Personal account - extract from the Unified State Register of Legal Entities

A certificate from the Unified State Register is a document that contains all the information about a registered organization. It is needed for notarization of documents of a legal entity, for banking operations, participation in tenders or in court, for concluding transactions. Such statements are issued by the tax inspectorate upon personal contact with the department. A faster and easier white paper is available at . Below is how to issue an extract in a few minutes.

Issuance of an extract via the Internet

The official website of the Federal Tax Service nalog.ru has information and services for easy communication with the tax authorities. Here you can for ordinary citizens, an individual entrepreneur, a legal entity. After registration, the user sees his tax accruals, debts to the budget, and can pay his bills online. Also through the office you can correspond with the tax office, get advice, ask questions of interest.

The portal is especially convenient for individual entrepreneurs and legal entities. The accounts of these categories of taxpayers are created for quick and convenient interaction with the Federal Tax Service. One of the most popular features of the site is the execution of an extract from the USRIP and USRLE. For legal entities, such a document may be needed at any time; without it, it is difficult for the owner of the organization to prove his rights to property.

The extract happens:

- official - this is the one that is issued only by the tax. A document in the form of bound numbered sheets, certified by the official seal of the tax;

- electronic - this is one that can be obtained remotely. It contains general information about the enterprise, which is available to everyone. Confirmed by an electronic tax signature, endowed with the same legal force as a paper counterpart.

In the tax office, you can only get an electronic version. It can also be printed on paper. Such a document is of interest to those companies that want to check information about counterparties or potential partners in order to eliminate risks.

The statement is generated like this:

- We go to the website of the FTS.

- If the portal already has a personal account, just . If there is no account yet, create it. It should be noted right away that such an account only provides for obtaining extracts from the Unified Register. To use all the features of the site, you need.

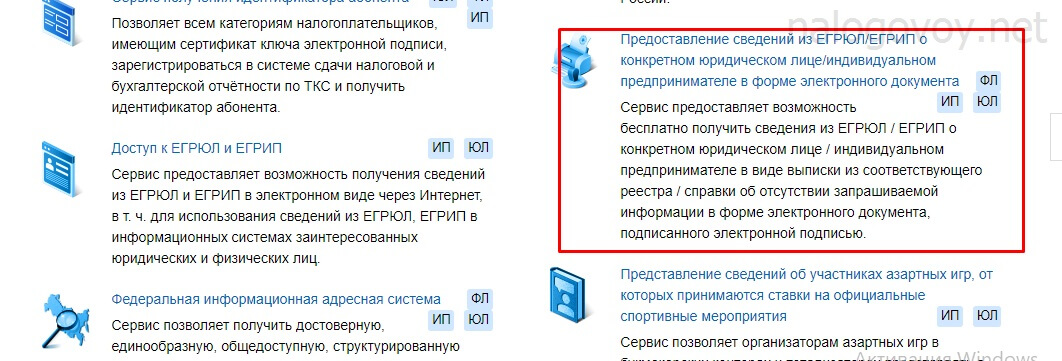

- On the main page we find the section "All services", go to it.

- A list of all electronic services of the Federal Tax Service will open. Among them there is a necessary section.

