Check the counterparty and yourself by TIN. How to minimize risks when concluding a contract?

A business partner is one of the most important aspects of any business. The prosperity of your company will also depend on how he fulfills his obligations. But how to check the counterparty and protect yourself from possible troubles? To do this is not so difficult. You will need to know a minimum of information about the future partner. Most often, it is enough to know only the TIN. How to check the counterparty and protect yourself? Read more about this.

Why check?

Even a novice entrepreneur knows: if you want to minimize business risks as much as possible, check yourself and your counterparty in every possible way. Most often, large firms with a well-established financial security service resort to such checks. Small companies, as well as single entrepreneurs, most often neglect such events. And in vain. Checking a counterparty for free, quickly and reliably is quite simple. You just need to know what exactly to pay attention to.

What does TIN mean and how to check its reality?

First of all, it is worth checking the counterparty by TIN. What it is? TIN stands for Individual Identification Number. It is assigned to each person or entrepreneur as a sign that he is registered with the tax authorities.

You can find it using any search engine. It is worth "hammering" the full name of the enterprise and you will immediately receive a lot of information, including the TIN of the company. You can also do the reverse operation - by the TIN number, find out additional information about the company.

Sometimes, however, it also happens that the TIN seems to be there, but no information can be found on it. It's worth thinking about here. Perhaps the proposed number is not real and is just a set of numbers. And the company is a one-day business. You can check the counterparty and protect yourself in this case. There is a simple formula with which you can check the reality of the identification number. For any legal entity, the TIN consists of 10 digits. We will use the first 9 for calculations, and the 10th is a test.

Take the first 9 digits and multiply them like this:

- 1st - multiply by 2;

- 2nd - by 4;

- 3rd - by 10;

- 4th - multiply by 3;

- 5th - by 5;

- 6th - by 9;

- 7th - increase by 4 times;

- 8th - multiply by 6;

- 9th - by 8.

Now add all the results together and remember this number.

Divide the number obtained as a result of addition by 11. If the resulting result has a remainder, then you need to discard the decimal part, and multiply the whole number by 11 again. Now compare the resulting number and the one that came out as a result of adding the products (we memorized it). You have to subtract one from the other. The resulting digit must match the last, tenth digit. If everything worked out - the TIN number is real, it didn’t work out - it’s worth considering.

How to find out the TIN by the name of the company?

If you do not want to be asked questions by the tax office, it is necessary to check the counterparty before concluding a transaction. If, apart from the name, you do not know anything about future partners, it does not matter. You can also find out the TIN. There are some small rules here:

- the name of the company is entered into the search engine without quotes;

- the search must be performed by the full name, without abbreviations;

- enter the name exactly as it is, even if there are spelling or grammatical inaccuracies.

Having found the necessary data, you can find out not only the TIN, but also some other data. Sometimes the difficulty may lie in the fact that several firms can have the same name. Then you can check by type of activity or some additional information.

How to find the TIN by other details?

Checking the counterparty by TIN is easy. But sometimes this data is not enough. If the company you are looking for has its own website, you can usually find details such as the Unified State Register of Legal Entities, State Registration Number or PSRN there. All this may be useful for further verification. Having learned as much additional information from open sources as possible, you can contact the Federal Personal Appeal, of course, it costs money, but the expenses are quite justified. The tax office will be able to check the counterparty very quickly. You will be provided with the most accurate and reliable information. For individuals, a certificate costs 200, and for legal entities - 400 rubles.

Collecting data about the counterparty: what to check?

If you plan to make a deal with a new counterparty, try to get as much information about him as possible. You will need copies of the following documents:

- certificate of state registration;

- certificate of the taxpayer;

- business license (if any);

- a copy of the company's charter.

Obtaining complete information about the counterparty includes the following items:

Basic data. This includes: surname, name of the founder, full name of the enterprise, TIN, date of foundation, legal and physical addresses, information about whether this entrepreneur has already liquidated firms.

Information about the enterprise. Data on the legality of the company, reviews, especially from independent sources.

