Coursework is an example of a valid commercial policy. An example of a commercial policy (typical structure) in the B2C market on the example of JSC "AVS" in the household appliances market Notes on the document Commercial policy of a trading company sample

An example of a current commercial policy.

1. Terms and abbreviations.

2. Scope and duration of the commercial policy.

3. Company strategy, goals and objectives of commercial policy.

5.1. Distributor sales policy

5.2.policy of sales to network clients

5.3. sales policy to trading partners

6. Quality policy.

7. Contractual system.

1. Terms and abbreviations

o TD- LLC "TD Pekar"

o Client- a legal entity engaged in the trade and procurement of auto parts and purchasing products from the TD

o PEKAR- products brand"PEKAR"

o Base Price- price, before calculating all types of discounts.

o Selling price- the price, after all types of discounts have been accrued, taking into account the category of the Client

o DS- Distributor Agreement

2. Scope and validity period.

Application area:

This Commercial Policy is subject to observance by all employees of LLC "TD Pekar" and applies to all categories of clients of TD.

Validity:

This Commercial Policy comes into force from 01.02.2009. and is valid until 31.12.2009.

3. Company strategy, goals and objectives of commercial policy.

Company strategy:

To maintain the position of one of the leading suppliers of spare parts for Russian car brands:

o form a stable system of sales of products, allowing to use the existing sales potential in the sales regions

o create a competitive offer in the field of assortment and commercial conditions

Goals, objectives of the Commercial Policy:

Target:

To form a stable distribution system for the current and future assortment of TD.

Tasks:

o define the basic principles, conditions and restrictions on the sale of PEKAR products on the market

o create conditions for mutually beneficial and long-term partnership of TD with Clients

PEKAR products can be shipped to the following categories of customers:

1. Distributors:

Wholesale companies in the auto parts market operating in a specific region within the Federal District, regularly distributing to small wholesale and retail channels of the serviced territory and / or customer base, having a sales potential of PEKAR not less than the standards established for this region, capable of providing a positive image of the products being sold, promotion in sales channels and training of sales personnel, ready to comply with the terms of the Distributor Agreement of TD Pekar.

2.Network clients:

Trade networks represented by at least 10 auto parts retailers belonging to one legal entity / individual or being one legal entity, located in one or several regions, having a unified procurement system, having a sales potential of PEKAR not less than the standards established for this type of customer.

3. Business partners:

Wholesale companies as well corporate clients that do not correspond to the profile of "distributor" and "network client" in terms of the sales potential of PEKAR and other conditions.

5.1.Distributor sales policy.

| Distributor UNIVERSAL | Distributor of MOTO | Distributor of VAZ | |

| Providing regular discounts, subject to the distribution agreement | 10% | 10% | 10% |

| Granting a deferred payment | at the request of the client, at a deferred price | ||

| Delivery | on the territory of the Russian Federation, at the expense of the TD; to the CIS countries and abroad - pickup or delivery - depending on the country. | ||

| Providing all accompanying information to PEKAR | at the expense of TD | ||

| Training on new products | at the expense of TD | ||

| Suppression of unfair competition | availability of quotas in accordance with the potentials of regions and / or client base fixed in the DS | ||

| uniform pricing policy for distributors | |||

| Trade marketing support | general program in accordance with product strategies, plus local programs - by agreement of the parties | ||

| Management | assignment of an individual manager (employee of the commercial service) TD for each Distributor | ||

The distributor complies with the following conditions:

| Distributor UNIVERSAL | Distributor of MOTO | Distributor of VAZ | |

| Exclusive | purchases of PEKAR products only from TD | ||

| Terms of payment | pays PEKAR according to the invoices and the terms of the contract; payment scheme - through the Central Office of the TD. | ||

| The minimum volume of the average monthly purchase in accordance with the potential of the region | 0.5-1.5 million rubles - depending on the potential of the region and / or the fixed client base | all regions - 250 t. rub. | all regions - 250 t. rub. |

| Minimum batch | 150 t. P. | 100 tr. | 100 tr. |

| Planning | |||

| Work in the assigned territory | shipment of products within the agreed territory | ||

| Regularity of work on PEKAR | monthly shipments according to calendar charts supplies and payments; compliance with regulatory stocks | ||

| Working with assortment | purchase of assortment according to the matrix agreed in the DS | ||

Criteria for obtaining Distributor status:

Any wholesale company that meets the characteristics in clause 4 of this policy can apply for the status of "Distributor" of the TD. After the Client contacts the TD, the sales potential and assortment profile are assessed and assigned to one of three types: "UNIVERSAL", "MOTO" or "VAZ".

Then the "testing period" is determined - 3 months, for which are established special conditions:

o terms of payment - prepayment

o minimum average monthly volume - individually

o discount for the development of the region for a limited period and volume - individually

Criteria for depriving the Distributor status:

In case of violation of certain conditions of the Distributor Agreement, TD has the right to deprive the Client of the Distributor status.

In this case The client is obliged:

o Return the trade equipment and other property belonging to the TD that is in the temporary use of the Client.

o Sell off the remaining PEKAR not below the base price.

5.2 Sales Policy: Network Clients

The AP provides the Network Client with the following conditions:

The network client meets the following conditions:

| Terms of payment | pays PEKAR according to the invoices and the terms of the contract |

| The minimum volume of the average monthly purchase in accordance with the potential of the Network client | 0.25 million |

| The minimum volume of a one-time purchase | 100 tr. |

| Planning | monthly, quarterly, annually: by product group |

| Compliance with TD pricing policy | work within the recommended margin |

| Regularity of work on PEKAR | annually by months in the context of product groups according to a three-month "rolling" planning scheme |

| Working with assortment | Purchase of assortment according to the matrix agreed in the Supply Agreement |

| Providing information on the result of sales of PEKAR | reporting in an approved form (regularly and at the request of the TD) |

5.3 Sales Policy: Trading Partners

TD provides the client with the following conditions:

Trading partners comply with the following conditions:

PRINCIPLES OF CONSTRUCTING THE COMPANY'S COMMERCIAL POLICY

Published by ID Grebennikov. Distribution channel management. 2009

The article explains how to formulate the commercial policy of an enterprise: correctly organize a distribution network, form effective principles pricing and discounts to interest both distributors and retailers. The stated principles are applicable in Russia for branded goods. The author describes only real-life models and feasible principles.

