Belarusbank by internet banking login. Connecting Internet banking of the Belarusianbank and working with it. Online banking transactions

M-banking is a service that allows cardholders using mobile phone and the special application "M-Belarusbank" installed in it, developed by LLC "Mobicon-Media", at any time and from anywhere in the world to perform a wide range of payment and other transactions (pay utility bills, mobile services, transfer funds from a card to card, replenish deposit accounts, etc.)

How to become a user of M-BANKING

To use M-banking you need:

3. Complete the registration of M-banking.

All operations within M-banking are carried out using automatically generated and sent messages, paid in accordance with tariff plan mobile operator. By default, the "Internet" is defined as the channel for sending requests (sending requests using WAP / GPRS / CSD technologies), in the absence of access to the Internet, M-banking users (available only for mobile devices on the Android platform) can send requests (checking the balance , selected payments) using SMS-messages (for mobile devices with the Android operating system in applications below version 3.7.4).

Payment for the M-banking service occurs by automatically debiting the required amount from the account after the user of the service confirms his consent to make such a payment. The right to use the service is provided for 30 (thirty) calendar days from the moment of payment and is extended after the next payment.

Who can access M-BANKING

M-banking can be used both by cardholders of JSC “ASB Belarusbank” and by cardholders of other banks of the Republic of Belarus.

For users of M-banking who are not cardholders of JSC “JSSB Belarusbank”, the range of operations may be limited.

M-BANKING Opportunities

M-banking allows you to conveniently and safely:

- make payment:

Utilities, gas, electricity, water;

Home phone

Mobile communication services;

Minimum transaction amount: 0.15 BYN

Maximum transaction amountpayment for services by mobile phone number: 99.90 BYN

Maximum transaction amountpayment services on a personal account / against a fine: 999.90 BYN

Cable TV services and Internet providers;

Security services of the Ministry of State Administration of the Security Department of the Ministry of Internal Affairs of the Republic of Belarus (for security, equipment and connection, fake call);

Insurance services;

Services by the payer independently entering the necessary payment details ("payment by details");

Other services through the Settlement system (AIS ERIP), etc.

- make charitable payments as part of a collection project Money for the treatment of seriously ill children, implemented by MBOO "UniHelp";

- repay loans issued by JSSB Belarusbank and other banks;

- transfer funds in Belarusian rubles from card to card;

Minimum transaction amount: 2.10 BYN

Maximum transaction amount: 999.90 BYN

The introduction of the maximum amount of the transaction is associated with the denomination of the Belarusian ruble and is a temporary measure aimed at minimizing possible erroneous actions of the bank's customers associated with the incorrect input of the amount when making transactions.

- view account information (account number, account number in IBAN format, account currency, etc.).

- transfer funds to deposit accounts opened with JSSB Belarusbank;

- receive notifications:

view information about the deposit (date of opening / closing the deposit, deposit currency, deposit account number in IBAN format, deposit currency, etc.);

open and close online deposits;

On the presence (absence) of the established overdraft limit, overdraft loan debt;

On the availability of an account of an individual and the amount of funds in this account;

On the presence (absence) of debt on the loan issued by JSC "ASB Belarusbank";

On the receipt of funds on the card (the operation is available only for the "Basic" and "Full" service packages);

About expense transactions made using cards (or their details) registered in M-banking (the operation is available only for the "Full" service package).

Within the framework of the notification, information is provided on the balance of funds on the account when performing the following operations using the card or its details:

Refill;

Payment for goods and services;

Transfer of funds from account to account;

Cash withdrawal;

About all transactions on the account;

About transactions carried out only in M-banking;

- use the "Banking Locator" service.

“Locator of banking services” allows you to find information on the location of the nearest ATMs, self-service terminals and institutions of JSC “JSSB Belarusbank”, as well as JSC “Belagroprombank”, JSC “BPS-Sberbank”, JSC “Belinvestbank”. For each selected object, you can see the detailed information of interest - address, operating mode, list of available operations. In addition, with the help of the Banking Services Locator, you can find the addresses of trade and service organizations, where discounts are provided when paying with Belarusbank JSB cards.

The Banking Services Locator is available in versions of the M-Belarusbank application for mobile devices with Android, iOs and Windows Phone operating systems. To use the service, you need to install the "M-Belarusbank" application on mobile device(registration of the application, as well as activation of service packages are optional) and connection to the Internet.

Money transfer to a card of any bank

- Select the menu item "Popular payments", section "Money transfer";

- Select the recipient of the payment "Card of any bank"

- Select the transfer currency BYN;

- Enter the recipient's card number, its validity period and the transfer amount;

- When making a transfer to a card issued by a non-resident bank, additionally enter the name and surname of the recipient of the transfer in the Latin alphabet;

- Check the correctness of the previously entered information and, having read the information about the amount of the commission for the transfer, confirm the transfer.