Employee data. Some firms conduct a large number of transactions through their employees, thereby diverting attention from the head.

Information about the proposed transaction. Particular attention should be paid to the amount of the contract. If we are talking about cooperation with individual entrepreneurs, then there can be no talk of any millions. If a certain LLC offers you a deal in the amount of more than 25% of the funds on the balance sheet of the company, you should think about such cooperation. Information about the state of the balance must be required even before signing the contract.

Check counterparty by TIN: Federal Tax Service

This is the very first instance, which is worth visiting for reliable information. The federal tax service can check the counterparty by TIN very efficiently. Of course, there is a temptation to do this quickly and for free, using the appropriate services on the Internet. But if the transaction is large, it would still be best to personally visit the tax office and make an official request. The received document will not only completely protect you from scammers, but will be a kind of "charm" from the tax authorities themselves. They will no longer have reason to claim that you have not taken sufficient steps to identify an unreliable counterparty.

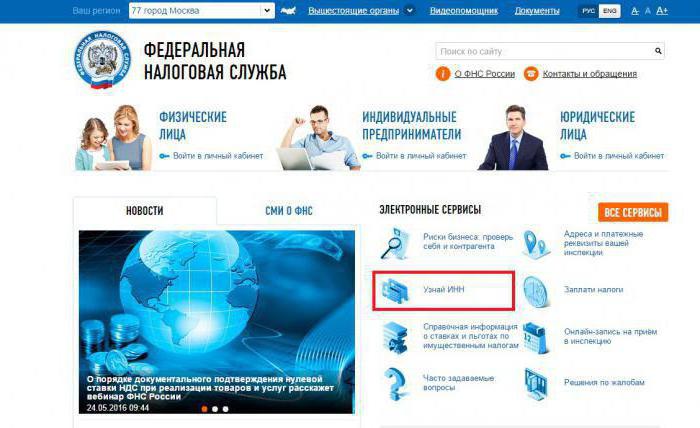

Nalog.ru: check yourself and the counterparty

If you don’t need an official document with signatures and seals, but you don’t need money for a paid check, you can use the official website of the Federal Tax Service. It is called so - nalog.ru (nalog.ru). Check yourself and the counterparty, and nothing threatens your business.

