Determine the cost of marketable products in the planning period. Cost of marketable products. Analysis of production maintenance and management costs

this work Determine the cost of marketable products in the planning period. Cost of marketable products (Control) by subject (AHD and the financial analysis), was custom-made by the specialists of our company and passed its successful defense. Work - Determine the cost of marketable products in the planning period. The cost price of commercial products on the subject of AHD and financial analysis reflects its topic and the logical component of its disclosure, the essence of the issue under study is revealed, the main provisions and leading ideas of this topic are highlighted.

Work - Determine the cost of marketable products in the planning period. The cost of commercial products, contains: tables, figures, the latest literary sources, the year of delivery and protection of the work - 2017 In work Determine the cost of commercial products in the planning period. The cost price of commercial products (AHD and financial analysis) reveals the relevance of the research topic, reflects the degree of development of the problem, based on a deep assessment and analysis of scientific and methodological literature, in the work on the subject of AHD and financial analysis, the object of analysis and its issues are comprehensively considered, both from the theoretical and practical sides, the goal and specific tasks of the topic under consideration are formulated, there is the logic of the presentation of the material and its sequence.

Topic9 « Costsproduction and production cost "

Objective 1.

There are 25 sewing machines in the sewing workshop. Power of each 3.2 kW. The power utilization factor for 15 sewing machines is 0.92, for 10 machines it is 0.87. The price of 1 kWh of electricity is 2.4 rubles. Equipment downtime for repairs - 7%. Sewing machines work in 1 shift lasting 8 hours. The number of working days per year - 250. Determine the amount of annual costs under the item "electricity for technological purposes".

Solution

1. The total power of all machines:

(15 0,92 + 10 0,87) 3.2 = 72 kW

Electricity cost:

72 kWt 2.4 rubles / kW (1-0.07) = 160.7 rubles.

3. The sum of annual electricity costs will be:

160,7 8 1 250 = RUB 321400

Task 2

In the reporting year, the cost of marketable products amounted to 450.2 thousand rubles, the cost per ruble of marketable products amounted to 0.89 rubles. In the planned year, the cost per 1 ruble of marketable output was set at 0.85 rubles. The production volume will increase by 8%. Determine the cost of marketable products in the planning period.

Solution

1. The volume of commercial products in the reporting period:

![]() rub.

rub.

2. The volume of commercial products in the planning period:

3. The cost of marketable products in the planning period:

Objective 3.

The prime cost of marketable products of the enterprise in the base period amounted to 380.5 thousand rubles. In the reporting period, it is planned to increase labor productivity by 6% and average wages by 4%. The production volume will increase by 8%. As a result of measures to reduce costs, fixed costs in the planning period will remain unchanged. The share of wages in the cost of production is 23%, fixed costs - 20%. Determine the percentage of cost reduction of marketable products and cost savings at the enterprise.

Solution

1. Decrease in production costs as a result of growth in labor productivity and an increase in wages in percentages:

![]()

2. Decrease in cost as a result of an increase in production volume with a constant value of fixed costs:

![]()

3. Reducing the cost of marketable products due to both factors:

![]()

4. savings from reducing production costs:

![]() rub.

rub.

Problem 4

According to the reported data, savings in material costs have been established. As a result of compliance with the economy regime, the consumption rates of materials have been reduced by 8%. As a result of inflation, prices rose by 3%. The prime cost of marketable products according to the report was 120.6 thousand rubles, the cost of raw materials and materials - 80.8 thousand rubles. Determine the reduction in the cost of marketable products as a result of the influence of these factors.

Solution

1. The share of material costs in the cost of production:

![]()

2. Change in the cost of marketable products:

Problem 5

The company has entered into a long-term contract for the annual supply of 1.5 million items. Contractual obligations can be secured in one of two ways.

1. Purchase of equipment with a capacity of 2 million items per year.

2. Purchase of two pieces of equipment with a capacity of 0.8 million items per year.

The cost of production of one product for each option at 100% equipment load is shown in the table.

Determine the best of the options according to the criterion of production cost.

Solution

|

Indicators |

Variants |

|

|

1.Usage production capacity |

|

|

|

2. Conditional variable costs, rubles / t. |

||

|

3. Conditionally fixed costs, rubles / t. |

|

|

|

4.Total cost |

||

The second option is the best at cost price.

Tasks for independent solution.

Task 6.