The commercial policy of the enterprise should contain the principles of the distribution system, the division of customers by sales channels, pricing, provision and methods of calculating discounts, logistic and financial conditions of work. A properly constructed policy is of interest to both distributors and retailers, which creates a natural "craving" for the product and makes it available to the consumer. The choice of policy depends on the existing or expected turnover, investment opportunities, the strength of influence of existing brands, the competitiveness and characteristics of a particular commodity market... With the correct reform, the financial result should grow faster than investment, and be manageable with the help of the described tools, including human resources and distribution. The article discusses the provisions implemented in the territory of Russia, the majority of regions of which are sufficiently homogeneous for the application of standards for building a distribution network. These provisions are suitable for companies with production in the territory of the Russian Federation, whose products have pronounced consumer properties and are intended for sale in retail stores.

The basis of pricing is the basic price list - Gross Price List (or basic price lists for each sales channel). To create it, you need to consider two aspects: the level of its formation and pricing by region.

Pricing by region answers the question of how the landed cost will change (the price of the goods, taking into account the cost of transportation to the warehouse) for the distributor, depending on the region. There are two basic models (Fig. 1).

1. The manufacturer fully pays for the delivery of goods to all distributors, landed Cost in Russia is the same for them (model 1 in Fig. 1). This simple, most common model is used by the category-forming companies: Pepsi, Coca-Cola, Mars, Chupa Chups, DANONE, Bunge, Yug Rusi, Kraft Foods Inc., enterprises of the tobacco and brewing markets, most companies with a turnover of over $ 50 million per year. With such a system, if an agreement is concluded with distributors to maintain the recommended mark-up on products, the price of goods on the shelves in retail outlets will also fall within a certain range in all regions. When analyzing the profitability of regions, the cost of transportation can be considered averaged over the territory of Russia. If strong competitors adopt this model, the start-up company can also use it effectively to generate rapid sales growth by offering competitive prices in uncovered nearby areas.

2. The distributor pays for delivery on the EXW basis, or the cost of delivery is included in the price on the CPT basis according to the current tariffs. Accordingly, the further from the place of production the distributor's warehouse is, the higher the landed cost will be (model 2 in Fig. 1). For most products, especially light ones (such as chips) or money-intensive products (such as cigarettes and chewing gum), the soil is created for uncontrolled product movements between regions, destroying the established sales structure. This model is effective for companies that position themselves as local.

Rice. 1. Regional pricing

The rest of the models are combinations of the first two: partial compensation of shipping costs (model 3 in Fig. 1) or free delivery over a fixed distance (model 4 in Fig. 1), and then the price includes the tariff for moving goods from the last point of free delivery to the warehouse distributor. These models can successfully deal with uncontrolled product movements. They were used by Bolshevik (DANONE group) and in some Pepsi units.

It is important to distinguish between the principle of regional pricing and the basis of delivery to customers. There are two main bases.

1. Delivery transport company by order of the manufacturer on the basis of CPT to the distributor's warehouse. This is good way creating a uniform shipping schedule, since, as a rule, the manufacturer plans it himself. As a result, the manufacturer and the partner have strong financial relationships and the issues of taking orders from the distributor are easily resolved. Manufacturers often plan weekly shipments, as an additional service of the eurotruck visits several customers in a row and delivers the orders made in the same way as when working with retail. The overwhelming majority of companies use this particular method, which makes it possible to effectively manage the operation of the warehouse and provide additional services to customers. In addition, the manufacturer will always be sure that the products have arrived at the distributor's warehouse, and not at the wholesaler located in the neighboring area.

2. The EXW delivery basis is used by manufacturers who cannot provide a good service during transportation or do not have enough resources to order transportation. This method narrows the range of clients, because not all distributors have a car park and it is not always possible to respond promptly to the removal of an order.

Therefore, the following logistic trading conditions must be specified in the commercial policy:

- minimum order lot (multiplicity of the order by name: shipment by pallet or by a layer of pallets; the total volume of the order, as a rule, depending on the vehicle - a wagon, a euro truck);

- terms of order fulfillment depending on the chosen delivery basis;

- determining at whose expense the delivery is carried out;

- the possibility of delivery on pallets and without, pallets are returnable or included in the price of products;

- regulations for claim work in terms of quantity and quality (franchise size, grounds for issuing claims letters - acts of the Chamber of Commerce and Industry (BTE), TORG-2, P6 / P7);

- Does the manufacturer exchange goods that have lost their shelf life on retail shelves?

Let's return to the basic price list and consider the level of its formation. There are two generally accepted options that differ only in management, the financial model is the same in both cases (Fig. 2).

Rice. 2. Distributor pricing

1. Sales prices set by the manufacturer for the distributor (basic price list 1). Benefits - ease of explanation to the distributor and ERP setup (model 1 in Figure 2). This model is effective for companies operating in the wholesale segment without retail sales representatives. It does not allow keeping the trade secret of the “bottom price” that the company is ready to offer. An intercepted lower price invoice does not provide a basis for claiming that the firm can afford it. For example, in this invoice, the price could include a discount for the volume of purchases, and a price list with a company stamp is an official document that can be used by the client to set requirements for improving conditions for himself.

