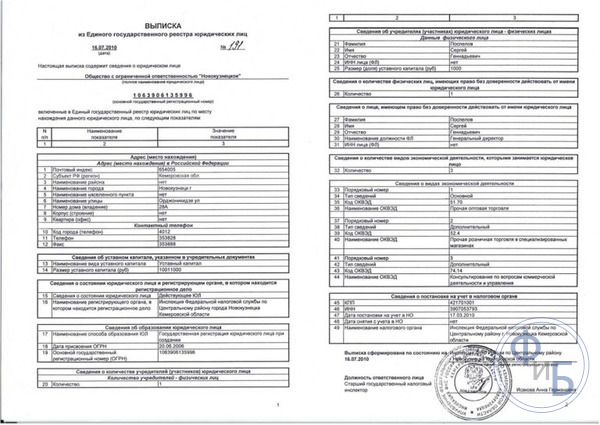

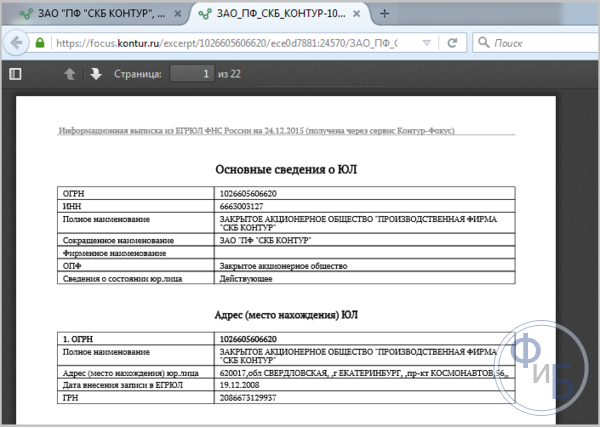

The extract contains a certain mandatory list of data that uniquely identifies the legal entity and indicates its location. The document may contain other additional data about the legal entity, their list and number depend on the activities of the economic entity, its activity and scale of activity, the presence of reorganizations and other changes in the structure of the company.

Standard statements can be issued in two types - regular or extended. The usual form contains publicly available information about the legal entity, and the extended one also includes personal data of the founders, sources of funding for the legal entity. Anyone can order a regular form from a tax or specialized organization, and only a tax one can issue an extended form, and then only to a narrow circle of people - authorized legal entities and founders, government agencies and extra-budgetary funds, courts. To obtain an extended extract, you will definitely need to indicate personal passport data, TIN, place of demand, it is officially issued only by the tax.

By ordering a regular statement, you will receive the following information:

- full name of the legal entity;

- the date on which it was registered;

- legal address of the organization;

- the amount of its authorized capital, indicating the shares of the founders and their transfer;

- the name of its CEO;

- TIN, KPP, OGRN codes

- codes of activities (OKVEDs) and data on available licenses;

- information on amendments to the constituent documents;

- information about existing branches/representative offices;

- company email.

Regular statements are actually required quite often, for example:

- to check your counterparty;

- to open or close bank accounts of a legal entity;

- when making various commercial transactions;

- transactions with the real estate of the company;

- for various notarial procedures (certification of constituent documents, etc.);

- confirmation of the authority of the director of the legal entity;

- to participate in competitions, tenders, auctions, public procurement;

- to confirm the existence of a legal entity;

- upon reorganization and liquidation of a legal entity;

- to obtain various licenses;

- for various inspections by government agencies, etc.;

- to file lawsuits and other court cases.

The extract will give accurate information about the fact of the existence of the organization at the moment or that it was liquidated, when and for what reason.

Such an extract can be obtained in paper form or in electronic form (in “.pdf” format), ordered in person or online. If you need a document with a seal, you can apply for an extract online and receive a paper version by registered mail.

An electronic statement with a digital signature now has legal force, without an EDS, as well as without a “wet” blue seal - no.

You can order a certificate for your organization and your partners, for example, before making an important transaction.

An extract for the applicant about himself is provided free of charge. Statements provided to third parties are issued only after payment of the state duty of 200 rubles, double payment is charged for urgency. Urgent paper statements during a personal visit to the IFTS are usually issued within 2-3 hours.

The validity period of information from this registry depends on what it was requested for. For example, for legal proceedings, the validity period is a month, for tenders - half a year, for various commercial activities - the period can be 10 - 30 days or more.

Deadlines for providing information to the Unified State Register of Legal Entities

The legislation currently provides for the following deadlines for providing information from the Unified State Register of Legal Entities:

- the tax service is obliged to provide information on paper within five days from the date of receipt of a regular request or on the next business day for urgent requests;

- specialized authorized organizations also provide information within five days;

- electronic data are provided to the tax office no later than the next business day after the registration of the online request.

