Ibank asb by login. Internet banking of Belarusbank: a complete guide to the service for individuals. Login and password recovery

Remote payments have become more accessible to compatriots, allowing you to save time and effort, conveniently conduct transactions, pay for Internet services, utilities, education, etc. Many people learn how to pay for the Internet through Belarusbank Internet banking, after which they actively use the service.

Each client of Belarusbank can get remote access to a current or card account, for which they contact a bank branch or register remotely at an info kiosk.

Basic operations with a Belarusbank card

Belarusbank is a financial institution on the territory of the Republic of Belarus that offers a range of services, including bank cards.

Bank branches are open in large cities of the country, so it will be useful to learn how to put money on a Belarusbank card.

Indeed, in this case, you can safely store money, transfer it to third parties, cash out at a convenient time.

How do I deposit funds into a card account?

To put money on a Belarusbank card, a person visits a branch of a banking institution, where he tells the operator the payment card number. The operation can be performed through a network of payment terminals with the Cash-in function or self-service kiosks. To replenish the card, it is not necessary to take plastic with you, since it is enough to know the card number and expiration date.

In the same way, a third party card issued in Belarusbank is replenished. Money is credited instantly. When replenishing without a card, the bank commission is 2.5% of the amount credited Money.

Money transfer

- Transfer from a current account or another card opened with the same bank. The operation is carried out in the department financial institution, at an ATM, self-service kiosk or using M-banking and Internet banking.

- Transfer from another bank operating in the territory of the Republic of Belarus. You need the full details of the card account: the code of the bank institution, its name, transit account, full name of the owner.

- Transfer from abroad. SWIFT transfer through correspondent accounts of banks, and in the currency of the card account.

Balance check

How do I check my balance? Should:

- Insert the card into the ATM and click on the "Balance" option.

- Call the hotline, answer the operator's questions, who will report the account balance.

- Connect SMS banking services at a branch of a financial institution or through a payment terminal, after which messages with the account balance will be sent to the user's phone after each operation (replenishment, withdrawal, transfer).

- Go to the Internet bank system, click on the card account number and view the balance.

Card blocking / unblocking

There are several ways to block a Belarusbank card, which is necessary if it is lost, stolen, lost, or if the card is left at an ATM.

The person calls the Call Center. After identifying the client, the operator will block the payment card within 2 - 3 minutes. Having access to Internet banking, the user can independently block the card account by clicking on it with the mouse and selecting the desired option.

The person calls the Call Center. After identifying the client, the operator will block the payment card within 2 - 3 minutes. Having access to Internet banking, the user can independently block the card account by clicking on it with the mouse and selecting the desired option.

To unblock the Belarusbank card, you will need to visit the nearest bank branch and write a statement, however, the operation can be performed remotely using the Internet banking or M-banking system.

Logging in with his username and password, the user independently performs the required operation, after which his payment card is unlocked.

Important! If blocking / unblocking of a card is made by calling customer support, a person must remember the code word that he indicated when opening a card account.Overdraft for a salary card

Overdraft translated from of English language means "overspending" and represents an authorized (or unauthorized) credit provided by a bank for a customer's card account. In other words, this is a short-term loan for a small amount that the user must repay within the agreed term.

| Maturity | Annual interest rate |

| 1 month | 33% |

| 3 months | 33,5% |

| 6 months | 34% |

| 10 months | 34% |

| 24 months | 34% |

Other Internet banking options

The Internet bank complex of a financial institution Belarusbank is designed to make payments online remotely. To pay for electricity, gas, internet, cable TV, a person is registered in the system, receiving an individual login and password.

Enter Personal Area can be done from any device with Internet access, after which the payment function becomes available.

Internet banking of Belarusbank allows you to:

Internet banking of Belarusbank allows you to:

- View the balance of the card account.

- Transfer funds to third parties.

- Open and replenish deposit accounts.

- Pay off loan debt.

- View the statement of the current account (income / expense).

- Pay for Internet, study, medical treatment or utilities.

- Replenish an account mobile phone any operator of the Republic of Belarus.

Internet payment

To make prepayment for the services of the Internet provider Byfly or any other through the remote Internet banking of the Belarusbank financial institution, you should:

Payment of utility services

To pay for utilities, perform the following actions:

Loan payment

A convenient function is to pay a loan through Belarusbank Internet banking, available to every owner. To pay off debt:

- go to the option "Payments and transfers";

- choose the section "Repayment of loans";

- then enter the number of the loan agreement, the amount of payment and make a transaction.

Phone payment

To pay for a landline or mobile phone after entering your personal account:

To pay for a landline phone, they choose a company - an operator providing wire communication services, enter the payment amount and personal account number, after which the funds are credited.

To pay for a landline phone, they choose a company - an operator providing wire communication services, enter the payment amount and personal account number, after which the funds are credited. Conclusion

Belarusbank is a modern financial institution where a person can open a card account, block and unblock a card, replenish it, or transfer funds to third parties. With the help of ATMs and payment terminals, a card account is also replenished with instant crediting of funds.

The Internet banking complex of a financial institution Belarusbank is a reliable system that allows you to pay bills, replenish your mobile phone, transfer money to third-party accounts, pay off debts, etc. To use the system, a person registers in remote banking, receives a login and password, and then makes a payment at any time of the day or night. A big advantage is payment without leaving home, with the ability to perform the operation through a laptop, tablet or smartphone.

The number of settlement transactions in the Republic of Belarus is growing. They are produced between legal entities up to a minute.

With large amounts and payments, Internet banking comes to the rescue, which allows you to manage bank payments right from home. Therefore, the question is: how to connect Belarusbank Internet banking?

What is this service?

Belarusbank's Internet banking system is implemented in the form of a personal account for a specific client on the bank's portal.

Using an individual login and password, as well as identification via SMS or session codes received during registration, the client enters his personal account, where he gets access to information about his account, the current bank products that he uses.

In the personal account, they perform various operations with the account. This allows you to carry out many important tasks without leaving your home and without visiting a bank office.

How to connect?

To enable the Internet banking offer, you need to write an application, for this come to a banking organization or sign up at the Internet Banking department using the online service.

As for the use of Internet banking, everything is not complicated here. First, a client of a financial institution receives data to enter the system, which allows him to enter his personal account on the banking website.

For login to the Internet banking system Belarusbank you will need the following information:

- login and password specified during registration;

- mobile phone or code card to confirm two-phase authentication.

You should have received the code card earlier. If you registered online, then the document should have been sent to you by e-mail within 10 days. Those who created an Internet banking account at a bank branch were issued a code card immediately.

Login to the personal account of Belarusbank Internet banking carried out by performing a few simple steps. To do this you need:

Read also:

User account

Having received the data for entering the system, as well as having drawn up a service agreement, the client can visit the banking website on the Internet, enter his personal account and take the necessary actions.

Usually, the cabinet interface is clear to most of the bank's clients, so there should be no incomprehensible management. With the help of Internet banking Belarusbank through your personal account, you can implement the following operations:

- View account status and costs by account.

- Opening and supplementing deposits.

- Loan payments.