2. Sales prices set by the distributor (or the manufacturer, if he has his own warehouses) for non-chain retail (basic price list 2). This option is used by the vast majority of international companies to facilitate the work of their sales representatives with retail. The essence of the model is that each sales channel is given a discount sufficient to obtain a minimum profit when working with a margin that returns the price to the base price list (see Fig. 2). For example, for companies with a turnover of $ 50-300 million per year, a markup of 15% (depending on the average order size from stores and other operational parameters) can provide minimal profitability when delivered to non-chain retail. Accordingly, having received a 13% discount for the channel and then charged 15%, the distributor sells at the recommended retail prices. He should receive the main profit through additional discounts, fulfilling the goals for the volume of purchases, etc.

Often, due to pressure from retail chains, manufacturers create a separate price list for this channel, the prices in which are high enough to provide discounts required by the chains on the invoice. It is clear that if the networks identify other price lists, corresponding fines may come into effect.

Also, the commercial policy should indicate how long the manufacturer will warn customers about the price increase. This period may be different for distributors and network retail clients: longer for the first and small (up to one week) for the second. In addition, since the agreement between the distributor and the network implies a longer delivery time at the same, lower prices than the agreement between the manufacturer and the distributor, the agreement should indicate who will bear the cost of maintaining the old prices, especially if the manufacturer has committed to provide a minimum distributor markup. When reducing the price of products, it is also important for distributors whether the manufacturer overestimates the inventory in their warehouses. Formally, this may not be fixed in the documents, but it should be a transparent company practice. Instead of revaluating inventory, the following suggestion may be made: distributors with large stocks of goods in warehouses, subject to the fulfillment of the procurement plan, with a decrease in the base price list, they have the right to redeem the goods with an additional discount. This offer is interesting both for a manufacturer that is increasing sales in a falling market, and for a distributor who, despite a large stock of goods, has a competitive price.

Table 1

DISCOUNTS AS A COMPONENT OF THE COMPANY'S COMMERCIAL POLICY

Discounts are the most important component of commercial policy. The system of discounts is usually introduced by order or order of the head of the organization. In order to avoid additional tax assessment as a result of inspections by tax authorities, all agreements legal entities discounts are made in writing. Channel and customer discount amounts should be planned within the annual budget and updated quarterly. Also, the enterprise should develop a classifier of discounts (Table 1), which contains a matrix of decision-making and budgetary responsibility. There are prospective and retrospective discounts. Their difference for management accounting is that all retrospective discounts in the ERP must be provided with appropriate reserves. Both prospective and retrospective discounts can be both conditional and unconditional.

Prospective discounts are governed by a decrease in the price on the account, and for retrospective discounts in Russian legislation, the following options exist:

- discount on the account: according to the Tax Code, on one account the discount cannot be more than 20% of the average market price, for which it is advisable to take the basic price list minus all permanent (basic) discounts, for example, distributor discounts;

- transfer in the form of a bonus (not subject to VAT);

- payment on the invoice according to the agreement for the provision of marketing or other services;

- transfer of "free" goods.

It must be remembered that in accordance with the Tax Code of the Russian Federation, the following types discounts:

- for the fulfillment of the plan for the volume of purchases by the client;

- for the sale of expiring goods;

- when a customer purchases goods during a specified sale period;

- for the sale of products that have lost marketable condition or other consumer properties;

- when promoting goods to new markets;

- when promoting new products.

Naturally, all discounts provided must be confirmed by the corresponding primary accounting documents and archived. It is the efficient construction of processes in the field of workflow between the commercial department, accounting department and the office work department, the division of the work of merchants into negotiation and technical functions that have the greatest reserve for optimizing the number of office employees.

Discounts are of a different nature. First of all, they can be divided into commercial and non-commercial. Non-commercial discounts are of two types:

1) operating (logistic);

2) financial.

Logistic discounts are provided when a full truck or a whole pallet of the same product is shipped, which is often used when working with retail chains and distribution centers. Delivery of an incomplete car with an order reduces the financial result. It is advisable to have different prices for shipping by wagon and container due to different tariffs. It is cost-effective to reward for the evenness of shipments over time (with limited shipping opportunities at the end of the month, when, as a rule, the plan is fulfilled due to the increase in the distributors' stock balances) or for the advance order submission (for productions with a long cycle of purchasing raw materials).

Financial discounts are available for advance payment or for payment before the agreed period. Like logistic discounts, they should reflect the market value of the service, as well as the company's willingness to promote a process that matches the discount. For example, with limited lending opportunities, a manufacturer by providing a prepayment discount that is greater than the cost of obtaining a loan from a distributor in a bank may encourage customers to make an advance payment. In addition to discounts, surcharges are possible, for example, for the provision of factoring services.

It is advisable to offer commercial discounts for the fulfillment of the plan for the volume of purchases, for the allocation of an exclusive team and support of its work, for compliance with the terms of interaction with modern retail formats of trade, for conducting trade marketing activities.

It is also important to describe in detail the basis from which the discounts are calculated. As a rule, they take the basic price list for it, which is easier for calculations, or the price on the account, taking into account all constant discounts, which gives savings, since each percentage of the discount from such a basis in absolute terms is less than from the basic price list.

If the manufacturer seeks to have a transparent commercial policy, he can provide a standard loan to all distributors or add the average delivery time calculated for each region to the standard loan length. For example, if the production is located in the central region, the standard credit length is 5 days from the date of shipment, if in Siberia - 15 days, if in the Far East - 20 days. In this case, all partners will have the same conditions for business development. Segmentation of distributors is possible using ABC analysis (volume of purchases, contribution to the development of distribution, provision of loans when working with networks and other criteria) for lending in accordance with the segment. Safekeeping warehouses as a veiled way of providing credit (funds are reflected in the reporting not as loans, but as a stock of finished products) are used less and less due to the complexity of accounting for the distributor and the need for additional control of the balances on the part of the manufacturer. By the degree of risk of non-return Money consignment warehouses in practice do not differ from credit. However, their advantage when working with national chains may consist in the fact that the distributor, on behalf of the manufacturer, dispatches products from his safekeeping warehouse, as a result, the products are delivered to the chain store with an invoice with the manufacturer's seal, which satisfies the chain's need for a single supplier.