Determine the planned and actual level of costs per ruble of marketable products, as well as its change as a percentage of the reporting period, if the enterprise produces 17 thousand items per year at a cost price of 540 rubles / unit. the plan for the coming period provides for an increase in production by 10% and a decrease in production costs as a result of the introduction of resource-saving technologies by 5%. Product price - 600 rubles / unit.

Task 7.

The enterprise manufactures products “A” - 7000 units, “B” - 4500 units, “C” - 2500 units. The sum total production costs the estimate is 90,960 million rubles. General operating expenses according to the standard amount to 140% of the wages of production workers. The salary for one product will be, respectively, by type of product: - 4300 rubles, 4000 rubles, 3500 rubles. Determine the general production and general business costs for one product and the total amount of general business costs.

Task 8.

The prime cost of marketable products of the enterprise in the base period amounted to 496 thousand rubles. In the reporting period, it is planned to increase labor productivity by 8% and average wages by 3%. The volume of production will increase by 15% as a result of increased demand. As a result of measures to reduce costs, fixed costs in the planning period will remain unchanged. The share of wages in the cost of production is 28%, fixed costs - 45%. Determine the percentage of cost reduction of marketable products and cost savings at the enterprise.

Problem 9.

In the reporting year, the cost of marketable products amounted to 4978 thousand rubles, the cost per ruble of marketable products amounted to 0.85 rubles. In the planned year, the cost per 1 ruble of marketable output was set at 0.92 rubles. The production volume will increase by 12%. Determine the cost of marketable products in the planning period.

Problem 10.

It is planned, as a result of the introduction of resource-saving technology, to reduce the consumption rate of materials by 5% with a simultaneous increase in prices for materials as a result of inflation by 3%. The prime cost of commercial products is 300 thousand rubles, including the cost of raw materials and materials in the prime cost is 58%.

Practical lesson № 10

State budget educational institution

middle vocational education

"College of Communications No. 54"

Panina Daria Viktorovna

economics teacher

ECONOMY OF THE ORGANIZATION

Topic: "Calculation of the cost of a unit of income"

Lesson topic :Task execution time: 90 minutes.

Purpose of the lesson: calculate the cost, calculation, cost structure, individual cost items, savings from cost reduction

The list of tools used in the performance of work: Teacher's handout (tasks).

Main sources of used literature:

V. D. Gribov, V. P. Gruzinov, V. A. Kuzmenko Economics of the organization (enterprise) - tutorial- 5th ed., Erased. - M: KNORUS, 2012 - 408 p.

L. N. Chechevitsyna, O. N. Tereshchenko Workshop on Enterprise Economics - Ed. 2nd, Rostov-on-Don: Phoenix, 209 .-- 250s.

- to group costs according to various criteria, calculate the cost price, calculation, cost structure, separate cost items, savings from cost reduction.

Practical part: Problem solving - 70 minutes

Methodical instructions:

Cost of products (works, services)

- these are the costs (production costs) expressed in monetary form for the means of production consumed in the manufacture of products, wages of workers, services of other enterprises, costs of selling products, as well as costs of managing and maintaining production, i.e. these are the costs of the enterprise, expressed in monetary terms, for the production and sale of products (works, services).

Grouping of costs by costing items.

№ p / p

Problem number 1.(sample)

Product A release - 500 units, material costs per unit. ed. - 120 rubles, basic salary for the annual release - 130,000 rubles, additional salary - 10%, payroll - 26%. Product B release - 250 units, material costs per unit. ed. - 380 rubles, basic salary for the annual issue - 80,000 rubles. General operating expenses for ed. A - 50%, according to ed. B - 35% of direct costs. Non-production costs by ed. A - 5%, according to ed. B - 7% of the production cost. Solution: МЗ (А) = 500 units. x 120 rubles. = 60,000 rubles; MZ (B) = 250 units. x 380 rubles. = RUB 95,000

Зз / п (А) = (130,000 + 10%) + 26% = 180 180 rubles; Зз / pl (B) = (80,000 + 10%) + 26% = 110,880 rubles.

Zpr (A) = 60,000 rubles. + 180 180 rub. = 240 180 rubles. Zpr (B) = 95,000 rubles. + 110 880 rub. = 205 880 rubles.

Ptot. (A) = 240 180 rubles. x 50% = 120,090 rubles. Ptot. (B) = 205 880 rubles. x 35% = 72,058 rubles.