- Payment for various services (electrics, communication services, etc.)

- Obtaining an excerpt on deposits.

- Transfer of money by bank transfer.

- View data on committed actions.

- Credit card service management.

- Various settings.

Personal settings

In your personal account, you can change the password, edit your information, etc.

To perform actions in Internet banking, you need:

To perform actions in Internet banking, you need:

- Visit the website ibank.asb.by.

- Write down your username, password and log in.

- Write down the key from the code card.

Code card activation

To activate the code card, the user must click on the "Cards" option. Upon activation, he enters the phone number, the activation code that came to this phone, the number and operating time of the card, the code indicated on the other side of the card.

Important! If you lose your code card, inform the bank about it to block your entry. You will need to tell the bank employee the code that is in the application.

From the time the banking institution receives the closing notice, your account is closed until the organization receives the unblocking request.

Secondary issuance of the card is carried out after the client contacts an arbitrary bank branch, which performs the fixation of Internet banking, and pays for the necessary services. When contacting a banking organization, you must have a paper that certifies your identity.

Payment instructions

If you systematically do the same, the “One-Button Payment” branch will come in handy.

To use the service you need:

- Log in to your account.

- In the “Payments” section, select the item “One-button payment”.

- Select the account from which the payment will be made.

- Select a range of services to be paid for.

- Press the "Continue" position.

- Write payment information.

- Click the "Pay" item.

Login and password recovery

If you still lost the information necessary to enter your personal account, you need to figure it out, how to restore Internet banking Belarusbank... There are 2 options:

- You forgot your username. In this case, the problem can be solved by contacting hotline Belarusbank by short number 147. When you are connected to an employee, you need to report your problem and provide the following data:

- Full Name;

- passport data;

- the codeword.

- You forgot your password. In this case, restore access to the personal internet banking account impossible - Belarusbank does not provide for such an opportunity. If you have lost your password, you will have to take your passport and contact the nearest bank branch.

Payment via Internet banking Belarusbank

Paying for services while at home is convenient. This method saves valuable time and hassle. Belarusbank also allows pay via Internet banking payments, including utilities. To use this service you need:

- Log in to Internet banking. In the upper menu "Payments and Transfers", select the item "Settlement System" from the drop-down list.

- Click the " New payment". Then you need to enter the data for the place of residence. Then click on "Utilities" and select a specific service (water supply, electricity and others).

- Indicate the current indicators.

- Click the "Continue" button.

If you make such payments on a regular basis, you can save this template. To do this, add the payment to your Favorites.

All receipts are saved in the payment history. This information is available for review at any time.

How to disable?

You can delete an Internet banking record yourself in the settings area by clicking on the "Delete your record" section or go to the bank. You need to have your passport with you to verify your identity.

Conclusion

To manage banking operations, you can use the services of Internet banking from Belorusbank. To register it, you need to fill out an application at a bank branch or online. To enter your personal account, you need to activate the code card.

Using the services of your personal account, you can make various payments. You can delete Internet banking yourself or through a banking organization.

The use of Internet services from financial institutions is becoming more and more popular. Simple, user-friendly interfaces, versatility of remote banking is combined with the ability to adapt to any, even the most busy schedule. The offer from Belarusbank is considered one of the most comfortable, promising and protected. This effect is achieved by progressive technologies, including the use of a code map.

What is it like

Outwardly, the code card practically does not differ from the plastic bank cards that have become familiar to everyone. It is the same size. The outer part pleases with a nice design, while the inner part contains several columns of numbered codes. The location of the codes is selected by a special system and is not repeated in other plastic media. Using individual data, the client receives a guarantee of the confidential use of his financial resources, also information on them.

You can only get one card per customer name. When changing the name or surname, you must contact the bank to re-register the relationship. Bring new documents with you to confirm the identity of the client

What is it used for

Belarusbank issues an original code card for each of its Internet banking users, the use of which will allow you to enter your Personal Account. Many banks offer their customers, besides the password and login, to enter one-time codes from telephone SMS when entering, or to answer phone calls. This practice requires unambiguous availability of mobile communications. If the phone has run out of charging, it is broken or lost, it becomes impossible to work with the bank remotely.

In this respect, the code card is much more user-friendly. The standard size allows you to store in a business card holder, along with the rest of the banking and discount cards... At the beginning of the session, after entering the login and password, the Belarusbank system prompts the user to enter a one-time password - a code from the back under a certain number. Thus, the client conducts a guaranteed secure session and at the same time may not be afraid of difficult situations with additional technical means- with your mobile phone.

In this case, the plastic carrier is issued once, there are no restrictions on the number of entries made with it.

Where and how to get

Despite the presence of several accounts, only one code card is issued, since Internet access in the Personal Account opens up the possibility of conducting transactions and obtaining information with all of them at once. It can be obtained in two ways:

- At the bank's office, where a specially developed application form is submitted. In the presence of bank card client and his passport, you can get a single access to all your accounts in Belarusbank. Documenting takes place on the spot, as well as payment for the service. The bank's specialist issues a password and login to the account to enter the Personal Account. In the same place, plastic is issued, after which only activation in the info kiosk remains.

- When submitting an application in electronic form on the official website of Belarusbank, it is enough to independently enter the basic identification data and pay for the service electronically from a bank card. The carrier itself is delivered by mail within 10 days in person after presentation of the passport. If during this period the owner is not present at the place of residence, the card is returned to financial institution and the request for remote service access becomes rejected. If the client failed to receive the card within 10 days, it is necessary to contact the specialists of Belarusbank again.

Activation procedure

In order to use the card, you must first activate it in the infokiosk. The latter is the same ATM, but without the ability to issue money. The work happens only with the receipt of information.

Before activating the Belarusbank internet banking code card, you need to obtain information on the location of the nearest infokiosk. To do this, you should use the advice of a bank employee, the map of the official website or a hotline.

When working directly with an infokiosk, you need:

- Correctly insert your bank card into the card reader of the infokiosk.

- Enter the PIN-CODE of your magnetic carrier.

- Among the "Service operations" select "Card activation".

- Clarify the choice among the proposed options.

- Enter the number of the received code card upon request. It is located on the back of the card.

- Re-enter the number.

- After offering options for receiving a check, choose the most comfortable one.

- Be sure to indicate the end of work in the information kiosk and get your bank card back.

After carrying out this procedure, the client receives an almost activated entrance to his personal account to be able to work remotely with his accounts.

If during the year the client never uses the received card, both will be automatically blocked back, and in the future will be completely canceled.

How to work with codes

In order to enter your page, you must enter the basic identification data for the portal - login, password and code under the number requested by the site. Only after that, the system allows the client to carry out banking operations and receive information on accounts.

In order to enter the desired code, you need to find the desired number on your card and enter the numbers from the plastic into the request line. It is important to prepare the card in advance, since the request is valid for only 1 minute, after which you will have to re-enter.

Security measures

Since the code card is a guarantee of the security of the client's finances, it is imperative to adhere to several rules:

- Prevent the code card from falling into the hands of third parties, including close relatives and bank employees.

