Personal account bps bank belarus. Internet banking of BPS-Sberbank. Interesting features, extensive functionality. What are the benefits of Internet banking

Hello friends. I decided to devote today's topic to the possibilities of Internet banking.

Internet banking Is a tool that allows you to carry out non-cash payments through your personal account.

A prerequisite for connecting Internet banking is the availability of the Internet, and a device with which you can enter your virtual bank (computer, smartphone, tablet, etc.)

The main advantages of internet banking are:

- Balance check anytime, anywhere.

- Instant payment of personal bills. (Payment, utilities, mobile communications, internet and more.)

- Transfer of funds from card to card without leaving home or in a place convenient for you.

- Payment of loans.

- Connection additional services(SMS - banking and SMS-notification, TV-banking) without going to the bank.

- There is no need to go to the bank or ATM and stand in line to complete the above operations.

How to connect Internet banking?

To connect to Internet banking, you just need to contact your bank with a passport.

After visiting the bank, you need to go to the bank's website and register.

registration on the website

- We go to the site http://www.bps-sberbank.by

- In the right corner, click the Internet banking button

- In the window that opens at the top right, select register.

- Next, enter your personal passport number, come up with and enter your username and password

- After entering the credentials (username, password and passport number), click continue. The system must authorize and register you.

- Go to the main page of the site, click on the Internet banking button in the right corner and enter your username and password. Click to enter. We go to the main page of our virtual bank.

- After we went to the main page of our "personal bank", we need to activate our card (s) so that we can first pay for Internet banking services, and then for making payment transactions. I already have one main card activated. For example, I activate another card with the initial card number 41 and the final 41. To activate the card, go to the action with cards tab.

- All your cards will be displayed in this tab. At the moment I already have one card active. Now I will show, using the example of the second card, how it can be activated. To activate the card, select the card we need (by clicking on it) and press the activate button.

- Next, an electronic application form for card activation will open. Here we click to continue.

- In the next window, your details will open, which you will need to confirm by entering the session key. Session Keys issued by a bank employee upon activation of the service.

- After entering the session key, press the button send to the bank and after a while the card should become active. After 3-5 minutes, go to the main page tab and make sure that our card is active.

As you can see from the picture, our map has become active.

As you can see from the picture, our map has become active. - Next, we need to pay for Internet banking services. Go to the Internet banking tab.

Here the system offers us two payment options: for 6 months and for 12. Choose the option that suits you best and click on it. Next, we follow the prompts of the system.

After paying for Internet banking services, we can proceed to other payment transactions.Payment of utility services

Most of us pay monthly utility bills for following formula Water + Light + Gas + ZhES + Phone + Internet = A certain amount. Here we will look at how you can pay for all these services through Internet banking. I will show on the example of the city of Baranovichi.

To pay for utilities you need:1. Click on the tab Payments - payment for services.

2. Open the tab System "Settlement" (ERIP)

2. Open the tab System "Settlement" (ERIP)  3. (a.) Payment for the phone, Internet, ZALA is made by selecting the Beltelecom tab in the menu (click). Next, in the list that opens, we need to select your place of residence. I have the city of Baranovichi, so I choose the line Brest and Brest region.

3. (a.) Payment for the phone, Internet, ZALA is made by selecting the Beltelecom tab in the menu (click). Next, in the list that opens, we need to select your place of residence. I have the city of Baranovichi, so I choose the line Brest and Brest region.  Further, depending on what we need to pay, select the desired line. If we pay for the Internet or ZALA, then the system will ask you to enter the contract number and the amount of payment. If we pay for the phone, you will be asked to enter the phone number. Next, the payment amount should appear. If it is absent, then the phone has already been paid for or the bases have not been formed yet. Therefore, I recommend making payments after the 15th.

Further, depending on what we need to pay, select the desired line. If we pay for the Internet or ZALA, then the system will ask you to enter the contract number and the amount of payment. If we pay for the phone, you will be asked to enter the phone number. Next, the payment amount should appear. If it is absent, then the phone has already been paid for or the bases have not been formed yet. Therefore, I recommend making payments after the 15th.3. (b) Payment of the remaining payments (gas, water, electricity, housing and communal services) is made by choosing your location (place of residence) from the main list. For Baranovichi it looks like this: Brest region - Baranovichi - Utility bills.

Next, open the tab communal payments

Next, open the tab communal payments Consider payment for housing services. To do this, open the HREU tab

Consider payment for housing services. To do this, open the HREU tab  Next, go to the Housing and utilities tab

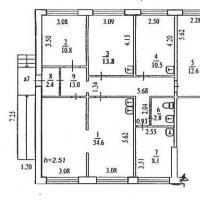

Next, go to the Housing and utilities tab  Here we enter our personal account. The personal account can be viewed on the receipt paid at the bank or by mail. Click to continue.