Spr (A) = 240 180 rubles. + 120,090 rub. = 360 270 rubles. Spr (B) = 205 880 rubles. + 72 058 rub. = 277 938 rubles. Zvnepr. (A) = 360 270 rubles. x 5% = 18013, 5 rubles. Zvnepr. (B) = 277 938 rubles. x 7% = 19,456 rubles.

7. Total cost: Cn (A) = 360 270 rubles. + RUB 18,013.5 = 378,283.5 rubles. Cn (B) = 277,938 rubles. + 19 466 rub. = RUB 297 394 Problem number 2.(sample)

In the reporting year, the cost of production for post offices amounted to 450.2 million rubles, which determined the cost of 1 rubles. products - 0.89 rubles. In the planned year, costs per 1 rub. products are set at 0.85 rubles. The volume of production will be increased by 8%. Determine the cost of production for the planned year.

Solution:

Vtp = Stp / Z1rtpVtp (report) = 450.2 million rubles. / RUB 0.89 = 505, 843 million rubles.

Vtp (pl) = 505.843 million rubles. + 8% = 546.31 million rubles.

Stp = Vtp x Z1rtp;

Stp = 546.31 million rubles. x 0.85 rubles. = RUB 464.364

Practical lesson

Lesson topic : Solving situational tasks for calculating the cost and the percentage of cost reduction per unit of incomeHandout:

Problem number 1. Determine the total cost of product A and product B for post offices.Problem number 2.

Problem number 3. Problem number 4.

Problem number 5.

№ p / p

Answers to tasks.

Problem number 1.Determine the total cost of product A and product B for post offices. Product A release - 150 units, material costs per unit. ed. - 370 rubles, basic salary for the annual release - 850,000 rubles, additional salary - 10%, payroll - 26%. Product B release - 800 units, material costs per unit. ed. - 540 rubles., Basic salary for the annual issue - 960,000 rubles. General operating expenses for ed. A - 60%, according to ed. B - 45% of direct costs. Non-production costs by ed. A - 2%, according to ed. B - 5% of the production cost.

Solution: 1. The total cost of goods for post offices is determined as the sum of all items of costs for the production and sale of products. First, let's determine the material costs: МЗ (А) = 150 units. x 370 rubles. = 55,500 rubles; MZ (B) = 800 units. x 540 rubles. = 432,000 rubles. 2. Let's calculate the labor costs: Зз / п (А) = (850,000 + 10%) + 26% = 1,178,100 rubles; Зз / pl (B) = (960,000 + 10%) + 26% = 1,330,560 rubles.

3. Direct costs for products: Zpr (A) = 55,500 rubles. + 1 178 100 rubles. = 1 233 600 rubles. Zpr (B) = 432,000 rubles. + 1 330 560 rub. = 1 762 560 rubles.

4. General operating expenses: Ptot. (A) = 1 233 600 rubles. x 60% = 740 160 rubles. Ptot. (B) = 1,762,560 rubles. x 45% = 793,152 rubles.

5. Production cost: Spr (A) = 1 233 600 rubles. + 740 160 rub. = 1 973 760 rubles. Spr (B) = 1,762,560 rubles. + 793 152 rub. = 2 555 712 rubles.

6. Non-production costs: Zvnepr. (A) = 1 973 760 rubles. x 2% = 39,475.2 rubles. Zvnepr. (B) = 2 555 712 rubles. x 5% = 127,785.6 rubles.

7. Total cost: Cn (A) = 1 973 760 rubles. + 39 475,2 rub. = RUB 2,013,235.2 Cn (B) = 2 555 712 rubles. + 127,785.6 rubles. = 2 683 497.6 rubles.

Problem number 2.

In the reporting year, the cost of production for post offices amounted to 580.2 million rubles, which determined the cost of 1 rubles. products - 0.75 rubles. In the planned year, the cost of 1 rub. products are set at 0.70 rubles. The volume of production will be increased by 6%. Determine the cost of production for the planned year.

Solution:

- Costs per 1 rub. products are defined as the ratio of the cost of marketable output to the volume of production in value terms, therefore, to determine the volume of marketable output, it is necessary to calculate the ratio of the cost of production to costs per 1 ruble. marketable products:

Vtp (report) = 580.2 million rubles. / 0.75 rub. = 773, 60 million rubles.

2. Determine the volume of marketable products in the planned year:

Vtp (pl) = 773.60 million rubles. + 6% = 820.016 million rubles.