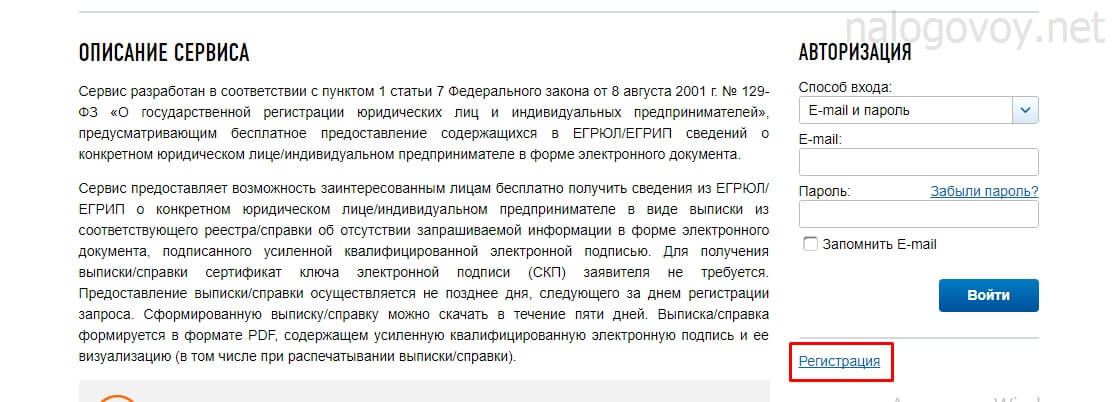

- We click on the link. If there is no account, a login block will appear. Below it is a link to register. We click on it.

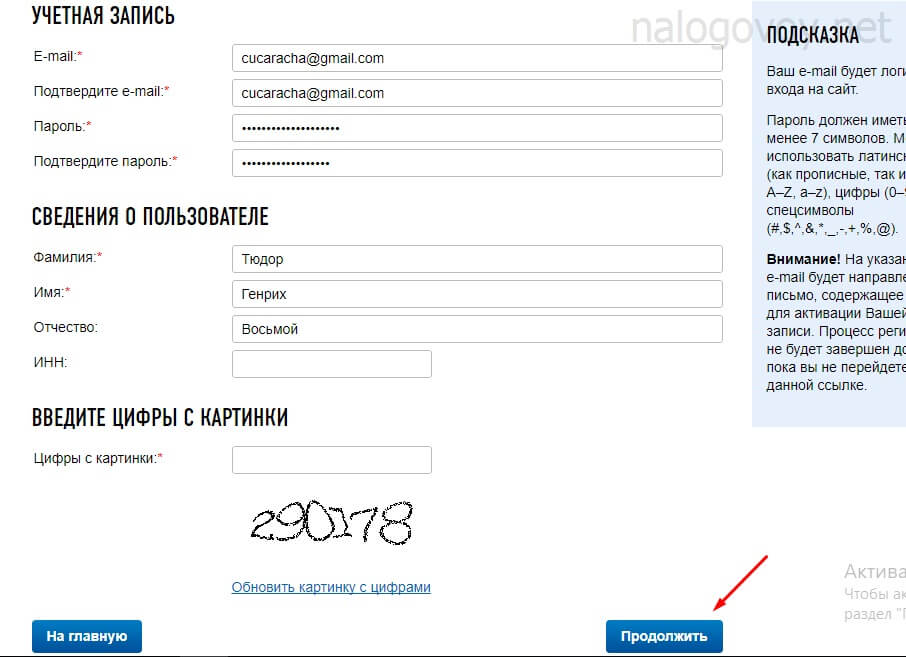

- In the registration card, we fill in all the fields, it is not necessary to enter the TIN and patronymic.