- In case of loss, as soon as possible, warn the bank's employees about the incident, as a result of which the card will be blocked. In the future, a secondary card will be issued, for which you need to contact any bank branch with a corresponding statement.

- Carefully enter the data on the site. If the information is entered incorrectly three times (login, password, code), the account is blocked. You can remove the blocking by calling 147 or using SMS. More detailed information on the official website of the bank.

Frequently asked Questions

Where and how can I activate the Internet banking service?

To connect to the "Internet banking" service, you must contact a bank institution, use the online registration service of the "Internet banking" system, or register using an MSI account.

Registration at a bank institution:

Contact the OPERA of the head office, regional (Minsk) department, branch, branch or center of banking services of JSC "ASB Belarusbank" (hereinafter the bank institution) with an identity document and a bank payment card issued by the bank (hereinafter the card);

Sign the Application Form for customer banking services using the "Internet banking" system;

Get Username and Password;

When using the online registration service of the Internet Banking system, you must:

Apply for online registration in the Internet banking system of Belarusbank JSB OJSC via the Internet on the bank's website ();

Registration using the ISI account:

To authorize in the Internet Banking system, the client needs to register in the Interbank Identification System (hereinafter ISI) (https://ipersonal.raschet.by) and select the Register function.

After successful identification of the client in the ISI, register in the "Internet banking" system. To register in the "Internet banking" system, the client must select the type of authentication "One-time SMS code" and click the "Login via MSI" button.

After a successful registration procedure, the client is provided with access to the Internet banking system.

Why is the message “Contact the bank” displayed during on-line registration in the “Internet-banking” system?

The information about the client available in the bank does not correspond to the personal data entered during on-line registration. If all the fields are filled in by you correctly (correspond to the passport data), then you need to contact the bank institution to make changes to the personal data that are stored in the bank. You must have an identity document with you.

How to change the password for entering the Internet banking system?

The functionality of the "Internet banking" system allows you to change the password. To do this, go to the section "Personal settings" - "Password settings".

Requirements for a password to log in:

1. the password must contain only Latin letters (lowercase and uppercase) and numbers;

2. the password must contain at least 8 and no more than 12 characters;

3. the password must contain at least one uppercase and at least one lowercase letter, as well as at least one number;

4. The password cannot contain three consecutive identical characters.

Is there a fee for payment in Internet banking, if there is, how much?

Payments for payment for services in the "Internet banking" system are carried out without charging a commission, except for:

Services for transferring funds from card to card of JSC “ASB Belarusbank”;

Making a payment according to the details;

Provision through the Internet banking system of mini-statements of transactions performed using the card or its details.

The commission fee for these operations is determined by the collection of fees for operations performed by Belarusbank JSB OJSC for servicing accounts opened with Belarusbank JSB OJSC, and other operations (sections 7, 8, 9 and 10, http://belarusbank.by/ru / deyatelnost / 10373/10505).

What is the Settlement system (ERIP), how and what services can be paid with it?

JSC ASB Belarusbank closely cooperates with the Raschet system (AIS ERIP, http://www.raschet.by). System "Calculation" - automated Information system unified settlement and information space (AIS ERIP), accompanied by OJSC Non-Banking Credit and Financial Organization "ERIP". The system is designed to provide comprehensive service payers on the principle of "one window", reducing the cost of processing transactions for payment of services, ensuring the possibility of making payments for services through any settlement agent from any region. Almost all banks of the Republic of Belarus are banks-participants of the Settlement system. The information provided by the Settlement system is displayed identically in all terminals of the Participating Banks and cannot be edited and changed on the side of the bank.

Most of the service providers in the Republic of Belarus are members of the Settlement system. Using the Settlement system, you can make a payment in favor of any Belarusian mobile operator, for utilities, the Internet and much more. A complete list of services that can be paid using the Settlement system is presented in the Payment Tree of the Internet Banking system in the Payments and Transfers section - Settlement System (ERIP).

To make payments in the "Internet banking" system in favor of service providers who are members of the "Settlement" system, you must:

Go to the section "Payments and transfers" - "System" Settlement "(ERIP)";

Press the button "New payment";

In the opened payment tree, select the region and city in which the services are provided (if the service provider provides its services throughout the territory of the Republic of Belarus, for example, RUE "BELTELECOM", select the "All-Republican" section;

Select a section with the necessary services;

Select a service provider;

Choose the service for which the payment is made;

Choose a payment card from which the payment will be made;

Fill in all the fields of the form;

Click the "Pay" button.

After making a payment through the "Settlement" system, information about it is saved in the payment history of the "Internet banking" system, and the data for a repeated payment is saved in the "Personal payments" section of the "Settlement" system and displayed by the "Internet banking" system on the main page of the system ...

After making a payment through the "Settlement" system, all the data of this payment can be saved in the "Internet banking" system (set a name and click the "Save" button on the last form) in order to quickly access the payment using the "Favorite Payments" service and other services , for example, "Pay with one button" offered to customers by the "Internet banking" system.

When you navigate through the payment tree of the “Calculation” system, a menu for quick navigation through the tree is displayed above the table.

If you could not find the service you need to make a payment in the payment tree, use the “Search for services” section, the link to which is located above the payment tree of the “Calculation” system.

All forms and text displayed by the Internet Banking system when making payments through the Settlement system are provided to the bank by the Settlement system and cannot be edited or changed on the bank's side.

For all questions related to making payments in the "Settlement" system, you can contact the Contact Center of the "Settlement" system by phone 141 or by e-mail [email protected] The payment options can be found on the website http://www.raschet.by.

How to use the One-Button Payment service?

In order to use the One-Button Payment service, you must:

On the Main page, select the section "Payment with one button" or go to the section "Payments and transfers" - "Payment with one button";

Select the card with which you want to make a payment;

Select, from the services previously saved in the "Internet banking" system, which you wish to pay for;

Click the "Continue" button;

Fill in the "Payment details" fields one by one;

Click the "Continue" button;

In the "Confirm payment data" window, check the correctness of the payment data;

Click the "Pay" button.

Transactions on payments for the selected services are processed by the system one by one in the order in which they were displayed to the client in the final form.

After making payments, a form is displayed with the results and details of all payments made. Next to each successful payment there is a "Print" button for printing a receipt. If all payments are successful, one general message "Payments were successful" (green) is displayed. Payments, during the payment process of which an error occurred, are highlighted in red, the "Print" button is absent. For unsuccessful payments, error messages (red) are displayed in the format "Name of the saved payment: Message".

With the subsequent use of the One-Button Payment service, the payments for which the previous payment was made will be automatically selected in the form for selecting saved payments.

Is it possible to transfer funds from card to card?

Transfer of funds from card to card is carried out between cards issued by JSC “JSSB Belarusbank”, as well as transfer to Visa, Mastercard of any bank.

How to transfer funds to an electronic wallet (belgi, EasyPay, WMB)?

To make a transfer, you must go to the section "Payments and Transfers" - "System" Settlement "(ERIP)" - "Republican" - " Financial services"-" Electronic money "-" (E-wallet replenishment, EasyPay sale, WMB (e-money) sale) ", select the card from which the funds will be transferred and press the" Continue "button. Then enter the "Wallet number" and press the "Continue" button. Please note that the minimum payment amount is limited, the amount of the limitation is indicated on the payment processing page.

