How to get an extract from the Unified State Register of Legal Entities: step by step instructions

Any company may need an extract from the Unified State Register of Legal Entities. Not everyone knows that it can be issued both for a fee and for free. In the article we will tell you why this document is needed and how to order it online or on paper.

What is this article about:

What information is in the Unified State Register of Legal Entities

The abbreviation stands for "Unified State Register of Legal Entities". This register contains data on all legal entities registered in the Russian Federation. Data about businessmen is stored in another "place" - the Unified State Register of Individual Entrepreneurs, or EGRIP.

An extract from the Unified State Register of Legal Entities is formed and issued to enterprises by the tax authority. It lists data about a legal or natural person. This is information that is available to everyone. The form was approved by order of the Ministry of Finance of Russia dated January 15, 2015 No. 5n (Appendix No. 2).

The information contained in the register is listed in paragraph 1 of Article 5 of the Federal Law of 08.08.01 No. 129-FZ. There are 18 parameters in total:

- full and abbreviated name of the organization;

- the size of the authorized capital;

- organizational and legal form;

- legal address;

- information about the founders;

- Full name of the director, etc.

In what cases is an extract from the Unified State Register of Legal Entities required?

The company has the right to order an extract from the Unified State Register of Legal Entities in order to obtain information about itself and about another company or businessman. Why is it needed? It performs several tasks.

- Check your information. In the state register, a mark about inaccurate information may appear. For example, such a mark will be if the tax authorities decide that the enterprise is not at its legal address. It is worth getting rid of it as soon as possible so as not to embarrass counterparties. Many buyers refuse to work with "unreliable" suppliers. In addition, the tax authorities report to the bank that the company is not located at the legal address. And banks block settlement accounts in this case, as they suspect the client of money laundering. If within six months the "black mark" is not eliminated, then the tax authorities will exclude the enterprise from the register (see. dangerous label in the state register: consequences and liability for false information in the Unified State Register of Legal Entities ). A note about the unreliability of the director can be dangerous. Starting next year, inspectors want to annul the declarations of firms that have an "inaccurate" director. Companies will report that the report failed. If no action is taken, the tax authorities can block the current account. In addition, the counterparty will also have problems. Since the supplier's declaration will not be in the FTS database, the invoice will not find a match. Because of this, inspectors can withdraw deductions. Sometimes the only way to prove the correctness is in court.

- Complete the correct invoices. From October 1, the addresses of the buyer and seller in the invoice must be recorded in the same way as in the state register (subparagraphs “g”, “k”, paragraph 1 of Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). Tax authorities will not remove deductions due to errors in the address, but you should not argue with them once again. By the way, the procedure for filling in the addresses of consignors and consignees has not changed - you need to write down the postal details.

- . Information from the state register is one of the ways to check the supplier or contractor (letter of the Ministry of Finance of Russia dated 10.08.2017 No.). If it contains information about unreliability, ask the supplier to explain the reasons. In addition, the document reflects data on liquidation or the beginning of bankruptcy proceedings. If the organization is not in the register at all, then it is dangerous to conclude an agreement with it - it is possible that this is a one-day business or even an illegal company. If the marks are unreliable, then continue to check the potential supplier or contractor in other ways. One extract from the state register may not be enough to form a dossier of the counterparty (letter of the Ministry of Finance of Russia dated 10/16/2015 No. 03-02-07/1/59422). Request copies of the charter, order on the appointment of the head,

- For presentation to various departments and institutions. For example, the bank will ask for information from the register before opening a current account for the company (see also how to get a bank guarantee ). Paper will be needed if the company obtains a license. But if this one is not provided, then the institutions themselves will request information from the Federal Tax Service.

- To participate in tenders. If a company works with the public sector, participates in tenders, one of the mandatory documents in this procedure is data from the register. They must be ordered no earlier than six months before participation in the tender.

The law does not set the duration of the papers. But in practice, departments themselves decide what “age” files are suitable for them.

