Southwestern bank sberbank guide. Board of Directors. It's the same with the banking business

The Chair South-West Bank of Sberbank appointed Evgeny Titov... Former head Victor Ventimilla Alonso went to St. Petersburg, where he will head the North-West Bank of Sberbank. The message was spread by the press service of Sberbank.

Mr. Alonso is one of the old-timers of the local banking market. He began his career in 1993 at Inkombank: for two years he headed the Rostov branch of the bank, and then became the senior vice president of the bank. From 1999 to 2009, he headed the Rostov branch of VTB, and in March 2010 was appointed chairman of South-West Sberbank.

They talked about Alonso's leaving a month ago, - commented on these rumors at the beginning of the year a source N in the banking sector, predicting that completely new person... - "Sberbank" adheres to the principle of horizontal movement of managers. This is done in order to discourage clannish management. So, in any case, it has been so far.

Interlocutor N believes that today the head of the regional Sberbank is more of an administrative figure, his powers in terms of approving new loans are seriously limited by the bank's risk assessment system. The risks of all borrowers without exception, according to him, are assessed by a subdivision in Novosibirsk, then the decision is made by Moscow.

N's interlocutors said that Mr. Alonso had a good relationship with the head of Sberbank, German Gref.

South-West Sberbank is the traditional organizer of Sberbankiada in Sochi. So, the head of the YuZB has more opportunities to communicate with the top officials of the bank than other regional heads of the bank, one of them explains. - Transfer to St. Petersburg for Alonso is a good option against the background of rumors about a possible merger of the South-West and Central Chernozem Sberbanks.

Victor Ventimilla Alonso is an intelligent person and a competent manager. For him, this, of course, is a promotion, a natural step in his career, - Kirill Zhitenev, the former head of the press service of South-West Sberbank, commented on the appointment.

His promotion is not only recognition of some merits or talents, I think that in his psychotype he is close to the current head of Sberbank, German Gref, '' one of the businessmen told the N correspondent, well knowing mr Alonso. - He never liked publicity, it's even difficult to say with whom he communicated closely from the Rostov business.

However, one can argue with the statement about the proximity of psychotypes. Any artist can envy Herman Gref's publicity: he always willingly communicates with journalists. Recently, his appearance in the form of a disabled person in one of the branches of Sberbank caused a heated discussion in the press and social networks. It is very difficult to imagine Mr. Alonso in such a situation. Information on the market position of Yugo-Zapadny Sberbank on the local market in last years so scarce that annual bank reviews N are traditionally made without taking into account Sberbank. Everyone knows that Sberbank is the largest bank in the Rostov region, but it is very difficult now to say how successfully it maintains leadership positions. Perhaps, with the arrival of Evgeny Titov, the situation will change and there will be more information about the bank's market position.

In recent years, Sberbank has been making serious efforts to automate its operations. This direction is likely to be pivotal in the work of the new leader.

In a world where almost everyone has a gadget, companies just need to be inside it. Sberbank has taken a course towards improving IT solutions. It is important to support talented employees who are ready not only to propose innovations, but also to implement them, ”Yevgeny Titov said recently at one of the events (citing the“ Golden Horn ”newspaper).

Evgeny TITOV, Chairman of the Far Eastern Bank of Sberbank of Russia, summed up the results of the first year of work in the Far East.

How successful was it, how does the # 1 bank in Russia fit itself into the regional development plans? About this "DK" talked with Yevgeny Titov.

Evgeny Viktorovich, you spent most of your life in the North Caucasus, worked in the North Caucasian bank of Sberbank of Russia. How did you perceive the Far East, can you say that it has become close to you?

If I said that in a year I became a Far East resident, it would be at least ridiculous. Of course not, but a lot has become more understandable to me, and the region itself is now closer. Before coming here, I visited many subjects of the Federation, and it seemed to me that - this is Murmansk or some Siberian city - the banking business is everywhere similar: there is uniform technologies, management principles. “Deep immersion” in the specifics of the Far East has seriously changed the paradigms of perception: a territory with a seven-hour difference in communications with the central part of Russia, high costs of logistics, energy, labor resources, etc., of course, requires a lot of efforts and costs from business.

- Is it the same with the banking business?

A characteristic feature of the regional financial market is that we have a very dense competitive environment here, there are many strong local players, especially in the retail business. And at the same time, the consumption market itself financial services limited due to the small population, customers are very demanding, so you constantly have to be in good shape and develop dynamically.

- What tasks were set for you when you were appointed to the post of chairman?