What to do if, when viewing the balance on a bank payment card, the system displays the message "No data to display on the card"?

This message indicates that the Internet Banking system is unable to obtain information about the balance of your payment card at the Banking Processing Center due to problems that have arisen during the interaction of several software and hardware systems. As a rule, interruptions in work are of a short-term nature. Therefore, you should try to log in again later.

What to do if in the "Internet banking" system, when making payments through the "Settlement" system, the ERIP displays the message "Failed to connect to the ERIP server"?

This message indicates that the "Internet Banking" system cannot connect to the servers of the "Settlement" system (ERIP). As a rule, interruptions in work are of a short-term nature. Therefore, you should try to make the payment again later.

What to do if in the Internet banking system, when paying for a loan issued by JSSB Belarusbank, the system displays the message “No information to display”?

This message indicates that the Internet banking system cannot receive information from the branch where the loan was issued. As a rule, interruptions in work are of a short-term nature. Therefore, you should try to make the payment again later. Also, in order to solve the problem as soon as possible, you can contact the Contact Center of JSC “JSSB Belarusbank” by short number 147 and provide the number of the branch where the loan was issued.

What document is a confirmation of payment in the "Internet banking" system?

After the operation is carried out in the Internet Banking system, a check is generated with the details and detailed information about the payment, with the possibility of its further printing (on the last form, when making a payment, click the “Print” button).

In the future, the user has the opportunity to print a check at any convenient time using the "Payment History" service. Find information about the payment using the search form, highlight the payment you are interested in, click the button "Details" → "Print".

According to the public offer agreement concluded during registration in the Internet banking system, “electronic messages used in the relationship between the Client and the Bank, successfully confirmed by the Client in the system, are considered equal in legal force to the corresponding paper documents drawn up when performing similar transactions in the institution Bank personally by the Client, and give rise to similar rights and obligations of the parties. " The check issued by the system contains the transaction identifier (TransID) with which you can uniquely identify your payment.

In cases where it is necessary to confirm by the bank an operation made through the Internet banking system, the client must contact the bank institution where the payment card was issued.

Is a receipt for payment of a loan in the Internet banking system a basis for a tax deduction of income tax?

In accordance with the clarifications of the National Bank of the Republic of Belarus and the Ministry of Taxes and Duties of the Republic of Belarus, the procedure for submitting a property tax deduction is established by Articles 165-166 of the Tax Code (Special Part) of December 29, 2009 No. 71-З. These articles of the Code provide that documents confirming the costs actually incurred by the payer and members of his family for the construction or acquisition of an individual residential house or apartment, repayment of loans from banks of the Republic of Belarus, repayment of loans received from Belarusian organizations and (or) Belarusian individual entrepreneurs(including interest on them, with the exception of interest on overdue loans and borrowings, overdue interest on them) actually spent on the construction or acquisition of an individual residential house or apartment on the territory of the Republic of Belarus, or the cost of training in educational institutions of the Republic of Belarus upon receipt of the first higher, first secondary specialized or first vocational education, repayment of loans from banks of the Republic of Belarus, loans received from Belarusian organizations and (or) Belarusian individual entrepreneurs (including interest on them, excluding interest on overdue loans and borrowings, overdue interest on them ), actually spent by them for the receipt of the first higher, first secondary special or the first vocational education by these persons must contain information about the surname, name, patronymic of the payer, the amount and date of payment, the purpose of the payment.

Checks generated when making an operation to pay for tuition or repay a loan using devices and remote banking services of Belarusbank JSB OJSC (Internet banking system, payment terminals, ATMs, info kiosks, etc.) contain all the necessary information and can provided by individuals to receive social and / or property tax deduction.

It should also be noted that these checks are not a copy of an electronic document and are not subject to article 20 of the Law of the Republic of Belarus "On an electronic document and electronic digital signature" dated December 29, 2009 No. 113-З and, therefore, do not require certification.

In accordance with clause 5.10 of the Regulation on the Ministry of Taxes and Duties of the Republic of Belarus, approved by the Resolution of the Ministry of Taxes and Duties of the Republic of Belarus dated October 31, 2001 No. 1592 (with amendments and additions), the Ministry of Taxes and Duties of the Republic of Belarus, in accordance with the assigned tasks for him, conducts explanatory work on the application of tax legislation. Consequently, the Inspectorate of the Ministry of Taxes and Duties of the Republic of Belarus at your place of residence is obliged to give you comprehensive advice on the issue of providing property (construction or purchase of housing) tax deduction. In addition, official advice on taxation of personal income can be obtained by asking a question on the official website of the Ministry of Taxes and Duties of the Republic of Belarus (Internet address - http://www.nalog.by).

In the "Mini-statement" menu, I would like to see the movement of the card for any period of time, as well as the receipt of funds. Is it planned or not?

Information on all movements of funds using a payment card, except for crediting wages and advance payment, you can get in the menu "Mini-statement" and "Payment history".

The "Mini-statement" menu provides information on the last 10 transactions performed using a payment card or its details, but not more than for the last 7 days.

The "Payment history" menu provides information on payments made by you through the "Internet banking" system for any period of time.

Currently, the implementation of "Mini-statements" with data storage for a longer period in the Internet Banking system is not planned.

The holder of the payment card is given the opportunity to receive a monthly statement of the state of the account for e-mail... This service can be activated through the Internet banking system or by submitting a written application to the bank institution where the payment card was issued.

The commission fee for the provision of a mini-statement is determined by the collection of remuneration for operations performed by Belarusbank JSB OJSC for servicing accounts opened with Belarusbank JSB OJSC, and other operations (section 7, http://belarusbank.by/ru/deyatelnost/10373 / 10505/21060).

Why is the account blocked and how to unblock it?

To ensure security when using the "Internet banking" service and prevent attempts of unauthorized access to the personal data of bank customers, the "Internet banking" system automatically blocks the user account after three incorrect input of authorization data (username (login), password (password) or session code). The system takes one minute to enter the session code, process it and transmit data to the server. If the time limit for entering the session code is exceeded, the system determines this attempt as unsuccessful.

To unblock your account, you can contact the operator of the Contact Center by calling 147 (on weekdays from 8: 30-20: 00, on weekends from 09: 00-16: 00) or use the "Unblock by SMS" service.

When contacting the operator of the Contact Center, the client must inform the operator of the last name, first name, patronymic, username (login), code word (mother's maiden name) specified during registration in the Application Form. When unblocking an account via SMS, you need to follow the link placed under the authorization data entry form, to the section "Unblock via SMS" and in the dialog box that opens, fill in all the fields ("Login", "Password", "Code from the code card", " Code from SMS "sent to the phone) and press the button" Unblock by SMS ".

If the user is blocked 3 times, provided that there is no successful login between the locks (2 times in a row the account was unblocked with the Contact Center operator or using the SMS Unblocking service, but they could not log in), unblock the account recording is possible only at a bank institution. In this case, you need to come to any bank institution and fill out an application for unblocking the client's account in the Internet banking system. You must have an identity document with you.