Where can I get an extract from the Unified State Register of Legal Entities

You can get information from the Unified State Register of Legal Entities:

- in the tax service;

- in authorized organizations (in commercial firms, in the MFC).

You can submit your request in person by sending it by mail or request data online (on the relevant website of the Federal Tax Service or an authorized organization).

Now on the Internet, there are quite a few organizations that provide such information online in the shortest possible time, they can be obtained in just five minutes.

Recall that the official paper version of the extract can also be ordered online by making an appropriate note in your request and indicating your mailing address.

Obtaining information through the tax service

The current rules state that for an extract from the state register, you can contact any inspection or its official website.

However, if you need any additional documents for the requested company, then you should already contact the inspectorate in whose territory the organization you are interested in is located. Sometimes it is more convenient to make a request to the tax base through the MFC office.

If you decide to receive an extract from the tax office, then you must first pay the state duty, submit an application indicating the organization, TIN, PSRN and KPP, as well as indicating the reason for the request for information.

You will receive a stitched numbered document with a blue seal.

Recall that in the tax, you can get information about organizations that have ceased to exist.

Obtaining information through a specialized authorized organization

Most large organizations that have many counterparties and are active in commercial activities very often feel the need for data from the Unified State Register of Legal Entities, obtaining such extracts. It is never superfluous to check a new counterparty before concluding a major deal.

Today, specialized authorized organizations can provide an organization with paid annual subscription access to the database with the Unified State Register of Legal Entities or a one-time access.

To do this, you need to select an authorized organization that suits you, send a request there by registered mail, you can send a request by e-mail or fill out the appropriate client electronic form on the website of such a company.

If you decide to send a paper or email letter, you can use the standard form from the state regulation.

Requirements for requests for information from the Unified State Register of Legal Entities

To obtain information from this registry, you need to submit a request, which may have a standardized or simple arbitrary form, but in any case, you must specify the following data:

- Name of the legal entity (full or short), TIN, OGRN, about which information is requested;

- Information about the applicant: name of the legal entity, full name of the individual - the applicant, his passport details, telephone number;

- Specify the method of obtaining information and where to send it (email or postal address).

Obtaining information online through the website of the tax service

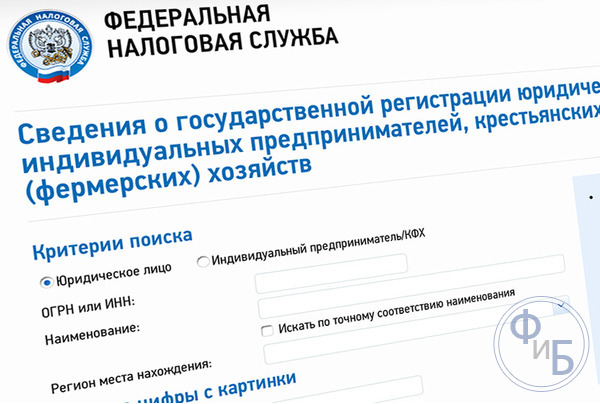

Consider step by step how to get an extract on the tax website.

First, let's take a look at the step-by-step actions for obtaining an introductory information statement without a qualified EDS:

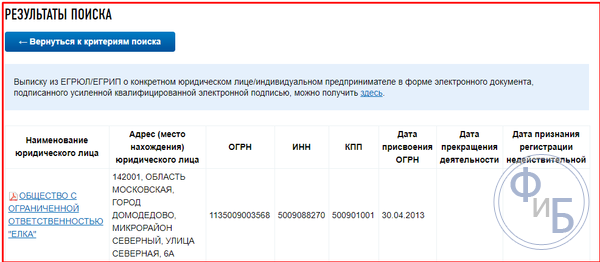

- Fill in brief information about the legal entity you are interested in - TIN or OGRN, or its name;

- The base will give you the statement you requested in a pdf file, you can view, download and print them.

This is the easiest way to obtain data, such an extract is for informational purposes only. But such an information option in most cases is enough, in this way counterparties are usually checked.

If you need an official document, you can order an extract with a qualified EDS or a paper version with a “wet” blue seal. Now we will analyze the step-by-step actions for obtaining an extract with a qualified EDS.

