Break-even point: how not to work at a loss?

“The more you sell, the more you earn” - any entrepreneur understands this formula. But, usually, not everyone calculates exactly how much to sell in order to break even and not get a loss. The volume of sales at which the business works to zero is called the break-even point. Knowing it, an entrepreneur can better plan the prices of goods, the volume of advertising, bonuses and many other important parameters. Let's figure out how to calculate the break-even point for any business.

variable costs

Variable costs are business costs, the volume of which depends on the production of a unit of output or on the provision of a service. They are variables because they will change when the volume of production changes. This usually includes the purchase of raw materials, payment for the work of subcontractors or personnel on a piece-rate basis, transportation costs, etc.

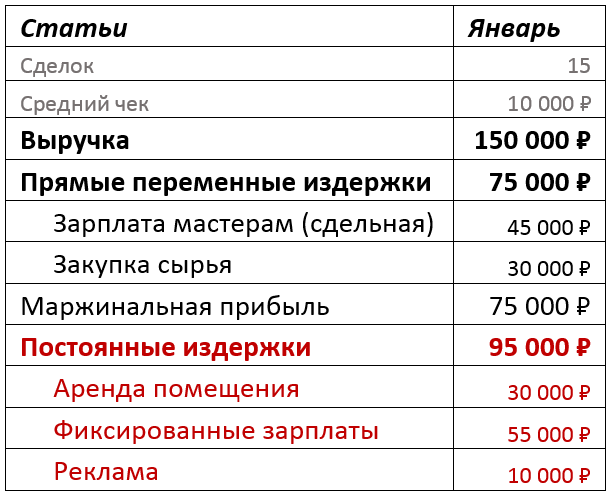

For a better understanding of all the calculations, let's consider the small furniture production Dobry Buk, which manufactures custom-made cabinet furniture. Summing up the results of the month of work, we see that, having completed 15 orders and received a revenue of 150,000 rubles, we spent 30,000 rubles on the purchase of raw materials and 45,000 rubles were paid as piecework payment to the craftsmen. These costs were directly related to the fulfillment of orders and therefore amounted to variable costs. The total amount is 75,000 rubles - or 50% of the proceeds. For clarity, we will keep a record of all amounts in an Excel spreadsheet.

Take a close look at the costs in your business and calculate the variable part. If you are engaged in trade, this will include the cost of purchasing goods. If you provide services, then most likely the payment of those who provide these services, if this payment can be accurately attributed to the fact of the provision of the service. For example, if you have a website development studio, a design studio, or any design organization, you should include all payments for the project in the variable part (an example of how the accounting of personnel payment for projects in such a company is organized is in one of our past ones).

If we subtract direct variable costs from revenue, we get an indicator called margin(or it is also called gross) profit. This is an important indicator that speaks about the effectiveness of the business, so it is important to consider it. If you have several lines of business, calculate the marginal profit for each of them, evaluate and compare them by this parameter.

In Dobry Buk, the marginal profit is 75,000 rubles. Expressed as a percentage of revenue, marginal profit is called - marginality. In our example, it will be equal to 50%. The calculation of marginality is useful for us to determine the break-even point.

fixed costs

Obviously, in addition to the expenses that are included in the variable part, the company may have other expenses: renting an office, warehouse or production space, fixed salaries for employees, a bank account, advertising their goods or services. All of these are fixed costs. They are also called indirect fixed costs, that is, those business costs that cannot be directly attributed to the sale of a specific product, batch, service or project. And these expenses are called fixed because, if in some month you have not concluded a single contract, you will in any case pay a salary to an accountant, pay for an office, etc.

Let's see what fixed costs our company Dobry Buk has. It took 30,000 rubles to rent the premises, the salaries of the craftsmen and the head of the company amounted to 55,000 rubles in total, and another 10,000 rubles were spent on advertising. Total fixed costs in the reporting month were 95,000 rubles or 63.3% of revenue. Let's put everything in a table:

Break even

Now that we have information about variable and fixed costs, we can calculate the break-even point.