How to activate the SMS Unblocking service?

To activate the SMS Unblocking service, you need to log in to the Internet Banking system, select the menu item "My profile" - "Personal data" - "Change contact information". In the dialog box that opens, specify the desired mobile phone number, service provider (MTS, Velcom, Life) and select the "Use mobile phone to unlock" option. Click the "Save" button.

How to unblock an account by SMS?

If the "Internet banking" system blocks the user account, an SMS message with a code will be sent to the specified one when the "Unblock by SMS" service is activated.

To unblock your account, you need to follow the link placed under the authorization data entry form, to the section "Unblocking by SMS" and in the dialog box that opens, fill in all the fields ("Login", "Password", "Code from the card of codes", "Code from SMS "sent to the phone) and press the button" Unblock by SMS ".

If the code sent to your phone was not received or lost, then you need to go to the section "Unblocking by SMS" and in the dialog box that opens, fill in the fields "Login", "Password", "Code from the code card" and press the button "Repeat SMS ". You will be re-sent the unblocking code by SMS.

You can request an unblocking code by SMS no more than 3 times in a row.

If the user is blocked 3 times, provided that there is no successful login between the locks (2 times in a row the account was unblocked using the SMS Unblocking service, but they could not log in), it is impossible to unblock the account by SMS. In this case, you need to come to any bank institution and fill out an application for unblocking the client's account in the Internet banking system. You must have an identity document with you.

Is there an opportunity to open a deposit (deposit) in the Internet banking system?

The Internet banking system allows users to open deposit accounts.

To open a deposit, you need to select the menu item "Accounts" - "Deposits" - "Opening a deposit", from the proposed list, select the type of deposit account and click the "Open deposit" button, then you will get acquainted with the public offer for concluding a term bank deposit agreement "Internet- deposit ”, select a payment card from which funds will be debited to open a deposit and click the“ Continue ”button. In the dialog box that opens, check all the data and click the "I confirm the opening of an account" button.

How do I get a 3-D Secure password?

To register a 3-D Secure password, in order to make payments on the Internet (http://belarusbank.by/ru/fizicheskim_licam/cards/uslugi/26958), you need to select the menu item "Accounts" - "Accounts with a card" - "Applications for the issuance of cards / Additional services" - "Password 3-D Secure / Internet Password Belkart". Next, you should select the payment card for which you would like to register the 3-D Secure Password and click "Continue".

In the field "Password 3-D Secure", create your own and enter the password (from 9 to 15 any characters).

In the "Personal appeal" field, create your own and enter a personal appeal (from 2 to 20 any characters), for example: "Good afternoon, Elena".

In the "Answer to question" field, create and enter (from 9 to 15 any characters) the answer to the Secret Question (in the future, the answer to the Secret Question will be used to obtain a new 3-D Secure password in case you forgot and / or want to change 3-D Secure password at the time of confirmation of the payment transaction with the 3-D Secure password).

Click "Register", wait for confirmation of the success of the operation, after which you can use the 3-D Secure password you created when confirming Internet payments.

If you have forgotten the 3-D Secure password and / or the answer to the "Secret question", you must re-register the 3-D Secure password in the "Internet banking" system in the menu item "Accounts" - "Accounts with a card" - "Applications for registration of cards / Additional services ".

If you no longer wish to use the 3-D Secure password, you must cancel the registration of the password in the Internet Banking system in the menu item Accounts - Accounts with a card - Applications for issuing cards / Additional services - Password 3 -D Secure / Internet Password Belkart ".

How to enable / disable the ability to receive an account statement by e-mail (e-mail) in the Internet banking system?

Is it possible to replace the current customer login with another one without going through a new registration?

Changing the username (login) is not provided for in the "Internet banking" system.

The mobile phone number has changed.

To edit your personal data, you need to select the menu item "My profile" - "Personal data" - "Change contact information". In the dialog box that opens, you can edit the following data:

Contact details.

If all session codes from the code card issued during registration in Internet banking have been used, how to get a new one and how much will it cost?

The "Internet banking" system assumes work with one code card, which is tied to the client's account. That is, there is no need to purchase another code card.

How can I recover my login / password to enter the system?

To restore the username (Login), as well as the register of its introduction (large / small letters), you need to call 147 (on weekdays from 8: 30-20: 00, on weekends from 09: 00-16: 00) and inform your identification data: last name, first name, patronymic, code word, personal passport number specified in the Application Form or contact the nearest bank institution. You must have an identity document with you.

If you have forgotten your password, then you need to contact any bank institution where you connect to the system and write an application to generate a new password. You must have an identity document with you.

What is the cost of connecting to the Internet banking system?

from July 16, 2018 JSC "JSSB Belarusbank" cancels the collection of fees for registration in the Internet banking system, incl. on-line registration, and issuance of a code card when registering in the system.

Why, when entering the Internet banking system, it displays the following message: “The client has not gone through all the stages of registration. Code card not activated ”?

1. This means that the client has applied for on-line registration in the "Internet banking" system, but has not received a code card, which is required to enter the "Internet banking" system);

2. When registering the Internet banking service at a bank institution, the code card is not activated in the information kiosk of JSC JSB Belarusbank.

How to proceed to registration in the application?

How do I register in the app?

- Go to registration in the application.

- Click on the "Next" button on the screen where the application offers to register the device.

- Click the "Accept Terms" button on the License Agreement screen.

- Set the access key that will be used for authorization in the application (The access key must consist of numbers and letters at the same time. The length of the access key is from 5 to 15 characters, letters can be used in Latin or Russian. If the entry fields of the access key are highlighted in red, this means that the user entered an access key that does not meet the requirements described above, or the values in the "Access key" and "Repeat access key" fields do not match. Accordingly, until the user fills in these fields correctly, he will not go to the next registration screen).

- Select operator cellular communication and indicate the phone number (it is important that the phone number is the one to which the SMS-banking password is registered), then click on the "Next" button.

- Confirm registration with the confirmation code sent to specified number phone.

How to register an application without access to the Internet of a mobile device?

Registration and operation of the application without the Internet is impossible on mobile devices with iOS and Windows Phone operating systems.

On devices with the Android operating system (in applications below version 3.7.4.):

- Disable Internet (both wi-fi and mobile data transfer).

- Go to registration.

- On the "Phone number" screen, click the "Next" button and click "Post via SMS" in the window that appears.

- Complete registration by entering the received confirmation code.

SMS with registration code does not come

If the SMS with the code has not arrived within 5 minutes, then you need to make sure that the fields "Phone number" and "Operator" are filled in correctly. Reboot the phone and re-request the registration code. If the SMS with the registration code has not arrived, contact your mobile operator about the non-delivery of the SMS.

After sending the registration code, the error "Invalid registration code or its time has expired" appears

The validity of the code is 5 minutes, if the SMS with the registration code arrives later, you need to click the "Retry request" button, check the phone number again and click "Next".