Types of extracts from the state register

There are only two types of statements - electronic and paper. Most often, companies turn to electronic form. Let's talk more about each of them.

Electronic form. This extract from the Unified State Register of Legal Entities has two main advantages - it is received quickly and free of charge. To do this, you need to use the service on the official website of the Federal Tax Service. That is, you can get an extract from the Unified State Register of Legal Entities for free without leaving the office. It usually forms within a few minutes.

The tax office signs a free extract from the Unified State Register of Legal Entities with a qualified electronic signature. Therefore, it has the same force as a paper one (clauses 1, 3, article 6 of the Federal Law of 04/06/11 No. 63-FZ, letter of the Federal Tax Service of Russia of 03.12.2015 No. GD-3-14/4585@). The printout of the electronic file will no longer have legal force. Therefore, if you want to use an Internet copy in your work, then send it in the form of a file downloaded from the website of the Federal Tax Service. For example, they are accepted when registering on electronic platforms and applying online for participation in public procurement.

paper form. Such an extract from the Unified State Register of Legal Entities is issued by the tax authority. Therefore, to get paper, you need to get to the inspection. This can be done by the director of the organization or an employee authorized by the company with a power of attorney.

A paper extract from the tax office cannot be issued for free. The cost depends on the production time. The usual one costs 200 rubles. The tax authorities will make it within 5 working days from the date of receipt of the request.

If such a waiting period does not suit the company, you can order an urgent extract from the Unified State Register of Legal Entities. Inspectors will generate it on the next working day after receipt of the request. Usually tax officials ask you to come for a document after lunch - if you come in the morning, there is a risk that it will not be ready yet. It makes no sense to complain about the inspectors - the law does not set the time in hours when the paper must be ready. The cost of an urgent copy is 400 rubles.

How to issue an extract from the Unified State Register of Legal Entities for free online

Getting a free extract from the Unified State Register of Legal Entities is quite simple. The algorithm consists of several steps.

Step 1. Register on the website of the Federal Tax Service

If you are already registered, then go to step 2.

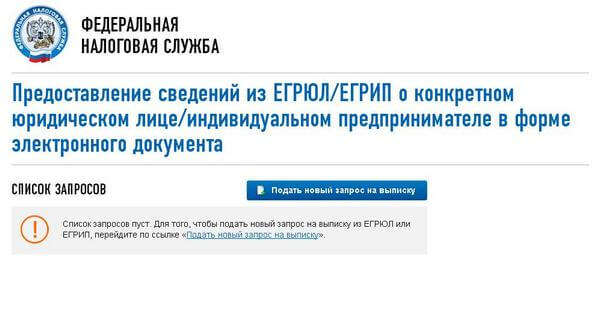

Go to the website of the Federal Tax Service in the section "Electronic Services", "Providing information from the Unified State Register of Legal Entities / EGRIP about a specific legal entity / individual entrepreneur in the form of an electronic document." Only registered users can use the service. To register, click "Register".

Picture 1. Service on the website of the Federal Tax Service (click to enlarge)

The screen will display the lines that need to be filled. Enter your name, email address, and create a password. Enter the code from the image.

Figure 2. New user registration (click to enlarge)

Within a minute you will receive an email to confirm your registration. Follow the link from it to confirm your registration. After that, you can purchase an extract from the Unified State Register of Legal Entities for free online.

Step 2. Apply

Figure 3

In the window that appears, enter the TIN or PSRN of the company about which you need information. From the service, you can also order data from the USRIP, just go to the tab "Individual Entrepreneur / Peasant Farm"

Figure 4. Ordering an extract from the Unified State Register of Legal Entities (click to enlarge)

Then enter the code from the picture and click "Generate Request". Thus, you sent an online request for an extract from the Unified State Register of Legal Entities.

Step 3. Get a statement

The document will be generated no later than the next business day. In practice, an extract from the Unified State Register of Legal Entities is generated free of charge in a few minutes, depending on the workload of the service.