Here we enter our personal account. The personal account can be viewed on the receipt paid at the bank or by mail. Click to continue.  If your account is correct, you must additional information the city, address of residence, your last name, first name, patronymic, as well as the amount to be paid will be displayed. Click continue. Next, you will need to confirm the entered data and the payment process can be considered completed, you can proceed to pay the following invoices.

If your account is correct, you must additional information the city, address of residence, your last name, first name, patronymic, as well as the amount to be paid will be displayed. Click continue. Next, you will need to confirm the entered data and the payment process can be considered completed, you can proceed to pay the following invoices.  Attention

Attention

Internet banking from BPS-Sberbank is a special online service with which you can remotely monitor your account status, carry out certain banking transactions, and so on. The functioning model of the BPS of Internet banking is as follows - the bank stores all data about the client on its server, and the client uses the Internet to connect to this database, enters his personal account and performs all the operations that the bank allows to carry out.

What are the benefits of Internet banking

Internet banking has the following advantages:

- To carry out most of the transactions, you do not need to visit the bank - it is enough to have access to the Internet. After all, there may be a long queue at bank branches, and the bank branch itself may be far from home. With the help of Internet banking, you can carry out a large number of operations (transferring money, paying for utilities, etc.) in a few clicks.

- A large number of services with which you can pay for various services. Using internet banking, you can pay for electricity, water, gas, telephone, internet and so on.

- Instant card blocking. If a customer's card is stolen, then he can quickly enter his personal account and block it so that an attacker cannot use the card.

- Reliable protection against hacking using SSL-protocol. Using this protocol, Internet scammers will not be able to hack into your computer and transfer your money to their account.

Where and how to connect BPS Internet banking

The BPS Internet banking connection looks like this:

- You go to the nearest branch of BPS-Sberbank with a passport and write an application for connecting to Internet banking.

- You are offered a service connection agreement; if you agree with it, then you sign it.

- You will be given a username and password with which you can enter the site.

- In some cases, you will also have to contact the Certification Center for Digital Certificates of the Bank to obtain and install crypto protection tools.

How much does Internet banking cost

You can connect Internet banking for the following fee:

- Connecting a client to the Internet banking system with the provision of an electronic key carrier - 25 Belarusian rubles, without providing an electronic key carrier - 12 Belarusian rubles.

- The monthly fee for using the service is 12 Belarusian rubles.

- Activation of the service of SMS-notifications during operations with the card - 3 Belarusian rubles.

- The monthly fee for using the SMS notification service is 3 Belarusian rubles and 50 kopecks.

Conclusion

With the help of Internet banking, you can carry out banking transactions using the Internet. Among the main advantages of Internet banking are simplicity, a large number of additional services, and a high degree of protection against unauthorized access. To activate the service, you need to contact the BPS-Sberbank branch and sign an agreement, as well as install a special program on your computer that will protect your computer from unauthorized access. It costs 12 or 25 Belarusian rubles to connect to Internet banking, and the monthly fee is 12 Belarusian rubles.

Internet banking BPS-Sberbank is a special service that allows you to remotely control your account and conduct various banking operations.

What is the advantage of Internet banking BPS-Sberbank?

This service has a number of undeniable advantages:

- there is no need to make a personal visit to a bank branch and stand in lines for most transactions, the main thing is to provide access to the Internet. Branches are not always close to home, so the service saves time;

- through this service, you can transfer money, pay for communal services, including water, electricity, communications, the Internet, etc.;

- you can instantly block the card if it is lost or stolen;

- your personal account is reliably protected from online fraudsters by the SSL protocol.

How to connect the service?

To connect Internet banking, you need to contact the nearest bank branch. You need to have your passport with you. An employee of the department will offer you to write an application for connecting the service. Your further actions:

- get acquainted with the contract for connecting the service, if everything suits you, and there is no doubt, put your signature under it;

- a bank employee gives you a username and password to enter the system;

- if you need to install crypto protection tools, you will need to contact the Certification Center for Digital Certificates at the bank.

How to pay for services through BPS-Banking?

To pay for services through BPS Banking, you need to go to your personal account, select the Payments and Transfers section in the horizontal menu, select the service for which you need to pay from the list. Let's give an example for clarity:

- choose "Health Insurance";

- in a new window, select the type of payment, for example, "Payment of the first part of the insurance premium";

- now you need to select the card from which the payment will be charged, and enter the short name of the organization that entered into the DSMR agreement;

- enter the required amount in the name of the payer, click "Next";

- check the correctness of the entered data, enter an additional password and click "Pay".

In a new window, a check card is formed, which can be printed, sent by e-mail or saved in PDF format. If desired, this payment can be added to the "Fast Payments" section by clicking the appropriate button.

