Obtaining an extract from the Unified State Register of Legal Entities: an algorithm of actions

An electronic extract from the Unified State Register of Legal Entities with an electronic signature is required both for participation in tenders and for ordinary business activities. Consider what steps you need to take to get it.

When required

An extract from the Unified State Register of Legal Entities or Individual Entrepreneurs (hereinafter referred to as the Unified State Register of Legal Entities / EGRIP) has long been a mandatory document that should be included in the application for participation in the procurement. Until recently, it was used in the form of an original or a scanned copy certified by a notary. At the moment, in most cases, an electronic document with a digital signature of an authorized person is sufficient, since it has the same legal force.

With the use of the modern version of the extract from the register, the following processes have been greatly facilitated:

- accreditation on federal electronic platforms;

- conclusion of a contract in the request for quotations;

- checking the company for non-location in offshore zones.

To gain access to bidding at online auctions, it must be provided as part of a set of constituent documents. When concluding a contract based on the results of a request for quotations, a certificate from the Unified State Register of Legal Entities / EGRIP is transmitted by the winner along with the signed contract (clause 11 of article 78 Law on the contract system). In this case, it can also be an extract from the Unified State Register of Legal Entities with an electronic signature.

How to receive remotely

There are a number of ways to get the necessary document without leaving home. Please note that only an extract from the Unified State Register of Legal Entities with an electronic signature of the tax service (signed by the digital signature of an authorized person of the Federal Tax Service) has the force of a paper version. Without it, it will contain only information from the Unified State Register of Legal Entities / EGRIP.

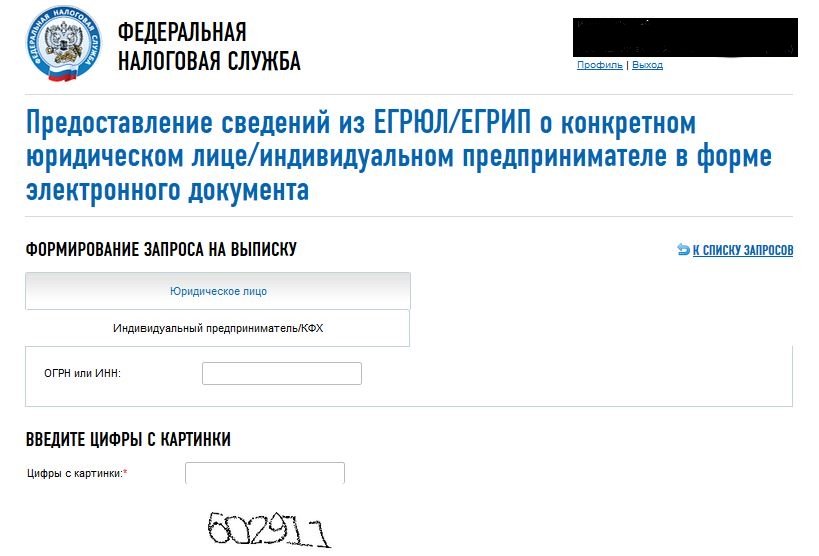

The document can be ordered on the FTS portal. An extract from the Unified State Register of Legal Entities with the EDS of the tax service is generated in your personal account at the link https://service.nalog.ru/vyp/. To receive it, you must go through the registration procedure on the portal, confirm your e-mail and log in. Formation of a document is possible when specifying the TIN or OGRN (OGRNIP).

A document with an enhanced electronic signature is generated within 10-30 minutes, sometimes a little longer due to the load on the servers, so it is best to apply in advance.

Formation of the document

As a result, on the date of sending the application, a file with an enhanced electronic signature of the .pdf format is generated, which is equivalent to an extract drawn up on paper and certified by the signature and seal of the tax authority. You can form them in an unlimited number for several companies at the same time.