3. The cost of marketable products is defined as the product of the volume of marketable products and costs per 1 ruble. marketable products:

Stp = Vtp x Z1rtp;

Stp = 820.016 million rubles. x 0.70 rubles. = 574.011 million rubles.

Problem number 3.

Determine the production cost of the product if:

- the cost of materials - 8000 rubles. basic salary for a product - 300 rubles. additional wages - 10% payroll charges - 26% costs for the maintenance and operation of equipment - 5% of direct costs shop costs - 120% of the costs of equipment maintenance general expenses - 40% of shop costs.

- Let's define direct costs:

- Let's determine the costs for the maintenance and operation of the equipment:

- Determine the shop floor costs:

- Let's determine the production cost of the product:

Problem number 4.

Determine the total cost of the product, if the material consumption per unit of the product is 40 kg, the price of 1 ton is 1500 rubles, waste - 2 kg - are sold at the price of 2000 rubles. per 1 ton. The basic wages of production workers for one product - 20 rubles, additional wages - 10%, payroll charges - 26%. Expenses for the maintenance and operation of equipment - 120 rubles. for one product. Workshop costs - 30% of the cost of basic wages, general operating costs - 50% of the workshop costs. Non-production costs - 100% of general operating costs.

Solution:

- Let's determine the cost of materials:

- Let's determine the cost of returnable waste:

- Let's define additional wages:

- Let's define payroll charges:

- Let's define direct costs:

- Determine the shop floor costs:

- Let's define general expenses:

- Let's define the non-production costs:

- Let's determine the total cost of the product:

Problem number 5.

Determine the total cost of the product, the cost of the entire issue, manufactured in a quantity of 200 units, using the data in the table:

№ p / p

Solution:

№ p / p

The plan for the cost of production is one of the most important sections of the plan for the economic and social development of the enterprise. Planning the cost of production in an enterprise is very important, as it allows you to know what costs the enterprise will need to produce and sell products, what financial results can be expected in the planning period. The plan for the cost of production includes the following sections:

1. Cost estimate for the production of products (compiled by economic elements).

2. The cost price of all marketable and sold products.

3. Planned cost estimates for individual products.

4. Calculation of the reduction in the cost of marketable products by technical and economic factors.

The most important quality indicators of the plan for the cost of production are:

cost of commodity and products sold;

unit cost of the most important types of products;

costs for 1 rub. marketable products;

percentage of cost reduction based on technical and economic factors;

percentage of cost reduction of compared products.

Production cost estimate is compiled without intra-plant turnover based on the calculation for each element and is the main document for development financial plan... It is compiled for a year with the distribution of the entire amount of expenses by quarters.

The cost of raw materials, basic and auxiliary materials, fuel and energy in the cost estimate is determined primarily by production program based on the planned volume, norms and prices.

The total amount of depreciation deductions is calculated on the basis of the current norms for groups of fixed assets. On the basis of the cost estimate, the costs for the entire gross and commodity output are determined. Production costs gross production are determined from the expression

VP = Cn - Zn.v

where Cn is the cost of production according to the estimate;

Zn.v - costs not included in the gross product.

Production costs marketable products determined by the formula

TP = VP ± (n + n),

where n is the change in the remnants of semi-finished products of its manufacture;

n - change in work in progress;

± - the increase in terms is subtracted, the reduction is added.

Cost of products sold represents the total cost of marketable products minus the increment plus a decrease in the cost of the remainder of unsold products in the planning period.

Calculation unit cost called costing. Calculations are estimated, planned, normative.

Estimate calculation compiled for products or an order that are executed on a one-off basis.

Planned Costing(annual, quarterly, monthly) is compiled for the mastered products provided for by the production program.

Standard calculation reflects the level of the cost of production, calculated according to the cost rates in force at the time of its preparation. It is compiled in those industries where there is a regulatory accounting of production costs.

Methods for planning the cost of production. In practice, the most widespread are two methods of planning the cost of production: normative and planning based on technical and economic factors. As a rule, they are used closely together.

The essence of the normative method lies in the fact that when planning the cost of production, the norms and standards for the use of material, labor and financial resources, i.e. the regulatory framework of the enterprise.