SALES SYSTEMS AND THEIR TYPES

The sales system is understood as the organization of the sale and subsequent delivery of products along the chain from production to retail outlets. There are four types of sales systems implemented by FMCG manufacturers in Russia, they are divided according to the degree of control by the manufacturer of the main elements of the distribution chain.

1. DSD (Direct Sales and Delivery): sales agents are on the staff of the manufacturer and are engaged in direct sales to retail outlets, warehouse, operating and logistics activities are managed by the manufacturer.

2. DS3 (Direct Sales Third Party Delivery): sales agents are managed by the manufacturer, warehouses and transport are managed or owned by the distributor.

3. 3PD (Third Party Distribution): the distributor is responsible for orders from the point of sale and delivery within the territory.

4. 3PD + merchandisers: in addition to the 3PD system, the manufacturer's merchandisers control the display at the point of sale. Two people come to the store: one from the distributor (takes the order and delivers it), and the second from the manufacturer (manages investments and works with the shop window, presents new products).

3PD system

In the 3PD system, the distributor provides all the services on site: taking orders, delivering goods and other operational activities. The system is used by companies whose marginality and turnover do not allow them to use more than effective methods, or firms that do not want to invest in product development through the distribution and control of retail shelves. For selected categories For products such as groceries, the least branded and most price sensitive, manufacturers cannot pay nationwide sales representatives. The system can be successful in companies offering a unique (with limited competition) or low-cost product, with a small number of items in the line and a high volume of sales of each of them. The limitations of the 3PD system lie in the ability to grow and control sales. The distributor's price list contains 200-2000 items; a sales representative cannot effectively offer the entire assortment to the store. As a rule, with 3PD, territorial agreements are not concluded and several distributors work in one place. In the extreme case, the system under consideration has a call-center: shops independently place orders by phone, and distributors deliver. The latter do not always have or can fulfill obligations for the exclusivity of products (lack of products of similar names of a competitor) in their price list. There are tendencies towards the allocation of separate teams of sales representatives to work with competing products and the introduction of barriers to additional bonuses to sales representatives from manufacturers. Few companies operate on the 3PD system at the national level, most of them have their sales representatives in large cities, for example, SCA Hygiene Products Russia, United Bakers.

DS3 system

When implementing the DS3 system, the manufacturer has a high degree of control over the shelves in the store, and the distributor ensures the warehousing of goods, their delivery, collection of cash, and the issuance of accompanying and accounting documents. An illustrative example of a good model: the distributor acts as a logistics operator, delivering orders, and the manufacturer has sales representatives on his staff who take orders at the points of sale. Large companies (Dirol-Cadbury, Kraft Foods Inc., Nestle) can afford the exclusivity of the warehouse and delivery: sales representatives sell, and the distributor allocates special transport for the delivery of the manufacturer's products, and sometimes a warehouse.

The issue of separate delivery of the order is important, since if the delivery of products will be carried out together with orders from other manufacturers, then the terms set by the store will not be met. As a compromise, the distributor may suggest defining a delivery day for each store and creating separate credit lines for product groups. This will require the manufacturer to increase control over the route planning of the sales representative. A separate line of credit is required for the sales representative to work autonomously, otherwise he will not be able to accept and deliver the order. Another main recommendation is the introduction of a sales representative into the distributor's CRM, this will greatly simplify the receipt of personalized reports on accounts receivable and completed delivery, and the achievement of key performance indicators.

Sales representatives can be on the staff of a distributor, manufacturer or outsourcing company. This is important in terms of additional costs for a sales representative, but there should be no difference in terms of managing him. Novice territorial managers who are on the manufacturer's staff cannot always immediately establish control over their subordinates in the distributor's staff, and they need serious training and mentoring to achieve synergy between the manufacturer and the distributor.

Another way to reduce the cost of the sales system while maintaining a high degree of control is the formation of a pool of suppliers and joint payment for the work of a sales representative by several manufacturers. A systematic association of producers at the national level is impossible, since they usually have different distributors in different territories. Accordingly, the formation of such a pool is the task of regional managers, and financial standards and payment principles is a task commercial director... In accordance with this, manufacturers for the pool are selected. Illustrative example: the distributor pays the sales representative a fixed part of the remuneration, and the manufacturer pays a variable part.

DSD system

The DSD system gives the manufacturer the best control over sales, distribution and store shelves. Often DSD can be the only alternative, in particular when selling specific products, for example, with a short shelf life (DANONE, Dairy Business), or when a competitor large company uses DSD (Pepsi - Coca-Cola, Istok - Gross - Ladoga). This system is used by firms with a large turnover in large cities, where "critical" sales volumes are achieved to ensure the minimum consignment of goods required to make a profit. The system requires a large staff: collectors, loaders, cashiers, operators, etc., so the product must have a significant margin and high turnover.

Accordingly, the larger the number of territories in which the manufacturer operates according to the DSD system, the more optimized business processes should be, and the cost of operations should become cheaper due to economies of scale. The head of each service has a functional leader in management company, which is dedicated to developing standards, implementing best practices, setting and tracking KPIs.

Knowing the cost of renting a warehouse, office, necessary vehicles, salaries of agents and service personnel and based on the objectives of coverage of outlets and the frequency of their orders, the cost of DSD operations can be calculated.

The main parameters of the DSD, DS3 and 3PD systems are shown in table. 2.