Frankly? The main task was to bring the Far Eastern Bank to the first position in the corporate rating of Sberbank of Russia. It is based on business performance indicators, the dynamics of various products and allows you to compare regional banks operating in different conditions of our vast country. At the end of 2011, the Far Eastern Bank ranked 14th - it was fourth from the bottom. We needed to ensure outstripping business growth rates, raise the level of return on assets, and achieve an increase in our market share in lending both in the corporate segment and in the retail segment.

In January I started working, and in February the First project was launched at Sberbank, which allowed me to simulate the result. We needed first places. I confess that the immersion in this project was difficult, a number of managers considered it too ambitious, I tormented the staff with strict requirements. To achieve the goals required not only more work, but also more creativity, the principle of "take more - throw further" did not pass.

- What was this creative about? What was special about the team?

The main thing is not to invent anything, but to effectively use the experience of colleagues and adapt it to our Far Eastern conditions. This practice allowed us to see in advance both the pitfalls and possible breakthrough moments.

- Did the work result suit you? Have you achieved your goals?

Our share in lending to the population in the region was 36%, corporate clients - 32%. We own 48% of the market for attracted funds from the population. At the beginning of this year, citizens kept 205.85 billion rubles with us, which is 34 billion more than a year earlier. The small business loan portfolio grew 1.5 times: from RUB 13 billion to RUB 13 billion. up to 19 billion rubles. The investment portfolio exceeded RUB 33.8 billion. With these indicators, we were able to reach the first positions in the corporate rating. Now you need to keep the bar.

Sberbank is too influential participant economic development countries, one might say, a state within a state. Does Bank # 1 have an Eastern policy?

This is an example of our participation in the APEC summit and the "Office of the Future" project, which we implemented at the FEFU site. It is small in capacity - just one office integrated into the university campus, but from the point of view of federal “winds” it is very indicative: we launched advanced technologies in Vladivostok, which are in Korea, Japan and which are not yet in Europe. This is not only our favorite Sberbash robot - a mobile payment terminal that traveled and met guests, and at the same time really served plastic card by contactless technology. Together with IBM, we tested the analysis technology on this site social networks, which makes it possible to understand the mood of our potential clients, analyze their needs.

Now this project will be broadcast throughout Russia, in Moscow the arrangement of such an office is entering the home stretch. This is a small part, as you say, of Eastern politics, but very important - the future belongs to technologies.

Of course, for Sberbank, the main topic is investment activity in the region.

Today we are not limited in resources and can participate in any large projects. Since they are not bound by a rigid limit policy, we can not split projects, but lead them from start to finish. This, by the way, is one of our competitive advantages. In the portfolio of the Far Eastern Bank of Sberbank of Russia loans for the creation of large industrial enterprises, infrastructure facilities, large shopping and leisure complexes, we are participants in almost all large-scale projects.

If we talk about geopolitical tasks, and this includes securing a permanent population in the East of the country, the Savings Bank makes, I think, a significant contribution to their solution. We provide loans to home developers and help them sell apartments through our mortgage programs. Our mortgage terms are the most loyal and diverse, this allows a wide range of citizens, including young people, to enter into it. Your accommodation and good job- these are the main conditions for life in the region.

We have several social projects, in which we participated on the principles of public-private partnership. PPP allows you to build not only production and infrastructure facilities, but also social ones. On Sakhalin, for example, in cooperation with the regional administration, construction company and the bank has already built 7 kindergartens. This is the social infrastructure that the Far East desperately needs, and we will develop this experience.

Well, given the border position of the Far East, I would single out a large arsenal of tools for servicing foreign trade activities that Sberbank offers. We are the main player here. The guarantees of Sberbank, which has world ratings, open access to cheaper resources of foreign banks, provide additional insurance for entrepreneurial risks in transactions, and convenient payment terms for contracts. These capabilities of the bank are most in demand in cooperation with Chinese partners, less Korean and Japanese. However, I would like to note that the volume of transactions using these instruments does not yet meet the challenges facing the region's economy as a whole. The more transparent companies and their transactions become, the faster we will develop this area, which will allow the regional economy to breathe better.

What, in your opinion, special conditions necessary for business development in the Far East? And what tools is your bank ready to offer for this?

With all the specifics of the Far East, for its development, in my opinion, it is necessary to provide real support for business from the authorities, and banks will pick up this initiative, provide simple financing for small and medium-sized businesses, up to startups, when, for example, an entrepreneur buys a franchise to the same cafe. Sberbank has several scoring products for small and medium-sized businesses, among which the most popular is the Doverie loan. The loan portfolio for this proposal of our bank in 2012 increased from 1.5 billion to 4 billion rubles.

