How to check yourself and the counterparty by TIN: Tax service website

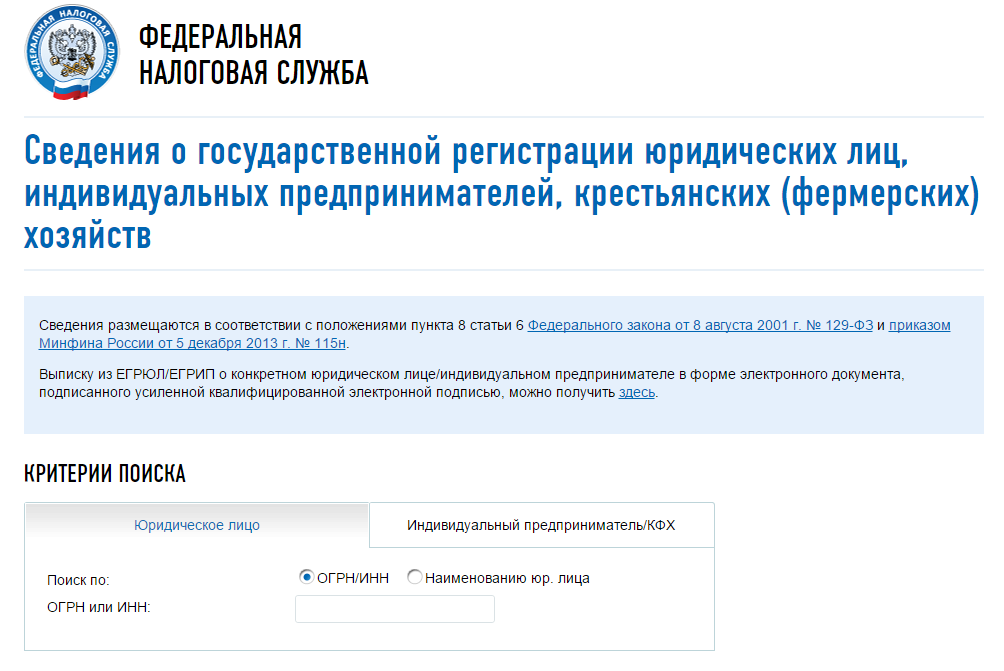

To ensure the integrity of business partners and achieve maximum transparency of the transaction, it is recommended to use the tool on the website www.nalog.ru and check yourself and the counterparty.

State registration is regulated by Law No. 129-FZ. The database provides information from the Unified State Register of Legal Entities. Verification involves the search and analysis of information about the counterparty to ensure its reliability.

According to the information provided by the tax authorities, a tax is paid for each transaction. At the same time, the responsibility for choosing a business partner lies entirely with the enterprise.

When checking, a deal with an unscrupulous partner is either not accepted for deduction or is not included in the expense item.

Important:verification of the counterparty is necessary to protect the enterprise from risks, such as the supply of low-quality goods and other violations of the contract.

Main verification criteria

Information on the disqualification of legal entities is also available on the website of the tax service. This term implies the deprivation of the right to carry out certain activities for a specific period.

In the tab where the register of disqualified persons is located, enter the data of the counterparty in the search bar. If an individual is on the list, it will be indicated under which article and for how long he is disqualified.

Checking by TIN of your own company

Checking a counterparty is a simple procedure that does not require much time. It will not be superfluous to check your own company by TIN.

Tax service services provide up-to-date information, and their databases are regularly updated. Check yourself for the following reasons:

- to keep abreast of the information that business partners receive;

- to identify shortcomings in the work of the company, as well as correct them. This could be tax arrears or incomplete reporting.

How is a debt check done?

The website of the tax service provides information on tax arrears. Information is indicated for both individual entrepreneurs and legal entities (for example,). You can use the service according to the same algorithm.

- Go to the website of the tax service.

- Open the "Individual Entrepreneurs" tab.

- The next transition is to the "Checking counterparties" section.

- Enter information (name or TIN).

- The system response will contain data on the existing debt.

What to do in the case when the information provided by the system in relation to a legal entity diverges from its own calculations? First, you should contact the local tax authority to verify the figures.

Federal data takes precedence over local data. In most cases, after verification, it becomes obvious that the branch has the debt, and not the company.

To receive a reconciliation act, a letter is being prepared addressed to the head of the tax service. It specifies the date by which this act must be drawn up, and the coordinates of the legal entity are attached.

It is preferable to send an urgent letter to avoid unnecessary formalities. The formatting requirements are:

- the letter is either written on letterhead or authenticated;

- the signature of the chief accountant or general director of the company is required;

- the letter indicates the method of response (preferably in writing, however, if a response is needed as soon as possible, a response by phone is possible).

To receive a response in writing, the authorized representative of the company must appear at the tax office. This must be done within the stipulated time.

How can a company protect itself from risks?

Unfortunately, no electronic service guarantees complete protection against unscrupulous counterparties. To protect the company, you can connect two more methods of checking the counterparty for good faith:

- check by name on the Internet;

- verification by TIN at the place of registration of the person.

The first way is the easiest and most affordable. The company name is entered in the search bar. It is worth familiarizing yourself with the official website, which provides information about the location of the enterprise and other details.

You can check the TIN there. This number is also used for verification with the tax authority where the company was registered.

Each company goes through the registration procedure. By visiting the local authority, you can clarify the information provided.

Each firm draws up its own list of activities for checking business partners. An employee responsible for searching and analyzing information about counterparties is appointed.

The most practical tool that provides detailed information about the counterparty is the service on the website of the tax service.

In relation to the counterparty, you can get information about the place of registration, managers, the absence or presence of tax debts.

Systems available online allow you to quickly collect and analyze information about counterparties.

Proper use of the tools at your disposal will allow you to minimize the risks of working with unscrupulous counterparties in business.

How to check a counterparty by TIN

How to check yourself and the counterparty by TIN: Tax service website

Ready-made business plan with calculations using the example of a web studio

Ready-made business plan with calculations using the example of a web studio Registration of an internal memorandum: sample document and drafting rules

Registration of an internal memorandum: sample document and drafting rules Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages

Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages Advance report is ... Advance report: sample filling

Advance report is ... Advance report: sample filling How to stitch documents with threads by hand?

How to stitch documents with threads by hand? Disciplinary sanction for non-fulfillment of official duties

Disciplinary sanction for non-fulfillment of official duties Binding your book

Binding your book