3PD system + merchandisers

The "3PD + merchandisers" system is the most expensive and effective. All tobacco companies, as well as some brewing and pharmaceutical companies can afford its use. Often 3PD is sold on a national scale by one distributor: SNS, Megapolis (tobacco and FMCG market), Protek (pharmaceutical market), Yuzhny Dvor (household chemicals and perfumery market). Procter & Gamble has about 10 distributors. They have high requirements for the product: as a rule, this is the average revenue from the sale of one item of goods at a point of sale. This parameter corresponds, for example, to the Red Bull products supplied by Megapolis. The quality of operations of these 3PD distributors is often not inferior to the quality of DSD: the same trading houses, branches, process models of work, etc.

Table 2. Comparison of 3PD, DS3 and DSD systems

Each of the systems can have one of two types of implementation.

1. Pre-Sales— pre-orders: the sales agent takes the order, it is collected at the distributor's warehouse, accompanied by documents and delivered at the specified time by the outlet through the delivery service. Pre-Sales is the most commonly used system.

2. Van-Sales - sales "from wheels": the agent drives a car with a stock of products, after receiving the order, collects it on board, writes out the accompanying documents there and immediately delivers it to the point of sale. A classic example effective work of this system are distributors of Procter & Gamble: "Magnat", "Credo Cosmetics". Van-Sales is widely used when a critical sales volume is reached and the product loaded onto a truck is sold in a day. This system is most effective for selling money-intensive goods such as chewing gum, cigarettes, coffee, and household chemicals. It is desirable that these products do not need to be promoted: in terms of sales skills, Van-Sales should require less qualification of sales agents than Pre-Sales. Manufacturers often use Van-Sales, such as DSD or DS3 based breweries, in large cities. As a rule, sales "from wheels" are carried out in cash; cashier's check and an invoice with a known number in advance.

The sales system is applicable to the territory defined as a set of outlets of one or all distribution channels to which efficient delivery by road from one warehouse can be carried out. If the territory is served by one distributor, he is interested in promoting the goods, values this contract, and it is easier for the sales representative to negotiate with the outlet. However, in the Federal Law "On Protection of Competition" the Federal Antimonopoly Service reminds that the agreements between the manufacturer and the distributor, restricting, on the one hand, trade margin the latter, as well as the conclusion of an exclusive agreement that prevents the sale of products in other territories, and on the other, the ability of other distributors to sell products in the place in question, limit the competition. Among the risks of commercial policy is the signing of contracts of this kind.

When there are two or more companies in the same territory, they compete primarily through the price of the product. This leads to a decrease in the margin, which is reflected in the price for the consumer - it is reduced by 3-5%. If the price struggle becomes protracted, then it becomes economically impractical for a distributor to invest in this product, and it becomes more and more difficult for a sales representative to sell the entire range, to promote new products. Competitive struggle between sales representatives after the price phase, it goes into the assortment phase: they sell only what the outlet orders.

Taking into account the geographical extent of Russia, the heterogeneity of its regions in terms of purchasing power and consumption of a particular category of goods, manufacturers in different territories can use different sales systems.

The above-described principles of the company's commercial policy should be reflected in internal documents: the commercial policy itself, as well as in the regulations describing the processes of implementing discounts, the emergence of new customers, etc. - and in external: contracts for the supply of channels and based on them additional agreements with distributors - on distribution, with networks - on the allocation of shelf space, listing of new products, etc.

It is important to understand that all other types of policy of the commercial directorate: for bonus payments to employees, trade marketing, working with modern retail formats, organizing a sales network through distributors / system of their warehouses (trading houses) - are derived from commercial policy. The organizational chart of a department, for example, aims to support the chosen distribution system, i.e. effective management of the number of field employees, which is calculated in accordance with the set goals for coverage, merchandising and revenue, and provide the necessary communications within the commercial department: collecting analytical information, processing it, effectively cascading goals and objectives.

SOURCES

1. Administrative regulations of the FAS Russian Federation... - http://www.fas.gov.ru/law/17391.shtml.

2. The Civil Code of the Russian Federation. - http://www.garant.ru/law/10064072-000.htm.

3. Tax Code of the Russian Federation. - http://www.garant.ru/main/10800200-000.htm.

Commercial policy of the Company - a set of rules and requirements governing all actions and relationships associated with the implementation of the distribution function of the Company's goods in the target territories of the Russian Federation and foreign countries.

The development of the commercial policy of the enterprise is one of the services of the Unit-Consulting company and is developed individually, taking into account the peculiarities of the current sales system and the specifics of the business of the Client Company.

More details about the system of operational and analytical control of sales, including: content, work forms, reports, procedures -

The proposed structure of the document is indicative, here is a summary of the main sections of the commercial policy.

Development of the company's commercial policy

The creation of a single document - "Commercial Policy of the Company", reflecting the principles of building a sales network and a base for mutually beneficial cooperation with a distribution network, consists of such sections as:

- Commercial policy objectives.

Determination of the structural and organizational (non-financial) goals of the company in the short term to create a distribution network and create a base for achieving the strategic goals of the enterprise.

- Ways to achieve the goals of commercial policy.

An enlarged description of the basic rules that will be used by the company when organizing the structure of distribution channels and the basics of mutual relations between channel participants and the company to achieve the goal of building a sustainable distribution system.

- Basic rules for creating distribution and used sales channels.

- Description of the distribution block diagram (description of the branch and dealer networks, their status, structure, geography, goals and objectives).

- Establishing the main sales channels for each product category / territory (such as a target consumer or counterparty).

- Sales channel policy.

- Organization's pricing policy and pricing in sales channels.

Determination of the base price level and the principle of its formation in terms of transport costs

Determination of the principle of markups / discounts to the base price for each target sales channel (see above) / product category.

- Motivation system for participants in the distribution network (discounts / bonuses).