Registration of a personal account

To register a personal account, you need to go to the address bps-sberbank.by and in the horizontal toolbar, click the extreme tab "Sberbank-online". In the new window in the side menu, select the "Registration" section. Enter the address in the registration form Email, mobile phone, Full name and press the "Continue" button.

We are testing self-service systems of Belarusian banks. Today we will evaluate the work of Internet banking from BPS-Sberbank.

Data registration and recovery

There are two ways to register in the system. The first one is if you are already a client of the bank and you have some kind of product, for example, a card or a deposit.

In my case, it's a map. To register, I needed a passport and a mobile phone, which received an SMS code for confirmation.

The second way to use the BPS-Sberbank service is to register in the guest account. You do not need to be a bank client to complete it. For this form of registration, you only need SMS - confirmation.

A feature of the guest mode is the ability to pay for some services using cards from other banks, but today we will consider full version systems.

If you forgot your username or password, then you just have to register again. However, there is one drawback - you cannot leave the previous login, the system will say that it is already taken, you will have to come up with a new one :(

Functional

This is how the main page of the Internet bank looks like. On it you will find all your issued products: cards or deposits.

Now let's take a closer look at "Personal menu"... The first service is "Operations history".

Here you can view transactions for any period, both for all cards, and for any one.

I really liked the ability to manage payments, you can also find it in the side menu. This is where your payments are stored, which can be renamed, deleted and grouped into various folders ...

Also, let's not forget that for all services, for example, payment for the phone or the Internet, you can set up automatic payment. However, this service is paid.

Perhaps one of the most interesting sections of the system is PF manager which can be found in the section "My finances"... The financial assistant will analyze all your income by cards, accounts and even loans :)

"Payment sheets"- undoubtedly a useful function, but it will only come in handy if the organization in which you work concludes a special agreement with the bank.

For example, you can change your login password or choose a convenient way to confirm transactions.

A pleasant surprise was the ability to customize the visibility of the products. For example, if you do not want to overload the main page, then you can leave only one main card, and hide deposits and loans.

Setting of limits is also available in the Internet bank. However, I was able to set restrictions only on the countries of the transaction, the limits on the amount and quantity gave me an "error" :(

In the next subsection - "My statements"- you can track certificates, loan applications, view concluded insurance contracts, and also find out the status of their execution.

Now let's go through the main sections. First - "Payments and transfers".

But the most unusual thing is the ability to pay with the cards of other banks. Moreover, you can pay for services in the ERIP system, as well as replenish deposits, and repay an overdraft, and even make transfers :)

At first glance, it is clear that translations are strong point jar. Literally any transfer options are available to you: by phone number, by card number, between cards of other banks, and even transfers in foreign currency outside Belarus :)

In chapter "Cards" you can order a card for a new account or for an existing one.

But not everything is so smooth - we did not manage to order a call and personal consultation in the system. Endless loading :(

In the section titled "Deposits and Accounts" you can choose a suitable deposit and open it without leaving your home ...

In chapter "Loans" only the application is available, but it seems not to everyone. Apparently, only the user who receives a salary on a BPS-Sberbank card can apply for a loan.

In chapter "Closed accounts" you will receive information about all the products that you have previously registered, for example, a deposit or a card account.

Personal opinion of the correspondent

In addition to the basic functions, you can find many interesting possibilities in Internet Banking, such as identifying Yandex Wallet or applying for insurance.

The functionality is extensive, especially in the translation section.

I would also like to note the presence of a PF manager and the ability to pay for services with cards from other banks.

Test result - 111 points out of 125 possible

Even more of the freshest and most interesting banking news on our channel in Telegram!

| Evaluation Criteria for Internet Banking | BPS-Sberbank | ||||

| connection | ease of connection (availability) online (immediately after registration) | 5/0 | max 12 | 5 | |

| authorization mechanism (login or password is enough to enter, or you need something else) | 2/1 | 2 | |||

| data recovery in case of loss of username and password (without visiting the bank) | 5/0 | 5 | |||

| convenience | is there any balance information on the first page? | 5/0 | max 47 | 5 | |

| is it possible to display fast payments on the first page | 3/0 | 3 | |||

| quick access to frequently used functions | 2/0 | 2 | |||

| session passwords (sms / cards) | 2 / 0 | 2 | |||

| connect / disconnect 3D Secure | yes / no 5/0 | 5 | |||

| connecting / disconnecting SMS - informing | yes / no 5/0 | 5 | |||

| the ability to manage limits | yes / no 5/0 | 5 | |||

| is there any information on tariffs and commissions on the card | yes / no 5/0 | 5 | |||

| list of card transactions in the "day to day" mode | 5/0 | 5 | |||

| the ability to change the PIN | 10/0 | 0 | |||

| Functionality | payments | the ability to create an auto payment | 1/0 | max 42 | 1 |

