How to find out or get a TIN?

TIN- This is the taxpayer identification number that the tax office assigns to individuals and legal entities. A unique taxpayer number is required in order to track the history of his tax deductions, debts to the budget, and reporting.

Individual entrepreneurs, organizations and civil servants must have a TIN number without fail. Ordinary citizens, although they are not required to have it, are also faced with the fact that the TIN is requested when applying for a job, contacting a bank, and making transactions.

How many digits are in the TIN depends on who owns it. The number of an individual has 12 digits:

- the first 4 digits are the code of the Federal Tax Service that assigned the code;

- the next 6 digits - the serial number of the record about the individual;

- the last 2 are the check number.

The IP TIN will be the same as that of an individual who has become an individual entrepreneur.

The TIN of a legal entity is shorter, it has 10 digits:

- the first 4 digits are the code of the Federal Tax Service that assigned the code;

- the next 5 digits - the serial number of the record about the organization;

- the last digit is the check number.

Example TIN - 563565286576

How to find out your TIN?

If you want to know your TIN or are not sure if you have one, you can check this information. To do this, you need to come to the tax office at the place of residence with your passport and a request. There is another way - find out the TIN online.

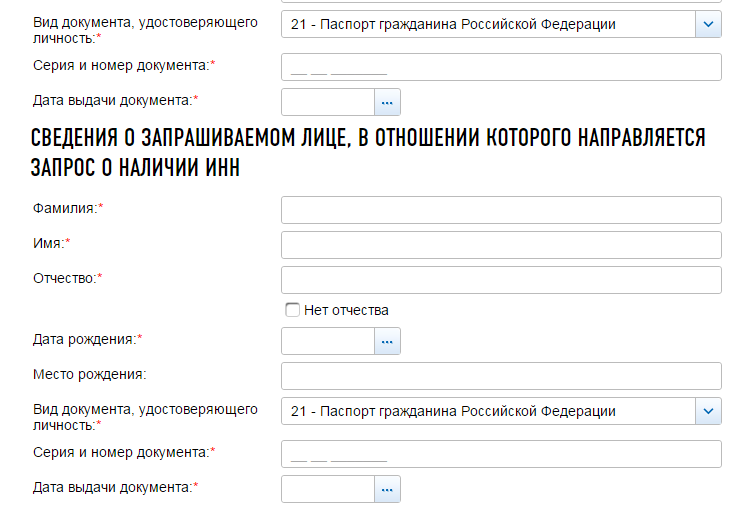

There is a convenient service on the website of the Federal Tax Service that allows you to find out the TIN from your passport. To find out your TIN, enter your passport details and click on the "Submit Request" button. In a minute on the page you will find out your TIN, unless, of course, you are registered with the tax authorities.

To find out the TIN of an individual (not your own), go to the form below. Be prepared to enter your passport details and the person whose identification number you want to know.

If you do not know the passport data, then you can find out the TIN of an individual only at the tax office. To do this, you will have to personally apply there and pay a fee of 100 rubles.

Where can I get a TIN?

If you have checked your data and made sure that you have not yet been assigned a taxpayer identification number, you can obtain a TIN from the tax office at the place of residence. To do this, you must apply for a TIN (form in the form 2-2 Accounting) and a copy of your passport.

Documents for obtaining a TIN do not have to be personally submitted to the Federal Tax Service. If you have it, you can get the TIN via the Internet by downloading the "Legal Taxpayer" program. In this case, you will receive a ready-made tax number certificate in electronic form or by registered mail.

If you don’t have an electronic signature, then you can get a TIN for an individual via the Internet by filling out an application on the website of the Federal Tax Service. In this case, you only submit an application online, and the certificate itself in paper form will need to be collected at the tax office at the place of registration. Tax registration takes place within five days from the date of receipt of the application.

How to restore the TIN in case of loss?

The TIN is assigned to an individual once in a lifetime and does not change when you change your place of residence, passport data or lose your certificate. If the document is lost, then not a duplicate is issued, but a new certificate with the same TIN. To get it, you must submit to the tax office at the place of residence:

- a free-form application for the issuance of a new TIN certificate;

- a receipt for payment of the state duty for the reissuance of a certificate in the amount of 300 rubles (Article 333.33 of the Tax Code of the Russian Federation);

- a copy of the passport indicating the place of residence.

If you apply to the tax office in person, then you need to have a passport with you. If you submit documents by mail or through an authorized representative, then a copy of the passport must be notarized. A duplicate is issued within five days, after which it must be picked up personally or through an authorized representative.

Ready-made business plan with calculations using the example of a web studio

Ready-made business plan with calculations using the example of a web studio Registration of an internal memorandum: sample document and drafting rules

Registration of an internal memorandum: sample document and drafting rules Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages

Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages Advance report is ... Advance report: sample filling

Advance report is ... Advance report: sample filling How to stitch documents with threads by hand?

How to stitch documents with threads by hand? Disciplinary sanction for non-fulfillment of official duties

Disciplinary sanction for non-fulfillment of official duties Binding your book

Binding your book