Establishing the main parameters of the performance of key direct Clients.

More about with creation of a regional distribution network -

Determination of a system of discounts / bonuses for various types of direct counterparties, aimed at stimulating their activities to achieve or increase the parameters of their performance from the point of view of the enterprise.

- Credit policy.

Credit policy of the organization's work with different sales channels, types of Clients and seasonal fluctuations in demand.

- Document flow and data exchange with Clients.

Establishing the quantity and content, creating documents that will ensure the management exchange of data between direct contractors of various types and the company, in order to increase the company's awareness of sales markets, control the situation and calculate incentive payments to Clients in accordance with the incentive system.

Learn more about how to get not too interested distributors to sell more -

As a result of the implementation of a professionally developed commercial policies Your company will receive:

- Increase in commercial interest from significant customers from the main sales channels: distribution, network, franchise, direct customers - enterprises and other channels

- Well predictable and manageable sales

- Increased loyalty and sales volumes of distributors and other trading partners

- Focusing managers on regions and clients with greater potential.

Sales strategy

The sales strategy determines the commercial policy of any company. She provides answers to the following important questions.

- Who are the clients of the company?

- For what purpose and how does the company sell its products?

- What price segment does the company operate in?

- What are the competitive advantages of its products?

From the answers to these questions, the short-term and long-term prospects of the business are formed. The sales strategy and its main provisions must be known and understood by all company personnel, and especially sales managers who directly interact with customers.

Sales strategy and specific numbers

For example, we analyzed the sales systems of two organizations. The first company has a sales strategy, the second does not. What does the first enterprise have? What is the presence of a sales strategy?

The answer is simple: the first enterprise has specific and numerical goals (for a month, quarter, year and more) for:

- Volume indicators of sales in value and real terms

- Client, product, price segments

- Regions

- Distribution channels

Sales strategy and plans

Most organizations present plans in monetary terms. But in some cases it is more efficient to focus not on cost, but on natural indicators: the number of units sold. This is especially important when the company operates in a high price segment.

Sales strategy and pricing / assortment planning

The influence of the price segment on the sales strategy consists in following certain pricing principles (from the client or from the market), as well as the optimal sales tactics - taking into account those conditions due to which we can change sales. For example, we change prices when seasonal demand changes (low and high seasons), when the competitive environment changes (competitors' activity), when the cost structure changes (decrease or increase in production costs), etc.

The assortment strategy of sales involves, for example, programs for the formation of sets of goods: with high and low margins, new products with the most popular goods, etc.

Regional sales strategy

Considering the fact that our country is located on a vast territory, it is most optimal for an enterprise to selectively approach the sale of its products to various regions. Our specialists have developed and are successfully using a special toolkit - a technique that helps not only to reasonably display regional manager sales plan, but also to fulfill a more global task: to determine which channels will be most effective in a particular region. Those. the technique allows for optimal for everyone a separate enterprise develop a regional sales strategy. Over the 16 years of work of our Company, this approach has repeatedly proved its effectiveness! It should be noted that the technique works not only in conditions of stable economic growth, but also in crisis situations. For example, in a crisis situation when sales in the industry fell by 15%, our client, using this method, managed to increase sales fivefold in the strategically important Ural region. More information on the methodology can be found in the book by Tatyana Sorokina "Branch network: development and management".

Distribution system. Tools for creating a competitive advantage Tatiana Sorokina

Intracorporate document "Commercial Policy"

We have determined the basic rules of the game according to which partners of suppliers in trade channels will work. Clear and written rules for organizing distribution serve as the basis for the document "Commercial Policy", which in most cases will be internal. In many companies, "Commercial Policy" is part of the "Marketing Policy" (an official document, a copy of which, upon request, is provided to the tax office to identify objects of taxation). First of all, the rules are fixed in relation to price and other basic commercial conditions of work. An example of a classic pricing model in channels (including not only the distribution link, but also traditional and systemic retail and HoReCa), as well as describing the average markups in channels, is shown in Fig. 10.

"Commercial Policy" is the main management document that a sales manager works with. Based on individual provisions of the "Commercial Policy", the manager builds interaction with all clients. He knows how the goals, objectives and conditions of working with a distributor differ from, for example, working with a regional chain of stores. The Commercial Policy defines what requirements a trading partner must meet in order to be assigned the status of a distributor, and what special price conditions it will receive. A sample content of the "Commercial Policy" is provided below. During ten years of work, Unit-Consulting specialists have repeatedly developed such documents for suppliers, and almost all of our clients highly appreciated their usefulness: "Commercial Policy" allows you to streamline relations with distributors and optimize tax risks.

1. Basic definitions.

2. Objectives and basic principles of the "Commercial Policy" of the company.

3. The principles of organizing a sales channel for the company's products.

3.1. Segmentation of the priority markets for the company.

3.2. Client classification.

3.3. Building a sales channel for the company.

4. Policy of working with priority sales channels.

4.1. Policy of working with different types of clients and priorities.

4.2. Price policy.

4.3. Credit policy.

5. The system of motivating sales channels (trading conditions).

6. Applications.

Case

Commercial policy: basic principles

Current situation

The confectionery manufacturer faced the challenge of qualitatively improving distribution sales. The logistic shoulder on which the company was ready to supply its products was 200 km from the city where the production was located. The company, in her opinion, has achieved satisfactory representation in its city and was planning to enter a neighboring city with a population of over one million (target region). The shelf life of products is two months. The company's development plans include territorial expansion of sales through a distribution channel. The base price was calculated taking into account the prices in the market with the minimum profitability of the manufacturer and included the cost of delivery to the client. A newly developed (progressive, according to the company) pricing system was used:

6% discount for pickup;

10% discount from the base price for distributors;

Price for retail chains 10% higher than the baseline.