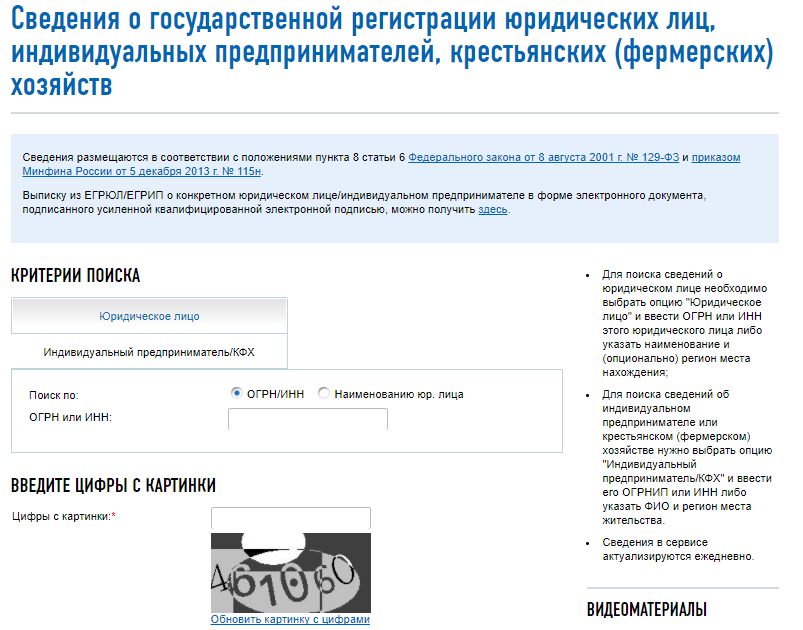

Quite often, another FTS service is used

In this case, you do not receive an extract, but only information from the register. They are formed immediately after filling in the required fields (OGRN / TIN) or the name of the legal entity and the place of its registration.

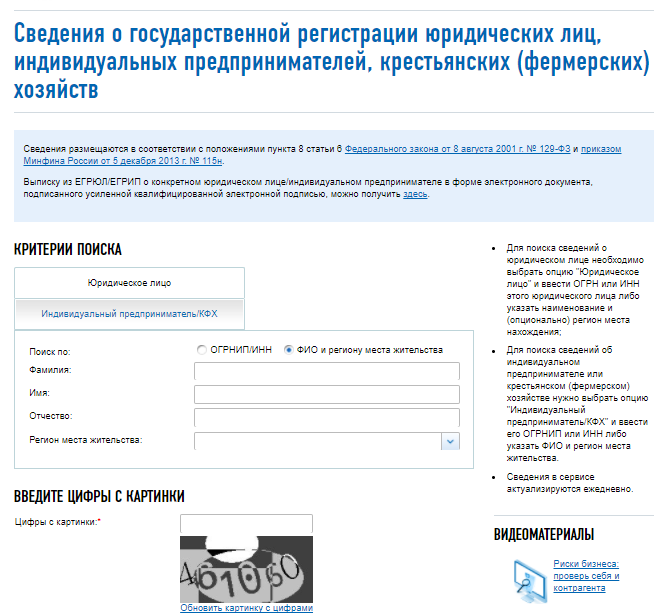

And information on an individual entrepreneur can be obtained by having information about his TIN / OGRNIP or knowing his full name. and region of residence.

Receipt on paper

It is worth noting that a paper statement is not free, unlike a certificate with an electronic signature obtained from the website of the Federal Tax Service. To apply for its formation, you must also attach a receipt for payment of the fee, today it is 200 rubles, for urgent issue - 400 rubles. The terms for providing information for ordinary needs are up to 5 business days, for urgent needs - no later than the business day following the day the request was submitted.

Ready-made business plan with calculations using the example of a web studio

Ready-made business plan with calculations using the example of a web studio Registration of an internal memorandum: sample document and drafting rules

Registration of an internal memorandum: sample document and drafting rules Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages

Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages Advance report is ... Advance report: sample filling

Advance report is ... Advance report: sample filling How to stitch documents with threads by hand?

How to stitch documents with threads by hand? Disciplinary sanction for non-fulfillment of official duties

Disciplinary sanction for non-fulfillment of official duties Binding your book

Binding your book