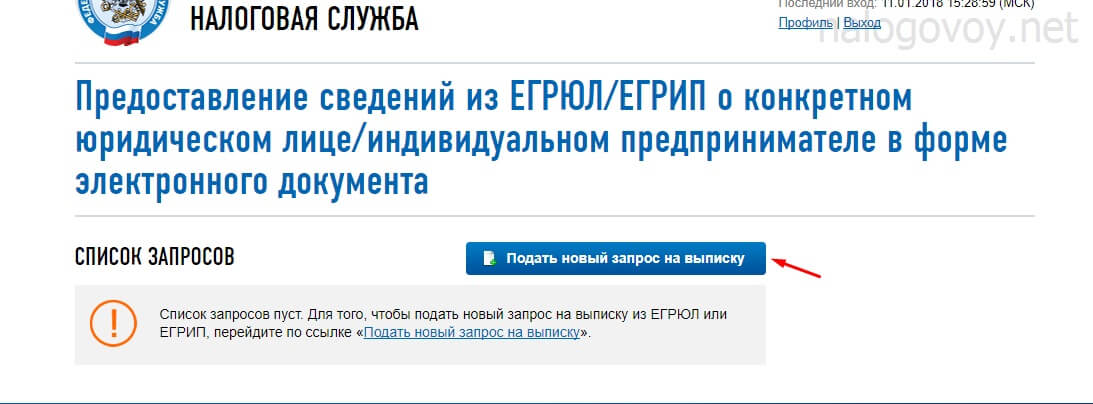

- Click the "Continue" button. An activation link will be sent to your email, click on it. Automatically, it translates to the request page, click "Submit new". Obtaining an extract from the Unified State Register of Legal Entities through your personal account is even easier, the request page will appear immediately after going through all the services.

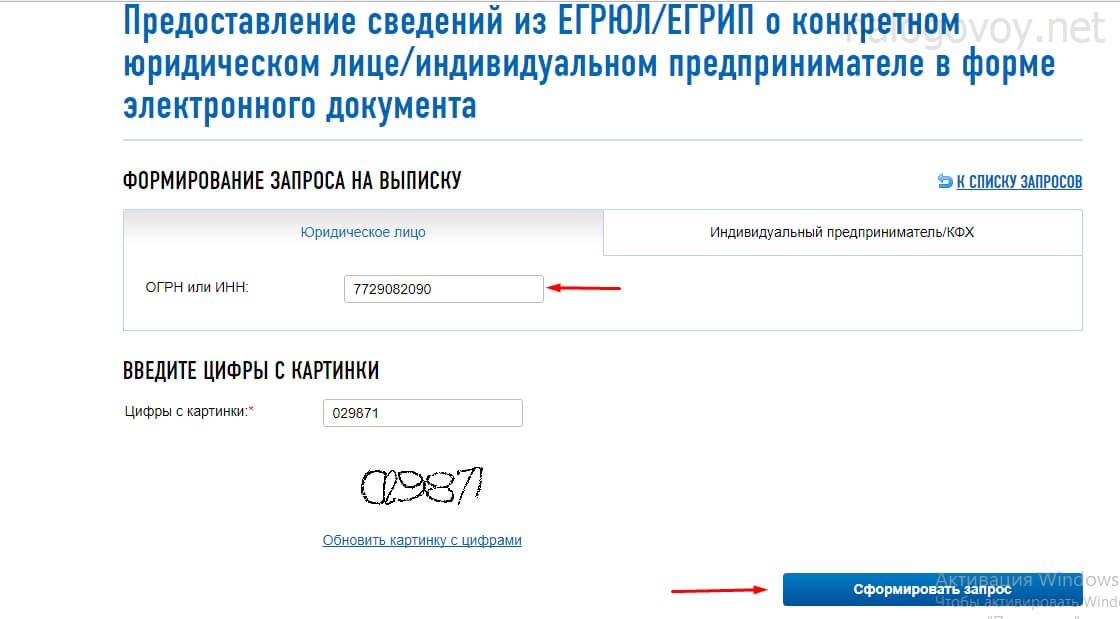

- Next, in the appropriate field, enter the TIN of the legal entity or PSRN. Click "Create Request".