An internal company study found that chains mark up between 20 and 30%. If the goods are coming to the network through the distributor, then the price for the network increases by the distributor's markup of 20% (this is the markup recommended by the manufacturer to the distributor when working with networks). As practice has shown, such a system worked well in the hometown of the manufacturer, but when it entered the regions, it began to malfunction: distributors noted an insufficient margin on the manufacturer's products to cover costs and financial incentives.

Problem

When renegotiating contracts with chains over the past two years, the company did not defend the increase in prices for its products, which negatively affected the sales of distributors, as it limited their ability to increase prices.

In the target region, the company established relationships with partners, and began deliveries to three distributors. The first, in addition to distribution, was engaged in the production of its own products. The second is mostly distribution bakery products, and confectionery was not a priority. The third distributor had an excellent warehouse and well-established logistics, good sales staff.

In general, the company assessed the work on conquering the target region as unsatisfactory and requested recommendations on improving the distribution channel.

Solution

It should be admitted that the company has done a lot of significant work to develop a transparent pricing system, but it still did not meet the conditions and demands of the market. For systematic work with distributors, Unit-Consulting specialists suggested that the company clearly define the statuses of regional trading partners. The status of a distributor is based on actual sales data of the company, as a basis, you can take data on sales in the manufacturer's hometown. Having identified 6-10 wholesale customers who make the largest purchases, it is necessary to indicate the minimum annual volumes for current sales to the selected distributors. Then you should reduce the amount received by about 5% (to ensure that each of them will fall into the coveted pool of distributors next year) and declare that the declared volume of purchases is the minimum for a company that has the status of a distributor. In addition to the guaranteed volume, the distributor undertakes to purchase at least 75% of the assortment produced by the company. It must be admitted that at that time not all of the selected seven distributors worked within the required assortment range, however, the gap was insignificant, and the partners could easily expand the purchased assortment. The status of a distributor also implied acceptance of the manufacturer's recommendations on prices for traditional and chain retail.

Subject to the fulfillment of the manufacturer's requirements, the trading partner received a special distribution price. Additionally, he could count on a quarterly bonus for meeting agreed sales targets. In terms of marginality, the proposed conditions (price + bonus) were slightly more profitable than the previously existing ones. The manufacturer also indicated price ranges for federal and regional chains. The company changed the selling price on the network, now the delta with the base price was 15%. In addition, the recommended price at which the distributor sold the goods to the chains was increased. Thus, the distributor's margin when working with the regional networks channel was significantly increased and amounted to 25–28%.

Further work was aimed at identifying the most promising region in which the maximum sales of the company's products could be expected. Comprehensive assessment regional markets showed that the selected target region is not the most promising. The forecasted sales volumes in another millionaire (by the way, less distant from the small homeland of our manufacturer) were calculated.

In order to develop “firmness in voice” and “flexibility in approach” among account managers working with networks when communicating the company's price terms to partners, a series of trainings on negotiations with networks was held.

Result

The results of the introduction of innovations in the annual time horizon were as follows:

1. Achievement of sales targets in the new region.

2. Growth in sales in the home market.

3. Growth of profit in the home market by 6%.

This text is an introductory fragment. From the book Debt Management. Debt collection and protection strategies from creditors the author Malkin Oleg5.1. Executive document The main regulatory legal acts that determine the conditions and procedure for the compulsory execution of judicial acts of courts of general jurisdiction and arbitration courts, as well as acts of other bodies, which, in the implementation of the established by law

From the book Anatomy of a Brand the author Percia Valentin From the book Retail chains. Secrets of efficiency and common mistakes when working with them the author Dmitry SidorovChapter 2 Commercial Policy trading company when working with retail chains How to enter a retail network and prepare a commercial offer? To begin with, it is necessary to clearly determine whether a trading or manufacturing company is ready at this stage to work with

From the book KPI and staff motivation. Complete collection of practical tools the author Klochkov Alexey Konstantinovich4.1.6. KPI for the sales department The goals of introducing a KPI system for the sales staff are to increase sales and revenue while ensuring reasonable prices for products, to maintain sales growth rates and

From book HR service enterprises: office work, document flow and normative base the author Gusyatnikova Daria Efimovna4.2.2. KPI for the sales department In this case, the implementation of the KPI system pursues the following goals: increase customer loyalty and satisfaction, increase the share of new product sales and increase sales, increase the profitability of sales sites and

From the book Puppets of Business the author Sharypkina Marina4.3.2. KPIs for the Sales Department Within the Business Processes perspective, the goals of the Sales Department are to improve planning accuracy while reducing lead times and improving the quality of preparation of plans and reports, fulfillment of the plan and increase in sales and

From the book Fast Management. Managing is easy if you know how the author Nesterov Fedor Fedorovich From the book The Practice of Human Resource Management the author Armstrong Michael5.5. Trade secrets Now, as promised, let's talk about trade secrets. The federal law"On trade secret" defines this concept in this way. Commercial secret is the confidentiality of information, which allows its owner with existing or possible

From the Kanban book and JIT on Toyota. Management starts at the workplace the author The team of authorsChapter 2. How a Commercial Company Works A successful career is like climbing an endless ladder, when you know exactly what you will be praised for on this rung and what needs to be done in order to step up to the next. Fedor Nesterov To manage a company or any of

From the book The Global Crisis. Beyond the obvious by Dolan SimonToday it is no longer enough just to produce a product - you need to competently bring it to the end consumers. In order to solve this problem, a properly built distribution model is required. Moreover, in the conditions of constantly changing markets, it is extremely important to be prepared for the fact that the system will have to be continuously improved and, at the same time, any wrong step will immediately lead to a decrease in sales, and therefore profit. This book will tell you how to develop and implement a distribution model that is optimal for your business and constantly keep it up to date, so that it meets all the challenges of modern domestic markets.

