How to Calculate the Break Even Point

Determination of the break-even point is the cornerstone of the effective functioning of any enterprise. The calculation of this indicator is of paramount importance not only for the owners of the enterprise, but also for its investors. If the former must be aware of when output becomes profitable, then the latter must be aware of the value of this indicator in order to make an informed decision on the provision of financing.

What is the break-even point and what does it show

This indicator helps to understand when the company ceases to incur losses, but is not yet able to earn a profit. At the same time, the production and sale of any additional unit of output entails the formation of profit. Thus, the break-even point is a certain starting point, starting from which the enterprise can begin to develop effectively. Those. This indicator is a kind of indicator that the company is moving in the right direction.

This indicator is also known as profitability threshold or simply BEP(from English break-evenpoint). It characterizes the volume of output of goods at which the proceeds from its sale will be equal to the costs of its manufacture.

What is the economic meaning of determining the value of this indicator? The threshold of profitability shows the company's output to pay back its costs.

A break-even point is said to occur when expenses are covered by income. The company fixes profit when this indicator is exceeded. If this indicator is not reached, then the company incurs losses.

So, the break-even point shows:

- the level above which the company begins to record profits;

- the minimum allowable level of revenue, below which the production of products ceases to pay off;

- the minimum allowable level of pricing, below which it is impossible to fall.

In addition, the definition of this indicator allows:

- identify problems that are associated with changes in the break-even point over time;

- identify how to make it possible to change the volume of output of a product or its production with a variation in price;

- calculate how expedient it is to reduce revenue so as not to incur losses.

Determination of the profitability threshold helps investors determine whether it is worth financing a given project, provided that it pays off for a given volume of sales.

Video - analysis of the break-even point:

Thus, most management decisions are made only after the break-even point is calculated. This indicator helps in calculating the critical sales volume at which the company's costs become equal to the revenue from the sale of goods. Even a slight decrease in this indicator will indicate the incipient bankruptcy of the company.

Important! When the company steps over the break-even point, it will begin to take profits. Before that, it works at a loss.

Calculation formulas

The threshold of profitability can be measured in kind or in monetary terms.

In both cases, to determine the threshold of profitability, it is important to first calculate the costs of the enterprise. To do this, we introduce the concept of fixed and variable costs.

fixed costs do not change over time, and do not have a direct relationship with the volume of sales. However, they can also change under the influence of, for example, the following factors:

- changes in company performance;

- expansion of production;

- changes in the cost of rent;

- changes in general economic conditions, etc.

These include the following costs:

- payment of administrative expenses;

- rental fee;

- depreciation deductions.

variable costs are a more unstable quantity, which depends on changes in the volume of production. This type of cost includes:

- payment of wages and other deductions to workers;

- the cost of raw materials and the purchase of necessary materials;

- purchase of components and semi-finished products;

- payment for energy.

Accordingly, the amount of variable costs will be the higher, the greater the volume of production and the value of sales.

Variable costs per unit of output do not change when the volume of its production changes! They are conditionally permanent.

Having decided on the concept and types of costs, let's find out how to calculate the break-even point (BEP) in kind. For this we use the following formula:

BEP (In-kind) = Fixed Cost / (Unit Selling Price – Variable Unit Cost)

It is advisable to use this formula when the enterprise is engaged only in the production of products of one type. However, this is extremely rare. If the company produces a wide range of products, then the indicators for each of its types are calculated separately using a special extended formula.

When calculating the break-even point in monetary terms another formula is used:

BEP (in monetary terms) = (fixed costs / contribution margin) * sales revenue

For a correct calculation, we use the data on the fact of costs and revenue for the analyzed period. In this case, indicators that refer to the same analysis interval should be used.

However, the use of this formula is correct when determining BEP with marginal profit, which is positive. If it is negative, then the BEP value is defined as the sum of the fixed and variable costs that are relevant to the given period.

Video - about the importance of determining the threshold of profitability in business:

Or you can use another formula for calculating the threshold of profitability:

BEP (in monetary terms) = Fixed costs / KMD,

where KMD is the marginal profit ratio.

At the same time, KMI can be determined by dividing MA (marginal income) by revenue or by price. In turn, MD is obtained using one of the following formulas:

MD = V - PZO,

where B is revenue,

PZO - variable costs for sales volume.

MD = C - PZE,

where C is the price,

PZE - variable costs per unit of goods.

Calculation examples

For greater clarity, consider examples of calculating the break-even point using the example of an enterprise and a store.

For an industrial enterprise

Suppose we are given the following conditions. The company is engaged in the production of products of one type. At the same time, the cost of a unit of production is 50,000 rubles. Price - 100,000 rubles. Fixed costs - 200,000 rubles. It is necessary to calculate the minimum volume of goods produced, at which the enterprise will reach the threshold of profitability. Those. we need to calculate BEP in physical terms. Let's use the above formula and get:

BEP (in kind) = 200,000/(100,000-50,000) = 40 (product units).