The break-even point is the amount of sales at which the business does not earn anything, but does not operate at a loss. This is achieved by ensuring that all 100% of the revenue received from customers for this volume of orders covers variable and fixed costs, but nothing remains for profit. The break-even point can be expressed in money (cash equivalent) or the number of orders (natural equivalent). For most small businesses, the break-even point is best calculated on a monthly basis.

The formula for calculating the break-even point is quite simple: to determine the break-even point, you need to divide the fixed costs by the margin.

Break Even Point = Fixed Costs / Marginality

Recall that marginality is the ratio of the difference between revenue and variable costs to revenue, expressed as a percentage.

Marginality = (revenue - variable costs) / revenue × 100

Let's calculate the break-even point for our company.

Step 1. Marginality \u003d 150,000 rubles (revenue) - 75,000 rubles (variable costs)) / 150,000 rubles (revenue) x 100% = 50%

Step 2. Break even point = 95,000 rubles (fixed costs) / 50% (margin) = 190,000 rubles.

So, the break-even point for our company is 190,000 rubles in monetary terms. It is this amount of revenue that you need to receive in order not to work at a loss at the current level of costs.

Obviously, Dobry Buk was operating at a loss this month: the number of received orders did not bring the required amount of revenue to cover all expenses.

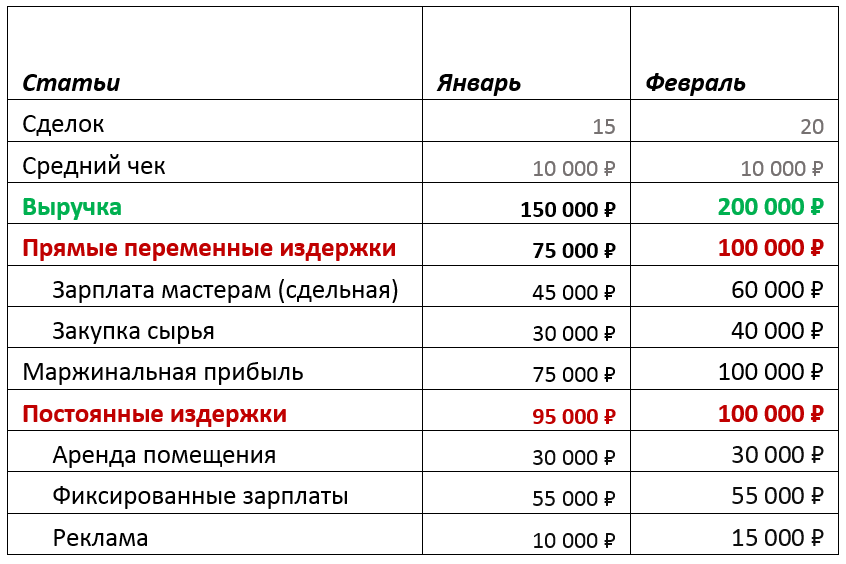

Let's try to change the situation by increasing the advertising budget in order to attract more orders. Suppose we increase the advertising budget by 5,000 rubles and as a result we will receive 5 more orders. This action will increase fixed costs this month, but will also lead to more orders and give an increase in revenue up to 200,000 rubles. If we keep the same level of marginality, we get the following structure of expenses and income:

Once again, calculate the break-even point for February:

TB = 100,000 rubles (fixed costs) / 50% (margin) = 200,000 rubles.

In total, in the current conditions, with a revenue of 200,000 rubles, our production will reach the break-even point.

The break-even point can be represented not only in terms of money, but also in terms of natural equivalent. For Dobry Buk, this will be the number of received transactions (orders) equal to 20 with an order amount of 10,000 rubles.