The method of planning the cost of production according to technical and economic factors is more preferable than the standard method, since it allows you to take into account many factors that will most significantly affect the cost of production in the planning period. This method takes into account the following factors:

1) technical, i.e. introduction of new equipment and technology at the enterprise in the planned period;

2) organizational. These factors mean the improvement of the organization of production and labor at the enterprise in the planning period (deepening of specialization and cooperation, improvement of the organizational structure of enterprise management, the introduction of a brigade form of labor organization, NOT, etc.);

3) change in the volume, nomenclature and range of products;

4) the inflation rate in the planning period;

5) specific factors that depend on the characteristics of production. For example, for mining enterprises - changes in mining and geological conditions for the development of minerals; for sugar factories - changing the sugar content of sugar beets.

All these factors ultimately affect the volume of output, labor productivity (output), changes in the norms and prices of material resources.

To determine the magnitude of the change in the cost of production in the planning period due to the influence of the above factors, the following formulas can be used:

a) a change in the value of the cost of production from a change in labor productivity (D CPT):

where J zp is the average wage index;

J pt - index of labor productivity (output);

J zp - the share of wages with deductions for social needs in the cost of production;

b) a change in the value of the cost of production from a change in the volume of production (D C V):

![]()

where J pack - the index of conditionally fixed costs;

J V - production volume index;

Jy п - the share of conditionally fixed costs in the cost of production;

c) a change in the value of the cost of production from changes in the norms and prices of material resources (D Sn.ts):

where J n - index of norms for material resources;

J is the price index for material resources;

J m - share material resources in the cost of production.

The total value of the change in the cost of production in the planning period will be (D C total):

We will show the methodology for planning the cost of production by technical and economic factors using a conditional example.

Example. During the reporting year, the volume of commercial products at the enterprise amounted to 15 billion rubles, its cost price - 12 billion rubles, including wages with deductions for social needs - 4.8 billion rubles, material resources - 6.0 billion rubles. Conditional fixed costs in the cost of production amounted to 50%. In the planned period, it is envisaged to increase the volume of marketable output by 15%, increase labor productivity by 10%, and average wages by 8% through the implementation of the plan of organizational and technical measures. The consumption rates of material resources will decrease by 5% on average, and their prices will increase by 6%.

Determine the planned cost of commercial products and the planned costs for 1 ruble. marketable products.

Solution

1. Determine the cost of 1 ruble. marketable products in the reporting period:

12: 15 = 0.8 rubles.

2. Let's calculate the planned costs for the release of marketable products, if in the planning period costs for 1 rub. marketable products remained at the level of the reporting period:

15 1.15 0.8 = 13.8 billion rubles.

3. Determine the amount of change in the cost of production due to the implementation in the planning period of organizational and technical measures:

a) due to the growth of labor productivity

that is, due to this factor, the cost of production will decrease by 0.8%;

b) due to changes in the volume of production

those. due to this factor, the cost of production will decrease by 6.5%;

c) due to changes in the norms and prices of material resources

those. due to this factor, the cost of production will increase by 0.35%.

The total value of reducing the cost of production due to the influence of all factors will be:

4. Determine the planned cost of production:

13.8 0.9305 = 12.84 billion rubles.

5. Determine the planned costs for 1 ruble. marketable products:

12.84: 17.25 = 0.74 rubles,

where 17.25 is the planned volume of commercial products (15 x 1.15). Thus, the cost of 1 rub. marketable products decreased by 7.5% (0.74: 0.8 x 100 = 92,5%).

Go back to

The cost of marketable products includes all the costs of the enterprise for the production and sale of marketable products in the context of the estimated cost items. The cost of goods sold is equal to the cost of goods minus the increased costs of the first year mass production new products, reimbursed from the fund for the development of new technology, plus the production cost of products sold from last year's leftovers. The costs reimbursed from the fund for the development of new equipment are included in the cost of goods, but are not included in the cost of products sold.

They are defined as the difference between the planned cost of the first year of mass production of products and the cost adopted when prices were approved:

SR = ST - ZN + (SP2 - SP1),

where CP is the cost of goods sold

ST - the cost of marketable products

ZN - increased costs of the first year of mass production of new products, reimbursed from the fund for the development of new technology

SP1, SP2 - the production cost of the remains of unsold (in warehouses and shipped) products, respectively, at the beginning and end of the year.

To analyze the cost price level for various enterprises or its dynamics for different periods of time, production costs should be reduced to the same volume. The cost of a unit of production (calculation) shows the costs of an enterprise for the production and sale of a specific type of product per one natural unit. Costing is widely used in pricing, cost accounting, planning and comparative analysis.