ATTENTION:

When transferring funds within the service, funds are debited from the sender's bank card account in Belarusian rubles, and credited to the recipient's bank card account is made in Belarusian rubles or in the recipient's card account currency at the rate set by the recipient's bank.

Carefully check the entered card details of the transfer recipient. It is impossible to cancel the transfer.

STOCK!

For new users of M-Banking a FREE "Full" or "Basic" package for the first 30 days for the first payment card connected to M-banking.

"Discount for the card". If you already have a card registered in "M-banking", paid (at full cost without discounts) and connected to the service package with the notification "Basic" or "Full", then when you connect each subsequent card to the specified service packages you will be provided discount of 0.60 BYN rubles ("Basic" - 0.25 rubles / 30 days, "Full" - 0.85 rubles / 30 days).

The Internet banking system is designed for remote access to users to manage their accounts online. You can use the services without leaving your home through your computer, as well as from anywhere in the world where there is Internet access, and around the clock.

Possibilities of Internet banking of Belarusbank:

- View the current balance and expenses by accounts.

- Opening, replenishment of deposits.

- Loan repayment payments.

- Payment for various services (housing and communal services, communications, electricity, etc.)

- Obtaining a statement of deposits.

- Transfer of funds by bank transfer.

- Viewing information on operations performed (income, expense).

- Management of other credit card services.

- Various settings (changing the password, editing personal data, etc.).

User manual

To work in the system, you need to be a holder bank card from JSC ASB Belarusbank. You also need to have a computer with a browser and Internet access.

How to connect?

To use Belarusbank Internet banking, you need to register. There are 2 ways to register - at a bank institution or online.

One bank client can have only one user account and one code card.

Registration at a Belarusbank branch:

Online registration in the system:

- Send an application for registration in Internet banking on the bank's website ibank.asb.by

- Pay for the provision of services in the Internet banking system using the card specified during registration.

- The code card will be delivered to your home within 10 days.

Tariffs

Register a personal account for Internet banking in the bank - 5 thousand Belarusian rubles. rubles.

- Get a code card - 5 thousand Belarusian rubles rubles.

- Online registration of a client in the system - 15 thousand Belarusian rubles. rubles.

How to use Internet banking Belarusbank?

To work in Internet banking you need:

- Follow the link ibank.asb.by in your browser.

- Enter your username and password, select the "Login" option.

- Enter the key from the code card and enter.

How to unblock Internet banking of Belarusbank?

If a user account is blocked 3 times, to continue working, you will need to contact the bank branch and apply for unblocking in the system.

Payment for services

If you regularly make the same transactions, the "One-button payment" option will suit you.

To use the service you need:

- Go to your personal account.

- In the section “Payments, select the option“ Payment with one button ”.

- Select the account from which the payment will be made.

- Select the services to be paid for.

- Click the "Continue" button.

- Fill in the payment details in the opened page.

- Confirm the operation and click the "Pay" button.

Payment via Internet banking Belarusbank may be subject to a commission. After the operation is completed, the user is shown a form with the results and details of the payment made in the form of an electronic check that can be printed.

In the future, when using this option, transactions for which payments were made earlier will be displayed in the form for selecting saved payments.

Arbitrary payment (by bank details)

- Select "Custom" - "New" in the "Payments" menu. Enter the data and details, click the "Continue" button.

- For all questions regarding work in the Internet banking system, please contact the Belarusbank customer support service by phone 147 (call on weekdays 8.30-20.00, on weekends 10.00-17.00).

OJSC Belarusbank provides the most convenient conditions for its customers. Financial institution provides a high level of security and offers to use a special service for managing personal accounts - Belarusbank Internet banking personal account. The system is designed in such a way that even inexperienced users can understand the interface at an intuitive level.

To start using the online service, you must first activate the service. To do this, you can use one of the following methods:

- Contact the bank. With a personal visit, you can leave a request to connect to Internet banking. To do this, you must fill out the appropriate form. Please note that when visiting a financial institution, you must have an identity document with you.

- Through the official website. It is necessary to enter the website belarusbank.by in the "Registration" section. In the online form, you must indicate personal information and a phone number to which an SMS message will be sent to confirm registration. You can use the system only after some time, which is necessary for the consideration of the client's application.

- By phone. To connect your personal account in the system, you can contact an employee of the company by phone: 146. A qualified specialist will help you sort out any issue. If desired, you can use the voice menu, which reduces the registration time, as it eliminates the need to wait for an operator's response.

If you have any difficulties during the registration process, you can contact customer support. Please note that a strong password should be used to enhance security. Otherwise, there are risks of account hacking, despite the fact that the financial institution provides a high level of security.