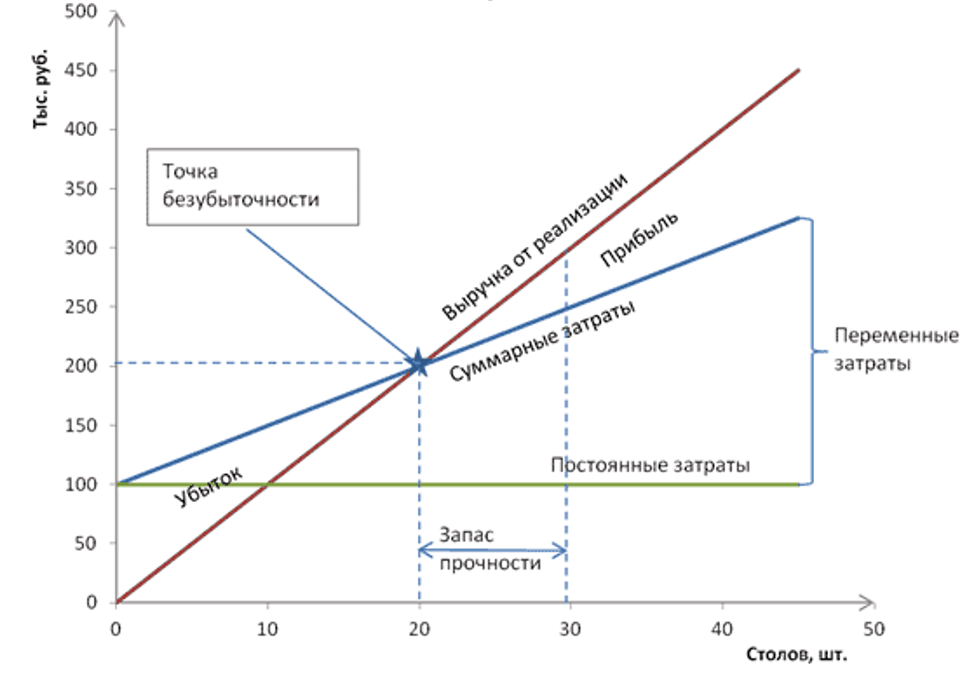

In addition, the analysis of the break-even point can be carried out in the charts. If we plot the amount of revenue on the y-axis, and the number of products / orders on the abscissa, we will get a graph illustrating the ratio of revenue, fixed and total costs (variables + fixed).

The break-even point on the chart is the intersection point of revenue and total costs.

The graphs show how the difference between revenue and total costs changes with an increase in the number of orders. This difference is the operating profit of the organization.

Knowing the break-even point, you can manage your business: increase sales, increase the average check, change something in variable and fixed costs, etc. The higher the revenue from the break-even point level, the greater the margin of safety for the business, and the more stable it is.

The main sustainability factor is the level of fixed costs. If it is large, the business needs a large turnover to cover it. If it does not have a lot of fixed costs, then the company will not receive losses when revenues fall. This fact is understood by all entrepreneurs, but not everyone can express it in specific numbers for their business.

Knowing the break-even point is important and useful: you can determine at any time whether a business has attracted the necessary volume of orders or sales to meet its needs or not. And if not, how much is left for him to sell in order to make a profit.

Conclusions: what gives knowledge of the break-even point

- It is easier to determine at what prices to sell goods or services, based on costs;

- It is easier to plan the volume of sales at each specific point in time and answer the question “How much do you need to sell to break even?”;

- You can monitor the change in the break-even point to find bottlenecks in the business;

- You can analyze the stability of the company in numbers.

Ready-made business plan with calculations using the example of a web studio

Ready-made business plan with calculations using the example of a web studio Registration of an internal memorandum: sample document and drafting rules

Registration of an internal memorandum: sample document and drafting rules Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages

Break even. Formula. Example of model calculation in Excel. Advantages and disadvantages Advance report is ... Advance report: sample filling

Advance report is ... Advance report: sample filling How to stitch documents with threads by hand?

How to stitch documents with threads by hand? Disciplinary sanction for non-fulfillment of official duties

Disciplinary sanction for non-fulfillment of official duties Binding your book

Binding your book