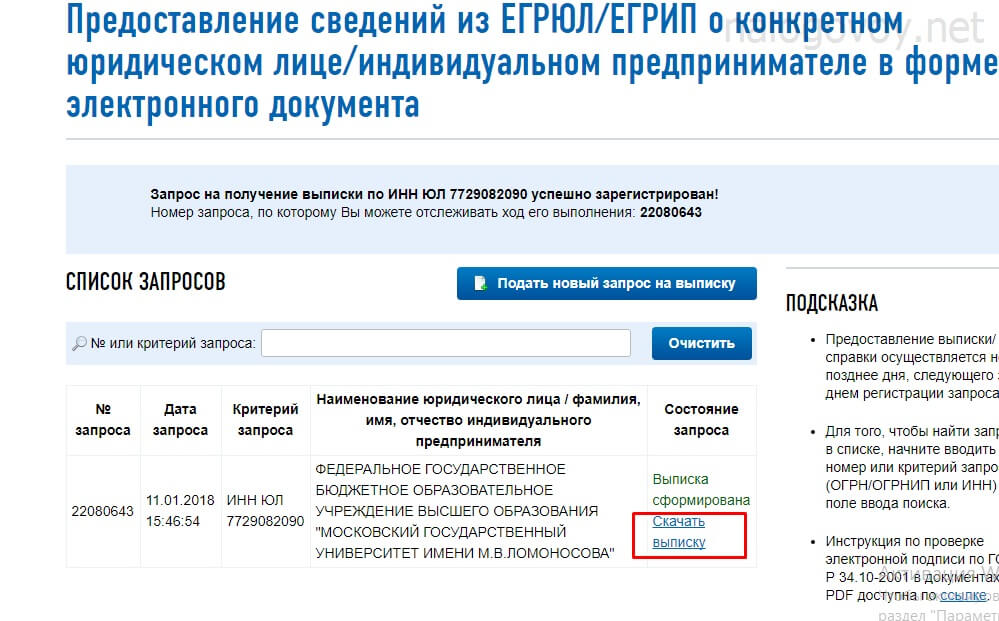

After that, it remains only to wait for the document to be generated. The process usually takes 2-5 minutes, for verification it is better to refresh the page periodically. If the certificate does not appear within 24 hours, you need to order an extract from the Unified State Register of Legal Entities again. When the document is ready, a link to it will appear in the report.

The document is generated as a PDF file. To view or transfer to electronic media, you just need to click on the link. Also, such a document can be printed if a paper statement is needed. It will provide complete general information about the company, its branches, the owner. The document does not contain any data that attackers can use.

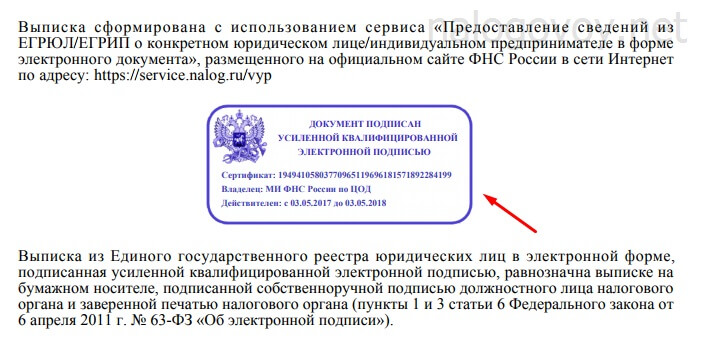

On the last page of the file there is a mark that the document is certified by an enhanced qualified signature of the Federal Tax Service. According to the described algorithm, you can get information about a personal organization or about an enterprise of competitors / partners / suppliers.

An extract from the Unified State Register of Legal Entities from a personal account is no different from a paper version and is endowed with the same legal significance. With a personal appeal to the Federal Tax Service Inspectorate for such a certificate, you need to pay 200-400 rubles, depending on the urgency. Through the Internet, it is much easier and faster to do this, besides, you do not need to pay a fee for obtaining an electronic statement. Now you know how to do it.

Ready-made business plan with calculations using the example of a web studio

Ready-made business plan with calculations using the example of a web studio Registration of an internal memorandum: sample document and drafting rules

Registration of an internal memorandum: sample document and drafting rules Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages

Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages Advance report is ... Advance report: sample filling

Advance report is ... Advance report: sample filling How to stitch documents with threads by hand?

How to stitch documents with threads by hand? Disciplinary sanction for non-fulfillment of official duties

Disciplinary sanction for non-fulfillment of official duties Binding your book

Binding your book