Conclusion: thus, with the release of at least 40 units of production, the enterprise will reach the break-even point. Increasing the company's output will lead to profit.

For shop

In the following example, we will calculate the break-even point for a store. Let's say that the store is a grocery store and has the following fixed costs (in rubles):

- space rent - 80,000;

- salaries of managers - 60,000;

- insurance premiums - 18,000;

- utility bills - 10,000.

Total: 168,000 (rubles).

The conditions also contain the values of variable costs:

- payment for energy - 5,000;

- raw material costs - 10,000.

- Total: 15,000 (rubles).

Let's say that the amount of revenue is 800,000 rubles. Let's define BEP in value terms. First, let's calculate the margin. To do this, we subtract variable costs from revenue and get 800,000 - 15,000 \u003d 785,000. Then the KMD will be 785,000 / 800,000 \u003d 0.98.

Then the break-even point will be equal to fixed costs divided by the resulting coefficient, or 168,000 / 0.98 \u003d 171,429 rubles.

Conclusion: Thus, the store must sell goods in the amount of 171,429 rubles in order for income to be greater than expenses. All subsequent sales will bring the store a net profit.

Schedule

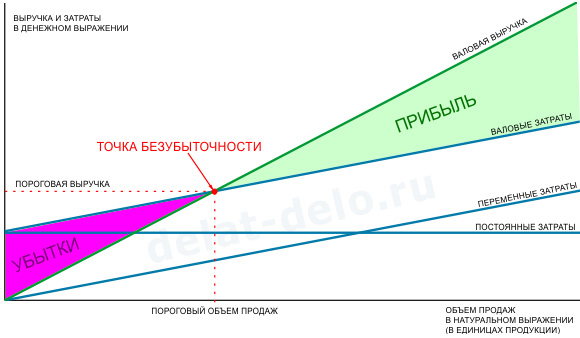

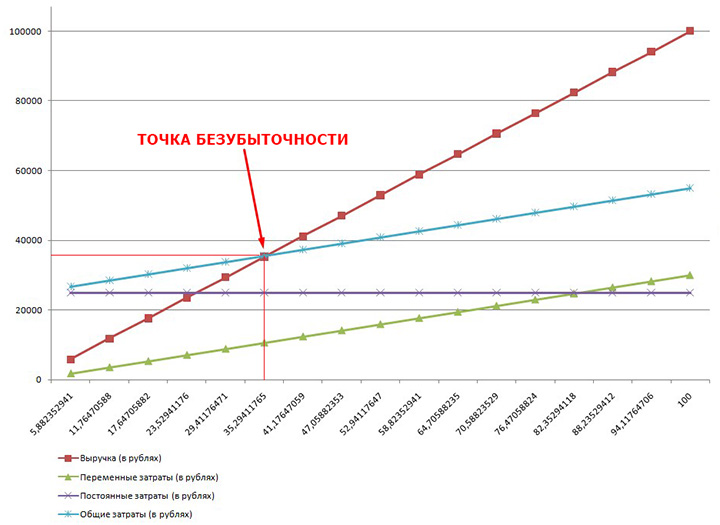

In order to find the threshold of profitability, you can use the graphical method for calculating this indicator. To do this, we will reflect on the graph fixed and variable costs, as well as total (gross) costs. The break-even point graphically corresponds to the intersection point of the gross revenue and total cost curves.

Let's look at this with an example.

The following conditions are given (in rubles):

- the amount of revenue - 100,000;

- production output - 100 (pieces);

- fixed costs - 25000;

- variable costs - 30,000.

Having noted these data on the chart, we get the following conclusion: the company will be at the break-even point when it receives income in the amount of 35,700 rubles. Thus, if an enterprise sells goods in quantities of more than 35 units, then it will fix profits.

Calculation of the break-even point using formulas in Excel

It is very easy and convenient to calculate the profitability threshold using Excel - for this you just need to enter the initial data in the appropriate table, after which, using the programmed formulas, we will get the value of the profitability threshold for our case, both in monetary terms and in kind.

You can download the calculation of the break-even point in Excel for a manufacturing enterprise specializing in the production of parts in the engineering industry at.

The schedule and formula for calculating the break-even point in Excel for the general case are given.

The calculation of the threshold of profitability is important for the normal functioning of the enterprise. There are several methods for its determination, the optimal of which should be chosen for each specific case.

Ready-made business plan with calculations using the example of a web studio

Ready-made business plan with calculations using the example of a web studio Registration of an internal memorandum: sample document and drafting rules

Registration of an internal memorandum: sample document and drafting rules Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages

Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages Advance report is ... Advance report: sample filling

Advance report is ... Advance report: sample filling How to stitch documents with threads by hand?

How to stitch documents with threads by hand? Disciplinary sanction for non-fulfillment of official duties

Disciplinary sanction for non-fulfillment of official duties Binding your book

Binding your book