Book:

Sections on this page:

We have determined the basic rules of the game according to which partners of suppliers in trade channels will work. Clear and written rules for organizing distribution serve as the basis for the document "Commercial Policy", which in most cases will be internal. In many companies, "Commercial Policy" is part of the "Marketing Policy" (an official document, a copy of which, upon request, is provided to the tax office to identify objects of taxation). First of all, the rules are fixed in relation to price and other basic commercial conditions of work. An example of a classic pricing model in channels (including not only the distribution link, but also traditional and systemic retail and HoReCa), as well as describing the average markups in channels, is shown in Fig. 10.

"Commercial Policy" is the main management document that a sales manager works with. Based on individual provisions of the "Commercial Policy", the manager builds interaction with all clients. He knows how the goals, objectives and conditions of working with a distributor differ from, for example, working with a regional chain of stores. The Commercial Policy defines what requirements a trading partner must meet in order to be assigned the status of a distributor, and what special price conditions it will receive. A sample content of the "Commercial Policy" is provided below. During ten years of work, Unit-Consulting specialists have repeatedly developed such documents for suppliers, and almost all of our clients highly appreciated their usefulness: "Commercial Policy" allows you to streamline relations with distributors and optimize tax risks.

1. Basic definitions.

2. Objectives and basic principles of the "Commercial Policy" of the company.

3. The principles of organizing a sales channel for the company's products.

3.1. Segmentation of the priority markets for the company.

3.2. Client classification.

3.3. Building a sales channel for the company.

4. Policy of working with priority sales channels.

4.1. Policy of working with different types of clients and priorities.

4.2. Price policy.

4.3. Credit policy.

5. The system of motivating sales channels (trading conditions).

6. Applications.

Case

Commercial policy: basic principles

Current situation

The confectionery manufacturer faced the challenge of qualitatively improving distribution sales. The logistic shoulder on which the company was ready to supply its products was 200 km from the city where the production was located. The company, in her opinion, has achieved satisfactory representation in its city and was planning to enter a neighboring city with a population of over one million (target region). The shelf life of products is two months. The company's development plans include territorial expansion of sales through a distribution channel. The base price was calculated taking into account the prices in the market with the minimum profitability of the manufacturer and included the cost of delivery to the client. A newly developed (progressive, according to the company) pricing system was used:

6% discount for pickup;

10% discount from the base price for distributors;

Retail price is 10% higher than base price.

An internal company study found that chains mark up between 20 and 30%. If the goods go to the network through a distributor, then the price for the network is increased by the distributor's markup of 20% (this is the markup recommended by the manufacturer to the distributor when working with networks). As practice has shown, such a system worked well in the hometown of the manufacturer, but when it entered the regions, it began to malfunction: distributors noted an insufficient margin on the manufacturer's products to cover costs and financial incentives.

Problem

When renegotiating contracts with chains over the past two years, the company did not defend the increase in prices for its products, which negatively affected the sales of distributors, as it limited their ability to increase prices.

In the target region, the company established relationships with partners, and began deliveries to three distributors. The first, in addition to distribution, was engaged in the production of its own products. The second one was mainly the distribution of bakery products, while confectionery products were not a priority. The third distributor had an excellent warehouse and well-established logistics, good sales staff.

In general, the company assessed the work on conquering the target region as unsatisfactory and requested recommendations on improving the distribution channel.

It should be admitted that the company has done a lot of significant work to develop a transparent pricing system, but it still did not meet the conditions and demands of the market. For systematic work with distributors, Unit-Consulting specialists suggested that the company clearly define the statuses of regional trading partners. The status of a distributor is based on actual sales data of the company, as a basis, you can take data on sales in the manufacturer's hometown. Having identified 6-10 wholesale customers who make the largest purchases, it is necessary to indicate the minimum annual volumes for current sales to the selected distributors. Then you should reduce the amount received by about 5% (to ensure that each of them will fall into the coveted pool of distributors next year) and declare that the declared volume of purchases is the minimum for a company that has the status of a distributor. In addition to the guaranteed volume, the distributor undertakes to purchase at least 75% of the assortment produced by the company. It must be admitted that at that time not all of the selected seven distributors worked within the required assortment range, however, the gap was insignificant, and the partners could easily expand the purchased assortment. The status of a distributor also implied acceptance of the manufacturer's recommendations on prices for traditional and chain retail.

Subject to the fulfillment of the manufacturer's requirements, the trading partner received a special distribution price. Additionally, he could count on a quarterly bonus for meeting agreed sales targets. In terms of marginality, the proposed conditions (price + bonus) were slightly more profitable than the previously existing ones. The manufacturer also indicated price ranges for federal and regional chains. The company changed the selling price on the network, now the delta with the base price was 15%. In addition, the recommended price at which the distributor sold the goods to the chains was increased. Thus, the distributor's margin when working with the regional networks channel was significantly increased and amounted to 25–28%.

Best Business Books: Ranking Popular Business Literature Authors

Best Business Books: Ranking Popular Business Literature Authors Structure of a business plan point by point: learning from clear examples

Structure of a business plan point by point: learning from clear examples How to write a business plan: step-by-step instructions with examples Budget money

How to write a business plan: step-by-step instructions with examples Budget money All about pellets: production rules, standards and quality control methods

All about pellets: production rules, standards and quality control methods Chicken leg trimming conveyor

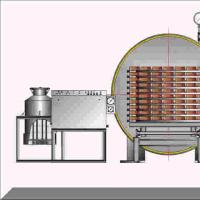

Chicken leg trimming conveyor Arrangement and construction of a drying chamber for lumber

Arrangement and construction of a drying chamber for lumber Improvement of the city, woodworking arrangement of pile foundations and pipelines Main units of machine tools

Improvement of the city, woodworking arrangement of pile foundations and pipelines Main units of machine tools