We are now aiming to be proactive in our projects. What did this idea grow out of? We know a lot about clients, their plans, but our problem is that we are waiting for them to come and ask: "Do you want to participate in such and such an investment project?" But we ourselves must go to entrepreneurs with ready-made ideas that can be jointly implemented.

There are still few such offers on the market, but we have already gained experience of such work on Sakhalin. We recently met with the Governor of the Amur Region and made sure that the authorities are interested in the initiative, followed by the creation of jobs and an increase in the budget revenue base. For example, there may be such options: during the recent crisis, companies had a lot of unfinished real estate projects. We know the team, its potential, we can structure the deal and move the frozen construction site off the ground. And we are not reinventing the wheel, this is the experience of many global financial structures that themselves come up with such an offer to their clients.

You are noticed that you often meet with governors, sign some kind of agreements with the business community. Is it a desire to use the administrative resource for your own purposes? Do banks need this resource at all today?

I am not a politician, and I do not need personal PR, but there are corporate principles that were developed with the arrival of Herman GREF at the bank, and one of them is the maximum availability of a manager. The image of a banker sitting in an office is a thing of the past.

From this communication, offers to the market and territory grow. Now a working group in our bank is engaged in investment projects, and we see good prospects for creating special innovative sites and technology parks in the Far East region. Each territory has its own directions for the formation of modern clusters specialized in certain industries. There is an interest of both business and government structures so that such growth points appear, Sberbank will participate in them with a set of its instruments.

There are special expectations today regarding the Primorsky Territory, in which large federal funds have been invested. How do you assess the activity of Primorsky business?

He is the main driver of development. In terms of business volume, our Primorsky office is 50% of the entire Far Eastern Sberbank. Indeed, the region has very high business activity and a lot of promising real projects. But here it is still necessary to create conditions to make it easier to do business.

Let me give you an example, in the Primorsky Territory there is one large project that we, together with the regional authorities, are trying to promote, we are discussing its details with the federal center. We are told: “The rental rates in the Primorsky Territory cannot be the same as in Moscow. This is unrealistic. " From a distance, it is difficult to imagine that in Moscow the rates are formed by demand, and in the Far East - by the level of costs. The basic costs of setting up production must be adequate, then no one will need to be persuaded to do business. The entrepreneur himself will come to the bank for a loan.

You are one of the largest employers. How many of your employees leave for the central part of Russia?

Sberbank is a territory for personal growth. We have a team of more than eight thousand people, and almost everyone learns in one way or another, expanding the range of professional competencies. This is the most important part of our corporate culture... We can say that we are all, including myself, regular students of the virtual school of Sberbank, where the library of the most best books, language courses, professional trainings, etc. Immersed in this environment, a person understands that he has ample opportunities to plan his career, but if you want to grow professionally - study. To the West - to the center of Russia - of course, someone moves, some continue to work in our system. But, believe me, professionals from other regions of Russia come to us, seeing the prospects for career growth and interesting work.

Chairman of the Board of Directors (Supervisory Board)

Date of initial election to the Board of Directors (Supervisory Board): 04.06.2003

Date of initial election to the Board of Directors (Supervisory Board) as Chairman of the Board of Directors: 04.06.2003

Date of last re-election to the Board of Directors (Supervisory Board) as Chairman of the Board of Directors: 30.08.

Information about vocational education: Middle East Technical University, graduated in 1980, qualification - bachelor, specialty - management.

Information about additional professional education: not available

Information about academic degree, academic rank: absent

- From 11.06.1997 to the present time he is the President of Denizbank A.Sh. (Turkey). His responsibilities include managing the current activities of the Bank, representing the interests of the Bank and concluding transactions within the powers provided by law and the charter.

- From 11.06.1997 to the present time he has been a member of the Board of Directors at Denizbank A.Sh. (Turkey). Carries out the duties of a member of the board of directors in accordance with the law and the charter.

- From 09.02.1998 to the present time, he is a member of the board of directors at Deniz Yatirim Menkul Kyimetler Anonymous Shirketi JSC (Turkey). Performs the duties of a member of the board of directors in accordance with the law and the charter.

- From 02.10.2013 to the present, he has been the Chairman of the Board of Directors at Intertech Bilgi Islem ve Pazarlama Tijaret Anonymous Shirketi JSC (Turkey). Carries out the duties of the chairman of the board of directors in accordance with the law and the charter.