| the ability to create a list of your payments | 3/0 | 3 | |||

| free payment function | 5/0 | 5 | |||

| the ability to rename your payments (templates) | 2/0 | 2 | |||

| are there any checks | 1/0 | 1 | |||

| you can print / forward receipts | 1/0 | 1 | |||

| you can make a repeated payment from the check | 2/0 | 2 | |||

| translations | to your bank card (without ERIP) | 2/0 | 2 | ||

| to the card of any bank in Belarus (without ERIP) | 5/0 | 5 | |||

| to the card of a foreign bank | 3/0 | 3 | |||

| personal financial manager service | yes / no | 5/0 | 5 | ||

| deposits | yes / no | 5/0 | 5 | ||

| credits | online application | 1/0 | 0 | ||

| online receipt | 5/0 | 0 | |||

| loan repayment | 1/0 | 1 | |||

| additional features | online application for card reissue | 2/0 | from 12 | 0 | |

| online application for an additional card | 2/0 | 2 | |||

| search for ATMs and branches (yes / no) | 5/0 | 5 | |||

| bank exchange rates | 3/0 | 3 | |||

| plus 2 points for each additional opportunity | insurance (+2 points), payroll (+2 points) | 4 | |||

| Feedback | is there a bank phone (yes / no) | 2/0 | max 12 | 2 | |

| there is online - support in real time, chat (yes / no) | 10/0 | 10 | |||

| personal opinion | general impression | no points | |||

| Maximum points | 125 | 111 | |||

With the development of the banking sphere of activity, the Internet banking service has become widespread. Sberbank offers its customers a convenient system that allows them to make payments, transfers and many other operations without leaving home. Those who want to always have a bank at hand should get internet banking.

What is the Internet banking service from Sberbank? This feature allows the customer to carry out most of the banking operations that previously could only be performed through a bank branch or ATM. Internet banking is available today to receive login via Personal Computer or an app on your phone.

Internet banking BPS Sberbank was transformed in 2015 into Sberbank online, which is operating today.

How to connect Internet banking BPS Sberbank?

To connect the Sberbank Internet banking service, you must contact any bank branch. It is worth having a passport with you, since when filling out an application for connecting the service, you will need to fill out a questionnaire in which the client's data are indicated.

To get access to Internet banking, you must:

- Show up at the Sberbank branch with a passport.

- Contact the cashier or the employee responsible for the connection.

- The bank employee will draw up an application for connecting the Internet banking service to the client. You must sign this statement.

- After the application is drawn up, an SMS notification will come that the Internet banking service is connected.

To access the Internet banking service, you must have a connected service Mobile bank to receive SMS notifications.

Internet banking is connected to one Sberbank card, even if the client has several of them. However, he will be able to receive information about all the cards online.

How to register with BPS Sberbank Internet banking?

To register in the BPS Internet banking system of Sberbank, you just need to submit an application for connection at a bank branch. After carrying out all the procedures, the user will be automatically registered in the system and will be able to use the Internet banking service. However, the initial username and password are set automatically and are not considered secure. In order for the use of Internet banking to become completely safe, it is better to change the username and set a new user password when you first enter your personal account.

Internet banking BPS Sberbank: payment for services

Any user can pay for services through the BPS Internet banking system. To do this, you need to enter your personal account by entering your username and password, as well as an SMS code. Since 2015, BPS Internet banking has been transformed into the Sberbank online system with improved protection using SMS notifications. That is why, when paying for each service, SMS confirmation will be sent to the user's phone.

To pay for services using BPS Internet banking, you must:

- Log in to your personal Internet banking account.

- Select the Transfers and Payments tab.

- Go to the item of the type of payment for services that you need.

- Enter the details of the recipient and the amount of payment.

- Click the Finish button.

- Confirm the correctness of the operation by SMS with a password.

- Receive a receipt for payment online.

It is necessary to correctly and accurately enter the payment details and be sure to check them before sending funds.

Thus, every client of the bank can connect Internet banking BPS Sberbank. All you need to do is have a phone number, a Sberbank card and a passport. Connection is free of charge. Availability personal account in such a system allows you to pay for services, transfer cash and perform a lot of banking operations from your own computer or phone.

What you need to open a hookah lounge, and how to do it correctly

What you need to open a hookah lounge, and how to do it correctly How to start a business and choose donut equipment

How to start a business and choose donut equipment Opening a company in Montenegro Open a company in Montenegro

Opening a company in Montenegro Open a company in Montenegro The carpentry shop as a business

The carpentry shop as a business How to choose a business direction?

How to choose a business direction? Sample business plan of a dental office

Sample business plan of a dental office Five best business ideas that brought millions What business to open so as not to go bankrupt

Five best business ideas that brought millions What business to open so as not to go bankrupt