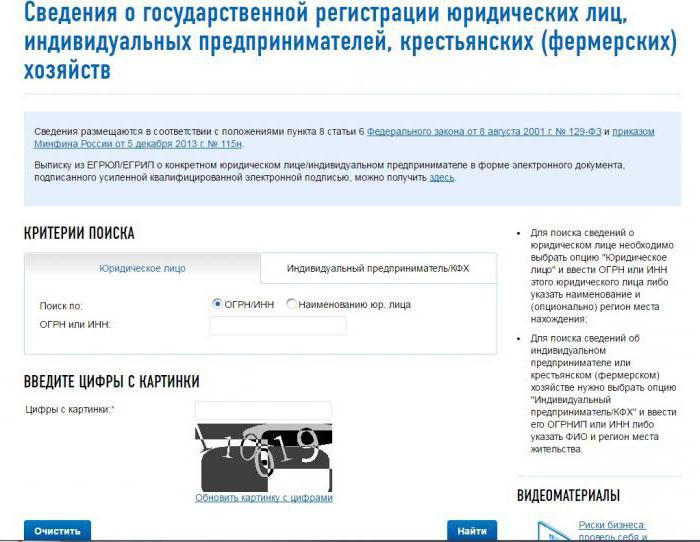

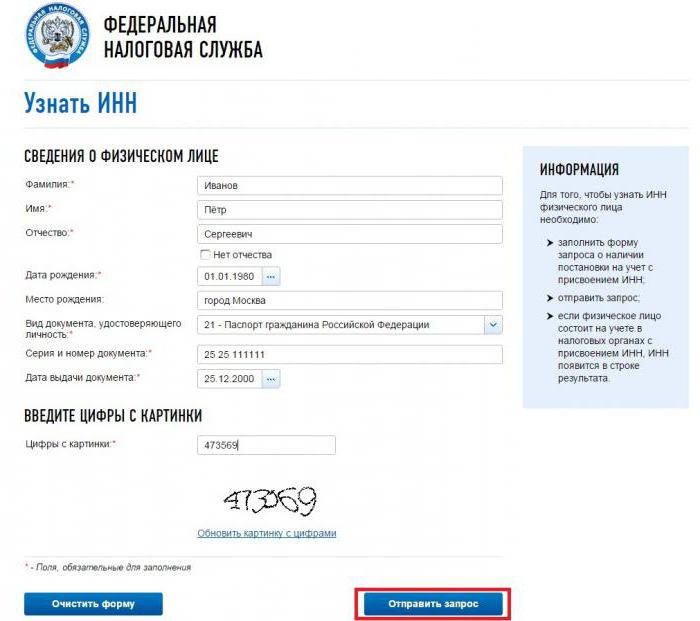

The site is pretty simple. It is intuitive even for those who rarely deal with a computer. First you need to go to the appropriate section:

- individuals;

- legal entity.

Now select the link "Check counterparty" from the list and go to the corresponding page. In the window that appears, enter the TIN / OGRN numbers or the name of the organization. In the window located just below, enter the captcha - a few numbers written in the picture. Now press the "Find" button and enjoy the result. On the page that opens, you can download a document in .pdf format, which contains almost complete information about the company.

So if you don’t want problems, go to nalog, check yourself and your counterparty and feel protected.

Other types of searches can be carried out on the FTS website:

- Information about the persons who submitted documents for state registration or for making changes to the constituent documents.

- Data on persons in respect of which a decision was made to liquidate, reorganize or reduce the authorized capital.

- Information about the exclusion of an inactive legal entity from the Unified State Register of Legal Entities.

- Register of disqualified persons and information about organizations whose executive bodies include such persons.

- and data on firms, with which there is no connection at registered addresses.

- Data on organizations that have tax debts or do not provide tax reporting.

- Information about individuals who have several registered organizations.

- Other data.

What can you learn about IP

If you decide to check the counterparty and yourself, and your counterparty is an individual entrepreneur, then with the help of the service department of the Federal Tax Service you can obtain the following information:

- surname, name, patronymic;

- citizenship;

- EGRIP registration number;

- date of entry in the register;

- data on the availability of licenses and their number;

- information on tax registration - date and TIN;

- OKVED - codes of types of entrepreneurial activity;

- data on registration with the FSS and the Pension Fund;

- information about the specific department of the tax service, in which the documents on registration of a particular individual entrepreneur are located.

What information can be obtained about a legal entity

If your counterparty is a legal entity, then the FTS website can provide you with the following information:

- Name and legal address.

- Date and registration number of PSRN.

- Information about the founders of the company, the creation or reorganization of a legal entity.

- Information about any significant changes in the activities of the organization.

- Data on the beginning of the liquidation or reorganization, if any.

- Information about the head of the company and the size of the authorized capital.

- Information about all divisions of firm.

- OKVED data and information about all available licenses.

- Information on registration in the FSS and PF.

- Information about the specific department of the Federal Tax Service, in which the package of documents on the registration of the company is located.

You probably already understood: “If you want to minimize business risks, check yourself and your counterparty.” By following this rule with every transaction, you will not only never have problems with the tax office, but also protect your money from scammers.

Ready-made business plan with calculations using the example of a web studio

Ready-made business plan with calculations using the example of a web studio Registration of an internal memorandum: sample document and drafting rules

Registration of an internal memorandum: sample document and drafting rules Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages

Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages Advance report is ... Advance report: sample filling

Advance report is ... Advance report: sample filling How to stitch documents with threads by hand?

How to stitch documents with threads by hand? Disciplinary sanction for non-fulfillment of official duties

Disciplinary sanction for non-fulfillment of official duties Binding your book

Binding your book