The file will be in PDF format containing an enhanced qualified electronic signature and its visualization. The signature icon will also be visible when printed.

Figure 5. Electronic signature on the statement (click to enlarge)

Sometimes it is enough for a company to receive not an extract, but only information from the Unified State Register of Legal Entities online. They can also be issued online without money. And it will take much less time. Use the service "Business risks: check yourself and the counterparty". The service is also available to unregistered users.

Figure 6. How to get information from the Unified State Register of Legal Entities online (click to enlarge)

You can search for the desired enterprise or individual entrepreneur by TIN or PSRN, as well as by name. Usually an online file is generated in a few seconds. The document will also be in PDF format. But unlike the extract, it is not signed with an electronic signature. The information in them is almost the same.

Figure 7. Online file from the Unified State Register of Legal Entities without an electronic signature (click to enlarge)

How to order a paper copy

To obtain a paper copy, you will need to contact the IFTS. The procedure is listed in the Administrative Regulations, which is approved by order of the Ministry of Finance of Russia dated January 15, 2015 No. 5n. This document has collected all the rules that must be followed if information from state registries is needed. The order will be as follows.

Step 1. Pay the state duty

Paper copies are paid. Therefore, before submitting an application to the tax office, transfer money to the budget. In addition, the tax authorities will require a payment for payment of the fee. Without it, they will not accept the request.

Whatever state duty you pay, the BCC is general - 182 1 13 01020 01 6000 130. A sample receipt can usually be found at the tax stand or ask the inspectors to give it.

Step 2. Make an application

The starting point for obtaining a document is the preparation of an application. The recommended sample application is in Appendix No. 1 to the Administrative Regulations. It already contains all the necessary details. It is enough for the company to enter them in the appropriate fields.

You can also record a free application. The main thing is that it contains all the required details:

- name, PSRN and TIN of the organization about which information is requested;

- name, PSRN, TIN and contact information (phone, address or email) of your organization;

- number of copies;

- type of document - regular or urgent;

- method of receipt - in person (through a representative) or by mail. If you do not specify the desired method, then the paper will be sent to you by mail.

For example, you can take the following statement:

Head of IFTS No. 1

Somov Valentin Petrovich

From Technika LLC

TIN 7720123456

Gearbox 772001001

PSRN 1037712345678

Tel. 123-45-67

I ask you to provide a regular extract from the Unified State Register of Legal Entities with information about Supplier LLC (OGRN 1037787654321, TIN 7726543210) on paper in a single copy.

Pickup method: in person.

Attachment: payment order for payment of state duty in the amount of 200 rubles.

Director of Technika LLC Mammoths Mamontov V.A.

Step 3. Send an application to the inspection

The request can be sent to any territorial body of the Federal Tax Service, which is authorized to provide data from the state register. It does not depend on the legal address of the applicant and the company or individual entrepreneur about which they want to obtain information (read also new rules for changing the legal address for organizations ). The list of tax authorities to which such applications can be submitted can be found on the official website of the Federal Tax Service. An application can also be submitted to the tax office of the applicant, they also accept such documents. There you will also need to pick up your copy.

You have the right to submit a paper version of the request to the inspection in one of three ways:

- send by registered mail;

- carry personally;

- use the services of multifunctional centers.

Step 4. Get the paper

If the company told the inspectors that it would take the paper in person, they would need to go to the tax office. Specify the specific day of receipt of a non-urgent file with the tax authorities at the time of submitting your request. The paper will come by mail to the address that is recorded in the state register.

Ready-made business plan with calculations using the example of a web studio

Ready-made business plan with calculations using the example of a web studio Registration of an internal memorandum: sample document and drafting rules

Registration of an internal memorandum: sample document and drafting rules Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages

Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages Advance report is ... Advance report: sample filling

Advance report is ... Advance report: sample filling How to stitch documents with threads by hand?

How to stitch documents with threads by hand? Disciplinary sanction for non-fulfillment of official duties

Disciplinary sanction for non-fulfillment of official duties Binding your book

Binding your book