When registering, the message "Registration error in the notification service" appears or a registration request is being sent for a long time

The error is typical for mobile device Nokia Lumia. When it occurs, you need to perform the following actions:

- Make sure that the phone is charged and that the heart-shaped icon is not displayed on the battery indicator (if the icon is displayed, you need to charge the phone or turn off the power saving mode).

Adding maps and activating packages by maps

How to add a card in the application and activate the package?

NSAfter registration, click on the "Add now" button.

Click in the lower right corner on the add card button.

Press the "Menu" button in the upper left corner on the main screen of the application and go to the "Maps" section. Then click on the "+" button in the lower right corner.

|

Ways to add a card |

||

|

According to the bank card |

By SMS banking password |

|

|

For cards of JSC "ASB Belarusbank": |

It is possible to add maps in this way:

or:

Register3D-Secure passwordWHOcanin ANDinternet banking JSC ASBBelarusbank»

. |

SMS banking phone number to whichregisteredAppendixe (« About the app»). |

|

For cards of other banks: |

SMS bankingmust be registered to the samephone number to whichregisteredAppendixe (it is possible to view in the section« About the app»). |

|

After filling out the form for adding a card, click on the "Next" button, select the required package and click on the "Activate package" button.

How to enable auto-renewal of a package by card?

Enabling auto-renewal of the package is available:

- when adding new card to the application;

- when renewing the package for an already added card.

Auto-renewal is available for the "Full", "Basic" and "Economy" packages.

To enable auto-renewal of a package, you must add a card or renew the current package using a card with the auto-renewal function of the package enabled.

How to turn off auto-renewal of a package?

To turn off the auto-renewal of the package by the card, you need to activate the package with the option "Auto-renewal of the package" disabled.

Also, the auto-renewal of the package is disabled automatically when the card is removed from the application.

ATTENTION!WHEN REMOVING THE APPLICATION, THE AUTO-RENEWAL OF THE PACKAGE DOES NOT DISCONNECT!

Errors when adding a map

"Completed unsuccessfully. Cardholder was not authenticated."

The error occurs when adding a card according to the bank card data and means that the 3D-Secure password is not registered on the card. Using Belarusbank cards, it is possible to register a 3D-Secure password in the Internet banking system and add a card to the application using it. Or choose another method of adding a card - SMS-banking password, having previously received the password at the bank's infokiosk or Internet banking system (only for Belarusbank cards).

"The 3D-Secure password has not been confirmed. Please add the card again."

The error occurs when adding a card using bank card details. Means that the time of the operation has expired (the time for entering the 3D-Secure password has expired).

“Connect SMS-banking in the info kiosk or Internet-banking Belarusbank and activate the card in the M-Banking application with a password for SMS banking. "

An attempt is made to activate the card using the bank card data. At the same time, the user does not have a 3d-secure password registered and the phone number to which the application is registered does not coincide with the phone number that was specified when the card was issued at the bank. The user will be able to add the card ONLY using the SMS banking password.

"There is no access to the SMS-banking service. Register at the Belarusbank info kiosk and activate the card in the M-Banking application."

The SMS-banking service has not been registered to the phone number specified during the registration of the application. To add a card, you need to register SMS-banking at the infokiosk or in the Internet banking system (only for Belarusbank cards).

This error occurs in two situations:

- When adding a card earlier, the SMS-banking password was entered incorrectly 3 times, and therefore, the registration of SMS-banking was canceled. In this case, you need to register SMS banking again.

- SMS banking password is registered to a different phone number

How to renew a package with a card?

On the map image, click on the "Activate" button

Lost SMS-banking password, is it possible to recover it?

It is impossible to recover the password. In the info kiosk or Internet banking (for Belarusbank cards), you need to cancel the old registration of SMS banking and register this service again.

When activating a package, the error "The selected package is not available for your card" appears.

The error occurs when activating the "Basic" or "Full" package. These packages are available only for Belarusbank cards.

Adding a card and activating the package is successful, but after that the card is displayed in the application as inactive.

Set the current date and time on your mobile device and re-enter the application.

How to activate the second card?

Adding subsequent cards to the application is identical to the procedure for adding the first card (the bank can set limits on the maximum number of cards). When adding cards using the SMS banking password, registration of SMS banking is required using the phone number to which the application was registered. The phone number to which the application was registered can be viewed in the section "About the application").

When activating a second or subsequent card, no discount was provided.

To receive a discount on the second and subsequent cards, at least one card must be paid for at the full cost of the package.

How do I remove a card from the app?

Go to the "Maps" section, then go to edit mode (pencil-shaped icon) and select the required map. On the card editing form, click on the "Delete selected card" button.

Are funds debited when changing a package?

If the package is changed to a package with a higher value, the full cost of the package is written off and the package is reactivated for 30 days.

Are funds debited when the card is added again and the package is activated (for example, after reinstalling the application on another phone)?

When adding a card with the same package, if the package has not expired yet, the funds are not debited again.

There has been a change (re-issue, renewal) of the card, do I need to do something in the application?

When changing the card, you need to re-add it and activate the service package (see clause 2.1).

Alert channel

How are alert channels different?

- Internet - notifications are received in the form of notifications, viewed and stored in the application (to receive notifications, a mobile device must be connected to the Internet).

- SMS notification - notifications are received in the form of notifications, viewed and stored in the application (To receive notifications, you do not need to have a mobile device connected to the Internet.

This notification channel is available for mobile devices with the Android operating system in applications below version 3.7.4. Starting from version 3.7.4, this notification channel is no longer available for Android devices).

- SMS - notifications come in the form of SMS messages to the phone number to which the application is registered, they are stored in the memory of the mobile device (like ordinary SMS messages).

How do I change the notification channel?

In the application, select "Settings" - "Notification channel" - select the desired channel and click the "Save" button.

The notification channel "SMS-Notifications" has disappeared in the settings

It is necessary to check the version of the client application (section "About the application" in the navigation menu). Notification channel SMS notification has ceased to be available since the application version 3.7.4 for phones with Android OS. Therefore, if the user has application version 3.7.4 or higher, then this notification channel will be unavailable to him. He can use either the Internet or SMS notification channel.

Only notifications about the receipt of funds are received, notifications about expenditure transactions are not received.

Notifications are received by cards that are added to the application. In the case of using a card that has not been added to the application (for example, the client has two cards to one account, one is added to the application, but uses the other to calculate), notifications about debit transactions will not be received.

SMS notifications are not received

It is required to try to restart the mobile device, change the settings of the mobile device, including the installed one. software(power saving mode, anti-virus programs, applications that optimize the performance of a mobile device, etc.) that may prevent the display of directed notifications. If the recommended actions do not solve the problem, it is possible to contact the cellular operator for advice (when contacting the cellular operator, to receive a correct consultation, you must indicate the phone number from which the sending is made - Mbank).

Notifications are not received via SMS notification and / or the Internet (Huawei mobile device).

For Huawei p8, y7 models:

Settings - Notifications and status bar - Notification manager - M-Belarusbank - enable banners, activate priority.

Settings - Battery - Disable applications after locking the screen (or something similar) - deactivate the option for the application.