- From March 21, 2014 to the present, he has been the Chairman of the Board of Directors at Destek Varlyk Yonetim Anonymous Shirketi JSC (Turkey). Carries out the duties of the chairman of the board of directors in accordance with the law and the charter.

|

Position held:

Date of initial election to the Board of Directors (Supervisory Board): November 14, 2006

Date of last re-election to the Board of Directors (Supervisory Board): 30.08.

Information about vocational education: information not provided

Information about additional professional education: information not provided

Information about labor activity:

- From 02.06.2009 to 21.02.2011 he was elected Executive Member of the Board of Directors of Denizbank A.Sh. (Turkey). Supervised banking services for corporate clients, project financing and lending to individuals.

- From 22.02.2011 to 18.11.2012, he was re-elected as the Executive Member of the Board of Directors of Denizbank A.Sh. (Turkey). Acted as Chief Risk Officer (CRO). Supervised the risk division.

- From 19.11.2012 to the present time he is an Executive Member of the Board of Directors of Denizbank A.Sh. (Turkey). Supervises the unit internal control, compliance and operational risk groups.

- From 12.05.2009 to the present, he has been a member of the board of directors of Denizbank A.Sh. (Turkey). Carries out the duties of a member of the board of directors in accordance with the law and the charter.

Position held: Member of the Board of Directors (Supervisory Board)

Date of initial election to the Board of Directors (Supervisory Board): 05/21/2004

Date of last re-election to the Board of Directors (Supervisory Board): 30.08.

Information about professional education: University of Ankara, graduation year - 1986, qualification - bachelor, specialty - public administration.

Information about academic degree, academic title: absent

Employment information:

- From 12.10.2009 to 26.12.2012, he was appointed Executive Vice President at Denizbank A.Sh. Supervised issues of corporate sales within the Banking Group, corporate banking, lending to individuals, Deniz Leasing and Deniz Factoring companies, foreign related companies (Denizbank A.G., Denizbank Moscow CJSC, Eurodeniz IBU Ltd., DenizBank Bahrain), and also provided support in the areas of project finance, cash management and insurance.

- From December 27, 2012 to the present, he is an Executive member of the Board of Directors at Denizbank A.Sh. Responsibilities include overseeing corporate sales issues within the Banking Group, including overseeing banking services for corporate clients, lending to individuals, Deniz Leasing and Deniz Factoring companies, foreign related companies (Denizbank A.G., ZAO Denizbank Moscow, Eurodeniz IBU Ltd., DenizBank Bahrain), as well as providing support in the areas of project finance, cash management and insurance.

- From 03.12.2009 to the present, he has been the Chairman of the Board of Directors at Eurodenise International Banking Unit Limited (Turkey). Carries out the duties of the chairman of the board of directors in accordance with the law and the charter.

- From 19.07.2010 to the present, he has been the chairman of the board of directors at Deniz Finansal Kiralama Anonymous Shirketi JSC (Turkey). Carries out the duties of the chairman of the board of directors in accordance with the law and the charter.

- From 19.07.2010 to the present, he has been a member of the Board of Directors at Deniz Factoring Anonymous Shirketi JSC (Turkey). Carries out the duties of a member of the board of directors in accordance with the law and the charter.

- Since December 26, 2012, he has been the Chairman of the Board of Directors at Deniz Factoring Anonymous Shirketi JSC (Turkey). Carries out the duties of the chairman of the board of directors in accordance with the law and the charter

- From December 27, 2012 to the present, he has been a member of the Board of Directors of Denizbank A.Sh. (Turkey). Performs the duties of a member of the board of directors in accordance with the law and the charter.

|

Hiree Jansever |

Position held: Member of the Board of Directors (Supervisory Board)

Date of initial election to the Board of Directors (Supervisory Board): 09/15/2011

Date of last re-election to the Board of Directors (Supervisory Board): 30.08.

Information about professional education: Istanbul Technical University, graduation year - 1998, qualification - bachelor, specialty - engineer / mechanic.

Information about additional professional education: Istanbul Yeditepe University, master's degree (MBA), date of acquisition - 01.11.2003.

Information about academic degree, academic title: absent

Employment information:

- From 01.12.2009 to 31.12.2009 he was appointed Manager of the Bayrampaz branch. Responsible for the development of banking products for legal entities, supervised all types of operations carried out by the branch. Supervision over the activities of the branch.

- From February 17, 2010 to June 30, 2011, he combined the duties of managing the Bayrampaz branch with the position of Senior Vice President in charge of the Corporate Client Service Department at the head office of Denizbank A.Sh. until 30.06.2011

- From 08/03/2011 to 01/17/2012, he served as Executive Vice President at Denizbank Moscow JSC, overseeing the work of servicing corporate clients.