Registration of Belarusbank Internet banking

When registering in your personal account, you need to enter only the correct data, which will help you to recover it without any problems if you lose your password. After all the necessary information is filled in, the user must agree to the terms of use of the service by checking the box in the appropriate box. If you wish, you can familiarize yourself with the public offer, which details the obligations of the parties to the contract.

Please note that all fields marked with an asterisk are required. Only after confirming that the information is current and true, the user is advised to enter the number of his personal plastic card, its validity period and captcha (symbols from the picture). Only after the registration is confirmed, the user can log into Belarusbank Internet banking.

Online connection of Internet banking

The most popular way to create your account is to use the official website of a financial institution. Almost all users prefer to save their time by registering on their own. This eliminates long queues and paperwork.

Please note that after registering in the system and authorizing in your account, you must fill in Additional information... V mandatory write down the password on paper. Do not store authorization data on your computer, as this increases the likelihood of an account being hacked. Be sure to log out of your personal account when you close the site. Send SMS confirmation of financial transactions.

Possibilities of Belarusbank

The Belarusbank website is an official source that provides a whole list of universal tools that simplify the actions of clients when working with personal accounts. Among the main features of the service should be highlighted:

- No need to visit banking structures and ATMs.

- View your balance on card accounts, replenish your card or pay off debt.

- Transfer of funds from one bank account to another.

- Payment for utilities, mobile communications, etc.

- Settlement in the ERIP system.

- Viewing the history of deposit statements.

- Control of ongoing transactions and storage of checks in electronic form.

In order to enter the system in Belarusbank Internet banking, you must pre-register. There are several ways in which this procedure can be carried out. Each user can choose the most convenient and suitable for himself, depending on individual needs.

Convenient settings for the Internet banking system

After you are logged into personal internet banking Belarusbank, the owner of a plastic product can study the interface and functionality:

- Home page. It is stated here actual information and latest news in the work of a financial organization and there is a menu to go to other pages of the site.

- Payments and transfers. This section provides for the selection of the required category for making financial payments in the ERIP system.

- Accounts. The owner of banking products can independently activate and deactivate plastic cards, as well as open savings accounts and manage them in free mode.

- Payment history. If necessary, in your personal account, you can view the history of transactions and print a receipt, which can be retrieved electronically.

To increase the level of convenience, the system provides for setting up monthly payments by pressing one button. You can also activate auto-pay, which is quite convenient, as it eliminates the likelihood that a person will forget to pay the bills.

Login for individuals

Provides a security system in Belarusbank Internet banking login to the system with SMS confirmation. This increases the level of security and helps prevent accounts from being hacked. Please note that if you change your current phone number, you must personally appear at financial institution and write an appropriate statement.

To enter the Belarusbank JSS system, you must use the login and password specified during registration. If the user has forgotten the password, then you can follow the link to recover it or call the customer support. To do this, you need to know the answer to the security question. Most often this is the mother's maiden name or the name and patronymic of the first teacher.

To enter the web system, use the link ibank.asb.by. Personal Area It is quite easy to use because it allows you to pay bills, make financial transfers and change settings or personal information.

Technical support of Belarusbank

If you need to change the settings in your personal account, you can contact customer support. To do this, you can enter the site and fill out the appropriate online form, indicating the reason for the request. If it is necessary to resolve technical issues, screenshots should be attached to the appeal, which will increase the time for correcting the error that has occurred.

With the help of technical support, you can change the password if you cannot log into your account or the authorization information has been lost. If you have any questions, you can contact the office of the financial structure yourself or call hotline (375 17) 226-47-50.

Conclusion

Belarusbank - open joint-stock company providing services at a high level. The financial institution takes care of the safety and convenience of each client, providing an opportunity to connect to Internet banking. You no longer need to stand in long lines or go to a bank branch if you have any questions. It is enough to leave a request on the company's website and a specialist will contact you to help you sort out any problem of a technical or informational nature.

In order to use the Internet service without interruption, enter your personal data correctly when registering. Make sure that the information for authorization in the system is not taken over by third parties, which will avoid the likelihood of theft of funds.

- Official site: http://belarusbank.by/ru

- Personal Area: https://ibank.asb.by/

- Hotline phone: +375 17 218 84 31

Interaction of the library with cultural institutions

Interaction of the library with cultural institutions Training seminar "Promotion of library services (Brand technologies in libraries)

Training seminar "Promotion of library services (Brand technologies in libraries) National library of latvia or castle of light

National library of latvia or castle of light Beautiful wishes for a good morning and a nice day

Beautiful wishes for a good morning and a nice day Trial sport Trial sport

Trial sport Trial sport How to fire a school principal

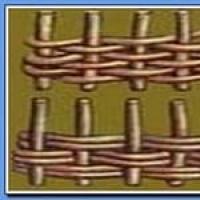

How to fire a school principal How to make a basket of vines with your own hands: the easiest way (MK)

How to make a basket of vines with your own hands: the easiest way (MK)