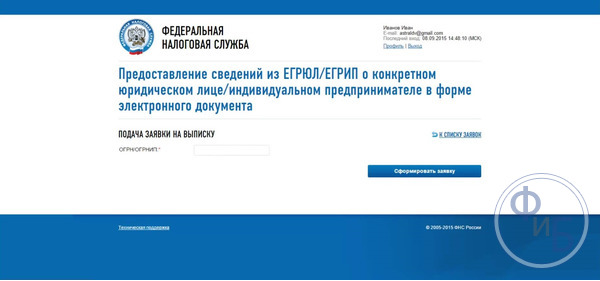

To obtain a legally significant statement, you need to send a request through the taxpayer's personal account. If you already have it, then the procedure is as follows:

- Open the website of the tax service;

- Select the "Electronic Services" section;

- Select the section "Check yourself and the counterparty";

- The window "Information on state registration of legal entities" will open;

- Follow the link "Providing information from the Unified State Register of Legal Entities in the form of an electronic document";

- Pass authorization or register a personal account if you do not have it yet;

- Enter the proposed captcha code;

- Click the button for generating a request;

- The database will give you the EDS statement you requested in a pdf file, you can view, download and print them.

This document is equivalent to paper and has legal force, it can be sent to government agencies or any other recipients.

If there is no personal account of the taxpayer, then it must first be registered. This is done in the following way:

- Click the "Register" button to create a personal account, as soon as you open the site or after you open the page of the service you need (by choosing not authorization, but registration);

- Fill out the electronic form that appears with your data, enter your email, enter the captcha code;

- After clicking the "Continue" button, an inscription about your created account will appear, then you need to activate it by clicking the link from the tax service letter in your email (it arrives in about 5 minutes);

- Fill out the electronic request form to obtain information about the legal entity you are interested in - TIN or PSRN, or its name;

- Enter the proposed captcha code;

- Click the button for generating a request;

The base will give you the extract with the EDS you requested in a file with the “pdf” format, they can be viewed, downloaded and printed - this one has legal force, it can be used in any cases, it is equivalent to paper.

The process of obtaining data through the tax website may seem too long and complicated to someone, but there are other alternatives - providing information through paid commercial services. Prices there are not much higher than in the tax.

How to get an extract online in 5 minutes on the tax website

You can also receive statements using your EPC key (CryptoPro format), which is also issued by specialized organizations. Most often, they are valid for a year, then you need to do an extension. With the help of such keys, you can not only receive information, but also draw up numerous documents, now online through digital public services, including public services. This extract will also be legally justified.

In this case, the sequence of actions will be as follows:

- We go to the website of the tax;

- Opening a personal account of a legal entity;

- We select the link "Order an extract from the Unified State Register of Legal Entities";

- We sign with a digital signature;

- We receive a digital document with an enhanced qualified signature - a legally significant document.

Recall that simple information statements (without EPTs and seals) do not require complex authorization for informational purposes, it is very simple to obtain the necessary information. The procedure for obtaining an extract by the subject about himself is simple and free.

Obtaining information online in 5 minutes through the services of commercial organizations

There are quite a lot of organizations offering such services on the Internet, however, not all of them can be trusted. Often such organizations use the "left" outdated databases of state structures and simply fraudulently earn on their clients, as a rule, such data is very outdated and does not correspond to the current state of affairs. Therefore, immediately look for, first of all, a reliable organization.

Many entrepreneurs and commercial organizations submit their current reports through the Kontur system, these services also have access to the Unified State Register of Legal Entities. Therefore, you can safely turn to such sources, as they use reliable data exchange channels with official databases. There you can make permanent subscriber access or one-time. This service will be for you a simple application to reporting services.

The cost of obtaining information from commercial organizations with a one-time request is from 500 to 1000 rubles, depending on the urgency of providing data. Here you can order a legally valid extract with delivery to your office for a fee. A digital version of the certificate is also available. To make a request, be sure to indicate the TIN or the exact name of the company in order to exclude the possibility of error.

Conclusion

We told you in detail about the extracts from the Unified State Register of Legal Entities and we hope that now you have received complete clarity on this issue - you have familiarized yourself with what an extract is, its options, what data it contains, why it may be needed, in what ways it can be obtained.

We considered several different options for obtaining both a paper and electronic document, as well as its trial version. Now you can easily determine what type of document you need now, and which of the ways to get it for you today will be the most suitable.

Ready-made business plan with calculations using the example of a web studio

Ready-made business plan with calculations using the example of a web studio Registration of an internal memorandum: sample document and drafting rules

Registration of an internal memorandum: sample document and drafting rules Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages

Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages Advance report is ... Advance report: sample filling

Advance report is ... Advance report: sample filling How to stitch documents with threads by hand?

How to stitch documents with threads by hand? Disciplinary sanction for non-fulfillment of official duties

Disciplinary sanction for non-fulfillment of official duties Binding your book

Binding your book