- From 18.01.2012 to 21.01.2013 was elected President of JSC Denizbank Moscow, carried out general management of the Bank.

- From January 22, 2013 to June 30, 2015, he held the position of Deputy General Director of the Corporate Banking Group at Denizbank A.Sh. (Turkey), supervising the corporate client service of the Bank.

- From 01.07.2015 to 28.12.2016 held the position Director General in JSC "Destek Varlyk Yonetim Anonymous Shirketi" (Turkey). He supervised the day-to-day activities of the company, assigned responsibilities and established bonuses to employees, coordinated the work of the relevant department in preparing the company's budget and financial tables.

- From 01/03/2017 to 01/01/2018, he held the position of Executive Vice President, heading the General Secretariat and coordinating the work of Sberbank in Denizbank A.Sh. (Turkey). Ensured the smooth execution of tasks within the objectives and vision of the DFSG in accordance with local and foreign laws and regulations.

- From 01/02/2018 to the present, he has been holding the position of Executive Vice President, heading the General Secretariat, coordinating the work of Sberbank and foreign subsidiaries at Denizbank A.Sh. (Turkey), and also heads the Department of Foreign Subsidiaries in Denizbank A.Sh. (Turkey). Ensures the smooth execution of tasks within the objectives and vision of the DFSG in accordance with local and foreign laws and regulations.

Position held: Member of the Board of Directors (Supervisory Board)

Date of initial election to the Board of Directors (Supervisory Board): 01/12/2010

Date of last re-election to the Board of Directors (Supervisory Board): 30.08.

Information about professional education: Istanbul University, graduation year - 1995, qualification: bachelor, specialty - economics.

Information about additional professional education: master's degree (MBA), date of acquisition - 03/27/2001.

Information about academic degree, academic title: absent

Employment information:

- From January 12, 2010 to August 31, 2011, he was appointed President of Denizbank Moscow JSC, carrying out the functions of the Bank's management.

- From 01.09.2011 to the present time he is the President of Denizbank Aktiengesellschaft (Austria), carrying out the general management of the Bank.

- From April 21, 2011 to the present time, he is a member of the Board of Directors of Denizbank Aktiengesellschaft (Austria). Carries out the duties of a member of the board of directors in accordance with the law and the charter.

- From 01.09.2011 to the present time he was appointed as the chairman of the board of directors of Denizbank Aktiengesellschaft (Austria). Carries out the duties of a member of the board of directors in accordance with the law and the charter.

- From September 30, 2014 to the present, he has been a member of the Board of Directors at Deniz Finance Kiralama Anonymous Shirketi JSC (Turkey). Carries out the duties of a member of the board of directors in accordance with the law and the charter.

Position held: Member of the Board of Directors (Supervisory Board)

Date of initial election to the Board of Directors (Supervisory Board): 10/31/2013

Date of last re-election to the Board of Directors (Supervisory Board): 30.08.

Information about professional education: Bogazici University (Turkey), graduation year - 1998, qualification: bachelor, specialty - political science and international relations.

Information about additional professional education: absent

Information about academic degree, academic title: absent

Employment information:

- From 12.08.2008 he was appointed to the position of the Head of the Department - Manager for the management of the loan portfolio of the Department for work with corporate clients, whose responsibilities included the management of the credit portfolio of CJSC "Dexia Bank", work with corporate clients.

- Since August 16, 2013, he has been appointed President of Denizbank Moscow JSC (date of approval for the position by the Bank of Russia: May 21, 2013). Manages the current activities of the Bank, represents the interests of the Bank and concludes transactions within the powers provided by law and the charter.

Additional Information:

From 2013 to the present, he has held the position of the Chairman of the Management Board of Denizbank Moscow JSC (the date of the last election was October 28, 2013).

What you need to open a hookah lounge, and how to do it correctly

What you need to open a hookah lounge, and how to do it correctly How to start a business and choose donut equipment

How to start a business and choose donut equipment Opening a company in Montenegro Open a company in Montenegro

Opening a company in Montenegro Open a company in Montenegro The carpentry shop as a business

The carpentry shop as a business How to choose a business direction?

How to choose a business direction? Sample business plan of a dental office

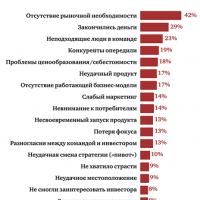

Sample business plan of a dental office Five best business ideas that brought millions What business to open so as not to go bankrupt

Five best business ideas that brought millions What business to open so as not to go bankrupt