Industrial enterprises in addition to the indicator of reducing the cost of a unit of production, they plan the cost of all marketable products in an absolute amount. When analyzing the fulfillment of the plan at the cost of commercial products, it is necessary to consider the actual consumption, identify deviations from the plan and outline measures to eliminate overspending and to further reduce costs for each item.

Evaluation of the fulfillment of the plan at the cost of all marketable products is made according to data on its actual volume and range, calculated according to the planned and actual cost the reporting year.

In general, the cost of production consists of material costs, costs of paying wages to workers and complex items of expenditure. An increase or decrease in costs for each element causes either a rise in price or a decrease in the cost of production. Therefore, when analyzing, it is necessary to check the costs of raw materials, materials, fuel and electricity, costs of wages, workshop, general plant and other costs.

The wages and salaries of production workers are recorded directly in line items. The wages of auxiliary workers are mainly reflected in the items of expenses for the maintenance and operation of equipment, the wages of employees and engineers are included in the shop and general plant costs. The wages of workers employed in auxiliary production are included in the cost of steam, water, electricity and affect the cost of commercial products not directly, but indirectly, through those complex items to which the consumption of steam, water and electricity is attributed. Therefore, the analysis of wages, first of all, is carried out according to its general fund and funds selected categories industrial production personnel of the enterprise, regardless of which items reflect this wages. After identifying the reasons that caused the change (deviation) in the payroll of certain categories of workers, it is possible to determine to what extent these deviations affected different items of the cost of production.

Reducing the cost of production is largely determined by the correct ratio of growth rates of labor productivity and growth of wages. The growth of labor productivity must outpace the growth of wages, thereby ensuring a decrease in production costs.

The indicator of costs per 1 ruble of commercial products is determined based on the level of costs for the production of commercial products in relation to the cost of products in the wholesale prices of the enterprise.

This indicator not only characterizes the planned level of cost reduction, but also determines the level of profitability of marketable products. Its value depends on both the reduction in production costs and changes in wholesale prices, assortment and quality of products.

In terms of the cost of production at the enterprise, along with the cost of 1 ruble. commercial products are available the following indicators: cost certain types products, the cost of marketable products, reducing the cost of comparable products.

Determination of the planned cost of individual types of products serves as the basis for planning production costs. The planned cost of all commercial products is calculated on the basis of data on the volume of commercial output and the planned cost of certain types of products.

Evaluation of the fulfillment of the plan at the cost of all marketable products is carried out taking into account the changes in prices for materials and tariffs for transportation and energy that occurred during the reporting year.

To determine the task for reducing the cost of comparable commercial products, a calculation of the cost for the entire range of products is drawn up based on the volume of production provided for by the plan of the enterprise and taking into account the planned indicator for the level of costs per 1 ruble. marketable products at wholesale prices.

Ways to reduce production costs

Continuous technical progress... Introduction of new technology, complex mechanization and automation production processes, the improvement of technology, the introduction of advanced types of materials can significantly reduce the cost of production.

The cost of production is characterized by indicators expressing:

A) the total cost of all manufactured products and the work performed by the enterprise for the planned (reporting) period - the cost of marketable products, comparable marketable products, products sold;

b) costs per unit of volume of work performed - the cost of a unit of certain types of commercial products, semi-finished products and production services (products of auxiliary shops), costs per 1 ruble. marketable products, costs per 1 rub. regulatory net production.

Cost reduction is planned for two indicators: for comparable marketable products; at a cost of 1 rub. marketable products, if in the total output specific gravity the production comparable to the previous year is not large. Comparable commercial products include all types of products produced in this enterprise in the previous period in mass or serial order.

![]()

Best Business Books: Ranking Popular Business Literature Authors

Best Business Books: Ranking Popular Business Literature Authors Structure of a business plan point by point: learning from clear examples

Structure of a business plan point by point: learning from clear examples How to write a business plan: step-by-step instructions with examples Budget money

How to write a business plan: step-by-step instructions with examples Budget money All about pellets: production rules, standards and quality control methods

All about pellets: production rules, standards and quality control methods Chicken leg trimming conveyor

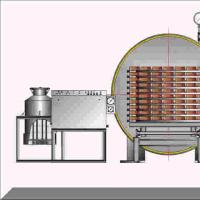

Chicken leg trimming conveyor Arrangement and construction of a drying chamber for lumber

Arrangement and construction of a drying chamber for lumber Improvement of the city, woodworking arrangement of pile foundations and pipelines Main units of machine tools

Improvement of the city, woodworking arrangement of pile foundations and pipelines Main units of machine tools