For Huawei p9 models:

Settings - Notifications and status bar - М-Belarusbank - activate all fields.

Settings - Applications - M-Belarusbank - Battery - deactivate the option for the application.

For versions below Android 5:

Settings - Protected applications - Mark the M-Belarusbank application as protected.

Power saving - Activate the power saving mode "Smart".

For Android 7.8 versions:

Settings - Applications and notifications - Notification manager - M-Belarusbank - activate all switches, set "Notifications on the lock screen" - "Display".

Notifications are not received via SMS notification and / or the Internet (Xiaomi mobile device).

Notification channel SMS notification is available for mobile devices with the Android operating system in applications below version 3.7.4.

In the standard "Security" application (or in the Phone Settings) select the "Permissions" section, then go to the "Autostart" menu and activate the options for the M-Belarusbank application, go to the "Other permissions" menu, select the M-Belarusbank application, activate all options.

Notifications are not received via SMS notification and / or the Internet (Samsung mobile device)

Notification channel SMS notification is available for mobile devices with the Android operating system in applications below version 3.7.4.

In the settings of the mobile device, the following actions are required:

For versions below Android 5.6:

Settings - Sounds and notifications - Application notifications - M-Belarusbank - activate priority.

For Android versions 7, 8:

Settings - Notifications - activate the option for the M-Belarusbank application.

Settings - Notifications - In the upper right corner the button "Advanced" - M-Belarusbank - activate "Allow notifications", set the priority, deactivate "Show without sound", activate the option "Show content" on the lock screen.

Notifications are not received via SMS notification and / or the Internet (Meizu mobile device).

Notification channel SMS notification is available for mobile devices with the Android operating system in applications below version 3.7.4.

In the standard "Security" application, you need to perform the following actions:

- Battery - Power saving mode - deactivate.

- Battery - Power saving mode - deactivate the "Network off in standby mode" function.

- Battery - Super Mode - Deactivate.

- Battery - Super mode - activate the "Software enabled in super mode" function for the M-Belarusbank application.

- Permissions - Application notification - activate all options for the M-Belarusbank application.

- Permission - Run in the background - M-Belarusbank and Google Play Service applications - allow work in the background.

- Permission - Software permissions - select the M-Belarusbank application and activate the "Notification" and "Show on the lock screen" options, set the "Run in background" option - "Allow work in the background".

Notifications are not received via SMS notification and / or the Internet (mobile device with Windows Phone operating system).

Notification channel SMS notification is available for mobile devices with the Android operating system in applications below version 3.7.4.

- Deactivate power saving mode.

- Restart your phone.

- Connect your mobile device to the Internet.

No alerts (Apple mobile).

If the mobile device is connected to the Internet in its settings, you need to do the following:

"Settings" - "Applications" - "M-Belarusbank" - "Notifications" - activate all options - select "Banner".

Notifications are not received via SMS notification channels and / or the Internet (general recommendations for other mobile devices).

Is it possible to perform operations in the application without using the Internet (set up an SMS communication channel)?

The ability to conduct transactions without using the Internet (via SMS) is available in the application (for mobile devices with the Android operating system in applications below version 3.7.4) and is carried out as follows. If you disconnect your mobile device from the Internet and click on any button that sends a request (for example, "Pay" or update the card balance), a pop-up window will appear that will offer to send a request via SMS.

Can an application installed on a mobile device with iOS and Windows Phone operating systems work without an Internet connection?

No. Mobile devices without a GSM module, including mobile devices with the listed operating systems, can work (transmit requests / data) exclusively over the Internet.

Making payments

How to find payment in ERIP?

To search for a payment, you need to go to the "Payments and Transfers" section, click on the search button for ERIP in the upper right corner of the screen (represented as an icon -), select a search criterion (Service name, recipient's UNP, Service code), enter data and complete Search. Find the required one in the proposed search results and go to the payment form.

Is it possible to make a payment through ERIP if the mobile device is not connected to the Internet?

The list of ERIP payments is generated online and is available only if there is a connected mobile device to the Internet.

Can I make payments using the ERIP payer number?

This feature is missing.

When making a payment, throws it to the main screen of the application?

If the user selects a service when making a payment (for example, MTS - selects "By phone number") and throws it on the main screen of the application, this means that the "Do not save actions" mode is activated in the settings of the mobile device.

To disable this mode, go to "Settings" - "For Developers" - "Do not save options" (either "Do not save actions" or "Destroy windows") - deactivate the mode). After re-make the payment.

How to make a payment using a QR code?

Via the "M-Belarusbank" application (For Android versions above 3.2, for all iOS versions):

To do this, go to the application, select the section "Payments and transfers" - "Payment by QR code" - point the smartphone camera at the QR code (the QR code is read automatically) - on the payment form, if necessary, enter additional data (meter readings, amount, etc.) and click the "Pay" button.

Via a third-party app that can read a QR code (for all Android and iOS versions):

To do this, you need to open any third-party application that can read a QR code (for example, "Lightning QR Scanner" or "QR & Barcode Scanner", etc.) and scan the QR code. After that, the application will display a link where the payment is available. This link can be opened using the M-Belarusbank application, for which the user needs to select the M-Belarusbank application in the provided list of possible applications and log in. After authorization and processing of the scanned QR code, a payment form will open, where, if necessary, you will need to enter additional data (meter readings, amount, etc.) and click the "Pay" button.

Contributions

How to go to the "Deposits" section?

To go to deposits, click on the "My finances" section, available in the navigation menu or under the card on the main screen, and select the "Deposits" tab.

The application operation log does not display operations for requesting the balance of funds on deposit accounts.

The balance of funds on deposit accounts is displayed in the application exclusively on the deposit account card.

The application does not display deposit accounts opened in bank branches by a non-resident of the Republic of Belarus.

The search for deposit accounts in the application is carried out by the personal passport number of the holder of Belarusbank cards added to the application. In this connection, only residents of the Republic of Belarus can view the deposit accounts in the application.

The application does not display a list of active deposit accounts after adding a card and activating the package.

The list of deposit accounts becomes available approximately 5 minutes after adding the card and activating the package.

How to make a deposit?

The replenishment operation is available in "Payments and transfers".

In the application you can top up:

- deposit by IBAN account number

- deposit by account number

- internet deposit

Can I open a deposit in the application?

Yes, you can open a deposit. To do this, go to the "My finances" section, select the "Deposits" tab and click on the [Open deposit] button at the bottom of the screen. Select the required deposit for opening, ! carefully read the terms of the contract! enter the minimum amount to open a deposit and click on the final button [Open].

Can I close a deposit in the application?

You can close in the application ONLY online deposit.

To close a deposit you need:

- Go to the "My finances" section.

- Select the "Deposits" tab. Click on the deposit you want to close.

- Click on the "Services" tab.

- Click on the operation "Close deposit".

Accounts

How to go to the "Accounts" section?

To go to "Accounts", click on the "My finances" section, available in the navigation menu or under the card on the main screen.

What information is displayed in the "Invoices" section?

The "Accounts" section contains the user's open card accounts with JSC "JSSB Belarusbank".

In the details of the card account, you can see the card account balance, account number, account IBAN, overdraft amount and cards linked to the account.

Cards linked to an account is a list of cards linked to this account and added to the application, as well as an element indicating that there are cards linked to this account, but not added to the application. If there are no such cards, then the element is not displayed.

How is the balance of the card account formed?

The balance of the account is formed without taking into account the overdraft and funds blocked by cards. The balance of the card account is updated once a day after the close of the banking business day.

How do I open an account in the app?

To open an account in the application, you need to go to the "My finances" section and click on the corresponding button "Open an account". This will open the form "Applications for a card", because a new card account is created for the new card. To successfully open an account, at least one Belarusbank card must already be added to the application.

Services

Checks (statements) are not received by e-mail.

- Check if the e-mail address is correct in the application.

- Check for the presence of checks (statements) in the "Spam" folder of the mailbox (associated with the individual settings of the client's mail or the settings of the spam filters of the mail service).

- Contact the support service of the postal service with a description of the problem.

- Change postal service(for example, mail.ru to yandex, gmail, etc.).

How to order an e-mail statement?

To order a statement by e-mail, go to the section "Services" - "Statement by e-mail" - if necessary, indicate the e-mail address (other requested data) - click "Request" (Account statement for the month is received on a monthly basis once a month, other statements within a few minutes after ordering).

Service "Card-check to e-mail".

Through the "Card-check by e-mail" service, it is possible to order a check by e-mail about the operation performed in the application by its number or checks on operations for a period not exceeding half a year (checks are received by e-mail within a few minutes after ordering ).

How can I get an e-mail statement if I reinstalled the application?

After reinstalling the application, you need to add the card to the application and activate the package for it, then go to the "Services" - "Statement by e-mail" section - if necessary, specify the e-mail address (other requested data) - click "Request" (Statement monthly invoices are received on a monthly basis once a month, other statements are received within a few minutes after ordering).

How to register a 3D-Secure password?

You can register a 3d-secure password only with a card that has already been added to the application. To register a 3D-Secure password, go to the section “Services” - “3D-Secure Password” - “Registration” - select the type of password 3d-secure - enter the requested data - click “Register”.

Types of 3d-secure password:

- static - it is set once and is used constantly, in the application there is an option “Create your own”;

- dynamic - each payment will receive a different password in a test message, in the application the option "Receive by SMS".

Application errors

"No internet connection"

You need to connect your mobile device to the Internet.

"Data retrieval error"

It is required to make sure that the mobile device is connected to the Internet and the connection is stable (For example, by accessing the Internet through a browser. If the search fails, it means that the mobile device is not connected to the Internet. Therefore, you need to connect your mobile devices to the Internet.).

If the mobile device is connected to the Internet and the connection is stable, but an error still occurs in the application, then it is recommended:

- Disconnect the mobile device from the Internet and reconnect.

- Restart your mobile device.

- Deactivate the mode of restricting Internet traffic in the settings of the mobile device.

- Deactivate modes of third-party applications (for example, AdGuard, AdBlock, Kaspersky, Dr.Web, etc.) installed on a mobile device that can block access to the Internet through the M-Belarusbank application.

For Xiaomi mobile device:

It is required to deactivate the mode of restricting the operation of the M-Belarusbank application on the Internet. For what it is required to perform the following actions in the settings of the mobile device:

Go to the standard application "Security" - "Traffic" - "Data transmission" - activate Wi-Fi and 3G / 4G modes for the M-Belarusbank application.

For Android mobile device:

Disconnect the mobile device from the Internet and perform the operation in the application via SMS (i.e., when attempting to perform the operation, an error will be displayed when connecting to the Internet with the ability to perform the operation via SMS). The successful status of the operation will confirm the problem of connecting the mobile device to the Internet. In this connection, it is required to check the positive balance, you can check the information with the mobile operator)

It is required to clarify whether the M-Belarusbank application was installed on any other mobile device or copied (restored) from a backup. In the above cases, the application must be removed and reinstalled by re-registering it, adding a card and activating the package (the application can work correctly only when installed from the application store, as well as on one device (the last one on which it was installed).

Error "Unable to send a request via SMS" or "Error sending SMS".

- You need to make sure that the balance on the phone is positive and, if necessary, top it up (when using a mobile device with two SIM cards, you need to check the balance on the SIM card installed in the main / first slot).

- Restart your mobile device.

- Change the settings of the SIM card in the phone (the SIM card with the number to which the application is registered must be installed in the main / first slot and there should be no restrictions on sending SMS by the phone number).

Error "Communication with the bank failed" or "Your card is blocked. Please contact the bank".

The card on which the request is made is blocked. On the added card in the application, you can see the last 4 digits of the card number, and then contact the round-the-clock customer service to unlock it by phone +375 17 299 25 25.

"Server address determination error", "Request forwarding error", "Debt information not defined".

The specified error occurs when repaying a loan using irrelevant details. In this case, to clarify the current details, it is possible to contact the bank institution at the place of issuing the loan or to the Bank's Contact Center by phone 147.

When checking the balance, "Refused. Please call 2992525"

The card may have a partial blocking (for example, the PIN code has never been entered). The exact cause of the error can be clarified in the customer service of OJSC "Banking Processing Center" by the number +375 17 299 25 25 .

Settings

How to go to application settings?

To go to the application settings, on the main screen, press the button with three lines in the upper left corner and select the "Settings" section.

How can I change / add an e-mail address?

Enter a new address in the application settings in the "Enter e-mail" field. The value of the new address will be applied automatically after exiting the settings.

PIN-code - an alternative entrance to the application. Access to the application using a PIN code is possible if the mobile device is connected to the Internet. If there is no Internet access or the connection is unstable (weak signal), then you can enter the application using an access key or using a fingerprint (if this function is supported by a mobile device). The number of unsuccessful attempts to enter the PIN code is 3, when the application is blocked by the PIN code, other login methods are not blocked.

Fingerprint is an alternative entrance to the application. The functionality of the mobile device is responsible for the correct operation of fingerprint recognition in the application. If fingerprints are not entered in the settings of the mobile device or the device unlock is disabled, then the fingerprint recognition will also not work in the application.

The number of unsuccessful fingerprint login attempts is 4-5 (depending on the mobile device); when the fingerprint login is blocked, other login methods are not blocked.

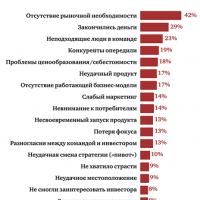

What you need to open a hookah lounge, and how to do it correctly

What you need to open a hookah lounge, and how to do it correctly How to start a business and choose donut equipment

How to start a business and choose donut equipment Opening a company in Montenegro Open a company in Montenegro

Opening a company in Montenegro Open a company in Montenegro The carpentry shop as a business

The carpentry shop as a business How to choose a business direction?

How to choose a business direction? Sample business plan of a dental office

Sample business plan of a dental office Five best business ideas that brought millions What business to open so as not to go bankrupt

Five best business ideas that brought millions What business to open so as not to go bankrupt